The drumbeat of press in favor of visibly failed austerity programs is simply astonishing. We have compelling evidence that they backfire in countries with heavy debt load, with Ireland and Latvia the poster children. By contrast, Iceland, with the mind-numbing debt to GDP ratio of 900% (some have put it at even higher levels at its peak), stiffed many of its foreign creditors (who should have taken notice that things were a wee bit out of balance, although glowing reports from the likes of Fredrick Mishkin may have blinded them to that fact). It also depreciated its currency and its voters turned down an IMF rescue which would have required Iceland to repay the foreign creditors of bust Icelandic private banks, to the tune of €12,000 per citizen.

Loans are also risk capital, but modern bondholders have rewritten the rules: “Heads I take a risk premium, tails I get taxpayers to eat my losses.”

As John Mauldin points out, forcing creditors to take their lumps is the right course of action. Iceland is already showing GDP growth, while Ireland, which is following the austerity playbook to perfection, is imploding.

But as Joseph Stlglitz points out, the advocates of austerity have a lot in common with medieval bloodletters. When it’s pointed out that their programs made matters worse, their response is that they simply weren’t implemented aggressively enough.

That is not to say we don’t have a lot of spending that could and should be redirected in the US. America spends more on its military, broadly defined, than the rest of the world combined. We have a heavily subsidized agricultural sector. We also subsidize banking heavily, when by any rational calculus we should either tax it aggressively or regulate the hell out of it. But in the austerity debate, these favored sectors (well, ex the sacred cow of banks) are being included on the theoretical whackage list, along with a whole bunch of other stuff, most notably Social Security, which the phony branding of the necessity of shared sacrifice.

To illustrate how badly discourse has been commandeered by misguided moralizing, consider the piece by Matt Bai in today’s New York Times. A representative section:

After all, generations of Americans have sacrificed plenty for the nation’s cause, and there’s no reason to think we’ve lost the capacity. What makes this case for sacrifice so much harder to embrace, perhaps, is that it goes to our national psyche, threatening our self-image as a land with limitless potential. While past generations have readily sacrificed for national greatness, debt reduction — at least in the gloomy way its advocates argue for it — feels like a call to sacrifice in the name of our national decline.

This is unadulterated bunk. Let’s start with the fact that it accepted budget trimming now as a necessity, and therefore took the goals of the deficit commission as a given. But that’s barmy. When households are deleveraging and businesses are saving, having the government also try to reduce deficits is a prescription for contraction (the only way to square this circle would be for the US to move into a significant trade surplus, something no one expects any time soon)

And let’s also get the targets right. Why have deficits in the US gone up? The big culprits are easy to spot: the Bush tax cuts to the rich, the Iraq war, and biggest of all, the financial crisis. The beneficiaries of those policies are a small sector of the population. In particular, the executives of the TBTF banks have engaged in a brazen and continued program of looting on an unheard-of scale. But no, the deficit commission and its pious mouthpieces like Bai would argue we all have to pay for the extortion of a few, and to add insult to injury, the application of leeches now is certain to leave all of us much weaker.

Moreover, the idea that government spending is inevitably unproductive is also a canard. Continuing extended unemployment insurance would increase 2011 GDP by 0.6%. The Internet and the US pharmaceutical industry are both build on the back of substantial government research and investment. The return on government spending on technology investments is 30-40%, the very level venture capitalists target.

An instructive paper by Tom Ferguson and Rob Johnson puts paid to other deficit myths. I suggest you read it in full. From its abstract:

This paper analyzes the arguments and evidence in current debates about the government budget deficit.

We critically examine claims put forward by Rinehart and Rogoð, the International Monetary Fund, and others about the dangers of rising debt to GDP ratios. We also scrutinize assertions by Alesina and Ardagno that cutting deficits is likely to be stimulatory. Our analysis of the U.S. budget outlook leads to surprising conclusions. We highlight the unheralded acknowledgement by the Congressional Budget Oðce in August, 2010, that financial assets held by the government should be netted out of U.S. debt calculations. This step takes the US further away from any hypothetical danger zone and should be a yellow flag to shrill warnings of danger from U.S. deficits.

Our analysis of threats to the budget finds that not entitlement spending or Social Security, but the excessive costs of oligopoly in health care and defense spending play a large role in current concerns. So does the contingent liability of another financial crisis. In an era of unbridled money politics, concentrated interests in the military, financial, and medical industries pose much more significant dangers to U.S. public finances than concerns about overreach from broad based popular programs like Social Security, which is itself in good shape for as many years as one can make credible forecasts.

The paper also examines two hypothetical scenarios: One involving a growth inducing public investment program and another, more pessimistic scenario in which underemployment equilibrium is allowed to persist for several years. From those scenarios we conclude that the risk to U.S. public finances, as measured by the debt/GDP ratio in 2020, is much greater on a trajectory of austerity than from any risk incurred by the very low public cost of borrowing to spur investment in infrastructure, education, and science that would generate large social and private gains in productivity.

In particular, the Reinhart/Rogoff claim that government deficits over 90% of GDP lead to lower growth is suspect. First, many of their examples come from gold standard or dollar pegged regimes, which make their relevance countries with currency sovereignity questionable. Second, as Ferguson and Johnson stress, correlation is not causation:

Many things happen, not because anyone in the country wants them to, but because outside forces – foreign multinationals, larger neighbors, eccentric billionaires, kleptomaniac rulers, or even hierarchal structures in the international system – e.g., military alliances leading to wars, etc. – compel them. When economic policies reflect such forces, spurious causal inferences readily follow. Some U.S.- supported Latin American dictatorships, for example, surely protected the position of economic elites in those countries at the expense of economic growth that would have benefited the whole population. To help keep social peace, or simply please insistent militaries, some of these countries piled up debts. The true lesson of such cases is nothing so simple as high debt to GDP ratios hold back growth rates.

This problem is first cousin to the broader problem of “reverse causality” highlighted by Paul Krugman. He observes that the causal relationship might well run “largely” from “growth to debt rather than the other way round.” Krugman explains that “That is, it’s not so much that bad things happen to growth when debt is high, it’s that bad things happen to debt when growth is low.” He cites the U.S. as an obvious example of this pattern:

This is definitely the case for the United States: the only period when debt was over 90 percent of GDP was in the early postwar years, when real GDP was falling, not because of debt problems, but because wartime mobilization was winding down and Rosie the Riveter was becoming a suburban housewife. It’s also clearly true for Japan, where debt rose after growth slowed sharply in the 1990s. And European debt levels didn’t get high until a␣er Eurosclerosis set in

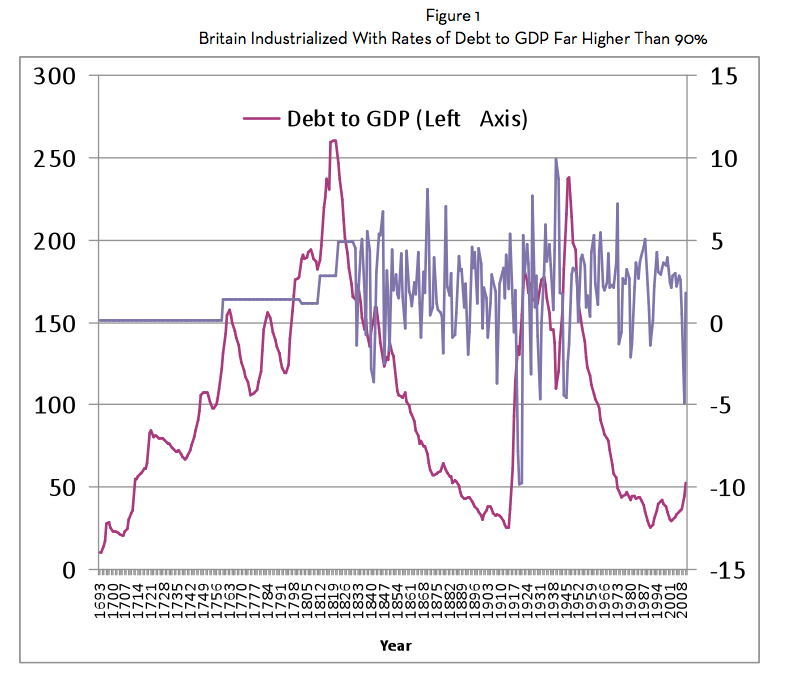

Consider this chart:

The article notes:

The point can be put even more forcefully: the UK made its epochal breakthrough to industrialization – leaving the rest of the world far behind – while carrying a debt load that should have crushed it, not only in the eighteenth century, but many decades into the nineteenth. And it was precisely as the debt to GDP ratio soared that the rate of growth finally picked up.34 Of course, British debt levels through most of the twentieth century remained almost as high because of expenditures run up for World Wars I and II.

Many of the confident assertions of the evils of high debt levels are presented as sweeping generalizations, when the specifics matter. But even as we see these austerity experiments play out disastrously in Europe, not merely failing to deliver the promised benefits, but clearly making matters worse, relatively small interest groups are creating deficit hysteria as a Trojan horse to enable them to gut social programs and preserve low taxes for the rich.

.

“… to gut social programs and preserve low taxes for the rich”.

That is exactly what this seems to be about and nothing else: the media manipulation and the political manipulation are not less important than the financial manipulation. All in order to rob the poor to give to the rich in an institutionalized manner.

geez it isn’t an either or argument – bailouts for the rich or entitlement programs. the middle class will be crushed by the vast flow of resources to those at the top AND government obligations. talk about a false argument.

With annual deficits well over $1T projected into the foreseeable future, we in America can sleep well at night knowing that the dreaded “austerity” will never haunt these shores.

Even so, too bad poor people and the unemployed aren’t getting a piece of all that action. If they’d hired a lobbyist maybe they’d have had a place at the table.

But you know the saying – if you aren’t at the table, you’re on it.

Nicely said.

When I started reading what you had to say, I expected an entirely different reaction. Thanks for surprising me.

The rich benefit enormously from deficits (whose pockets do you think all that money ends up in?). The rest of us pay through inflation.

Also, the concluding sentence makes no sense:

“… interest groups are creating deficit hysteria as a Trojan horse to enable them to gut social programs and preserve low taxes for the rich” Attacking the deficit will require higher taxes and possibly a national sales tax.

You should try to get this article published in Japanese. I’m sure they would have a thing or two to say about Keynesian clownery being used to cover atrocious policy decisions.

One more thing: Krugman is an idiot. The moron proposed death panels on national TV. Yes he backtracked but the damage he did to efforts to create a proper medical system was immeasurable. His writings over the years are all over the place. He’s a complete idiot.

Gregor,

If you’re going to cite the Japanese experience, you might as well get your facts right. Japan’s high debts are a function of stop-start fiscal policy, NOT sustained government spending. They INCREASED the consumption tax by 40% in 1996, only to be followed by a huge external shock to the trade account via the Asian financial crisis in 1997/98, followed by a further trade shock in 2001 when the dot.com bubble burst. Fiscal policy didn’t actually ease significantly until 2003 (2 years after so-called “quantitative easing” began) and the economy grew steadily at that point until 2008. Japan is always wrongly cited as evidence that government spending makes things worse, but people like you never actually look at the evidence when they trot out this canard.

Japan is always wrongly cited as evidence that government spending makes things worse, but people like you never actually look at the evidence when they trot out this canard. Marshall Auerback

I can believe that government spending would help since one form of government spending, a bailout of the entire US population, would surely fix our problems (excessive debt).

Less direct methods such as infrastructure building and maintenance should help too since that is the government’s responsibility. However, as Mish Shedlock points out, what does the government do once the last pothole is filled? The answer, imo, is a bailout of the entire US population.

I second Marshall as someone who spent most of their life in Japan, and is fluent in Japanese.

It’s appalling that people continuously cite Japan as an example without understanding an iota of what really happened over there. The idea that the Japanese problem was caused by the deficit is just nonsensical on so many different levels. There is nothing Keynesian or anti-Keynesian about the fact that it’s simply false.

It had been the second biggest economy in the world until very recently, and the bust it experienced was in many ways the prelude to what the rest of us are experiencing now. So learning the Japanese experience is absolutely one of the most important keys, yet, people continue to either ignore that big episode or create a revisionist history around it.

Yves,

The title of your post seems to assume that your interests and the interests of the austerity crowd are one and the same, but the austerity crowd are just too stupid to understand that austerity is a bad idea.

I invite you to ask the question “a bad idea for whom?”

You’ll quickly realize that the austerians have completely different conception of who matters than you do. You care about everybody, and for that, I commend you. They, however, don’t care about anybody but themselves. They’re sociopaths in the Chicago School tradition.

Anyway, all I can say is hang in there, but stop assuming that people who disagree with you are stupid and/or misguided.

They may be just evil.

Tao,

I’m sorry but I’d have to agree with Yves with respect to ignorance of those in media and elsewhere that would otherwise be on our side. What we really need is an opportunistic person who randomly uses polemics(some extreme) against random people(both the big people and people in media) to send the message. Nobody will listen to a random critic of the prevailing view without such a strategy.

To illustrate how badly discourse has been commandeered by misguided moralizing, … Yves

The moral argument for austerity fails for at least the following reasons:

1) The US has been victimized by a government backed counterfeiting cartel, the fractional reserve banking system. Both borrowers and savers have been cheated by it.

2) How can it be moral for the innocent, the unemployed and those on SS, to pay for the sins of the bankers?

3) Debt forgiveness is commanded in the Bible (Deuteronomy 15) even for legitimate debt. How much more then is debt forgiveness a moral necessity for “debt” to the counterfeiting cartel?

I had the tremendous misfortune of starting to read the Matt Bai piece in the NYT earlier today. It goes without saying I didn’t finish it. I can easily tolerate the smell of burned flesh coming from the electric cauterization process during surgery, but this vapid, slothful and moralizing piece of trash that is considered an opus magnus in PetersonLand? No thanks!

That someone can get paid to utter this Everest-sized grade-AAA steaming pile of male bovine digestive remains, while high-quality bloggers like Yves barely make any n’gwee ofr outstanding posts is yet another proof this country has a screwed up sense of priorities.

It’s the difference between Sarah “Glacier Babe” Palin, who make 12 millions/year spewing shrieking stupidities and the folks at Media Matters who carefully research and debunk tons of stuff for a pittance.

As anyone can tell, I’m in no mood to spare the merchants of chickencrap.

How long will US & EU spend in the fudging nightmare years of ’90s Japan? Write it down, take the pain, get on with it. That’s the real lesson from R&R’s “800 Years”.

Americans can continue to sell debt to fund “healthcare” (tremendous cost for shitty outcomes) and “defense” (power projection thwarted by fertilizer and garage-door openers) while stifling the young. For a while.

… but clearly making matters worse, relatively small interest groups are creating deficit hysteria as a Trojan horse to enable them to gut social programs and preserve low taxes for the rich. Yves

As long as we have a fascist money system (government backed FR banking) then socialism for the poor is justified.

The facts are absoultely clear:

1. No one, I repeat NO ONE among the elites cares about the deficit or the debt. The Bailout, the wars, Pentagon budgets, Big Ag subsidies, and all other corporate welfare proves this.

2. “Austerity” is not, and is not intended to be, any kind of “fiscally conservative” or “fiscally responsible” measure. By definition any such conservative would focus 100% on the corporate welfare listed in (1).

“Austerity” is and is intended to be nothing but robbery, plain and simple. Anyone who advocates one cent in SS cuts or any other spending cuts before ALL corporate welfare has been purged is simply a thief, or advocating this crime.

3. To give a specific example, since health care costs are so out of control, and since we all know Single Payer is the only policy which would save a huge amount rather than increase these costs (the Obama-Republican racket bailout will only increase them; their own CBO says so), no one who supported Obamacare (like all Democrats) or will support it going forward (like Republicans who refuse to repeal it; we can be sure if Reps push that, they’ll get enough Dems to join them) has any right to an opinion at all on the cost of anything, or to claim any concern for “responsibility”.

4. Deficit terrorism like that propagated by the NYT (which is a rabid supporter of the wars and also supports the Bailout, health racket bailout, and corporate wefare in the broad sense) is therefore nothing but a criminal propaganda campaign on behalf of “austerity”. It’s qualitatively similar to telling people being herded onto trains that they’re being sent to a place with better conditions. Some Nazi propagandists (“journalists”) were later tried for that.

5. This is clas war, plain and simple. (The likes of Stiglitz and Krugman are also conscious liars when they continue with nonsense like this:

But as Joseph Stlglitz points out, the advocates of austerity have a lot in common with medieval bloodletters. When it’s pointed out that their programs made matters worse, their response is that they simply weren’t implemented aggressively enough.

It’s their part of the scam to pretend the austerity-mongers are well-meaning but mistaken. Thugman explicitly said “I don’t think you can resort to class war explanations”. He knows this is a lie. Krugman and Stiglitz in fact support the overall agenda, or at least won’t oppose their system as such. Either way they want us to think, “these are our elites, they mean well, and we have to believe in them overall, even if we disagree about this or that.”

A medieval bloodletter wasn’t intentionally trying to murder the patient.)

6. So the people’s agenda here is clear:

We have to absolutely reject deficit terrorism. It’s been proven to be a false idea, and at any rate not one single person who argues in favor of it has any standing to do so whatsoever, since the only true fiscally responsible position would be: Let’s end ALL corporate welfare, including the wars and the Bailout, and restitute everything the banks stole. Let’s institute Single Payer, which will save trillions. Then we’ll see whether or not we need to cut any social programs.

Since there is no such advocate, we can regard the subject as closed, and stick to a few simple demands:

Total Austerity for the Corporate Welfare, Not One Cent More From the People.

No Taxes on the Non-Rich. (Meaning we must reject absolutely any new tax or tax increase which isn’t 100% upon corporations and the rich.)

And again, refuse to even discuss deficits or debt except in terms like the ones this comment outlines. Refuse to even discuss beyond: “Deficits? OK, then let’s end all corporate welfare.”

rong Attempter..Super Big Fail!!!

You said; “No one, I repeat NO ONE among the elites cares about the deficit or the debt.”

This is only marginally about the ‘deficit or the debt’. Those are actually only supporting actors though important. The more important aspect is the specific (personal) deficit or debt, which is partially caused by the general/national, deficit or debt.

The only thing that the “elites” don’t care about is who we all owe our personal debt to. They don’t need to personally own our piddling mortgages or credit card debt. All they need is that we should somehow be chained and burdened with enough debt to prevent us from wrecking the system.

I don’t see how you’re disagreeing with me, let alone that I had a “super big fail”. The deficit and debt we’re talking about is obvious: The “federal” one, which is the only one cited for why we need to gut SS and impose the rest of “austerity”.

I think my way of saying it is better, more pithy, than yours, so I repeat: No one among the elites cares about the deficits or the debt. Not one of them. They’re all liars. their actions prove it, as I demonstrated above.

“Deficits? OK, then let’s end all corporate welfare.” Yes, and most conspicuously, let’s terminate all criminal wars and the illegal security/intelligence police state!

I disagree with Paul. Your argument is indisputable, but I suppose his point really is that you don’t cut the viscera deeply enough. Or, as Lily Tomlin said, “No matter how cynical you get, it’s impossible to keep up.” It’s a very dark rabbit hole.

“‘Austerity’ … is intended to be nothing but robbery, plain and simple.” True, but IMO, such massive larceny only serves and cloaks a far more hideous evil—the violent crimes of state terrorism and mass-murder, toward amassing absolute global power. The gang-banksters only cloak the merchants of death, relentless in their sadism and power-lust. Obama is either in league with these monsters or completely overpowered and cowed. Medieval bloodletters were noble and kind in comparison. From Global Research:

“The ‘Great Game’ and the Conquest of Eurasia: Towards a World War III Scenario? Mackinder’s Geo-Strategic Nightmare.” by Mahdi Darius Nazemroaya

http://www.globalresearch.ca/index.php?context=va&aid=22140

What’s most vile about them is that their mass murder is in the service of no goal whatsoever but that same simple gutter greed.

Even Hitler was actuated by an ideal, sick as it was.

Um, there seems to be a lack of qualification in the above post by Yves as well. The countries where we see austerity becoming painful are the countries with the greatest imbalances and malinvestments of resources. The greater the malinvestments the more painful the correction process. Now let’s say the government doesn’t opt for austerity during the transitions stage. The problem is that the only avenues open to the government to distribute and spend money is along the avenues of the very imbalances that need to be corrected, thus supporting and possibly even expanding the malinvestments. So as long as the government continues massive spending that many times only props up the imbalances then how does one propose in knowing how to change the price signals that businesses need in order to put resources to the best use? How could one even know this? Massive governmental intervention into the market implies that one can know what the prices signals should be for a healthy economy without those price signals being present. This is something that governmental expansions also avoid: how do you know where to put resources to the best use when the the source of governmental revenue is involuntary?

This is a straw man. I point clearly to the example of Iceland, the world champion of banking binges. They refused to take the IMF medicine and let their banks go bust. After a painful downturn, they are on the mend, unlike the austerity adopters, who have actually resolved nothing,

You need to write off bad debts. Austerians seek to validate them and have taxpayers bear the burden.

You’re begging the question; what’s in doubt IS the government’s ability to gauge price signals from a position of involuntary revenue streams.

Sorry, Yves, the above comment was for Attempter

Brian,

Ok it’s good that you responded again having said you weren’t replying to Yves. Just a note of caution for you though: the word “malinvestment” exists in no dictionary.

I think it’s premature to call Iceland a healthy and recovering economy as of yet–especially since they’re a peripheral and small economy that may be very subject to the larger economies around it. However, that being said, I think you’re clumping all Austerians into the same boat. I would agree that many supposed Austerians only want austerity in terms of governmental services in order to support the financial sector; but not all Austerians argue that: some argue that choking off the banks is a part of the Austerity measures. And nor are some austerity plans about doing nothing, but a question of who should be doing what; and I myself would argue that entrepreneurs should be freed up to take action, while the governmental role should be to act as a safety net to prevent utter destitude.

Massive governmental deficits are being used to either give governmental contracts to the politically connected or the money is employed in forms of stimulus that can only travel along the routes of the current economic network, which is heavily imbalanced in malinvestments (and this includes cash for clunkers, first time home buyers, and build America bonds).

As for both establishment camps, deficit spending and Austerity, they both argue for the same thing: supporting the financial system in its current form: they just disagree on how to go about doing that. This of course doesn’t make anyone who argues massive deficit spending or austerity on the surface a camp member of either establishment.

But my question is: is the deficit hysteria over hyped when what the deficit spending is doing is ramping up debt? Because I agree with you completely that debt is ultimately the problem, and that the creditors are being given a free ride for they’re irresponsible behavior. Nor would I argue that a country should employ austerity under the lead of the IMF, as the IMF never offers a true austerity plan, but how the money should be redistributed.

Brian,

Ignoring the fact that you again used a word that doesn’t exist until Ron Paul uttered it, “malinvestment”, it’s obvious you miss the point when you ask your question. The first point of confusion is that you are confusing different sorts of debts. When we are talking about “debts” of the United States governments or other economies with sovereign currency, it is not a problem. You CANNOT go bankrupt issuing your own currency…there are only real limits in terms of inflation and such, but right now that is not an issue AT ALL. Further, as Yves argues above and as other have done countless times, it’s completely idiotic to go into austerity mode when that is exactly what the private sector is doing…our growing debt is a function of this financial crisis. We MUST SPEND to produce employment more immediately, but I know you’d much rather an invisible hand came in and fixed this by itself, right? There are no miracles, and one thing you must realize that the government is always a part of the economy, particularly when it is the issuer of the currency used by the people. Further, thinking of government spending as “waste” completely misses the point(and ultimately counterproductive, but that’s another discussion). The point is that money somehow, someway enters the economy and through multiplier effects spurs employment. Money spent on infrastructure, on the other hand, helps in a different sort of way.

either way, expand your brain please. All of your current beliefs and your continued use of the word malinvestment are annoying.

First, the term ‘malinvestment’ has been in use before Ron Paul, perhaps that is when you had first heard of the word used; it has been employed by economic thinkers before Mr. Paul.

The government acting as a counter cyclical tend still begs the question that I am asking: how does the government put resources to it’s most efficient use from a position of involuntary revenue, that is, it doesn’t have a consumer demand price signal that is always sustainable by productive aspects of the economy; and I say “not always” because there is the possibility of government planners making a lucky call.

Nor have I called all government spending “waste” or have I made the claim that the government could ever be eliminated from the economy, which would not be advisable. The question is employing resources in the MOST efficient manner on a sustainable level–the private sector is not always efficient: it’s a matter of what position has the better chance of employing resources effectively.

The other issue that we run into is a world of decreasing resources that we are cannibalizing from the future in an unproductive capacity. The impact that expanding credit aggregates has on the environment.

Also, government debt is still debt, that is, the government acting as a consumer, consumes through the current avenues of the imbalanced economy that needs to adjust, thus inevitably stalling the needed adjustment. And as far an inflation being under control, um, you might want to check what’s happening in the commodity sector, and as commodity prices soar with massive slack in the economy it promises to crush profit margins which will lead to more lay offs: not more employment. You seem to be implying that inflation appears in the economy uniformly, which is not true.

and yes, you can go bankrupt when you can issue your own currency: it’s when no one wants to use it as a medium of exchange anymore. Do I think that will happen with the dollar? Probably not, but at some point the Fed cannot continue to monetize the debt.

Also, the invisible hand is NOT the absent of government, as you seem to imply: the invisible hand concept used by Adam Smith involves the question of what role the government is to play in regards to the economy, and in Adam Smith’s notion it is to uphold the rule of law and to protect liberties and competition–this is anything but the elimination of government.

Further, if you find what I have to say uninformed and annoying than I have no idea why you see the need to reply to and to do it repeatedly. I usually find that those who consider their opinions an expansion on the mind act as if they’re infallible and to disagree must simply be an act of ignorance are those that speak from the least knowledgeable position.

Further, the government acting as a counter cyclical consumer only has a chance of being effective if it does it from a position of savings–but hey who knows, the government has only been acting counter cyclical for ten years now and all that has happened is it has had to expand its role: President Bush’s deficits were employed as counter cyclical measures, and here we are ten years later with an economy in ruins.

“Austerians seek to validate them and have taxpayers bear the burden.” This certainly the case for the Pete Peterson, big money type, of Austerian. But the “no bailout” Austerianism more characteristic of the Tea Party seeks to force private austerity, which will hit big money, in terms of monetary accounting of losses, hard.

The countries where we see austerity becoming painful are the countries with the greatest imbalances and malinvestments of resources. The greater the malinvestments the more painful the correction process.

Yes. They have tremendous imbalances and malinvestment in the form of their finance sectors, which they should get rid of.

Now let’s say the government doesn’t opt for austerity during the transitions stage. The problem is that the only avenues open to the government to distribute and spend money is along the avenues of the very imbalances that need to be corrected, thus supporting and possibly even expanding the malinvestments.

Exactly, 180 degrees wrong. They can simultaneously liberate the money, productively distribute it, and wipe out the malinvestments, by taking back their money sovereignty from the banks. They can directly issue money based on the economy’s productive capacity, and distribute it toward economically productive goals.

You’re begging the question; what’s in doubt IS the government’s ability to gauge price signals from a position of involuntary revenue streams.

Why would price signals be such a mystery in a steady state economy based on sustainable food production? (Which is the only alternative to the full restoration of feudalism.)

“…the only avenues open to the government to distribute and spend money is along the avenues of the very imbalances that need to be corrected, thus supporting and possibly even expanding the malinvestments.”

Yikes! Following Attmepter’s answer, why on earth would we deepen the same sewer ditch and expand on the same stupid malinvestments inflicted on us by rigged-market casino captialism? Malinvestments in healthcare profiteering, sub-prime housing, endless wars, oil (versus alternatives), and explosive derivatives rocketed beyond any reasonable proportion to the real economy—all under the supposedly disinterested, invisible hands of casino-operators Greenspan and Bernanke.

Oh wait…sorry … we are doing exactly that—expanding most of those same stupid malinvestments, including new wars and derivatives, even though we’ve now proven that the “nobody could’ve foreseen” excuse is utter bullshit. But now, in order to dig the same hole even deeper, we absolutely must choke final demand to death by cutting the safety net, including Social Security, even though it is self-funded and has nothing to do with the deficit. What would Einstein would say about such manifest insanity?

Why can’t a democratic society, with a government run in a businesslike manner by and for its public shareholders, choose much smarter investments with higher returns in clean energy, smart grids, smart cars, high-speed light rail, public healthcare, beautiful cities, urban forests, and new urbanism, etc? We need new leaders with imagination, vision, and courage. We need real hope and change.

The Rogoff 90% debt limit always seemed suspect to me. The matter of when you are beyond the limit of being “adequately refreshed” and too drunk instead is very individual. There is always a debt ceiling that should not be ignored, beyond which point countries simply have to spend too much cash on servicing debt. Obviously, the farther you have moved above the ceiling (whatever that may be), the more difficult it will become to go to that first, crucial meeting with the AA/Bond markets and to change your habits, i.e. the path towards your future.

Making sure that those who are not in the elites believe that the burdens are sufficiently fairly shared is of course the first rule of survival for the elites. The vote in Ireland next week and the developments there in the coming months will show whether le Irish peuple will buy into the official line or revolt in some way, shape or form.

Swedish Lex, you’re absolutely right about Rogoff and Reinhardt’s data. R&R resort to outright distortion. For example, let us say that one wanted to look to previous crises in Greece to look for clues to understanding its current crisis. In their “detailed” appendices, where

Reinhart and Rogoff examine specific crises, two entries are devoted to Greece. There was a crisis in 1931 and the entry reads “The country defaulted on external debt and left the gold standard in place”; the second is for 1991–95 and reads “Localized problems required significant injections of public funds” (366). That is it. Admittedly it is not fair to expect the authors to provide much detail for the hundreds of crises they cover. But one could read every entry for every crisis covered and it is questionable that the accumulated knowledge obtained would be anything more than “ok, there have been a lot of crises,” so that even a careful reader would have no better understanding of crises after reading all the appendices.

But that really is not the main problem with their approach. Over the past eight hundred

years (and even over the past two centuries that are the focus of the book), institutions, approaches to monetary and fiscal policy, and exchange rate regimes have changed fundamentally. The last time the U.S. government “defaulted” was in 1933. At that time, the United States operated with a “small government” that was constrained by the gold standard—a promise to convert government IOUs to gold at a fixed exchange

rate. Federal government spending was only 6% of GDP in 1933, higher than the 1929 level of 2.5%, but not due to higher spending, but largely because GDP fell almost by half from 1929 to 1933. Today U.S. government spending typically averages a fifth to a quarter of GDP, with “transfer payments” that add another 10% or more. This transition is common among “advanced” countries, with most of them operating with governments that are closer to 50% of the economy. Do those variables matter? If so, as I think they do,

simply aggregating small governments on a gold standard and large governments with nonconvertible currency and floating exchange rate regimes provides no useful information.

Now, Reinhart and Rogoff do argue that government debt ratios matter, which is indirectly linked to government size (a government that is just 3% of the economy is probably not going to run up a debt that is large relative to GDP). There also seems to be some understanding that the currency in which debt is issued matters—again, something that argues against simple aggregation across countries and over time. Indeed,

the finding that “emerging” nations are constrained by debt ratios of 60% rather than 90% appears to be linked by the authors to emerging nations’ propensity to issue foreign currency denominated debt and to foreign ownership of the debt (with domestic holding facing greater risk of default). They also find that when governments float their currency and limit government debt to domestic currency denomination, constraints are much looser. Indeed, that appears to be a large part of the process through which countries

“graduate” from serial default to non-defaulters. I concur; and just wish they had made

much more of this distinction.

The problem is that the ratios provided by Reinhart and Rogoff do not usually make such distinctions; indeed, even on a careful reading of their book it is impossible to determine which government defaults occurred under fixed exchange rates (either a gold standard or a peg to a foreign currency) versus a floating rate (no promise to convert at a

fixed rate).

Indeed, their finding that “advanced nations” appear to “graduate” is nothing

more than the transition to sovereign currencies that was completed for most developed

nations with the abandonment of Bretton Woods.

So far as we can tell, there are no government defaults on debt (domestic or

foreign) in the case of a floating rate currency contained in their data set. We are not sure

because it is not possible to tell from their analysis. They do distinguish between

“domestic debt” (presumably denominated in domestic currency) and “external debt” (in

the case of emerging countries this is said to be “often” denominated in foreign currency,

but no data is provided to make a distinction) (10, 13). In one of the appendices to the

book, they list data sources for domestic public debt and under commentary they note

“dollars” for some countries. Does this mean that the countries listed have adopted the

U.S. dollar as their “domestic” currency? We are not sure, but if so, why would this be

considered to be domestic debt?

In our view, the most important distinction one can make between what we call

sovereign debt (issued by a government that does not promise conversion on demand to

precious metal or foreign currency at a fixed exchange rate) and nonsovereign debt (that

can include government debt issued with a promise of conversion at a fixed exchange

rate) is the currency in which the debt is denominated. Interestingly, Reinhart and Rogoff

rightly argue that a pegged or “heavily managed” exchange rate tends to set in motion

processes that will generate crisis and default. For example, when government either

explicitly or implicitly operates with a peg, there is a strong inclination by domestic

residents as well as by the government itself to issue foreign currency debt whenever the

domestic interest rate is higher than foreign rates. This leads to an accumulation of debts

in foreign currency—essentially trading-off lower interest rates against exchange rate

risk. However, for government, the trade off really comes down to lower interest rates,

but with insolvency risk (Reinhart and Rogoff 2009a).

This is because the imperative of finance itself for a sovereign nation with a

floating, nonconvertible currency (no promise to convert at a fixed exchange rate) is a

very different matter. Reinhart and Rogoff appear to have some understanding of the

9

difference: “If the exchange rate is heavily managed (it does not need to be explicitly

pegged), a policy inconsistency arises between supporting the exchange rate and acting as

lender of last resort to troubled institutions.” (271) They go on, in the case of debt

denominated in a foreign currency, “depreciation or devaluation of the

currency…increases the odds of external and domestic default if the government has

foreign currency-denominated debt” (272). And, finally, they note “Even an implicit

guarantee of exchange rate stability can lull banks, corporations, and citizens into taking

on heavy foreign currency liabilities, thinking there is a low risk of sudden currency

devaluation that will sharply increase the burden of carrying such loans. In a sense, the

collapse of a currency is a collapse of a government guarantee on which the private sector

might have relied…” (272–3).

Yet if they had fully recognized the importance of the difference between a

sovereign currency (as defined above) and a non-sovereign currency they might have used

that distinction in their data sets. But they didn’t. A government that operates with a nonsovereign

currency, issuing debts either in foreign currency or in domestic currency pegged to

foreign currency (or to precious metal), faces actual operational risks and does face

solvency risk. However, the issuer of a sovereign currency (that is, a government that

spends using its own floating and noncovertible currency) is not operationally

constrained and cannot be forced into default

Yves – Please shred the Jamie Dimon puff piece in the NYT magazine today.

He is unbearably unaware of the damage he and his industry have caused to the US economy.

Only you can do the piece justice.

Oh I missed it, I can stand only so much awfulness in one day. I need to turn in, will get to it later.

Baseline Scenario has a long anit-Dimon piece, but it’s not as direct as you’d like, but might help for now.

As Keynes’s ideas were taken over and distorted by the Keynesians, so have Rogoff and Reinhardt’s words been captured and distorted. In my reading of ‘This Time is Different,’ they expressed a flexibility regarding the 90% limit. They were basically making the commonsense point that the more debt a country carried, the more difficult & limited were its options. And 90% was a rough average of when countries began to slow down under the burden of that debt.

It also seems to me from a reading of R & R that they would disagree with the massive austerity imposed by the ECB & IMF on Greece, Ireland, etc. Much better would be to reduce the debt burden, and restructure/shrink the banks who are stupidly & greedily responsible for much of the problem in the first place.

I very much hope Ireland defeats the proposed budget/bailout, either this week, or when a new gov’t comes in. That should help to put the pressure back on the banks, where it belongs!

You are still missing the causality issue. In many cases, the debt results from bad policies, like crony capitalism, that also produce slow growth. They assert the debt directly impedes growth. That’s a correlation = causation fallacy.

You correctly say this: “. . . the advocates of austerity have a lot in common with medieval bloodletters. When it’s pointed out that their programs made matters worse, their response is that they simply weren’t implemented aggressively enough.”

And this: “Let’s start with the fact that it accepted budget trimming now as a necessity, and therefore took the goals of the deficit commission as a given. But that’s barmy.”

And this: “. . . having the government also try to reduce deficits is a prescription for contraction.”

And just when it looks like you understand MONETARY SOVEREIGNTY (See: http://rodgermmitchell.wordpress.com/2010/08/13/monetarily-sovereign-the-key-to-understanding-economics/), you ruin everything by saying this: “Why have deficits in the US gone up? The big culprits are easy to spot.”

Culprits? Why culprits? The federal deficit is the federal government’s only method for adding money to the economy. Without federal deficits America would be in the worst depression in history. Without federal deficits, we would have no money. “Federal deficits” is a synonym for “federal money created.” If we didn’t mistakenly use the word “deficit” and instead used “money created” we wouldn’t have this discussion.

Deficits are not a burden on anyone. Deficits do not cause inflation (See: http://rodgermmitchell.wordpress.com/2010/04/06/more-thoughts-on-inflation/) The U.S. federal government cannot go bankrupt.

Every time we try to reduce deficits we have a recession or a depression. (See: http://rodgermmitchell.wordpress.com/2009/09/07/introduction/) ). Deficits are absolutely, positively necessary for economic growth. Why are these facts so difficult to understand?

Rodger Malcolm Mitchell

And I neglected to mention your comment, “the risk to U.S. public finances, as measured by the debt/GDP ratio.”

Utter nonsense. The Debt/GDP ratio does not measure any “risk to public finances.” It does not measure the federal government’s unlimited ability to service its debts. It does not measure the potential for inflation, deflation, recession, depression or any other negative economic event.

In fact, Debt/GDP does not measure a darn thing. It is a completely bogus fraction, with the denominator a one-year measure of production, and the numerator a money measure for the entire life of the nation. See: http://rodgermmitchell.wordpress.com/2009/11/08/federal-debtgdp-a-useless-ratio/

The repeated use of this nonsensical fraction is further proof the debt-hysterics simply do not know what the heck they are talking about. In their world, intuition trumps facts.

Rodger Malcolm Mitchell

Rodger,

The noble lie need not be understood as such so long as it achieves its intended purpose. [Plato]

But I do appreciate your drawing attention to debt/GDP as a useless statistic in this most recent round of lies – too many of which go unchallenged or accepted as the truth ex cathedra so to speak…

What I do find compelling in the MMT argument is that money came into existence as a means of paying taxes in lieu of livestock or perishable commodities. [At least in Randall Wray’s argument] It sure beats the noble lie that it came into existence “spontaneously” to facilitate exchange… another fairy tale of orthodox economics. But this also fuels the anarchist antistatist positions of libertarians and some on the Left.

I’ll leave it at that.

This is unadulterated CLASS WARFARE from ABOVE. But when hasn’t this been the case? Perhaps the postwar period 1945-1970 was the exception and not the rule, requiring a complete rethinking of deeply held beliefs by most Americans. Revisionism II, or III, or… the End of American Exceptionalism?

What is different is the intensity, scope, and DURATION.

The hysteria for AUSTERIA is at a fever pitch as the MSM drowns out any dissenting voices implying that there is a “consensus”, that drastic action must be taken NOW to forestall armageddon reminiscent of the “bomber gap” or the “misslie gap”. Except this CLASS WARFARE from ABOVE is on the American people… and can no longer be easily exported. The chickens have come home to roost!

The proposed scope of AUSTERITY is across the board and takes aim at what’s left of the New Deal – Social Security and Medicare – the emasculation of which has long been a target of reactionary elites in this country since either program’s inception. Of course, that’s all that’s left as the private sector has been looted already. Workers’ comp and unemployment are also on this chopping block in some states. Given that almost any intervention by the government is deemed “socialism” testifies to the effective indoctrination of the American populace as well as their seeming acquiescence to it. Whether “bailouts” of TBTF or individual Americans down on their luck, the populace is not in a generous mood often blaming the victim for his/her misfortune, further reinforcing the belief in the “need” for brass knuckle AUSTERITY – getting back to fundamentals and “traditional” values.

Depending on where one wants to start, 1964 with Goldwater, 1968 election of Nixon, or the election of Reagan in 1980, this CLASS WARFARE from ABOVE began in earnest. One might even go back to McCarthyism of the 50s… But make no mistake about it, its DURATION is what has made both the intensity and scope of this class warfare possible. A generation or two has become “acclimated” to this climate and now accepts AUSTERITY as inevitable.

As Yves has noted elsewhere there was a fundamental policy shift during the 70s in which the most debilitating form of AUSTERITY – UNEMPLOYMENT – became the vehicle with which to suppress inflation [wages and rising expectations]. In Dec 1968 unemployment was 3.4%. It has steadily increased ever since, rising to 9.8% yesterday [NYT]. And that’s not U6! That this increase coincided with the hollowing out of manufacturing and decimation of organized labor, as well as a downward pressure on wages is only further evidence that this CLASS WARFARE from ABOVE has intensified, broadened its scope, and laid the foundations for the brass knuckle AUSTERITY that is now the policy rage. The “credit spigot” merely masked its inception, allowing many a “Reagan Democrat” to live the lifetstyle of his/her parents on borrowed time… Well, now the piper wants to be paid. And we all know that “payback’s a BITCH”. [No sexist affront intended or implied.]

Is there a silver lining in this 40 year round of CLASS WARFARE from ABOVE? Only if THE MAKING OF THE AMERICAN WORKING CLASS results in the ending of this class warfare from above which remains to be seen. Disorganized labor would seem to be of little consequence in such a setting but let’s not jump to conclusions based on past historical examples. Perhaps the “critical mass” requisite to waging class warfare from below will not emerge out of the workplace but from another source. Yes, I know this isn’t consistent with Marx’s predictions but we have to remember that we may make history but not always as we would like…

“…there was a fundamental policy shift during the 70s in which the most debilitating form of AUSTERITY – UNEMPLOYMENT – became the vehicle with which to suppress inflation [wages and rising expectations]. In Dec 1968 unemployment was 3.4%. It has steadily increased ever since, rising to 9.8% yesterday [NYT]. And that’s not U6! That this increase coincided with the hollowing out of manufacturing and decimation of organized labor, as well as a downward pressure on wages is only further evidence that this CLASS WARFARE from ABOVE has intensified,…”

And this downward trajectory can continue until our “unemployed class” becomes so poverty-stricken and desperate that corporations can begin to bring back our manufacturing plants from “third world” countries, unhampered by any union rules or OSHA regs. People will be happy to work 6 days a week, 12 hours a day for just enough money to buy some food and keep a roof over their heads. Kids too. Think of the money we can save on schools. Long live those “dark satanic mills!”

Propaganda does not deceive people; it merely helps them to deceive themselves.

–Eric Hoffer

We have to ask ourselves why the arguments in favor of austerity have been so successful.

Undoubtedly this is a morality play and not one of material self-interest. But the unvarnished truth is that austerity has been accepted as received truth by a great many people, even though it is detrimental to their pleasure utility.

Part of austerity’s appeal could be in our hardwiring. Human beings lived and evolved in small hunter-gatherer groups for all but the last 10,000 years of their 2,000,000,000-year existence. And anthropologists studying extant hunter-gatherer groups have found strong taboos against overly ostentatious or hedonistic behavior, along with the belief that character can be built through hardship and adversity.

But if the impulse towards austerity is not innate, it certainly is built into our culture. The uses of adversity run like a thread through both Western and Eastern philosophy. From the ancient Stoics and Buddhists, to Plato, to St. Paul and St. Augustine down to Tolstoy, there has existed a belief that breaking attachments to external things and cultivating an attitude of acceptance leads to fulfillment.

In this vein, Jonathan Haidt in The Happiness Hypothesis asks “Must we suffer?” He then goes on to explain the current theoretical framework extant in Western thought:

The adversity hypothesis has a weak and a strong version. In the weak version, adversity can lead to growth, joy, and self-improvement, by the three mechanisms of posttraumatic growth described above. The weak version is well-supported by research, but it has few clear implications for how we should live our lives. The strong version of the hypothesis is more unsettling: It states that people must endure adversity to grow, and that the highest levels of growth and development are only open to those who have faced and overcome great adversity. If the strong version of the hypothesis is valid, it has profound implications for how we should live our lives and structure our societies… It means that heroic societies, which fear dishonor more than death, or societies that struggle together through war, might produce better human beings than can a world of peace and prosperity in which people’s expectations rise so high that they can sue each other for “emotional damages.”

This article suggests that the deficit was caused by the Bush tax cuts and we need more government spending to straighten things out. Why is it that all the bailouts and spending so far have failed? We were told that without TARP, unemployment would reach 8%. Now it’s approaching 10% (actually 17% real unemployment) and job growth is almost non-existent. Now you suggest more taxes on the rich as a solution? That’s a great way to kill the last few remaining jobs.

We need less government and more freedom. That’s what made this country prosperous in the first place. Centralized control has never worked and is failing for us now. We have big government Republicans and Bigger Government Democrats spending us into oblivion. We’ll continue to decline until government is shrunk.

Freedom in a market economy is expressed by spending. Hunger not backed with money is invisible to the market. All income is the result of prior spending, income does not come from nature in an industrial economy. Markets work where the maximum number of individuals spend into the market to express demand for the things that the maximum number want. This demand signal steers investment and productivity into the things for which there are popular demand.

When political systems or market failures prevent large numbers of people from having incomes, those people loose all freedom to participate in markets. So called conservatives who only conserve the value of their private holdings would have the unemployed pay in hunger and exclusion for the bad investment decisions of wealth holders that created the bubbles that caused the collapse.

What we have is a government that is captured by large financial interests that sees citizens as an extractive resource. The issue is not the size of the government, read the paper Yves linked in this post. The problem is who’s interests the government is serving.

“We need less government and more freedom. That’s what made this country prosperous in the first place.”

That’s why in the last hundred years we’ve seen a Great Depression, the S&L crisis, and our current fiscal malaise, not to mention numerous wars, social inequities, moral lapses and a general trend toward antebellum ethics of privilege and destitution.

Big Government.

While I’m willing to engage in rational discussion, compromise, I can’t accept the absurd as part of the package.

FDR kept the Depression going for a decade until he died in 1945. Congress immediately passed term limits, because they didn’t want another imperial Presidency. Progressives ignore this and view FDR as a great man because he kick-started the welfare state with Social Security.

Big Government programs are preventing the poor from making progress and destroying the middle class with taxes. Meanwhile, politicians are getting rich from crony capitalism. Unfortunately, liberals are so blinded by partisan bias that they can’t see that Big Government is the problem, not the solution. For example, they criticise the Iraq war because Bush promoted it, but not Afghanistan because that’s Obama’s thing. Obama can execute terrorists covertly, but Bush was bad for keeping them in Guantanamo. Meanwhile, both parties are taking away your freedom and enriching themselves.

If Big Government is the solution, then why did the USSR fail, why is Cuba broke, and why do millions live in squalor in China? The first experiment in communism in America was conducted by the Pilgrims. They almost starved until they allowed each family to work their own plot of land.

Socialism/Communism can’t work because they go against human nature. If the rules are “From each according to their ability, to each according to their needs”, then most people will choose to be takers rather than producers. That’s what welfare and socialist societies create …. a population of takers. However, this makes everyone equally poor if that’s your objective.

Big government is not the ultimate solution. However, as long as we have a government backed banking cartel using the government enforced monopoly money supply then the government is responsible for the problems that result.

Socialism in this country (the US) is just a reaction to banker fascism. Eliminate the banker fascism and the need for socialism should “wither away”.

ugh.

/Pavan

“FDR kept the Depression going for a decade”

You aren’t serious, are you?

Outside that dubious statement, my point was Big Government (FDR in your parlance) did not cause the Great Depression. The mess was inherited, to put it charitably, from ‘little government’. Ditto others.

/Pavan

“For example, they criticise the Iraq war because Bush promoted it”

George Bush just didn’t promote the second Iraqi conflict, he created it, under a shroud of deception and half truths (half truth – full lie).

/Pavan

“Obama can execute terrorists covertly, but Bush was bad for keeping them in Guantanamo.”

Again, not sure this is an argument as to size and purpose of government, but o.k., Obama is Bush on many priorities. {Suggestion: you might want to post this on a more pro-Obama site).

/Pavan

“The first experiment in communism in America was conducted by the Pilgrims. They almost starved until they allowed each family to work their own plot of land.”

Communism when Pilgrims colonized the Americas? Maybe you mean ‘Big Government’?

/Pavan

“From each according to their ability, to each according to their needs”

This saying did not originate from Karl Marx, but from early Christian societies:

“Acts 2:45 – And they sold their possessions and goods and distributed them to all, according as anyone had need.”

and

“Acts 4:32-35 And the multitude of them that believed were of one heart and of one soul: neither said any of them that ought of the things which he possessed was his own; but they had all things common…Neither was there any among them that lacked: for as many as were possessors of lands or houses sold them, and brought the prices of the things that were sold, and laid them down at the apostles’ feet: and distribution was made unto every man according as he had need.”

Not of Christian bent?

For further enlightenment on communal societies, I would suggest reading on the Israeli collective communities, Kibbutzim, whose combination of hard work and communal ethics transformed the swamps of Galilee and desert of Negev into productive land. Although they accounted for only a small percentage of Israel population, the influence on Israeli society far outstrips lack of numbers. And yes after almost one hundred years, some form of communal Kibbutzim exists today, albeit not without problems caused, as some would argue, by a more worldly capitalistic society.

–

I’m not arguing the U.S.A. should be made into one giant Kibbutz. That’s Pavan’s polemic of big and little government. I hesitate to state the obvious, but more economic stimulus by a government not involve transfer to a Communistic system. It didn’t in 1940 and it doesn’t now. Such simplistic thinking has in the past and will in the future do much harm.

I would also review your appraisal of ‘human nature’. Maybe in your corner of the World lack of the perception of social justice is the norm, but in mine it is not. While you can never build a system on complete trust and sacrifice (leaving aside some religious permutations) you can at least strive.

(by the way strictly speaking, I’m not a Marxist; or even a lowly Liberal. I would suggest your response imply another turn)

I’m in Colorado, Pavan. Read some Western history. Who provided land, financing, favorable laws so that the railroads could be built? Whose armies subdued the Native Peoples so that their land could be stolen? Whose programs regularized the giving away of said land to settlers? Whose programs today give large tax breaks to landowners for allowing just a few cattle to graze on their property?

Individual people don’t create a “successful” economy in some kind of a vacuum. There is always – always – a social framework of customs, laws and enforcement mechanisms that is administered by a government.

“Now you suggest more taxes on the rich as a solution? That’s a great way to kill the last few remaining jobs.”

Hardly. Most of the truly rich are just rent collectors. They could be taxed at extremely high rates, and it wouldn’t impact the economy at all.

“We need less government and more freedom. That’s what made this country prosperous in the first place.”

Freedom helped, but the main contributors to the wealth of the US had nothing to do with government size, but rather (a) less wealth-destruction via warfare than other countries, and (b) lots of open land, hence less parasitic rent-collection.

Excellent post! Thanks for the link to the paper.

This is where the legalization of bribery under the euphemism “campaign finance” is most destructive. Those mostly financial interests that see value preservation for their holdings as more important than the health of the nation are both funding a nonstop and unanswered propaganda campaign on Fox, bribing every national politician.

The national stock of debt, that not held by the Fed, is an inventory of private savings. To decrease the deficit is to decrease private savings. Stupid in the current economic client. Political “giving” is bribery pure and simple. Until these realities are generally acknowledged those who would use the publicly created US dollar as a tool to enslave the US population will be empowered.

Well said, Yves. I think Krugman and Stiglitz make a good pair. Krugman maybe a little too happy with his mathematics. I like Stiglitz’ ability to back off more and look at externalities which seem to be at least partly influenced by his growing up in an industrial rust zone. (similar to Taleb growing up watching Lebanon falling apart influencing his Black Swan theories)

If I may give a few excerpts from his excellent book Freefall

“”American corporations (and those of many other countries) are only nominally run by the shareholders. In practice, to a very large extent, they are run by and for the benefit of the management.

When private rewards are well aligned with social objectives, things work well; when they are not, matters can get ugly. (he gets into this in more detail but ie if someone produces a great new electric car and makes great profits great. If someone charges large fees for predatory mortgages and makes huge bonuses as their companies are going bankrupt not so great)

Economic policy involves trade-offs — winners and losers — and such trade-offs can’t be left to the technocrats alone. (ie Congress should keep an eye on the Fed, especially when it has moved so strongly into fiscal policy such as buying up trillions of dollars worth of mortgages at taxpayer expense)

The perception and reality, that the rescue packages were “unfair” — unfairly generous to the bankers, unfairly costly to ordinary citizens — has made dealing with the crisis all the more difficult.””

Deficit Hysteria, is that truly an appropriate styling of the dilemma at hand? Probably not. The diatribe teeters and totters, this way and that. The reality appears to be that the level of debt relative income is getting awfully high. Given the current rates of change attributable to debt and income it is is becoming increasingly apparent that we are fast approaching a limit to our ability to service the growing debt.

What to do? Stop borrowing? Increase earnings? Both? Restructure the debt? Repudiate the debt? All of the above?

Siggy, read the paper Yves linked to. “Deficit hysteria” is an appropriate description of the US and UK debt discussions because these two countries are sovereign issuers of their own fiat currency. To be obsessed with decreasing the stock of national debt at a moment of massive private deleveraging is hysterically irrational. On a fiat currency system the stock of government debt is nothing but the inventory of private savings. When the private sector is trying to save and pay down debt to reduce the budget deficit at the same time will not only deprive the private sector of the ability to save and pay down debt but also drive up the total stock of government debt as tax revenue collapses and public support payments expand. It is quite hysterical. Debt stocks shrink when economies out grow them. Shrinking economies precipitate debt deflations.

You are quite right that the debt to income is quite high. But the debt is fixed by contract, income by the performance of markets. Shrinking income will not fix the debt to income ratio. Growing income will. It is suicidal to try to shrink your way out of a debt deflation. Look at Ireland, look again! Compare to Iceland as Yves did today. Hmmm.

Seems to me that Iceland repudiated debt, that’s a direct reduction in the amount of credit money in circulation.

I don’t favor austerity per se. What concerns me is that we are adding to public debt rather than holding it constant when the problem is the level of debt itself. We have a raw sore called debt so we have elected to dig at it. Just when will it go to sepsis?

What I want is a currency that fullfils the objective of being a stable store of purchasing power. The artificially low yields to Treasury securities identify the risk that they represent, an extreme loss of purchasing power.

Programs such as QE2 add to the level of the public debt while benefiting only the banking community. The harsh reality is that the primary dealer banks still carry enough bad debt to put them into bankruptcy. The Fed is the agent of the banks and the federal government. There’s a conflict of interest in that relationship. It is working to the public’s detriment.

Holding the Federal debt constant while the production sector of the economy deleverages is the course that we should be following. Note that the artificial level of excess reserves is extraordinary while the velocity of money is declining. Also, you are a corporate treasurer and your concern is operating cash in a market where commercial paper is extremely difficult to write. What do you do, you hoard cash.

It seems to me that the deficit hysteria is in the court of the Fed. The public is intent on realigning its obligations to a level that current income will support. Adding to the level of Federal debt has not produced a notable increase in incomes. Why?

Seems to me that Iceland repudiated debt, that’s a direct reduction in the amount of credit money in circulation. Siggy

I think you have it backwards. Repudiating the debt leaves the money in circulation. Under fractional reserves, the loan creates money (credit) and repayment of the loan destroys it.

As I see it the role that federal debt has played poorly in the last three years is in stimulating real economic activity. This would have happened if the Gov had spent the money on real things like infrastructure or R&D rather than bail outs and income support for bankers. Even unemployment only yields half of the benefits that employment yields: the unemployed can continue to express demand through spending, but can not add to the total stock of wealth nor put idle capital stocks to use as they would if employed. So bad stimulus and bailouts are bad policy.

The currency was not a stable store of value for the “low inflation” era of the last decades. What the currency documented through prices was where income was concentrating. $35,000 Louis Vuitton bags, $800,000 Bugattis and absurd PE ratios were the expression of the changes in demand that resulted from concentration of incomes.

When “structural unemployment” was re-defined upwards in the early 1980, labor (and here I’m talking about the atomized worker, not organized labor with which I have many problems) was deprived of bargaining power and what had been a fairly equal split of productivity gains between labor and capital up to that point vanished. Almost all of the gains of the last three decades went to the top. As to whether the added amount of reserves results in a loss of purchasing power, it seems to me this remains an open question.

While asset prices have inflated to reflect the purchasing power of the purchasers of assets, consumer price inflation remains low despite or possibly because of competitive devaluations. Commodity prices are rising as all of the major currencies sink and I do expect that to ripple through. As I see it low treasury yields represent too much money sloshing around looking for profitable investment. And profitable investment will only appear when the producers of real stuff start to see growing demand for their stuff.

QE2, as best as I can tell does not change the stock of public debt, just its maturity profile and where it sits on the balance sheet. But I don’t pretend to really understand it. It looks like an attempt to give Onion readers the bubble they demand:

http://.theonion.com/articles/recessionplagued-nation-demands-new-bubble-to-inve,2486/.

Lets get that trickle down started again!

But that the velocity of money is declining is the central argument in favor of adding to the federal deficit right now: that decrease in flow is the direct consequence of private savings and debt service subtractions from spending that will ultimately stop the flow unless spending to support the incomes from which it is taken comes from some where. In the best of worlds, the beneficiaries of the last three decades deficits would start purchasing stuff and our foreign trading partners who have vast dollar reserves would start building infrastructure here for us producing some future return on their holdings while creating velocity in money now. But that is a Visa commercial, not the world we live in.

A claw back of epic proportions is what the Regent did when the Mississippi bubble burst in 1720, he had the army round up rich people and imprisoned them until they paid up enough to re-float the economy. Hoarding cash is a rational individual decision, but a systemic disaster that government deficits can solve.

Added deficits have not added to incomes because of the unbelievably stupid way they were run up: tax breaks do nothing for those without income; bailouts both maintained the fiction of solvency for insolvent banks and the reality of income for people who do not spend meaningful proportions of their income; the stimulus, minus tax breaks was tiny compared to the problem and had the effect of merely postponing declines we are now beginning to see.

As with most things its not what you do but the way that you do it, and in our political economy it seems that everything the Government does is for the benefit of its corporate and financial masters rather than citizens. Support from government has prevented a worse collapse, but its still not to late to have a proper collapse!

There’s a number of reasons for our deficits – health costs, boomer retirement, defense spending are a few but the tax cuts seem like a bad place to start if you don’t believe in austerity. It makes me wonder how to determine the appropriate highest marginal tax rate – should it be the rate at which deficits are eliminated? Or maybe the rate at which some wierd ideal of fairness is achieved… I think 39% is as arbitrary as 25% or 90% depending on your politics. I find advocating no-austerity at odds with raising taxes.

Its possible that austerity is a bad idea because we don’t project our deficits out for a long enough period. I’m no expert but when the boomers die is there less required spending? Maybe, but my point is that we may be myopic on all this austerity stuff.

Last, if you are an austerian and you wanted to bail out the banks and the make the tax payer pay for it you’ve completely lost your senses. Sadly thats what happened to Ireland (and in the U.S. only we’re richer) where there was plenty of good policy and economy but way to much lending to real estate by the banks. The governemnt bailed out the banks’ creditors – a big mistake. Well not a complete mistake – the government could have bailed out only one creditor – the depositor – and left the rest to the markets to sort out. Ireland woud probably be growing like wildfire now had this course been pursued.

Terms that give me a headache: debunk, rent-seeking, strawman, bankster…help me out here…

There was a wag on Wall Street who in the late 60’s avered that the sell off of that time was a ‘debunkle on Wall St.’.

What we need here is a debunkle of the hype that lies on either side of the the Debt to GDP metric and its associated propaganda. The spin masters have run amok with pointed scissors in hand, beware lest you be impaled.

Now, under our debt is money system (fractional reserve banking), the reduction of debt will reduce the amount of money in circulation. When that occurs, the purchasing power of the money in circulation should increase, some would say that we will be beset by the Dreaded Deflation Demon. On the other hand the reduced supply of money in circulation could circulate faster whilst prices generally hold firm. Therefore, I am inclined to suggest that increased purchasing power is generally a good thing and not the onset of the collapse of the universe.

Now who is responsible for the apparent excessive level of debt, public and private? I make it to be that 70% accruses the lending community and 30% to the borrowing community. My ratios are arbitrary; but, I feel fair. Profligate borrowing requires profligate lending. It is the lender who controls the transaction. Now it could also be that profilage borrowing will not occur if there is not a surfeit of money in circulation; i.e., so much money that the velocity of money is impeded by the size of its quantity in circulation. Siggy’s dictum, ‘Big things tend to move slower than small things’.

I don’t feel hysterical about the level of debt extant. I am getting exercised about ZIRP and the effect it is having on my retirement. The yield curve is an important metric in the calculus of the investments that create productive vehicles. What confounds me is that yield rates to Treasury securities are artificially low whilst my costs of medical services are increasing, my costs of food are increasing, my costs of gasoline and electricity are increasing; but then, we eschew monitoring such niceties as food and energy from our ‘official’ metrics for the evaluation of inflation.

We need a bout of debunkle on Wall Street. We need a debunkle of the Fed, and the Congress, and the President. We need a restoration of the purchasing power of the currency and in order to do that we are going to have to reduce our level of indebtness and welcome the reduced level of prices that would follow.

Now who is responsible for the apparent excessive level of debt, public and private? I make it to be that 70% accruses the lending community and 30% to the borrowing community. Siggy