A news story today provides further confirmation of the rule by the banking classes in the US, with only token gestures to the rule of law. Per Bloomberg (hat tip Tom Adams), Citigroup is ponying up $75 million to settle SEC charges that the giant bank was not sufficiently forthcoming in the runup to the financial crisis about losses on billions of dollars of subprime exposures:

The company made misstatements on earnings calls and in financial filings in 2007 about assets tied to subprime loans, the Securities and Exchange Commission said in a federal lawsuit yesterday in Washington. Some disclosures omitted more than $40 billion in investments, it said. Citigroup’s former chief financial officer and head of investor relations agreed to pay a total of $180,000 for failing to disclose the risk….

Citigroup executives publicly stated four times in 2007 that the New York-based bank had reduced its exposure to subprime mortgage securities by 45 percent to $13 billion, as investors and analysts clamored for information about the deteriorating market.

The Financial Times provides additional detail:

The SEC said Citi stated four times in July and October 2007 that it had reduced its subprime exposure from $24bn to $13bn at the end of 2006. Yet the bank failed to inform investors until November 2007 that it held more than $40bn in “super senior” tranches of CDOs backed by subprime mortgages and related instruments called “liquidity puts”, the SEC claimed.

Yves here. I guess I am a bit thick. In 2007, subrpime exposure was the thing investors were most worried about. Recall that the first acute phase of the financial was in August-September 2007, when the asset backed commercial paper started contracting and money market investors shunned funds that had any taint of subprime.

Recall also that Sarbanes Oxley, passed in 2002, provides that a public company’s principal executive and principal financial officers certify both annual and quarterly financial statements for accuracy and completeness. Section 906 further

contains a certification requirement subject to specific federal criminal provisions and that is separate and distinct from the certification requirement mandated by Section 302.

So….what do we have here? A $75 million fine, imposed on the company…and so coming out of Citi’s coffers, which comes (in theory) from shareholders (but given that financial firms pay high percentages of revenues in bonuses, this fine would have a microscopic impact on pay levels).

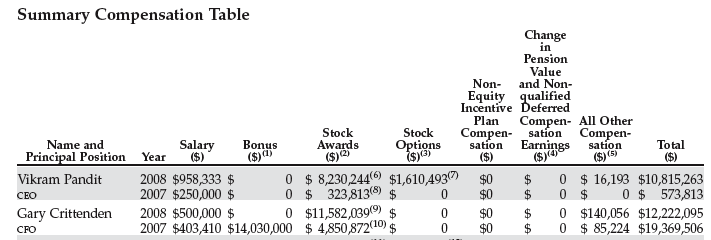

More striking is the mere slap on the wrist of the execs involved. The former Citi chief financial officer, Gary Crittenden, who held the job from March 2007 to March 2009, will pay $100,000 of the total $180,000, with Arthur Tildesley, then in charge of investor relations, agreeing to cough up $80,000 to settle charges.

To give you a sense of proportion, Crittenden was Citigroup’s second highest paid officer. From Citigroup’s 2009 proxy:

He also sits on 8 boards. Do the math: this settlement is a mere inconvenience. And note, more important, the failure of the SEC to pursue Chuck Prince (in charge through November 2007). If investors weren’t finding the answers to vital questions in the bank’s financial statements, one could argue the written disclosures weren’t adequate either (it appears the SEC wasn’t willing to pursue this angle).

And Citi virtually thumbed its nose at the charges in its statement:

Mr. Tildesley is a highly valued employee of Citi and is making significant contributions to the company.

As Tom Adams noted:

When people talk about banksters this is what they mean – lying with impunity is not only not problematic, it is critical to career advancement and company “success”.

The message seems pretty clear. Sarbox was intended to curtail phony corporate accounting in the wake of Enron. But why resort to complicated transactions like the energy company’s famed Raptors when Citi shows that mere lying will produce the same results with much less fuss?

Since we no longer have the rule of law in the grand old USA, there is no reason to hope for anything better.

Yves,

If Wachovia was able to escape ANY consequences for laundering 384 billion dollars of drug money for the Mexican drug cartels, you think Citi would get a stiff penalty for lying?

We have no rule of law for those who kill, maim, fight oil and pipeline wars, and steal from other sovereign governments or from the US taxpayer. It is shameful that Obama is a part of this total abdication of moral responsibility. But don’t worry, the guy who leaked to Wikileaks will no doubt get the book thrown at him.

The Street’s water carriers have promptly swung into action:

http://www.theatlantic.com/business/archive/2010/07/the-insignificance-of-citis-75-million-fine-for-subprime/60640

groan…….

Without the rule of law providing a disincentive to misstate earnings and assets, investors are left without protection against false accounting.

As this ruling shows, the law and its enforcers have no real teeth.

Therefore, the investor has no protection. The 10-Q’s aren’t worth the paper they’re printed on, since they can be falsified with impunity.

Market investors are practically back to square one (pre-SEC Act of 1934)

Alright by me, but this new risk factor demands a much higher dividend, without which I cannot justify investing in stocks, particularly financial stocks.

It’s honestly amazing to me that TPTB don’t realize that they’re destroying the social contract upon which civil society depends…

A government that asserts its legitimacy via a claim that it acts as an agent of its people must achieve:

“consensus NOT by universal agreement on any specific law or policy, which is a very rare event… but a consensus that rests upon a common faith that the process was generally fair and that the intention was for the common good to the extent those representing us could determine.”

Money and the Machinery of Representation

http://culturalengineer.blogspot.com/2010/07/money-and-machinery-of-representation.html

Things like ‘accountability’ don’t seem to apply to some… and the contempt for the citizen’s ability to perceive this… and the lack of workable political mechanisms for citizens’ to respond effectively is paving the way for an ugly political and economic future.

While it does seem to be possible to “Fool some of the people all of the time, and all of the people some of the time”…

and the success both parties have had at that… has made the political/economic elite quite cocky about their ability to continue the show…

It’s inevitable that the rest of that quote will finally be recalled.

The entry points into the political system we have (the Republicrat Party) is nothing more than a sociopath vetting system. If a politician proves to the owners of the Party he’s sociopathic enough (an amoral scumbag who will say anything in return for bribes – aka campaign contributions) he’ll get promoted to higher levels within the Party. This means TPTB in the Republicrat Party are simply THE smartest amoral scumbags of the political system.

It’s pointless to analyze the effects of politics without making a stab at the psychology of the system.

So, regarding this:

It’s honestly amazing to me that TPTB don’t realize that they’re destroying the social contract upon which civil society depends…

Why would sociopathic politicians care about “society”?

Wow! 75 million! They probably had that hanging around in cash in their wallets.

I’m sure this will change their future behavior… :)

Vinny

Only three more months and then the ‘blame the Republicans’ meme can really start to bite. We know that the journOlist members reconfigured on some other smalled listserv will shut down any suggestion that this WH sold Americans and every other ordinary investor straight down the river. I always suspected that Dems were every bit as corrupt as Republicans, as indifferent to the plight of the poor, ignorant of the most fundamental laws of fair play and accountability.

Politicians come and go. Banksters are forever. They’ll still be pulling the strings after November and both sides will be happy to blame the other while taking the banksters cash to fund their election campaigns. Utterly revolting and highly instructive.

Welcome back.

Predictable in a society run by sociopaths.

No point in worrying about stuff like this anymore.

Just in case the administration and Citigroup lovefest wasn’t strong enough, the appointee for OMB director probably still has some of this deposit from Citi sitting in his bank account:

http://www.washingtontimes.com/news/2010/jul/28/omb-nominee-got-900000-after-citigroup-bailout/