It’s becoming increasingly clear that morality applies only to little people, especially the sort that are cannon fodder for our mortgage industrial complex.

The Florida attorney general, Pam Bondi, joined three other Republican attorneys general in arguing against the principal reductions called for in the so-called mortgage settlement on the basis of “moral hazard”. Their argument? That it would reward those who “simply choose not to pay their mortgage”.

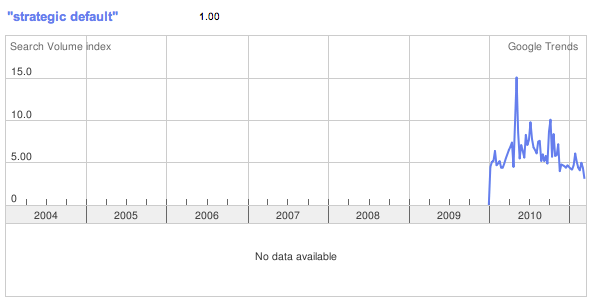

Boy, am I naive. The term “strategic default” appeared out of nowhere and had a pre-packaged sound about it.

And my DC sources were very clear that right wing think tank dollars were being thrown at it. But there has never been any evidence to support the idea that strategic defaults are happening at anything other than trivial levels (the logical candidates is a second home), and all the “academic” studies arguing for it happening at meaningful levels are very shoddy to complete BS. Some have argued, for instance, that people who suddenly default after a history of being current on all their bills must be strategic defaulters. Without further detailed investigation of that group, this conclusion is unfounded.

What may well be happening is a behavioral shift that does not fit the profile attributed to “strategic default” (someone who can afford to pay but chooses not to). For instance, it’s every bit as plausible that people in their group were paying their bills but had a very thin margin of safety, and Something Bad happened: hours cut back, job loss, diagnosis of very serious illness not covered by insurance. They might continue paying normally for a short time under more prospective or actual financial stress while looking into their options, recognize that they are not going to make it, and determine that their under-water house is the most sensible thing to sacrifice. In other words, I find it more logical (and more consistent with what I hear from bankruptcy attorneys and people I know under financial stress) that these are anticipatory defaults, not elective defaults. If so, these are people who would have, absent a big change in fortune, missed some payments and gotten ground up in the servicer bogus fee/payment misapplication machine.

There are big disincentives to defaulting: giving up a house you had invested in, literally and emotionally, disruption to children, damage to one’s credit record which now also seriously impairs employability now that credit checks have become an important job screen. So the “strategic” part isn’t, I suspect, that they are financially comfortable and just chose to stick it to the banks/investors and jettisoned a losing investment. It is more plausible that many if not most/virtually all are financially stressed AND are being more rational. Why struggle to keep an underwater investment if it is going to drain your finances and possibly/probably push you into bankruptcy to try to keep it? It costs money to move; if you think it’s inevitable, better to do it before you are totally broke.

But selling the public on the preferred interpretation of strategic default (the tipoff is the complete absence of meaningful investigations, which would include extensive case study examination) now serves as an excuse to oppose principal mods. Was this the intent all along?

Now contrast Bondi joining in with other pious moralizers about suspected borrower bad behavior with her conduct when presented with actual bad behavior by a foreclosure mill. Via 4closurefraud, hat tip Lisa Epstein:

Today Florida Attorney General Pam Bondi announced a first-of-its-kind settlement against attorney Marshall C. Watson and his law firm, one of the largest foreclosure firms in Florida, for alleged improprieties in the prosecution of foreclosure cases throughout Florida.

This settlement, which calls for a $2 million payment and imposition of certain requirements to conduct business, is the first stemming from numerous investigations into Florida foreclosure law firms.

$2 million is at most what Watson makes in two weeks, more likely one week. In Alabama, the pickings for big foreclosure firms are much lower than in Florida. Not only is the default rate worse (Alabama didn’t bubble up anywhere close to the degree that Florida did) but Alabama is a non-judicial foreclosure state, while Florida is a judicial foreclosure state, so the fees per foreclose are greater in Florida because more legal work is involved.

One of the big foreclosure mills in Alabama, Sirote & Permutt, makes $4 million a month on foreclosures. It’s pretty unlikely that one of the largest players in Florida would be pulling in less.

So in one corner, a wealthy and likely politically connected law firm gets off easy despite widespread reports of abuses in Florida (see 4clousurefraud, Fraud Digest, foreclosurehamlet.org for more sordid details) while little guys are presumed guilty and denied a remedy that lenders actually prefer because they come out ahead too. Even among the capitalist class, the banks and their minions are asserting their right to be first at the food trough.

The top lawyer is a politician. It is the same in other States, but Florida has received the most attention with notorious fraud and a high speed “borrower gallows” system.

Public officials are owned, even with the legacy of attrition in Florida, the class war means they will be bought. I’m waiting to see more borrowers arrested, held as a political prisoners in debt jail. Once a ward of a corrupt State, they can kiss all their whining civil rights goodbye.

Then there is Schneiderman in NY. who is willing to say “no deal” to lame settlements.

But debtors’ prisons are so Dickensian and picturesque! Maybe we’ll have a remake of Little Dorrit, set in contemporary south Florida!

I suspect that part of this is that the people making the accusations are superimposing how they think onto other people with very different backgrounds.

We have seen that the wealthy businessmen view defaults as strategic. A number of their organizations go through various types of re-organization periodically, or require negotiated bail-outs/subsidies from governments, or simply renegotiate terms with lenders. As a result, it would not surprise me if they simply believe that the average man on the street would do the same thing withut blinking, despite the knowledge that those people’s credit rating would get nuked.

Good point. That projection thing, like death panels brought to you by?

My relatives in Canada are trying to figure what the death panels are that are supposed to be in their health care system. Whenever they hear Americans talking about the Canadian health care system, they think their must be another country called “Canada” because the Us representation of the Canadian health care system doesn’t resemble the one that they use.

For some odd reason, my relatives appear to believe that the US private health insurance system looks more like death panels since it can decicde to throw people out of the health care system, unlike in Canada.

I’ve talked to a lot of homeowners who were always current and then defaulted, which apparently to rightwing think tanks and intelligentsia focused on publishing papers to support the power structure rather than documenting truth via research, makes them “strategic defaulters.”

The problem with that is, all the homeowners I talk to 1)had a sudden loss of income 2) blew through most or all of their life savings, including their retirement dollars (more ramifications will flow from that) trying to support the mortgage 3) along the way, asked for a sustainable modification, while current, but were told they had to be in default to be helped. And so defaulted on instruction of their mortgage servicer.

Now surely not every homeowner in default matches the profile of the ones that reach out to me, but they are not aberrational either.

Add to that three facts:

1) businesses in bankruptcy “strategically default” all the time; part of what bankruptcy is for to let them do that. But society doesn’t stigmatize business bankruptcies as moral failures the same way it does personal ones. The bankrupt business may be viewed as poorly run businesses, and disliked or even condemned for bad business judgment, but they’re not viewed as moral failures.

2) No homeowner with an underwater mortgage would be anywhere as near as underwater if the investment banks and mortgage lenders such as Countrywide and WaMu didn’t demand mortgages to securitize regardless of underwriting. That large demand drove the supply which drove up home prices. Ditto to the false appraisals the banks knowingly demanded, etc.

Those homeowners are not blameless, in that they took out the loans, but in the borrower/creditor relationship, it’s the creditor’s money and it’s the creditor’s job to figure out if the borrower should be allowed to borrow it: underwriting.

In short, principal reductions are a remedy for a problem the banks had a huge, and proximate, role in creating.

3) Without conceding that widespread mortgage principal reductions would create a moral hazard (because I’m not conceding the volume of strategic default and because I blame the banks for a good chunk of the over inflation of home prices) we as a country decided that moral hazard was the price to pay to bailout and save the financial system. The greater good justified the moral hazard.

(The fact that insolvent banks aren’t illiquid because everyone accepts that the government will continue to bail them out demonstrates the hazard was real)

But somehow the hypothetical moral hazard created by the principal reductions is not justifiable, even though truly sustainable modifications would have a profound positive effect on the economy, a Greater Good:

1) money being thrown at unsustainable mortgages could be saved or spent in the economy, creating demand to fill our demand deficit;

2) people could afford to sell and move to where jobs are;

3) stopping foreclosures by making homes affordable again would protect our chains of title/basic system of private property; and, on the moral scale, banks would face consequences for their decision not underwrite.

The “underwriting” is proprietary code, you can’t see it. No one seems to be writing much about this, but if it can be shown conclusively that systems were set up to extract wealth from marks/borrowers then this entire situation could be brought to rest. Computerized shell games, and foot solider/brokers were empowered.

Borrowers are largely blameless, millions are already out of their houses, but we’re still kicking the victims eh? Quick – let’s get out the neo-liberal measuring stick, scrutinize the poor for “viability”, punish them for guilt by association and dreadful immorality. Truth, justice, cruise missles!

interestingly, Bushitters allowed corporate interests to re-write bankruptcy laws-obviously they all had no idea any of this was coming, did they?

(in rightwing circles, THIS sort of “speculation” earns one

“conspiracy theorist” labeling-dissembling off issue)

meanwhile actual speculation is dissembled rather than addressed..

I’ve always wondered whether there wasn’t a correlation/causality problem here.

Did banksters lobby/pay for tougher bankruptcy laws for years because they knew the bubble was going to burst, a lot of people would be going bankrupt and they wanted to be prepared to extract every possible cent of value from bankrupt households?

Or, knowing that they could still extract value even from bankrupt households, were they incented to be less demanding in the granting of credit, thereby loosening underwriting/credit standards so dramatically?

If there’s anything you’ve learned here, Caitlin, it’s to trust your instincts when you read about the Industry. Of course they changed the laws ’cause they knew what was coming. What politician will stand up for someone who doesn’t have any money to give them, like a bankruptee? Is there any doubt in anyone’s mind that Hank Paulson was sent into the gov’t to save the Company from his own colossal idiocy? I wonder. Fannie and Freddie have been transferring all their files from the crooked David Stern to Marshall Watson. Do you think they would do that without knowing the fix was in with the attorney general, who will be looking for a lawyer job in the state in three short years? I wonder. Notice that the settlement says the company is liable for bad files in placed with the court only dating back to June ’10. All bad files since 6/10 have to be fixed. “Don’t worry about the others,” Bondi may have said. “Those are on me.” I wonder.

It’s a sad legacy for what has been a very arduous struggle up for the rule of law from the arbitrary corruption that still afflicts so much of the world… that here in this country it’s the legal profession itself that is doing so much to destroy its own foundations.

Corruption is growing dangerously and rapidly.

Are there any in the legal field still interested in protecting its integrity? Where are those investigations? No Pecora’s around anymore?

The belief so encouraged by the political myth-makers of both parties in some sort of exceptionalism plays right into the self-congratulatory ignorance of the citizenry which is so helpful to clever fraudsters everywhere.

Citizens, please begin to examine your META-politics*. Its not a question of Left or Right anymore… both parties will play lip service to their current simplistic mythologies but both myths are in second position to a growing pathology in the stagnant and in-bred relationship between the state and large enterprises. And guess what… You’re the patsy!!

Yes! We need some large enterprises… but who the Hell talked you into giving away your legal, individual and NATURAL rights to due process and basic justice?

*Meta-politics refers to systems and procedures rather than particular positions on particular issues.

P.S. Dear Mr. Stumpf… what’s your position on improving the political system? Do you believe things are going well? And just for fun… what’s your opinion… Was the mass transfer of wealth to the top in the last few decades because the ‘little’ people weren’t willing to work so didn’t deserve any of the increase in productivity?

And regarding the FED, I understand that the rationale is to ensure independence and neutrality… that makes sense… and I’m sure the pathological metastasizing and enrichment of the financial/banking sector that controls the FED is entirely a product of that neutrality.

I know these aren’t all your fault Mr. Stumpf, I just wondered if you thought you could be helpful in fixing these problems? (Of course, that assumes you see them as problems at all!)

While I’m not a Floridian I wish Ms. Bondi a short career, and I hope her fellow citizens, even those not directly involved in the issue come to realize that they too are being betrayed by a public servant so beholden and enamored by powerful interests lacking integrity.

What afflicts the legal profession these days is the same thing that afflicts the rest of society: neoliberalism and the monopoly capitalism/neofeudalism it has wrought. “Too Big To Fail” begat “Too Big To Jail” begat “Too Big To Offend.”

Recent rulings here in Oregon have homeowners anticipating another reason for default. If the Judge says the MERS phantom has no legal standing to foreclose then does it have the legal right to collect payments? And if/when the homeowner hangs tough and completes 360 payments will the phantom be legally able to reconvey?

Do you schmucks know anything at all about mortgages, or are you just talking to make yourself feel smart? MERS is only used for servicing the loans, and is only evident on the mortgage. What really gives someone standing to foreclose is an original note endorsed to blank, which most of them are.

“So in one corner, a wealthy and likely politically connected law firm gets off easy despite widespread reports of abuses in Florida (see 4clousurefraud, Fraud Digest, foreclosurehamlet.org for more sordid details) while little guys are presumed guilty and denied a remedy that lenders actually prefer because they come out ahead too. Even among the capitalist class, the banks and their minions are asserting their right to be first at the food trough.”

Wouldn’t it be ironic if, five years from now, some of those brave folks participating, in the Arab awakening (Egypt, Libya, Tunisia, Syria, Jordan, et al) create functioning democracies that truly work for the good of the people, while we Americans only get to look on in envy?

Any chance we as a group can take inspiration from them and do something extraordinary?

It really is an all or none situation. The govt. can’t bail out homeowners with second loans taken out to pay off credit cards yet not bail out folks who did not opt for the second loan and kept the credit card debt. Same debt yet one group will get off and the other group left to suffer with judgements, collectors etc.

You can’t reduce my neighbors principle and not reduce mine. There is absolutely no way to determine if the lucky winner of a principle reduction did not spend out of control while I saved the last 10 years and still paying my mortgage while he stopped.

FICO scores and credit rating threats to main street Americans mean nothing anymore. They have figured out many options to get around a bad credit score. The banks will still do business with anyone who can prove they can pay monthly.

This is the reality folks.. My suggestion is to get out of the house a bit and see what is really going on.

I know many underwater homeowners who would walk away now but for the high cost of rent. If rent starts to fall they will have no problem walking away. I know many underwater folks are waiting for a solution. If the solution is to just help a small segment they will walk tomorrow and they have every right to. I think it is wrong we have not given a break to all folks from usurious credit cards rates and penalties incurred the last 10 years to underwater homeowners. They should all be given the chance to walk away before they liquidate their savings and retirement.

lee,

It just eats your heart out that some other little person might get some pittance that you don’t get, while the banksters are driving off with 18-wheelers loaded down with cash.

I think we’ve already lavished over $13 trillion on the banksters, including outright gifts and zero-interest loans.

If we were to distribute that amount equally amongst America’s 114 million households, they’d get over $114,000 each.

Here’s an idea for you. Why not give every household in America $114,000, regardless of whether it’s a homeowner or renter, has debt or is debt free? But here’s the hitch. If the household has debt, the $114,000 has to be applied to debt reduction first. And anything left over the household gets a nice check from Uncle Sam in the mail.

Does that seem fair to you?

Needs a few edits.

“It really is an all or none situation. The govt. can’t bail out BANKS with second loans taken out to pay off credit cards yet not bail out BANKS who did not opt for the second loan and kept the credit card debt. Same debt yet one group will get off and the other group left to suffer with judgements, collectors etc.

You can’t reduce my BANKS principle and not reduce mine. There is absolutely no way to determine if the lucky winner of a TARP BAILOUT did not spend out of control while I saved the last 10 years and still paying my mortgage while he stopped.”

This, is the key-

“This is the reality folks.. My suggestion is to get out of the house a bit and see what is really going on.”

Where have you been for the past 4 years?

Republicant talking point rules for posting-

Start with a seeming fact, move onto the slippery slope of logic that end with a rant against deadbeats. End the post with an insult for anyone who has taken the time to read it.

Rake the votes in come election time.

The John Stewart show did a piece about 12 months ago showing that the American Mortgage Bankers Association (I think that was the association name) had defaulted on it’s contract to buy or lease a building for its headquarters. At the same time it was screaming about the iniquity of borrowers walking away from mortgages and the dangers of “moral hazard”. Apparently there are different morals at play when it comes to corporations rather than individuals. Corporations, not just banks, walk away from their bad deals all the time; only Joe Citizen is expected to suck it up for the moral good of society!

That was in the real news too. If I recall, they had a $80 million mortgage on their fancy piece of Manhattan property that they overpaid on during the boom, and walked on it. The spokesman for MBA said it was strategic move, but stopped short of using the words “strategic default”. I was wondering if they took out a “liars loan” to buy the property, because then they may be open to regulatory prosecution as we’ve seen lately…lying on a liars loan.

Now there’s something for Stewart to sink his teeth into. A MBA representative sitting in front of his loan broker. The loan broker pulls out the loan app form with “Liars Loan” printed across the top. “Will you complete this loan app, please?” the loan broker says, barely concealing a smile…..

It is acceptable, but sad, that the stupid and blind can’t see or understand the implications of a Naked Emperor riding an Elephant indoors.

As intelligent sighted people it is amazing that Americans are still missing the implications and continue to allow it to happen without comment while the guy cleaning up the poop left behind is arrested for having contraband elephant poop…

Hopefully Americans will see the truth and ask why the emperor is naked and riding an elephant in the first place…

Continue to call a Naked Emperor naked and have the due diligence done to make the banks pay one poopy loan at a time… Negotiated private settlements are coming! Do not expect the system will produce a just settlement by itself. We must all fight individually to compel a just outcome for ourselves. Educate and arm yourself and please step into the ring. The Banks may have unlimited resources but Americans have an unlimited will to fight for justice!

http://diligencegroupllc.net/

American Homeowner

-AH

Save us “anti-Bank” website! (How about a coherent opening paragraph AH?)

“We dissect every aspect of a mortgage transaction, uncover all material defects, and testify as to those defects in a highly detailed findings analysis report to be used as evidence in a legal context by attorneys in courts of law. Our analysis, however, may also be used by other interested parties as leverage to accomplish any number of specific objectives according to their needs. ” Uh oh.

The FBI defines mortgage fraud as “any material misstatement, misrepresentation or omission relied upon by an underwriter or lender to fund, purchase or insure a loan.

Throw borrowers in jail with a careful look at their loan documents, dotted i’s an crossed t’s.

Ah Ha!!! Misrepresentation!! Borrowers destroyed the economy!

Yves, how can you expect moral decisions in a system operated through economic incentives? I guess it comes down to the role of the administration of justice.

No intertubes sarkiness, genuine question.

After interviewing (heck, counseling) many people considering default, I agree that far from the common image of “strategic default,” a greater number are carrying out what you refer to as “anticipatory defaults.” The term I’ve been using is “prudent walkaway,” I put an article about it on HuffPost a couple of days ago: http://www.huffingtonpost.com/nicholas-carroll/shifting-the-focus-from-s_b_838843.html

Did you counsel on deficiency judgements for folks in those applicable states? I would think servicers could sue, ‘specially for them piggyback 2nds. Why tell people to take this sh#t lying down?

HuffPost only allows me so many words, so I didn’t mention deficiency judgments in that particular article. However I do regularly point out in print that people should be concerning themselves about potential deficiency judgments a lot more than their credit report. It’s a hard sell, since folks are obsessed with their FICO score (as much as the Ancient Mariner with his albatross), but deficiency judgments are a missile that isn’t on their radar screen — yet.

Yves, thank you for all the great work you do.

Did you catch this article in the NYT about a borrower who has gone to prison for a ‘liar loan’?

http://www.nytimes.com/2011/03/26/business/26nocera.html?_r=1&hp

This whole discussion about the supposed “morality” or otherwise of defaulting is bizarre and misplaced. The mortgage agreement is a contract. The contract states that if mortgage payments are not made, then the Bank has the right to take the collateral (the home). Nowhere does the contract state the home”owner” (sic) must make payments until they are unable to do so anymore, it simply says that if the payments stop then the bank gets the house. Simple. No problem.

Whether the bank actually wants the house is absolutely no concern of the debtor.

Bingo!

You made your own bed, you filthy governemnt backed counterfeiters. Not so comfy now?

That’s absolutely correct.

Somehow, someone changed the subject. This was once about the contract honoring, libertarian respected, conservative, free market result of letting the home go back to the lender and living with the contractual consequences.

It has now been magically transmuted into a supposed moral need to honor extra-contractual, unwritten, un-agreed-upon conditions that no business in the country, including the MBA, would themselves feel obligated to meet.

Nice trick, that.

Exactly. Oddly enough, the SAME people who are now hand-wringing about “strategic default” see nothing wrong with declaring, “oh, the federal/state/city government doesn’t have enough money, so we’re voiding all the union contracts”. Apparently contracts also only apply to poor people – well, them and the very rich who are on the winning side (ie, getting bonuses from bailed-out banks).

Bondi or any other attorney general using the “moral hazard” argument is a joke. That said, I still find it tragic that Yves and most who comment on this blog can be so clear in their conviction as to how patently hypocritical Bondi is, but have such a hard time acknowledging that there are, in fact, thousands of borrowers who have the ability to pay but are choosing to walk away. You can call it whatever you want, “strategic default” or “prudent walkaway”, but it is happening. People who can afford their monthly payments and that aren’t in financial straights are choosing to walk away in droves. How many of those commenting on this blog post live in Florida, Las Vegas, or Southern California? How many of those commenting on this blog post work for borrowers, lenders, or servicers? How many people commenting on this blog post deal with renters who are about to be evicted because the owner of the property stopped paying the mortgage, taxes and insurance (or condo fees) over a year earlier, meaning the owner was simply pocketing the rent money (or using that rent money to hire an attorney to drag out the foreclosure even further to pocket more rent money) on a property in which the owner took out a loan declaring it was their personal residence? Friends, family, acquaintances, clients, doctors, lawyers, bankers, teachers, police officers, janitors, they are all doing it. Open your eyes! Is it moral? Who cares? Who gives a shit what your neighbor does? As Porter states above, this should be simply a contractual matter. But please don’t try to back up claims by willfully turning a blind eye to reality. The impact of the otherwise valid point gets significantly diminished when you paint one category of the debate in an overly broad and sympathetic brush.

b,

Please reread the post. You are attributing a black and white stance that is not there. But having said that, this HAS become a mortality tale in the political arena, and if you don’t acknowledge and deal with that reality, you lose

And what exactly is your data sample for you contention that thousands are defaulting who can pay and are under no financial stress? I’m having trouble finding them. It appears you did not read Abigail Field’s comment above. She’s at attorney who has been writing about this topic for months. She’s very clear that the pattern claimed by the spin-meisters to represent a strategic default is in fact the result of financial stress, the point I argued in the post.

I talk to BK attorneys and I’ve found a grand total of ONE case, and it was a guy and his wife who owned 9 homes, meaning investment properties. So they were really a business rather than normal homeowners. I know through my contacts thousands if not tens of thousands of defaulted borrowers. If I’ve found only one strategic defaulter, that says they are as rare as unicorns.

but have such a hard time acknowledging that there are, in fact, thousands of borrowers who have the ability to pay but are choosing to walk away. You can call it whatever you want, “strategic default” or “prudent walkaway”, but it is happening. People who can afford their monthly payments and that aren’t in financial straights are choosing to walk away in droves. b

So what if they can pay today? What about tomorrow? Ever hear of a deflationary spiral? Should people wait till their job is lost to prepare for the future?

When fractional reserve loans are repaid, the money (“credit”) is destroyed. When people cease paying, the money remains in circulation. Which is better for the economy do you think?

I wish the entire US population would strategically default. It would be a self-service Jubilee; we are long overdue.

One can easily argue that default is the MORAL thing to do. Is debt to a counterfeiter morally valid? No, it isn’t.

Some people may be shy about calling the bankers counterfeiters but I have thought it through and that is exactly what they are.

We need a Jubilee or bailout of the entire US population plus fundamental reform to put an end to this nonsense before it puts an end to us.

This stuff amazes me. I cannot understand how a government (to include state governments) can sit back and allow these things to happen. It’s unbelievable. Who in their right mind would risk having so many people evicted from their homes, their children deprived of a normal childhood, education, etc… just because a few people might be trying to play the system; regardless of the fact that businesses and banks do nothing but play the system.

It’s called “trickle down morality”. When a corrupt system rewards those that act in deliberate bad faith and punishes those that are honest then EVERYONE will be FORCED to abandon their morals and ethics in order to survive.

Third world countries operate like that, hence the “Rule of Whim” and the violation of contracts because “It makes me money”. Argentina is a good local example.

A nation with the ethics/morals and Business climate of 300 million Wall Street bankers ALL looking out for number one… It’s change alright!…

“Winners default and keep the money, Chumps pay for MY bad debts” That is the lesson being given to everyone in the United States every day, how many are listening and agreeing?

What is it like to live in a society with that ethical/moral business climate? For those of you who are citizens of the United States, you will know the answer within a few years at most.

The United States of Nigeria. Yes We WILL.