Yves here. I did a small study for a then midlevel, now top level Russian oligarch in the early 1990s who bought a US retail chain. It wasn’t exactly the most astute purchase. One of the factoids I came across in assisting him in figuring out how to scrub it up for resale was the proliferation of retail store space. As of then, it had increased considerably over the 1980s to 27 square feet per capita. Compare this with the figures in Quinn’s piece that follows.

By Jim Quinn, who writes at The Burning Platform

There is a Part 2 to the story of Consumer Deleveraging that will play out over the next decade. Consumers will deleverage because they must. They have no choice. Boomers have come to the shocking realization that you can’t get wealthy or retire by borrowing and spending. As consumers buy $500 billion less stuff per year, retailers across the land will suffer. To give some perspective on our consumer society, here are a few facts:

* There are 105,000 shopping centers in the U.S. In comparison, all of Europe has only 5,700 shopping centers.

* There are 1.2 million retail establishments in the U.S. per the Census Bureau.

* There is 14.2 BILLION square feet of retail space in the U.S. This is 46 square feet per person in the U.S., compared to 2 square feet per capita in India, 1.5 square feet per capita in Mexico, 23 square feet per capita in the United Kingdom, 13 square feet per capita in Canada, and 6.5 square feet per capita in Australia.

Despite the ongoing recession and the fact that consumers must reduce their spending over the next decade, irrationally exuberant retail CEOs continue their death march of store openings. Below are announced expansion plans for some major retailers:

* GameStop – 400 new stores

* Walgreens – 350 new stores

* Dollar General – 315 new stores

* Ashley Furniture – 300 new stores

* Target – 128 new stores

* Starbucks – 100 new stores

* Best Buy – 55 new stores

* Kohl’s – 50 new stores

* Lowes – 45 new stores

Retailers expanding into an oversaturated retail market in the midst of a Depression, when anyone without rose colored glasses can see that Americans must dramatically cut back, are committing a fatal mistake. The hubris of these CEOs will lead to the destruction of their companies and the loss of millions of jobs. They will receive their fat bonuses and stock options right up until the day they are shown the door.

All of the happy talk from the Wall Street Journal, CNBC and the other mainstream media about commercial real estate bottoming out is a load of bull. It seems these highly paid “financial journalists” are incapable of doing anything but parroting each other and looking in the rearview mirror. Sound analysis requires you to look at the facts, make reasonable assumptions about the future and report the likely outcome. Based on this criteria, there is absolutely no chance that commercial real estate has bottomed. There are years of pain, writeoffs and bankruptcies to go.

Let’s look at some facts about the commercial real estate market and then assess the future:

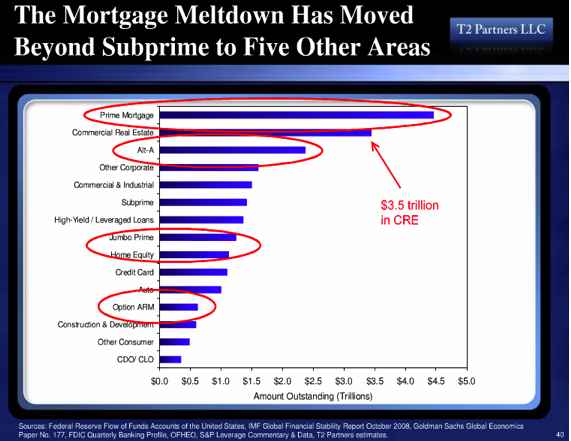

* The value of all commercial real estate in the U.S. was approximately $6 trillion in 2007 (book value, not market value).

* There is approximately $3.5 trillion of debt financing these commercial properties.

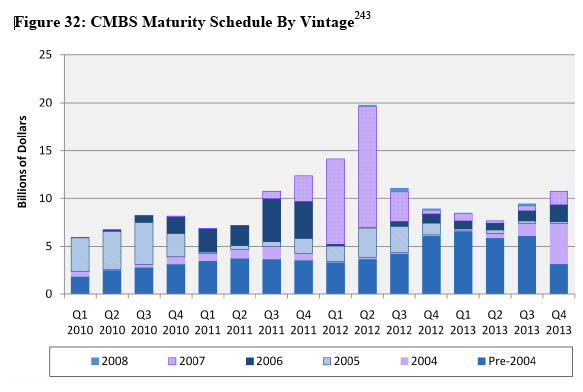

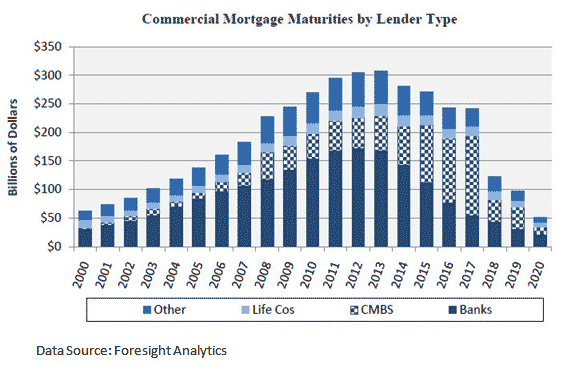

* Approximately $1.4 trillion of this debt comes due between now and 2014.

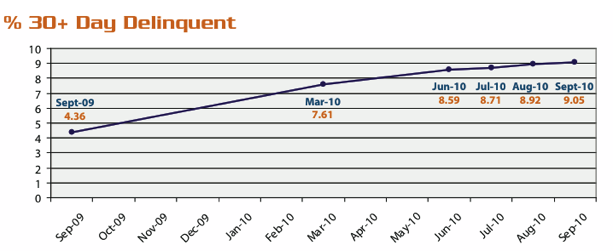

* The delinquency rate for all commercial backed securities exceeded 9% for the 1st time in history last month and has more than doubled in the last 12 months.

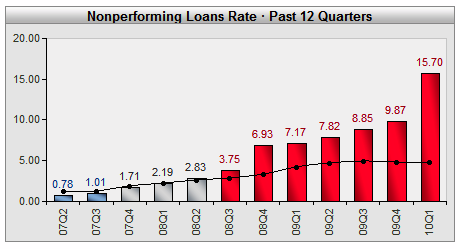

* Non-performing loans are close to 16%, up from below 1% in 2007.

Do these facts lead you to believe that the commercial real estate sector has bottomed, as stated in the Wall Street Journal? The Federal Reserve realized the danger of a commercial real estate collapse to the banking system over a year ago. They have encouraged banks to extend and pretend. The website www.MyBudget360.com describes in detail what has occurred:

What has happened is the Fed has allowed this shadow monetization of the debt and banks let borrowers roll over CRE debt without even making payments in many cases! Think of an empty shopping mall. There is no buyer for this in the current market. So why would a bank want to foreclose on the borrower? Instead, they pretend the asset is worth $10 million while the borrower makes no payment and the Fed keeps funneling money into the banking system. In the end, the value of the dollar gets crushed and you end up bailing out the banking system. Commercial real estate has collapsed even harder than residential real estate. This market is enormous in terms of actual debt. There is no official bailout on the books but it is occurring through a slow and deliberate process. Banks know that they are essentially insolvent and they are dumping this junk onto the taxpayer.

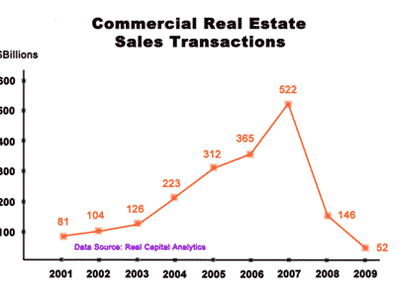

This grim story began between 2004 and 2007. The horrifying ending will be written between 2011 and 2014. Commercial real estate loans for office buildings, malls, apartment buildings and hotels usually have 5 to 7 year terms. If you thought the debt induced bubble in real estate only affected residential real estate, you are badly mistaken. Before the boom, a normal year would see $100 billion in commercial real estate transactions. Between 2004 and 2007 there were $1.4 trillion of deals done, with 2007 reaching a peak of $522 billion of commercial real estate deals. Shockingly, the Wall Street banks, run by MBA geniuses, loaned developers a half trillion dollars at the very peak in the market. Sounds familiar. Thank God the taxpayer has bailed these Einsteins out so they could live to make more bad loans and collect big fat bonuses.

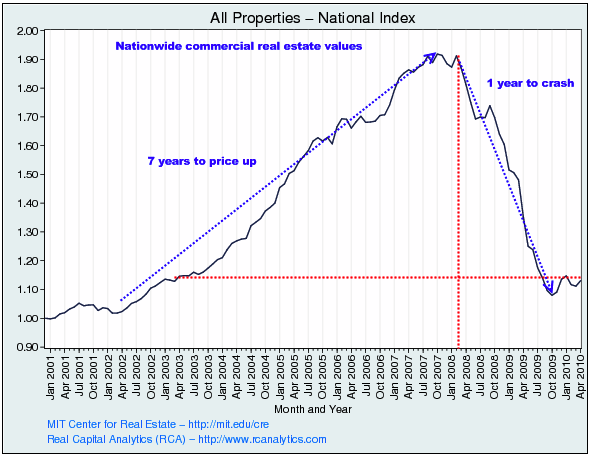

Commercial real estate prices rose 90% between 2001 and 2007, driven by the loose monetary policies of the Fed and complete lack of risk management on the part of the banks making the loans. Knuckle dragging mouth breather developers built malls, apartments, offices and hotels with abandon as billions of dollars rained down on them from Wall Street. The consumer delusion of debt financed wealth led to the developer delusion that 100% occupancy and increasing rents for all eternity were guaranteed.

Commercial real estate prices have dropped 42% in just over a year. This means that the $6 trillion value of all the commercial real estate in the country has dropped to $3.5 trillion. The debt remained in place. The billions in debt issued in 2003 – 2005 is coming due between 2010 and 2012. The underlying assets are worth billions less than the debt that must be refinanced. Commercial loan payments by owners can only be made from cash flow generated by rental income. A key requirement in generating rental income is tenants.

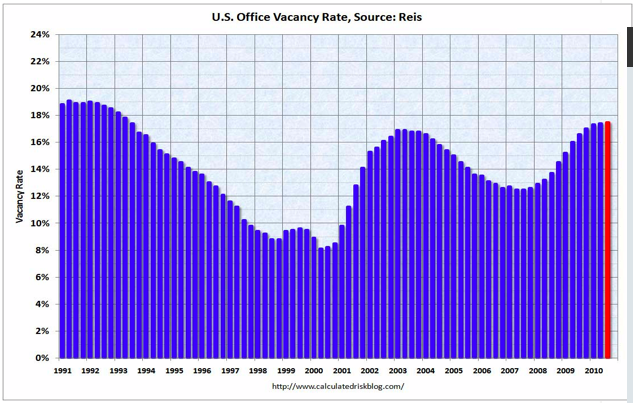

Let’s examine the current state of vacancy rates for offices, shopping malls and rental properties. The current office vacancy rate of 17.5% is the highest since 1993 and is just below the all-time high 18.7% in 1992. The WSJ has concluded, with no data or analysis, that the vacancy rate has bottomed. As the employment data proves, companies are not hiring employees. New companies are not being formed. Government mandates and regulations regarding healthcare and uncertainty about taxes will keep the formation of new small companies at a minimum. Conglomerates continue to ship jobs overseas. Part 2 of this Depression will drive more companies out of business. Office vacancies will remain at record levels for the next five years.

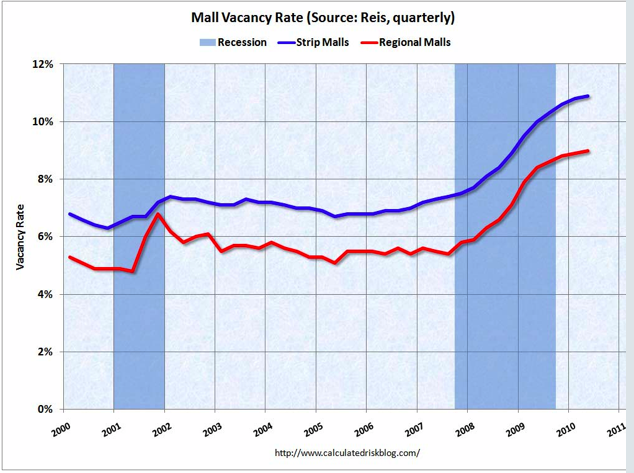

Mall vacancies between 9% and 11% are at record levels. There is absolutely no chance that these vacancy rates decline over the next few years. With consumers deleveraging, wages stagnant, unemployment high, and retail oversaturation, there are thousands of retail stores destined to close up shop. Ghost malls are in our future. They will come in handy as homeless shelters and soup kitchens. Mall developers will be defaulting in record numbers.

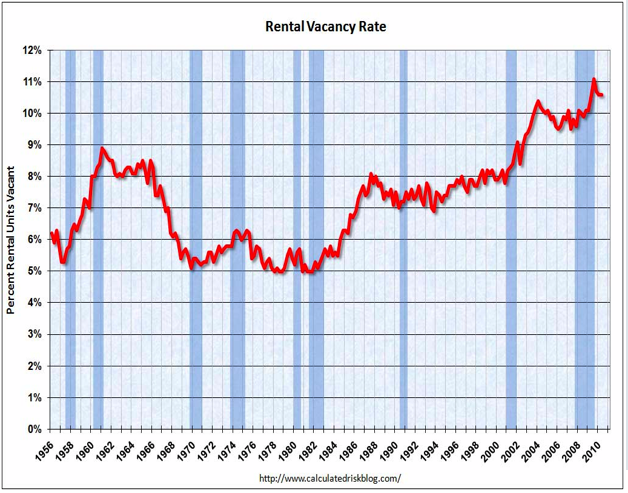

Apartment vacancy rates peaked at 11% in 2009, the highest level in history. With millions of vacant homes and millions of available rental units, rental rates will stay low for years. The cashflow of apartment developers will under stress and will lead to more loan defaults.

Based upon the current rising delinquency rates of 15.7% for commercial real estate loans and 9.05% for CMBS, there is no bottom in sight. Only raging mindless optimists like Larry Kudlow could ignore the facts and conclude that all is well in commercial real estate world. Banks pretending that the loans on their books aren’t worth 40% to 50% less, while also pretending that borrowers with negative cash flow can make loan payments, is not a solution. It is a Federal Reserve encouraged fraud. Allowing loans to be rolled over with no hope of ever being repaid will only prolong the pain and delay the inevitable.

The facts are that hundreds of billions in commercial loans are coming due, with a peak not being reached until 2013. If banks were to properly account for the true value of these loans, hundreds of regional banks would be forced to fail. This is unacceptable to government authorities. They will insist that the fantasy continue. Banks and real estate developers will pretend to be solvent, hoping the economy will miraculously repair itself and eventually make them whole. I understand these bank CEOs and delusional developers also believe in Santa Claus, the Easter Bunny, and the Efficient Market theory. It seems our entire financial system is based upon debt, fantasy, fraud, and delusion.

Ah, yes, the knuckle dragging mouth breathers. Sadly, I’ve encountered a few, and boy, howdy you will not find more devoted believers in the Efficient Market Theory. I suspect that they assume Santa will drop off a few Hooters waitresses in their next Christmas stocking, and that they have ‘taken risks’ that ‘earned’ them a lifetime of golfing.

Apart from their own stupidity, regional banks viewed them as excellent customers, and — at least in my region of Washington State — local (occasionally buffoonish) electeds on city and county councils couldn’t roll out enough red carpets to collect all the supposed B&O (business and occupation) tax that these mouth breathers were supposed to be generating by building all these crap commercial spaces.

The bank fantasies will continue, as will the fantasies of the political class — until it is untenable. The buffoons that I have seen have no concept of how to run a municipality without REET (Real Estate Excise Taxes), and B&O taxes.

When you base your taxing system — and therefore, too many government services — on fantasy revenue generated by mouth breathers who don’t actually develop, invent, or manufacture actual products, you kind of find yourselves in a mess.

We urgently need new economic paradigms — including, how to fund basic government services on something other than B&O and REET taxes.

Yves, thanks for another ‘blockbuster’ of a post.

You are on a roll!

“…you will not find more devoted believers in the Efficient Market Theory.”

Ah yes, and that efficient free market theory invariably includes using consultants, contractors, and subs as involuntary banks, deferring payments for 3-5 months until written threats of work stoppage arrive, is simply efficient cash-flow management. It’s just good business.

It just feels like a rerun of the great depression, just in slow motion. I’ve been rolling my eyes whenever economists like Romer or Krugman say that we should heed the lessons of 1938 . . . I’m not sure we are even past 1930 in the present cycle.

The implication that the taxpayer will have to bailout the banks and CMBS holders through Fed monetization is that at some point the hole in the Fed’s balance sheet will be plain to see. Bottom line is that the USD and/or Treasury bonds are toast since the Fed would have hoovered all bank debt and ABS.

The banks will fail in any case. The charade can continue only for so long. The taxpayer who also happens to be the deleveraging consumer will be even more toast since they will have declining wages and even higher taxes which means even more defaults.

The Fed cannot print its way out of this hole even if they are now determined to try! Good luck Ben.

Commercial real estate is worth exactly what the appraiser says its worth.

It doesn’t matter what changes take place in the state of the national and local economy, nor the unemployment rate, nor changes in disposable income, nor tax treatment under federal and state tax law, nor energy price trends, nor labor rate trends, nor changes in demand for space, nor changes in interest rates, nor changes in property tax and insurance rates, nor any other factor.

Commercial real estate is worth exactly what the appraiser says its worth, and they work for the bankers. If that wasn’t so, banks would have to write down their loans, because they basically own the properties. Therefore, cre is worth exactly what the appraiser says its worth. End of story.

good comment and excellent eye. I trashed Quinn really bad a couple of years ago when he was really hardcore right wing. I like his moderate approach now and his research and presentation are impeccable…except for these partisan biased slips like the one you pointed out. Nice to know there are others who pick up on this.

Good article except for the crack about “Government mandates and regulations regarding healthcare and uncertainty about taxes will keep the formation of new small companies at a minimum.”

B.S.! Businesses aren’t forming because no one can afford to buy their products. Even after all we’ve seen you have to throw in that right-wing talking point. UGH.

As an honorary member of the “professional left,” I agree with this right wing talking point. It would be difficult to design a more uncertain piece of legislation than the insurance industry bailout boondoggle. It is completely unworkable as written, and it is going to be hanging over our heads for the next four years.

Nobody knows how much premiums will rise in the interim, but they will almost certainly rise more than the revenues available to pay the subsidies. The legislation will need to be rewritten regardless of how the next two election cycles go, but nobody knows whether it will be better or worse than the nonsense currently on the books.

There’s no Santa Claus?

“It seems our entire financial system is based upon debt, fantasy, fraud, and delusion.”

Amen! Ably assisted by Government and Fed!

More reasons to END THE FED! Bernanke is probably the most powerful man on earth today. How did he get there .. by screwing tax-payers, savers and retirees and generally serving his bankster pals.

Quinn states that Target has plans to open 128 new stores. So I went to the transcript of Target’s August 18, 2010 conference call, which states “after closings and relocations we expect to add ten locations this year. We plan to steadily build from this very light program in the next few years, adding 20 or more new locations in 2011 and more than 30 in 2012.”

Then I checked on Commercial Real Estate Sales Transactions at the Real Capital Analytics web site. Their Market Stats box states that during the past 6 months, the annual rate of contracts within the US was $124 billion. As one would expect, it has increased from the $52 billion shown on Quinn’s graph for 2009.

There is undoubtedly excessive commercial real estate space in the US, but Quinn has a problem in his treatment of data.

I don’t have a problem in my treatment of data. The 128 store openings was their plan. They may have come to their senses.

http://retailindustry.about.com/od/statisticsresearch/a/2010_us_retail_industry_store_openings.htm

What does the $124 billion in the last 6 months have to do with the $52 billion in 2009? Your recent data supports my contention that the CEOs of these companies are delusional idiots.

Thanks for supporting my article.

BTW Mr Quinn – your old nemesis BN Fox here. I have to say again that ever since knocking heads with you a few years ago and seeing your more bipartisan approach since then , you have been writing some of the best stuff out there. As usual, your research and presentation are impeccable and this piece is no exception.

The Fed with another great investment of YOUR tax dollars:

NY Fed takes $180m hit on Hilton debt restructuring

By Francesco Guerrera in New York

Published: October 7 2010 00:04 | Last updated: October 7 2010 00:04

The Federal Reserve Bank of New York has suffered a loss of about $180m on a debt restructuring that staved off financial problems at Hilton, the hotel group owned by Blackstone, the buy-out fund.

The Fed’s decision to agree to a lossmaking sale of about $320m of its Hilton debt to Blackstone highlights the problems faced by US authorities as they manage billions of dollars in assets acquired during the financial crisis.

EDITOR’S CHOICE

Fed plays risky game toying with bonds – Oct-01Plosser voices concern over further easing – Oct-04Future in doubt for New York Fed chief with a ‘scarlet letter’ – Jun-02The Fed and other lenders could, however, still recoup their losses because the deal left them with better terms on other portions of the debt, according to people close to the situation.

The central bank received $4bn of the $20bn in loans used to finance the leveraged buy-out of Hilton in 2007 when it took on $29bn in troubled assets from Bear Stearns, the stricken investment bank bought by JPMorgan Chase.

The Hilton takeover was emblematic of the credit boom that preceded the turmoil, and saddled the hotel operator with high levels of debt just as the economic downturn hit the hospitality industry.

In April, Blackstone renegotiated the Hilton debt to improve the company’s financial health, buying back $1.8bn of debt for $800m – a steep discount to its par value.

The deal led to a 56 per cent loss on the debt held by the Fed that was sold to Blackstone. More than 20 other lenders, including banks and hedge funds, accepted the same terms and actually sold more of their debt holdings than the Fed, said people familiar with the deal.

The Fed, Blackstone and BlackRock, which manages the Bear portfolio on behalf of the Fed, declined to comment.

From an accounting standpoint, the loss on the Fed debt sold to Blackstone was offset by a paper profit on the remainder of its Hilton debt. The mark-to-market gain reflected the fact the restructuring eased Hilton’s financial constraints and made its debt more liquid and more valuable, said people familiar with the situation. The paper profit will remain unrealised until the Fed sells more of its Hilton debt.

By contrast, the realised loss of about $180m will be included in the yearly accounts of Maiden Lane I, the Fed vehicle that holds Bear’s assets. The Fed also won an unusual promise of compensation from Blackstone if the banks involved in the restructuring underwrite a Hilton listing. Fed supporters say the moves increased the chances that taxpayers will be repaid.

But critics said the Fed should have not accepted Blackstone’s discounted offer. Courtney Alexander, of Unite Here, the hotel workers’ union, said: “There was no question the Fed was going to get paid at maturity, so why accept less than full value now?”

This is but a subpart of the Big Policy Call in DC/NY which is No Bond Haircuts. Naturally, the perps will smash and grab more since the get out of jail card is sitting right in their pockets.

No Bond Haircuts = Japanification/zombification/eternal bleeding of the real economy to bail out parasites

Which in turn = zero real return (at best) on stocks and bonds = need to save more = reduced consumer spending = continuing depressionary conditions for employment, politics (whatever your favorite issues is, forget about addressing it) and more

No one discusses the Big Policy Call any more. It has killed the Obama Dawn. It will kill our country.

All the rest of it is, ahem, collatoral damage.

Thanks for the noble effort at truth-telling.

Agreed—Christalmighty does the “no bond haircuts” thing piss me off.

Thanks!

You have done lot of detailed work on this one. It should now save lot of people from faux pas fatale. In 2005 I was looking around inside Louden County Strip Mall as I became suddenly astonished at how the World had become so glorious in spite of mounting public debt and off-shore-outsourcing. “How do we do the impossible?”, I asked myself.

Grazia

!

These retailers are cannibalizing there own stores. It ultimately comes down to ROI. There is a fixed capital cost to build a store. If the incremental income from adding that store ends up being an incremental loss, the retailer will eventually fail. Walgreens and CVS are at war. Someone will lose.

Heh. Sister-in-law works for Walgreens at their headquarters. Told us Walg was opening a store around here, which is CVS territory.

I’ve been studying a fairly small, yet agressively expanding retailer in my industry (financial) growing about +10% a year in locations. Even though their 5+ year same office sales are declining -5%, their aggressive expansion (when I model it) will still provide them with increasing revenues, clients, and I believe profits for years to come.

For these retailers in your article, if expansion means at least one dollar more in profit and some bit of increasing EPS, do same store sales really matter to them? For example, when will Walgreen’s stop adding profits? It seems like they got a lot of crappy neighborhoods to still enter despite the high vacancy rates.

Another part of the equation is who was buying and selling in 2005-7. In 2005 I briefly worked for a major CRE company that owns and manages buildings. It’s an established company that’s experienced boom-bust before. Most of the buildings they owned in our market were sold to REITs while the company retained management.

Who was buying? Calpers.

There is an argument for expansion in the face of an economic contraction. Normally, assets can be purchased during these periods relatively cheaply. If a company has the cash, buy buying property/ plant/ equipment relatively cheaply during the contraction, it can put itself in a good position for the ensuing expansion. Same with refinancing or even adding debt during a period with low interest rates.

For retail companies and this particular contraction, there are a number of problems with this strategy. First, it looks like the contraction will last much longer than people are accustomed to, or there will be no more post-contraction expansion, more of a stabilization. Obviously the positioning yourself for the next expansion idea doesn’t apply in such a situation.

Second, commercial real estate prices have been more resiliant than they really should be, its just not time to buy cheaply yet. Third, for a retail company the way to do this is to buy other companies that are having a hard time weathering the recession, as opposed to renting out more store locations.

That said, I thought that Starbucks at least had admitted that they overexpanded and were cutting stores?

This was magnificent stuff. You guys (Yves and the author) excelled yourselves on this one. I didn’t know whether to laugh or cry reading it. Yes, the biggest, slowest, worst train wreck in history, and thanks to you guys its a ring side seat. Amazing and appalling and fascinating and horrifying all at once. Thanks!

Neat article. The huge differences between Europe/Canada and the U.S. in retail sq. footage per capita bring to mind an important cultural distinction that has grown over time: the elimination of public spaces in the U.S.

In Europe/Canada, you may spend time at a cafe or out shopping, or you may simply walk through a public park or plaza. In the U.S., our public spaces are shrinking and I would guess that much more of our time is spent in private spaces (including malls and shopping centers).

Well, at least we know we’re free, unlike them socialist Yurpeens.

Jim Quinn: “The hubris of these CEOs will lead to the destruction of their companies and the loss of millions of jobs. They will receive their fat bonuses and stock options right up until the day they are shown the door.”

True, but since there’s no clawback mechanisms they will still hang on to their fat past bonuses (more than enough for each of them to retire comfortably), hence the incentive to expand no matter what.

As most of the note holders are regional banks does this mean the FED won’t bail them out because they aren’t TBTF?

Maybe the term will have to be changed to “Too Many To Fail”.

Jim: Great post!

Yves: Thanks for posting!

Gentlemen the internet is killing retail space and the next generation habits are changing . This is going be ugly no doubt and if your a business owner you want locations in heavily unionized locations sad isn’t it.