Normally, I don’t reproduce or excerpt from John Mauldin’s popular e-newsletters, but today he features a writer I particularly like, uber bear Albert Edwards of Societe Generale.

To repurpose an old saw about pessimists, bears are bulls who have all the facts. Some of Edwards’ arguments, while well documented, aren’t new: employment stinks, the forward-looking manufacturing indicators say more deterioration is in store. But he has some interesting comments on the nature of bear markets, and why investors who believe that QE will keep equity values aloft are likely to be disappointed.

From Edwards:

The current situation reminds me of mid 2007. Investors then were content to stick their heads into very deep sand and ignore the fact that The Great Unwind had clearly begun. But in August and September 2007, even though the wheels were clearly falling off the global economy, the S&P still managed to rally 15%! The recent reaction to data suggests the market is in a similar deluded state of mind. Yet again, equity investors refuse to accept they are now locked in a Vulcan death grip and are about to fall unconscious.

The notion that the equity market predicts anything has always struck me as ludicrous. In the 25 years I have been following the markets it seems clear to me that the equity market reacts to events rather than pre-empting them. We know from the Japanese Ice Age and indeed from the US 1930’s experience, that in a post-bubble world the equity market merely follows the economic cycle. So to steal a march on the market, one should follow the leading indicators closely. These are variously pointing either to a hard landing or, at best, a decisive slowdown. In my view we are poised to slide back into another global recession: the data is slowing sharply but, just like Japan in its Ice Age, most still touchingly believe we are soft-landing. But before driving off a cliff to a hard (crash?) landing we might feel reassured when we pass a sign that reads Soft Landing and we can kid ourselves all is well.

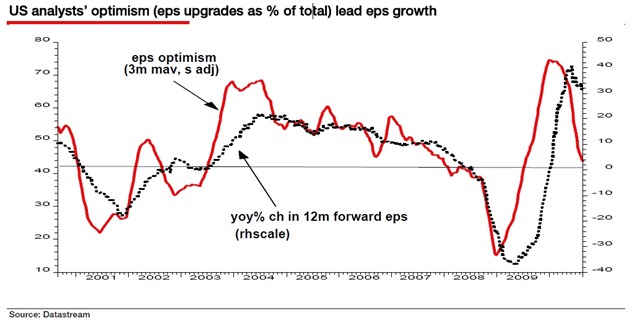

I read an interesting article recently noting the equity market typically does not begin to slump until just AFTER analysts begin to cut their 12m forward EPS estimates (for the life of me I can’t remember where I read this, otherwise I would reference it). We have not quite reached this point. But with margins so high, any cyclical slowdown will crush productivity growth. Already in Q2, US productivity growth fell 1.8% – the steepest fall since Q3 2006.Hence, inevitably, unit labour costs have begun to rise QoQ. This trend will be exacerbated by recent more buoyant average hourly earnings seen in the last employment report. Whole economy profits are set for a 2007-like squeeze. And a sharp slide in analysts’ optimism confirms we are right on the cusp of falling forward earnings (see chart below).

I love the delusion of the markets at this point in the cycle. It bemuses me why investors cannot see what is clear as the rather large nose on my face. Last Friday saw the equity market rally as August’s 67k rise in private payrolls and an upwardly revised July rise of 107kbeat expectations. But did I miss something? When did we switch from looking at headline payrolls to private jobs? Does the fact that government is shedding jobs not matter? Admittedly temporary census workers do mess up the data, but hey, why not look at nonfarm payroll data ex census? Why not indeed? Because the last 4 months run of data looks notably weaker on payrolls ex census basis than looking only at the private payroll data (ie Aug 60k vs 67k, July 89k vs 107k, June 50k vs 61k and May 21k vs 51k). But these data, on either definition, look dreadful compared to the 265k rise in April and 160k in March (ex census definition). If someone as pathologically lazy as me can find the relevant BLS webpage after a quick call to the BLS, why can’t the market? Because it is bad news, that’s why.

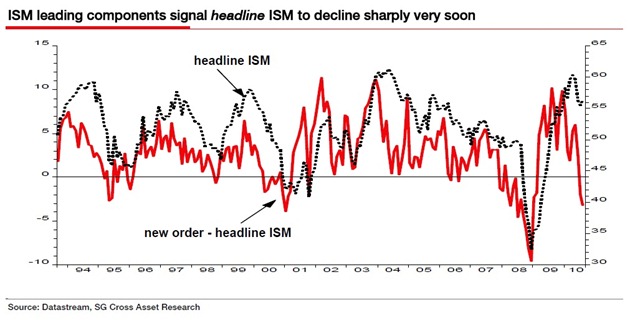

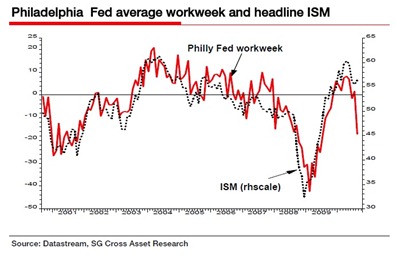

August’s rebound in the US manufacturing ISM was an even bigger surprise. This is a truly nonsensical piece of datum as it was totally at variance with the regional ISMs that come out in the weeks before. The ISM is made up of leading, coincident and lagging indicators. The leading indicators – new orders, unfilled orders and vender deliveries – all fell and point to further severe weakness in the headline measure ahead (see chart above). It was the coincident and lagging indicators such as production, inventories and employment that drove up the headline number. Some of the regional subcomponents (eg Philadelphia Fed workweek) are SCREAMING that recession is imminent (see left hand chart below).

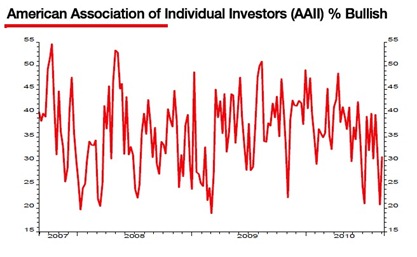

The real reason why markets reversed last week was that they got ahead of themselves. Aside from the end of 2008, government bonds were the most over-bought they had been over the last decade. And in equity-land the AAII two weeks ago recorded a historically low 20% of respondents as bullish (see chart above). These technical extremes will now be quickly worked off before the plunge in equity prices and bond yields resumes.

I am often asked by investors with a similar view of the world to my own (yes, there are some),whether the equity market will ever reach my 450 S&P target because of the likelihood that further Quantitative Easing will prevent asset prices from falling back to cheap levels.

Indeed we know that a central plank of the unhinged policies being pursued by the Fed and other central banks is to use QE to deliberately target higher asset prices. Ben Bernanke in a recent Jackson Hole speech dressed this up as a “portfolio balance channel”, but in reality we know from current and previous Fed Governors (most notably Alan Greenspan), that they view boosting equity and property prices as essential for boosting economic activity. Same old Fed with the same old ruinous policies. And by keeping equity and property prices higher, the US and UK Central Banks are still trying to cover up their contribution towards the ruination of American and British middle classes – (see GSW 21 January 2010, Theft! Were the US and UK central banks complicit in robbing the middle classes? – link).

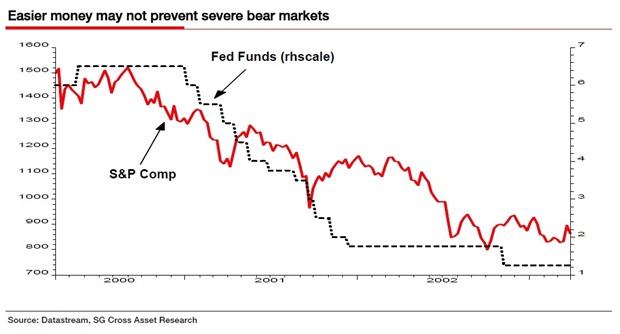

The Fed may indeed prevent equity prices from slumping with any QE2 announcement. But this sounds a familiar refrain at this point in the cycle. For is monetary easing in the form of QE that different from interest rate cuts in its ability to boost equity prices? Indeed announced rate cuts in previous downturns often did generate decent technical rallies. But in the absence of any imminent cyclical recovery, equity prices continue to slide lower (see chart below). The key for me is whether QE2 can revive the economic cycle, not equity prices temporarily.

In the absence of a cyclical recovery I cannot see how QE is any different in its ability to revive asset prices than lower rates in anything other than a temporary fashion. (Interestingly many of our clients think QE2 might give a temporary fillip to the risk assets but that the subsequent failure to produce any cyclical impact will cause an extremely violent reaction as investors lose faith in QE as a policy tool and Central Banks in general.)

If we plunge back into recession, do not place too much confidence in the Central Banks having control of events. As my colleague, Dylan Grice, said last week “let them keep pressing their buttons.” Ultimately they cannot fool all of the investors, all of the time.

Once one ask: Cui bono? it becomes obvious who the Fed is working for>

It’s not us, that is for sure.

To be fair to the Fed (and its Wall Street masters), the Fed is no working solely on behalf of the Wall Street.

The lesson that should be learned from the Pecora Commission is that industrial entrepeneurs, true capitalists, will turn on the financial speculators if it becomes clear that the speculators prey not only upon labor but upon capital.

Propping up the secondary bond and equity markets is essential to keeping the dumb (stupid) money dumb (silent).

“… industrial entrepeneurs, true capitalists, will turn on the financial speculators if it becomes clear that the speculators prey not only upon labor but upon capital”.

It won’t become clear until too late. There’s some degenerate consensus of “predate while you can”, “become bigger and richer at any cost”. This is nothing new (at least since Reagan) but it’s been degenerating more and more and there’s no replacement system, nobody is taking action (such as regulate massively or dislodge the too-big-to-fail applying anti-trust laws) because nobody seems to hold the power anymore.

Presidents are just powerless products, even the Fed is weak. Such action would need a political consensus but this is forged nowadays not by “statesmen”, which don’t seem to exist anymore, but the media. And the media is owned by the speculators, the too big-to-fail.

This is what you get when you let “market” rule society instead of using some market as tool for society’s needs.

The only ones benefiting to some extent of this are those states that have some sort of “old fashioned” protected (regulated, state intervened with quality planning) economy like China, Singapore, Sweden…

“Those whom the gods wish to destroy they first make mad” (Euripides?). Though little consolation, before too long, Wall Street will join Main Street as victims of its success.

If wisdom were common… I worry that worrying over who fixes what isn’t what we should bellyache about. Yes, there’s horror in this crash. Yes, we’re timid with the culprits. Yes, thumbscrews ache. It seems 1,000 Feds might be helpless or wrong. That’s becoming tiresome.

What are we? How do we slog ahead? Months and months go by, you know. Unless strong narrative stretches these old numbers, we have no future.

Yo! Stop culling me. You see where I’m going. Bitching isn’t leading. Better effort will affect us all. More politely: Every tiny bit of advice makes tomorrow. It’s time for that.

You want advice?

Things are going to get a whole lot worse. Then they will get better gradually.

I’d argue that criticism is much more important right now because people still do not properly understand what the problem is. Seriously, you have people who believe that the CRA caused all this, in spite of the fact that household writedowns in the aggregate are around $150B in the aggregate since peak credit, while financial debt (e.g., to buy derivatives) is around $1.5T.

We shouldn’t be jumping to solution space until we understand what the problem is.

“We shouldn’t be jumping to solution space until…”

Yes yes yes. That’s true.

“As my colleague, Dylan Grice, said last week ‘let them keep pressing their buttons.’ Ultimately they cannot fool all of the investors, all of the time.”

Nobody is fooled. We’re all just betting on whether the buttons they are pressing will continue to work. That’s life in the casino.

If things get worse again they will get much worse, because global geopolitics will become unglued. We are very close to the precipice now, much closer than anyone in power will say out loud. Michael Pettis, much clued into the international diplomatic front, has been sounding the alarm bells.

Just look how fast the China-Japan naval dispute blew up, from a rather small incident.

Unfortunately, Faber sounds all too reasonable we he says we are all doomed.

“The notion that the equity market predicts anything has always struck me as ludicrous.”

No, Albert, the just grins and says in Alfred E Newman fashion, “What, me worry” and leaves the worrying to others. It’s capacity to ignore (filter out) bad news, whether coincident or leading is under-appreciated by many mkt participants. That is why, as it rolls merrily along, it is so shocked and reactive when a bomb is dropped on its “What me worry” attitude. But it takes a shitload of contradictory evidence (bombs) for the mkt to implode, and by that time, it will have overestimated the strength of the economic cycle, be it anemic or robust….

You see all the “Talking Heads” in the media, big CEOs including WARREN FREAKING BUFFET– proclaiming “NO DOUBLE DIP”. Not to mention the various GOVERNMENT GOONS touting the same mantra. I guess they have to pump their “stock”. I confess that is not realistic that they get up and say the Jack Nickelson TRUTH (The public could not handle it, or would take it badly) So go ahead pumpers, and tout that BULL****. There are the hardy few that do not believe this drivel.

This time it is different. We are not talking about general QE, we are talking about the Fed and its proxies directly interfering in the stock market.

In all the general indifferenciation between public and private that has become the rule in our Western civilization (pretty much the same stuff is going on in Europe…) one of the problems is that… WHERE IS the power, for example ?

Is there… POLITICAL power anymore, or are the multinationals running the political show too ?

In the meantime… the nation state is up for sale, (and challenge) and nobody particularly seems to be reacting to THIS momentous situation…

It’s actually worse, from an unemployment perspective:

Private sector employment grew by 67,000 in August.

Let’s see now:

-illegals entering from Mexico (net): 46,500

-illegals from all other countries (net): 11,625

That means we have: 8,875 private sector jobs to cover;

-people arriving legally (yearly average / 12): 38,583

-guest workers (annual average / 12): 10,833

So we have negative 40,541 private sector jobs to offer the;

-growth in the US labor force (annual / 12): 11,250

Thus we have gained:

-negative 51,791 private sector jobs last month

Of course the numbers are a bit different if we use total jobs instead of private sector, then we’ve gained:

-negative 105,791 jobs last month

It’s important to realize that 1) markets are essentially part of the paper economy, and 2) they are completely rigged. They predict nothing about the real economy from which they are largely divorced. Similarly, data from the real economy, or the real world generally, are just excuses for HFT plays. Everyone seems to remember when markets “react” to some report or announcement, but markets also often don’t react. In these cases, there is just a wave of wand, a sprinkling of pixie dust, and the glib reply that such and such has already been “discounted”, i.e. it wasn’t part of the riggers’ current play.

I would agree that we are headed into recession and worse in 2011, but then that is what I have been predicting for more than a year. I also agree that QE is unlikely to goose markets higher. They have been going sideways for months. If they could have been driven higher, they would have been. Nor was it a question of money. While the real economy can be mostly ignored, it can not be entirely ignored. The real limit here is credulity. In the absence of any positive signs in the real economy, markets as manipulated as they are can only be pushed so far.

Everyone is looking for the “quick fix”. It took around 25 years to get into this mess. Sorry, but there is no magic pill this time.

1 – “propping up asset prices” is potentially a good idea, if it is done by general inflation. Why? General inflation magically eliminates debts, and currently far too many people have far too much debt. Unfortunately, the Fed is managing to NOT prop up asset prices through general inflation, but instead by pouring money into bad sectors.

2 – The other way to eliminate debts is general relaxation of the bankruptcy laws. Good luck with that in this defective climate.

What was the source of Thomas William’s numbers in the 12:45 post? I copied the post into a Word document for future reference. I’ve never seen the numbers broken down that way elsewhere.

I noticed two things about the numbers. First, enough private sector jobs were generated in the U.S. in August to cover both the native increase of the labour force AND permanent immigrants arriving legally. If you could somehow eliminate the guest worker program and the illegal immigrant problem, we would be generating enough private sector jobs, though of course this ignores the cutbacks in government jobs.

Second, something like 80% of the illegal immigrants are illegal immigrants from Mexico.

So to a large degree our employment problem is an illegal immigration problem, and our illegal immigration problem is an illegal immigration from Mexico problem. Mexico is probably also the source for most of the guest workers.

Another way to look at this is to take away the guest workers and the illegal immigrants entering from Mexico. Then about a quarter of immigrants (ex -Mexico) are illegal. This is pretty bad but not horrendous. Remember it looks like the economy can absorb the legal immigration.

I suspect that the civil unrest in Mexico, particularly in the southern states, is much greater than has been reported in the U.S., and our illegal immigration problem from there has taken on some of the characteristics of a refugee crisis. People don’t tend to migrate to places with high unemployment, or at least they will go home once they realize they have wound up in a place with high unemployments. Refugees from a civil war are another story.

I am not sure we are heading into a new recession and I think that serious quantitative easing will be a tonic for the economy, paper and real. Even more so if QE2 leads to a mild devaluation of the dollar.

Come on, you guys. You are too pessimistic. We will surely all die at the end and some of us may indeed suffer a horrible death. Until that happens, look alive and smile a little :)

Please, there is too much pessimism around regarding the economy. This alone makes me think that the conditions may be ripe for a new leg in the bull market.

Surely Albert is wrong in his analysis of why the S&P can get to 450?

ZIRP means money is cheap and it forces investors chase yield and return, investment undertaken by ‘private’ (cynicism about TBTF/bullion banks aside) investors (banks, professionals, individuals etc.). Namely, the FED itself doesn’t invest under ZIRP.

This is surely where QE2 can have a profoundly different effect; the FED purchases assets outright – it is now an investor. Asset prices no longer are held up by indirectly subsidising the cost of money and the concomitant search for yield/return by private investors (as interest rates are 0), but the FED now joins the party in a direct fashion, gobbling up MBS, CMBS, equities… you claim the asset is necessary to QE and it is so. QE is basically a blank cheque for all assets listed on a blank piece of paper.

On that basis, with enough warm notes greasing its palms, it can ensure that the S&P can never reach 450, as Faber proposes.

This is the tail of a long financial cycle that ended in Ponzi finance. The Great Unwind is still going on and will for some time. The wealthy who are the creditors that hold the bad debt don’t want to lose, so they are holding out for getting blood out of the stones. Until the debt clears, there will be no real recovery, just false starts. The debt has to clear one way or another. It has to be written down or defaulted on, or pretend and extend for a lost decade, or governments have to take the debt on their books. There will be some of all of the above. It isn’t going to be pretty, and it is going to be awhile. Just pray that the idiots in charge manage to avoid outright deflation, but the odds of that are rising. Gold is rising in anticipation of trouble on the currency front, too.