This Sydney Morning Herald story (hat tip reader Gordon) highlights a Bank of England report that not only points out the magnitude of the financing needs of major banks over the next few years, a daunting $5 trillion, but also indicates that US and European bank refinancings are falling short of their rollover calendar. This suggests that we may witness a combination of balance sheet shrinkage and more covert and overt funding support.

From the Sydney Morning Herald:

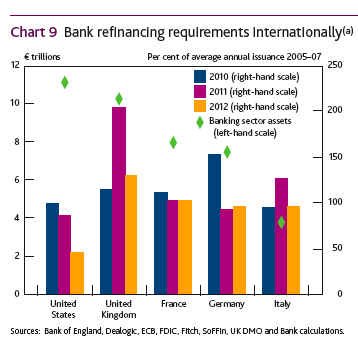

Banks around the world must refinance more than $US5 trillion ($5.8 trillion) of debt in the coming three years, a massive rollover that poses threats to financial stability and growth.

The need to replace these funds, which are medium and long term, will place pressure on bank profit spreads and in turn may either prompt deleveraging, where banks sell assets that they can no longer economically finance, or simply lead to a bout of credit rationing, where borrowers must pay more to borrow, thus crimping investment and economic growth…

US banks have issued $US230 billion of debt in the first five months of the year, about 60 per cent of the rate they need to achieve over the three year period. Euro zone banks have issued $US133 billion, or about 70 per cent of their needed run rate.

One easy to see consequence is that, all things being equal, the cost for banks to issue debt should rise, as should competition among banks for consumer deposits. It is possible that a global desire to save more helps to blunt this effect, but even so the macroeconomic effect and the effect on asset prices will both be strongly downward.

The Bank of England June 2010 Financial Stability Report gives a more detailed breakdown:

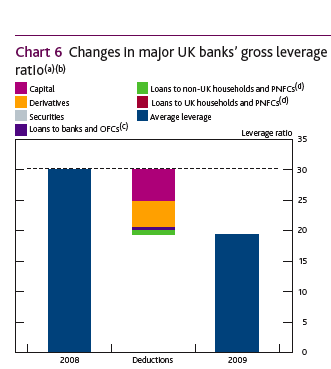

This is what deleveraging looks like…and note that these challenges remain after banks have already made progress in improving their capital buffers. This chart shows the fall in UK banks’ overall leverage (click to enlarge):

The headline 5.8 trillion is in Australian dollars – the article itself uses 5 trillion U.S. dollars. Even these days, 8/10ths of a trillion is still a real amount of money.

Thanks, and I checked against the Bank of England report detail, which says “at least $5 trillion” FWIW.

In retrospect, putting the big banks into receivership wouldn’t have been such a bad idea…don’t you think, Mr.President?

2012 huh? Just in time for the next election cycle. Sounds like it’s going to suck big time.

Excellent post, and excellent obersvation by the folks at the Sydney Morning Herald. I wish we had journalists in the U.S.

The one thing that I’ve been puzzled by over the last few weeks is why is Wall Street calling for austerity? Yes, I know that it is “officially” Germany, the UK, and the G-20 calling for austerity, but we know who is calling the shots. I’m talking about Obama’s bosses.

It’s now clear to me that Wall Street needs to reset expectations in order to preserve their valuations (i.e., stock prices) in the face of the impossible task of convincing people to take on debt that they cannot afford. There is zero possibility of Wall Street showing earnings growth unless they can fill the credit shortfall, and they know they can’t. The best they can do is adopt a Mad TV inspired “lowered expectations” model of courting shareholders to keep their stock price up. And they will have the added bonus of buying our deflated real assets using bailout money that we have been forced into austerity to pay for. Nice.

The Borg are moving on to emerging markets where debt/gdp levels are still low. There they will be able to load up the masses with debt and continue their modus operandi.

http://baselinescenario.com/2010/06/29/what-is-goldman-sachs-thinking/

http://www.youtube.com/watch?v=WZEJ4OJTgg8

that’s just what I said last year. The world is full of billions of people with no assets and no debt. All you have to do is get them to stop killing each other in tribal wars — and then monetize Nature (like the minerals in Afghanistan) by lending against it. And then you have wealth and profits.

And you can monetize the absence of killing and presence of cooperation. And when you monetize all of it, you can reboot the Big Rape Machine, oh, for at least another generation. The big problem is consciousness itself. We go from tribe to whole and then back to tribe and then to whole == like a staggering drunk. And “the whole” constellates around “property”, “money”, “Islam”, “Communism”, “DemocracY” etc. Ying and Yang, Zero and One, bit and byte, particle and wave — al the dualities shrink to one and then they divide into two — like the day destroy the night, night divide the day, try to run try to hide -J Morrison —

So yes, Nature everywhere can be monetized and so can people and if it all works out, they can thread the needle.

But getting it to work out, that’s why the American military is everywhere. Because the heathen rage. And why they need fiat currency, to lubricate it all, to lubricate the Hand of the Angry God of the Old Testament and Acts of the Apostles and the Big LifeGuard with the tan.

Thus saith Profitus Maxiumus,

Book V

The Confabulations of Sesterces

Immeasurable sums, so close to infinity that no human will ever understand their meaning.

The End

A now, a random theme song…

http://www.youtube.com/watch?v=Tybj8l9qa0A

Nothing to see here,

from the report:

“UK banks also need to extend the maturity of their wholesale funding, around 60% of which falls due within one year.”

That’s just not true. Maybe it would be smart to lock in long term rates at reasonable prices, but that hurts the bottom line. They will roll it short for some time. You know it, I know it and the American Public knows it.

The Banks will be slowly recapitalized and de-levered at the expense of savers across the globe. The mechanism will the various central banks, and it may or may not stagnate growth for years. Oh well. Or as they said in the report:

“That underlines the importance of some front-loading of efforts to term out funding, despite its relatively greater cost given the current slope of the yield curve. (they’ve acknowledged the inherent instability, but they just won’t do it. Cuz it costs more)

and

“It is possible that a global desire to save more helps to blunt this effect,”

Thats an under-appreciated statement. Loaning money to JPM or Deutsche is like buying Treasuries. Yield hunters will oblige. Your pension will be buying these bonds like mad.

Maybe its wishful thinking that the “Banks will get in trouble”, so we can get tough with ’em. That ship has sailed…

Reminder, they were levered 40 to 1, blew out as hard as possible, and are still standing. (Fuck, some of em have decent stock prices still )They’ve cut leverage down significantly, are getting direct and indirect subsidies across the board, getting assets stripped off their books at par, and no one really even wants a loan anymore anyhow. ( Private sector too busy retrenching themselves.) So that’s less debt they need to roll on average.

So their earnings wil suffer a touch, but with the yield curve steep, and global rates low-ish, and the express backing of the full faith and credit of any central bank, They’rre baaaaackkkkk….

Now the Auzzie banks have a nice playbook to run off of if/when their bubble pops.

Well you certainly seem to have it all figured out.

Personally, I think I’ll throw my lot in with craazyman, who asserts that “if it all works out, they can thread the needle.” (emphasis mine)

But a can is not a will, which is one of the points Martin Wolf was trying to make in his article in today’s “Links.” The assumption that austerity will result in renewed growth is, well, just that, an assumption.

Agree with Scharfy, by their nature, banks borrow short and lend long. Obviously, if you look at their liability structure, they will tend to have more short-term liabilities than longer term ones, and they can always roll them over, at a price, if there is confidence in solvency. What alternatives are there for holders of these $5trillion of notes? What other asset classes are there to absorb $5trillion? If enough bank noteholders pile into treasuries and agency-backed paper, it will lower their yields and increase spreads on bank paper, increasing the attractiveness of bank paper. Somehow we will reach an equilibrium.

I would say that Italy is looking a bit under water, so to speak. But maybe its holy water and so that would be ok.

How does “Chart 6” work? The deduction column is showing from which class of asset the reduction in leverage came? If it’s mostly “capital”, that implies that the banks are leveraging up less on factories? Sorry for the stupid question, I was trying to think that graph through and just couldn’t figure out what the implication was.

Interesting stuff. But is this large in a historical context? We know that bank balance sheets have been shrinking for 2 years. This, all else equal, would suggest that previous rolls were larger (although market conditions were obviously better).

Hi Yves,

That is my column from Reuters, which the SMH ran without byline or credit. Here is a link to it on Reuters, or you can read it in today’s International Herald Tribune.

http://blogs.reuters.com/great-debate/2010/06/29/the-5-trillion-rollover/

Thanks and bests,

Jim Saft

Love the blog, btw.

Also – Tao, I am based in the U.S., in Alabama.

When I linked to your piece in the SMH (in the Links thread for 29 Jun. – picture of ferret) it was in the context of a question. What is the point of further QE (which Ambrose Evans-Pritchard is predicting) if the money is just going to sit in banks’ accounts at central banks or is going to be warehoused as banks’ capital?

I don’t see how, now that we’re at the zero lower bound, that further QE is going to benefit Main St. Of course, this is basically the Prof. Krugman line, but it seems very plausible to me.

Further QE aimed at filling a $5 trillion hole in banks’ balance sheets seems to have no economic logic, if economics is more than just financial manipulation.

Any thoughts?

And a P.S.

There is another Ambrose Evans-Pritchard piece (see Links for 30 Jun.) where he says (in between excoriating Kartik Athreya) that:

“The Fed has since made a hash of quantitative easing, largely due to Bernanke’s ideological infatuation with “creditism”. QE has been large enough to horrify everybody (especially the Chinese) by its sheer size – lifting the balance sheet to $2.4 trillion – but it has been carried out in such a way that it does not gain full traction. This is the worst of both worlds. So much geo-political capital wasted to such modest and distorting effect.

“The error was for the Fed to buy the bonds from the banking system (and we all hate the banks, don’t we) rather than going straight to the non-bank private sector. How about purchasing a herd of Texas Longhorn cattle? That would do it. The inevitable result of this is a collapse of money velocity as banks allow their useless reserves to swell”.

Pretty much what I’m asking about, though buying cattle might not have the max. “bang for the buck” on Main St.

Glorious. There is stuill a chance to let this fradulent system collapse. Bring it on…

Sad but true.

As the article states:

The track record of the past three years tells us one thing is likely: the banks will get their money, courtesy of government support if needed.

Unless there is a profound sovereign debt crisis, we can count on governments taking the needed steps to see that the banking system does not fall over for lack of funding. So, if liquidity or support schemes need to be extended or invented anew, they will be.

So the only way to topple the existing governments in the US, Great Britain and Europe—-where the neoliberals have their hands firmly upon the levers of political power—-is to bring the entire house of cards tumbling down.

Are we sure it is not $15 Trillion? – http://www.zerohedge.com/article/us-lunatic-asylum-ie-economy-facing-approximately-15-trillion-roll-risk-2012

All of this is just financial terrorism and suicide-debt bombers.

Think the esteemed zero hedge was quoting Moody’s data while I based mine on research by the Bank of England.

Hmmm, an organization which rubber stamped a financial apocalypse vs one which presided over the silliest housing bubble this side of Dubai.

This is true indeed. Now take into consideration that Moody’s was put on watch for a downgrade by S&P and you now have even further reason to doubt the authenticity of the $15 Trillion. Perhaps it is even higher.

http://www.forbes.com/feeds/ap/2010/06/30/business-broadcasting-amp-entertainment-us-s-amp-p-moody-apos-s-rating_7733776.html?boxes=financechannelAP

This is a circus of nonsense.

“financial terrorism and suicide-debt bombers”

Great lyrics; I’m writing the music today!

I have to give credit where credit is due, so thank Max Keiser for those terms.

I met with someone in Compliance for the Dealer Specialist Department of Key Bank in my area when paired up golfing over this weekend. When he and I got to the point of conversation where we asked what each other does, I could hardly contain myself. I asked him, “With 70% of the market being traded by HFT primary dealers that have access to ZIRP, those same primary dealers recycling the free money into treasuries to support the bond market, and then taking those negative interest risk-free profits back in the equity market, who in the hell would put any “retirement” money into the US stock market?” He could only reply the HFT is just providing liquidity to the market. I said that is just a PhD word for legalized theft. He laughed and said, “I’ve really never seen anything like this since I have been in the compliance end of the market since the early 80’s. What you said is precisely why money is on the sidelines right now.”

I told him I had one more question to add and then we could get back to talking about golf and what not. I asked, “Is it true that the majority of banks are insolvent right now. The FDIC is in the red and Tier 2 and Tier 3 capital requirements are mark to myth and no bank has realized the full extent of the losses on their balance sheet yet. Is that a correct assessment?” He didn’t answer and we just went back to golfing.

F’ this fractional reserve fiat paper dollar world.

yes how do with bring these banks/governments down, so we can crash this house of cards. that is the only question that need answers. the sooner the better

If banks started to sell off assets, this could well expose the overvaluation of those assets and the likely insolvency of the banks. This would be a double whammy. The triple whammy would be a mass sell off would create a classic Fisher deflationary debt spiral on top of all this.