The media has been so preoccupied with acute symptoms of the debt crisis – sliding home prices, foreclosure abuses, ongoing Euromarket bank/sovereign debt stress, ongoing battles over financial regulation implementation, unhappiness over the Fed’s QE2 – that lingering problems are not getting the attention they deserve.

High on the list is the how the weak job market is affecting new college and advanced degree program graduates. We have an unspoken social contract: young people who get an education, particularly a “good” education (which means more elite universities, more serious courses of study, graduate degrees) are supposed to be rewarded by higher lifetime earnings. And the prospect of higher lifetime earnings in turn makes it rational to borrow to invest in education.

But this whole premise has started to go awry, and the huge uptick in unemployment has started to make matters worse. A guest post at Baseline Scenario by UMass-Amherst students Mark Paul and Anastasia Wilson outlines the grim conditions facing new graduates:

Currently, even after a slight boost in jobs growth, unemployment for 18-24 year olds stands at 24.7%. For 20-24 year olds, it hovers at 15.2%. These conservative estimates, using the Bureau of Labor Statistics U3 measure, do not reflect the number of marginally attached or discouraged young workers feeling the lag from a nearly moribund job market.

The U3 measure also does not count underemployment, yet with only 50% of B.A. holders able to find jobs requiring such a degree, underemployment rates are a telling index of the squeezing of the 18-30 year old Millennial generation.

Take note: half the recently-minted college grads are in jobs that do not require a college degree.

Now if these graduates were going to college for the mere love of learning, and didn’t mind working at Home Depot because they could work on a novel in their garret, this picture might not be quite as terrible as it looks. But I sincerely doubt that anyone in the US goes to college to become a working class intellectual.

But the economic (as opposed to social and personal) value of higher education is exaggerated. The widely-touted College Board claim that lifetime earnings for college grad outpace those of mere high school grads by $800,000 does not stand up to scrutiny. The author of the 2007 study which the College Board relied upon disclaims that estimate and says $450,000 is a better figure. Mark Schneider, a vice president of the American Institutes for Research, who used actual earnings data of graduates ten years after college, and allowed for other factors such as taxes, pegged the difference at $280,000.

And these estimates are averages. Students who are drawn to fields such as architecture, which require advanced education but are not terribly well paid, will fare less well.

In addition, the value of a degree is premised as much on its scarcity and credentialing value as it is on actual gains in skills. If college educations go from a sign of achievement to a mere social norm, do they really provide that much income benefit to the recipient? James Galbraith, in The Predator State, argued that encouraging more people to get college degrees actually lowered its value, but also served the useful social function of delaying entry into the job market, and hence reducing employment pressures.

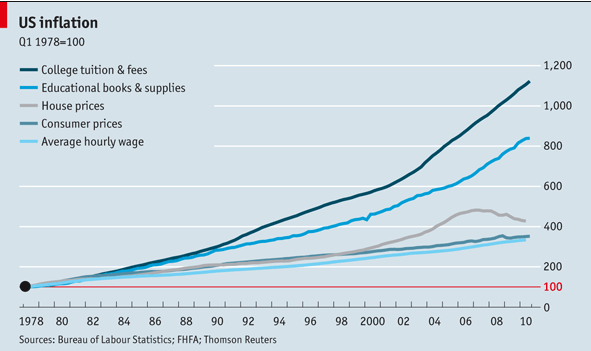

But students and their parents have been sold on the value of education as an investment, and it isn’t hard to see why. As higher education costs have skyrocketed, more and more students need to borrow to finance their schooling. The Economist gives an overview:

For decades, college fees have risen faster than Americans’ ability to pay them. Median household income has grown by a factor of 6.5 in the past 40 years, but the cost of attending a state college has increased by a factor of 15 for in-state students and 24 for out-of-state students. The cost of attending a private college has increased by a factor of more than 13 (a year in the Ivy League will set you back $38,000, excluding bed and board). Academic inflation makes most other kinds look modest by comparison.

In the stone ages of my youth, many middle class parents could afford to send their kids to Ivy League schools. A year at Harvard, with room and board, is now over $50,000, on a par with median household income.

And perversely, student loans are the only form of consumer debt that is virtually impossible to discharge in bankruptcy. Per FindLaw:

Thanks to a provision the 2005 Bankruptcy Abuse Prevention and Consumer Protection Act signed into law by then President George W. Bush, the current law only allows the discharge of private student loans in bankruptcy after a showing of “undue hardship,” the same requirement that is made for federal or non-profit backed student loans. Undue hardship requires a separate showing to a bankruptcy judge proving, in essence, that the borrower would never be able to pay off the loan. This is an extremely difficult legal standard to meet.

New graduates are, or at least should be, very attractive to employers. Someone who can’t find a good job right out of school will face even higher hurdles down the road. Paul and Wilson describe how high unemployment rates for young people represent a an economic and ultimately a social problem:

Recent college graduates, those in the labor force with the freshest batch of knowledge and skills, are currently underwater and sinking fast with unprecedented student loan and personal debt. Average student debt for the class of 2008 was $23,200, an increase over four years of about 25%, meaning that students are knee deep in negative equity between their educational investment and actual earnings.

Between inflated student debt and the lack of available jobs for qualified graduates, students are defaulting at an all time high level of 7.2%. From 2008 to 2009, student debt defaults jumped about 30% to $50.8 billion. This earning-to-debt gap not only hurts lending institutions, but also may affect students’ future abilities to borrow – a significant hurdle in our credit driven economy.

If student debt and job stagnation continue, younger workers will face real structural unemployment (as opposed to the fake kind that had been suspected by some economists, but was recently debunked by the San Francisco Fed). The more time these young workers spend unemployed and underemployed, the greater chance for future structural unemployment due to deteriorating human capital.

High debt, high defaults, and low family earnings will prevent many students from finishing college at all. High unemployment for those who do manage to graduate with a degree will create barriers for those unable to start their careers.

This is a slow motion train wreck. Optimistic estimates of economic recovery project unemployment reverting to pre-bust norms by 2015; more realistic forecasts put it at years later. And the more students drop out of college, the worse job market pressures become.

At the end of their piece, Paul and Wilson make a persuasive case for action:

In order to solve future structural problems in the United States and ensure a future for the sandwich generation, fiscal policy focused on educational and job growth is crucial. While deficit hawks may squawk about the costs, the burden of repayment is on younger people. Without adequate education and careers for students, we will never be able to balance the budget. In the long run, it makes more fiscal sense to create jobs and collect tax revenue than to rely on a model that merely waits for the private sector to invest.

But the “long run” and “fiscal sense” don’t count for much in deficit debates. Sadly, the very real plight of this cohort is certain to be ignored unless they can find a way to make their needs heard.

Well, well, well, someone has finally found the end run societal gambit. I have been wondering about this for quite a while. My thinking which I am presently acting on is that student loans are going to be as large if not larger problem than housing not for financial reasons but those of social stability. Basically the average student debt load is so high as be be likely unpayable in real if not even in nominal terms. The recent proliferation of for profit schools has exacerbated this problem. Furthermore these high debt loads delay purchases like homes and delay or prevent new household formation. And maybe most importantly the lesson from the last 3 years I took away w/r/t debt and the government is that it is better to gamble on the Federal Government embracing moral hazard than to be prudent. Lastly the interesting thing about student debt vs. any other loan is that while they might wreck your credit if you fail to repay, a. they cannot take your degree or knowledge back and b. they will pursue you to a foreign country to get the money. So if a person were smart they might get in as deep as possible and if the job market here leaves them cold just go where the work is…..

See my comment below. The problem is that as the US is losing the respect of the world, so are American degrees. It used to be easy for an American graduate to have his degree accepted abroad. Now it’s getting harder, and for good reason, because American higher education is getting worse by the day. The current exponential growth of for-profit education will completely prostitute American education.

Similarly, getting a work visa abroad for Americans is becoming harder. This is why I have been harping around here for a few years now about the importance of having two citizenships. For example, some EU nations are still willing to give citizenship (or at least residence and work visas) to somebody who can trace his or her roots to that country for up to 3 generations. Might come in handy.

Psychoanalystus

American Degrees may be devaluing world wide, but if you attend a top 100 university here (as I do) you degree is very likely to be accepted abroad. And as for living abroad, well I have the luxury Tri-citizenship which features two countries in two different unions (MercoSul and EU) which allows me to work and live theoretically in over 30 countries. As you said, most European countries will grant you citizenship if you proof ancestry and/or if you meet their residency/language requirement. The Southern European countries are practically handing out these citizenship in an attempt to bring in more skilled labor. To get my Italian citizenship was so easy (3 Great Grandfathers). It has been my plan for some time that if I cannot payoff my loans, I just plan to leave for Europe, where they actually treat their students much better.

Bigvic,

Do you have any advice about getting Italian citizenship? I have 3 great grandfathers from there as well and I know that I qualify according to the Italian consulate. I am searching for practical advice in terms of accumulating the necessary documents or speeding up the process on the Italian end.

Thanks,

Brian

Brian, what I suggest you do is track the names of your great grandfathers. I’m sorry, I misspoke, I meant I had three great grandparents. The fact that you have three great grandfathers is actually much more to your advantage, because of their old jus sanguinis laws which were paternal. When you track down the names of these great grandparents, you should look for the regions in Italy that they were from, from there you should try and track the city or town. Once you do that, you should contact the church, which is where the birth and marriage documents were held. Once you have these documents, you should get in contact with your local Italian consulate (or embassy if your near Washington). This is the process me and my father went through. I hope this was helpful.

Sounds like you have a sound plan of action. I’m already spending half of my time in Europe and half in the US, and hope in 2 years to stay in Europe full time.

I think other factors to take into account are, lifestyle, social environment, social safety, crime, etc. Lifestyle in Europe is so much nicer than in the US, the social environment is family-friendly, the European social safety is wonderful, and violent crime is much, much lower than in the US. Europe is just a wonderful environment for a family. I certainly don’t plan to raise my daughter in the US.

Psychoanalystus

I agree completely, Europe in general is just a more pleasant place. I am a little scared of the rightward move of Europe, but I am confident that Europe will remain Europe. I think a lot of what is wrong is that we (America) keep exporting our culture of greed outward onto the world.

I think the jury is still out on the for-profit educational institutes. My firm has (relatively) expanded hiring of graduates of these types of schools and the results don’t suggest that the educations are valueless with respect to the jobs we need done. Who knows what this means? It could mean that the credentialism implicit in degrees from the more traditional schools will revert to a new mean being created with the for-profits included, which might rein in the pricing power the traditional schools have been leaning on so heavily. Also, it is kind of a laugh to think of traditional schools as not profit seeking. Might be the legal definition, but when you consider what the staff and administration is seeking – very big salaries and wages – the bottom line for the student is you may as well consider you tuition and fees as going to profit-seekers.

“See my comment below. The problem is that as the US is losing the respect of the world, so are American degrees. It used to be easy for an American graduate to have his degree accepted abroad. Now it’s getting harder, and for good reason, because American higher education is getting worse by the day.”

Any proof of this. Any idiot can make a statement on a blog.

If American higher education was getting worse by the day, we wouldn’t have foreign citizens coming over to get their higher education. Just in my job (which requires at least a bachelor’s degree and is intensive work) I work with 2 Indians, a Brazilian, a Ghanaian, a Jamaican, a Mexican, and a Venezuelan, and a ton of Americans.

A lot of what needs to disappear are the “pointless” degrees. If you want to go to school to get them for the sake of getting them, the power to you, but a person should be told up front you’re not getting a job with this and the state should provide less subsidy for it. It disgusts me people complain about not being able to get a job with their bullsh*t degree and they tell me this who went and became an engineer.

“The current exponential growth of for-profit education will completely prostitute American education.”

The state for-public schools were all for-profit by fact if not in name a long time ago. It’s a business.

“Similarly, getting a work visa abroad for Americans is becoming harder.”

In the case of Europe, that’s nothing to deal with the U.S. and everything to deal with the European Union and free movement over borders. To borrow a completely bizarre example, unless you have a British grandfather or something it’s near impossible to get a work permit to play rugby in Britain. As for the rest of the world, Australia, New Zealand, South Africa, Japan, etc. you can still go to more or less if you want and work visas are easy to get approved. And why would Latin America turning down American money, although you can make more money here than there.

“I work with 2 Indians, a Brazilian, a Ghanaian, a Jamaican, a Mexican, and a Venezuelan, and a ton of Americans.”

Clarification: not only do I work with them, but to tie it to the discussion they all did high-level schooling here as well.

will not pursue a person to a foreign country, pardon me.

Psycho

There are frequently perverse incentives with these loans where default is the DESIRED outcome for these bankster dirtbags.

What else could explain a situation where you deny the person a license and by doing so also negate any possibility of that person paying back.

I’d be willing to bet that if you looked at how your friends who have been denied licenses loans are structured you would find that they are much more valuable in default.

http://www.studentloanjustice.org/argument.htm

Great article! In addition to my clinical work, I also teach part time at a private medical school. Some of my students graduate with as much as $350,000 in debt. I think the average is around $150,000.

Another problem is that in many professions, if a graduate falls behind in paying his student loans, the DOE sometimes will go as far as to prevent that person from getting a license to practice. I know several doctors, dentists, and psychologists with huge debt in that situation. And, since they cannot practice, they obviously aren’t able to pay their student loans. Catch-22. I know a few who were forced to leave the country because of this, and now practice in Europe just because here their careers were ruined by student loans. It is an insane system.

Psychoanalystus

The prospect of getting a job as an associate at a big firm right out of law school has disappeared over the past few years for just about anyone who hasn’t gone to a top tier law school and graduated in the top 5% of the class.

Law school doesn’t even begin to arm you with the skills necessary to litigate against a major defense firm, so these new lawyers would be no match for the army of experienced lawyers the law schools would hire to defend any class action suit for the fraud they have committed. And since the case would likely be a loser, it would be very difficult to find a worthy plaintiffs’ law firm willing to sink the money into a case on a contingency fee basis. Moreover, the ABA would absolutely pull out all stops to keep their little law school ripoff scam running. Most of the judges are active ABA members too, so I can’t see them having too much sympathy for the plaintiffs.

My best friend graduated from Michigan State University Law School a few years ago and passed the Georgia bar on his first attempt. He has over 100K in student debt and has only been able to find “document review” jobs in other cities. This is the new future for law school graduates that they don’t tell you about when you take the LSAT. He is driving to another city away from his family, paying for his own hotel room and food, sitting in a room with 50 other lawyers for 12 hours per day, and making $17 per hour with no benefits and no overtime (professionals are exempt).

Big pharmaceutical companies hire these contract lawyers to review tetra bytes of documents to see if they contain privileged information. Really, a gaggle of monkeys could probably do the same job. It certainly doesn’t require a juris doctor degree, but I suppose since there are hundreds of thousands of new lawyers out there who cannot find anything else, why not hire them for peon wages and make them feel like they’re practicing law while they look for a real legal job.

Take a look at some of the jobs that new law school graduates can expect. http://www.shitlawjobs.com/. How can anyone pay back a student loan at wages that are only slightly higher than Starbucks when you factor in benefits? My friend tells me that, of the 50 attorneys in the document review room, most everyone has placed their student loan in deferment status.

I am puzzled about why it’s taking so long for people to figure out that law school is a three-year ripoff. I guess every student wants to believe that they will graduate in the top 5%, but the odds are very much stacked against them.

Sorry. I meant to post this reply to Attempter–not Psychoanalystus.

Yes, I said I think it’s dubious from the point of view of winning the suit.

I was thinking in terms of a political assault by lawyers who realize they were dispossessed before their careers ever began.

Why not burn one’s ships and fight back, instead of settling for indentured servitude? That was my idea.

Thanks for the added detail on what a scam it is.

So uh, can you explain to me why it’s the case that only the top 5% at elite law schools get said jobs? That seems like an awfully small number, if law school classes, are, say, on the order of 500 or so people, and you pick the top, I dunno, 10, you’re talking only 250 new graduates per year able to get competent jobs?

The intelligencia, in their short-term quest for personal profits certainly doesn’t seem to mind the coming future shortage of doctors. Fools.

The goal of the health racket bailout is to drive the masses out of the system (while making them pay for the worthless, extortionate “insurance” Stamp). The elites expect there to be plenty of doctors to go around for themselves.

http://attempter.wordpress.com/2010/11/14/the-austerity-mechanism-of-the-health-racket-bailout/

I’ve already heard of a few cases of law students suing their law schools for having fraudulently represented the value of the degree and the jobs that would be available to them, and inducing them to take out student loans on that fraudulent basis.

Poetic justice (for both parties, in the case of law students) aside, the moral soundness of such a suit is clear. This is a clear-cut case of predatory lending. You fraudulently represent an expensive asset as being an investment which will always appreciate in value, and induce the mark to take out a usurious loan in order to purchase it.

The parallel with housing is clear, and the fraud is even more direct. In the case of mortgage lending fraud, the seller was usually technically the previous homeowner, with the banks and their flunkeys managing the sale (and the government only propagandizing for it).

Here the school and the government themselves, along with the banksters, are active participants in the loan fraud.

It’s even worse in this case because there are no non-recourse student loans. There’s no house collateral to repossess. There aren’t even recourse loans which can be discharged in bankruptcy. Instead the “repossession” on a default can be nothing other than indentured labor. Legally, there’s no walking away from a student loan. Once the distressed student borrower can’t pay, he’s placed in the Hobbesian state of nature vis the indenturing system. The 2005 bankruptcy law has only made this worse.

Then there’s the fact that many of those who went on to post-graduate study did so expecting to be hired at asset-appreciating rates by the very educational system which was making these promises for these assets. Yet everywhere today we see the schools themselves failing to hire in sufficient numbers, and low-balling those they do hire, and seeking neoliberal structural adjustments for professors and teachers at every level.

It’s there that the loan fraud is most stark, direct, palpable.

So I’d love to see class action suits against the universities by the distressed student debtors, and a parallel political campaign unmasking this systematic lending fraud on the part of the schools and the very government which makes it impossible to discharge the debt, but wants to turn it into indentured servitude.

While here it’s not legally possible to jubilate the debt from the bottom up (the way it is with e.g. mortgage debt), it’s possible to politically demonstrate it to be predatory debt, the victims being the children (and by extension the parents who have to keep financially helping them) of the very middle class who would be the target audience. And this way may lie some kind of political relief, some kind of top-down acquienscence in the demanded jubilee.

(Meanwhile, I don’t know how legally viable such lawsuits would be. The law is no doubt rigged against them, and even if not it would still depend upon non-corrupt judges, judges who aren’t pro-bankster. But I think the main point of such suits would be political. Money shouldn’t be a problem, if we have all these unemployed lawyers. All you need is enough of them who recognize that the most likely path to relief is political, and that such suits can be part of that political campaign even if they don’t prevail in the proximate legal sense.)

Beyond that, this is yet another stark lesson in the fact that the government and system institutions have become on the whole enemies of the people. What other conclusion can be drawn from the fact that they’ve taken the education aspiration itself, something which throughout history was the shining emblem of socioeconomic advancement, always right at the core of the work-hard-and-play-by-the-rules propaganda (and let’s recall how just a few years ago the likes of David Brooks were trumpeting the notion that America needed to aspire to universal college attendance), that they’ve taken this and turned it into another malevolent dead end and debt trap.

We know what Hobbes said the person who has been cast out and placed back in the state of nature should do, what he’s morally entitled to do, if the sovereign unilaterally breaks the social contract. The student debtor, the victim of top-down loan fraud and the target of indenture, should recognize that the existing system first lied to him and then unilaterally declared war upon him. He should regard it in kind.

The only way my wife and I got around her student debt is putting it all on the regular credit card, and then declaring bankruptcy. Ces’t la vie.

Educational debt is more or less exempt from bankruptcy.

http://www.finaid.org/questions/bankruptcyexception.phtml

They transferred the balance to the credit card, then declared BK. So the discharged debt was credit card, not educational.

Note, however, that if this became widespread, it would stop working, because the transfer is a so-called “fraudulent conveyance” — a transaction specifically designed to escape an obligation.

The only real solution is to fix the bankruptcy law. And deliver better ROI (i.e. lower priced) college education.

Expect a large expansion of the “grey labor market” where college grads are paid under the table. No visible income, no loan repayments….

That’s what the US gets for destroying sane bankruptcy laws. Among other things. When the law becomes absurd, people just start ignoring it, and once enough people do so, the law becomes unenforceable.

sad but true. well put.

the unrepressed overflow of insane ID ENERGY into cultural super-ego is absolutely crushing the ego structure. this will not end well. watching the manic depravity of it all, unmediated by gnostic reflection and the channeled boundaries it would create, is like watching a lion eat red meat.

I had a strange dream last night about lions who lived at the bottom of a bizarre pond in a suburban enclave of sorts settled next to the shore of some blue/grey flat ocean, and the lions would crawl out of the pond and wander in the wooded parklands that projected from the pond and that created a minor wilderness in the midst of the town. the lions were invisible, until one came upon them in the woods along the stream in the park. And then there was no telling what would happen.

The invisible lions are prowling our perimeters and wandering through our universal mind and they are eating.

I remember back in the late seventies when the “Lyon” moving company had a nightmarish line drawn lion splashed across the sides of their vans: looked like it was straight from hell. I shook my head and shuddered every time I saw one. We thinking reeds tend to discount the invisible hidden world within and ascribe “reality” to only what we can see and touch. This tendency becomes more pronounced in a mostly cybernetic world that requires plug-in pieces and not balanced human beings. The result is a collective “id” if you please that grows more primitive and violent by the day. “Look at that monkey bangin’ on them drums!” “I got to move these microwave ovens.” “Money fer nuthin’ and yer chicks fer free.”

All this primitive anger and rage from our monkey minds will be channeled by the likes of Sarah Palin or worse. These shills will, in turn, be controlled by the same old devils who’ve been pulling our strings for the last three hundred years. I’m kinda hopin’ the monkey mind just goes bananas and on a rampage that even the devils can’t control. Will it be painful? You bet. But the alternative of a human animal turned into a “borg” at the service of the wealthy and their diabolical machinery seems to be the “happy ending.”

I’m old and probably would have a different POV if I were twenty. But maybe not. In any case, a meaningless speculation. But it’s a sad state when Mad Max seems the better outcome.

Very well put, craazyman!

I suspect our societal unconscious will create a very dramatic and brutal defense mechanism to defeat these lions. Perhaps something very radical, like revolution, followed by communism.

Psychoanalystus

We have a deranged id whose worst elements have hijacked the super-ego.

What will the beleaguered ego do?

“And this way may lie some kind of political relief, some kind of top-down acquienscence in the demanded jubilee.”

I don’t think said jubilee will be as popular as you do. There is broad discretion in how much garbage any prospective student/ their parents swallows with regard to education debt. People make compromises in this regard all the time and those who cut their losses by going to less expensive schools, stopping with a BA/BS, etc view those who “sit in school” forever with great ire already.

If those who sat in school forever turn around and complain about it, seek a “government bailout” of their own choices, the other ones–not to mention the much greater number of people without degrees, jubilated or otherwise–are not going to go along.

In that regard, it’s going to be just like the mortgage mess, only more personal. People are sick of being condescended to by the credentialled classes.

On the other hand, the lack of employment opportunities extending to even those with educations is much more politically viable, because the only answer anyone in the government or out of it has given the working classes and displaced white collar workers for the past 30 years is to get an education or go back to school. This is a deeply frustrating answer that makes no sense to anyone who has ever found themselves in that position. THEY know there are only going to be so many lawyers.

If the education game is up, then it’s up. Attention to this issue is right on, but a student loan jubilee as its leading cause is mostly going to be divisive.

Pretty much anything worth trying is going to be divisive. Especially since the criminals will astroturf ignorant rage.

But one has to go ahead and try it anyway. Like you say, the more this middle class realizes how it’s being liquidated as we speak, the more opportunity there’ll be to tip its rage toward the right attractor and away from the wrong ones.

The ultimate irony of this is, of course, that most of the tuition fees go to mowing the lawn in the campus square (all decent institutions have endowed professorships). Hope you enjoyed the picnics on the grass!

And to those mocking a young person making an ill-advised decision to go to law school, look at your own f*cking glass house for a change and stop the sanctimonious holier-than-thou shit. If everyone else if so f*cking awful, just f*cking off yourself and stop using our f*cking oxygen; you won’t have to deal with all the bad-faith criminal idiots that way. Wouldn’t that be better?

Most of the schools give graduate relatively little in what can be used in real world (that is, comparing three years of doing stuff vs. being at school results in one getting considerable more out of the former).

The schools used to be more of a signaling device – something that could tell the employees (louder than any words on the CV) that you were committed, hard-working etc.

Unfortunately, with proliferation of the degrees, the signal disappears. Moreover, the result of the signal, will, for some people, become the signal itself – sort of a degree cargo cult – confusing the causality.

Having widely available student loans only make it paradoxically worse. Student loans mean that institutions can (and have) incentive to charge more – and that dodgy institutions are encouraged to set up. When they have incentive to charge more, then they have higher incentive to let the students pass (somehow), as institution where you pay a lot and get failed will probably not attract much students.

Galbraith “but it means they enter workforce later” argument is a rather short-sighted one, as it means that we force the students (by taking student loans) to pay for the privilege of not working, with prospects of no better income afterwards.

Room here for the wise words of Sir Richard Mottram:

“We’re all f#cked. I’m f#cked. You’re f#cked. The whole [system] is f#cked. It’s the biggest cock-up ever. We’re all completely f#cked.”

Yves: “But I sincerely doubt that anyone in the US goes to college to become a working class intellectual.” Anymore. I did, and I’ve striven _manfully_ for my right to write in my garret, I’ll say it. And it actually IS a garret, fourth floor, under a roof, beautiful view worth double my controlled rent! Not that I was working class. In the family I grew up in, my mother was a Smithie and got a masters, and my father cut a trajectory through Bard, Oxford, Columbia Art, and Carnegie-Mellon. But I found the life of a working class intellectual considerably more attractive than that of another bourgeois taxidermological specimen.

Why do I mention this personal history? Because the real _value_ in a college education isn’t in ‘revenue enhancement.’ That is a curious bourgeois concept which has become the dominant meme in American discourse. It is, as Yves and others lay out, much less than as advertised. Credentialing _has_ driven down the value, just as Jamie Galbraith posits. But moreover, the frauducation industry has never been about education, at least in its administrative design. Oh for a certainty, many professors are tireless and dedicated teachers; even while their institutions are money extraction mills. Prices up _by a factor of 24_ in forty years, and that despite the fact that the college enrollment has never been higher. How can the industry get away with this? Because those enrolling don’t do so on a rational basis but on an aspirational basis: a college degree is a ticket to a certain place in the class structure. And I don’t mean the class of the clasroom variety. It was like a certificate of minor nobility, and well understood to be such at the _emotional_ level. So folks will sign the loan agreement to get that without even looking at the figures seriously. It’s all about acceptance. Really. A professional degree? That’s middling nobility. I mean, who _doesn’t_ want that.

The frauducation establishment realized back when student loans-and-grants became a formalized process that all it took to make money was throughput. Satifaction, career success, learning: all very good, all very unnecessary to making money. Because most students are going through on other people’s money in the first instance, so there really isn’t much price resistance. Only the working class who had and have much less access to other people’s money to pay for a higher education were particularly price sensitive. That was the system as of fifty years ago. Not that the price has always been affordable even time was. I remember turning down Harvard because I couldn’t affort $6000 a year, sheesh. But I didn’t screw up my life by borrowing the money because it was clear in the rational view that that would be the result. A college education later, I turned down a graduate acceptance for the same reason, got a library card and a computer and educated myself. I know, I’m an outlier, but I’ll tell you that’s better than a ‘liar’ liar.

The costs have been more extensively shifted onto the enrollees themselves in the last twenty years, shockingly so, but the process still mimicks using other people’s money so it just doesnt feel that way when both acceptance and promissary are on the table. And in fact, the two are never on the table at the same time. All of this is much worse at the graduate level, where most of the payments are in fact other peoples money so long as the relevant programs can get the mark to take the hook for their plurality of the actual cost. So as you can see, ‘what it all means’ to the enrollee is the least of all cares, really. The only thing that matters is throughput. And the lemmings keep coming because a) they want a lock on their aspirational place in teh class structure and b) they’ve been sold on the idea that they’ll actually make money out of the privilege.

The great joke of course is that the opportunity to learn is the best possible return on the money even while it is the least of all reasons that most enrollees actually scrawl on the line. Many colleges are great places to learn if that’s what one wants to do. Y’know, that ‘intellectual’ thing. The best chance many will ever have in their lives. They’re a great place to meet interesting friends, some of whom will stay with one from life, and more of whom one can learn who really one really enjoys as company. But most who say they’re there to learn are in fact there to yearn and to earn, so it’s far easier to con them since the process is already something of a self-deception. This is why the frauducational law programs turn out faaaarr more lawyers than there are positions for them; why oceanography programs turn out far more people than there are conceivably jobs for them to fill; why MFA programs exist—to shake down marks in return for a mongrammed set of backscratchers; why degrees in English are even permitted.

So my advice is to drop in. Go there for the learning and the experience, and watch the costs. Get off the career route and find out what your life’s about. Very Sixties, I know, but at least the lies you tell yourself put a smile on your face bigger than the whole in your wallet. Don’t buy the lie is the best advice one can ever get. Those of you who aspire to illusions: it’s gonna cost yah.

Well spoken. I dropped-in to the Ivy League in my thirties. During the dot.com boom it was easy to make money, nobody cared about credentials…

The truth is all employment markets are saturated. If you have a degree in ‘Business Management’ from Phoenix university, the market is saturated… if you have an engineering degree from a top ten school… that market is saturated too. People like to dismiss the college thing as being ‘overvalued’ but the life of a skilled carpenter or machinist is no easier.

Yeah, the truth is that the world is overpopulated, including the developed world.

If you carefully look at history, it becomes clear that all of that famine and disease and war really did have a purpose, as horrible as it was. By accelerating what would naturally happen anyway, death, it resulted in periodic “clearing outs” if you will that allowed the upcoming generations to take their place in the labor market.

There’s reason to believe that the Black Death helped to cause Europe’s dynamism in the following centuries, because so many serfs died off, that labor finally had bargaining power, and this was the beginning of trade and the rise of the merchant class.

It’s impossible in a world of 7,8,9 billion humans, 300,400,500 million Americans, for everybody to have the good life. Not when there’s a limit to the amount of fossil fuels that can be extracted for a profit. Not when we’ve just got through the biggest credit expansion in history. I don’t care what the idiot, utopian economists say.

We are the midst of a big crash, folks.

Big crash indeed. What with global warming, we face real chances of total human extinction.

Or we might get off lucky and just end up on the bust end of a boom-bust population cycle. This one boomed pretty far, though. Wonder what it will drop to — one million world population, maybe?

My neighbor called me a month ago to ask for advice about obtaining student loans, for her daughter who wants a career in hospital administration. I don’t know about prospects for such a career, other than that the baby boomers + the new mandatory insurance legislation might seem to assure patients for beds.

Knowing the grim statistics on student loan debt and paucity of job prospects for new graduates, I first warned her against for-profit ‘colleges’ and tried to dissuade from any college at all for her daughter. This is a blue collar family that doesn’t yet realize that the American Dream is over. They are hard-working. The kids work. They are in deep debt from a cash-back refi……

Nevertheless, they’re scouting local state school offerings. Here’s my question: Would it be worth it for this young woman to take some business classes at the community college?

Currently the unemployment rate for college graduates is one half of the overall unemployment rate. So the degree is not worthless.

Some years ago I read that the average income for college grads was roughly the same as for high school grads during the first half of their working career. But during the last half of their working career their income quickly rose well above a high school grads. So again the degree is not worthless.

But… the inflation rate for college tuition is comparable to that of health care. In the case of health care, the patient has a strong incentive to pay whatever the cost. The same is not true of college tuition and parents should have intervened to discourage excessive debt. I certainly did that with my own children.

Worse case, new college graduates move back in with mom and dad, take some low paying job offering some meaningful experience, and ride out the storm. My daughter lost her job and it took 18 months to find a job with only a 20% pay cut. Her degree was not worthless.

Any attempt to allow student loans to be discharged in bankruptcy will bring out the usual cast of banksters predicting doom, but it should be done anyway.

Young people and their parents will have to avoid the colleges and universities with the highest costs. ‘Caveat emptor’ rules the day in our society.

I question whether you understand the metric of whether a student loan is worth it.

There are several metrics that together brings into question whether student loans are worth it:

(a) Over the life time of the worker does he or she earn enough to justify the cost of the student loans and the time not working.

(b) What are the long term prospects not just for finding a job, but also finding one that pays the bills. You admit here that your daughter is making 20 percent less. From my perspective, I have no idea how anyone can reasonable conclude that’s a good thing if her outlays to bills such as student loans aren’t reduced by the same 20 percent. In other words, the principles on her student loans aren’t reduced by 20 percent so your argument on that level seems unhelpful.

(c) Why do you assume everyone can move back home to family?

(d) You seem not to also grasp that there are societal issues involved in wanting a well educated middle class that comments like this ignore: “The inflation rate for college tuition is comparable to that of health care. In the case of health care, the patient has a strong incentive to pay whatever the cost. The same is not true of college tuition and parents should have intervened to discourage excessive debt. I certainly did that with my own children”

Frankly, I don’t want to go on. Your comment as I think about it strikes me as the typical blame the individual, don’t look at the system that’s destroying the system.

These issues are systemic. Yet, one would assume from reading your post that you don’t get this. So, my question is- do you get that these are systemic issues? That the discussion here is about the over all picture rather than whether you think individuals can address the problem by themselves? the reason why things are getting so bad in other areas is that we keep shifting the risk to the individual without looking at systemic risk?

Do you see the problem with this when individuals must operate in a system with systemic risks? How does the individual avoid those risks? You can certainly, I guess, just blow it off with a lot of libertarian type talking points, but its not very useful analysis in the real world.

In the real world, well, let me compare this to other countries such as in Latin America. For this reference, I will pull from pop culture. If you have ever seen the show Ugly Betty, that show was actually a remake of a Latin American show. The difference is that the classes are so stratified in the Latin American culture that even with a college degree one can not move up into the middle class.

That’s the systemic risk here. The concern that we are once again assault systemically the middle class.

Pointing out how you are able to individually avoid such a concern is not frankly useful info. The question is how to do we as a society address the systemic risk? How do we prevent a Ugly Betty society from arising where a college degree- at the very least- has decreasing value. If the value is decreasing, that’s still a wrong direction trend.

Finally, you show your libertarian/industry hand with the caveat emptor line. There’s a reason why that concept was rejected over a century and half ago in the law- that’s because its a horrible way to conduct a market as far as risks are concerned.

Trust me, you wouldn’t want to live in the world that you are trying to push onto others. Nor, do I really believe you really want to live in that world.

You left one of my comments out: “Any attempt to allow student loans to be discharged in bankruptcy will bring out the usual cast of banksters predicting doom, but it should be done anyway.”

That is not libertarian!

I was not happy that my daughter had to take a 20% pay cut but I was pleased that she found a job. There are many others without a degree who have not been nearly so lucky. That is the reality we face.

Beyond that, colleges and universities will charge as much as they can get away with. I would not hold my breath until we inflict price controls on them. So parents and their children will have to take their business elsewhere in an attempt to get them to moderate the price increases. That is the reality, as unpleasant as that is.

College degrees still have some value for the reasons which I gave. But cost is a factor which can’t be ignored. People have been treating a college degree as though it would always pay for itself in the near future. That never was completely true, and now it is much less true.

Caveat emptor’ rules the day in our society. You seem to believe that is not the case,and I wish it were not. But I am a realist, unable to ignore the evidence that to a large degree our government has deregulated business and left us to fight it out in court. Fighting it out in court guarantees us a net loss. So ‘Let the buyer beware’.

The libertarian by default position is that you have no choice in the matter. Why bother? Its the way things are. Saying its not libertarian because you mention bankruptcy, but then going on to defend the default is indeed libertarian. Its just by circumstance rather than by ideology.

Jane Doe says: “The libertarian by default position is that you have no choice in the matter. Why bother? Its the way things are. Saying its not libertarian because you mention bankruptcy, but then going on to defend the default is indeed libertarian. Its just by circumstance rather than by ideology.

I don’t understand your logic there.

If you entered into the loan then your only hope is to pay the loan off or hope that bankruptcy will be allowed for the debt.

But you are starting to sound like the Florida home buyer/flipper who now would like someone to save him!

Do you believe that someone who did not get your college education should pay for it? Should those who have only a high school diplomas pay for your college education?

Oops pressed submit to quick.

Anyone who has been closely following the home foreclosure crisis understands that ‘Caveat emptor’ has served the mortgage brokers, and bankers very well. If their behavior was illegal the jails would be packed.

Jim, you wrote: “Any attempt to allow student loans to be discharged in bankruptcy will bring out the usual cast of banksters predicting doom, but it should be done anyway.”

I’m not one of the bankster, and I am not predicting doom, but allowing to discharge student debt like other debt seems bad to me: first it will make interest rates of new loans higher, because of the increased default risk; second, it is unfair, because, the students bought something with the borrowed money that they can keep, and a federal allowed default amounts to a significant federal subsidy. Instead, I suggest a “milder” form of debt default: repayment size for new loans will be capped to a percentage of the income, and defaults of old loans can’t lead to giant fees, which make a defaulted loan more valuable for the lender than a non-defaulted one. Could that take care of many problems without destroying the student-loan market?

The right way to look at this is NPV. Public data suggests private college delivers negative lifetime ROI to a majority of attendees, as follows:

http://nostradoofus.com/2009/10/19/has-college-become-a-bad-investment/index.html

Education joins the housing bubble as a mishmash of government tax policies and subsidies misdirected the allocation of savings into the jaws of scamsters and usurious lenders.

The Housing bubble was blown because of the FRB induced inflation and US taxation of inflation gains in assets at the time of sale. The mortgage interest deduction was the poor man’s arbitrage of inflation rates versus the alternative of paying taxes on interest “income” that was less than inflation.

Now the US has an “educational bubble” from hell where increases in education prices have exceeded increases in the CPI. Government tuition gifts and guaranteed loans and tax credit policies have given for profit schools and culinary institutes as a prime example the smokescreen to do predatory lending. Recently some for profits agreed to stop recruiting students from homeless shelters.

But even the independent non profit and state schools are in the bubble.

Graduate school loan burdens are catching early attention, but the undergraduate school tuition increases are an even larger bubble of unrepayable costs.

The chief issue with education is that it has become a commodity like other non-commodities in our society. This has its genesis with Reagan in the 70s in California and has spread across the country.

Generally speaking, education has moved from being a social good that our society promotes to being a commodity that one must take a risk on obtaining. Therefore, once again shifting a systemic risk (that of an uneducated population) to individual risk (where one gambles about the value of a degree being worth while as far as jobs are concerned). The problem with education being a gamble is that its even worse than housing. If one gambles wrong with housing, one still has a house to sell or go into foreclosure, etc. If one gambles wrong with education, one has non-dischargeable debt, and no meaningful prospects regarding the middle class in this society.

This risk factor along with a bundle of other risk factors are what I describe as the core bundle of risk shifting that has been happening in our society for decade. They are almost all related to necessities or near necessities because they are almost all items that people need in order to either survive (health care) or to have a shot at being in the middle class (education). I don not think this is by accident. Its by design of what organizations can overcharge people on in our society.

Some here will argue “its the incentives.” They will blame things like student loans. The problem with these arguments is that student loans predate the hyper inflationary increases in the cost of getting an education in America. Therefore, the argument is, at best, self serving as far as pushing an ideological agenda goes. But, more likely dangerous, because it misses out on seeking the real causes of our middle class economic situation in this country.

The chief issue with “education” is that, like “intelligence”, we don’t know what in hell it is anymore. A technical education has a half life of five years if you’re lucky and probably a decay rate more than exponential. How much is it worth to know how to run today’s Intel fab line? How much is it worth to know how to run the fab line they had five years ago? Factor that with the likelihood that your education will be for the five year old line because that’s what the “teachers” know. Just an example.

If we can’t even define the term meaningfully then talking about what it’s worth to the recipient is empty and unuseful chatter.

The real value of “education” accrues to the institutions dispensing it. They make the immediate profit and they have no legal obligation to fill the student vessels with employable skills. If they were legally obliged to providing a stipend to any graduating student who couldn’t find satisfactory work relating to their field of study the situation would change almost overnight. The next strategy would be for the institutions to keep the student until the last half of senior year before kicking him out for bad grades.

Our hearts are crookeder than the grain of a Eucalyptus stump. We all want honesty and kindness – in everyone else but the quality we personally hold most dear is the ability to drive a sharp bargain.

Oh, *I* can define a good education. It’s not hard. Critical thinking, reasoning (logic, etc.), learning empirical methods (knowing the great statistical and probabalistic fallacies, for instance), rhetoric, history, etc…. oh, let’s start with literacy and numeracy, too.

Do you need a college education to get this? No. Do you necessary get any of this from a college education? No. Hmm.

Well put and right on. I especially appreciate your point about risk shifting. Is there a conflict between your risk-shifting and class-conflict ideas?

State university tuition has gone up for two basic reasons. First and foremost, the states reduced tax-based funding in order to pay for more prisons and tax cuts for the wealthy.

Second, university education remains largely handwork and therefore necessarily expensive. Like all handwork, its price must go up faster than inflation, since productivity increases will always be below average.

However, the most important reason it has become unaffordable for the middle class has nothing at all to do with the educational system. The main problem is that the middle class hasn’t gotten a pay increase in a generation — all the productivity increases since Reagan have gone to the upper, and lately the upper upper, income brackets while we have simultaneously shifted taxation from the wealthy to the middle class, using social security taxes, for example, to finance tax cuts for the rich, and refusing to pay state taxes necessary to finance education and other services that can only be provided by government.

Struggling to cope with the massive cut-backs in state funding, universities and their students have looked for any salvation possible, and they found the same solution that the middle class has found in every sphere — borrowing.

The borrowing solution is nearing its end. Our educational system is in serious crisis. To be sure, we can squeeze it a little longer, as one can always cut R&D a little more. But in the end, if we continue to refuse to fund it through government, we will have an educational system in as good shape as our railroad system — i.e., nonexistent — or our medical care system — excellent for the rich and disastrous for the nation.

And then we’ll be able to complain even more about government failure as our economy collapses around us.

Great comment.

Furthermore, we live in a system that values the dollar spent building a prison the same as a dollar that builds the campus. Goldman sacks.

Thanks, Prof. Hard to believe such valuable insight is free :-) Indeed, it’s hard to argue that our society has not been strip-mined by design. The reckoning will be severe.

This is a ridiculous comment.

1. In most states the decrease in tax funding has been at least partially offset by HOPE lottery contributions. And putting it all on prisons?!?! C’mon, it’s impossible to take you seriously after such a statement.

2. Handwork? Please. Technological advancements, the ability to teach online, etc. mitigates against the notion that the expenses associated with the “handwork” of college education must to be so out of line with inflation. And besides, the “Handwork Premium” over inflation has always existed. The difference over the past 30 years has nothing to do with this premium.

3. As for the middle class stagnation. This is a fair point. Yes, with respect to inflation, the middle class income has stagnated. But at the same time–with respect to inflation– college costs have skyrocketed. Handwork Premiums and taxpayer funding diverted to prisons don’t even come close to reconciling these increase costs.

The fact of the matter is, what you provide is not worth the cost. A motivated person has the rest of his life to learn about humanities and social sciences if he is so inclined. One can learn high level mathematics on the internet with weekly consultations with a good tutor. Same goes for accounting, finance as well as undergrad biology and chemistry (with access to a lab). Management…and marketing? Picked up with experience and internships. Etc., etc,

Obviously, there is an important place for University education–especially at the graduate level, or for disciplines like medicine and some aspects of the dialectic associated with law school.

But as presently constituted, the benefits of college matched against its costs are way out of alignment.

The college degree is a qualification. There was a time in the US when explicit qualification was an important weapon in the arsenal of labor. It was used to protect the rights of workers against abusive compensation, hiring and firing practices. Your comment shows how out-dated that concept has become in the US.

Look at the California state budget. Quite simply the budget is mostly going to prisons.

Good comment. However, you seem to imply that tuition increases, though high, could be proportionate, given education’s handwork-like character. You seem to be working from the cost side up to the price and thereby giving educational oligarchs a break. They have market power and set the going price with little regard for costs. How much does it cost to educate an average university student for one year? Recent reports indicate the Pheonix spends about $4500 on a student. German universities were spending about euro 12000 several years ago (in a high-wage economy). Let’s say UCal spends about $15000 and the private elites twice as much. Add 10k for room and board (and remember that dorms close for 4 months/yr). Back-of-an-enveloping like this indicates that the going price – 55k – is excessively high.

I think your argument is totally upside down, you suggest lack of funding from the government as the cause of these higher costs in education when it is too much funding from the government that is the cause.

If it were not for these guaranteed student loans cost of education would drop substantially.

Rampant inflation in education costs are once again an example of best intentions having an adverse economic effect.

In European countries, higher education is generally funded by the government. Full stop. Not loans. Grants. Full-ride grants. (For anyone smart enough to pass the admission exams.)

That’s the sense in which there isn’t enough funding from the government. Get it?

Nathaneal

“pass a test?” “smart enough to get in?”

Well if the same rules applied here I’m sure that would be very deflationary as it would squelch demand.

How do European college education costs compare to ours?

Very accurate summary. It’s part and parcel of what happened to the whole economy. As nobody but the top 1% saw any income increases, but inflation continued apace (until 2008), borrowing was the substitute in order to maintain standard of living. But that wasn’t sustainable and it just collapsed.

Should be interesting to see what comes next. The thing is, without a vibrant middle (and lower!) class, the ability of the rich to make money starts to vanish. Because the way rich people make big money is by selling to huge numbers of poorer people. And the poorer people can’t afford it any more.

Control of agricultural operations may revert to being the main sort of profiteering, as they were in the middle ages.

Excess credit/debt expansion role of promoting growth which in this case generates commercial buildings for the purpose of advanced education winds up being nothing more than a political/financial inducement to boast GDP. The political class along with the so called economic profession needs to face reality that pumping excess credit into the system generates unproductive growth and the illusion of wealth no matter how noble the cause.

“student loans predate the hyper inflationary increases in the cost of getting an education in America”: well, yes; without Student Loans there would have been no hyperinflation in college fees.

I’m not sure I agree with your statement, Dearieme.

I think what Prof is saying is that what students pay for education (the stated “tuition”) is not the actual cost. The full cost of both non-profit private and state higher education systems has always been subsidized, to a greater or lesser extent, by endowments/gifts (in the case on the privates) and by taxpayers (in the case of state universities).

He says that the states have shifted funding away from their higher ed systems, resulting in students having to bear an increasingly larger share of the “real’ cost of their education. Therefore, tuition has risen at a faster rate than overall inflation.

For a typical “working class” family who aspires to send their kids to State U, their real wages having stagnated since the 70’s, their option is to borrow, in order to fill that gap between the rapidly increasing tuition and their steady-state wages. Or not to send their kid to college.

Non-profit private colleges have always been “perfect price discriminators”, able to charge each student the tuition they think they and their families can bear. If the student applies for financial aid, the college has all the details of the family’s finances, and can pick the right price point. The real cost of the education is then divided between the student and the college’s endowment/gift funds. The reasons here for a steeper increase in student/borne costs is murkier – at least to me.

Saying that student loans caused costs to increase makes no sense given the amount of decades (not weeks, months or a few of years) that student loans predate cost increases.

Here’s a link:

http://www.thehistoryof.net/history-of-student-loans.html

In other words, if you are going to rebut me, you are going to have to prove causation in some way that explains the lack of increase for nearly 2 decades.

Jane

During this initial 20 year phase in student loans, were the loans explicitly backed by the government?

There was a time that banks would not lend unless they expected to be paid back, with government backed loans they will loan to anybody, this is obviously inflationary and we have seen the results of this recently in housing as well.

If you let a banker lend risk free…..he will certainly lend and then some.

Interesting that you send us to a site by Gareth Marples. Doing some googling, you can see that Gareth Marples offers tips on using credit, all kinds of credit. So of course Jane Doe may have some skin in the game so as to NOT blame the easy access of credit for the increase of student loans. For if it was decided that student loans are the cause of price increases and thus changes have to be made in the usage of the credit system for schooling, then Gareth Marples could lose some income.

Suggesting that Jane Doe is trying to make a buck by referencing a website is pretty low. Her point is that there is no substance to the argument that student loans cause tuition inflation. People who preach this canard ignore historical data and delude themselves with the notion that higher ed is purely a personal choice. Doe’s argument that the current regime transfers risk from society to the individual is worth considering. The fact that many individuals in the education “market” accept this transfer with open arms is evidence of pervasive ignorance.

When did the loans become explicitly backed by the government?

I would suggest from looking at the chart this happened in the early 80’s because that’s where the extreme divergence begins.

You cannot have rampant inflation without the supply of money and the banks would not make the loans if they were not explicitly backed by the government this creates an apparently risk free trade for the bankers so they make loans with abandon.

The colleges can charge whatever they want because the banks are willing to make the loans due to the explicit guarantee from the government.

Any situation where bankers feel they have a risk free trade will create a massive bubble like this one in education.

AndyC’s point is well taken. There may be a moral hazard here, one that contributes to tuition inflation. The ultimate guarantee of state rescue via TBTF made mortgages easier to grant which fueled a real estate bubble with rising real estate prices. Similarly an explicit federal guarantee of college loans could encourage lenders to make loans easier to get, which could fuel demand for loans. More demand would force tuition up.

I’m uneasy with the idea and asking the following:

1. Would students take loans just because they seemed easier to get? Would I be willing to buy a car if when financing is negotiated there are fewer questions asked about my income? Probably.

2. Would the federal guarantee trigger fast-tracking and lower costs for student borrowers?

3. Would the number of students entering the market increase significantly?

4. To what degree does college tuition respond to demand?

5. Assuming that demand for elite degrees is greater than demand for non-elite degrees, does 55k/yr accurately reflect the difference? Second tier liberal arts colleges charge as much if not more than the king-makers – why isn’t demand reflected here? You’d predict Harvard to cost substantially more than Sarah Lawrence.

The answer is deflation in college costs. Someone will have to take a hit, or fewer people go to college. Take your pick.

Everybody is quick to criticize Sarah Palin’s college career, but it was paid for. She worked her way through. We had a great Republican candidate for state AG in Iowa this year. She too worked her way through college and law school. Too bad, so sad for those who overpaid for an education and borrowed money to do it. They are learning that decisions have consequences, a piece of real education in the real world.

Yes, I am an evil, uncaring, insensitive conservative. Feel free to pile on with the insults.

18 years old is awfully young to be thrown to the wolves, per your survival-of-the-fittest instincts. Wealthy “conservatives” certainly don’t do that to their own most of the time. But then, I guess your apparent attitude is “What’s wrong with Kansas.” :)

sorry, no insult from me. ;)

Deflation of college costs is right on. The whole higher education racket is nothing but a loot and fleece operation. And it’s reinforced by the sadistically pathetic practice by corporations of seeking out the “top school” graduates for new hires under the cretanic theory that they’re somehow smarter and more capable employees.

I mean shit. Even way above average corporte jobs don’t take much in the brain department. And the top school grads are usually the decently smart kids who didn’t have the imagination or spiritual energy to really rebel against the socially engineered jailers bars, or had highly emotionally supportive families who steered them through the labyrinth to get where they got.

doesn’t mean jack shit in terms of real-world ability, intelligence, dedication to task, imagination, creativity, etc. Frankly even, the kids are so brainswashed by the time they get out of these quasi-mental-institutions that all they can do is man their stations on the corporate press gan gulag archipelago. Maybe it all makes a certain sardonically dark sense after all.

I think college could be half the cost it now is, and there wouldn’t be any difference in what kids would really learn. But the administration SG&A might be lighter and the endowment fund managers wouldn’t make their 7 figures. Instead, society would look on this for what it ethically is — fraud and theft.

And yet, you don’t think this is going to effect you and yours. This is selfish, short-term thinking on your part. It’s true that no man is an island, and this sort of thing will have societal effects far and wide. This is just proof that regulation is needed in order to protect the less savvy from predators in the economy.

(a) there is nothing conservative about cost cutting regarding educational cost. My issue with your post is that you assume it is. The difference is not identifying the solution but how to go about it. Who do you put the pressure on to enact your solution?

(b) Sarah Palin is not exactly a model for educational standards for a system. Exceptions to the rule don’t provide models.

(c) The truth of your overall point is correct. However, this is where you and I probably differ and why Sarah Palin doesn’t help your position.

I don’t place the pressure on the individual to produce some sort of “rational market” that will deflate cost in the educational market.

I place the pressure on the system of education to deflate the cost because I do not see education as a commodity. Therefore, they should not be charging fees that reequires such huge loans.

Its a societal good. If we want a well-educated working population that can compete against other countries, then we don’t want to saddle that working population with debt. Where your analysis miss the boat is that you don’t seem to realize that education is increasingly not cheap regardless of where you go. The assumption that there is some way around the inflationary increase is cute, but not accurate. There’s a reason why the numbers overall for even public schools, when one excludes private schools, are still higher than the rate of inflation.

Right on again Jane Doe. Believing that higher education is a personal choice will get you a hefty debt. If you also happen to choose the wrong major then you’re really f**ked. As Jane argues, the higher ed oligarchy has transfered risk to the individual and sold it by calling it free choice and claiming that they actually discount our future earnings so you don’t have to worry even though you are 30k in debt. Education is a social good that should be provided virtually free-of-charge by society from infant day-care to post-grad.

You know what the difference is between your degree from Duke and one from a German state university? A basketball arena.

My wicked side sincerely hopes you get to suffer first hand under Sarah’s presidential guidance and decrees. It’s hilarious that you bring up her up as an example. I’m sure she did pay for her own education – probably about five night’s work. And she obviously learned more from the work experience.

I know what a complete idiot I was at 18 and I suspect you were too. I like to think I’ve changed. We still believed that you can trust in what your elders tell you. They told me to go to college and get that sheepskin. Direct quote.

So cut the William Ernest Henley crap and get a clue.

Welcome to the party Yves. This “slow-motion” trainwreck is picking up speed with each passing day. This represents not only the death of entrepreneurship (how can you build capital for a business with 20-100k in nondischargable debt owed to someone not subject to FDCPA?), but is the final nail in the coffin of the social compact.

Right now, students are fleeing to grad school to “wait out” the recession. They’re going to wake up to miserable reality in a few years. Hyperbole aside, how this gets resolved will determine whether the U.S. continues to exist in anything resembling its current quasi-democratic form within the next decade.

Again, grey market. Expect people with higher ed. degrees to work for cash under the table.

My college education was paid for, as well. And, my graduate degree. Because it was relatively easy for me and my middle-class family to do, at the time.

My freshman year at the University of Michigan, in 1972, cost a grand total of $2000 — tuition, fees, books, room and board, clothes; everything; I kept good, detailed accounts — and my parents and I had the $2000.

So, the decision was easy, and easy to pay for, and the quality of education was pretty good.

I think I made about $9000 in my first year after college, in a menial job, and about $12,000 in my second year, in a pretty good job, which escalated to about $30,000 fairly quickly.

I should mention I lived in a major city, with many options for low-rent living; $12,000 was right on the margin for living in an apartment without a roommate; that first year, I lived in a kind of rooming house — truly dreadful. Those options were to disappear in the ten years after I moved there, in a spate of gentrification and condo-mania.

As Prof indicated in his excellent comment at 10:20 am, the systematic, institutional changes that have channelled all productivity increases into greater income only for the top 2% have altered the “choices” so valued by evil, uncaring, insensitive conservatives.

I would just observe that student loan financing is just one aspect of this, systematic redistribution of income and wealth, based on making borrowing the only, appararent “choice”. This is the superhighway to serfdom.

In Calif education is an industry funded initially by bond measures created and financed by the construction industry with assistance from bond underwriting firms. These eduction build outs run from grade school to University level that generally are built in smaller cities and towns with the intent of pushing out the urban boundaries creating more urban housing,highways,shopping malls and government infrastructure all promoting more construction. The educational bond funding system is centered around the build out phase leaving the day to day and long term financing needs to annual budget processes with the net result that the state has generated a large aging expensive educational system built to promote urban growth rather then educate.

For those who worry about the moral hazard of a debt jubilee, many indentured-servant former grad students would be perfectly happy to be able to refinance our loans on the terms the TBTF banks are getting from the Fed–or even half as good as those, actually.

But for people who had to refinance once already during one of the many employment troughs since they graduated, or because of a family crisis, the rigid rules of the Department of Education forbid taking advantage of these historically low interest rates: you can only refinance once, in the form of consolidating different loans. Once you have one consolidated loan (serviced by a private financer who employs thousands of call center people at minimum wage courtesy of the 8,9,10 percent interest on your legacy loan; their job is to call you if you’re a week late on a payment), you’re ineligible.

The system is so bad that the Congress actually changed it to cut out the bank middlemen; but the legislation is prospective only, with no relief for the millions of us already in high-interest debt bondage. And the Republicans will work hard to gut that legislation now anyway.

Student loan servicers, mortgage servicers…..hey, what a coincidence!

Go ahead bankers, and screw with the lives of young, impressionable and EDUCATED people and see if that does not bite you in the ass.

Do you really wish to have unemployed chemists and engineers on the lose? And let’s not forget unemployed economists and the mischief they can dream up ala Marx.

And let’s not forget the trained killers of your useless wars. Those folks are coming home some day and they may not be happy to discover they were sent on a fool’s errand.

We need a bailout of the population from the current banker fascism and the implementation of genuine free market capitalism.

Or continue to foul your own nest, bankers.

This. Precisely.

One need only look at Mexico to see what happens under an oligarchy when engineers and poorly paid soldiers and special forces are left unemployed for a few years. They do find jobs eventually.

Is genuine free market capitalism something like perfect competition?

Is genuine free market capitalism something like perfect competition? bmeisen

I’ll tell you what it isn’t: It isn’t a government backed fractional reserve banking cartel using the government enforced monopoly money supply. That is fascism.

Like perfect competition, genuine free market capitalism doesn’t exist. Attempts to achieve it lead to chaos. Democracy is the most desireable alternative to chaos. Democracy requires above all educated voters. Education is therefore a public good and should be provided virtually free-of-charge at all levels. This priciple alone is sufficient to establish government with regulatory as well as taxing powers.

Back when Adam Smith was writing “Free market” meant free from monopoly/oligopoly but not necessarily ‘tariff-free’. Now it means free of tariffs (aka exporting jobs) along with tolerance, even encouragement, of olgopolies.

It’s a clever and effective bit of newspeak from the banksters.

Yup. This is one more way in which the bankster/CEO overlords are actively courting revolution.

But then they never bothered to study history in college, so they don’t know what “France 1789” means….