We were surprised that Ireland capitulated so quickly to pressure from its Eurozone confreres and accepted a punitive bailout of its government, when it was in fact its banks that were a mess. As we noted in November:

Note that the Irish government is still holding out for a banking-system-only bailout, even if the funds are channeled through the government. Since I am not aware of any IMF bailout being done on this format, it’s likely to be a sticking point if the Irish refuse to back down (recall that the government itself is under no immediate funding pressure; they have six months before they need to go to market, which is an eternity in crisis-land).

The other major bone of contention is Ireland’s super-low corporation tax, which served as a significant incentive for multinationals to set up shop in Ireland. The Germans and French are insistent that it be increased to balance the budget. The Irish objections here are plausible, particularly since the low rates are a cornerstone of their national strategy (do you want 12.5%, the current corporate tax rate, of a decent sized number or 25% of a vastly smaller number?). The Irish have made it clear that they are non-negotiable on this point, and as keenly as the rest of the eurozone would like to beat Ireland back into line, I doubt they’d be willing to risk negotiations failing over this issue.

Fast forward, the Irish agree to a deal, the ruling party suffers substantial losses precisely for accepting the terms demanded by the eurozone and the IMF, and the new incumbents are much less willing to play nicely with counterparties who are engaging in what amounts to “every man out for himself” behavior, no matter what spin is put on their demands. From Gideon Rachman of the Financial Times:

….the fundamental European problem is now not economic – it is political…

The row involving Ireland last weekend makes the point. The new Irish government was told it would get a cut in the usurious interest rate that the rest of Europe is charging it, only if the Irish in turn agreed to raise their super-low corporate tax rate. This is a concession that no Irish government can make. Ireland’s ability to set its own corporate tax rate has become a symbol of national sovereignty. Successive governments have promised never to give it up – it seems all the more important as a means to attract investment, as the country struggles to revive its economy.

Yet, for the French and German governments, it is politically imperative to demand a change in Ireland’s tax rates. How can they persuade voters to make concessions to a country that is seen as stealing jobs through “tax-dumping”?

All the governments involved are under enormous political pressure. Enda Kenny, the new Irish prime minister, has just seen the last Irish government eviscerated at the polls by voters enraged by the euro crisis. Nicolas Sarkozy, the French president, is facing opinion polls for next year’s presidential election that see him trailing behind Marine Le Pen, of the far right National Front, which rejects the European project as alien to French national interests.

As for Angela Merkel, the German chancellor, she too fears electoral disaster. The German press and public are screaming about the prospect of further emergency loans to Europe.

In the last few days, there has been a sudden recognition, at least on the part of some Irish commentators, that Ireland has the upper hand. A default would be a disaster for European banks, and anyone who has been paying attention knows that the refusal to restructure periphery country debt is a way to avoid bailing out not very popular German and French banks.

The long-form statement of this view comes from “economist, broadcaster, author” David McWilliams (hat tip Richard Smith):

No one here believes a word that comes out of the European Commission, the ECB or the organs of the Irish state.

The traders I chatted to see the numbers….all agree that the way to go is to default on the bank debt and start again, protecting the sovereign in the process…..all of them believe that, if Ireland stops paying the ‘‘odious’’ bank debts, the economy will recover extremely quickly. They also indicated that they would consider buying Irish government paper if we got rid of our bank debt. But with the bank debt, there is no way…

Unfortunately, it now seems that the Irish banks are going to need an awful lot more cash.

Let’s imagine for a minute that the government is crazy enough to commit another €50 billion (which is not an unlikely figure) to the banks, which would increase our government debt to €195 billion.

Then add the deficits that we will need to fund for the next five years. That’s about another €45 billion.

This gives leaves our national debt at €240 billion.

Even if we manage to finance all of that at 4 per cent (which is the lowest possible figure under current arrangements), it would cost nearly €10 billion a year in interest payments alone.

That is equal to 80 per cent of the government’s income tax take in 2010. It is unsustainable. There is no way around it.

Paying interest on debt is a draw on an economy – it means money that could be invested in an economy is leaving the country. If we are paying €10 billion in interest every year and our GDP is in the region of €150 billion, we need to expand the economy by more than €10 billion each year, just to stand still.

It works like this: GDP on January 1 is €150 billion. During the year, extra economic activity in the economy adds €10 billion value to the economy, giving a GDP at end of year of €160 billion. But the economy has to pay €10 billion in interest. So we have to take that €10 billion from the €160 billion to get end-of year GDP.

That leaves the GDP at the same level as it was at the start of the year: €150 billion.

The economy will have to run to stand still. Something has to give….

A structured default now is the game-changer we need. The view from Wall Street this afternoon is that this is the answer.

A footnote: John Ihle reports in The Post:

Consultants from Blackrock – the world’s largest investment firm, with €2.5 trillion in assets under management – are taking a ‘‘deep dive’’ into the banks’ loan portfolios to determine their likely losses over time.

Blackrock is looking at loan-to-value ratios, the impact of forbearance, loan restructuring and other granular elements not included in the broader stress tests.

Earth to base, this is a garbage in, garbage out exercise You can’t value loans against illiquid real estate by sitting around playing with models. Our Swedish Lex, who worked on the Swedish bad debt liquidation exercise, said a lot of assets were pretty much impossible to value (or more accurately, yes you could come up with a rationale for slapping a number on them, but anyone with an iota of common sense would know it was garbage). So I suspect the reason for Blackrock coming in is completely political: to rationalize whatever number is deemed to be necessary and possibly to prevent one avenue of escape for the Irish, that of putting out an estimate of banking sector cash needs that raises justified concerns about UK and Eurobank solvency (given Blackrock’s useless but impressive modeling skills, any dissenting views, no matter how well informed, will be dismissed). And in case you think Irish bank solvency is not tightly connected to bank solvency in the eurozone, consider this Financial Times editorial from last year:

But the most urgent problem is not the solvency of the Irish state; it is the solvency of the Irish banking system….If Irish banks collapse – and if one falls it will not fall alone – it may well trigger bank failures across a continent that remains full of institutions whose earlier stress tests were remarkably stressless…

And before you think this talk of Ireland defaulting is just some wishful thinking on the part of naive journalists and bloggers, Irish ministers, in particular ones with relevant portfolios, are talking about it openly. From BreakingNewIreland (hat tip Richard Smith):

The Junior Minister for European Affairs has said Ireland holds the bargaining card in the negotiations over the interest rate on the EU/IMF bailout package.

Lucinda Creighton said it’s not in the interest of other European countries for Ireland not to be able to repay this loan.

She said this fact will give Ireland more bargaining power in these negotiations: “The very worst case scenario would be for some sort of sovereign default in Ireland which would have a ripple effect across the EU,” Ms Creighton said.

“It would have devastating consequences for the euro, I think that our partners around the EU table know that.”

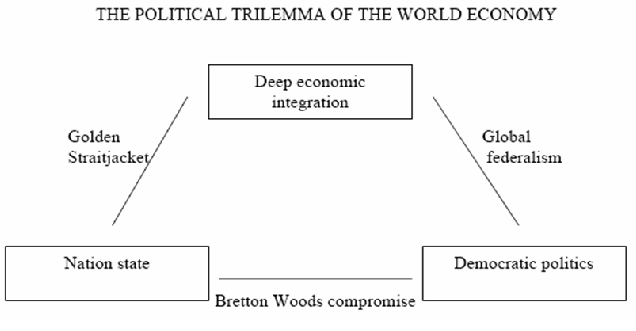

The eurozone is up against Dani Rodrik’s trilemma:

You cannot have all three corners of the triangle at once. The creators of the European Union knew that the end game was the dissolution of nation states. But the inability to work out a process for achieving the intended aim meant the architects left troublesome issues unresolved, with the idea that inevitable crises would force resolution.

But what they failed to anticipate is that the costs of these crises would be visited on the inhabitants of particular nation states, and that would lead them to rebel against the “inevitable” integration. As long as democratic mechanisms are intact in enough of the countries being pressed to wear the austerity hairshirt, revolt is indeed possible. Economists argue that the cost for any nation to exit the eurozone is prohibitive. But how does that stack up with a “rescue” program that virtually guarantees continued economic contraction and depopulation for Ireland?. Faced with two unattractive alternatives, the desire for self-determination and for punishment of coercive European technocrats may make supposedly irrational moves seem compelling.

The Irish objections here are plausible, particularly since the low rates are a cornerstone of their national strategy (do you want 12.5%, the current corporate tax rate, of a decent sized number or 25% of a vastly smaller number?).

When you say the Irish objections are plausible, you should note that they’re only plausible if Ireland is a special snowflake that deserves special pleading. France and Germany could wipe out Ireland’s corporate attraction strategy quite easily, by offering a low tax themselves, at which point Ireland’s income would quickly become 12.5% of a vastly smaller number. Ireland’s strategy is not for the tax to be 12.5%, it is for the tax to be *lower than everyone else’s*.

Isn’t that precisely what the GOP says of the US personal income tax rate: That it’s far better to have a top marginal rate of, say 15%, that everyone will pay, then a higher rate that many will avoid?

Since experience has shown that the richest people are also the most predatory and the least empathetic, why would they not evade their taxes no matter how low the rate? To me the height of Republican hypocrisy is there ongoing battle to defund the IRS.

I enjoyed this post greatly, but I don’t quite follow what you mean about Blackrock; are they to scare the eurocore into giving in to Irelands demands, so that Ireland cannot default without moving the goalposts?

They aren’t there to scare Ireland but to take away one of the ways it could be disruptive short of defaulting or threatening to default, which is to publish a really big stress test number (as in expected losses) for its banks. You can’t have a big stress test number test number from Ireland and virtually no losses from banks in some other countries given the cross exposures.

When it comes to Ireland and tax, the tax rate is only one part of the picture. The other issue that annoys other countries is the much more hidden, but perhaps equally important, issue of the tax base: that is, what Ireland does and doesn’t tax. Ireland provides exemptions for all kinds of income, and its laxity in this respect encourages corporations from around the world to shovel profits through Ireland to dodge their taxes. This Bloomberg story illustrates one such dodge, where Google uses the “Double Irish” trick to cut its global overseas tax rate to just 2.4% – well below Ireland’s famous 12.5% rate. http://bloom.bg/9I48eh This stuff is very much the “every man out for himself” behaviour (I call it tax havenry) that you describe in this blog.

The Europeans would be better off insisting that Ireland closes the worst of these hidden loopholes. This would allow Irish politicians to cling to their totemic 12.5% rate and show their voters how strong they are, while behind the scenes the Europeans get Ireland to eliminate some of these wasteful and unproductive abuses which are harder to justify, politically speaking, than the 12.5% rate is. The U.S. could take quite an interest in this too, given the amount of U.S. corporations that route their finances through Ireland to cheat on their tax bills. For a rather wonkish overview of what Ireland’s up to, see here http://bit.ly/hhxzul

Thanks for this comment and thanks to Yves for the educational posting. This is the sort of public education and discussion that needs to take place among societal adults to cut through the BS.

This is so much an example of the rich through their mostly owned multi-national banks and corporations playing countries off against each other for cheap labor and tax dodges….and all the time the lemmings are being told the plutocrats are “doing God’s work”.

Ireland’s ability to set its own corporate tax rate has become a symbol of national sovereignty.

Given that they feel compelled to keep this rate ultra-low in order to shackle themselves to multinationals, that’s one of the most ironic sentences I’ve seen.

Successive governments have promised never to give it up – it seems all the more important as a means to attract investment, as the country struggles to revive its economy.

Yup. Even those who are relatively sane enough to want to default still haven’t learned the full lesson. They need to experience far more pain, and they will. And they deserve to, given their contempt for the people of other countries:

Yet, for the French and German governments, it is politically imperative to demand a change in Ireland’s tax rates. How can they persuade voters to make concessions to a country that is seen as stealing jobs through “tax-dumping”?

But then, the people of those countries are also shackling themselves to globalization and corporatism in the first place.

The trilemma is only a partial truth and really a modified version of the Big Lie of globalization. It was always a direct assault on both national sovereignty and democracy, as its architects always knew and intended. Indeed, a primary goal of globalization from the start was not just proximate profiteering but this very destruction of democracy and sovereignty. Read the founding documents like David Rockefeller’s Trilateral Commission manifesto.

Economists argue that the cost for any nation to exit the eurozone is prohibitive.

That’s an indication, not a counterindication. Certainly, the proper response to any threat about the collapse of the Eurozone and its banking sectors is, “Is that a threat or a promise?”

Faced with two unattractive alternatives, the desire for self-determination and for punishment of coercive European technocrats may make supposedly irrational moves seem compelling.

On the contrary, nothing could be more irrational than failing to break all ties with this proven structural failure. What’s irrational is for a drowning man to keep clinging to the anchor, refusing to let go, when he can save himself at will by swimming for himself.

I will believe that Ireland can default only when it does. I do not believe politicians will do the right thing by the people irrespective of the party to which they belong

“the last Irish government eviscerated at the polls by voters enraged by the euro crisis”.

Incorrect – and transparently motivated by the FT’s campaign against the Euro. The euro crisis wasn’t forefront in the minds of voters. We in Ireland eviscerated the last government for providing unlimited corporate welfare while slashing social provision, savagely deflating the economy even before the IMF arrived, and for ballooning unemployment and forced emigration.

Being Irish (or more charitably, refusing yet to believe that this crisis of capitalism is unsolveable withing capitalism), the people then elected a government that will continue the previous government’s disastrous policies regarding the unsustainable indebtedness.

The Fine Gael / Labour government are a tame centre-right creature of the economic orthodoxy and will never seriously go to the brink over default.

My guess is that the there will be some give by the Irish on transfer pricing (another way that Ireland historically facilitates corporate welfare) in return for a modest decrease in the interest rates demanded by the ECB.

The Irish state will totter on for a year or so and then there will be an almighty sovereign default. This government will have wasted the opportunity to force the European banks to get a bit real, and share some of the gambler tax throughout the EU.

s/withing/within/

Pope, I agree with you, though I hope that we are both wrong. I wonder whether FG will rely on the advice of bankers as to what to do with the banks, as FF did? I would dearly love to see our leaders play hardball for once.

I am favorably surprised that the new Irish government is ready to state the obvious and not just lick Merkel’s, Cameron’s and Trichet’s boots.

It makes no sense that the EBC is lending to private banks at near 0% rates and to Ireland only at 5%, when Ireland is a member state and the banks are not.

It is true that Ireland should raise taxes but I do not think this is the quid of the question: the quid of the question is that Dublin should declare retroactive bankruptcy of all nationalized banks on the day prior to their nationalization.

That’s what Cowen must have done. And that’s what the new government must do. And also give the toxic rescue back to Brussels in the process.

Sure you’re right in terms of fairness, but Ireland’s not going to pay the money back anyway. Ireland will continue to borrow as long as their primary gov’t accounts are in deficit, but when it comes times for the primary budget to swing to surplus and start to net pay back…well, they just won’t, nobody would.

Maju: “It makes no sense that the EBC is lending to private banks at near 0% rates and to Ireland only at 5%”

Please note that Ireland does NOT borrow from the ECB, but from other euro countries. Those countries have to borrow the money they lend to Ireland on the markets themselves.

Remember the euro dinner last Friday night?

euro 500 billion (!!) rescue fund to be established, partly guarantees, partly cash. The cash that countries give to the rescue fund has to be borrowed, at market interests rates.

Only big banks get money for free.

I say do it.

Just default.

The entire globe is saddled with debt it cannot pay and that debt is keeping individuals, businesses and nation states from moving ahead.

Time to hit the reset button and to hell with the banks. Some will survive and some new ones will form. Yes many millionairs and billionairs will get wiped out along with many above average Joe’s but in the end all we have been doing is treating symptoms on a cancer patient. We need to cut out the rotted flesh.

Let’s remember that money is either just paper or bytes in a computer. The ECB should just regenerate the deposits for all account holders, up to a certain amount…. Say 2,000,000 euros, which I am sure will recover the deposits of 98% of the population of Europe. Then we need some method of debt forgiveness. We also need to institute sane credit limits for companies and individuals and force all regulated financial institutions to get out if casino banking ( both directly or indirectly via loans or shadown ownership to institutions that would engage in casino capitalsim.

I like your thinking. You must not be part of the problem.

We may forget what was behind the EU but “core” Europeans hopefully haven’t. In 1950 Robert Schuman the French Foreign Minister proposed the ESCU to to “make war not only unthinkable but materially impossible it is still there” by tying Germany into a supranational economic union. The addition of the peripheral states may have clouded this truth but it remains.

Ireland was neutral in WWII leaning toward Germany. Perhaps the Great Fear is not in their minds. But as been suggested Greece and Ireland have been the scavengers in the EU; both suppose a special entitlement

based upon their ancient roots.

But Germany cannot be pushed to seriously consider going it alone. Compared to that, the periphery must be considered expendable.

So Germany’s earlier imperial ambitions get transformed into neo-imperialism, or neo-liberalism? And this name change somehow changes the underlying reality?

The fact that we’ve butchered language by calling the old imperialism by a new name, liberalism, changes nothing. The only way to impose imperialism, that is neo-liberalism, is with violence. No population, when they finally figure out that neo-liberalism is nothing more than imperialism in drag (and this can take some time because of the traitors within their midst) accepts it voluntarily.

This is the lesson of Argentina. This is the lesson of Chile. Violence is the only way to impose neo-liberalism.

Yes, I wish more knew the importance of language. That’s where the play begins.

aeolius quoted: a single euro currency to “make war not only unthinkable but materially impossible “.

That was nonsense at the time it was uttered and it still remains nonsense.

Both world history and our current time are overloaded with civil wars: humans fighting each other though they use the same currency.

The euro crisis has revealed a truth some politicians did/do not want to know: there are no europeans, but Germans, French, Italians, Greek, Irish, etc.

Mr. Aeolus… Your comments are needless fear mongering and fascist German extremism arose because of it’s humiliation and economic privation imposed on it from the victorious British and French of world war 1. If anything, the privation imposed on Spain, Ireland, Greece, Hungary and latvia are more likely to inspire extremism than the prospect of germany leaving the eurozone. And recently, Der Speigel reports the presence of ‘Brown Shirts’, openly marching in the city square of Budapest…..

“British and French of world war 1”

And Americans!

Although Fritz Fischer asserts that Prussian millitarism did not go into exile with the Hohenzollerns… let us say there were folks who wanted a war, and the ruthless reparations made the idea popular.

“In the last few days, there has been a sudden recognition, at least on the part of some Irish commentators, that Ireland has the upper hand. A default would be a disaster for European banks, and anyone who has been paying attention knows that the refusal to restructure periphery country debt is a way to avoid bailing out not very popular German and French banks.”

The Irish might be overly confident in this respect.

As I said elsewhere:

“Prof Sinn of the Ifo-Institute calculates in this presentation of 14 dec 2010 (”Europa in der Krise” in German, http://mediathek.cesifo-group.de/player/macros/_v_q_1000_de_640_480/_s_ifo/_x_s-764870657/ifo/index.html?locale=en

that potential losses of German banks on peripheral loans (20-30% haircut on a big amount of loans) were covered by TWICE AS BIG GAINS on German bunds held by German banks (+10% on a huge amount of loans).

Now, I don’t know how many Bunds the banks sold back when the chart was made and since then the German Bunds came back down again due to fears that Germany would be saddled with GIPS-debt. But that would reverse the moment Germany decides not to bail out the GIPS-countries. So, no real risk for the German banks: either they are saved via bailout, or they make up for their losses by selling the then surging German Bunds. Win – win for the banks … Tough luck for either the German or the Irish taxpayer …”

The 20% to 30% loss number is too low, at least for Greece. Willem Buiter, former central banker, now chief economist at Citigroup. estimated it at 50% to 75%.

And how well do you think German bunds are gonna trade if the German banking system is taking big losses from sovereign defaults? The dirty secret is that the German banking system is WAAY too large for the German government to credibly backstop it.

“Yet, for the French and German governments, it is politically imperative to demand a change in Ireland’s tax rates. How can they persuade voters to make concessions to a country that is seen as stealing jobs through “tax-dumping”?”

Let the French and German governments bail out Societe Generale and Duetsche Bank themselves.

«As long as democratic mechanisms are intact in enough of the countries being pressed to wear the austerity hairshirt, revolt is indeed possible.»

As long as the democratic institutions in the countries are intact, they don’t need to revolt. The can just vote for the right thing/party.

As soon as the democratic institutions are no longer working, revolt is the only way to resist. But, of course, revolts will we put down, because the important thing is “stability and continuity”.

That’s why the democratic institutions will be destroyed by the those psychopaths. It gives them total control.

“Revolt” meant revolt against EU austerity. Ireland is not Greece, at least not yet.

Donald Trump is the business model for Ireland: deal with my spectacular failures or I will take you down with me.

This is like listening to a group of bums under the freeway overpass talk about how each owes the other a billion dollars,

and how they need to extend loans to each other to avoid a solvency problem.

Mental deficiency is the phrase that comes to mind.

The Irish should hit the bank reset button, and the debt

reset button, and the reality reset button.

Vendor financing always ends in tears, or wars.

But I guess if it’s marketed as “globalization”, people are

too stupid to recognize the shell game they’ve played

before.

I have written a piece regarding the Euro common currency on other websites. Instead of the various countries fighting with one another regarding bad debt, budgets, and other issues, it would be better to repeal the Euro currency. In its place, either go back to each countries original currency or have regional common currencies that could be better managed. For example, Denmark, Iceland, Sweden, Norway, and Finland could have a Scandinavian common currency. Maybe, Germany, Austria, and Hungary could have a common currency. The other nations could be group in various ways for a common currencies for them. It would be easier to manage and Europe could have maybe five to seven common currencies that would be better for trading goods and sevices instead of more than 20 individual currencies.

Default. Debt is the lever used to control the world. Austerity will last decades and forever change the people into gray cogs in a machine of neo-feudalism. Default will cause the same economic pain but of a much shorter duration and leave a people not beaten into submission by years of making do. The Irish people didn’t cause their crisis, they shouldn’t bear the cost. Really that simple.

Bailing out the banks failed, spectacularly, here in the US.

Bankster fraud has reach alarming proportions, and is yet increasing, as “The Fed” “buying” bonds will exacerbate inflation.

So… Why would anyone, anywhere else in the world, consider bailing out a country’s banksters, rather than that country’s people? It is, after all, those very same people who create the wealth being given away to the banksters.

Banksters, it seems, create only debt and fraud. When they open their books to honest auditing, THEN I will show some care for them!

Default and leave the EMU. Prosecute the bankers and their enabling politicians.

The Ireland deal is like the Treaty of Versailles war reparations in that future default is certain.

The globe was snookered. Get over it already. Stop the madness. How did everyone become so deluded?

> How did everyone become so deluded?

No one is deluded.

There is still stuff that isn’t nailed down, to be stolen.

When there is nothing left to steal, this ends in reset.

Good read,Thank You for posting !

Will Ireland threaten to default? Yes.

Will Ireland default? No.

Will people riot? Eventually.

Will Ireland leave the euro in the next few years? Not until after the public has been looted. Then they can have what’s left.

Let me elaborate —

Irish politicians will threaten to default to get leverage over the vested interests dependent on sticking it to Irish taxpayers. Those vested interests being Irish banks, Anglo banks, American bank, german banks, French banks, American central bankers, European central bankers, European politicians. Irish politicians will play Irish taxpayers against these interests for their own benefit by threatening default, but ultimately not.

Irish taxpayers will grumble, but the pain won’t lead to action until it’s too late. By then the banks will have cheated their way into the black.

if default is so painless as described, why didn’t Ireland default already? Why don’t all countries with excessive debt just default? As the article says, just default and start over! Or am i missing something?

hum… hum… YES!!! Ireland will default… all countries with Evil Democracy like the Irish Government, they are not different then Our Criminal U.S. Goverment; they allowed to rums freely all these Crooked Banks like The DEUTSCHE BANK rippen in Complicity the Poor,Humble,Gullible,Stupid,Crazy Hard Working People.

Karl Whelan, an economic professor at University College Dublin, proposes a solution in today’s Irish Times for the €150bn owed by banks to the ECB and the Irish Central Bank.

He says: “In the absence of the banks raising private funding of anything close to this amount, I believe the answer is that the Central Bank loans need to be converted to equity. The problem is that many suspect the banks are insolvent but the scale of the insolvency hole is simply unknown. Under these conditions, it is hard to expect international stock or bond investors to hand over their money. However, if the €150 billion in funding from the ECB and Irish Central Bank is converted into equity, then these banks will immediately be solvent beyond even the doubts of the most pessimistic observers and, at that point, they could be sold into private ownership.

This equity conversion could work as follows. The European Financial Stability Facility could issue €80 billion in bonds, loaning these funds to the Irish banks, who would then pay off the ECB, allowing it walk away unscathed. The EFSF would then convert its €80 billion loan into an equity stake. Similarly, the Irish Central Bank would convert its ELA loans into equity with a legal promise from the Minister for Finance that any losses on the equity share would be covered by the State. The banks would then be owned by the EU and the Irish State but would be prepared for sale to private ownership.”

Finfacts: http://www.finfacts.ie/irishfinancenews/article_1021845.shtml

That proposal is known as “giving taxpayer money to crooked bank executives”. Look through the details of that proposal carefully; it’s as bad as the bullshit the US pulled with AIG.

Ireland is being as we say: “cute”.

We will default only if asked to pay interest, as opposed to rolling it up into the debt. All parties are aware of that. It is simply the illustration of the if I O U $1…… but if I O U $1,000,000 …. argument!

If the EU federalizes, then the debt will be shared among all of the EU, 100 times the size of Ireland. If it is not then the “Iceland!” argument will prevail. The EZ and EU banks lent too much. The Irish noticed and said, ahhhh….. thanks softly. They have a chance to sort out their economy now, with the subvention of a massive cushion of cash that will never be repaid to banks that are after all, bust. That all the banks in the EZ will end up in the ECB is merely a difference in nomenclature. Ah NomenKlatura! The bankers were seen coming in other words and default is the last thing the Irish will need to do! They will get yet more subsidies from the EZ and UK whose banks are collapsing slowly inwards.

Thanks for all the Fish!