Served by Jesse of Le Café Américain

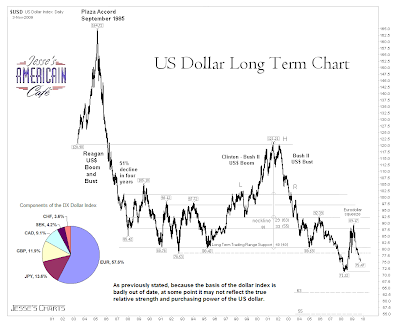

Here is an update of the US Dollar (DX) Very Long Term chart last shown on 3 April 2009 when the Eurodollar short squeeze was still abating.

We do not see any reason to change the longer term targets based on what appears to be a confirmation of the continuing decline.

The reasons for this decline are obvious, but so many miss this that we have to wonder what people are thinking. Despite the credit writedowns, and even a potential unwinding of the dollar carry trade which may be a bit overblown even as the demand for dollars in commercial lending is slack, most analysts are missing the bigger picture of a huge overhang of eurodollars that are becoming increasingly less useful to foreign holders, especially if the power of the petrodollar further declines.

There is a potential double bottom to be made at 71, with a possible target in the higher 80’s based on the charts.

The fundamental scenario we would see supporting a reversal rally is a significant equity market dislocation and/or an exogenous geopolitical event that caused another artificial short term demand for dollars and the T bills. Currency dollars are, after all, sovereign debt of zero duration and in any panic there is a rush to the short end of the curve, to the point of accepting negative rates of return for the safety of capital as was seen in the last financial panic leg down.

But after that event, the decline of the dollar will gain again in momentum lower unless there is a profound financial systemic reform and a restructuring of the federal budget deficits.

A genuine reform may be unlikely, since even a reform Administration in the US seems to be attracted to maintaining several costly mega-banks, to act as the potential instruments of national financial policy on the world stage. But even clever frauds can work only so many times, and there is nothing particularly clever or sophisticated about Wall Street’s latest antics, excepting of course their size and their audacity which the average mind cannot well grasp.

The US should not be surprised if the rest of the world does not view new proposals of financial innovations with AAA ratings as favorably as in the past. And as the 700 military bases around the world have proven, large inefficient constructs of empire are expensive to maintain, especially those in the financial world not so easily controlled and certainly more well paid than the usual deployment of ‘weapons of mass destruction.’

With regard to the shift of some dollar heavy central banks into a greater portfolio diversity, including some gold and even silver in the case of developing economies with less dollar reserves, this should come as no surprise to anyone who has been following the news, except those who dismiss anything the developing world might attempt to do in managing their own financial affairs. As stated at the bottom of the news piece here, the entire gold reserves of the IMF are not enough to slake the desire for a harder reserve asset like gold should China continue on its current diversification.

Interestingly enough, none of this has yet shown up in the NY Fed Custodial accounts, where the foreign central banks purchase US guaranteed debt obligations for their portfolios. But it should be remembered that this is a somewhat opaque set of holdings, and does not encompass all of the central bank dollar holdings at all, they being perfectly capable of purchasing dollar assets through commercial sources and open markets without the help of the NY Fed.

The TIC report helps a bit, but it also is not comprehensive and difficult to square with other sources because of some central bank secrecy and reporting lags and errors. Eurodollars have been even more difficult to track than usual, therefore, and as they are the one major component of M3 that is lacking, it makes it difficult to be estimated by those who generate faux M3 reports based on correlations and trends.

A Broader Trade Weighted Dollar Index

Here is an alternative index of the US dollar from the Federal Reserve that is much broader than the DX in its constituent components. It is a weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners.

Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia.

It shows the same Eurodollar squeeze and subsequent decline. As a point of order, the term eurodollar is a bit misleading from its historical roots. It basically refers to any US dollars being held overseas, and not just in Europe.

What happened in 1985?

A bubble in the post Nixon US dollar was burst rather effectively perhaps by the Plaza Accord.

http://en.wikipedia.org/wiki/Plaza_Accord

As noted on the chart, the fixed-weight Dollar Index is very badly out of date and does not reflect the true value of the dollar anymore. The Fed keeps an up-to-date version of the Dollar Index and it shows the dollar is very strong over the long term.

Yes I am aware of the Fed’s work in this area, if you are referring to the Price-adjusted Broad Dollar Index which is indeed ‘strong’ and suitable for slowly boiling frogs.

There is also a Morgan Stanley Index of the Dollar, or at least there was.

If you are referring to the Fed’s TWEXB, Trade Weighted Exchange Index: Broad then your reading of the chart seems to be a bit eccentric. I will include a version of that chart in a few minutes on this post and in my blog.

It is broad, and it shows the dollar broadly declining in value after the eurodollar spike. This index is Averages of daily figures. A weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners.

Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia.

Bob, the dollar is in a bear market, no matter how one looks at it.

By the way, and this is strictly non-attributable and based in part on hearsay, it is said that Treasury itself does not know the extent and distribution of the US dollar overhang internationally.

The eurodollar squeeze, and the stream of high level complaints from foreign administrations, put young Tim on the spot so to speak, although he was bailed out by Ben’s currency swaps.

It has been suggested that a nice young economist who specialized in read TIC and the arcane source materials of eurodollars left his blogging life for a position at Treasury or a subcontractor of same to help them puzzle out the extent and distribution of the dollar hang, with the intent of managing it more carefully, especially in the event that there is some sort of currency crisis.

His input is missed by yours truly, since it required me to do my own reading and analysis in this area once again, having gratefully laid back and ridden in part on his coattails for a time.

Lot of people miss bsetser blog!

The fundamental scenario we would see supporting a reversal rally is a significant equity market dislocation and/or an exogenous geopolitical event that caused another artificial short term demand for dollars and the T bills.

…

it is likely going to achieve the targets indicated unless there is a major liquidation event

I love how the deflationary outcome is always tagged as “artificial,” “temporary,” “forced deleveraging,” “margin-driven selling,” etc. You hear something similar from the TV pundits touting the recovery: “things will keep getting better unless there’s some kind of ‘exogenous’ new event to take markets down.” Oh, you mean like maybe the implosion of bank commercial real estate portfolios, or an Eastern European banking crisis, or any number of other shoes poised to drop.

I guess saying that any contrary moves will be “artificial” provides one with the leeway to claim that even if you got it wrong, you still had it right. I guess anyone who winds up losing his job and having to sell the gold he saved for half what he paid for it can take comfort in the fact that he got caught up in a temporary “liquidation event.”

(BTW, I say all this as someone with 20% of his portfolio allocated to physical gold.)

I believe that if I were a senior technocrat in the government of a successful emerging markets country in Latin America or Asia ((with a graduate degree in economics from a good American university and, say, 20 years into my career–Tenoch’s father, in Y Tu Mama Tambien, if you watch movies) I would look at your chart and respond, “We can live with the long term trend, that’s easy enough, to live with and plan for. But, to there too much volatility, something need to be done about that. Nin hao?”

And the concerns of those guys are going to be trumping the appetites for volatility and trading profits of the financial center capital markets players. It’s time to realize that the politics are being put back into political economics. And as that happens the techncal trip-ups and comparative accuracy/fidelity of various alternative indexes goes by the boards (and not just message boards).

The trend is what it is, and for some very good reasons in this case.

Countertrend bounces occur in every market. This last one was outsized and was attributable to some very definite and quantifiable circumstances.

That is what traders and analysts do. They deal with facts.

Anything can happen. But not everything is likely to happen.

The pound is structurally is worse shape than the dollar, and yet for some reason it is resilient beyond its means. The Debt to Income ratio of the UK is a horror story compared to the US.

When the trend changes, the trick is to recognize it, and account for it, and be serene enough to admit that they were wrong. Then it will not be an ‘artificial’ change but a real one with long term implications.

Picking a future outcome, and then distorting the data with emotional attachment to suit that bias is what separates a fool from his money in the markets.

I have been over the deflationary outcome as a possibility with a fine tooth comb since A Gary Shilling started predicting it, and that is a long time.

I also freely admit that it is possible and know exactly what it would take to achieve it. I don’t Ben has the latitude to do it, but 20% overnight rates would do the trick in a Manhattan minute.

Trade the market and the economy you have, accept the reality in which you live, and anticipate the future with the appropriate fear and trembling. There may be prophets, but few of them waste their time talking about something as profane as the dollar index.

Jesse – Just a brief note of appreciation for your insightful posts here and at your Cafe.

Wow

What a datamined argument. Frame the dollar squiggly line on the Plaza Accord. You do realize don’t you that your picture changes if you start a decade or two earlier? You might want to look at the long-term Deutsche Mark/Euro chart…it is quite different from the Yen chart….overall, interesting argument, but it shows how misguided one can be when ignoring the devil in the details