A post by Edward Harrison

About a month ago I wrote a post called “The coming wave of second mortgage writedowns” the gist of which was that the big four banks (Citi, JP, BofA, and Wells) had a shed load of exposure to now worthless second mortgages. With many first mortgages now hopelessly underwater, it stands to reason that second mortgages on those same properties have zero value.

The big four are certainly well aware of this problem and are looking for ways to extend the wherewithal of underwater borrowers and pretend they don’t need to take losses on these loans. On paper, these companies are very well capitalized. However, in the real world, the likely losses they must eventually take on loans already on their books would probably render them insolvent. This is what I hinted yesterday in my post on the stress tests.

I said:

I would say the stress tests were a mock exercise to instil confidence in the capital markets. This was important first and foremost because it would induce private investors to pay for bank recapitalization instead of taxpayers. But it was also important for the economy as a whole as the sick banking sector was dragging the whole economy down. The key, however, is that the tests were a mock exercise. Despite the additional capital, banks are still hiding hundreds of billions of dollars in losses in level three, hold to maturity, and off balance sheet asset pools. If asset prices fall and/or the economy weakens, all of this subterfuge would be for nought.

And when I use the phrase ‘mock exercise,’ by mock, I mean fake. Mike Konczal has done a remarkable job of putting these two concepts – the worthless second mortgages and the stress tests – together.

He writes in a recent post:

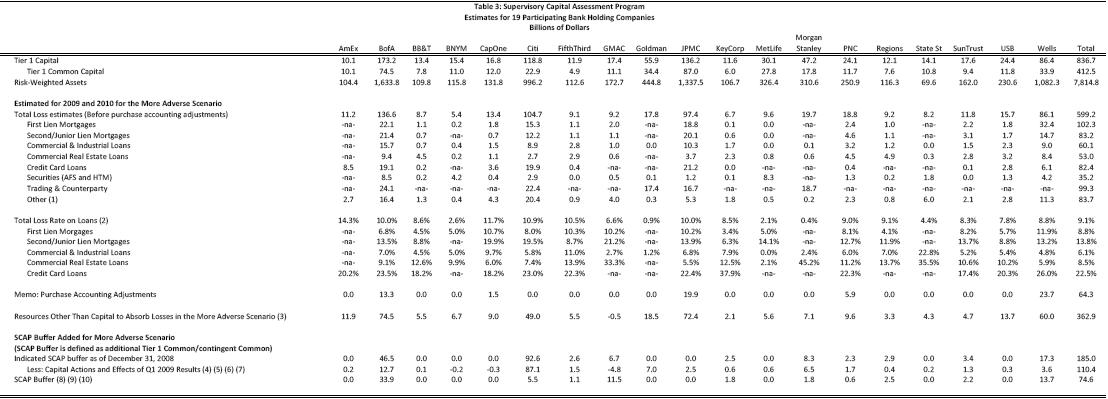

Let’s talk specifics: Last June I made a DIY Stress Test, using values reversed-engineered from the public documents, where you could play around with the values online or download an excel spreadsheet yourself (it’s still one of my favorite blogging items). The backbone of the overview of results, page 9 from the Federal Reserve’s document, looks like this:

I’m going to isolate the four largest banks Frank questioned about second-liens, along with their loses as they’ve legally sworn to being accurate during the stress test:

Again, this is data as reported to the government by the major banks during the stress test of 2009. So what’s going on here? The four major banks have about $477 billion in junior liens, either in the form of a second mortgage or a home equity line of credit. If you go to the Fed Funds data online, you’d see that there’s about a trillion dollars of 2nd/Juniors out there, so the four major players have about half the market.

The four major players each report that they expect to have a 13-14% loss on these items under an “adverse scenario”, with Citi reporting a 20% loss under an adverse scenario. That means of the $477bn, $68.4 bn is junk that’ll never be collected on. This, combined with all the other expected losses (see the link to the stress test for the rest) meant that the four biggest players needed around $53bn to be raised.

Notice how Frank’s letter, and pretty much anyone you’d speak to who isn’t working for the four largest banks, assume that second liens in the country aren’t worth 86% of their value (for a 14% loss). You see in Frank’s letter “no economic value.” Huh. Well, that’s a problem.

Let’s look at these values again, assuming that the expected total loss would be 40%, and then 60%.

So the original loss from second-liens, as reported by the stress tests, was $68.4 billion for the four largest banks. If you look at those numbers again, and assume a loss of 40% to 60%, numbers that are not absurd by any means, you suddenly are talking a loss of between $190 billion and $285 billion. Which means if the stress tests were done with terrible 2nd lien performance in mind, there would have been an extra $150 billion dollar hole in the balance sheet of the four largest banks. Major action would have been taken against the four largest banks if this was the case.

See what I mean by fake? The point is this whole charade is transparent to anyone who actually runs the numbers. Yet, you have people like John Cassidy spreading disinformation in the New Yorker, writing puff pieces of zero negative value with drivel like this:

Other critics dismissed the tests as a sham, arguing that the economic assumptions underpinning them were too benign. As the tests unfolded, however, it became evident that the government’s loss projections were quite high, and that many banks would be forced to raise considerable sums of money—in some cases, more than ten billion dollars.

Baloney. Run the numbers like Mike did, John; and then you wouldn’t make such asinine comments. Of course the stress tests were a sham. They were a confidence trick to raise more capital and buy time for the banks to earn yet more still. The point was to allow the banks to ease into their losses. And that’s exactly what’s been happening for the past year.

The problem with the stress tests, however, is they gave the banks a way to get from under the yoke of the government’s TARP program. The banks said, “look, we are now well-capitalized even in the worst case scenario of the stress test. We want out of TARP.”

This is bad for three reasons.

- The big banks all paid back $25 billion in TARP funds. Smaller banks like Northern Trust paid back $10 billion or less. That’s hundreds of billions of capital that they all could have as a buffer against losses. Some of them raised additional capital to replenish the coffers. Nevertheless, net-net, we had less banking capital in the system after the repayments than before.

- Banks free of TARP paid out a lot of cash in bonuses that could have gone to shoring up their capital base. Every dollar paid in cash compensation to staff is a dollar less of capital. Had these banks been under TARP, they would have been forced to pay lower bonuses – if only for this year.

- The lower capital – and the fact that banks know that having renewed capital problems would mean the end of the line for them – means that banks are less likely to lend freely. They understand that now is the time to husband capital. Heads would roll if a big bank or super regional which had repaid TARP had another capital shortfall.

The real question is: why is the Obama Administration running victory laps, unrolling the ‘Mission Accomplished’ banner on the credit crisis, as Mike Konczal describes it? I suspect this is just a political stunt to provide cover in the mid-term elections to somehow demonstrate that the Democrats fixed the problem which the Republicans created.

I think it could backfire if only because the underemployment rate is still 17%. Nobody wants to hear the “I saved the economy routine” when they’re unemployed and losing their home.

All attempts to claim the Bush and Obama administrations were ever acting in good faith, that they ever thought the Bailout had anything other than a larcenous purpose, that they were ever sincerely trying to save what they sincerely thought was a salvageable system, will always shipwreck on the fact that they not only left the existing bank cadre in place but allowed it to continue looting on a personal basis (“bonuses”), and that they geared every one of their own actions (e.g. the scam stress tests) and allowed every bank action (e.g. the rush to pay back the TARP) on this loot-seeking basis.

And always remember, this isn’t even just “normal” corporate looting on behalf of the shareholders, but a special level of fraudulent conveyance by the executives and select employees. Obama and Geithner know this, approve of it (they’re “savvy businessmen”), and want to help it along.

Was holding the TARP funds baked into the stress tests? Or was the probability that the phony good marks would be used as the pretext to pay back the TARP “priced in”? Well, I can guess the answer to that.

This is another example of a basic scam of the “growth” ideology. We’re always hearing about things like “improved efficiency” and better-distributed risk.

But the only way these things can really be achieved (i.e., achieving real and not Orwellian efficiency) is by creating some slack in the system, a buffer, some extra space.

But under growth capitalism, the mandate, the compulsion, is to cram more of something into any spare space the moment it exists.

So for example we had the alleged risk mitigation effects of CDS immediately nullified when the extra risk “space” opened up was used to cram in more risk. The result was to not only to not lessen exposure as such, but to render it quantitatively far more severe.

That’s why any sane observer should have known that any alleged risk management “innovation” was a scam. Anything like that will always be a scam where the system mandate is to increase risk to the maximum attainable. Any such “innovation” would simply increase that maximum level, not render some steady-state level less risky.

So the stress tests are the same kind of scam. They claim a not-so-dire likely scenario and bestow good grades based upon it, pretending they don’t know damn well that those good grades will then be used as the pretext to do things like pay back the TARP and ramp up the personal “bonus” looting.

Once again we have the same basic lessons: There’s no longer any such thing as “innovation”, only scams; and there can be no “reform” of this system.

If we’re talking closed end seconds issued in 2006 or 2007 I’d say 50% loss on the portfolio is more accurate. I do have to hand it to Geithner though, the stress tests were brilliant move; He effectively called a time out. We all know the stress tests were b.s. banks do stress tests with regulators all the time…. but the trick worked anyway.

“Bankruptcy [insolvency] for profit will occur if poor accounting, lax regulation, or low penalties for abuse give owners [CEOs] an incentive to pay themselves more than their firms are worth and then default on their debt obligations.”

— G. Akerlof and P. Romer, “Looting: The Economic Underworld of Bankruptcy for Profit” (1993)

That the Rhambama administration has been late and limp in addressing the poor accounting, lax regulation and incentives for abuse by management tells us all we need to know. The Democrats have taken the wheel of the get-away car while the crony capitalists loot the treasury.

Justicia,

+ 1.

The whole premise of the analysis is that the home equity loss rates for the stress tests are too small (13.2%-19.5%). These loss rates could be too small, but to speculate on 40% to 60% loss rates is just irresponsible.

Etrade, the poster child for HELOC losses, has reported a 15% charge-off on home equity loans from Sept 07 to Dec 09. With a little bit of luck, the loss rate will top at 20%. Given that, a 40% loss rate, much less that a 60% rate, is just unrealistic.