A lot of people are still feeling very bruised by last Friday’s market actions (Felix Salmon went as far as ordering all retail investors to get out of the pool). A message from a reader with ample trading desk experience:

BTW, hope you didn’t have any sell-stops yesterday, WTF was that?!?!? I covered my SPY short with a market buy order on the bounce (HAD to be .gov buying S&P 500 futures, some serious ammo bid the mkt very hard) and my shares were bought in 2 blocks, a freaking NICKEL apart?!?!? Normally SPY moves in nano-penny increments, one of the most liquid things on the planet. Def smells extremely fishy, somebody made a killing running the stops then pulling liquidity away from the system at the same moment. Somebody STOLE a bunch of AAPL from folks, among many other things. You’ve got to imagine every hedgie on the planet (that didn’t get blown up yesterday) is thinking about how to engineer and profit from a similar event down the road. I am flat as a board right now, this mkt scares the hell out of me on both the long and short side.

Yves here. Even if the his widely shared suspicion, that the air pocket in the market was orchestrated, proves to be incorrect, the second part of his comment is almost certainly true, that hedge funds are studying whether they can engineer a little P&L flattering volatility of their own.

But the investigations seem to be characterizing the problem in a way that is not helpful for the laity or policy makers, at least if the New York Times is reporting accurately:

It was an unintended consequence of a system built to place a circuit breaker on stocks in sharp decline. In theory, trades slow down so that sellers can find buyers the old-fashioned way, by hand, one by one. The electronic exchanges did not slow down in tandem, causing problems, according to two officials familiar with the investigation.

That could mean that the computers first flooded the market with sell orders that could not be matched with buyers. Then, just as quickly, many of these networks withdrew from trading. The combined effect might have set off a chain reaction that sent shares of many companies spiraling during the 15-minute frenzy.

Yves here. This is a poor explanation, and worse, may reflect a mischaracterization of the issues. The circuit breaker mechanism is a way of halting panicked selling, when volumes on the sell side become so overwhelming that the bottom drops out, and buyers rationally stand aside to see how far the downdraft will go before bidding. The fact that you could not get halts across all platforms is a problem (not that one was implemented, since after 2:30 PM, the NYSE does not allow for circuit breakers).

But the second is in the “hand by hand” v. computer contrast, which may be inapt drafting. The issue isn’t that the humans are SLOWER, it is that they serve a different function. NYSE specialists serve as market makers (they take a position, as in inventory risk. to keep a market functioning) while the computer systems simply match orders (in fairness, the article does say later the effort was made to shift orders over to the specialists, but orders were routed to electronic exchanges)

Contrast the reports at the Times and the Wall Street Journal, that the officialdom is pouring through the records and is still puzzled after a full three days on the case, versus this analysis produced by a lone sell-side analyst (who sadly must remain anonymous) roughly 24 hours after the implosion. Be sure to take note of the boldfaced section at the end (his emphasis):

Time to set the record straight. “Trader error” or “fat finger” may have been a catalyst for certain elements of yesterday’s action, and it may not have been. It may have been a “computer error” and it may not have been. Do you notice how we’re unwittingly restricting our analysis to what the sellers did? The offer side of the trading that saw the S&P 500 lose -5% of its value in the span of about 3 minutes – that after it had already declined by over -3% – is a RED HERRING. It’s misdirection – hand wringing over what is irrelevant at the expense of ignoring what is relevant…and what’s relevant is the bid side of the market, that is, what the buyers did.

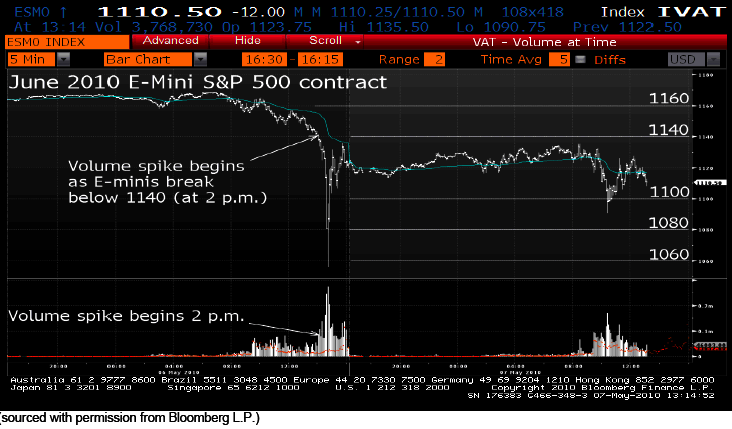

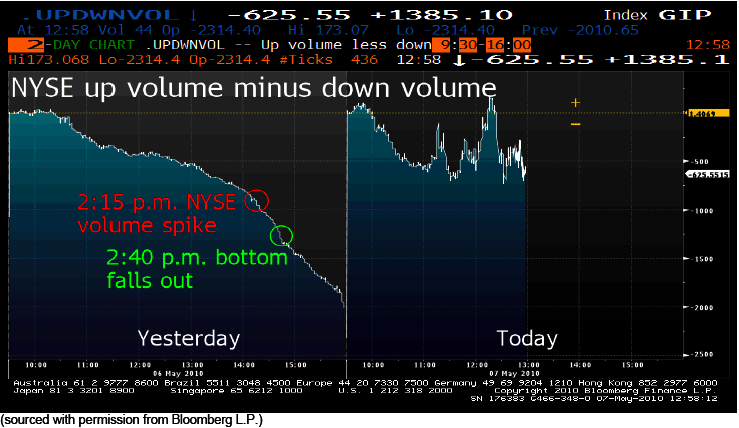

Volume was gigantic yesterday before we really went into freefall. As of 2 p.m., some 40 minutes before Armageddon, we were tracking for a massive 15.6 billion share day (we ended up doing 19.3 billion – the second largest day ever after the October 10th, 2008 whitewash). Half an hour later, at 2:30 p.m. – still ten minutes before the bottom fell out – volume had surged and we were tracking for a 17.2 billion share day. The period between 2 p.m. and 2:40 p.m. saw immense selling pressure in both the cash market and the futures market, and that occurred with the E-minis still north of 1120. Check out the below graphs (click to enlarge).

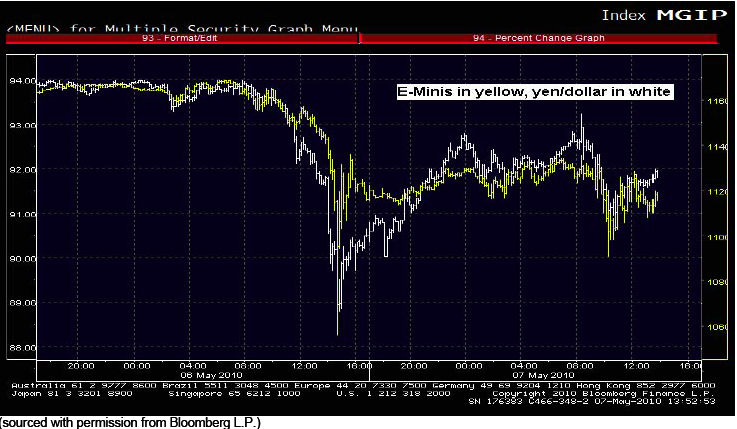

In other words, it was not a sudden, random surge of volume from a fat finger that overwhelmed the market. It was a steady onslaught of selling that pressured the market lower in order to catch up with the carnage taking place in the credit markets and the currency markets. Take a look at the chart below which clearly shows the surge in the yen preceding the drop in the stock market.

But what about the final thrust lower – the seeming air pocket? We know, thanks to our friends at CNBC who were fixated on this particular stock, that Proctor & Gamble tumbled by over -35% in the span of about 5 minutes. It’s impossible to tell by looking at a chart of the stock, but when you look at the individual prints you can see that this was not a case in which two or three “erroneous” prints marked the tape down to $39 before the stock sprang back to $60. I’ve got 28 pages in front of me of P&G prints that occurred between $39 and $50 per share and between 2:46 p.m. and 2:51 p.m. At 36 prints per page, that means P&G traded over one thousand times at those “crazy” and “surely erroneous” levels. I’m sorry, but that isn’t an error, THAT IS WHAT WE LIKE TO CALL TRADING. So what happened here? Three things:

1. Sellers probably had orders in algorithms – percentage-of-volume strategies most likely, maybe VWAP – and could not cancel, could not “get an out.” These sellers could be really “quanty” types, or high freqs, or they could be vanilla buy side accounts. It really doesn’t matter. The issue here is that the trader did not anticipate such a sharp price move and did not put a limit on the order. The fact that the technology may have failed does not mean the trader deserves a do-over, it means that the trader and the broker who provided the algorithm need to decide whether any losses should be split.

2. Sell stop orders were triggered which forced market sell orders into an already well offered market.

3. While the market was well offered, it was not well bid. Liquidity disappeared. For example, in P&G, 200 shares traded at $44.10 at 2:51:04 in the afternoon and one second later, at 2:51:05, three hundred shares traded at $47.08. That’s a three dollar jump in one second. Bids disappeared, spreads blew out, and no one was trading except a handful of orphaned algo orders, stop sell orders, and maybe a few opportunists who had loaded up the order book with low ball bids (“just in case”). High frequency accounts and electronic market makers were, by all accounts, nowhere to be found.

It boils down to this: this episode exposed structural flaws in how a trade is implemented (think orphaned algo orders) and it exposed the danger of leaving market making up to a network of entities with no mandate to ensure the smooth and orderly functioning of the market (think of the electronic market makers and high freqs who can pull bids instantaneously as opposed to a specialist on the floor who has a clearly defined mandate to provide liquidity).

Markets are broken. Eu leaders engineered bailout is working well with European exchanges up 3-5% , Asian markets are up 2-3% as well.Print money and we will live happily ever after. Dollars and Euros galore will make everyone on the plant rich

Abhishek, I think you are on the plant & not the Planet :-)

This, I think correctly, highlights again how the system is structurally set up in a reckless, scoiopathic way. It can never, other than purely by accident, provide any of the benefits alleged for it (like guaranteeing liquidity during a spot crisis), and in fact these guarantees represent political fraud, since “legally ” the entities have no such mandate.

There’s no need to believe in this level of calculated agency:

http://www.zerohedge.com/article/call-%E2%80%93-fictional-look-25-minute-market-crash

Ironically, that piece is too lenient on the system, since it implies that events this severe could only occur through a strenuous action by the finance cabal, when the reality allows for disasters to occur by accident or absent-mindedness as well.

I don’t say that to absolve them of criminal intent, however. Although I don’t think people receive orders in sealed packets to tank the market when Congress is getting uppity, that’s just because they don’t need to.

Unlike the workers (alas..), Wall Street has a clear sense of its interest and strong discipline, so everyone who matters knows how to punish any sign of a public interest action or inaction (e.g. letting Lehman go down, voting down the TARP, Geithner’s irresolution in describing how the new administration would push forward with the Bailout, and on up to Brown/Kaufmann and the fed audit amendment on the same day).

The ideological algorithm is very simple – the Bailout, corporatism, secrecy, congressional freeze-outs of “populist” amendments, etc. = good, seek market stability, bull, buy; any hint that ideas in the public interest are advancing or evern getting a hearing = bad, seek chaos, bear, sell.

The stock market’s a collective terrorist entity, like a malevolent column of army ants.

It absolutely reeks of the smoke-(and mirrors) filled casino, strictly for high-freak-rollers and fools. Like a carnival rollercoaster, futures today are up 2-3%, on news that this (fourth, fifth?) Greece bailout is real.

I was wondering what the count was on the Greek bailout. I lost track. I think it was beyond five.

(I saw what I think was a joke number at Zerohedge that this is iteration 47.)

I posted this further down: Barry Ritzholz does give some credibility to the conspiracy slant to the crash.

Yves; at the risk of sounding like a paranoid, I cannot help but feel that this was a message to Mr. Sanders and his supporters.

Well, I’ve been looking for an explanation of the drop that made sense. I guess this is it, but as a casual observer the graphs and buzz words are mostly gibberish. I think I get the general gist, though.

Wasn’t the original purpose of the stock market so that people could invest some money with companies that they thought might grow or at least generate steady income, in hopes of sharing in the rewards for the investment of their money?

Seems very clear to me that that simplistic idea is now abstracted beyond any recognition into a giant crap shoot casino game, where the actual companies really don’t matter much in driving the market up and down.

Quants and algos and schemes and ploys seem to be the whole purpose for the big fish in this cesspool. The incredibly fast drop and bounce back on Thursday made it pretty certain to me that the machines must be driving most of it. Especially with no special spark to start or stop it.

The game is all. Underlying reality of the actual companies hardly matters anymore.

In Vegas, card counting can get you thrown out of the game, not to even think of using a computer. The current Wall Street sham is like a bad Sci Fi movie where the geniuses have populated the world with robots to make our lives better, but alas, there is a flaw in the design and the robots start teaming together and killing us. Some of this could still be turned off if the masters could be awakened to the true demented nature of their creation.

I managed to accumulate a bit of money and was happy for a while thinking I could make safe investments and live happily ever after. As luck would have it, it now seems the whole game is rigged; a simple strategy makes me a guppy. The assholes running the asylum are living in their own insane reality. What are the rest of us to do?

“The current Wall Street sham is like a bad Sci Fi movie where the geniuses have populated the world with robots to make our lives better, but alas, there is a flaw in the design and the robots start teaming together and killing us.”

The scarier part is, “the assholes running the asylum” also control the world’s deadliest drone military and nulear arsenal—terror wreaked by artificial stupidity devoid of humane values.

Cash out and invest your money locally, where (a) you know it will do some good, and (b) you know who and what you’re lending too.

My best ROI investment recently was with a local pool cleaning service.

Well, you can’t do anything except place a bet. Everything has a price but nothing has value, so tomorrow’s price is anybody’s guess. Once again the problem is leverage, derivative bets, quantum money. The idea that a specialist system could solve anything is idiotic. What specialist could possibly absorb this kind of volume? It wouldn’t surprise me to find Treasury intervention providing the only real support to stock prices. The only thing dumber than being long in this market is going short.

The best place to invest your money? Probably in a bribe on a government stimulus contract.

Please use the term “lobbying”, “bribery” has been deprecated.

I’m completely with Felix on this one. Equity markets are completely gamed at this point. Individual investors, even large institutional investors are simply cannon fodder for the universal masters of finance, grist for the bonemeal in the bread of the ogres of capital (to spawn a metaphor or two, hey!). Between massive but blunt government shadow interventions that only want assets to go up, high freqs with their death-of-a-billion-nanoctus shaving the coin on normal investors day in and day out, and CDS speculators completely distorting the function of equity markets—to raise liquid investment capital—into wholly predatory mulit-dimensional roulette jigs, these markets are no safe place to place or make money.

This is what we have come to from ‘financial innovation’: digital piracy. If we ultimately get functional reforms to change this state of affairs, it won’t be due to the ire of us in the blogosphere, I fear. It will come from the political revolt of the bulk of the investor class who are being grossly cheated by the Wide Boys and the upper government pay grades captivated by the same. It won’t be a populist revolt which brings change in short, but a capitalist one from those just outside the oligarchy. This can’t come too soon.

Gaming platform pure and simple.

If your new or uninformed your a nub, after a bit some pros might throw you a bone (give up secrets), if your likable or assist them cheating the system/rules, then your a regular, if your driven enough and learn all you can, and apply it with success, you become a pro, and other pros will accept you for your ability to kill/score points. As long as you don’t go after them! Then they gang up and go after you! Which at that point you band together to kill the nubs with relish and glee.

The server nodes around the world for the markets, are just the same for gaming. Bigger/faster more populated platform’s make more money/get more kills for pros.

I can create key macros to the millisecond 10 keystrokes long or scripts to enact complicated action sets with out error…find exploits in the system, holes in the rendering missed by mappers (get under, inside, outside regulated play areas and kill with impunity) or do some grifting (go on opposite team to crate distractions or play poorly to effect the out come of the match)…HFT/darkpools any one.

Disclaimer: I personally play default, more of a challenge that way and it real pisses off the exploiters, to no end, when they spec me.

Kids don’t play these games, most are well educated males in technical or management positions…some mates of mine are nuclear plant engineers, work for Bechtel, security firms, own or run small/medium server nodes etc.

BTW over the last 10 years many of our young university mathematicians, computer hardware and software engineers start off their learning on gaming platforms. Hell even the HQ for Ernst & Young in my region, less that 2 years ago had in house Friday HL2DM (half-life 2 death match) tournaments between departments to sharpen the killer instinct, pull the trigger reflex.

Personally I find all this sophistry surrounding the markets, money creation and destruction, MMT, political nuance and any more steaming excrement you can find to pile on top of this epic fail, the mother of all snow jobs, a true blizzard of lies and deceit, of which your serf ass is slowly carved and steamed and placed before your betters for their gastronomic delight…Bon Appétit.

Disclaimer: I’m full out now, not one red cent invested, less than 5k in the bank, no credit cards/cash only, ZERO debt and will stay that way for ever after, and instructing my kids to do the same when they enter the real world.

Skippy…simple FPS (first person shooter) gaming platform-gaming psychology 101, that’s what Wall st has evolved into, added and abetted by the technology is always…the way forward crowd.

PS. how does it feel to have your life’s toil 401K, Insurance life/health, Mortgage/House, small to medium Business ranked nub status…if they want you, your dead…got that, every part of the system is in their favor, its their system, and every person out side the system control room is just electrons to be traded, from citizens to consumers to electrons…got that.

En Fin…proceed resumption of sophist nuance whilst Hannibal feeds you…your frontal lobe.

How about FX? Where was the inflow?

It’s simple……, “…. It was a drunken swinger’s orgy on crystal meth and Exlax gone wrong….”

The question is, who put the Exlax in the punch…..?

Best regards,

Econolicious

The whole global monetary system is like this huge, complex, corrupt and inefficient engine that’s never run very well but now has thrown a rod and is completely broken…

It’s inertia is keeping it turning over for a while but big pieces are flying off in all directions.

Apparently its engineers believe they can fix it by throwing massive chunks of metal at it while its flying apart.

My suggestion is to get as far away from both the engine and its engineers as possible.

Unfortunately I don’t know where that would be…

I would have loved to be able to make an automatic buy of P&G in the midst of its dip. Don’t know why sell orders are the only automated trades. If we’re going to be subject to so much volatility, might be worth the risk to set up automatic buys of good companies in event of huge dips. Not to bet the whole shop of course.

Very good and plausible explanation of the Big Dive. It puzzels me as to why the comments are so strident and crumpled aluminum hat oriented.

If you noticed, the bear market rally from the lows occured on relatively thin volume; i.e., not much buying strength and not much resistance because sellers had sold. Now comes a concerted move by the makers of the rally to capture profits; ergo, sell in May and Go Away.

As structured, the markets did what they were programed to do and voila, you have a nifty little 700 down and up move on the DOW. I’m not a Cramer fan and not especially enamored of CNBC, nonethless I just happened to see him opine on the P&G flop flip as it occurred. His observations on P&G are cogent in a way that is different than what he expressed directly. As I see it a knowledgable trader wouldn’t sell P&G down that deeply while an algo would. Similarly, knowledagble traders will buy into a selloff if the fundamentals for the asset and the economy are is stable to improving.

I am reminded of the day Kennedy was shot. Market sold off, we lost a whole train of soybean oil and trading was suspended. My little OTC book went very long taking all offers. Like it or not the sun was going to rise on the morrow and there is a very nice Constitutional provision for the contigency of the President’s death. Waited a week, went flat and pocketed a very nice profit and a lovely little bonus in an otherwise mediocre year.

Clearly there are flaws in the current market structure and the controls that are in place. It occurrs to me that eliminating volatility may not be an entirely desirable objective. I always wondered where the specialist went when we had major selloffs. Couldn’t get a bid from him and he’d have been a fool to offer one. Always felt that the liquidity function was a dodge.

Thanks again for this very helpful explanation.

How many days has GS traded with out a loss…eh…do the probability quotient.

GS has ZERO trading loss days in the last quarter.

Felix is right. To paraphrase a saying in the west, this market only has steers and queers – anybody who isn’t a sucker, is a bankster.

Unfortunately, the biggest sucker is the US taxpayer who’s been propping up this rigged game.

Exellent post. I thought it was some sort of market glinch in P&G before which is not far from the truth but is not the whole truth apparently. This is the most plausible scenario. Thanks for sharing.

Yves – the circuit breakers mentioned in the article are not the index arb circuit breakers you hear about sometimes on CBNC – the author was talking about the NYSE’s Liquidity Replenishment Points. They result in slowed trading on the NYSE while the specialist steps in and tries to regain order – but the consequence is that the NYSE’s quotes are no longer “protected” as part of the NBBO, and thus can be traded through on other electronic exchanges (which had much thinner order books)

if you want to know more, let me know, or you can read all about it on my blog. i wrote 6 posts on the “crash” over the past few days.

this whole drama just seems like another good reason to implement some sort of transaction tax on buying/selling.

why would the program traders and hedgies ever stop playing so fast to make a buck (or even a penny) unless you tax them to make them think about whether a transaction is worth it or not.

Hopefully they can keep the food distribution system operating and the lights on! Clearly the political class has become disconnected from real time as they look further to paper over financial events with digital strokes but our JIT food distribution system only has a couple days of inventory which could could not be restocked by pushing a few buttons on the screen!

Barry Ritzholz gives some credibility to the conspiracy aspect to the market crash.

Another potential viticm squeezed today? Ouch!

As I said before, we dont mind to have legal shorts. They are allways welcome.

http://www.jornaldenegocios.pt/index.php?template=SHOWNEWS&id=424791

If you want a good laugh, check out today’s Dow Jones graph. No volatility whatsoever. Either everyone is on their best behavior, or computerized trading has been banned. The bad boys are just sauntering along with their hands in their pockets, whistling some innocuous tune — waiting for the next “big” opportunity. First time tragedy, next time farce. Thank you, Karl Marx.

See also Paul Kedrosky’s piece on the “Shadow Liquidity System” at

http://paul.kedrosky.com/archives/2010/05/run_on_the_shad.html

Interesting piece that echos these thoughts.

What happened is as follows:

1) A human agent pulled the trigger via some computer hack. Much easier to buy on the dips if you can induce them.

2) The problem was “chaotic” in the sense that systems made up of many elements following simple rules create period of unpredictable behavior (e.g. weather, turbulence, world economies, and so on).

If this was a human engineered, but local event limited to one expert hacker, expect more dips in the upcoming months until the hack is addressed, if that can be done.

Whether this was, or wasn’t a human engineered event, expect that thousands of hackers worldwide were suddenly alerted to the possibility that such an event can be initiated in the electronic trading system – to great personal profit. In that case, expect dips to become more and more frequent and severe over time.

If this was a true chaotic event and nobody tries to recreate it (Ha!), then it will happen randomly, but infrequently in the future.

J::: This was neither random nor hacked! On any given day the brokerage houses and individual traders maintain an “order book”, on the major stocks. This is called “market depth”. Ranked orders to buy and sell an individual company’s shares at different prices.

This is maintained for two reasons:

a) to provide price stability and

b)in case of an opportunity to by these premium shares at a discount if there is a sudden downturn. The same rank of orders exists on the upside to sell if there is a sudden opportunity on that side. All the major brokerages probably have contractual obligations with companies the size of P&G and Apple to provide this market stabilizing function.They are called Market Makers. In return for doing so they recieve what amounts to a first call on all information about the company and other advantages. They make profits from that. So where were these companies when the orderbook suddenly became unbalanced? These people who could just lift a phone and get honest information about the health of Proctor and Gamble and anyone else. They probably removed most of their underlying buy orders and began selling into the remainder (in effect selling to themselves and their cronies) until they overwhelmed the resistance of the individual buyers. In the case of the bravest of these individuals the market regulators made certain that they did not profit from their actions by decreeing that transactions in stocks that fell 60% would be canceled??? Why this cut off, I’ll probably never know, but somebody does.

These points are very similar to the issues I raised in our “Price Shock Update”. It was a good old fashioned crash, this time propagated by program trading and algorithms. http://bit.ly/cBFAww

…and nobody responsible for making a fair and orderly market, leaves us susceptible to this –

http://www.huffingtonpost.com/janet-tavakoli/banging-the-us-stock-mark_b_570239.html