Even though St. Louis Fed President Jim Bullard created a bit of frisson last week by discussing deflation, and Treasury yields are awfully reminiscent of Japan, investors and consumers have been so conditioned to be on the watch for inflation (particularly increases in food and fuel prices), that the suck of deflation on much bigger fronts (housing and increasingly, pay) is not being weighted as seriously as it deserves to be.

Steve Greenhouse of New York Times, keying off a data release earlier in the day that showed a teeny fall in incomes, reports that more employers are rolling back pay. It’s most common among state and local government employees, but far from limited to them.

It is hard to prove in a tidy way, but I see more signs of discounting in the economy, even in goods and services aimed at upper income consumers supposedly unaffected by the downturn. There is a great deal of price cutting afoot, even in TARP/Fed funded Manhattan, via keeping nominal prices the same but offering more widespread and deeper “special” discounts or freebies. Readers are welcome to add to this list: rentals (free months, free amenities), health club memberships, cruises, decorators.

From the New York Times:

Pay cuts are appearing most frequently among state and local governments, which are under extraordinary budget pressures and have often already tried furloughs, i.e., docking pay in exchange for time off. Warning that they will have to lay off people otherwise, many governors and mayors are pressing public employee unions to accept a reduction in salary of a few percentage points, without getting days off in exchange.

At the University of Hawaii, professors have accepted a 6.7 percent cut. Albuquerque has trimmed pay for its 6,000 employees by 1.8 percent on average, and New York’s governor, David A. Paterson, has sought a 4 percent wage rollback for most state employees. State troopers in Vermont agreed to a 3 percent cut. In California, teachers in the Capistrano and Pacheco school districts have accepted salary cuts…..

In a 2010 survey by the National League of Cities, 51 percent of the cities that responded said they had either cut or frozen salaries of city employees, 22 percent said they had revised union contracts to reduce some pay and benefits, and 19 percent said they had instituted furloughs.

Some businesses are also cutting workers’ pay, often to help stay afloat or to eliminate their losses, although a few have seized on the slack labor market and workers’ weak bargaining power to cut pay and thereby increase their profits and competitiveness….

Factory owners sometimes warn that they will close or move jobs to lower-cost locales unless workers agree to a pay cut. In its most recent union contract, General Motors is paying new employees $14 an hour, half the rate it pays its long-term workers.

Sub-Zero, which makes refrigerators, freezers and ovens, warned its workers last month that it might close one or more factories in Wisconsin and lay off 500 employees unless they accepted a 20 percent cut in wages and benefits…

David Lewin, a professor of management at the University of California, Los Angeles, who has written extensively on employee compensation, says some cuts are also quietly taking place among nonunion employers.

Reed Smith, a firm with 1,500 lawyers, has cut salaries for first-year associates in major cities to $130,000 from $160,000. Warren Hospital, a nonunionized facility in Phillipsburg, N.J., ordered pay cuts of 2 to 4 percent because lower Medicaid reimbursements had squeezed the hospital’s finances…..

Fast-rising pension and health costs are making benefit costs grow more rapidly than wages, some employers say, and cutting wages is often easier than other ways to pare labor costs. But some workers say these cuts are unfair at a time when corporate profits and employee productivity have risen strongly.

With this sort of pressure on incomes (both direct and indirect; even if an employee’s compensation is intact, there is no assurance it will stay that way), it’s no wonder consumer confidence is plunging. In addition, the Consumer Metrics Institute, which maintains a set of indexes on consumer spending, sees patterns that bode ill (hat tip reader Scott):

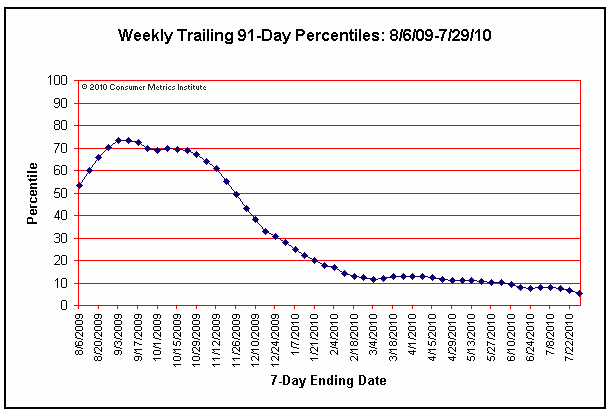

Since last week our ‘Daily Growth Index’ has dropped significantly, putting the trailing 91-day moving ‘quarter’ at a contraction level that would place a similar calendar quarter of GDP growth below the 5th percentile of all quarters since 1947. Under normal circumstances we might expect a quarter that bad once in slightly over 5 years:

The chart above clearly shows that things were much better one year ago, when the recovery was peaking in late August and early September of 2009….The decline during in the 4th quarter of 2009 was spectacular, and it has been steady throughout 2010. For those of you who are curious, the last time that our ‘Daily Growth Index’ passed the 5th percentile on the way down was on July 16th, 2008.

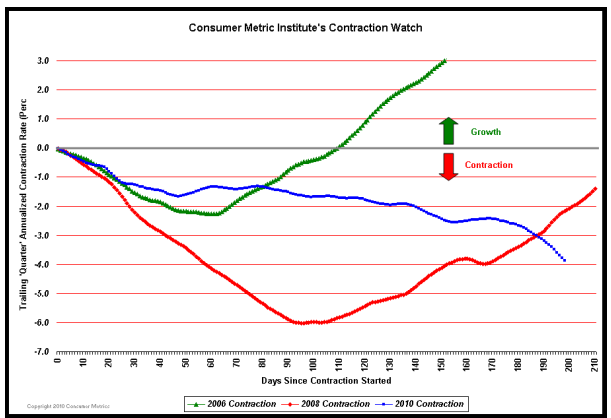

Yves here. In another shades of Japan development, the consumer falloff, while not as bad as 2006 or 2008, looks more stubborn:

More telling perhaps for economic forecasts is that the longevity of the current contraction is somewhat rarer than its nominal severity. Our 183-day moving ‘two consecutive quarters’ growth index would place that 6-month span in the 4th percentile of consecutive quarters since 1947. Only roughly one in every 25 six-month periods since the first Truman Administration would have been worse. The lingering nature of the current contraction can be seen in our Contraction Watch:

…. As we approach 200 days of contraction the 2010 event is now worse on a day-by-day basis than either of the two earlier slowdowns, and unlike the prior two events the current one has not yet formed a bottom.

I didn’t read this yet but I just wanted to say that when I came back from overseas a few weeks ago the first thing I said to myself after doing my almost daily comparison of prices was “oh shit, deflation has taken hold…we’re about to go through some nasty shit”.

Paul Volcker, 1979: “The standard of living of the average American has to decline”.

Empire is ever harder to maintain for the U.S. ruling class and the serfs much be prepared to sacrifice , if not in battle then on the homefront.

must be…

But at least as SERFS we would have jobs for everyone!

I’ll bet you my last n’gwee that we won’t see any cut in executive pay and bonuses within corporations that require sacrifice from their workers.

No, no, no… this has to be wrong.

Bernanke just yesterday said rising wages will lift the economy.

Sure you have charts, be he’s the Fed chief! He should know, right?

Right?

Raising wages will lift the economy. But no employer will raise wages.

Yves,

Perhaps my memory is wrong, but I thought wages in the depression and in Japan were not a strong part of deflation. The expression “the depression wasn’t so bad if you had a job” reflected higher purchasing power for those who remained employed.

In my world here in Seattle, we are catching up with the rest of the country on home price deflation, but there still seems to be bidding wars for technical talent.

Yes, this is correct. Because part of what produced the depression, as opposed to the recession that began it, was the policy of keeping wages and prices high. As part of this, price cartels were encouraged, and closed shop unionization was encouraged also. The predictable result was a two class economy where those in work did OK, but there was severe lack of investment and companies were very reluctant to hire, and demand remained low.

What changed? In 1936 the US abandoned the earlier Hoover-Roosevelt approach, and implemented something like modern IMF measures. Having freed up the economy, things improved a lot. This, before anyone brings it up, was before pre-war rearmament.

Those are the facts and are generally accepted by economic historians and economists. Of course, in some quarters, to say this, is instantly to categorize oneself as a neo-liberal right wing fundamentalist anti-evolution Tea Partier…. But that does not change the facts.

Are you completely out of your mind? That’s a a flat out incorrect depiction what happened in the Great Depression, in terms of timing, policies, and outcomes.

The deflation, which started in 1930, did feature an effort by Hoover to keep wages up and a gold standard. Even JP Morgan, in one of his only two public pronouncements in his life, spoke in favor of Roosevelt going off the gold standard and specifically endorsed the idea that it would combat deflation. However, unions most certainly were not weakened by the Depression, as you imply (Google Wagner Act). Wikipedia: “In 1934-36, during what the US department of state calls the “Second New Deal,” Roosevelt and his party moved left, and added social security; the Works Progress Administration (WPA), a national relief agency; and, through the National Labor Relations Board, a strong stimulus to the growth of labor unions. Unemployment fell by ⅔ in Roosevelt’s first term.”

“Everything was fine if you had a job” is also utter crap. The impact of commodity price deflation on farmers, a much more important part of the economy than now, was devastating until abandoning the gold standard and direct intervention in the gold market provided relief. Did you forget the impact of bank failures? My grandparents had jobs during the Depression. One lost all their savings (in three banks) due to bank failures and as a result lost their house, the other was reduced to getting meat (3 oz of beef) once a week, for a family of four.

The growth that the Roosevelt deficit spending, the polar opposite of modern IMF measures, which BTW were supported by a cohort of large banks and multinational firms (read Tom Ferguson on this one, the idea that Roosevelt didn’t have support of businesses is also rubbish), led to very rapid GDP growth. Wikipedia notes, “The economy reached bottom in the winter of 1932-33; then came four years of very rapid growth until 1937, when the Recession of 1937 brought back 1934 levels of unemployment.” Premature efforts to balance the budget in 1936 led to a resumption of the Depression in 1937.

Ah, yes. The Golden Rule. Excellent book. Point is that Roosevelt had the support of more capital-intensive industries. His policies helped labor, which impacted labor-intensive sectors more; and the benefit to the cap-intensive guys of supporting R was access to the power of the state.

Not correct. I worked for one of the biggest Japanese banks. They’ve had massive wage compression. At big companies (and remember, in Japan, unlike the US, big companies have been much more important in terms of overall hiring and employment), bonuses (more modest than in the US at banks, but still a part of annual comp) pretty much disappeared, with the result that workers, including those who wind up in management, see virtually no pay increases over their career. The lack of expectation of any rise in pay over one’s career is a very big deal, as my Japanese colleagues stress to me.

The deflation isn’t sharp, unlike what happened in the US initially in the Great Depression, but to say mild deflation hasn’t had an impact is incorrect. The Japanese domestic sector has been terribly weak as a result, what’s kept the economy going has been a continued robust export sector (at least until the yen went through the roof recently)

My research into how private, North Carolina colleges handled the Great Depression (published as “Managing Hard Times: How Five Colleges Survived the Great Depression”) contradicts the notion that the depression “wasn’t so bad if you had a job”. One college had good payroll data from that time, and the average faculty salary went from $1418 in 1929-30 to $1050 in 1933-34 (a 26% reduction) and had only partially recovered to $1105 by 1938-39. Two colleges only paid part of the promised salary to their faculty – they were given IOU’s for the remainder of their pay. The colleges were still paying owed wages at the end of the depression. Correspondence from public university officials indicated that UNC faculty and staff suffered salary declines in excess of 30% during this period. So deflation in salaries was probably wide-spread during this period.

Well, this is what Wall Street wanted. Obama, Bernanke and the GOP have obliged them.

Hope it works out for everybody.

State and local governments are badly squeezed therefore lowering wages is typically a better solution than layoffs. The private sector is doing much better and many companies show significant increase in profits. If such companies lower employees’ income they should be publically shamed and pressure should be applied to them as hard as possible. (The administration can close contracting, financial support and may be send an IRS audit team in their direction – war is war.)

Any anthropo-economists here?

I am curious to know if Neanderthals had to worry about deflation or hyperinflation.

My guess is that, once you learn to hunt and gather, you will never go hungry nor out of work, whereas if you get a prestigious Ph.D. in economics, you might still die of starvation and/or unemployed.

Re: I am curious to know if Neanderthals had to worry about deflation or hyperinflation.

There’s got to be a caveman skit regarding economists in here someplace.

Could someone tell me what a ‘bankster’ is? Is it someone who works for a bank? Or someone in management at a bank? Or a bank shareholder? Or does it bear the same relation to banking that “Micro$oft” bears to “Microsoft”? That is, it refers to the exact same thing, but has the equivalent of a smiley after it to express the writer’s feelings?

“Bankster” means a member of a class of thugs in the financial sector who (a) extract enormous economic rents, and (b) gamble, collecting when they win and backstopped by the state when they lose.

We averted a Great Depression 2 through a policy response of unprecedented scale. Now we’re heading for a repeat of Japan’s Lost Decade+, and there is no policy response on the horizon. TPTB are clearly aware of the risk, and the fact that the risk is slowly becoming reality, yet are either unwilling or unable to muster a response.

Wealthy ruling elite deflationary herd thinning flight, “Operation Perpetual Conflict”, continues its precision radar descent through the fog of propaganda …

TOWER: “increase speed to 240 knots maintain 230 knots

reduce to minimum approach speed”

WRE: Copy that.

TOWER: “slightly below glide path correcting nicely”

WRE: Copy that.

Deception is the strongest political force on the planet.

Farmers were hit hard by the depression. My mother told me that one year they took their yearly tobacco crop into the warehouse for the auction and the floor charges exceeded the price they received for the crop! The cash from that crop was supposed to tide them over the winter, buy items they could not produce, and plant the next years crop.

Here is a link to Consumer Price Index for All Urban Consumers: All Items-

http://research.stlouisfed.org/fred2/data/CPIAUCNS.txt

Note that in 1929 the index was 17.3 before it started to fall. It fell to 12.6 in 1933 before starting to rise. The index returned to 17.3 in 1943.

So it took about 14 years to return to where it started in 1929.

As to today, there may be some price cutting but there is also some price raising on items which we can not do without. I don’t think my cost of living is going down. The official statistics are so unreliable that it will take years to get the truth.

We are approaching the new normal. Once there, we can prepare for the next step down to an even lower normal. (I am assuming that our national policies on global free trade will stay the same.)

International trade statistics 1999 from the WTO (See Table II.11):

http://www.wto.org/english/res_e/booksp_e/anrep_e/anre99_e.pdf

In 1998 we imported .944 trillion dollars and exported .682 trillion dollars.

International trade statistics 2004 from the WTO (See page 19):

http://www.wto.org/english/res_e/statis_e/its2004_e/its04_overview_e.pdf

In 2003 we imported 1.303 trillion dollars and exported .723 trillion dollars.

International trade statistics 2009 from the WTO (See page 12):

http://www.wto.org/english/res_e/statis_e/its2009_e/its09_world_trade_dev_e.pdf

In 2008 we imported 2.169 trillion dollars and exported 1.287 trillion dollars.

Is it any wonder that other countries’ economies suffer when our economy sinks?

We will repeat the Japanese experience unless we address our fundamental underlying problem. We need to move toward more American workers producing and selling to each other.

Don’t hold your breath. :^)

I don’t know how globalization will survive without a robust U.S. consumer. Even the relatively minor piracy in Somalia is a direct result of the U.S. being bogged withdrawn. A first class Navy is dependent on a relatively prosperous people. World navies are stretched just to deal with the Somali pirates who aren’t even anarchist-types. Globalization and climate change will lead to more Somali-like pirates, and no one will be able to deal with them. The new normal will probably represent the end of a number of nation-states and a collapse of the trade of manufactured items.

Jim,

“I don’t think my cost of living is going down.”

It isn’t! The CPI is a real laugher… excluding food and energy???? Prices are not falling as would be expected in a deflationary cycle.

I have noticed that the prices for many items in grocery stores have remained the same but that the quantity/volume/quality of the product purchased for that amount has decreased? Same amount of money buys LESS and LESS… Purchasing power per unit is decreasing. Have you noticed this? To my way of thinking, this is INFLATION – not deflation.

Explains why plastic bags are used instead of the standard brown paper ones. With a zillion plastic bags full of one or two items, the consumer believes that his/her money is buying alot – after all the grocery cart is FULL. If it was the standard brown paper bag, he or she would quickly realize that the same amount of money is buying less. Of course, with credit/debit cards now widely in use, this practice itself masks this “shorting” as well. If one pays in cash the effect – bite out of your ass – is much more immediate!

There is a very cogent quote above to the effect that the average US citizen has to reduce his standard of living. The wage compression noted here is the product of a market enforced reduction in living standards.

So long as there is this enormous labor arbitrage between the US and the rest of the world, especially China and the rest of asia, you will have this problem of economic imbalance.

The easy solution in the thirties, and today, is seen to be something called moderate inflation or quantitive easing. The collapse of markets in the thirties was the product of easy credit, rampant speculation and fraud. The problem we have today is, at its core, essentially undifferentiated.

For those employers who are squeezing wages, they should prepare themselves for the consequent reality of reduced demand. What they and what most of the economic players have yet to focus on is the fact that the medium of account, the money we use is the problem.

Consider the house price bubble which is in the process of correcting itself. Did that rapid runup in house prices occur because we had this enormous shift to the right in the level of demand for houses; or was the apparent price appreciation the result of the realization of an accelerating rate of reduction in purchasing power? Was this house price bubble facilitated by the energetic use of credit money? As we have all this credit money to play with do we not need to put it out there? Gotta get some yield because this stuff won’t buy much tomorrow.

A critical engine in the initiation and acceleration in the rate of inflation (the loss of the purchasing power of the medium of exchange) is credit money. The lender issues a credit denominated in the medium of exchange. That transaction is a transaction in credit money. When the credit money is subsequently spent it becomes money undifferentiated from base money.

So was/is the house price bubble merely a speculative bubble; or is a profound statement as to the fallacy of a fiat currency coupled with fractional reserve banking gone amok operating as the fuel for unprosecuted fraud?

What would be the ideal resolution? A rise in the living standards of the rest of the world concurrent with a reduction in the living standards of the US to a point of near equilirium. Or perhaps a nice period of QE. Either way, the exit door is for reduced US living standards.

“Either way, the exit door is for reduced US living standards.”

For all but those at the top, who will wind up richer than ever. This BTW, is by design and the inevitable result of the policies pursued for the last 3 decades.

I think the cheap money is just to keep the banks from falling apart and trying to sell off this oversupply housing stock.

One of the most stimulative things the government can do right now, instead of just giving money to the banksters at zero percent, is to refinance any loan, anybody has, at 3-4%. that would go alot futher to fix the economy than printing money or anything else. Or at least just refinance housing mortages, and maybe commercial real estate,(without picking winners and loosers). Becuase this is the biggest expense everybody has is housing. If that monthly payment drops $500-1500a month per family, how good would that be for main street?

The results will be a lot better than just higher food and gas prices in my mind.

“If that monthly payment drops $500-1500a month per family, how good would that be for main street?”

Wow, you just don’t get it. You have suggested government should be pursuing policies designed to improve the lives of its citizens and delay payments to banks or people who’s only real worth is how well they move stored energy from point A to point B. Next you will say the United States government is supposed to “promote the general welfare” or that Ike “97% tax rate” Eisenhower wasn’t a communist.

http://www.zerohedge.com/article/mega-refi-rumor There’s been chatter among banks, issuing out memos on such a plan…

Hey Not,

Try to keep it professional. no need to insult the working class.

I do get it. It is better than throwing a bunch of money to the banksters(only to inflate food and oil, or buy treasuries).

1)It saves housing

2)Provides a huge stimulus the economy.

3)fixes the some of the economics that are hindering a recovery. Mainly high rents, high leases, and high mortages sapping all the economic activity out of the economy at the moment the way I see it.

From What the news has been saying lately:

1) cooporations have a bunch of cash and don’t have the creativity to deploy it.

2) The banks that only know how to buy treasuries with all their 0% free money right now.

3) the banksters should be allowed to fail, like everybody elese in the real world. It would be more right than bailing out the very criminals that were most reponsible for the mess we are in today.

My point is their is no easy or perfect solution. We are forced in to choosing winners and loosers or else the whole system will collapse. The challenge becomes how to best fix the problem.

As a part-time landlord, there are some rents that are just not obtainable now. I would not think of increasing rent at this point. And renting anything about $1,250/month in Kansas City is extremely difficult.

On the labor front, I hear wages are increasing a bit in the private sector, but think of it this way: Company lays off 7-10% of workforce while the rest of the workforce gets an average 3% increase. Basically, the company reduces labor costs while wages increase.

Yesterday’s story about the East St. Louis police department showed another labor issue. The police refused furloughs and wound up reducing their ranks by 30% or so. Hard bargaining by the cops, but kind of stupid. The furloughs are more of a collective solution. In CA, the 3 furlough days per month is the equivalent of almost 14% labor cost cut (assuming 21 working days per month). What would you rather have? A 14% workforce reduction or a 0% workforce reduction with a 14% wage reduction. I’d prefer the latter.

I would like to hear the real examples of people getting wage hikes right now.

I know of a project engineer, who hasn;t even been laid off, that has been forced to take a 50% pay cut. He was later given a raise, BUt only to 70% of his previous salary.

Cut spending to bare essentials, reform the archaic tax system to a progressive system whereby luxury/discretionary consumption has higher taxes, while income is taxed at a low rate. Lower the corporate tax rate and incent investment in production oriented industries versus bullsh**t service industries (i.e., financial and professional services)….how many brokers, bankers, lawyers, accountants, hair stylists and reality TV stars does a one country need…

Here is my take for what’s it worth. No price increase for materials till this quarter on average 15% to 20% big hit as it looked like things were getting better then we get hit with the increases. The problem I have is that I don’t make money on material anymore I only make it off labor my labor charges have come down about 20% in the last year,so I must increase my prices, because of material increases, but I am not making any money on materials only labor but my labor prices have become a bidding war the lowest bid wins the contract hands down. How do I stay in business I have to cut my labor cost only option,I don’t make money on material anymore, so I must charge more to the customer but I am making smaller profit margin, banks not lending any money unless your willing to pay 18% plus putting up your house to back up the loan/credit line. I get paid less for the contract, the companies I work for take longer to pay they are dealing with the lack of credit so I am dealing with getting paid later 30 days is now 60 to 90 days and my profit margin is less so I pay my help less but they are happy to still be working. Where is the lending show me the cash,cash is king if you can get paid under the table is better. This is what I see anyone else seeing this? I have been in business starting 1987 last one standing win! Why don’t I make money on materials see The Home Depot / Lowe’s / Internet / China