By Alexander Gloy, CIO of Lighthouse Investment Management

As I was traveling through Vietnam in the mid-nineties our bus drove through an area visited by a taifun. The road was running on a slightly elevated dam, so initially there was no obstacle to continue the journey. Looking out of the window there was water on both sides as far as the eye could see. Eventually the water rose to overflow the road, but the bus kept going.

A Volkswagen transporter, after having passed the bus in a moment of exuberance, was soon found in the ditch with water up to the roof – there was no way to tell where the road ended and the ditch began. The water rose further and started entering the bus through the front door. Still, the driver kept going. I was amazed at how little damage occurred despite the vast flooding. The flood waters slowly receded towards the ocean. Uninhibited by any dams, the water had enough space to expand.

At one point, the water had washed out the elevated road, and a gaping hole forced even our bus to stop. I thought this to be the end of the trip. Miraculously, a bunch of locals showed up, and, with the help of a bulldozer, quickly filled the hole with large rocks. All passengers were asked to de-board as the bus slowly wiggled across the rocks. And we were ready to resume our trip. Closer to the coast we saw the effects of wind damage; at least every third home had been cut in half by a fallen palm tree. Pigs and chicken ran around disoriented, as their barn had probably disintegrated. Despite the damage there was no feeling of this being a catastrophic event; the houses would probably be repaired (they were covered with palm leaves) within a few days, and life would get back to normal.

Compare this to what happens in our “developed” countries when house prices decline by 10 or 20 per cent: the wheels of the entire financial system come off.

I am not suggesting we all live in thatch covered huts. But building higher and higher dams with flimsy sandbags just increases the pressure (and leads to much greater damage when the dam finally breaks).

Look at how Euro-zone politicians and central bankers are increasing the risks by building higher and higher dams with flimsy sand bags. Nobody seems to understand why the water (debt) rises – and nobody seems to understand how to shut of the water. All they can do is building dams.

Euro crisis: amateur hour at the EU

For Angela Merkel time is running out. Until now she was able to use the threat of the German constitutional court to extort concessions from other countries. The Bundesverfassungsgericht is expected to rule on a bunch of cases challenging the legality of the Greek bail-out, the EFSF (European Financial Stability Fund) machinery, and ECB (European Central Bank) bond purchases possibly in February. On its website only two (unrelated) decisions are scheduled[1].

According to Der Spiegel, German Chancellor Merkel will launch a new “pact for competitiveness” to save the Euro-zone at this week’s EU summit.[2 ]The key points:

1. Harmonization of tax rates (hello Ireland – yes, you guessed it, the corporate tax heaven is about to end, and companies will leave Dublin, making the recession even worse)

2. Adjustment of retirement ages (hello France – you set cars on fire when the government dared to increase it to 62 years – wait until you are “upgraded” to the German level of 67 years)

3. Improve job opportunities; mutual recognition of professional qualifications (please – what does this have to do with the debt crisis)

4. A “debt brake” to stabilize public finances (weren’t the Maastricht criteria supposed to limit public deficits and spending? Oh, wait, Germany and France decided to abolish them when they themselves were unable to fulfill them).

Give me a break. Are you serious, Mrs. Merkel? This isn’t even worth discussing.

Let’s take a look at a proposal apparently being discussed in financial circles. Somebody had a brilliant idea: given Greek government bonds trade at around 70% of par why not have Greece buy back those bonds at a discount – with more loans from the EFSF?

Suddenly economists figured out that IMF predictions of Greek debt-to-GDP peaking out at 150% in 2013 were pure fantasy as now 160% seems more likely.[3]

And what do we need to hear from the Irish Central Bank? Irish GDP “will probably rise by 1% this year instead of 2.4% forecast in October, after falling an estimated 0.3% in 2010″[4] Remember the “National Recovery Plan 2011-2014″? It was based on real GDP growth of 0.25% in 2010, 1.75% in 2011 and 3.25% in 2012[5] (Irish Central Bank now says GDP “may expand by 2.3% in 2012). When will politicians and central bankers stop embarrassing themselves?

Back to Greece: Apparently the plan is to lend Greece another EUR 50bn and, get this, extend the maturity of existing loans from 3 to 30 years. [6] Greece would be able to buy back part of its own debt with the fresh loans and reduce the debt level (since debt is bought back below par, at, say 75%). This would be a “voluntary” debt restructuring (nobody is forced to sell at 75%) and hence not trigger a default (with unpleasant consequences for banks).

Let’s assume the plan works. 75% of EUR 50bn equals 37.5bn, saving 12.5bn. Greek GDP was EUR 330bn in 2010, so that’s less than 4% of GDP. Debt-to-GDP will still go up to 156% (instead of 160%). Still unsustainable.

Further: the ECB has been buying EUR 76.5bn of European peripheral bonds, predominantly Greek, Irish and Portuguese bonds. Will the ECB sell its bonds back to Greece at a loss (that would be a hidden subsidy by the European taxpayer)? What about the Greek government bonds pledged as collateral at the ECB? The owners (Greek banks) surely do not want to (and are unable) take a loss on these bonds. Why would a private investor sell at a loss when Mrs. Merkel “guaranteed” no losses from sovereign bonds until mid-2013? Moral hazard all over again.

If a country cannot pay back its debt you give more loans to the right hand so the left hand can give some money back? Please. Who comes up with this half-baked stuff?

An accounting identity: fiscal, private sector and external sector balances

Back to economics school: GDP (the” production” side) can be calculated as

GDP = C + I + G + (X – M)

where C= consumption spending, I = investment (private), G = government spending and (X-M) the difference between exports and imports.

After some manipulations (the exact nature of which escapes me temporarily[7]) you end up with the following equation:

(S – I) = (G – T) + (X – M) or

0 = (G – T) + (I – S) + (X – M)[8]

Nice letter soup, you might say. But what does it mean?

In economist gibberish, the domestic private sector financial balance (I-S), the fiscal balance (G-T) and the net external balance (X-M) must add up to zero.

In plain English: Savings of households and companies plus budget surplus/deficit plus trade balance must add up to zero.

Meaning: If a country has a trade deficit (X – M < 0), it must have either a budget surplus (less government spending than tax revenue – rarely seen) or the private sector (households and companies) has to dip into savings (or rack up more debt). In the long run this leads to either an indebted domestic private sector or, if foreign savers buy domestic bonds, more and more debt service towards foreign entities (or both). This is what happened in Europe and is the source of the problem. Whoever does not understand these national accounting rules does not understand the problem, and hence cannot solve it. It’s so simple – yet so widely ignored.

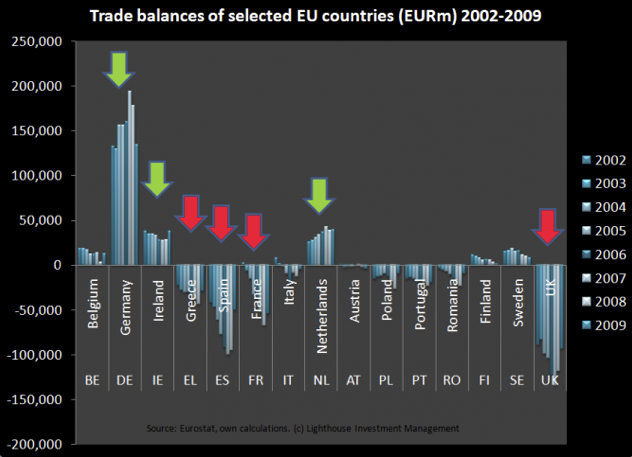

Let’s look at the trade balances of select EU members over the past few years[9]:

While Germany racks up a nice positive trade balance (more exports than imports), other countries (UK, Spain, France and Greece) have notorious trade deficits. Apart from Germany, only the Netherlands and Ireland (!) have significant positive trade balances – in absolute terms[10].

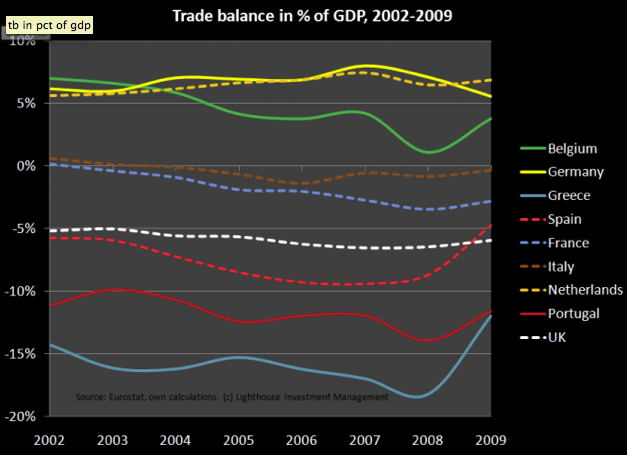

Now let’s look at the same data, but relative to the size of the economy[11]:

On a relative basis you can see that Greece, Portugal, UK and Spain have trade deficits in the range of 5-20% of GDP. Remember (G – T) + (I – S) + (X – M) = 0 ?

If (X-M) is negative by 10% of GDP, either the government (G-T) must run a budget surplus of 10% of GDP or the private sector (I-S) must dip into savings (or rack up debt) to that amount. Or a combination of those two.

A large trade deficit leads to imbalances for the fiscal and/or private sectors

Think about it this way: a trade deficit means more goods are coming into the country than leaving the country. Those goods need to be paid. Meaning more money is leaving the country than coming into the country. A trade deficit needs to be financed. In the long run, this leads to increased debt levels. It is unsustainable.

In the case of Greece (“EL” in above chart) we have trade deficits in the area of 15% and a 2009 budget deficit of 15.4%[12]. That implies the private sector (i.e. consumer, companies, banks) has to increase debt by 30% of GDP. With 2009 GDP at EUR 237bn that’s a cool EUR 71bn (or EUR 6,500 per inhabitant[13]).

Now that Greece has reached a (public) debt-to-GDP ratio of 115% (as of 2009) and its banks are insolvent (hanging on thanks to loans from the ECB) the Germans roll in and demand a reduction in deficits.

How do you improve your trade balance? Increase exports. How do you achieve that? Make products more competitive or desirable. How? Make them cheaper. How? Devalue your currency. Oops. We’re in the Euro-zone. Can’t do that.

The trade balance will not be of much help in reducing the deficit (except for reduction in consumption of imported goods by Greek consumers due to financial hardship).

What is left is a further increase of debt by the private sector (households, banks, companies) – the last thing Greece needs. It will lead to further financial instability.

Of course, one way out of the problem could be “internal devaluation”: since you cannot change your exchange rate, domestic wages and prices would have to fall to regain competitiveness and improve the trade balance. This would mean severe deflation. Apart from social unrest this usually means bankruptcies and banking crisis.

Despite forcing Greece into a combination of deflation, high unemployment and financial instability the Germans say “Just be like us”. Is that at all possible?

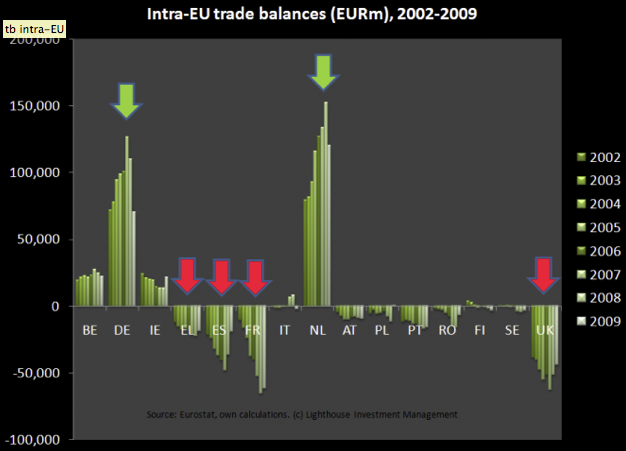

Let’s look at intra-EU trade balances[14]:

Germany and, especially, the Netherlands enjoy large positive trade balances – at the expense of (almost) everybody else. I don’t know what the Dutch are up to – they run a large trade deficit with non-EU countries, but a huge positive trade balance (>20% of GDP) with their EU counterparts. UK, Greece, Spain, Portugal and France, among others, have trade deficits within the EU and with non-EU countries. This is a clear sign they would need a lower exchange rate. With Mr. Bernanke pretending to print money (he isn’t – but the US government is: by running large fiscal deficits) the Euro is unlikely to weaken versus the dollar. Meaning: those countries probably would need to get out of the Euro (not the UK – fortunately for them, having its own currency).

In the past, large trade imbalances would lead to pressure on exchange rates to adjust (as regularly done under the European Exchange Rate Mechanism). If Greece imported too many goods, the additional Drachma paid to foreign exporters would, all else being equal, automatically lead to a declining exchange rate. But that is impossible in the Euro zone.

You could probably make a case that Germanys trade balance really started to take off once the Euro inhibited currency adjustments[15]:

Of course, those large positive trade balances allowed German households to save 15-17% of gross disposable income between 2000 and 2008[16]. Greece (apart from Lithuania) was the only country in the EU with a negative household saving rate in 2008[17]. While German households were able to reduce their gross debt-to-income ratio from 105% (2000) to 89% (2008), Greek households saw an increase from 17% to 71% over the same time period.[18] Ironically, excess German savings are what fuels German bank lending to peripheral Euro-zone countries, constituting a form of vendor-financing. The circle will be complete once those countries default on their unsustainably high obligations.

Highly indebted banking sectors can even take down entire countries (see Ireland). Once the banking sector debt reaches several multiples of GDP, the government will see itself run out of money in an attempt to save the banking system. Any government guarantees (for deposits) then become worthless, as witnessed by the recent accelerating drain of Irish bank deposits (EUR 40bn in December, EUR 110bn or 60% of GDP in 2010)[19]

What does the end game look like?

Rob Parenteau looks at the example of Spain[20]. To reduce its fiscal deficit from 10% to 3% within three years (the “Stability and Growth Pact”), the trade balance must improve by 7% of GDP or the private sector must leverage up by the same amount (or a combination of those two). Improving the trade balance by this amount seems unlikely, as Spain’s main trading partners have to undergo same austerity measures, which will curb domestic demand. This leaves only a further leveraging of the private sector. Rob writes: “It is highly unlikely Spanish businesses and households will wish to raise their indebtedness in an environment of 20% plus unemployment rates, combined with the prospect of rising tax rates and reduced government expenditures as fiscal retrenchment is pursued.”[21]

It is not a coincidence that the lowest unemployment rate in the EU can be found in the Netherlands (4.3%)[22], while Germany recorded its lowest number of unemployment workers since 1992[23].

With Spanish youth (under age 25) unemployment rates of 42.8%[24] (not a typo) it is only a question of time until someone, after a long day of staring at the Mediterranean Sea, thinks “I need to start a riot”.

What if the private sector does not want to or cannot increase debt? “Prices and wages in Spain’s tradable goods sector will need to fall precipitously, and labor productivity will have to surge dramatically, in order to create a large enough real depreciation.”[25]

Declining wages and deflation make it difficult to service debt, resulting in bankruptcies. And here is the irony: “As it turns out, pursuing fiscal sustainability […] will in all likelihood just lead many nations to further destabilization of private sector debt.”[26]

Rob concludes: “[…] for the sake of the citizens in the peripheral Euro zone nations now facing fiscal retrenchment, pray there is life on Mars that exclusively consumes olives, red wine, and Guinness beer.”[27]

You cannot cure the situation by lending more money to countries with a chronic trade deficit. It makes the situation worse (interest payments add to the outflows).

There are only two solutions: continue the current path of austerity and deflation until a large bank or en entire country blows (financially) up (at which point the country might as well leave the Euro) or have Germany and the Netherlands exit the Euro for the benefit of the Euro.

Strong countries leaving the Euro will less likely lead to bank runs than weak countries leaving.

Germany and the Netherlands might want to create a “turbo-Euro” which trades within a certain range towards the “Club-Med-Euro” with the possibility of realignment if necessary. The Germans would be well advised to act before discontent with the Euro, the EU and austerity overwhelms peripheral government.

Unfortunately there is little hope policy makers will abandon their current policy of increasing dams while letting the water run. When the dams finally break, many innocent victims will be swept away.

[1] www.bundesverfassungsgericht.de/aktuell.html

[2] “Merkel’s plan could transform the European Union”, in: Der Spiegel, January 31, 2011

[3] “European Union talks on Greek debt as IMF flies in”, in: The Guardian, January 30, 2011

[4] “Irish Central Bank Cuts 2011 Growth Forecast on Fiscal Squeeze”, in: Bloomberg, January 31, 2011

[5] “The National Recovery Plan 2011-2014″, page 111

[6] “Bond Buyer of Last Resort”, in: Wall Street Journal, February 1, 2011

[7] I really should have paid more attention at University.

[8] CofFEE (Center of Full Employment and Equity): Working Paper no 08-10, by: James Juniper and William Mitchell

[9] Eurostat: External and intra-EU trade – Statistical Yearbook – Data 1958-2009, 2010 edition, pages 82-83

[10] Ireland might be a special case as a lot of goods and services just transition through the country to make profits appear in this low-tax environment – but the local population never sees any of the benefits.

[11] Eurostat: External and intra-EU trade – Statistical Yearbook – Data 1958-2009, 2010 edition, pages 82-83

[12] Eurostat: News release 170/2010, November 15, 2010

[13] Greece has around 11m inhabitants

[14] Eurostat: External and intra-EU trade – Statistical Yearbook – Data 1958-2009, 2010 edition, pages 82-83

[15] Source: TradingEconomics.com

[16] Eurostat: Economic Statistics, 2010 Edition, page 149

[17] Eurostat: Economic Statistics, 2010 Edition, page 149

[18] Eurostat: Economic Statistics, 2010 Edition, page 151

[19] “Irish bank flight quickens despite EU rescue”, by: Ambrose Evans-Pritchard, in: The Telegraph, February 2, 2011

[20] “Will the Earnest Quest for Fiscal Sustainability Destabilize Private Debt?”, by: Rob Parenteau, in: Outside-the-box by John Mauldin, March 9, 2010

[21] “Will the Earnest Quest for Fiscal Sustainability Destabilize Private Debt?”, by: Rob Parenteau

[22] http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/Unemployment_statistics

[23] “German Joblessness Falls to 18-Year Low”, Bloomberg News, February 1, 2011

[24] http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/Unemployment_statistics

[25] “Will the Earnest Quest for Fiscal Sustainability Destabilize Private Debt?”, by: Rob Parenteau

[26] “Will the Earnest Quest for Fiscal Sustainability Destabilize Private Debt?”, by: Rob Parenteau

[27] “Will the Earnest Quest for Fiscal Sustainability Destabilize Private Debt?”, by: Rob Parenteau

Thanks. That was very enlightening. Can you do another one of these analyses for the US now please?

LOL, I really don’t think you want that comparison… Read the part about improving the trade balance by incresing the indebtedness of the people?? Already done..:(

So the US is worse off than Greece.

The elephant in the room has not been

mentioned: China.

China is holding tons of EU bonds and

Europe is one of its most important export

markets.

China does not want that market to implode

and China does not want the value of its

bonds to reach zero either.

So maybe instead of ‘Mars’ we could say

‘China’?

A country does not enjoy a trade surplus. The corporate sector of that country does. The financial sector enjoys the privilege to export that capital (mostly wasting it) while the normal people pay through less consumption and the degradation of their nominal savings

In Europe: Some stupid HRE or Landesbank lends (mostly off-balance-sheet) money to Greece. Greek people drain that money from the Greek state and buy Mercedes. Daimler makes some money and pays its workers which now maybe can “afford a Ford”. The Greeks – big surprise- do not pay back (- have they ever?). Landesbank falls back from the Länder Government to the Bund. Bund puts it off-balance-sheet. Landesbank managers got bonus for five years and now gets silver parachute. Daimler managers showed sales increase and got stock options. Mercedes stays in Greece. German taxpayer and saver totally f*****.

All Merkel is putting up now is for show. NO german party (not even a minority in any party) has the brains/balls to follow a Plan B. Instead they go for superficial assurances which may make the Euro more solid for German savers. But Spring 2010 showed that no contract or promise will be honored. The situation (and Paris) will dictate the terms again.

There is no need to complain about anything negotiated by Merkel because it will be worth ZERO. Maastricht and Amsterdam treaties were worth ZERO in the end, why should anything else be worth more now, when the shit already hit the fan? The Greeks will call their retirement work and the French will retire whenever they feel like it; all concessions will be on paper only – to proscribe these things from Berlin now looks desperately stupid. One should complain less and laugh more about it.

Brilliant summary of the situation, Hubert. Love it!

I think Gloy gets quite a bit wrong. It’s hard to build a super-state when the only morality promoted, other than a faux Euro common culture, is that of neoclassical economic theory, whose only morality is that of greed and selfishness.

My conceptualization of the EU is a group of groups, the coming together of various groups (nation states) in order to form a competitive super-group or super-state (the EU) that could compete on a level playing field with other super-states, principally China and the US. But for this to happen, there has to be intra-group cooperation within each nation state, and there has to be inter-group cooperation between the nation states. From what you describe, there is neither. But how could there be cooperation when the only ethic proselytized by the reigning economists (read pristhood) is that of a dog-eat-dog, every man for himself jungle?

Utopian romantics of both the libertarian and Marxist stripes have dreamed of a return to simpler times, and Gloy seems to share in this romanticism. Mexican Marxists of the 1920s to 1960s, for example, thought they had found an example of this past Shangri La in the ancient cultures of West Mexico. Richard F. Townsend, writing in Ancient West Mexico: Art and Archaeology of the Unknown Past, describes this fantasy world as follows:

Free from domination by priests and the demands of complex rituals…the ancient West Mexicans had had time to concentrate on “the little things in life.”

[….]

By the 1960s West Mexico seemed to be securely defined as a kind of frontier Eden, a place that had avoided the authoritarian states and empires of Mesoamerica proper.

Gauguin thought he had found his paradise of innocence amongst the more primitive cultures of Tahiti. He idealized these cultures in paintings like this and this.

But the reality of Gauguin’s own material existence belied his imagined paradise. Here’s how Diane Kelder describes his stay in Tahiti in The Great Book of French Impressionism:

Suffering from poverty, malnutrition, and syphilis, he contemplated suicide in 1897. Yet somewhere he found the inspiration and the strength to work on this oversized composition [D’Où Venons Nous/ Que Sommes Nous/ Où Allons nous], which he clearly viewed as both a personal testament and a new interpretation of the traditional religious and philosophic view of human destiny. Using a rough-textured sackcloth, he created a friezelike composition whose flat but monumental forms and exotic color create visual equivalences of the peace and harmony he had admired among the Polynesian natives.

What happens when super-states, like the Roman Empire, fail ? Here’s Bryan Ward-Perkins description in The Fall of Rome and the End of Civilization:

I also believe that the post-Roman centuries saw a dramatic decline in economic sophistication and prosperity, with an impact on the whole of society, from agricultural production to high culture, and from peasants to king. It is very likely that the population fell dramatically, and certain that the widespread diffusion of well-made goods ceased. Sophisticated cultural tools, like the use of writing, disappeared altogether in some regions, and became very restricted in all others.

And how did we come to worship primitive cultures? Here again Ward-Perkins provides some insight:

Economic complexity made mass-produced goods available, but it also made people dependent on specialists or semi-specialists—-sometimes working hundreds of miles away—-for many of their material needs. This worked very well in stable times, but it rendered consumers extremely vulnerable if for any reason the networks of production and distribution were disrupted, or if they themselves could no longer afford to purchase from a specialist. If specialized production failed, it was not possible to fall back immediately on effective self-help.

[….]

The enormity of the economic disintegration that occurred at the end of the empire was almost certainly a direct result of this specialization. The post-Roman world reverted to levels of economic simplicity, lower even than those of immediately pre-Roman times with little movement of goods, poor housing, and only the most basic manufactured items. The sophistication of the Roman period, by spreading high-quality goods widely in society, had destroyed the local skills and local networks that, in pre-Roman times, had provided lower-level economic complexity. It took centuries for people in the former empire to reacquire the skills and the regional networks that would take them back to these pre-Roman levels of sophistication. Ironically, viewed from the perspective of fifth-century Britain and of most of the sixth- and seventh-century Mediterranean, the Roman experience had been highly damaging.

Gloy actually poses two questions. The first: Are super-states a good thing? The second: What makes super-states work? And to the second I would answer: Certainly not the partial truths and gross simplifications of neoclassical economic theory. As Stephen Toulmin explains in Cosmopolis:

[I]n practice, the rigor of theory is useful only up to a point, and in certain circumstances. Claims to certainty, for instance, are at home within abstract theories, and so open to consensus: but all abstraction involves omission, turning a blind eye to elements in experience that do not lie within the scope of the given theory… (emphasis Toulmin’s)

So what are some “elements of experience that do not lie within the scope of” neoclassical economic theory? Peter Turchin in War and Peace and War gives a prime example:

The early Romans developed a set of values, called mos maiorum (ancestral custom), which governed their private and public lives. Probably the most important value was virtus (virtue), which derived from the word vir (man) and embodied all the qualities of a true man as a member of society. Virtus included the ability to distinguish between good and evil and to act in ways that promoted good, and especially the common good. It also meant the devotion to one’s family and community, and heroism in war. Unlike Greeks, Romans did not stress individual prowess, as exhibited by Homeric heroes or Olympic champions. The ideal of hero was one whose courage, wisdom, and self-sacrifice saved his country in time of peril. “Who with the prospect of death, envy, and punishment staring him in the face, does not hesitate to defend the Republic, he truly can be rekoned a vir,” says Cicero.

[….]

One cannot overemphasize the importance of these personal qualities of early Romans to their subsequent rise as an imperial nation. Note how the Roman virtues served to limit individualism (gravity and constancy), strengthened ties within family (piety) and community (faith), and sacrifice for the common good (virtus).

And this was not the hollowed out, faux morality that we see manifested in the self-righteous pieties spouted by so many American “elites” these days. It was genuine and heartfelt, truly worthy of Nietzsche’s elite “superman.” As Turchin goes on to explain:

Unlike the selfish elites of the later periods [of the Roman Empire], the aristocracy of the early Republic did not spare its blood or treasure in the service of the common interest. When 50,00 Romans, a staggering one fifth of Rome’s total manpower, perished in the battle of Cannae, as mentioned previously, the senate lost almost one third of its membership. This suggests that the senatorial aristocracy was more likely to be killed in wars than the average citizen. Add this to the peculiarly Roman practice of “devotion,” which was always performed by a member of the noble lineage, and it is easy to conclude that generally Roman aristocrats led the commoners in battle, and were the first to die.

Another example of the “elements of experience that do not lie within the scope of” neoclassical economic theory is this one provided by George Orwell in his essay “England Your England”:

The British ruling class were not altogether wrong in thinking that fascism was on their side. It is a fact that any rich man, unless he is a Jew, has less to fear from fascism than from either Communism or democratic socialism. One ought never to forget this, for nearly the whole of German and Italian propaganda is designed to cover it up. The natural instinct of men like Simon, Hoare, Chamberlain, etc., was to come to an agreement with Hitler. But—-and here the peculiar feature of English life that I have spoken of, the deep sense of national solidarity, comes in—-they could only do so by breaking up the Empire and selling their own people into semi-slavery. A truly corrupt class would have done this without hesitation, as in France. But things had not gone that distance in England. Politicians who would make cringing speeches about “the duty of loyalty to our conquerors” are hardly to be found in English public life. Tossed to and fro between their incomes and their principles, it was impossible that men like Chamberlain should do anything but make the worst of both worlds.

One thing that has always shown that the English ruling class are morally fairly sound, is that in time of war they are ready enough to get themselves killed. Several dukes, earls and what-not were killed in the recent campaign in Flanders. That could not happen if these people were the cynical scoundrels that they are sometimes declared to be. It is important not to misunderstand their motives, or one cannot predict their actions. What is to be expected of them is not treachery or physical cowardice, but stupidity, unconscious sabotage, an infallible instinct for doing the wrong thing. They are not wicked, or not altogether wicked; they are merely unteachable. Only when their money and power are gone will the younger among them begin to grasp what century they are living in. (emphasis Orwell’s)

Thank you for your input.

DownSouth quoted Orwell: “One thing that has always shown that the English ruling class are morally fairly sound, is that in time of war they are ready enough to get themselves killed. ”

This is a reminder that America’s elite are MORALLY BANKRUPT. They avoid military service like it was the plague, but that doesn’t stop them from advocating sending other family’s children off to war!

In that light, their other depraved activities are completely predictable.

Yes, and I might add how in our culture modern-day sociopaths like Ayn Rand and H.L. Mencken took Nietzsche and perverted his writings, turned them on their head.

Here’s Nietzsche:

The great man is an end; the great age, for example the Renaissance, is an end. The genius—-in work, in deed—-is necessarily a prodigal: that he spends himself is his greatness… The instinct of self-preservation is unhinged as it were…. He gushes forth, he gushes over, he uses himself up, he does not spare himself—-with fatality, disastrously, involuntarily as a river’s overflowing its banks is involuntary. (emphasis Nietzsche’s)

And Nietzsche again:

Many things are more highly valued by the living than life itself; yet out of this very valuing speaks—-the will to power!

And here’s George A. Morgan talking about Nietzsche in his book What Nietzsche Means:

Business and politics, he perceived, were the dominant forces of the time, and, as dominant, barbarous. Instead of subserving higher goals they perverted art, education, and philosophy to their own sordid purposes, making all modern life restless and spiritually empty…

Uncivilized in its strength, the age was also weak and false in its so-called culture. The preponderant type of man was the philistine, the “flock anima,” who permitted himself occasional excursions into art or philosophy, but was careful to distinguish these amusements from the “serious business” of life, such as making money. Not so much his mediocrity as his shameless self-satisfaction in mediocrity, as if he were rightly the measure of all things, aroused Nietzsche’s ire.

The best crystallization of this Untermensch who is complacent in his materialistic mediocrity and even proud of it is probably section 5 of the Prologue to Also Sprach Zarathustra.

All I could find was the old Thomas Common translation which is marred with some undue archaisms, but the sense is still there.

When Zarathustra had spoken these words, he again looked at the

people, and was silent. “There they stand,” said he to his heart;

“there they laugh: they understand me not; I am not the mouth for

these ears.

Must one first batter their ears, that they may learn to hear with

their eyes? Must one clatter like kettledrums and penitential

preachers? Or do they only believe the stammerer?

They have something whereof they are proud. What do they call it,

that which maketh them proud? Culture, they call it; it distinguisheth

them from the goatherds.

They dislike, therefore, to hear of ‘contempt’ of themselves. So I

will appeal to their pride.

I will speak unto them of the most contemptible thing: that,

however, is the last man!”

And thus spake Zarathustra unto the people:

It is time for man to fix his goal. It is time for man to plant

the germ of his highest hope.

Still is his soil rich enough for it. But that soil will one day

be poor and exhausted, and no lofty tree will any longer be able to

grow thereon.

Alas! there cometh the time when man will no longer launch the arrow

of his longing beyond man- and the string of his bow will have

unlearned to whizz!

I tell you: one must still have chaos in one, to give birth to a

dancing star. I tell you: ye have still chaos in you.

Alas! There cometh the time when man will no longer give birth to

any star. Alas! There cometh the time of the most despicable man,

who can no longer despise himself.

Lo! I show you the last man.

“What is love? What is creation? What is longing? What is a

star?”- so asketh the last man and blinketh.

The earth hath then become small, and on it there hoppeth the last

man who maketh everything small. His species is ineradicable like that

of the ground-flea; the last man liveth longest.

“We have discovered happiness”- say the last men, and blink thereby.

They have left the regions where it is hard to live; for they need

warmth. One still loveth one’s neighbour and rubbeth against him;

for one needeth warmth.

Turning ill and being distrustful, they consider sinful: they walk

warily. He is a fool who still stumbleth over stones or men!

A little poison now and then: that maketh pleasant dreams. And

much poison at last for a pleasant death.

One still worketh, for work is a pastime. But one is careful lest

the pastime should hurt one.

One no longer becometh poor or rich; both are too burdensome. Who

still wanteth to rule? Who still wanteth to obey? Both are too

burdensome.

No shepherd, and one herd! Everyone wanteth the same; everyone is

equal: he who hath other sentiments goeth voluntarily into the

madhouse.

“Formerly all the world was insane,”- say the subtlest of them,

and blink thereby.

They are clever and know all that hath happened: so there is no

end to their raillery. People still fall out, but are soon reconciled-

otherwise it spoileth their stomachs.

They have their little pleasures for the day, and their little

pleasures for the night, but they have a regard for health.

“We have discovered happiness,”- say the last men, and blink

thereby.-

The parts about becoming “poor or rich” and “ruling or obeying” refer to spiritual matters. The materialistic mediocrity is of course all about temporal greed and powerlust.

The term superman upsets me a great deal. The only place I ever heard this term was in respect to Hitler and his views. A much better translation would be above man. It is a shame that we accept Hitlers propaganda as fact about Nietzsches writing.

Kaufmann used “Overman” for several reasons including that one.

But as for the English term “superman”, Shaw used it in his play “Man and Superman” in 1903. I don’t know offhand if he actually coined the term or not, but at any rate that’s long before Hitler.

The name “Chamberlain” is by now a symbol of caving in, and yet he would never have surrendered to Hitler and served him. When Hitler pushed him too far, he found a backbone.

But when you look at today’s US “elites”, it’s easier to ask, “Who do you think wouldn’t sell out and serve as a quisling?”

Just look at the way they genuflect before their corporate master, and the way they’re already seeking to deliver the people into slavery.

As for the corporate filth themselves, in Germany and in all conquered countries they gleefully served the Nazis.

I am heading to France.

“A country does not enjoy a trade surplus. The corporate sector of that country does.”

Agree on that, on a aggregate sector balance level it do balance and make e.g. a public surplus possible but it docent necessarily is positive for the domestic household sector. In an advanced industrial country as Germany or Sweden the export industry produce more and more with declining employment. One of the prime vehicles to spread export surplus in the domestic economy in the age of post war boom decades.

Sweden has now for decades of record high trade surplus, there is an correlation high trade surplus, high unemployment.

http://img413.imageshack.us/img413/8789/unempnetexp2.png

External surplus have been larger than public surpluses. So the situation is now that the average amass a fortune on a per capita basis is 6th highest in the world, but less than 10% owns 72% of the wealth (among the highest share in the world) . 1/3 have no assets or in negative. The household debt is higher than in USA and on par with euro crisis countries as Spain, Portugal and Ireland. At least since 2000 about half of domestic consumption growth has come from households leveraging montages. Last years the CB have estimated that household’s disposable income have increased by 2-3% per year due to increased debt.

Slightly of main topic:

Re. “I don’t know what the Dutch are up to – they run a large trade deficit with non-EU countries, but a huge positive trade balance (>20% of GDP) with their EU counterparts”

Could it be that they are a major oil import destination, which is then refined and distributed to the rest of Europe.

I.e. high imports from rest of world, high exports intra EU.

Just a thought.

Yep, that’s what I thought: another example of the artificiality of accounting. Doesn’t it make you wonder about arguments based on national accounting identities?

Yes, that’s right. Besides of crude oil, the Dutch act as “entrance door” for several non-EU-originated goods (both rough materials and finished goods) esp. from China and US that are then resold throughout Europe.

It seems to me that this article has the application of the national accounting rules a bit messed up.

According to the accounting identities (X – M) = (S – I) + (T -G).

In general if a country has a trade deficit(or, more precisely, a current account deficit), it must have either:

a) A budget deficit larger than the private sector surplus;

or

b) A private sector deficit larger than the budget surplus;

or

c) both a private sector deficit AND a budget deficit, whose sum equals the current account deficit

In the case of Greece where in the year 2009 (X – M) = – 15% of GDP and (T-G) = – 15.4% of GDP (a large trade deficit and an even – slightly – larger budget deficit) this means the private sector of the country has actually deleveraged a bit – it certainly cannot have increased its debt by 30% of GDP as this article states…this could have happened only if the Greek state had run a budget surplus of 15% of GDP – for in that case foreigners and the state would be lending to the private sector!

A different mix was present in the case of Spain in the years prior to the financial crisis: the country ran a huge foreign deficit, alongside an even greater private sector deficit and a small budget surplus.

The key factor in both cases is the foreign imbalance, and the EU certainly has not presented until now any credible plan to deal with this problem, which is the deep cause of the crisis in the four so-called PIGS.

Yes, this is wrong, and I’m embarrassed not to have caught it (the perils of reading at 3 AM). I was amused by his discussion of Merkel’s position, and because he had read and was citing Parenteau, just skipped over that part. My bad, am trying to reach Gloy to get this corrected.

Thank you, Jose, for pointing out my mistake. You are absolutely correct. Apologies.

Taking Greek 2009 numbers (-15.4% fiscal balance, 12% trade deficit) the equation should actually read as follows:

(S-I) + (T-G) + (M-X) = 0

(S-I) – 15.4% + 12% = 0

where (S-I) = 3.4% (domestic private sector deleveraging).

An excellent article by Mr. Gloy, although he did seem to get the terms “surplus” and “deficit” confused where writing Government funding in the national accounts identity. In the U.S. for 10 years, Rubinites and Cheneyites, no matter what their other disagreements, expresed complete indifference to the U.S. trade deficit. For Rubin and Summers, it was always the strong dollar. For Kudlow and Mankiw, the current account deficit was a “sign of the U.S. economy’s strength” and gave consumers access to cheap goods. It has not ended so well.

Both Mr. Osborne of the UK and Congressman Ryan of the U.S. apparently continue on in complete ignorance of this equation.

“High-street gloom as consumers stop spending

• People cut spending on everything from homes to DVDs

• Record numbers of people declared insolvent”

“Bank of England chief Mervyn King: standard of living to plunge at fastest rate since 1920s

Households face the most dramatic squeeze in living standards since the 1920s,

…

“The squeeze on living standards is the inevitable price to pay for the financial crisis and subsequent rebalancing of the world and UK economies.””

Mervyn King

Inspite of all the rational analysis for months, ‘extend and pretend’ has won so far with equity market rising against the wall of skepticism b/c greater fool theory is trumpeting everything on it’s way so far!

Spin doctors have won! Perception is the reality and has shown more power than facts, no matter how the excellent analysis of the fundamentals.

Those who thought and acted on rational basis have lost!