The New York Times yesterday made the an observation that seems to be lost on Team Obama, that high unemployment levels and second Presidential terms do not go together. We’ve predicted that the Osama bin Laden bounce won’t last long. Bush I, after all, had 91% approval ratings right after the invasion of Iraq and he still lost the reelection thanks to the state of the economy.

Another factor weighing on the collective psyche, and thus voter attitudes, is the inability of most people to get ahead in real economic terms. Reader Francois T pointed out an article in Investors Business Daily that highlighted that real wage gains in the last ten years are even worse than during the Great Depression:

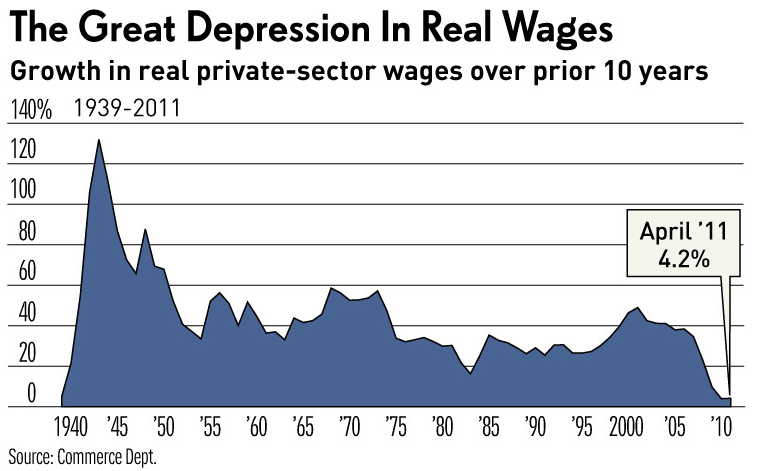

The past decade of wage growth has been one for the record books — but not one to celebrate.

The increase in total private-sector wages, adjusted for inflation, from the start of 2001 has fallen far short of any 10-year period since World War II, according to Commerce Department data. In fact, if the data are to be believed, economywide wage gains have even lagged those in the decade of the Great Depression (adjusted for deflation).

Two years into the recovery, and 10 years after the nation fell into a post-dot-com bubble recession, this legacy of near-stagnant wages has helped ground the economy despite unprecedented fiscal and monetary stimulus — and even an impressive bull market.

Over the past decade, real private-sector wage growth has scraped bottom at 4%, just below the 5% increase from 1929 to 1939, government data show.

To put that in perspective, since the Great Depression, 10-year gains in real private wages had always exceeded 25% with one exception: the period ended in 1982-83, when the jobless rate spiked above 10% and wage gains briefly decelerated to 16%.

There are several culprits, of which by far the biggest has been the net loss of 2.7 million private nonfarm jobs since March 2001. (Government payrolls rose by 1.2 million over that span.)

That excess supply of labor has given employers the upper hand in holding back wage gains.

There is a curious failure to mention why wage gains were higher in the Depression despite even higher unemployment. Funny how it does not occur them to mentions unions as helping give workers some bargaining power.

Admittedly, the big factor differentiating the Depression from now was that many families were deprived of their only safety net when banks collapsed. My maternal grandparents had their savings in three different banks and still lost 97% of their money, and as a result, their home as well. The loss of jobs and savings had millions in soup lines and living in their cars or in shanty-towns. By contrast, in this crisis, consumers have lost savings in the form of home equity and investments, and they have delevered and may continue to do so, which also has an impact on the standard of living.

Nevertheless, the sad fact remains that the financial meltdown is continuing to impose costs on those who are not at the top of the food chain and the prospects for than changing any time soon are not high.

“There is a curious failure to mention why wage gains were higher in the Depression despite even higher unemployment. Funny how it does not occur them to mentions unions as helping give workers some bargaining power.”

And don’t forget the New Deal. Most union workers would have simply got the hose — or worse — if it wasn’t for Roosevelt and the Institutionalist economists that were advising him. They did this through the NRA (National Recovery Act):

http://www.blurtit.com/q303439.html

“This was run by General Hugh Johnson and aimed to set reasonable profit levels for industry and fair wages. Codes of fair competition were set up for all industries. They had to agree to fair prices for their products, to pay a minimum wage to their workers, not to employ children and to allow trade unions. If they signed up they could put a blue eagle on their products to show the public they were helping the New Deal. Massive Parades were held to advertise the NRA. By end of 1933 22 million workers were involved.”

The fact that wages are dropping precipitously is very worrying. Some time ago Bill Mitchell ran an analysis of the Tory government in Britain’s ‘recovery plan’. Buried deep within it he found their key assumption: increase private debt.

They figured that if wages fell and government spending were to dry up, then private sector borrowing must pick up the slack — they weren’t wrong, but they didn’t pay much attention to this simple, but very important fact.

The problem, of course, is that private lending is extremely difficult to get your hands on — even if you want it, which many don’t. The result: well, Britain are pushing themselves into a permanent recession. But at least they have a Labour Party that are getting their act together on the sidelines to step in and fix the mess to the best of their ability when the next election comes around.

America, on the other hand? Well, they’re following the same program and the result is going to be nasty… very nasty. Double dip? More like quadruple dip… perhaps even infinite dip…

Oh and an FYI from Wikipedia:

http://en.wikipedia.org/wiki/National_Recovery_Administration

“By the time it [the NRA] ended in May 1935, industrial production was 22% higher than in May 1933.”

Hmmm… But in neoclassical theory if wages FALL employment should rise and if wages RISE employment should fall. That’s unusual… it seems like neoclassical theory is completely wrong and cannot account for novel facts.

Noted philosopher of science Imre Lakatos called research programs that cannot highlight and explain novel facts as ‘degenerating research programs’. But what on earth could all this mean?

“There is a curious failure to mention why wage gains were higher in the Depression despite even higher unemployment. Funny how it does not occur them to mentions unions as helping give workers some bargaining power.”

Ah yes, a balance of power – government backed labor unions to balance the government backed counterfeiting union, the banking system.

And now the labor unions have been out-manoeuvred leaving US at the mercy of the counterfeiting union.

Thanks FDR, for not fundamentally reforming the system when you had the chance. NOT!

By all rights, the real comparison for Obama should be LBJ in 1968 or Truman in 1952.

But on the other hand, having your opponents’ main solution be to gut Medicare does correlate quite well with a second term, thank you. If I was a conspiracy theorist, ……

I can’t help but wonder what would happen if there was even a centrist alternative on the ballot. There is a huge gaping vacuum for any campaign beyond the pale of the financial sector and its media.

“By all rights, the real comparison for Obama should be LBJ in 1968 or Truman in 1952.”

I think Yves has it right. Wages weren’t falling to hazard levels in those administrations. Employment was reasonably decent too.

http://static.seekingalpha.com/uploads/2008/10/30/saupload_unemployment.jpg

Roosevelt is a better comparison by almost any measure. Sorry, did I say Roosevelt should be compared to Obama, because that would heresy. Obama should be compared to ‘slash-and-burn’ Hoover.

The 1930s are the correct era for comparison though.

Too loose with my analogy.

I meant Obama should be so obviously likely to lose that he can’t even make it through his own party’s selection process. Of course, LBJ in 1968 was about Vietnam not the economy and Truman in 1952 was about Korea.

And if Obama is Hoover, then the Republicans are going to run whoever Father Coughlin approves of. Hoover never had it so lucky.

Jessica;

I love your Freudian Slip there. Good point though. The Two Parties in America are looking more and more like the old Soviet “Official” candidate and his “Official” opponent. Democrats I win, Republicans you lose.

This is also my stong opinion Jessica about forming a Centrist party. Mulitple parties would serve the people best, as a each party would have a flavor that matched well with a current given economic/geopolitical cycle. However, that is an unrealistic goal in the intermediate term but a viable third party that represents the people as their own lobbyist voice isn’t.

Capital should cheer such an idea on, for to be another cycle of nice profit and growth, it cannot happen without serious, structural reform. And until the global worker can afford ‘wants’ instead of just ‘needs’ again growth is actual headed into REVERSE.

Now longevity has increased centralization of wealth in our age. God bless all of you geezers and I mean it! Quite an accomplishment to have extended life near permanently for all mankind.

Ageing compels stockpiling. Makes sense as we all slow down and save for a rainy day, doesn’t it? This is where I cannot condemn SOME of the actions of Alan Greenspan to discourage savings in the 1990’s. That theory back fired but I did have one hell of a party in the 1990’s.

Now the elders should consider succession plans and some mentoring of the younger generations. As we have all slowed down with age I believe enough strength exists to do this one last task and meet global energy and food production demand, good investments for latter years. But doing it all ourselves is not realistic so technology, especially Internet, must lead the way on digital education and making it simpler to share information and conduct non-bias debate.

Worker wages will increase steadily in 2014, the reforms are

coming in 2013. Challenging and refreshing. Good news is mostly what is needed is brain power. We’re the most educated population on earth in the West, time to gear toward fiscal policy.

Obama’s team of Geithner, William Daley, fresh from the Executive Committee of JPMorgan Chase & Co, and Immelt seems to pretty well sum up his policies. I don’t think many who voted for him thought they were electing such a strong corporate team.

One of today’s links seems to sum it up pretty well.. Geithner and Goldman, Thick as Thieves TruthDig

“”But they survived, as the guys from Goldman always do. With the general “no banker left behind” program pursued by Geithner under both George W. Bush and Obama, the theory was that saving the banks would save the country. The first part worked out brilliantly, but the second act never occurred.””

“… why wage gains were higher in the Depression despite even higher unemployment”.

According to Washington’s Blog today “Unemployment during the Great Depression has been overstated and current unemployment understated“.

Actually some graphics he shows are very similar to the ones you do but, while he is talking of job creation, you are talking of real salary growth. The parallel between the to aspects is so striking that the first few seconds I thought you were mirroring him (but nope: an interesting complementary coincidence).

…

Besides, the key issue is that, as salaries and jobs are demolished, so is aggregate demand and social stability. Without significant jobs nor salaries, Capitalists find themselves in many cases unable to find markets (so they must close, so more jobs are lost, etc.) and workers find themselves pushed to the hole of no hope in such huge numbers that they must revolt and are in fact revolting already (even in the typically quiet USA).

Since this is wages and not total comp it must have something to do with health insurance. Would be interesting to see this graph using total compensation.

I’m absolutely not going to the effort of trying to figure this out from 1929 up until today, but the Employment Cost Index is what you’re looking for:

http://en.wikipedia.org/wiki/Employment_Cost_Index

Here’s a graph which is rather interesting:

http://www.bls.gov/spotlight/2009/125_anniversary/images/figure05_eci.gif

That seems to indicate that benefits have broadly tracked wage trends since 1980. It also indicates that they don’t add a very significant amount to total compensation (see how the ‘total compensation’ is only a tiny bit higher than ‘wages and salaries?).

This indicates that real wages is still the best measure.

If you want to try to figure out total compensation since 1929-30, I’d suggest the following resources — and a cup of strong coffee:

http://www.bls.gov/news.release/eci.toc.htm

http://www.bls.gov/ect/home.htm

“It also indicates that they don’t add a very significant amount to total compensation (see how the ‘total compensation’ is only a tiny bit higher than ‘wages and salaries?).”

My mistake — Christ, I’m half asleep — that doesn’t indicate that at all. The changes are relative, so benefits may add a significant amount to total compensation.

The graph does show that benefits tend to track wages, though — and these have both definitely been falling since 1980. So that may provide some clue.

So….when your cost of health care doubles, but you still cannot buy a tank of gas with health care, that’s Winning!

A gent with humility. New found respect earned Philip. And thank you for the links. However, I prefer stiff spirits to coffee pouring through it.

Dear Dave;

They’re way ahead of us here. Look at the figures for rising ‘co-pay’ and ‘premium splitting’ in business supplied health policys. The last place I worked I forewent some wages to get company sponsered health insurance. In the six years I was with them the “Annual Deductable” rose from US $1200 to US $4000. Add to that the non existance of real market competition and you have what looks suspiciously like a predatory trust.

Another aspect of this problem that isn’y getting much consideration is the proliferation of, for want of a better term I’ll call ‘Unfunded Mandates.’ People are living much longer now than then, and so lifetime medical expanses are much greater as a share of lifetime earnings. Most of us need autos to function, only big metropolitan areas have good public transport, and half or more of Americans live outside the public transport network. Cars cost money, and then there are those pesky ‘mandatory insurance’ laws. (Can we say transfer of wealth boys and girls?) How many people even had telephones in the Thirties, much less mobile information devices? As for computers, I had a Calculus teacher in high school who worked on the Manhattan Project, and he always considered a ‘computer’ to be a person with an aptitude for lightening organic computation. All of this costs money, money people didn’t have to spend way back then, in both senses of the word.

So, comparing the two eras isn’t so cut and dried, I agree. Problem is, that fact cuts both ways. It’s like the story about the Oregon house. Nice place, but the carpet moves. Tread lightly now.

The economy won’t truly recover until the economic outlook for the majority of people recovers. Most people’s wealth comes from jobs and earned income so that is the index by which the success of the economy should be measured–everything else, i.e, GDP, is just so much BS.

true dat! Amazing more people don’t catch on to how much the GDP smells of BS. Those that are in power have sought power and chose to use it to their advantage. No different from the pre revolution days of England.

The jobs of workers were automated and outsourced with their own stolen purchasing power via the government backed counterfeiting cartel, the banking system.

Posted this in the links section, but thought one part in particular was relevant:

http://www.cepr.net/index.php/data-bytes/jobs-bytes/jobs-2011-06

“Wage growth remains weak. Over the last three months the average hourly wage increased at a 1.6 percent annual rate. This is down slightly from its 1.8 percent rate of growth over the last year.”

Real wages will never recover as long as their is excess global free trade, and global excess labour and substantial differences in living standards, envirnmental standards; under these conditions the principles of Supply and Demand will dominate the wage/employment situation, and the result will be declining middleclass wages.

And let’s be clear, there are ALOT of poor people who could want work, or want work under slightly better livIng standards, but whose compensation levels are many multiples below that of an American or European. A few days ago, Ed Harrison pointed out that China may be facing a ‘Lewis Turning point’, ( they are running out of cheap labour), …. Well that still leaves a supply of Cheap labour in Vietnam, Cambodia, Burma, India, Phillipines, Indonesia, and most of Africa…just another 2 Billion or more to go.

Damn you Ming, you just ruined my buzz. Salient comment though…

Real wages will never recover as long as their is excess global free trade, and global excess labour and substantial differences in living standards, envirnmental standards; under these conditions the principles of Supply and Demand will dominate the wage/employment situation, and the result will be declining middleclass wages. Ming

Probably true. But who needs wages if they have an income? Workers have been cheated by the government backed counterfeiting cartel, the banking system, and the corporations that borrow from it. Restitution is thus called for.

The counterfeiting cartel should be abolished and the entire population bailed out with debt-free money from the US Treasury.

Obama will of course win, despite doing nothing to stem the bleeding, but only because he’s not facing any opposition outside of the Liliputians. If he were facing even a candidate as formidable as John McCain (not very) then he’d be trouble.

But, we seem to be down to Mitt Romney, Sarah Palin & Michelle Bachman as possible candidates. It looks like they are going to jam Romney down the throats of the Tea-baggers who will then rally to oppose the Kenyan Socialist. But, he’s not exactly a great candidate and he doesn’t excite their base any more than McCain did.

And he can’t bring in another “X” factor like Palin. What’s that leave?

And the media is NOT going to highlight Obama’s real difficulties, and no Republican is going to talk about jobs — beyond claiming that tax cuts for the top 1% = “job creation.”

Only we just lived through the Bush era so that promise rings hollow. They can’t exactly say “Remember how great things were under George Bush! Let’s go back to that era!”

Dear Cujel;

Sorry, but the Bush era revisionism is already starting. Consider how the ‘Voodoo Economics’ reanimation is proceeding. When one embraces the Big Lie method, as the Rightists have whole heartedly done, nothing is too ‘sleazy’ to be trotted out as “The Truth.” It took the real world rubbing our noses in it to get the public behind FDR in the thirties. Even then it was a close race, as the Supreme Court stuffing controvercy and Pecorra Investigation battle showed. My favorite expression of that dynamic goes: “No one ever went bankrupt underestimating the intelligence of the public.”

This is the smartest blog I have seen for some time. This is exactly what people need to read. I have only recently started reading this site, but the quality of the debate is improving with blogs like this one.

What no one seems to have actually acknowledged is that we can say all we want about where we would like the economy to go but the fact remains that the bears have been right for years.

Professor Steve Keen has predicted very similar outcome for Australia.

Wages have fallen significantly and look like they will again before the year is out.

Foundation

Housing Affordability in Australia Forum

Supply and demand has little effect on pricing anymore. The government allows large corporations to manipulate pricing regardless of supply or demand. The government provides tax breaks and incentives for oil companies who continually raise prices on the pure speculation of oil shortages in the future as they record profits.

The housing industry was manipuliated by builders as they tried to convince everyone there was no more land left as they squeezed more and more homes onto an acre.

“Supply and demand has little effect on pricing anymore.”

Supply and demand are still at work. Those who are in denial about that tend to be the people who deny environmental damage, overpopulation, etc. Do you think the wealthy WANT the population growth to slow down? If they did, illegal immigration would not be the problem that it is. Economic growth requires larger inputs of resources, labor and consumers, even if those consumers and workers get poorer due to less to go around and more competition.

The supply of AFFORDABLE HOUSING was constrained, and still is because affordable housing means low property values, which means a crackhouse down the street and terrible schools to middle class America. So, large, expensive housing was constructed in areas that, until sometime in the mid-20th century, were home to a modest number of people (and life, areas like deserts and hurricane and flooding zones), areas that cost a whole lot of money to pump water to and provide liquid fuel to. Hence, the Iraq invasion. How else is America’s suburbs going to function without more friggin oil?

In other words, don’t you realize that “growth” leads to higher prices in a finite world? Or are you into those silly cornucopian myths that are being spun? Billions of barrels of ‘abiotic’ oil under your feet? C’mon.