Assuming current fiscal policies remain in force, our economic model suggests that interest rates will rise considerably over the next decade, with the yield on the 10-year Treasury note reaching nearly 9% by 2021.

– Private interest rates will rise as federal borrowing competes for saving that might otherwise finance private investment.

– In addition, yields could rise if there is growing risk associated with current fiscal policy. If such risk is systemic, it raises yields generally. If it reflects a growing probability of sovereign default, it raises Treasury yields relative to private yields.

– Rising rates would be a precursor to something worse: a full-fledged fiscal crisis with further sharp increases in yields, declines in stock prices, and a plummeting dollar.

Pethokoukis says “this is bad. Really bad.”

My take: this is bogus. really bogus.

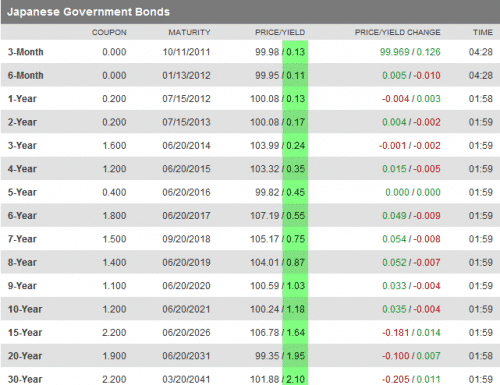

At a time when the US government is getting free money, borrowing on the short end for zero percent and interest rates are 3%, not 9%, why would anyone believe this stuff? Riddle me this: why aren’t Japanese JGBs yielding 9% instead of 2% all the way out to 30 years when they have debt to GDP of 200%?

I’ll tell you why: this piece from Macroeconomic Advisors is another example of bogus, junk economics driven by ideology. The purpose is to scare people into supporting spending cuts to bring the debt burden down. It’s not like you want the US to be like Japan, so there are plenty of reasons and ways to bring the debt burden down without utilising voodoo economics.

Yields don’t rise if there is growing risk associated with current fiscal policy. This is just made up. The Federal Reserve controls short-term interest rates through open market operations The yield curve as represented by the term structure of interest rates reflects mainstream market place expectations of future short-term interest rates. We will need to see some serious inflation to get the Fed to start hiking rates enough to justify a 9% yield. More likely, the Fed will remain on easy street for “an extended period”.

If the Fed is destined to keep rates below three percent for the next ten years, why would you sell a 3% bond at a yield of 9%. That’s a price that is a massive loss when all you need to do is hold to maturity. It makes no sense at all. That’s why JGBs yield 2% out to 30 years despite a debt to GDP twice that of the US.

But, of course, people worry that the federal government won’t be able to sell its bonds. The Fed just showed us with quantitative easing that they can and will be the buyer of last choice. So unless the Fed is about to allow interest rates to spike and kill the economy, I don’t see how you get to 9%.

Fear mongers want you to be scared to death that interest rates will skyrocket. As I have said many times in the past, long Treasury rates reflect inflation and interest rate expectations. Full stop. The default risk isn’t there since government creates the currency in which the debt is denominated.

It’s only when government acts like it would default for political reasons that you might get a default premium, creating a non-existent problem for ideological purposes. And even then that doesn’t get you to 9%. Ignore the fear mongering and stick to cogent, objective analysis and you’ll be fine.

As for the economy, the scare tactics of bond market vigilantes seem to be working.

Fair enough, but many observers take the argument one step further: since inflation expectations are low today, we can engage in loose monetary and fiscal policy until the bond market gently signals us that it’s time to tighten up a bit–which of course we have the tools to manage without provoking a major downturn. This argument is empirically challenged and serves as a license for politicians and central bankers to act irresponsibly.

So the blowing out of yeilds in Ireland Greece and Portugal are a result of risk of default because they can’t print more currency?

Fine I can accept that for the sake of argument.

But follow your logic one step futher…in the extreme case that demand for US Treasuries falls way off as you suggest may happen, then if the Fed buys virtually ALL the bonds it’s a circle jerk as we finance all government expenses with printed money and inflation goes parabolic. Bond markets would sniff that one out just a little bit ahead of occurance and then the face value of the bonds would go towards zero so the bonds are worth sh**.

So US treasuries are exempt from yeilds and price moving in the opposite direction? Hmm. Maybe the dollar value plunging through the floor is the mechanism that allows yeilds and price of the bonds to stay firm while bondholders still get screwed by holding a worthless bond.

One more data point, is you said that the only reason rates would rise is if markets sniff an intentional default coming. Current US debt ceiling situation and yeilds aren’t budging? So the market things there is 100% chance our congress and president are competent enough to prevent that with less than a month to go? Do you believe that?

I think markets change much faster now than 10-20 years ago, which skews peoples perception of cause and affect and therefore how the midterm future will play out. We could be heading into the abyss finantially in less than a month with a US default and ALL markets are acting great!

As long as the US Treasury can print unlimited numbers of dollars without affecting prices then we’ll be safe, but if the ROW were to gain some independent leadership and decide they’ve had enough of the games and start using another currency exclusively, then Americans eating their young will be just around the corner (and I bet the elite will find a way to transfer their wealth out of dollars and disappear from North America before it all goes down).

Mr. Harrison’s article is wholly cogent and correct. Indeed, maybe we should try to get this article printed on the front page of the Wall Street Journal, New York Times and the Washington Post, so as to counter the deficit hysteria.

You have an interesting line of thought Tim, but I have a question for you, under what conditions would you feel that demand for US treasuries would collapse, such that interest rates to clear the treasury auction would be in excess of 9%. It is a fact that the Fed has some leeway to print without trigering any inflationary expectations in the bond market (for both governement and private debt). Prior to 2006, the Fed had approximately $800 billion in US treasuries, then by mid-2009 it had inflated its balance sheet to $2.4 Trillion in US treasuries…and yet there is still no substantial inflationary expectations in the bond market. So what do you think is happening?

I’m with Harrison and Ming!

At the current rate the USG will have to borrow something like another 10 trillion from the world over the next ten years. You would think that would make rates go up. But if the Fed decides to do open market transactions of $10 trillion in 3 months t-bills and roll ’em as they come due…anything is possible.

High Frequency Trading makes good things for live’n!

In fact, I think I can write a software ‘bot that will handle the volume, and I’d rather help them with that than see my paid for SS disappear.

But I’m worried that we will be at war with Albania by then, and my SS will disappear anyway?

Dang it. Namazu beat me to it. Sorry for the mostly redundant post.

I have tried to understand all that for quite some time know. I agree, it makes sense, but… What if bond holders or willing buyers actually believe that sovereign government can go bankrupt? I guess you can agree that it’s a rarity to find a person who understand our monetary system well. So what if government debt rises and to some particular point bond holders start believing that government won’t repay their money and start selling bonds therefore pushing yields up? Isn’t this the case?

Then the Fed buys the debt. The interest on the debt is paid back to the Treasury.

The only limit on how much debt the Fed can buy up is inflation. We have record-low inflation (deflation?) right now, so it’s not a rational worry.

The only reason people bring this up is to scare us into slashing government debt. They want to pay off debt by slashing social services. That’s all the talk about Treasury rate increases is ever about — cutting (gutting) welfare, social security, public services.

The rich don’t want the tiniest fraction of their money going to anyone but themselves. And slashing public services would mean privatizing erstwhile public utilities at firesale prices — great for the rich.

So the end result is increasing tolls and parking fees, utility prices, public park admission fees, more natural resource giveaways (and accidents) — all to appease the imaginary wrathful bond buyers.

The free market has a toll.

Scott,

Classic response. Why ignore the real increases in commodity prices which occurred with QE2? Printing (FED buying Treas. debt) results in more money chasing same goods which leads to higher gas, corn, cheetos, clothes and other goods. The Gov. gets the bogus money first and buys real goods and services but as more fiat money enters the economy prices go up and ultimately, the poor and the weakest are victimized by the higher prices. A very clever and indirect way of extracting even more from those which you purport to care about. Shameful.

Well, it’s not an informative answer. :) Ok, FED buys all of the government bonds to keep the desired interest rate since no one else is buying. And say that affects inflation expectations. Well, doesn’t matter if that happens imediatelly, after a year or five. But what happens when it evetually affects inflation expectations? What’s the solution then? Let the FED to keep buying bonds or what?

Does the Fed have to announce when they SELL T’s?

Part of my thinking is that they are holding such a large inventory of T’s in order to keep rates positive. When there is a rush to safety, and bills go negative(prices up), the fed sells.

Rates clicked negative a little while ago(end of june). Did the fed sell enough supply to keep rates positive?

As the baby boomers relentlessly keep turning into grumpy old people who hit the early bird specials at Perkins, watch the deflationary effect on consumer spending/the overall economy.

It seems there is still room for arguing that our economic environment is so deflationary that it impossible to print enough money to be inflationary.

As I said earlier if everybody stopped buying Treasuries and the Fed buys them all it would be buying enough to cover the entire deficit (1.6T currently, does that include interest payment on the debt?). I hypothesized that would be hyperinflationary. Maybe it wouldn’t be.

Does anyone think that printing 1.6T dollars a year into a 14T dollar a year stagnant or declining economy would truly be hyperinflationary?

An existing data point is we had QE2 for 600B over 9 months for an anual rate of 800B/yr. So if you doubled the affects of that QE year in and year out indefinitely that is a sporty worst case scenario.

So again, do the deflationists or disinflationists here believe that the worst case of indefinite 100% monetization of public debt issuance with a stagnant economy will not be hyper-inflationary or even highly inflationary (>10% yearly inflation)? I am curious to understand the alternate view on the worst case inflation inducing scenario.

It’s futile to disucss inflation.

It’s different for different people.

It’s different for the same person at different times. You wouldn’t complain at this moment if you are thinking about buying a house in 2013 and you had a chance to do the same in 2005. But in 2005, you would complain bitterly.

By the time you squeeze all that into a number, 2.3% – it means very little.

Good for chitchatting and spreading your voodoo religion though.

I would not trust James Pethokovkis with a dime of my money. His statement about interest rates is so ignorant that I predict the man will lose a fortune investing.

As for the people replying to this blog, all of you should read billyblog by Professor Bill Mitchell every day and learn something about economics. Then, none of you will ever listen to people like Mr. Pethokovkis again.

By the way, in doing quantitative easing, the Fed is not printing money, it is merely swapping a short term asset for a long term asset. It is not inflationary.

Just wait, those bond ninjas are “about to” demand higher yields from their JGBs.

Let’s hope the market samurai’s can defend!

http://youtu.be/s9jAwRBXPQA

The bond vigilantes are the same folks who do not understand Monetary Sovereignty (http://rodgermmitchell.wordpress.com/2010/08/13/monetarily-sovereign-the-key-to-understanding-economics/). If they did, they would realize a Monetarily Sovereign nation does not need to issue bonds.

The federal “debt” could be ended tomorrow, if the government merely stopped creating purposeless T-securities.

Those who do not understand Monetary Sovereignty do not understand economics.

Rodger Malcolm Mitchell

The reason they can make these claims is their model of Government Budget Constraints contains an unknowable assumption.

This allows anyone to make any claim and have it be “correct”, because there is no way to know if the claim is true or false.

This is not an academic argument about philosophy. Bond Vigilantes use the faulty logic of the government budget constraint to force us to be much poorer than we need to be.

It has massive real world consequences.

http://traderscrucible.com/2011/05/03/the-concise-way-to-destroy-the-igbc-and-why-to-destroy-it/

http://traderscrucible.com/2011/04/29/chapter-2-in-which-the-traders-crucible-slays-the-intertemporal-government-budget-constraint-and-mr-rowe-demonstrates-his-worth/

9% bond yields or 2% bond yields – who can tell? It’s all possible in a model where knowledge about our current situation is explicitly excluded.

This post is driven by ideology as well and is nonsense economics.

of course, the FED can buy all the bonds it can at, even at 0% yield but that wont be without consequences.

the govt can fully erase its debt, it suffices to nationalize private assets, tax heavily its citizens and corporations, or just print money out of thin air. i guess thats what you call monetary sovereignty.

the point is that there is no free lunch. if you do this, well, probably the state finance will get better, but at the huge economic expense of its citizens, and probably property rights and freedom rights as well will have been usurpated in the process which will be chaotic without any doubt.

anyway thats exactly where we are headed. there is no discussion about it.

as for Japan.

Japan is not a free market economy. if you take the BOJ, the Public pension fund, the (Public) Post Office, the 3 big private banks which are regularly “invited” to buy JGBs by the MOF, you understand how it can last so long. the market structure is not yet like that in the US, but you need something closer to that to get those 1% yields.

JGB market is a ticking bomb and a ponzi scheme.

it works because the marginal buyer is still the private investor who views JGBs as the riskless asset. when it doesnt the market blows out. it would suffice to see yields at a mere 3% for things to snowball.

same for US. Govt Spends. money ends up in a bank account. excess money used to buy US bonds (what else ?). market breaks when US bonds are not perceived safe anymore, and banks reduce the duration of their USTs, and the only buyer of duration becomes the CB !

Greece was still able to issue 3m 6m bills for a while.

Govt bond auctions are designed not to fail because of PD requirements. There wont be someday a surprise bidless UST auction. or just a one-off.

the real day of reckoning comes when nobody cares anymore about $ assets or buying bonds, using $ for commerce as people dont trust the banking system and fear that when they put 1000$ in a deposit, they wont get it back, or when they can get it back, they can only buy a hamburger with it.

when it happens, probably the FED will hold nearly 100% of USTs.

i am not a libertarian, gold bug, or so…

i just believe economic systems, like civilizations, are like biologic systems. they birth, have their childhood, become adults, then they become tired, and then they die.

there is no system which can last forever, because all things around change. we are fools to think otherwise.

all the big FIAT currencies are suffering from a cancer.

libertarians, gold bugs say thats because its ponzi structure etc… i dont care about what they say. these FIAT currencies were a BIG success, the world has never grown so much before, and there has been much improvement in the well being in the western countries mainly and also in other areas in the world in the last 40 years. but this is about to be over, and certainly hopefully we will find something which will work next.

but whether we get austerity, or we try to go the Japanese path extend and pretend, thats going only to buy time. and it wont last as much as in Japan because Japan is Japan. Actually i would be ready to bet Japan will be the first to collapse, bringing everybody else with them.

If the US Treasury has an issue with T-Bills maturing in August ($300 plus Billion) what happens if a T-Bill matures and is owned by a Non Dealer or citizen vs. if it is owned by a Primary Dealer or the Federal Reserve itself?

Can the FED try to buy up the Bills on the open market so that the liability can be internalized on the FED Balance Sheet as a negative asset in the Treasury account at the FED?