One indicator of commercial activity is shipments, such as train and truck traffic.

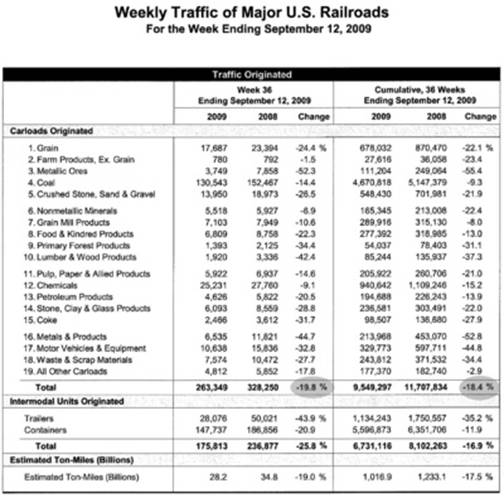

Reader Marshall Auerback provided this sighting which shows that the decline in shipments is accelerating. Note that one of the general reasons for optimism is that many indicators are getting worse less quickly and some appear to be stabilizing.

Now this is merely a one-week shift and may be noise, but the change was pretty dramatic, and in the wrong direction. As Marshall noted:

The latest data out of the Association of American Railroads has been released. While a month ago the weekly YoY decline hit a very troublesome -17.1%, the last weekly decline added another almost 3% to the deterioration, and is now down -19.8% for Week 36. Cumulative traffic decline is flat at -18.4%. Including intermodal traffic or ton-miles in the calculation does nothing to improve the conclusion. Not a single “carload originated” category has improved, and in fact even the relatively stable ones from the prior update have slumped.

The data are not seasonally adjusted so when you actually take a look at the levels, they are all the way down to where they were in 1993.

Add to it the sinking baltic dry index and sequentially weaker coal imports into China. I can;t decide if Goebals wuld be proud of the effort or dissgusted at how stupid the masses are -then again that question gets anwsered everyday in a referendum via the cramer show

I think that the week included Labor Day and so maybe not representative.

Good catch, Anne. The AAR mentioned that in their PR.

http://www.aar.org/NewsAndEvents/PressReleases/2009/09_WTR/091709_RailTraffic.aspx

I suspect that this is an artifact of a later than usual labor day weekend and that the data will go back to “normal” next week.

That seems to be what happened with initial jobless claims last week.

I lived near railroad tracks in Omaha for many years. Freight trains run 24/7 even if most traffic seems to be during daylight hours and weekdays. I’m not buying the Labor Day theory.

I agree with D. Even old style heavily unionized railroads base pay on mileage (actually converted back and forth to hours but whatever). Holidays are not important to pay, even if you are working on Christmas, if you are within your mileage, it is regular pay. They do this specifically because the trains run 24/7, holidays be damned.

It will be interesting to see how this develops.

Maybe I am reading your comment wrong, but I disagree. My grandfather loved the holiday runs from Boston to Maine and back. He had seniority and crack at the runs. They were at least time and a half, but some, like Christmas, was double time and a half.

They always ran, though.

If you have actual family experience then that trumps what I know but my understanding is that is does not work that way. The guys with seniority use that to stay off the line during the holidays.

But given all the railroads and all the contracts, it could be different at different times and places. Even on the same line, different unions can have different deals.

But the trains alway roll.

I keep hearing about trade collapse and freight collapse but I haven’t noticed any shortages on the shelves. I asked me coworkers and they weren’t even aware of the trade situation. How long before we actually see the effects of the slowdowns on store shelves?

chad,

Why would you expect shortages on shelves? You don’t need to see such a thing necessarily, if all this happens due to decrease in demand. Then you even could have overflowing shelves, if no one is buying.

rc

Chad – The slowdowns in train volume are mainly industrial and construction related (coal, gravel, etc.). We already are seeing less stuff on store shelves – items that people aren’t buying aren’t being reordered by the stores. Take a closer look. Some people are noticing barer Wal-marts. Not to mention there are lots of stores that are no longer here compared to last year and those shelves are gone forever.

When stores start reporting same store sales over the next few months the results will be interesting because they will be comparing against the bad months of late 2008. Last year’s figures should be easy to beat – we’ll see how that turns out.

Good point. Target has been particularly aggressive about under-stocking. Their managers are making an art out of spreading inventory to cover increasingly bare shelves in low-volume departments.

Yes train plus long/short haulage is down YoY and should stay flat or dip considering the enviroment.

If one wants to see something really scary check out vending distributers in America, buy and sell via mobs like Trade Key. Think of all thoses mom and pop machines across the country as retirement plans and the cyclic effect on huge distrabution warehouses.

Skippy…traffic at distrabution centers, to me is the nexus of it all.

You should note the first paragraph of the press release:

http://www.aar.org/NewsAndEvents/PressReleases/2009/09_WTR/091709_RailTraffic.aspx

AAR Reports Rail Traffic Down During Labor Day Holiday Week

Comparison Week From Last Year Did Not Include Holiday

WASHINGTON, D.C., Sept. 17, 2009 — The Association of American Railroads today reported that freight traffic on U.S. railroads was down during the Labor Day holiday week compared to the same week last year. The comparison week from last year, however, did not include the Labor Day holiday.

For the week ended Sept. 12, 2009, U.S. railroads reported originating 263,349 cars, down 19.8 percent compared with the same week in 2008. Regionally, carloadings were down 18.4 percent in the West and 21.8 percent in the East.

Hey . . .

To ship overseas the conatiners are railed to the coast. To receive overseas materials in Chicago from China, the containers also go by rail. If the Baltic Index is down and ocean shipping is dead, fewer containers are being railed to the coast or railed coming from the coast.

It is a misconception that Bernanke spoke about ‘Green Shoots’, he was actually referring to ‘Green Chutes’ as in the American game of ‘Chutes and Ladders’.

This game can be used as a teaching tool about the financial market; one throws some dice to determine your move and then you climb up a ladder to receive undeservrd rewards or you slide down a chute to lose your shirt.

Outside of the USA the game is called ‘Snakes and Ladders’ and can be used to teach people about the banking system.

Calculated Risk says west coast port traffic was up in August.

Weak dollar maybe.

I’m interested to see how west coast port traffic does in Sept. Most of our holiday junk merchandise should be arriving now. Some maybe in Aug.

Your article is disingenuous. Here is a link to the source of that information:

http://pragcap.com/the-latest-railtime-indicators-report-from-the-aar

Average weekly U.S. Carloads were greater in August 2009 than they were in July 2009; July 2009 is seasonally a poor month but July 2009 was above June 20009. I don’t see a reason for alarm like you do – at least not here. For what it’s worth, the chart reminds me of U.S. Steel Production. Things fell off a cliff in Q4-Q1 2009 and have since picked back up.

“Libenter homines id quod vedant credunt.”

My take is that the Christmas season will be fairly mediocre.