The spin-meisters continue to package things that ought to incite outrage in anodyne wrappers in the hope no one will look inside. “The new normal” and “structural unemployment” join the universe inhabited by such gems as “extraordinary rendition” and “pre-emptive strike”.

“New normal” is particularly insidious, since it implies that we must accept current conditions, since they are “normal” hence it would be abnormal and/or require exceptional effort to experience anything else. “New” acknowledges things have changed, but “new” usually has positive connotations, and masks the fact that pretty much nobody except the banksters and some members of the top 1% are exactly keen about present conditions. It also had no footprint of how things changed; if you didn’t know what it stood for, it could just as easily be used to describe a dramatic natural shift, for instance, how the weather changed in the wake of the Krakatoa eruption.

“Structural unemployment” is not only sneaky, but also downright misleading. The catchphrase is meant to convey that unemployment just can’t be helped, it results from fundamental problems in the job market. Now since we have on average something like one job opening for every five unemployed people, even if structural unemployment was a real phenomenon, it is far from sufficient in explaining why we have U6 unemployment at over 16%.

I had been planning to write about this, and it turns out other people are on to this wee bit of branding. Per reader Francois T:

As you pointed out a while ago, Washington has not shown great urgency with the high UE rate. That is in part understandable, since our political elites has a negative attitude toward the needs of low income people, which have been hit much harder than anyone else during this recession.

But you can’t say things like “We don’t like you and you suck” to a large swat of the electorate. So, a justification, a narrative was needed. In came the “New Normal” the new “Structural Unemployment” that, God knows how, let alone why, has settled in during this Great Recession. Why did entire sectors of the economy employed X people at the beginning of 2007, and suddenly and for the foreseeable future (say 5, 10, 20 years…who knows?) said sectors would only need Y (where Y< X ) people. We are generous here, since we're assuming the previously alluded to sectors would survive. So, that is that: UE shall be high, suck it up (thank you Charlie Munger for the unsolicited advice...moron!) and get used to it.

The narrative behind the “structural unemployment” spin goes something like “there really are jobs, but those crappy workers, they don’t have the skills (i.e., as in they didn’t work hard enough at the right stuff earlier in their life) or they are in the wrong location.” We’ve seen the MSM dutifully take up this narrative, and had readers point out that in many cases, the “jobs are going a begging” is due to companies making such lowball pay offers that they are coming up short on takers.

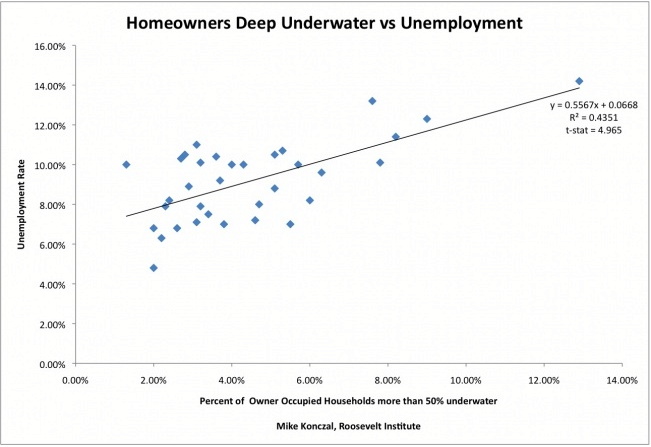

Two (in a way, three) articles debunk this idea. The first is an IMF study, which concludes that the housing bubble implosion has far more to do with unemployment than a skills mismatch. Mike Konczal has a nice write-up, and he’s a bit peeved because he had worked up an analysis from what he saw as better underlying data and had wanted to refine it further before releasing it. But bottom line, he and the IMF independently come to the same conclusions. Mike is entertainingly annoyed in his lead in:

When IMF experts put the United States’ so-called “structural unemployment” under a microscope they find that the large majority of this is the result of the massive of wave foreclosures and underwater mortgages and only a small part is related to skills/education mismatch.

The real problems are far more likely issues of TARP not having created a cramdown provision, second-liens being over-valued on the stress test and community groups like ACORN fighting against foreclosures being under-funded and under attack, not that we aren’t ‘shocking’ teacher’s benefits or getting a pair of pliers and a blowtorch and getting medieval on the minimum wage’s ass or whatever feverish dreams constitutes our elite’s thoughts about the unemployed lucky duckies.

Here’s his money chart:

So get this:

This [IMF] paper shows that a large majority of structural unemployment is the result of underwater mortgages and foreclosures. In addition, when foreclosures are added into the regression alongside SMI, SMI loses some of its value, and when a cross term is added skills loses a bit more. Right now, the story is one of foreclosures.

So groups that fight foreclosures, say what many over-worked and under-paid community organizers do now, are groups that fight to reduce structural unemployment for everyone. Same with those trying to get cramdown and right-to-rent and better short sales. Which is a worthwhile thing to be doing…..

Bonus: Let’s say that Bank of America drove a truck full of chemicals into a town square and proceeded to burn the chemicals. The toxic fumes of these chemicals caused a statistically significant number of workers to be so sick that they ended up not able to work and detached from the labor force and forced major costs onto municipalities. We’d tax the hell out of BoA for burning those chemicals, right? Externalities and all that.

So let’s replace “burning toxic chemicals” with “foreclosures.” It’s the same story….So why aren’t we taxing the hell out of foreclosures?

Yves here. I know some readers will start on the “deadbeat borrower” theme, but there are three reasons this is wrongheaded:

1. Earth to readership, normal behavior in creditor land is to restructure debts of borrowers who get in trouble IF the borrower is viable at a level that is better than liquidation. Given massive loss severities right now (60%-70% if not higher with foreclosure costs included), you’d think this would be happening. But the servicers who make the decision to foreclose are NOT the creditors. They get paid to foreclose, they don’t get paid to mod (and the HAMP subsidies are way too low to induce then to change behavior other than to scam the program).

2. Many borrowers are victims of servicing errors, even predation. Servicers, in contraction of federal law, will apply a payment first to fees (say late charges) and then to the regular amount due. Servicers have also been found to hold checks to make them late. So say a payment is treated as late, because it was delayed in the mail (your routine mailing date allowed too little room for error), or servicer chicanery or incompetence. You are treated as late, you are charged a fee AND may also incur an interest penalty. The fee is taken out first, usually on the next month payment. So that one is short, since the fee comes off the top, hence treated as late. So more fees.

Servicers typically don’t tell people their payments are late. This sort of thing goes on 6-7 months and by that point, the borrower is several thousand dollars in the red. The borrower may not be able to come up with the extra amount, or reluctant to (it will disappear into the maw of the servicer, dream if you can straighten out the improper fee charging practices). The borrower is on his way to foreclosure.

3. Some borrowers are also victims of origination fraud. Most borrowers who are behind on payments don’t fight to keep the house (indeed, the whole strategic default meme says it even makes sense for borrowers who can afford their house to walk away). But some were steered into taking mortgages they could not afford, and some will try, when foreclosed upon. to get their story heard. There have been many variants of bad originator behavior, the biggie being the borrower being told deal terms, not having the sophistication to check the documents at closing, and signing for a completely different deal (and this isn’t a matter of education level but finance savvy: I heard of a PhD being sold a 30 year fixed rate and signing for an option ARM). I’m in the process of getting cases, but there are instances of borrowers signing commitment letters, then being told they had to accept the deal on greatly worse terms because it had already been financed, and if they didn’t, they’d be sued into oblivion.

The Economic Policy Institute also found the structural unemployment case sorely wanting and has its own lengthy report to back it up:

A better explanation for high unemployment is that there are simply not enough jobs to go around. …

Consider the evidence. Manufacturing capacity fell to 71.6% in June 2010 from 79.1% in December 2007. Vacancies in commercial offices now stand at 17.4%. Total demand in the second quarter of 2010 is still below its pre-recession level……

The claim of extensive structural unemployment presumes that millions of workers are now inadequately prepared for available jobs even though they were fruitfully employed just a few months or years ago.

Let’s look at that line of thinking from a few different angles:

Productivity, Technology Investment: Productivity did grow a pretty spectacular 6.3% from early 2009 to early 2010, but that was the extent of productivity growth since the recession started in late 2007. Net investment in business equipment and software in 2009 (the latest data) was actually negative, for the first time since World War II. This alleged structural transformation of production processes that left four to five percent of the labor force inadequate for the available jobs was clearly not associated with new equipment or new technological processes.

Location: If all of the country’s unemployed workers were to relocate to states with low unemployment, there would still not be enough jobs to go around. There are only 11 states — with a total adult population of about 17 million — where the unemployment rate in June was less than 7.0%. If all the unemployed moved to those states they would nearly double the labor force there.

Construction: It is true that construction has suffered in this downturn, losing nearly two million jobs, or 25% of all private-sector jobs lost. But this is not what is fueling the unemployment problem. Figure A shows that in the second quarter of 2010, unemployed construction workers comprised 12.4% of the unemployed and 12.5% of the long-term unemployed: They are no more likely to be long-term unemployed than those displaced from other sectors. Even before the recession, in 2007, unemployed construction workers were 10.6% of all unemployed and 11.0% of the long-term unemployed…

n fact, one of the curious aspects of this misguided theory of structural unemployment is how hard it is to find any research tying this story to actual detailed trends in employment, unemployment or output data.

So I hope at a minimum when you read “structural unemployment” your bullshit detectors will now go off and you’ll start reading for where the logic or data are questionable. Generalizing from isolated cases and making them seem representative is sadly all too common in the mainstream media.

Thanks Yves, for this important post. Indeed how do workers become obsolete virtually overnight?

You suggested mortgage cramdowns but how about just an equal bailout of the entire population (including savers so they won’t lose in real terms)? This would even fix the banks.

And no new debt is needed; the US Treasury can create some new debt-free, legal tender United States Notes for the purpose. And if inflation became a problem then have Congress raise reserve requirements to 100% if necessary.

It’s much easier for the comfortable class to lie about unemployment than to help and support a drastic lowering of it. That’s quite normal behavior for a class that has enough or more for a living. Since the administration, basically, ignored unemployment for about 18 months and since it was elected with the strong support of the comfatables, we get the structural unemployment garbage.

Even with no analysis one can see that in the last 2-3 years the employment sources have stayed the same in type (not numbers), why does the same economy have a chronic disease now?

And the #$@$$% responsible for all this is none other than Ben Bernanke who has seen stupendous increase in his wealth. This guy has spread so much stench in terms of moral hazard that throwing a shoe whenever he stands up to speak would probably be the right thing to do.

“Structural” unemployment was a concept invented in the first place to ideologically obstruct the call for proven stimulus policy. Chicago invented the pseudo-nobble prys for ekonomicks precisely to reward such good thinking.

And today it’s performing its ultimate duty, ideologically justifying the Permanent Mass Unemployment regime, part of the terminal liquidation of the middle class as we’re slated to return to feudalism.

Last month I wrote a post on Obama’s “New Normal”.

http://attempter.wordpress.com/2010/08/13/permanent-and-very-unnatural-rate-of-unemployment/

I’ve worried about structural unemployment as an aspect of globalization and outsourcing. I’ve questioned that econ’s comparative advantage (or whatever its called) means net gains to current workers.

Basically, if we have free trade won’t certain jobs migrate down to a global pay scale, and if that’s too low for American workers, doesn’t it mean structural unemployment?

@john personna. The short answer to your question is yes. The larger problem is that it is by design. Large US and multinational corporations have decided that the emerging market economies of China and the like will have many more consumers (economies of scale) to absorb the lower priced goods relative to lower wages. Gradually raising the standard of living of workers in the emerging markets is cheaper and more profitable in the long run. The American middle class standard of living is being exported. Wholesale.

Expectations are rising very quickly throughout Asean and China; these folks don’t want their kids to be a cog in a factory. There are shortages of factory workers in China right now because bosses can’t or won’t raise wages enough. This may lead to a profitability crisis in short order and where will factories go next ?

What about “structural” being somewhat accurate in terms of the contracting of the credit bubble? Consumption is roughly 66% of GNP and consumption for years was financed in good measure by borrowing.

So “structural” in that sense that capacity across most consumer-oriented industries becomes excessive relative to spending ability after the credit bubble burst.

The notion of a structural skills mismatched is more than far-fetched though. What skills would sop up 16% unemployment? We all can’t be biotechnology scientists or bankruptcy workout lawyers.

I’m not sure that there’s anyway to kick start a healthy economy by reigniting the debt-fueled consumer toy machine.

The food industry is a poster child of this. The number of kitchen appliances and speciality food items for sale — enflamed by stupid celebrity chef cooking shows — became absolutely insane. Anecdotes are not statistically very valid to be sure, but an ex-girlfriend of mine has a small apartment in New York and a house in Connecticut. Each had a chef’s kitchen with, I kid you now, restaurant quality stoves and hundreds of knives, appliances, pots and pans hanging from the ceiling and from the walls.

She never cooked. It was all basically decoration.

There was enough kitchen equipment there for 10 sane single people. You could start a junk yard with all the metal she had hanging from the walls.

I have 3 pots — a frying pan, a soup pot and a spaghetti boiling bot. I have two big knives and a few sets of knives and forks. I can cook anything. I have a cheap aluminum bowl I use for salads, cereal, anything.

Same with TVs and entertainment centers.

These are structural patterns of demand resulting from an overwrought and atrophied social imagination — sort of the equivalent of “panem et circensis.”

I meant “I kid you not” instead of “now”.

“circenses”

“Structural unemployment” is also a way to resolve the paradox of employers demanding higher immigration even though unemployment is high. They say there is a “labor shortage”, and when challenged to explain how there can possibly be a freaking labor shortage, they insist that the unemployed domestic workers don’t have the right skills.

But they’re never going to have the right skills if they’re never trained by employers, and never rewarded by employers for training themselves. Domestic skills shortages don’t cause headhunting: cheap headhunting causes domestic skills shortages.

To me, it seems that it’s more complicated than just simple structural vs. demand. What about both with some auxiliary compounding factors?

1) Plain old lack of cash. People are tapped out. Their bank accounts are empty, their home ATM has been pumped dry, and all 10 of their credit cards are maxed out. They’re paying down debt as fast as they can. They might want to spend, but they simply can not. Perhaps revisiting the idea of the “debt jubilee” would help here.

2) Businesses still not hiring, people stay on unemployment (or continue to burn savings/wind up destitute if they’re all 99’ed out.) They don’t hire, and they don’t invest, depressing demand further. So far, the deflationary cycle/demand story works fine.

3) Due to offshoring, employers have gotten a taste of what it’s like to have people work for peanuts. Going back to paying 10-100x (or more) that’s wage again to hire US workers is a tough one to stomach. If you got used to buying bread for $1 a loaf, how would you feel about it going up to $100? Can we bring the standards of living (hence wages) up to our level? Takes too long. Protect certain industries with regulations? Politically very difficult, and may not even work due to the globalized nature of today’s economy. Bring ours down to theirs? We’d hope not, but it seems like that’s all we’re left with. This would count as “structural.”

This doesn’t even touch the issue of having to go back for a second or third degree in order to compete (more debt, difficulty associated with going to school and working at the same time [though distance learning is helping here].)

“Perhaps revisiting the idea of the “debt jubilee” would help here.”

Or what the Athenians called “the shaking off of burdens” when Solon canceled all outstanding debts in the 590s BC.

He also abolished enslavement for nonpayment of debts, another idea which might work 2600 years later. :)

BTW, I teach history at a very blue-collar community college and you wouldn’t believe the class’ reaction when I lecture about Solon. That’s change they can REALLY believe in!

They endorse it? That’s a healthy sign.

Some time ago, I think it was Baseline Scenario had a post discussing a Warren post from a few years back about how her Harvard students consistently took the pro-bank/predator view of things. I think it was about fraud in selling cruise ship tickets or something like that. The “students” sided with the fraudsters.

These aren’t exactly Harvard students, dude.

They’re more like the victims of Harvard MBAs.

Here’s Warren’s post. Harvard Law; first year contract students.

There’s certainly no “skills mismatch” at the elite level, eh? They’re trained to be looters, liars, and thieves, and they’re doing exactly that.

I have no doubt that those in charge of managing our economy have lost almost all touch with any notion of a social contract which requires even a modicum of responsibility toward those who are most financially vulnerable. Nor am I afraid to call this indifference evil.

That said, I think Craazyman’s logic can’t be dismissed. If you believe, as I do, that our consumption based economy is founded on fundamentally flawed principles, there’s no easy path to recovery. Unfortunately, we are still a very long way from shifting our priorities away from runaway consumerism.

Finally, knowing how Yves properly exposed the fallacies of Milton Friedman’s “unrealistic assumptions”, I would think she would be a little chary of using Gaussian statistical data to “prove” anything. Specifically her unchallenged citation of “regression” in the following statement troubles me:

This [IMF] paper shows that a large majority of structural unemployment is the result of underwater mortgages and foreclosures. In addition, when foreclosures are added into the regression alongside SMI [Skills Mismatch Index], SMI loses some of its value, and when a cross term is added skills loses a bit more.

consumption based economics driven by excess credit creation has pumped GDP but the current idea that the elite’s can somehow drive the economy with their spending habits is more denial and accounts for much of the slack from the political elite regarding job creation. The media push to continue the Bush tax cuts along with the lack of discussion regarding how the tax code rewards the financial sector nor any desire to change outsourcing jobs and manufacturing as free trade further supports the idea that the new normal is OK. Denial is still the primary component of the economic crisis with a bit of anger which still has lots of room to grow as unemployment benefits along with a variety of state and local support programs are cut.

Chinese bosses are also complaining about a ‘skills’ mismatch, in that they can’t find factory workers and there are ‘too many’ unemployed college educated. Apparently in the mind of China’s elite, their nascent middle class is perhaps becoming spoiled.link

As for the so-called American skills mismatch, it is a nice tool to promote the lazy-American-worker theme, i.e. we demand too much in wages, pension sand benefits, etc etc.

Bosses everywhere are just having a hard time finding good help.

I do believe that we have an increasing structural unemployment problem. We have an increasing supply of labor with the wrong skills. We have a changing method of production which increasingly requires different skills. These different skills are heavily dependent on educational attainment with an emphasis on mathematics and logic. Adapting to these new skill requirements is easier said than done, especially as for the likes of a forty or fifty year old auto assembler.

We have a failed currency that distorts the allocating function of prices and which failed currency tends to abet fraud. Intelligent and capable young people are looking to the art of money grubbing quite simply because that is where high wages are paid. In a social, structural sense, the question that is not being examined is: Just what is the appropriate level of compensation for money grubbing.

To offer ‘structural unemployment’ as an explanation and excuse is, in deed, to attempt to propagandize as something empheral that which has very hard and measurable attributes. It’s the damm money supply and most particularly that which is initially credit money. The profligate extension of credit to individuals and enterprises that are incapable of servicing the debt is the crime in our face.

This time is no different than any other financial collapse. This time it is again about money that has been made cheap by the excessive creation of credit money to be used in consumption as opposed to in income producing assets and enterprises. When you borrow for consumption beyond your capacity to service the debt, you should immediately consult a bankruptcy attorney. That’s where we are today, looking for a bankruptcy or default bailout. Unemployment is a result of a much larger social, political, and economic problem.

Siggy –

You may be right about structural unemployment, but the Roosevelt Institute paper “The Stagnating Labor Market” that was discussed in a 9/20 post (here on N C) by Mike Konczal is strongly suggestive that any such problem is a very small part of the whole picture.

There is also anecdotal evidence (I know, that’s a weak type of evidence, but still) from software engineers I know that there is high unemployment among perfectly good software engineers, and that the main difference between American engineers and those who are hired via H1 visas from India etc. is age (young) and pay scale (low). Apparently the employers don’t even offer Americans the lower pay rates, they just assume they’d be unhappy at those rates and bypass them entirely.

So I guess my point there is that people with the right skills who are considered “too expensive” cannot be counted as a “structural unemployment” problem. They are simply victims of foreigners’ lower expectations coupled with laws that make it easy for American companies to take advantage of the lower expectations. In short, they are victims of globalization.

link:

http://www.rooseveltinstitute.org/sites/all/files/stagnant_labor_market.pdf

I think that “we” underestimate the role played by human neuro-biology in all of this stuff. Greed, herding behavior, jumping on the band-wagon, etc. All of these behaviors—irrespective of social class affiliation—are quite often borne NOT of rational thought (as controlled by that workings of our pre-frontal cortices), but stem from actions precipitated by our primitive neurological response mechanisms. Human beings make decisions and take action far more often than not because our primitive brain compels us to such actions: only in retrospect do we look back and wonder how the hell we made such choices.

Let’s not say “unemployment.”

Let’s say “disemployment.”

Normalizing 10% nominal (20% real) disemployment is a policy objective shared by both legacy parties in Versailles. Of course, just like gutting Social Security, only a D would be permitted to get away with it: “Only Nixon can go to China.”

This is all games within games. Nor is this even new. Back in the Bush years, the “new” paradigm was the jobless recovery. This formulation arose because even before the housing bubble burst and the economy went into recession, Bush had lousy job creation numbers that didn’t even keep up with population growth. The “new normal” has been around for a while.

Like the Bush Administration, Obama has done almost nothing to address unemployment. It is just so much easier to define it out of existence by raising the “natural” unemployment rate.

The U-3 stands at 9.6% and represents 14.8 million unemployed. The U-6 is at 16.7% and represents 25.7 million un- and under employed. Apply a 67% participation rate (typical of a good expansion) to the potential working population and you come up with another 5.4 million who are not getting counted by the BLS statistics at all. They push the un- and under employment rate to 19.5% or 31.1 million Americans.

But through the magic of numbers, look how our politicians can make problems go away. If you only look at the U-3 and then say, call 7% the new structural rate, you have reduced the problem to 2.6% or 4 million. This is still a large number, but it is far more manageable, especially considering that for each of these 4 million there are 6 3/4 workers who aren’t being considered at all.

Not bad, huh? Take 31.1 million and with a few taps of the calculator cut it to 4 million. Of course, this same kind of mathematical wizardy is what blew up the economy in the first place and will do so again.

In India, the banks were run by a Mr. Ruddy (sp?) who mandated 30% down on all home mortgages, no loans for raw land, and limits to derivatives. No problems in India.

In the US we have houses for millions more folks that can afford them, something like 20% Now, there is no construction, low prices, bad mortgages, huge boat anchor for the economy.

Let me tell you a secret. When there is a health insurance “tax”. employers will do everything they can to not hire Americans. In a slight variant, German employers face the same problems and outsource their jobs as well. I know tons of situations where, just as Agriculture did before, mechanical and computer systems are so much more efficient, there is need for far fewer jobs to do the same work.

But the real part of the piece is that the party in power benefits from three things, Acorn and Houston style massive vote fraud, massive voter registration of illegal immigrants, and a larger and larger population dependent on some government handout, making the removal of such benefits very difficult.

What should the repubs do.

1. Create as many individual “deputies” who check on the validity of voting lists, everywhere. It’s not hard.

2. Choose those folks who will vote democrat anyway and minimize their govt payments, or make them conditional on doing work or training, on the internet.

3. Slow down development of big expensive weapons sysytem. No more aircraft carriers.

4. Limit size of many overseas bases.

5. Trim out enormous govt payments to academia. They vote dem anyway. This bubble will bust soon and internet based learning will take its place at 1% the cost.

6. Let lots more doctors in the country. Let them compete as private business. Let companies and individuals choose to opt out of Obamacare and its cost. For uninsured folks, have a policy of collecting debts within limits and income based, instead of fee based.

7. Folks get choice of some super low expense insurance policies, that permit offshore surgery and competitive prices. Keep rates down by competition. Allow inexpensive light insurance policies

8. Massive tax incentives for folks to live together and take care of each other. Elderly of single parents families should have enormous incentive to move in together and cut back on medicare.

9. No company is too big to fail. All banks and companies that go broke should be allowed to go broke.

This is a great post. When I read the comment about businesses offering crappy salaries, I wondered if this might be due, at least in part, to deflationary expectations. It seems we are all holding our collective breath waiting to see demand return before we buy/hire/raise salaries. (Ok, the raise salaries part only applies to the non-executive pay/non-banking sector.)

The term “structural unemployment” is in part correct.

The machines in the structures that used to house people to work on the machines were moved to China and India by the wall street class in their Ivory tower structures.

Structural unemployment by outsourcing.

I am of the opinion that origination fraud was rampant. A Year or two ago, I wrote a news story about a Texas woman who would be Wall St.’s poster child of a “greedy” homebuyer. Her story was so convoluted, it took lots of unraveling. At the time I was and still am pretty sure she was swindled by a pushy co-worker, who received a finder’s fee from the lender/realtor. (I couldn’t prove this and could not make any strong assertions for fear of a libel suit)

The story can be read here (sorry it’s a .pdf, pg. 21 I think)

http://www.dentonrc.com/sharedcontent/dws/includes/drc/advertorials/dentonupclose09.pdf

I’d recommend reading the entire series of stories in the .pdf folder. All are about different aspects of foreclosures in Denton County, TX

I’m afraid my take on the “structural unemployment” meme is a bit more severe than what is presented here. To me, SUE is merely neoliberal economics’ way of saying that they don’t (can’t) deal with unemployment at all without messing up there nice little theories (like cost of labor NOT tying directly back into aggregate demand).

Neoliberalism is a sick ideology; bought, sold, and paid for by economic elites demanding that their ROI not fall as their share of the pie increasingly approaches monopoly. It is the economics of those for whom having it all is simply not enough.

Perfect, concise rant on unenlightened self-interest.

A great post… and unfortunately, until the private labor employment issues are addressed, all the public labor creation wont’ help… it will just add to the debt creating further challenges in the days ahead.

Krugman just banged this drum too:

http://www.nytimes.com/2010/09/27/opinion/27krugman.html?_r=1

So, for those that think the Wall St bailout was necessary and a success.

Where’s our bailout?

The problem here is not that ‘structural’ is the wrong descriptor – it is that within a neoliberal context, there is no possible way to understand ‘structures’ other than personal responsibility. So structural unemployment translates as skills mismatch.

But in my opionion, there IS structural unemployment – only more so in the sense that Marx refers to – that the relentless pursuit of profit has the consequence not only of keeping wages low, but of throwing individuals out of the labor force entirely.

Is it possible to see the foreclosures mess as a structural problem (not just of greedy individuals and individual institutions, but of a system wide need to prey like vultures on poor and working poor people when other less risky profit – generating schemes are not available?

Is it possible to see the lack of proper skills as a result of the structured and relentless destruction of public education, and the switch of resources away from schools and towards prisons?

Is it possible to see the lack of good jobs as a result of the structured assault on labor (outsourcing plays a big role, but lack of security, low wages and poor benefits also increasingly exist here) – not because industry hates people – but because industry has to keep the bottom line looking good so investors don’t flee?

in my opinion, there are a lot of structural reasons that unemployment is high – but thats a different structure than the simple binary proposed by neoliberals:

personal responsibility = realm of action

structural = realm of inaction

its our role, on the left, to think in terms of structural action… and not to cede the concept to its immobilized purgatory on the neoliberal right.

Excellent post!

There’s no comfort watching politicians, economists, etc… struggle to explain the high rate of unemployment with no clear answers.

Id shouldn’t be so hard to explain, especially since the macro economic numbers or so large. Cash has been bleeding out of the US economy since 1976 through an ever increasing trade deficit. Dollars that stay within a nation’s economy circulate and demand jobs, dollars that leave a nations economy are gone and drain jobs.

The numbers are startling. The trade deficit has grown from approx $6 Billion (or .3% of GDP) in 1976 to $700 Billion (or 5% of GDP) in 2008.

How big is $700 Billion. If the average middle class wage is $81,000 thats 8.6 million jobs. Does this number sound familiar?

We should not be surprized that $700 Billion in stimulus was only enough to temporarily stop the loses. With the stimulus done and the trade deficit or bleeding continuing its no wonder economists are worried about a double dip recession.

I’m not trying to slam trade. I think trade is good. The point is that it is way out of balance and something clearly needs to be done.

Hi Yves:

I hate to pull the causation/correlation excuse, but I’ve thought about your post and I think I can pull it here. I have not read the full IMF article, or Konczal’s article, so if I am just lazy, then I am going to pull the misrepresentation argument. If that is the case, it’s on you because as the facts are presented, we’re looking at two different things.

First, your statement:

“Two (in a way, three) articles debunk this idea. The first is an IMF study, which concludes that the housing bubble implosion has far more to do with unemployment than a skills mismatch.”

Mike Konczal’s statement:

“When IMF experts put the United States’ so-called “structural unemployment” under a microscope they find that the large majority of this is the result of the massive of wave foreclosures and underwater mortgages and only a small part is related to skills/education mismatch.”

I think these two statements are materially different. You say the housing implosion is more responsible for unemployment than a skill mismatch, Konczal says foreclosures are responsible for unemployment. The graph is the giveaway. We can draw a regression, so one causes the other.

I agree with your statement. I see the connection on the second as a reach. Consequently, I’m pulling the old scapegoat, when does correlation imply causation? I have not done my homework, but you posted, so I think this is a good time to pull crap.

Thanks again,

Scott

“pretty much nobody except the banksters and some members of the top 1% are exactly keen about present conditions”

hence also their bought creatures, congress and the administration