Some Fedwatchers were proven incorrect when the Fed inched towards a renewal of QE today by stepping up to buy Treasuries to offset shrinkage of its balance sheet due to principal runoff on the MBS it bought last year. The staff apparently favors renewed QE, due to the signs of faltering economic activity; the Board, by contrast, is more hawkish, and also concerned re the efficacy of resumption of QE (both due to the limited impact it has had, plus possible unwelcome side effects. For instance, if the dollar were to decay significantly as a result, which would in theory have a positive effects on our trade balance, the immediate impact of higher oil prices could more than offset any benefit).

The problem, of course, is that with the Fed having failed to clean up bank balance sheets, all these efforts to throw money at the economy look an awful lot like pushing on a string.

Andrew Horowitz of The Disciplined Investor noted:

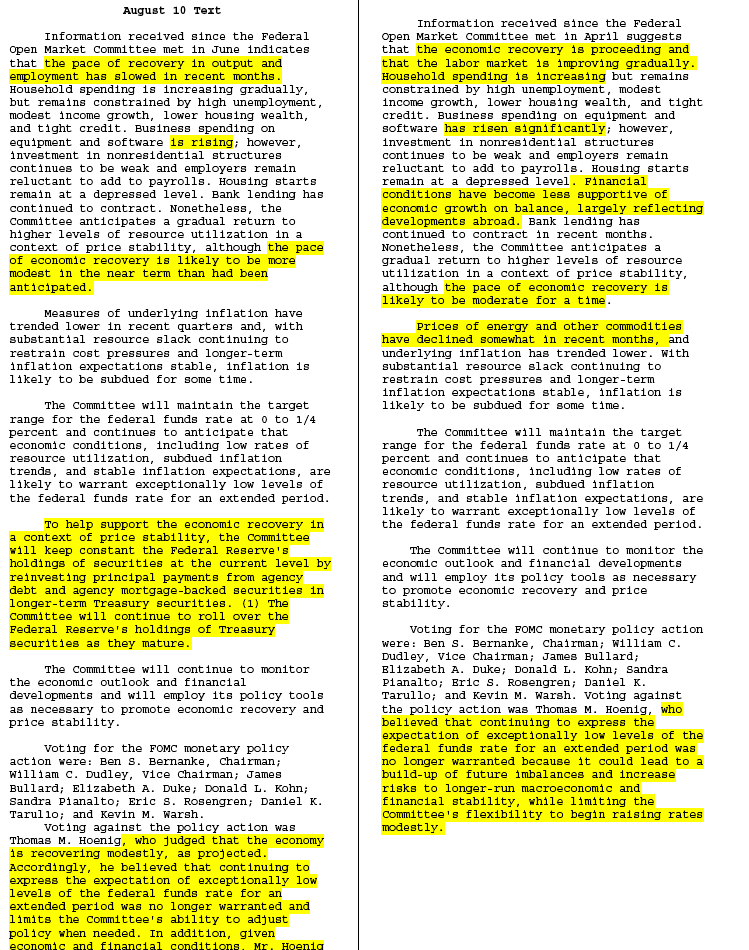

As you know, all attention was focused on the 2:15pm Fed decision today. As expected, the rates were held, but there was some finesse in the language that discussed the addition of purchases of long-dated treasuries with principal payments from mortgage-backed securities. This will have the benefit of keeping longer rates (those often which mortgage rates are based on) low for some time. Markets were confused as the general tone of the report was dour, but cheered that the next phase of the Fed’s quantitative easing was about to begin.

Click to enlarge the side by side analysis:

it was imperative that someone took over who saw the crisis coming. clueless ben is adding more and more stress into this system and eventually its going to completely collapse. The government will run out of borrowers to fund all this nonsense. We can turn into a Greece situation in a week.

Actually, we don’t have to have a Greece-Italy-Spain-Portugal-Ireland-Iceland-Ecuador-Argentina problem. Even though, like those countries, our national government took over the debts the elites racked up in a speculation fever, any debt we have is in our own currency. We pay in our own money, which we print ourselves, so we can never have too little. Except to perform political grandstanding.

Even if we defaulted on Treasuries, which is not as unthinkable as all that, it might be to our advantage. Foreign capital is only important if you can’t raise your own, and we could. It’s a big enough country to be economically autonomous, mostly.

Indeed, the jolt of tax revenue that will come with letting the Bush task gift expire will get lots of people thinking about how our debts might be paid by the people who caused them. Bush’s Big Government benefited the rich and the large corporations. With only the mildest of raises, Bush III could benefit the nation.

The US is entirely dependent on imported capital and imported energy. Interrupt either (although one hiccup implies the other), and you can hang out the ‘Bienvenidos á Argentina del Norte’ banner at JFK airport. That is, if there’s any avgas to fuel the planes.

As the Fed ballooned its balance sheet from $0.9 trillion to $2.3 trillion during the crisis, promises were made that the mountain of securities would be sold off when conditions returned to normal. But they haven’t returned to normal, and with the specter of sovereign default having emerged this year, may not ever do so.

In its tertiary stages, the US economy exhibits Ponzi-like characteristics. Ever larger increments of debt are required for each incremental dollar of GDP. And at the base of the pyramid, the Fed’s assets can move in only one direction: up.

With US fiscal policy passively tightening, and with active tightening overseas, any attempt to shrink the Fed’s balance sheet will usher in a repeat of 1937. Then, the Fed raised reserve requirements and the discount rate; the economy promptly plunged into the final phase of Depression I.

A Ponzi economy depends not upon absolute values, but upon the rate of change. Bicycling across a high wire with a pyramid scheme balanced precariously on his nose, Ben Bernanke cannot afford to stop, much less reverse.

Today’s FOMC statement was a tacit admission that the Fed’s balance sheet will never again decline below $2 trillion. We’ll see $3 trillion before we see $2 trillion. Too much ain’t enough. Pedal, Ben, pedal.

Re: Bicycling across a high wire with a pyramid scheme balanced precariously on his nose, Ben Bernanke cannot afford to stop, much less reverse.

HA!! Good one!

Classic Red Queen’s race….the problem is the law of exponents. Market Ticker blog discusses this repeatedly. PIMCO also discussed it back in 2002 I believe. And plenty of others I am sure. The incredible shrinking effect on GDP of every additional dollar of debt. It’s why huge companies can’t move the dial on earnings.

In effect, what is another half a trillion of debt created cash-flow going to do when the public and private sector debt is already 30 trillion plus? Not much.

So the Fed bides it’s time, waiting for the elections to clear, and

then we will see the real QE of 5 trillion or so expected by Janjuah.

Bernanke is a prisoner of the status quo; anything to maintain the present order, instead of letting the chips fall where they may, OR, start calling things as they are.

He basically has to tell Congress, the White House et al. that real change is needed.

Sounds political?

Well, it is…because a lot of the problems we have stems from a total failure of imagination and true leadership.

There has been a lot of a talk about a federal consumption tax. Well, we need one. Make it, oh say 15-20%, and apply it ONLY to imported goods-enough to represent the totality of the trade deficit in revenues. Tie it to the trade deficit, if we go into surplus the tax goes away, etc… Make it a blanket percentage that covers oil, anything, that is imported so it is simple and understood by everybody. YES, the weekly trip to the gas station and to walmart will bite, but then we can use that money to plug the budget deficit. Result? The cash that the domestic corporations are sitting on gets invested by them into producing domestic substitutes and they hire domestic workers-in essence we reverse what has gone on in the last 20 years. We will be manufacturing a higher and more sustainable share of our own basic day-to-day consumption needs. NOT high tech.

Well since about %1 of the population owns about %40 of the total US wealth I think the best approach would be to tax that wealth so that it comes down to say %20 of the US. Use the proceeds to give a tax free year to those with less than say $500K for family and double the help to the very poor. I call that trickle down economics…

That would be a blatant violation of WTO terms. This kind of protectionism would lead to a global depression and riots in the streets. No thanks. It’ll take a lot more work and much more intelligent thinking to get out of this pickle. Thea pain can’t be awvoided, the piper has to be paid. Bernanke’s just kicking the can further down the road.

Yves:

No sh*t, you think the Fed is gonna abandon Labor before an election? They will pull another Voclker afterwards.

I am sure the Fed could come up with something more to show how utterly unconnected to reality they are but I can’t think of anything at the moment. Maybe they could wear clown suits and the meetings could be televised. For me, it’s like watching the Public Safety Committee on the Titanic ponderously debating the best course of action and deciding it is to maintain course but at slightly greater speed, four hours after hitting the iceberg and with water sloshing at their feet.

FED = Faustian Enema Delivery