Lordie, I can’t believe someone who professes to understand markets has written, at length, that caution, no, “excess of overcaution,” was a major contributor to the criss. Or has Felix Salmon been spending too much time with lobbyists from ISDA and SIFMA?

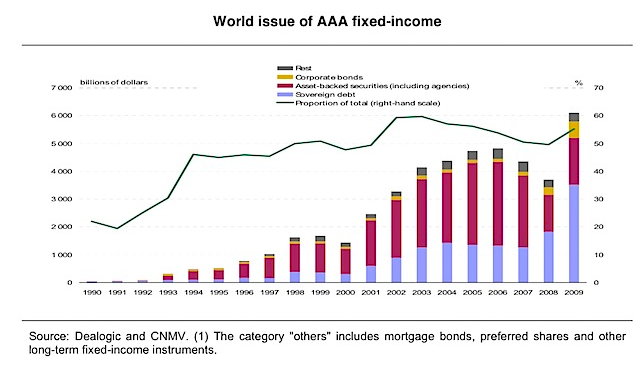

I hate seeming rude, but Felix has a habit of tearing into Gretchen Morgenson for errors much less significant than the one he made in a post today. He wrote, apropos this chart, which comes from FT Alphaville:

The big-picture thing to remember when looking at this chart is something which I’ve said many times before — that it wasn’t an excess of greed and speculation which led to the financial crisis, but rather an excess of overcaution, with an attendant surge in demand for triple-A-rated bonds. On a micro level, triple-A securities are safer than any other securities. But on a macro level, they’re much more dangerous, precisely because they’re considered risk-free. They breed complacency and regulatory arbitrage, and they are a key ingredient in the cause of all big crises, which is leverage….

Then look at the green line. Triple-A debt wasn’t a huge part of the bond market back in the early 90s, but for the past decade it has invariably accounted for somewhere between 50% and 60% of total global fixed income issuance. That’s possibly the most horrifying bit of all: it simply defies credulity for anybody to be asked to believe that more than half the bonds issued in any given year are essentially free of any credit risk.

Now anyone who had read the Financial Times in 2006-early 2007 or was in the credit markets then would know that this statement, “it wasn’t an excess of greed and speculation which led to the financial crisis, but rather an excess of overcaution” is demonstrably counterfactual. All you had to do was look at the spreads for risky assets. There was a simply astonishing compression between the yields of perceived-to-be-risk-free assets, such as Treasuries and their toxic counterfeits, the AAA rated tranches of CDOs and CLOs, and risky assets, like the lower-rated tranches of the same bonds, as well as junk bonds. If there was “overcaution” you would have seen a wide spread between AAA bonds and lesser-rated bonds.

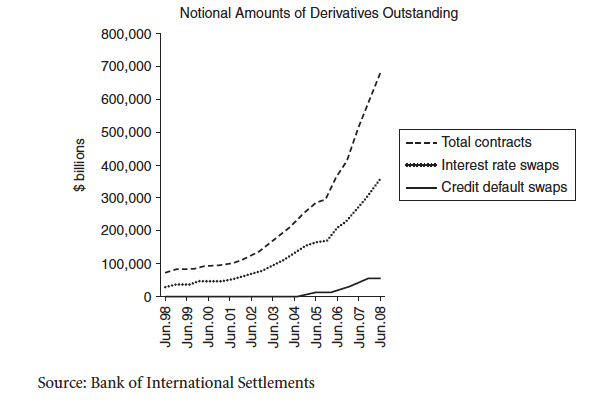

But to Felix’s point, demand for AAA paper was robust. But that was not the result of caution; two big drivers of demand (particularly for “manufactured” AAA paper, the kind created by structured credit legerdemain, was as repo to serve as collateral for OTC derivatives positions, and for bonus gaming. In the 1980s, the ONLY acceptable collateral for repo was Treasuries; that started expanding as time went on to other AAA rated assets (and even lower rated assets, but the haircuts were significant). We described both in ECONNED. First on the explosion of OTC derivatives stoked demand for AAA instruments:

Brokers and traders often need to post collateral for derivatives as a way of assuring performance on derivatives contracts…

Due to the strength of this demand, as early as 2001, there was evidence of a shortage of collateral. The Bank for International Settlements warned that the scarcity was likely to result in “appreciable substitution into collateral having relatively higher issuer and liquidity risk.”

That is code for “dealers will probably start accepting lower-quality collateral for repos.” And they did, with that collateral including complex securitized products that banks were obligingly creating.

As time went on, repos grew much faster than the economy overall. While there are no official figures on the size of the market, repos by primary dealers, the banks and securities firms that can bid for Treasury securities at auctions, rose from roughly $1.8 trillion in 1996 to $7 trillion in 2008. Experts estimate that adding in repos by other financial firms would increase the total to $10 trillion, although that somewhat exaggerates the amount of credit extended through this mechanism, since repos and reverse repos may be double counted. The assets of the traditional regulated deposit-taking U.S. banks are also roughly $10 trillion, and there is also double counting in that total (financial firms lend to each other).

In other words, this largely unregulated credit market was becoming nearly as important a funding source as traditional banking.21 By 2004, it had become the largest market in the world, surpassing the bond, equity, and foreign exchange markets.

Now I must confess I have not tried to update the BIS chart. But I have a sneaking suspicion that while derivatives outstandings took a hit in the crisis, between a rise in risk aversion and a concerted effort in credit default swaps land to reduce the notional amount outstanding by netting out offsetting positions, that the old pattern of derivatives outstanding growing more rapidly than the economy has resumed. And now that no one is terribly interested in using AAA rated CDOs as collateral for repo, Treasuries are probably even more important as repo collateral than they were before the meltdown.

A second, significant demand for AAA rated paper was structured credit product creators uncharacteristically eating their own cooking because it enabled them to game their firms’ bonus systems. If you hedged an AAA instrument with a credit default swap from a high rated counterparty, Basel II allowed firms to treat it as having no capital requirement (and there was considerable latitude in the rules as to how much or little hedging was necessary to achieve this happy outcome). US banks in theory had analogous capital weightings, but their higher funding costs for this sort of activity and less permissive treatment of the hedges meant they didn’t do this sort of trade in anywhere near the same volume (save at Merrill, which engaged in accounting chicanery).

The net effect of these so-called negative basis trades were to allow the trading desks to credit FUTURE income (often years into the future), namely, the yield on the instrument less the funging and hedge costs, discounted to the present and was credited to the desk’s P&L. Nothin’ like getting paid on income never to be earned.

Now how significant was this activity? Again, from ECONNED:

J.P. Morgan estimated that Merrill and other major CDO vendors like Citigroup, UBS, and Deutsche Bank wound up keeping roughly two-thirds of the top-rated tranches of the 2006 and 2007 deals, which accounted for the bulk of the value of a transaction, typically 65% to 80%.

Read that again. 2/3 of the AAA CDO tranches were retained by the issuers. These were most assuredly NOT “overcautious”. Has s Felix forgotten some of the pre-crisis dismissals of caution, like US investment banks hoovering up subprime originators and servicers in late 2006 and early 2007? Or how about former Citigroup CEO Chuck Prince’s famously ill-timed expression of optimism in a Financial Times, right before the crisis began in earnest (early July 2007):

Chuck Prince on Monday dismissed fears that the music was about to stop for the cheap credit-fuelled buy-out boom, saying Citigroup was “still dancing”.

The Citigroup chief executive told the Financial Times that the party would end at some point but there was so much liquidity it would not be disrupted by the turmoil in the US subprime mortgage market.

It’s alarming that someone like Felix, who not merely lived through the crisis but also chronicled it in some detail, seems so keen to engage in revisionist history.

I think Mr Felix is employing word gimmicks to attract eyeballs by implying something profound is about to be said ;-)

Yup. Brains of a journalist in action.

Yves’ analysis, conversely, shows why she’s Yves Smith and Felix is a journalist.

Or Dunning–Kruger effect.

“The Dunning–Kruger effect is a cognitive bias in which unskilled people make poor decisions and reach erroneous conclusions, but their incompetence denies them the metacognitive ability to appreciate their mistakes”

That explains the existence of the Tea Party, and all those who think a U.S. government default would have no serious implications.

I don’t think the D-K effect has anything to do with the Tea Party, but it does a very nice job of explaining you.

pot meet kettle. now go kiss and make up.

wishing I studied more cognitive science in undergrad wrote:

“Or Dunning–Kruger effect.”

Most journalists are poster children for Dunning-Kruger. Indeed, journalism as an institution is almost systemically designed to select for Dunning-Kruger-type behavior one way or another.

Full disclosure, as they say: I earn part of my living as a journalist.

Jeez, he’s hilarious sometimes. Felix: buyers wanted AAA bonds with higher yields, and the banks responded by counterfeiting them.

I don’t think CDOs counterfeit AAA bonds; they just use tranching of the existing bond supply to transform it closer to what the market demands. I suspect that what was at fault was naive investment/capital/collateral rules relying on ratings as a single simple measure of credit risk, that got gamed by the securitisation industry and investor principal-agent weaknesses. The demand for AAA bonds was a desire for risk that looked cautious. And since the raw material of the CDOs was lower-rated bonds, their spreads tightened too.

Yeah but the ‘Synthetic CDO’ was kind of the dictionary definition of ‘counterfeit’ wasn’t it? You had things masquerading as ‘asset backed securities’ that were, in fact, simply bundles of credit default swaps, which a number of people say are basically gambling. There is nothing created in a CDS, it comes out of thin air – its an agreement between two parties based on some other event that they may or may not have any relation to. On the scale from ‘legitimate business risk’ to ‘speculation’ to ‘gambling’, they dont seem to fall very fall towards the legitimate side.

The banks were intimately involved with the ratings agencies in creating these products — They payed the ratings agencies to do the rating! Even as Warren Buffet warned about ‘financial weapons of mass destruction’, it didnt stop him from making huge profits off of his stake in Moody’s, which was giving AAA ratings to those weapons. Buffet was a financial arms dealer.

Now, Yves has pointed out that some of the biggest customers for this AAA garbage were the banks themselves. So she has thoroughly convinced me that Mr Salmon is very erroneous to say this stuff about over caution. The cocaine abusing whoremongers of the bank’s CDO departments were not ‘risk averse’ people ‘worried about caution’. They were interested in a quick buck and only cared about AAA ratings because it meant they could market something to “suckers”, or lie on their balance sheets and SEC reports…so that they could in turn make even more money. they didnt care about AAA ratings for the purposes of having safe investments. i.e. they were not ‘cautious’.

And when Stanley O’Neill and Dick Fuld and others actively fired and demoted the risk specialists at their companies, while they told their CDO desks to charge into the breach, it wasnt because they were being ‘overly cautious’. It was because they were chasing Goldman Sachs.

Ironically, the headline does the same thing Salmon himself is doing – tries to find some kind of “mistake” where we’re simply dealing with crime.

I’d put it more like, “Felix Salmon Distorts…” or “Felix Salmon Lies About…”

And then Salmon systematically lies about what “AAA” even means, pretending it was ever anything but snake oil, a con. The “oversupply” of AAA was supplying greed, not “overcaution”. “AAA” is a scam that helps the greedy to game what little is left of regulation.

See my reply to SteveA above.

Odd. The desire for AAA rated bonds is seperate from greed? Isn’t that the worst type of greed: the desire to gain without risk? How un-American!!

Back in the real world, Salmon completely ignores the fact that there will always be the desire to buy safe debt and that Demand does not ensure Supply.

What happened is that the Supply of safe debt was crowded-out by fraudulent products in the guise of safe debt. Fraudulent mortgages were made despite the recipients ability to pay; securities were bundled despite the ability of banks to verify that the underlying mortgages were junk; credit agencies gave high ratings to these securities without any actual verification (the banks did it; why should we?).

What Salmon does get right is that there was too much demand in an area where there should have been little demand. So instead of investors investing in corporate bonds to enable job growth, industrial expansion, research etc… they went with the easy money built on a huge bubble of unsustainable house prices and unpayable private debt. Of course he doesn’t directly state this, but that is the basis of his argument whether he realizes it or not.

Did you miss the discussion in the post of how the growth of derivatives required more collateral, and AAA instruments (and cash) were the preferred form of collateral? More OTC derivatives positions required more collateral. Both dealers and hedge funds were sources of demand.

No Yves, I didn’t miss it: I found it irrelevant. The crisis wasn’t caused because of a demand for investment products. Investors will always want a sweet deal; the problem is that there are few sweet deals. The crisis was caused by people who falsely manufactured sweet deals.

Besides, high demand means there was a surfeit of cash in a specific sector and that itself speaks of other problems, e.g. low taxes on the rich, high debt burden of the populace, or even excessive balance of payment deficits, etc…

The crisis happened despite a large section of the investment community’s desire for low-risk. That’s called irony; perhaps even a paradox…

By the bye, it’s nice to see you pay such close attention to everyone’s comments. Thanks for the response.

The point about repos is 100% spot on. This however still leaves Ricardo Caballero’s point re shortage of safe assets unanswered. Which I suspect is what Felix Salmon is referring to here.

Leaves unanswered? How so?

The reason why the banks were having trouble growing before the mid-1990s (and why many companies only grow through mergers and the like) is simply because there is too much money floating around for it to be healthily investable any more. Lots of excess money -> low aggregate yield on investments -> incentive to start ‘investing’ in riskier stuff (asset bubbles). The AAA+CDS-hedging fraud was a way to shovel as much money at these investors (pension funds, among others) as possible without the bubble bursting quickly. Nothing unanswered about it. ;)

I’ve linked to this paper previously, it’s the single best discussion of the “wall of liquidity” phenomenon that stoked the crisis.

http://www.scribd.com/doc/58602806/Cracking-the-Credit-Market-Code

Thank you; very informative, and readable even for laypersons. This seems to cover many of the details I’d been wondering about fairly nicely. Will read it in detail when I have more time.

I’ll readily admit I’m still having trouble figuring out how the whole money creation thing in with the growth issues being experienced. Perhaps the low growth simply led to willingness on the part of the regulators to be more lenient wrt the banks, and then the banks created an entirely new problem on top of the old one?

Anyway, two questions, if you’re willing to indulge me: this paper suggests I should see non-bank financials as the primary drivers of demand for the structured credit products. However, in doing so they seem to be sort of underplaying the (in my estimation) essential role played by the banks (and CRAs) in creating an validating the crap. But why did (the funders behind) those non-bank financials turn to finance as a source of revenue growth? (So, in other words: why did, for example, Enron turn into what was basically one big hedge fund?)

And second, they suggest the hedge funds account for 28% of the demand for structured credit, and mostly restricted themselves to the junior tranches. That leaves out 72% though, as well as the (more) senior tranches. I imagine pension funds and the like fit in here somewhere, especially given that they are required to buy only “very safe” stuff. But who else?

“But why did (the funders behind) those non-bank financials turn to finance as a source of revenue growth?”

When they say “non-bank financials” I think they mean life insurance companies, mutual funds, pension funds, etc…

But I’m looking forward to reading that paper too. Be good to see it all in one place for a change.

Ah, yes, forgot about the insurers, for one. I’ve been reading about this economics/business/finance stuff for about a year and a half now, but I still haven’t met all the animals in the zoo.

Mz Smith;

Ah ha! More homework! Thanks again teacher, my economic education goes apace. (“Don’t look at that man behind the curtain!” And of course everyone looks.)

If I recall correctly Caballero argued that the shortage of safe assets was driven by central bank buying, but as I argued at the time ( http://reservedplace.blogspot.com/2008/05/enigma-inside-conundrum.html ), that should have led to wider spread product spreads. My conclusion is that the securitisation boom encouraged lending, and the resulting spending boom exacerbated the current account deficit associated with the reserves inflows from China etc.

There’s a BIS paper by Claudio Borio that debunks the notion that trade related flows or the “savings glut” had anything to do with the crisis.

That was quite a bizarre post on the part of Felix. Like the problem with the world is we are too risk-off and not enough risk-on.

Not question why is debt going up exponentially, and why don’t we have the chart for non AAA debt too?

Don’t worry that eurobank bond traders have figured out how to achieve infinite leverage. Who needs a money multiplier anymore?

Don’t worry you can pocket the lifetime yield of a long term bond next bonus day and not suffer the indignities of credit, interest rate and currency risk – and any problems that may cause for your margin account or mark-to-market beancounter types.

It’s all good!

Felix Salmon’s Diary

Yeah…it was a tough night. she burst into my hotel room just as I was about to snort a line of The Heaven’s Dust off the ass of Mercedes, a stripper who’s “working her way through law school.”

Of course, Kate just had to get all hysterical on me.

I tried to reason with her:

“Kate…Baby, please. It’s not as bad as it looks. I can explain….

“See, my therapist told me that my soul has a hole. Actually he said it was a ‘bottomless pit’, but “hole” rhymes better.

“Anyways…he said that the abyss of this bottomless pit is never satisfied.

“But it’s not greed that puts me in this bed with Porche, here. No, my heart is not dark like that! You gotta believe me.

“See…I do these things, not out of greed, but rather out of caution. I’m overly-cautious.

“I’m overly-cautious for your love, Baby…because…because I’m afraid that I am going to lose you and I can’t stand the thought of being alone.

“Please…come to bed with us. And hold me.”

Haha. Doesn’t quite work, but close enough.

Anyway, I suspect that the problem for Felix is that he’s thinking of this system as somehow caring about its own health. Because if he’d started by talking about how the banks/shadow banks were looking for ways to profit, and then stumbled upon (via Basel 1?) the best way to realize those profits, he would’ve had a much harder time talking about how “everyone was really just looking for safe investments”. Sure, some institutions (most notably pension funds) were looking for safe investments, but no, this just meant that the banks just had a really big incentive to figure out a way to redefine risky crap as safe assets, because as soon as they managed this, they could start shoveling that crap at them as quickly as possible (with the hedgies happily jumping on the bandwagon to buy the high-yield junior stuff).

Too bad Mandelbrot was ignored when he demolished the theoretical underpinnings of the whole con game.

Nice interview with Taleb and Mandelbrot.. http://www.pbs.org/newshour/video/module.html?mod=0&pkg=21102008&seg=5

This is from Oct09 and the argument could certainly be made that our policy decisions have exacerbated the situation rather than taking stress off the situation. Interesting that they compare this crisis to the American Revolution rather than the Great Depression.

Mandelbrot:

‘turbulence in social systems makes things not a little more complicated but enormously more complicated’

‘conventional theory thinks that things move slowly and gradually and can be corrected as they change’

Taleb:

‘now you understand why I’m worried’

Mandelbrot:

I sleep better than Taleb but I don’t sleep very well

http://www.upi.com/Science_News/2010/10/16/Benoit-Mandelbrot-fractals-pioneer-dies/UPI-11551287266964/

“””Mandelbrot developed the idea of fractals while trying to determine the length of the British coastline, when he realized a seemingly smooth shore becomes more and more detailed as you zoom in. He applied his mathematical insights to areas as diverse as wheat prices and the growth of mammals’ brains.

He once said his own life showed the same properties as the coast.

“If you take the beginning and the end, I have had a conventional career,” he said. “But it was not a straight line between the beginning and the end. It was a very crooked line.” “””

scary thought —

what if some of the pension funds were ‘in on it’ too?

did any of them get kickbacks?

what kind of social pressures occur in the rarefied circles of ‘fund managers’? don’t they all go to the same schools and attend the same 50,000$ kindergartens as the bank CEOs and the ratings agency experts and the insurance company executives?

Mr. Felix is engaging in a little blame-shifting, here.

The AAA rating is written into many penision portfolios, endowments, municipal funds, etc. It’s what kept most of the money out of the bond markets in the right, earlier end of that graph. There’s always been lots of money in the world, it’s just that most of it kept away from high risk flutters.

The inflated AAA rating allowed bond salescreatures to flog larger and larger piles of these gambling chits into widows and orphans funds. In that way, the bogus rating opened wider the market universe, allowing the wall of liquidity to rise a bit higher.

If the supply side argument is true, that simply offering the instrument means it’s going to be sold, then putting a safe as mother’s milk rating on it wouldn’t matter. Pretending it’s not a convoluted, confused collection of tag ends depending on small pockets to repay is part of the sales pitch. It’s because the marks, er, investors avoid risk they need to be uprated.

Basically, he’s blaming the suckers for getting cheated. A little projection common to swindlers, flim-flams, hedge fund managers, wealth mangement professionals, etc. The implication that the buyers were in on the scam may have been true in some cases, but couldn’t be true in all. Even the myth of the Free Market depends on the vast majority of its participants to play by the rules.

Back when he was at Roubini’s place M. Salmon would write some financially sophisticated but tendentious stuff that made it seem that the key to his success was very good sources, and pretty good financial or applied-math training, and having just fell off the turnip truck. He still produces a lot of excellent, detailed exposition about how Uncle Frank pulled that quarter out of his ear.

I disagreed with Felix at his site so I will defend him, partly, here. I do not buy his overcaution line at all, but neither do I think it should just be blamed on the greed of the sellers of the products. It is the greed and deliberate blindness of the buyers that is at fault. It does not take a great mind to determine that a lot of AAA rated debt is not riskless.

As a deliberately unsophisticated investor I can see plenty of risk and am not willing to accept such miniscule interest rates in return. Yet very well paid and well-trained investors have been doing it for years. It was not caution that had institutions buying Greek debt at 3 percent when the problems of that country have been well known for years. Instead they chose not to believe what is happening now could happen.

I also think applying Mandelbrot and Taleb unnecessarily flatters financial markets that have once again proven themselves to be anything but infallible and efficient. When you ignore a risk, and it happens, it is not a black swan.

I agree that the financial crash was not necessarily a black swan in and of itself as it was caused by much fraud and some people did see the bubbles developing. The problem now seems to be where the flying parts of the crash are going to end up.

High commodity prices as a cause of the Arab Spring. Many opaque over the counter derivatives hiding in the wings so that stock market and currency exchange volatility can have unexpected effects especially with tightly coupled global systems. The problem of income inequality getting worse as many countries seek to apply austerity programs. Growing distrust of financial organizations and governments..

‘The idea of chaos theory is that what appears to be a very complex, turbulent system (the weather, for example) can begin with simple components (water, air, earth), operating under a few simple rules (heat and gravity). One of the characteristics of such a system is that a small change in the initial conditions, often too small to measure, can lead to radically different behavior.’ (Deep Survival)

I don’t disagree with you entirely. My point is that investors have been too accepting of AAA and other high ratings, and extraordinarily low returns, in relation to the risks. It is not just a crash Greece, Spain and others are vulnerable to, it is any economic slowdown. Yet the market chose to overlook that risk.

To make themselves look smarter they blame it on black swans and rely on chaos theory, which may be partly true. But is definitely true they were lacking due diligence.

I don’t think that the agent investors did not believe in the risk; such tail risk just fitted their own risk (termination) / reward (bonus) profile. In short, IBGYBG (I’ll be gone, you’ll be gone)! The securitisers and agent investors were cynical enough to exploit this, and the principal investors were too lazy and greedy to do proper dilligence.

but isn’t Smith’s point that the sellers were largely the same organizations as the buyers? wasn’t it greed that caused those CDO departments to load their own companies up with garbage, and wasnt it greed that drove the CEOs of these companies to push for this activity to happen?

I wish Mr. Salmon would write on the virtues of Big Pharma over the past 25 years and then perhaps you would hit him with both barrels, the kitchen sink and a big ol’ blacksmith hammer.

debt on one side of the balance sheet is shown as an asset on the other (debt-buyer’s) side – the debt-buyers (banks, mutual funds, pension funds) then “bank” those “assets” as “reserves” in a central bank and use it as leverage for more buying more debt with fiat money “created” by the central banks. financial capitalism is a mass delusion which only becomes clear when the actual money flows don’t suffice to service the interest (much less principal) on debts.