The IMF has a passel of articles up on income inequality. “Unequal = Indebted,” by Michael Kumhof and Romain Rancière, focused on macroeconomic effects.

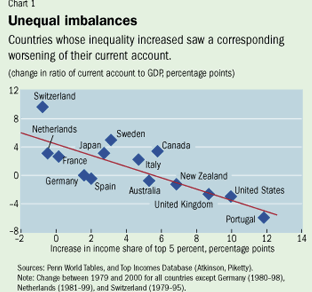

It stars with the observation that countries showing a significant increase of income inequality (defined as the share going to the top 5%) have deteriorating current accounts (note these are all advanced economies; they discuss the glaring exception of China later in the article).

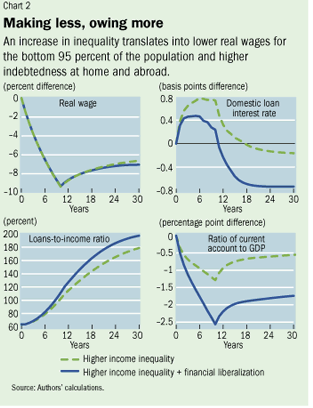

Economists being economists, they have to construct a model to see whether what works in fact also works in theory. In the model, the top 5% has an increase in its bargaining power over 10 years. Even though they like to consume, consuming (as John Kenneth Galbraith) is work, and they also derive satisfaction from investing, which includes lending more to the great unwashed 95%. And since the bottom group isn’t getting as much of the income pie as it once did, it is receptive to the idea of borrowing more. We know how this movie progresses: the bottom group accumulates more debt, and over time, the risk premium to them rises.

The authors note:

In an open economy, the task of financing the bottom group’s borrowing demand following a negative income shock is shared between the domestic top group and foreigners. This enables the top group to deploy more of its higher income in domestic plant and machinery investment and consumption than would be possible in a closed economy. But externally the result is a deterioration of the current account, which peaks at more than 1 percent of GDP.

In reality, increases in income inequality are often followed by political interventions to prop up the living standards of the bottom group, whose real income is stagnating. This is generally done not by directly confronting the sources of inequality, such as declines in the collective bargaining power of the bottom group or shifts in the tax burden from the top group to the bottom group, but rather by promoting policies that cut the cost of borrowing for both individuals and financial institutions (Rajan, 2010). These policies include domestic and international financial liberalization, and they put additional downward pressure on current accounts.

The authors added the impact of financial liberalization to their model:

So what are the results of liberalization? More of the high income cohort’s funds go into financial assets at the expense of real assets. The bottom group gets to consume more, but the affluent invest less in productive capacity, which leads to lower real income of the bottom 95% and further deterioration in the current account.

And why is China different? China has immature financial markets, so the poor and middle class can’t readily borrow from the rich. The inability to use lending to shore up consumption leads to an export-oriented model, with the result that the savings in the economy are, to a fair degree, deployed overseas.

Note that in this sceanrio, more mature financial markets at home are no remedy:

But if lending is liberalized without addressing the underlying income inequalities, the result would simply be an increase in indebtedness within surplus countries (between the rich and the rest of the population), rather than vis-à-vis the rest of the world. In other words, there would be a globalized rather than a regional increase in domestic indebtedness of the poor and middle class. While this would reduce cross-border financial imbalances, it would exacerbate domestic debt-to-income ratios and thus vulnerability to crises. In the long run, there is therefore simply no way to avoid addressing the income inequality problem head-on. Financial liberalization in surplus countries buys time, but at the expense of an eventually much larger debt problem.

Ouch.

Kumhof and Ranciere give a very brief treatment of possible solutions. The don’t seem too keen about taxing capital more and labor less, since capital can flee. They prefer more progressive taxation of labor income (but that leaves the problem of income from capital unremedied). They seem to regard direct efforts to improve the bargaining power of labor as most effective but conceding they are the most difficult reform to implement. They nevertheless arguie that the costs of the failure to reverse course are too high to ignore.

Well, who knows, maybe restrictions on the flow of capital will not be too far off (meaning within 1-3 years) as governments try to hold onto the wealth within their borders when having to impose higher taxes even on capital gains as workers will be unable to carry more load.

Yeah that’s a little mystifying.

“Capital can flee” — if you *let* it, sure, it can.

But I suspect that capital controls are literally unthinkable for many people — it just would never occur to them that you could even *do* that. If we force fleeing capital to take the form of smuggled gold bars…

Gee, they’ll become Marxists (Graeberians sounds terrible) yet.

I don’t think this is a correct rendering of the logic behind why China hasn’t developed domestic markets (particularly the word ‘immature’ — I realize that this is a bug from the perspective of the capitalist, but it may well be a feature from the perspective of the Chinese). If you look at East Asia, the only countries that managed to develop domestic markets, are Japan and the Tigers — countries that are/were heavily protectionist. China has (for reasons unknown, of course) afaik not done so, or at least not in the same way.

They may simply have the causality backwards in the case of China, the export model was the focus, the inattention/suspicion of financialization was derivative. Michael Hudson advises them, and the Chinese HATE neoclassical economics.

I was really remiss in not noting that in the post.

Thanks, Yves! Having gotten beaten over the head making a similar argument last night on Denninger’s forum, being accused of everything from being a thief to being “sick”, you couldn’t have posted this article at a better time.

I read that commentary on the Ticker BigB. Ticker has many Libertarian commentators that mirror Karl Denninger. He is a good man for his pursuit of justice but is a tad dry on sympathy.

I was once a rugged Libertarian myself until I began my own blogging utility. My purpose of it was unofficial civil duty to disseminate truth. The market research phase of interfacing with hundreds of people really woke me up to:

1) As humans we’re born imperfect. Social benefits for those that need it make a better civilization. Euthanasia is a pathetic, lazy alternative for those unable to produce. But by all means stop the vote buying and means test!!!

2) People’s politics often reflect the luck of the draw in what deck of cards dealt in life. American Libertarians are truly rugged individualist that work hard and play by the rules. Like the fortunate elite born into privelage I have found Libertarians to be the upper middle class version that faced little or no disruption in their plans to succeed. To them, their are no victims of circumstance. I did everything perfect to retire at 40. I had three acquisition bids in February of 2008 between 6.2M and 6.8M. As we were nearing conclusion, oil kept spiking up until all three

companies cancelled all acquisitions for the year. A Libertarian would tell me I should have done my homework on market research and if I failed I must never seek the temporary relief of the social safety net. While I didn’t need it (that research did pay off enough to still earn decent living) I find such attitudes as cruel, despite strongly relating to the other meme of the rule of law and defense of private property. Those fundamentals on equality are where much common ground can be reached but the cruel attitude toward fellow American sufferings is why trying to herd Libertarians is like herding cats.

The population has been looted; purchasing power knocked flat down. So a portion of society steals from their neighbor or employer. Plunder is the flaw of our inherit imperfection of attempting to do the least for gain which includes cheating.

Agreed. They would never accept the role of the luck of the draw. I’ve done well myself but don’t think for a minute I didn’t have an unfair advantage. Different parents, an unfortunate accident, one bad decision, all could have been different. Civilized society doesn’t forsake those who are no longer useful.

Beyond that, there is a level of exploitation or extraction however that has occurred in wealth accumulation over the last few decades. At risk of sounding like a Marxist, the labor portion of the economy has seen its share of the profits decline, while the investor share has risen. The tax system adds to the problem. Instead of a system that rewards higher levels of production with profits commensurate to levels of sweat equity and ingenuity, we reward greed and quick and easy profits through asset price speculation. No economy can survive without a strong middle class. The difference between the Great Depression and today is that everybody took similar hits. I foresee the wealth disparity continuing to increase as the social safety net is reduced, we add a class of permanently unemployed, and because of these and other economic factors, employers are able to further reduce wages and benefits.

Interesting sidebar: Some US employers have been told by Chinese officials that they are not allowed to cut their number of employees, as part of the Chinese effort to maintain employment levels. So, the Americans layoff in the US instead. Surely this doesn’t escape the notice of the Chinese, who must think we are royal dumbsh*ts.

Your not sounding like a Marxist BigB for noticing labors share of wealth falling off a cliff or for the understanding of necessity of a middle class for a nice society.

Good last point about China thinking American leadership is stupid as shit. If I were the Chinese, I would be so thrilled with trading permanent wealth production measured in the trillions for rented near slave labor. The Sr. i side leadership loved the short terms gains as well!

The entire idea to mandrake to China is riddled with massive geopolitical risks American leadership ignored. And the Chinese culture executes traitors. I believe those investors expecting to live over there, basking in the glory of China’s fifty year ascent are going to be gravely dissapointed.

Too many Libertarians take for granted that the social safety net which they excoriate, is protecting thier sacred, precious, involiable at any cost-property rights.Thats actually its primary function. That net, dangerously weak as it already is, is not there to fulfill the emotional need of 40% of the rentier class to be “compassionate” and assuage thier pangs of guilt. Just a glance back at (acutal not romanticized or fabricated) history shows what remedies the “unproductive” seek when there are none within the society they live in, when they become a large enough group. People, generally speaking, are born with powerful survival instincts.They take what they dont have from those who have when no other relief is possible. Destruction by revolutions, riots, brigandage,political and economic chaos are the INEVITABLE fate of such societies.A handful probably look forward to the looting opportunities that come with the downfall of empires, I cant believe people who genuinely believe that freedom from coercion by threat of violence ,as Libertarians do, would consider a might makes right anarchy to be desirable outcome. But thats the path were being forced down.

Thanks for the reply Rotter and expanding on what my recent business research taught me. I also am a big history buff, the saying of George Santayana come to mind of what happen to those that do not learn from

history.

My closest libertarian friend was born on second base, worked some prime years as a software consultant during the run-up to the dot-com bubble, and has no compassion for anyone who strikes out or gets hit with the pitch and dies uninsured.

Those that would_take_regardless of the greater social consensuses have two paths…conquer or canoe.

Skippy…not much use for the canoe any more, guess its conquer or nothing meaningful in life for some.

PS. Hug a Libertarian, it may help.

I would believe that the issue is not that there would be capital flight if the top 5% were to have a more appropriate proportion of their income taxed. They have already done a more than fine job in this country of insuring that they will not be held to account for their extractive tendencies.

Once you accumulate a certain level of capital you can’t help but make more money which has always seemed the fundamental flaw in capitalism. How much is enough? Inter-generational accumulation strikes me as inefficient and I would’ve thought hefty estate/death taxes would fix so many problems. Buffet seems to recognise this much to the chagrin of his “potential” heirs

I would be fine with almost virtually eliminating inheritance entirely. Why does someone feel they are “entitled” to be rich simply because they fell out of a rich woman’s vagina? What did they DO to “deserve” the inherited wealth? Snort coke? Go on the party circuit? Go sailing?

No, if you didn’t earn the wealth, you don’t get the wealth and falling out of a vagina is not earning anything. EVERYONE falls out of a vagina so there’s nothing special about that.

Tax the CRAP out of inheritance because it is nothing more than winning the lottery and lottery winners have to pay quite a bit in taxes. What was done to “earn” the winning is virtually equivalent (except the lottery winner actually probably had a crap job somewhere and actually had to expend the energy to buy the ticket and scratch it…unlike the wealthy do-nothing who simply won the vagina lottery).

Tell me your not going to be rewriting the Vagina Monologues! But I agree on taxing inheritance.

If it was a round world I would say taxing inheritance isn’t fair. But it isn’t a round or fair world. The dead should never be permitted to rule the living.

The Book that warns us against usury from our fellow countrymen, counterfeiting and oppression of the poor and which commands periodic debt forgiveness also says this:

A good man leaves an inheritance to his children’s children, and the wealth of the sinner is stored up for the righteous. Proverbs 13:22 New American Standard Bible (NASB)

Federal taxation destroys money. Unless there is substantial price inflation we should not be in favor of destroying money.

The soft side of the book.

Kill the Entire Town if One Person Worships Another God

Suppose you hear in one of the towns the LORD your God is giving you that some worthless rabble among you have led their fellow citizens astray by encouraging them to worship foreign gods. In such cases, you must examine the facts carefully. If you find it is true and can prove that such a detestable act has occurred among you, you must attack that town and completely destroy all its inhabitants, as well as all the livestock. Then you must pile all the plunder in the middle of the street and burn it. Put the entire town to the torch as a burnt offering to the LORD your God. That town must remain a ruin forever; it may never be rebuilt. Keep none of the plunder that has been set apart for destruction. Then the LORD will turn from his fierce anger and be merciful to you. He will have compassion on you and make you a great nation, just as he solemnly promised your ancestors. “The LORD your God will be merciful only if you obey him and keep all the commands I am giving you today, doing what is pleasing to him.” (Deuteronomy 13:13-19 NLT)

Kill Women Who Are Not Virgins On Their Wedding Night

But if this charge is true (that she wasn’t a virgin on her wedding night), and evidence of the girls virginity is not found, they shall bring the girl to the entrance of her fathers house and there her townsman shall stone her to death, because she committed a crime against Israel by her unchasteness in her father’s house. Thus shall you purge the evil from your midst. (Deuteronomy 22:20-21 NAB)

God Will Kill the Children of Sinners

If even then you remain hostile toward me and refuse to obey, I will inflict you with seven more disasters for your sins. I will release wild animals that will kill your children and destroy your cattle, so your numbers will dwindle and your roads will be deserted. (Leviticus 26:21-22 NLT)

You Have to Kill

Cursed be he who does the Lords work remissly, cursed he who holds back his sword from blood. (Jeremiah 48:10 NAB)

God Promises More Killing

I will make Mount Seir utterly desolate, killing off all who try to escape and any who return. I will fill your mountains with the dead. Your hills, your valleys, and your streams will be filled with people slaughtered by the sword. I will make you desolate forever. Your cities will never be rebuilt. Then you will know that I am the LORD. (Ezekiel 35:7-9 NLT)

More Rape and Baby Killing

Anyone who is captured will be run through with a sword. Their little children will be dashed to death right before their eyes. Their homes will be sacked and their wives raped by the attacking hordes. For I will stir up the Medes against Babylon, and no amount of silver or gold will buy them off. The attacking armies will shoot down the young people with arrows. They will have no mercy on helpless babies and will show no compassion for the children. (Isaiah 13:15-18 NLT)

Kill Followers of Other Religions

While the Israelites were camped at Acacia, some of the men defiled themselves by sleeping with the local Moabite women. These women invited them to attend sacrifices to their gods, and soon the Israelites were feasting with them and worshiping the gods of Moab. Before long Israel was joining in the worship of Baal of Peor, causing the LORD’s anger to blaze against his people. The LORD issued the following command to Moses: “Seize all the ringleaders and execute them before the LORD in broad daylight, so his fierce anger will turn away from the people of Israel.” So Moses ordered Israel’s judges to execute everyone who had joined in worshiping Baal of Peor. Just then one of the Israelite men brought a Midianite woman into the camp, right before the eyes of Moses and all the people, as they were weeping at the entrance of the Tabernacle. When Phinehas son of Eleazar and grandson of Aaron the priest saw this, he jumped up and left the assembly. Then he took a spear and rushed after the man into his tent. Phinehas thrust the spear all the way through the man’s body and into the woman’s stomach. So the plague against the Israelites was stopped, but not before 24,000 people had died. (Numbers 25:1-9 NLT)

Beard the good book[???], selective usage out side the totality imbued in it…is an act of deception. You can not pick and choose, you have to *accept*_all of it_as LAW, your lord demands it.

Skippy…obey or burn, its not a choice as a believer, so stop jerking people around with the soft fuzzy stuff, expose your belief for all it is, or do you feel shame, trepidation, your lord would not be pleased by my readings. Why do most Judo-Christians never read the bible completely, commit to memory, instead allow priests to orate selectively. Things that make me go ummm.

PS. as you should know this is just a faction of what I could display, rape, slavery, human sacrifice eh (Judges 11:29-40 NLT) (Deuteronomy 13:13-19 NLT). Understand your belief or stop using it as a tool to justify your positions. Country men….roflol…should read…BELIEVERS…SIGH…fixed that.

@Skippy,

There is no doubt that the Lord will kill but it is usually for things that you would probably hate yourself such as oppression of the poor, widows, orphans and aliens, refusal to release indentured servants every 7 years, child sacrifice etc. and only after repeated warnings and much long suffering.

But in any case, Christians are not bound by the Old Testament though we should be guided by it. Thus I am perfectly free to pick and choose from the OT those things that have to do with economics.

I suppose you have problems with the New Testament too? But if you don’t, then you should know that Jesus upheld the Old Testament:

For truly I say to you, until heaven and earth pass away, not the smallest letter or stroke shall pass from the Law until all is accomplished. Whoever then annuls one of the least of these commandments, and teaches others to do the same, shall be called least in the kingdom of heaven; but whoever keeps and teaches them, he shall be called great in the kingdom of heaven. Matthew 5:18-20

@Beard,

God did not kill any one, people kill[ed in the name of god. You see humans have made up countless beliefs over the eons (the god of Abraham is just one of the best sellers at the moment), and as there no proof (does not do personal appearances) its believers should really own up to it.

On the other hand the planet does stuff, were just in the way, death ensues, ask every other living thing from the beginning.

New testament, old testament, ? , its the bible, word of god and no one is allowed to screw with it, whats your point?

Christians{?], oh you mean Judaism for gentiles. I wonder what the trinity thinks of Constantinople, conversion of an entire empire for political purposes (free will thingy).

Skippy…any way the killing continues (god made me do it), one book can never encompass every thing beardy, so believe what you like (not trying to stop you), just a heads up that increasing amounts of people around the world are fed up with the hypocritical, washing of hands from responsibility, double speak, rubbish dressed up as truth.

PS. once again a complete side step to evidence put under your nose ie. country men, in the bible (old testament) it refers to jews only. It cannot be taken out of context, god was speaking to his chosen people and not readers of NC. Stop making stuff up, you should be ashamed.

Maybe you’re missing the point by looking at inheritance from the wrong direction.

The point is the person who made the money has the right to give THEIR money with their last breath to whomever they chose, and of course most often they chose their kids (Anyone who has ever been a parent would consider this sound thinking).

The government has the right to tax the transaction, but to take all of it would simply be theft. Of course people would simply make sure to physically transfer their wealth before death as much as predictively possible.

By the way current inheritance taxes on really large inheritances are quite substantial in america ~50%. Small inheritances not so much.

I disagree with taxing income after it has already been taxed. I also see the transfer of wealth from elders to their children as part of family rights, and an important act of love between the old genertion and the young.

However, I belive that the issue at hand is that there is not enough tax on those persons who earn super high incomes (via wages or Capitol gains) and there are too many legal loop holes for people to shift incom away from the tax man ( I.e. Transfer payment accounting, shell companies, etc…). Taxes on super high incomes that earned from business activity in the united states should be reflect the fact that those incomes, on national level, can only be earned if the nation of the USA is healthy. I beleive a tax of 60% on all income earned domestically or any money transfer or paid out of the country , above $1,000,000 per year is fair.

Special allowances can be made for genuine inventors or creative types (true entrpreneurs or sciene types)

Ming and Tim,

The tax rate is one thing, how much collected is another. Are either one of you familiar with the collected inheritence tax? I think when tax rates approach 50% people take extreme measures toward avoidence unless the benefits were phenominal, perhaps like Germany, although that level of benefit isn’t sustainable without extreme protectionism disrupting the revenue stream.

I liked you point about love to the kids to give them a good start in life. The common argument is that often the next crop sit on the dough and do more trouble with it then good. I see a lot of them piss huge chunks away which I suppose isn’t actually bad forma consumption economy.

Trust funds that continue the desires of their parents use to have some merits, some still do but most are there as you mentioned exist as tax shelters or used to continue to project the exploitative nature of the parents in death as in life.

I mentioned I would oppose the inheritance tax at all in a round world. And societies don’t do well that pick winners and losers with tax policy. A Scrapping the archaic and hyper control thinking of an income tax should go. Why not scrap all taxes save a simple one page tax code on consumption? A rounder world is possible.

A Scrapping the archaic and hyper control thinking of an income tax should go. Why not scrap all taxes save a simple one page tax code on consumption? JasonRhines

Because the rich should pay for the government enforced counterfeiting cartel so long as we have it, not the poor whom it exploits.

Consumption taxes are regressive. You should be ashamed of yourself.

If I recall correctly, it is an ancient and honored thing to give everything to your children, and for them to squander it. The Athenians pointed to their wastrel children as one of the reasons to kill Socrates.

And recall that the generational accumulation of wealth was one of the main foci of feudal society, who used divine right instead of personal accomplishment as the reasoning.

Yves, you left out part of the sentence at the end:

“They seem to regard direct efforts to improve the bargaining power of labor ___________, arguing that the costs of the failure to reverse course are too high to ignore.”

We can infer they approve of increased labor bargaining power, but it could be clearer.

Great post though I wonder if the IMF has been producing such wonderful insights for a long time, and ignoring them for just as long…

Ah. Indebtedness. Welcome to travelling down the road to Hayekian Serfdom!

They are mixing up cause and effect.

The Dirty Fed creates both income inequality and indebtedness.

“China has immature financial markets, so the poor and middle class can’t readily borrow from the rich. “

The poor do not borrow from the rich. The rich leverage their capital via the banks by 20-1 (assuming a 5% capital requirement) creating 20 times as much “credit” as their capital. But where does the purchasing power for that credit come from? 95% of it comes from the non-capital owners, the general population. So the poor do not borrow from the rich, the poor steal purchasing power from each other.

So how are the rich able to counterfeit 20 times their capital? Ans: Central banks and other privileges for the banks.

Keep explaining this and perhaps someone besides you and me will understand it. I have given up trying to explain it.

From a historical perspective, the risk of capital flight tends to be overblown. The rich may bitch and moan endlessly about having to pay for them, but they genuinely value the social services (educated workers, good roads, reliable plumbing)that a robust state cheaply provides them as public goods. Instead of trying to leave rich countries that demand they pay their share, they instead focus on corrupting the political process so they can push the tax burden onto less influential people, and as any historian can tell you, this has been the aristoi pattern of behavior as far back as you care to look.

Lots of noise gets made regarding capital flight to London during the 90s, but I think that ignores the discrete situations under which that flight occurred. To begin with, a large part of that was rich Russians fleeing first an ineffective, Goldman-Sachs-looted central government, and then Putin, a man entirely willing to murder you for your wealth. Secondly, due to Eurozone reforms, the barriers to relocation from one Euro financial center to another were uniquely low. Thirdly, London has never really faced significant competition for financial business from other European cities; it saw one of the first stockmarkets, and The City has been financially preeminent on the continent ever since. Fourthly, due to how close everything is in Europe, how robust their transportation systems are, and how social infrastructure in Northern Europe tends to be uniformly excellent, the drawbacks to relocation are near non-existent. None of this applies to the US, and so, capital flight in the US has seldom been a concern, and it shouldn’t be something we worry ourselves about now, either.

Totally agree, Heron. Excellent summation.

“Capital flight” has merely been a shibboleth of the Libertarian/Right since the mid-seventies. It hasn’t been re-tested since the heydays of the late fifties-early sixties when the upper rate was 90%.

During that period of 90% taxation for the super-rich I don’t ever recall seeing any sort of research or even hearing anecdotal evidence based on 1 to 2 examples of super-rich Americans fleeing the country in order to avoid the tax-rate.

Since then we’ve not had anything like that rate and, thus, the reasons to flee become less. Now we have genius Paul Ryan suggesting that taxes need to all be paid by formerly middle-class folk while the super-rich rate is effectively lowered to zero.

That will effectively6 kill any social perks of doing business in America as education and infrastructure, government protection for anyone of any sort will be past.

Methinks it’s time to quit talking about revolution and start making another one.

The actual cause of “capital flight” is when those services (roads, passenger trains, sewage treatment, health care) start to disappear, and the rich people decide to go somewhere which has fast trains, a national health service, and sewage treatment plans.

Watch out. It’s happening in the US.

Second that, Heron. How many people want to leave everybody they know behind?

In addition, how many countries, you’d want to live in, have lower tax rates than we do to flee to?

>> The rich may bitch and moan endlessly about having to pay for them, but they genuinely value the social services (educated workers, good roads, reliable plumbing)that a robust state cheaply provides them as public goods.

But, they’ll soon stop valuing these services, because they will start to rely on technology (cameras, drones, terminators) to guard them, clean their mansions, grow their crops, and cook their food.

The US upper class no longer needs the rest of the society. Watch out.

Third that, Heron. “Capital flight” is another economic half-truth. There are many reasons why capital stays in the US or leaves. But economists can only readily measure and accurately quote the tax-rate, so that becomes their sole explanation. They wilfully ignore all the other reasons, because they are “intangibles”.

Money should not be lent into existence; it should be spent into existence. That way, the money does not necessarily have to be paid back. And even if it is paid back (by exchanging it for goods and services from the money issuer or by paying taxes to the issuing government), there would be no interest due on it.

F. Beard. I couldnt reply on the other comment. I am not at all ashamed of my position of taxing consumption. Might have had the gullible citizens from going on a debt binge to buy toys and other Chinese trinkets. So educate me on why I should be ashamed. Your answer on the flawed model of Central Banking did not provide why not every individual under the poverty line should pay a flat-tax on consumption. Didn’t Israel back then require FLAT tithe to provide for the government expenditure? The bible and historians talk of the splendor and wisdom of Solomon. Was the regressive consumption tax successful or was Moses being shameful?

I do like some of your extrapolations of ancient Israel’s monetary system. Seems they borrowed a lot of ideas from the Babylonians. I think Skippy made a point about Moses militant instructions from the Lord. I have read the bible multiple times cover to cover. Call me at 603-953-3388 if you would like to have a civilized private debate on scripture, economics or history. As this is an economic thread on cause and effect of equality it would be rude to delve much further here on God/Creator etc.

So educate me on why I should be ashamed. JasonRines

Because the non-poor are already “taxed” – by the government enforced private money monopoly for the benefit of the rich and the banks.

As for the 10% tithe, that was a religious requirement not a civil one. Civil government did not come about (against God’s warning – See 1 Samuel Chp. 8) till Saul was anointed as King.

And economically speaking, any taxes during a recession don’t make sense UNLESS they are needed to control price inflation and in that case they should directed against the rich. The principle being “If you misuse government money to drive up the price of food or other necessities including housing then the government shall tax that money away from you.”

Two fixes: Capital controls and Tobin Tax.

Labor income should be taxed LESS than wasteful, robber-baron interest income, capital gains, dividends, etc. ANY income that derives from not making anything, not DOING anything to get it, should be taxed. Any income that derives from actually making something (working) should be lightly taxed.

Capital controls and Tobin Tax.

Indebted = enslaved

Obama finally is offering up the redistributive mechanism of the state to regulate the over reaching wealth concentration of America. Of course, other than this being the only way to fund the government and start to reinvest in restructuring the economy, it is only words without deeds. That would take the acts of Congress to vote on the law actually taxing the wealthy and foregoing the Bush tax cuts for the wealthy in addition to new taxes that would be net increase over the sunset provisions of the Bush cuts.

But even saying this out loud, in public, forcefully, regularly, in the face of the republican cries of “Oh No, I feel the vapors coming upon me, I must surely faint!!! It is a Yankee coming to tax me OOOHHHHH!!” Even the apparent futile effort to ask for taxation increases to actually reduce the deficit increase and fund worthwhile spending, is so radical, in and of itself. It deserves attentive commentary. While the Republicans are trying to push the sands of time back to 1913, Obama is trying to bring back 1953. You have to start somewhere, the republicans have been trying to destroy the IRS, the Post Office and Social Security for the last 75 years. The Democrats have to also wage war over the decades in order to achieve their policy goals.

If Obama were to turn into FDR tomorrow, every time Congress vetoed anything of his he could go on national television and make his case. He would have extraordinary populist leverage.

All of the conservative arguments for tax increases and social democracy can be easily destroyed. He would just need to go on the offensive and mercilessly broadcast it. Put the liars on Fox and talk radio on the defensive. Have legions of people call in and debate them. They’re position is so weak!

I would say the problem with Obama so far has been trying to appease the Republicans a bit too much. From the day 1, he should have accepted the fact that this nation has become as polarized as ever and bite the bullet. He failed to take the initiative and thus a lengthy list of lackuster political results since 2009.

Especially when there is a situation in which crap is hitting the fan, it is excruciatingly difficult to please everybody, especially deeply entrenched fear-mongers like the Republicans and their constituents.

Exactly.

“Obama is trying to bring back 1953.”

please, please..enough of that. Obama is trying to become a 2 term president. His own communications people are on the cable news circuit openly talking about what “strategies” (read this as hot air) will “bring back” enough of “the base” for him to garner just enough of the votes of the 48% of the ELIGIBLE population which actually votes, to be elected again after which event, presumably, he will resume his well established policy of servicing the every needs and desires demands of the 5%’ers.

The extreme degree of wealth inequality we see is not just an economic problem but an economic crime. This is where all economic analyses that do not take into account kleptocracy fail. Redressing the economic balance is also a law and order matter. We don’t tell the bank robber, “I guess you can keep the money you stole since if we try to get it back you will just send it overseas.” We go after the money and the culprit.

But in so many of these analyses it is as if wealth inequality just happened and capital flight can happen. Sorry, but money doesn’t flee, looting doesn’t occur on its own. There are people making criminal decisions that produce these results. If you want to reverse this process, go after the people behind it.

They have cause and effect backwards. The current accounts deficit (i.e. trade deficit) causes income inequality and not vice versa. Its a pity Donald Trump didn’t run for President, he understood the real issue is the trade deficit, not the budget deficit. Of course Warren Buffett has been saying the same thing for years. That’s the Buffett Rule the President should have adopted.

“What I really would be strongly in favor of is having countries that are ripping us off contribute hundreds of billions of dollars back into this economy,” Trump said in a March interview with the conservative newspaper Human Events, “and you wouldn’t have to worry so much about cutting too much out of the budget…”

“When this country becomes profitable again, we can take care of our sick; we can take care of our needy… We don’t have to cut Social Security; we don’t have to cut Medicare and Medicaid.”

http://www.politico.com/news/stories/0411/53562.html

Import Certificates are a proposed mechanism to implement balanced trade, and eliminate a country’s trade deficit. The idea was proposed by Warren Buffett in 2003 to address the U.S. trade deficit.

http://en.wikipedia.org/wiki/Import_Certificates

Unequal = Indebted = Slave

Modern slavery in a PC world.

Slaves do revolt from time to time however as the article implies…

Hi,

I am Alex,owner of some quality financial domains on Mortgage, Real estate, Loan, Debt & other various finance topics. Today, while searching for a suitable blog, I just come across yours. I have gone through it and found it very resourceful. I must appreciate your hard work and wish you good luck.

It will be my pleasure if I can contribute some quality content absolutely free of cost for your site:(nakedcapitalism.com). Each of my content is analytical, relevant and copyscape proved. If you wish, you can suggest few topics also for your website.Not only that, I will give you the total rights to edit the article and modify it as per your needs.

In return, I would gladly place your articles in my websites. This mutual content exchange will help our websites to get more targeted visitors.

let me know your thoughts. Waiting for your positive reply.

If you have any questions or need anything feel free to contact me at : brown.alex916@gmail.com

Regards,

Alex Brown

Yves has some severe allergies, and one is to the use of the word “quality” as an adjective. She’ll be getting back with you once the wheezes let up and the hives aren’t so itchy.

We must all appreciate YOUR hard work, too, Alex, and wish you the best of luck as well!

Alex, you will find better results for collaborative syndication if you spent the time to find Yves email and contact her privately. Good luck with your efforts.

Interesting. Does anyone know how far western trades unions have sought to empower unions in non western economies in an effort to drive up their wages – in so doing gradually making their wages less a factor in manufacturing cost comparisons across countries globally?

Never really understood why libertarians aren’t socialists.

Freedom from want, having their life ruined by a chance illness, freedom from unaccountable economic tyranny and the whims of the rich, the pollution of the commons,freedom from ignorance, freedom from discrimination. The maximum freedom for the maximum number and a life free of the constraints of the whims of the wealthy, the powerful, of chance and birth. I believe that is the liberal socialist ideal.

Those things, they think, only happen to weak people.

Of the critiques of the “Just me and my Glock” kind of libertarianism, the best I’ve read is B. Traven’s _The Treasure of the Sierra Madre_. At the risk of a spoiler: by the end of the book, everybody who’s still alive and happy is in a village. We survive by our human relationships.

This is one movie that follows the book almost exactly, apart from asmall speed-up towards the end. To the book’s advantage, it lasts longer and it’s easier to think about.

Thanks, Mel. I’ll read it.

I’ve been doing some research since the last comment.

Traditionally, libertarianism has been a broad statement of what political society should aspire to: freedom and the free society. As such, it is open to, and have a left, right, and anarchist interpretation. (My intuition was correct: hooray!)As such, think it could be easily argued that liberalism is moderate libertarianism, or that libertarians are extreme left/right liberals.

Given the above, it’s curious as to why every person I’ve come across on message boards that claims the mantle of ‘libertarian’ is a Randian right-winger.

At any rate, it’s easy to see why liberalism has such animosity towards Randian libertarianism and its emphasis on inviolable property rights. Liberalism was born in the struggle against the feudal society and the unjust power of king and noble–i.e. the propertied elite. It is inherently democratic.

Randian libertarianism is basically this feudal opponent of liberalism with the principal of meritocracy in place of hereditary element. (This is an interesting subversion of liberalism where the principle of merit has been usually been contrasted with the principle of propertied priviledge.) It is inherently anti-democratic.

Of course, as any liberal will point out, the propertied/meritous identity is circular with AMPLE evidence to the contrary, and any society organized around it will ultimately destroy liberty.

The Randian libertarian, in my experience, tends to reply that the identity WOULD be true if it weren’t for government distorting the process and giving wealth to the undeserving, and that once society is properly organized (government eviscerated),and society will be free because the propertied will be superior, meritious people and they won’t have a ‘big’ government to use as a yoke. Their whole position seems to rely on the position that government is inherently a tool of oppression and cannot be a tool for freedom.

Liberals tend to think this utopian thinking and offer examples of weak government societies like Somalia.

Libertarians respond that they want strong (rule of law) but small government–government that doesn’t interfere with private property.

And this brings us back to property rights. A liberal will respond again that this is utopian. Without limitations on wealth accumulation, the wealthy will then leverage their wealth to give themselves power.

A libertarian would reply that they can’t do that because they don’t have a government as a tool.

The disagreement seems to boil down to the libertarian view that government is inherently oppressive AND oppression is ultimately governmental.

I am happy to have provided some food for thought. Damn your bright to have researched and provided a cojent analysis in an hour of research!

The end result of Randian Libertarianism is also dictatorship (it all leads there with pyramid structured organizations). So yes, Randian Libertarianism is utopian thinking. It works great for EMU’s and devolving countries for a short time but not in developed countries. The risk seems to be the nation may wind with an Adolph Hitler. Liberalism as you pointed out is also utopian thinking because it is about OPM and the inevitable vote buying, busted government and misery that Alexander Tytler studies. I like his study of governments.

Abraham Lincoln once said if you wanted to know who a man is, assign him power. I did that with one bright, perhaps promising Libertarian. In the end, I was asking this person how his thinking of ends justifying means made him any different than Goldman executives doing the recent looting he railed against. In other words, if this person had chosen banking, it would have been him being Lloyd crying out how he is doing God’s work.

I have to admit I like Ron Paul and see no Hitler threat but if he was elected he would be wise to choose a mixed cabinet.

You had me at “freedom from ignorance”. I don’t know how that fits into the socialist ideal, but it odes sound ideal!

Eccles (President Roosevelt’s first Fed Chief) on income/wealth inequality…

http://www.wealthdaily.com/articles/great-depression-ben+bernanke/1785

“As mass production has to be accompanied by mass consumption; mass consumption, in turn, implies a distribution of wealth — not of existing wealth, but of wealth as it is currently produced — to provide men with buying power equal to the amount of goods and services offered by the nation’s economic machinery. Instead of achieving that kind of distribution, a giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth. This served them as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied to themselves the kind of effective demand for their products that would justify a reinvestment of their capital accumulations in new plants. In consequence, as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped.

That is what happened to us in the twenties.

Yep,

I keep saying ever played monopoly? What happens if there is no “pass go and collect $200”? The game quickly collapses. Money has to circulate.

It might be worth thinking about the role of population growth in the inequality problem. Imagine that a disease came along and knocked off 10% of the world population. Do you think the balance of profit distribution would shift more in favor of labor? Between automation and globalization, the competition for relatively fewer jobs among relatively more workers runs right into that basic economic principle: supply and demand.

Why imagine? It’s going to happen. This is exactly the demographic time bomb facing most industrialized societies. Replace “disease” with “old age”, and “10% of the world population” with “Boomers” and that is what we are — except we have to feed and house “the dead” for another decade or three after they “die” from the labor market.

Well, I was referring to people still in the work force, since employment is the topic at hand. I agree (as one of those boomers you seem anxious to be rid of — are you going to feel the same way when you hit 60?) that lengthening post-work life spans are a problem too. A disease that knocked off everyone over 60 or so would certainly solve our Social Security and Medicare problems, wouldn’t it?

Are you (or rather they) certain about the direction of causation. Couldn’t it be that an overvalued currency results in limited real investment opportunities. This creates a headwind for the economy and pushes down real wages. The central bank rsponds with lower short term real interest rates which encourages borrowing.

P.S. I forgot one further step, the combination of low short term interest rates and consumer borrowing (supporting consumption but without domestic labour costs) increases inequality.

If you look at this 2009 report (and it’s a total fluke it’s from McKinsey as I hit it on my first Google search for my comment on this piece)and the chart Exhibit 4, you see household debt by quintile.

Note first how much debt the top 2 quintiles had amassed into 2007, positively dwarfing bubble debt held by the bottom 3. Then, apart from asking just why it was that the entire educated, affluent population went nuts, consider:

1)How unbelievably dishonest it is for so many to lay any portion of the blame for even 1 moment of this on the average Joe’s presumed prudential shortcomings – the kind of typical, lowly moral hazardness these less worthies exhibit that forces leaders and execs to, with all due regret, cut jobs, incomes, pensions, all those darn entitlements, public goods and services of all kinds. “We’re all to blame.” Pretty neat trick

2) Why would one bother to do anything so silly as risk the ire of the criminal class one outnumbers many thousands to one, when the deep, rumbling beat of “Bernanke. Bernanke. Bring on Bernanke.” to pump those markets is just so much more…civil – irrespective of the certain current damage to half the population and certain future damage headed inexorably up the ladder?

Fool that I am, I forgot the link:

http://www.mckinsey.com/mgi/reports/pdfs/us_consumers/MGI_US_consumers_full_report.pdf

Take a closer look at the data: it’s from 1979 to 2000. What, no later data points? While 21 years of annual data is barely adequate – far from ideal, 30+ years would be better – for econometric studies of this type, the longer the data set, the more believable the results. We’re missing the entire boom period of the 2000s and the financial crisis of 2008 and thereafter. Inclusion of developments from this time frame would, probably, improve the arguments of the authors, which makes its non-inclusion more puzzling. The Penn World Tables are available from 1950 to 2009: choosing a small subset of that time frame is suspect, as their arguments would be vastly bettered by including the most recent years (and would give you 59 years of data, which for this analysis would be quite sufficient).

Simply put, this data set is too old to have that much relevance to the problems of inequality today, which have been, if anything, made worse by the boom period excluded from the cited study.

But what really irks is the assumption of causality: the title here makes clear that income equality *produces* indebtedness and global imbalances.

As such, it doesn’t: rather, increases in income at the top 5% results in increases in savings of that cohort, which, given the increase in capital, reduces real interest rates for the rest of the population. Now, that is in and of itself a good thing: capital is more easily available. There is no analysis here, however, of where those loans go to: only that debt increases (duh: it’s cheaper to go into debt, hence debt increases) and, presumably because much debt goes into consumption rather than investments with the rest-of-the-population 95%, the current account worsens as domestic supply of consumer goods fails to meet the short-term effects of increased demand, which are instead met by imports (worsening the current account deficit).

But to say that income equality *produces* this is to fail to understand that it’s not income equality producing this, it is a functioning open capitalist economy that produces this. Increasing inequality in a country won’t cause it’s current account deficit to increase: the increase in the current account deficit is the result of increased consumer spending, in this case fueled by consumer debt, which increased because rich folks are competing to lend those less well-off money (making interest rates less expensive). You can’t cut out those intermediate steps without making it look like there is some sort of direct cause-and-effect going on here. The increase in debt and current accounts are intermediate effects of this, but not direct effects.

This is intermediate because the players involved change: it is the consumers who go into debt at a faster rate who “cause” this, not the top 5% income earners. The latter can’t make consumers go into debt: they merely make it possible. There is, as well, an upside: lower income folks were able to acquire equity for lower costs than would have been the case otherwise. Of course, if they chose to use that equity unwisely by spending it on consumption, rather than investments, you can’t blame the top 5% of wage earners for that (unless, of course, you have an ideological axe to grind).

There are also external factors in play: countries such as Switzerland, the Netherlands and Germany, for instance, have very strong current accounts due to structural advantages and by design (Switzerland and the Netherlands occupy strategic trading points; Switzerland and Germany also are heavy exporters of advanced machinery and equipment). This distorts, of course, the results.

Nonetheless: an interesting analysis that could be improved on…

Your analysis is shallow.

You have to factor in the large, large class of people who can *only* make ends meet by borrowing. The curious trend where financial institutions lent to people who were obviously not creditworthy. This is clearly not the fault of the poor borrowers — better to borrow than to starve — but the fault, first, of the financial system which failed to give them wages they could live on, second, of a government which failed to provide them a social safety net, and third, the fault of the financial intermediaries who lent money to them, using the money deposited by the rich.

Indeed, the excess accumuluations by the rich run directly into the excess lending to the poor, and unless you have an ideological ax to grind, you cannot blame the poor for it. You really have to blame the intermediaries — the credit card companies and similar operations who, in order to manufacture “investments” to sell to the rich (who have too much money to invest productively), started turning poor people into debt slaves.

High rates of debt slavery never end well for a society. Unless the debts are forgiven, which they should be.