By Richard Baldwin, Professor of International Economics, Graduate Institute, Geneva. Cross posted from VoxEU

The Eurozone crisis moved into phase 2 this August when the contagion spread to Italian debt, Spanish debt, and most EZ banks. Radical ECB actions prevented a disaster. This column argues that the ECB emergency policies are unsustainable politically and perhaps legally. The only policy combination that EZ leaders could agree on quickly enough involves political cover for ECB bond buying in exchange for national fiscal reforms of the German “debt brake” type.

IMF Chief Christine Lagarde made phase 2 official: “Developments this summer have indicated we are in a dangerous new phase” (Lagarde 2011).

Phase 1 was the Eurozone (EZ) periphery;

Phase 2 is the EZ core (Gros 2011).

It is now possible that more Eurozone nations will need bailouts and Europe will fall into a Lehman-size recession (Wyplosz 2011).

This changes everything. Eurozone leaders must wake up and get a grip on the situation before it tumbles out of control. They’ve been sleepwalking since May 2010, so it may take a stock market crash to stir them to action – and the stock-market alarm clock looks set to go off soon.

The crisis – phase 1 and 2 – turns around perniciously entwined bank and government debt problems (Wyplosz 2011, Eichengreen 2009).

The danger

There is a line between illiquidity and insolvency for nations and banks. However,

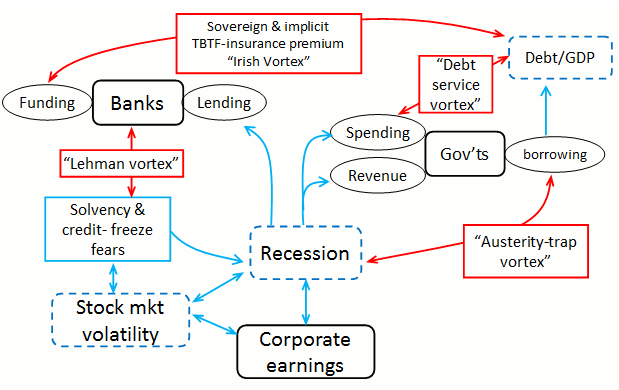

Fear-gravity can drag illiquid nations across the event-horizon and into the black hole of insolvency; this is the debt-service vortex shown in Figure 1. If the nation tries too-little-too-late austerity, it can fall into a Greek-like austerity vortex (Figure 1, ie austerity lowers incomes hence worsening the deficit).

Fear-gravity can also pull banks across the event horizon via the Lehman vortex (Figure 1, ie fear of solvency freezes long-term funding which makes banks insolvent).

As bank failures would mean too-big-to-fail bailouts – and such bailouts would throw some nations into insolvency (the Irish vortex in Figure 1) – the banking and government problems are perniciously entwined (EZ bank liabilities are a multiple of EZ government debt). The connection also works in reverse; as banks hold vast amounts of government debt, sovereign insolvency could produce bank insolvency.

Recession fears are central (Figure 1); they feed on and are fed by the Lehman, Irish, debt-service, and austerity-trap vortices.

In early August 2011, fear-gravity pulled Italy and Spain and most of the major Eurozone banks sharply towards the event horizon.

Italian and Spanish yields jumped into solvency-alarm territory, EZ bank stocks plummeted, and both of their default-insurance prices soared.

The ECB quelled fears by buying eye-popping amounts of Spanish and Italian debt (Trichet 2011).

Keystone problem: ECB actions are not sustainable

The problem that makes this mess into an historic moment is the simple fact that the ECB’s actions are unsustainable politically, and perhaps legally. A situation where the unelected President of the ECB sends ultimatums to the Prime Ministers of large democratic nations cannot go on (especially when they call his bluff). And it will not. Someone needs to rouse EZ political leaders so they can work out a more permanent solution.

Figure 1. A dangerous new phase

Short-term solutions

The Eurozone’s long-term flaws have been widely discussed by Vox columnists over the past few years; the last eBook provides a compendium of long-term solutions which are still relevant (Baldwin et al 2010; also see Suarez 2011 and Cooley and Marimon 2011).

The short term solutions, however, are much more limited. Someone needs to backstop the debt of solvent Eurozone nations. (Note that EZ banks are already backstopped in the short term by the ECB in the same way Irish, Greek, and Portuguese banks are backstopped already but in the longer run they too need more durable backstopping; see Onado 2011.) As Guido Tabellini said: We need to draw a line between EZ nations that are solvent and those that are not – before the market does it for us (Tabellini 2011).

There are two options:

The ECB continues backstopping government bonds, but gets political coverage (Wyplosz 2011), or

Leaders create a Eurobond scheme, ie a NATO for EZ debt.1

EZ leaders must choose between these two paths in the immediate term. But both debt-support options are politically infeasible unless the inflow of new debt is credibly controlled. No one in Europe wants to give a blank check to profligate governments. Here there are two options:

National government adopt credible domestic institutions (eg Germany’s debt brake), or

Fiscal policy is shifted to the supranational level (eg fiscal union).

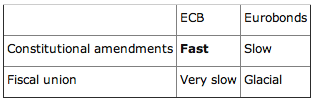

Vox columnists have discussed many variants (see the new EZ Crisis: Phase 2 page here), but the choice is really not that difficult, as Table 1 shows.

The only short-term solution that can be adopted fast enough is the combination of the ECB backstopping government debt in exchange for credible, domestic fiscal institutional reforms.

This was the package that was put together in the panic of early August 2011.

It seems likely to be the only one that could be embraced by EZ political leaders in a realistic horizon.

Table 1. Speed of short-run solutions.

Things that won’t work

Eurozone leaders thought they had fixed the problem with their July 2011 package. Although this has not yet been passed – and it does need passing – the July package is essentially irrelevant to Phase 2. As Gros (2011a) writes, “…the EFSF will simply not have enough funds to undertake the massive bond purchases now required to stabilize markets. It was sized to provide the financing promised to Greece, Ireland, and Portugal.” Moreover, the EFSF itself may get caught in a vortex.2

The debt of Spain and Italy is a few trillion euros. The EFSF is capped at €440 billion, but the real problem is that it is capped at all. Once investors start to fear it might run out of buying power, they will try to take out their trillions and thereby validate their fears.3

Policy paralysis

Much of the August panic was due to the growing perception that policymakers are paralysed by dysfunctional politics. Political leaders spun a web of fictions to shield themselves from the blame they deserved for the 2008 crisis and the resulting Great Recession as well as sluggish income and job growth. These fictions are hindering them from tackling the underlying problems.

Conclusion

EZ leaders are hoping against hope for growth redemption – a strong recovery would end almost all these problems costlessly.

But this hope has faded. Partly this is due to external factors (US policy paralysis and the current shortage of traditional macro policy leverage), but also partly due to Eurozone leaders’ failure to act – and increasingly, a perception of their inability to act. At this late date, it is better to pull out the aching tooth before the infection spreads to the point where more radical surgery is needed.

I think the stock-market alarm clock will finally wake up Europe’s leaders. I just hope they actually get up and put the crisis to bed, rather than hitting the snooze button and heading back to bed themselves. Leaders must act now, or prepare to become the Calvin Coolidges of the Eurozone.

“Leaders must act now, or prepare to become the Calvin Coolidges of the Eurozone.”

Coolidges? I don’t think so. This thing is moving much faster than that.

I suspect he meant Herbert Hoovers.

The author is not proposing workable “solutions”, just clichés:

“National government adopt credible domestic institutions (eg Germany’s debt brake)”

That’s exactly what Spain has just done with the constitutional reform and “markets” (i.e. speculator banksters) do not care at all.

“Fiscal policy is shifted to the supranational level (eg fiscal union)”.

It’s not possible. Even at state levels sometimes fiscal policies exist at lower levels (for example Basque provinces, Belgian regions, etc.) Fiscal union without previous political union is not a credible option and, would not work in any case.

The problem of the Eurozone is obviously to focus too much in the economical convergence without first forging enough political and social convergence. It’s building the house beginning with the roof.

Then he somehow jumps to this old formula:

“… in exchange for credible, domestic fiscal institutional reforms”.

The only credible fiscal reform is to persecute seriously (and not just symbolically) tax evasion. There’s no interest in doing that. Spain may have €100 billion tax evasion and the goal of the government is to get back €1 billion (a merely symbolic goal).

Also taxing financial transactions and companies quite more, because with the decrease of private incomes it’s virtually impossible to tax the common citizens much more (actually the taxes extracted from them tend to decrease quite fast).

The only option is to declare an orderly bankruptcy and jubilee for all. And whoever is creditor lost the musical chairs game: too bad (but deserved for speculating with peoples’ lives).

I don’t know how much of his overly abstract recommendations result from the author being an economist, versus he sees the situation as beyond redemption but he can say that only in a coded manner.

Surely you’re right, Yves: if someone writing for an income says what we’re saying here for free (i.e. that the situation is desperate and leaders had no clue of what they are doing), he or she probably loses that income.

Unless you’re able to get paid for being frank.

The main problem with propaganda/publicity is that it you end up living in a reality of almost systematic falsehood and that’s no way of dealing with real problems. That’s why democratic systems are supposed to be more efficient: because at least some people may speak out and not be jailed/executed for that, maybe eventually ringing a bell at the decision-making levels.

As a former economist agree with your assessment Ives.

On another note, a fascinating American trait (noted by Mencken) is that any critic or dissenter has to offer solutions! Its not enough to point out problems, clarify misconceptions but you have to give A SOLUTION. The nature of what constitutes a solution is of course a another matter (all civilization has been a series of solutions to problems real or imagined, to achieve some ideal state which of course is subjective anyway. Moreover, many of humanities problems are insoluable or if there is s solution many would find it unpalatable.

Capo, you provide a useful insight to those who are great operators of the day to day world of finance, but not real good at seeing the larger social context they operate in. The finance crisis has transcended finance. So, we now see a lot of people, who may have been frozen out of the dialogue in re economic pronouncements, because they have not made enough or managed a big enough pile of money to have a valid opinion.

Now that that money is NOT being made, you can’t bar people from the club of those who make valid statements about the economic and now the even larger political events that we are desperately trying to understand, much less solve. Getting a good, clear description, comprehending what just happened, a simple, valid analysis, is necessary before we can fix the problem. We have to know what the problem is. The technocratic tweaking that central banks, large banks, governments etc, are attempting, seem to do little more than prolong the agony and allow for a similar disaster to occur again. It has been several years, and given the risk taking, the clock is winding down.

Now, we have seen every earnest, sincere and even cynical and corrupt attempts to band aid the sucking chest wound to the economy to no avail. Here on NC, much of the meritocracy has been exposed to be without merit, and thoroughly debunked. The flaks that are sent here to troll the postings and comments are so idiotic, that no one even bothers to engage them with complete sentences to argue. I will say without doubt, that what has to been done, are major structural changes to the social order in order to repair the damage, and that is a political struggle. There is no policy inertia, or dysfunction, there is the chaos of a fight to the death over the future of the political economy. The republicans in America have laid bare their plan to complete roll back the New Deal, The Great Society, The Civil Rights and other equal rights for the majority of citizens and relegate them to menial servitude at best.

That is not solution making, that is power grab for the commanding heights of capitalism.

Wow. Great post and very insightful. Beware “solutions” profered on knee jerk ideological grounds without understanding what is going on! e.g. Left: Spend more Right: Less taxes let the magic of the market take over.

I think this would be bad, but politically I think the only option with any chance of working is not fiscal union, but fiscal colonization: the northern countries keep their fiscal independence, the peripheral countries lose theirs, then hold on tight and hope their is no explosion in the periphery. And if they were going to go this way, or be swept along in this direction, the trick would be to make the colonization angle as obvious as possible in the North but try to hide it as much as possible in the South.

If this is the situation, then the discussion among those with status to lose will be veiled and obtuse. Or abstract.

That is precisely what they are doing. And is not going to work in any way: it is NO solution and it can only fuel inter-ethnic hatred. And there are many many different ethnicities in Europe, many of them with formally sovereign states and armies. You don’t want EU to become Yugoslavia II, do you?

Any solution needs to fit the diversity of Eurozone needs (a balance) and the majority of Eurozone demographic weight (the South).

But IMO there’s no solution: bankruptcy is necessary and f**k the banks. The real economy does not need the banks, only farms, industries, transport, workers, managers…

The real problem is that under this late and decadent version of Capitalism, the economy is not at the service of the people (it was never the case but at times there was a pretense of that). The solution is to force the economy to serve the people, providing goods and services the people need: food, clothes, housing, communications, economic infrastructure itself (roads, energy, waste recycling, machines, distribution…) and some decent leisure and culture (and management). If banks have problems, that is irrelevant for the real economy, which I just outlined.

Real democracy requires that the economy is managed of the people, by the people and for the people. Anything else is a crime against humankind.

The European Union is a banking arrangement, not a political union.

Call it economic union if it pleases you.

What it is, in practice, is a joint checking account shared by near-strangers in a dormitory. Daily proximity inspired the choice of partners, not real economics.

For decades, the push was to get everybody in the dorm to join, and the big thing was to invest in tulips or credit swaps or sumthin’. Anyway, in the going thing at the time.

Which went all to pieces in 2008. The joint account is overdrawn beyond comprehension.

There’s no recipe here for cooperation. There never was.

If Europarl declared a fiscal union plan, announced that the private banks which caused the problem must have their executives jailed, and ordered the printing of money and the liberalization of bankruptcy laws… it would probably have just about enough credibility to push it through.

Europarl appears to be out to lunch, though.

Hahaha! The European Parliament is just a circus to give a touch of “democratic legitimacy” to essentially authoritarian and anti-democratic institutions. The EP has almost no real power and anyhow the EPP and the PES are there to defend what their leaders at state level want – and like in all member states the twin-party system rules at EU level, without realist third ways, without right to referenda, without anything but routine 4-year wasteful elections in which most citizens vote on state or local clues, not European ones.

The EP is not mean to be but the farce it is.

Admittedly, I’m not a trained economist (which may not be such a bad thing!)…so I don’t get caught up in the jargon and adrenaline rush of language known as “Econo-speak.”

Kindly observation: The mental masturbation in this field is at least equal to the mental masturbation I’ve found in my own (prior) fields of social psychology and religion (saying a lot)! So…

…letting go of such (a prerequisite, me thinks, for gaining a clear vision), here’s a proposed solution that’s making its way on the Internet and actually across the world in smaller interest groups (which may grow, no doubt, esp. with younger people speaking up more regarding what many see as complete insanity re: the whole “System” we’ve chained ourselves to for who knows how long):

First, realities:

1. There are limits to (physical) resources, and we are fast approaching those limits. (How many more mountain tops are we gonna blow up? How many more land masses are we gonna “frack”? How many more oil wells are we gonna drill in deep waters?)

2. We’re also reaching limits re: our penchant for dumping waste involved in such extraction and resource use…anywhere we feel like it. Simply: The world’s garbage cans are full, and our land, water, air cannot take much more abuse from us. Add: Developing countries are beginning to get wise as they see more and more of their citizens getting sick and dying from the carcinogens the rest of the world so conveniently dumps on their shores via the waste we try and get rid of once we tire of the latest cell phone or I-pad.

Translate: Our manic-oriented, never-ending consumerist society MUST transition into a steady-state, shared resources “contributionism” society if this planet is going to be around anytime for the foreseeable future.

How this relates to economics and money:

1. More and more people are “waking up” to the dystopianism of using money (and banks) as some kind of central role in the life of this planet.

2. More and more people are “waking up” to the possibility of phasing out money (and banks), and phasing in a shared resources/resource-based/contributionism “economy.”

Anyone who doesn’t see the tipping point this world is at…me thinks is still wearing blinders. The Old System…is simply not relevant anymore. And certainly way beyond “fixing.”

We need a major “Shift” here. A major Shift.

I won’t leave links, but trust if some part of you “gets” what I’m suggesting…you’ll start your own online search.

Bottom line: Many on the planet are moving beyond hyperbole and vocabulary and formulas, ratios, status quo analyses that come from traditional frameworks. And instead are beginning to offer completely New Models. NEW models.

Simply: We’re not in Kansas anymore.

We’re not in Kansas.

Thanks for considering.

I am 62, and agree with you completely. I give my age, because throughout those years, it has become evident that money, in and of itself, is the destroyer of worlds. I feel there is a hugh change occurring and it will bring about a “wealth” for all peoples.

Well said, Barbyrah. Keep it up!

I emphatically agree.

Let’s say that Spain and Italy pass and adopt constitutional amendments that call for a balanced budget within six months.

How are they expected to grow. And what happens to the ECB balance sheet when, on account of no growth, Spain and Italy’s debt/GDP continues to creep up?

Fiscal union without prior political union is perfectly viable — it’s actually been done before. It’s just unusual.

It tends to result in the immediate withdrawal of some percentage of the “creditor” countries, who don’t want to play. But the ones who want to stay in stay in and it can work.

“The only short-term solution that can be adopted fast enough is the combination of the ECB backstopping government debt in exchange for credible, domestic fiscal institutional reforms.”

“The debt of Spain and Italy is a few trillion euros. The EFSF is capped at €440 billion, but the real problem is that it is capped at all.”

The capacity of the ECB to backstop its nations’ sovereign debt is precisely the capacity of those nations to grow. If they don’t grow, all the money in the world (whatever that means) is not going to help at all. Whence does the money come to backstop debt? From the future earnings of those indebted nations. We have only ever been able to borrow from ourselves, but growth has made that Ponzi dynamic seem sensible, permanent. Growth ‘pays’ for everything (ignoring externalities of course!). So growth is essential to this system. If growth does not happen, that “backstopping” will prove to be monopoly money. If a sufficient number of the citizens of Europe (in which Spain has over 40% youth unemployment, and I think Europe wide that figure is over 20%) fall out of love with Growth, Consumerism, The System, and no longer want to play ball; if a sufficient number renege on the famous social contract and step outside state processes to start building alternative systems of governance and finance, then the ‘expected’ growth will never come. “Backstopping” is totally moot. And if the maths of peak oil are accurate, then even with the willing compliance of all Europe’s citizens knuckling down and being good little workers, the kind of growth we enjoyed during the 20th century is not coming back. The key factor here is therefore growth. If that can’t be delivered, all this shunting of debt here there and everywhere is rearranging deck chairs.

“EZ leaders are hoping against hope for growth redemption – a strong recovery would end almost all these problems costlessly.”

Just as the author’s ‘plan’ implicitly requires.

“But this hope has faded. Partly this is due to external factors (US policy paralysis and the current shortage of traditional macro policy leverage), but also partly due to Eurozone leaders’ failure to act – and increasingly, a perception of their inability to act.

No, the reasons are far more fundamental. Peak oil; an interest-bearing, debt-money system which has the same basic dynamic as a ponzi scheme; the profound emptiness of consumerism, and the corresponding loneliness it delivers; societal atomization run amok; and the dawning awareness of people across the planet that these things are so. Politics cannot cope with this challenge because it cannot fathom a different way of doing things.

Holy Maze of Cyprus Batman!

Does that chart come with an instruction manual? or is there some class I can take to get up to speed?

Toby you hit the bone on the head. Although frankly I’m not sold on the Peak Oil theme, as emotional as that gets for many folks, I really do think that energy and mobility technologies will evolve to take up the slack and there will be a rise from the ashes.

For the eurozone, the path of least resistance is some sort of common eurobond, which I’m sure the Germans will find a way of agreeing to once they’ve thought carefully through all the options. Most people are lazy and it takes a lot of energy to live through a social collapse. It sounds exhausting to me. Maybe they’ll even decide to buy some exports from the periphery just to put some cash in the pockets. After all, they can convince themselves their debtors are working to pay off what they owe.

PS, I’m not sure it’s a total cooincidence that the archeologists discovered that Roman gladitorial school outside of Vienna just now using underground imaging technologies to penetrate the surface. It’s all a metaphor for the “wake up call”. There’s always a sign in the sky if you look.

I’m not emotional about the peak oil thing, nor do I believe we, long term, have an energy problem. Nevertheless we cannot afford the consumerism and growth that characterized the 20th century, and this truth has enormous ramifications. Also, oil is not just about energy; there’s oil-based fertilizers and plastics and much else to consider. Soil fertility is falling across the planet, and big ag farming is terribly wasteful of the planet’s water. I don’t think these issues are being addressed seriously enough, certainly not in the mainstream. It does not get much more serious than soil and water (apart from air, and that’s another issue).

As for bonds, they´m is interest bearing debts, which require growth not to be ’empty’ paper-money. I’ve maintained all along that we need an entirely new money system, and now I’d include the break up of nation states down to regional ‘independence’ loosely federated across the planet. But that’s way too much to deal with in a simple comment section. If the mood so takes you, check out Charles Eisenstein’s “Sacred Economics” which has good ideas for transitioning to the steady state economics we need to embrace as quickly as we can. Whatever it ends up looking like, it will be very different to the Perpetual Growth model we are still insanely trying to whip back to life. And Graeber’s “Debt: The First 5,000 Years” is excellent. A Very Important Book.

I’m glad to finally have hit that bone on the head. It’s been pissing me off for years.

The Germans don’t want a Eurobond. Neither do the citizens of northern European countries.

Why is it that some believe that they know what’s good for Germany better than the Germans themselves.

What’s the difference between a NK reader believing that he knows what’s better for Germany moreso than Germans themselves, and Congressman Ryan and his supporters, who believe that the American electorate is too ignorant to realize just how “unsustainable” the Safety Net is?

In both cases, I defer to the wishes of the electorate. In Germany, that means no Eurobonds, no transfer union. In the US, it means no vouchers for Medicare.

Where’s the Mosler bond? Still nowhere to be seen. Half that Vox EU lot are a dodgy bunch anyway. Daniel Gros — the Vox EU master of ceremonies — on Irish radio this morning:

“Eurobonds are not realistic because some European governments will simply refuse to wind down their debt-levels should the bonds be issued,” said Mr. Gros, speaking on the Pat Kenny show this morning. “There’s no real solution to this crisis if Italy and Greece don’t start behaving themselves.”

Translation: “WAAAAAAAAA!!! *Moan* *Moan* *Moan*”

Radio presenter points out that austerity is becoming discredited.

Gros: “No it’s not — look at Latvia.”

Thank you Daniel Gros for falling from the catagory of ‘mildly interesting’ to the catagory of ‘completely irrelevant’.

“EZ leaders are hoping against hope for growth redemption – a strong recovery would end almost all these problems costlessly.”

The same exact thing is happening with America right now. Based on experience with post-WWII recessions, the President and members of Congress from both parties have been expecting that the economy would “fix itself”, one way or another, for the past couple of years, and continue to cling to this false belief. The typical post-WWII American recession has lasted just a few quarters, and then a year or so after its official end, growth naturally came roaring back. The experience window needs to be rolled back to include the 1850-1940 period. This particular type of event, which we (Americans) haven’t seen in a long time, can go on for many years, and may never resolve itself absent some impetus of enormous magnitude from the government. Japan found this out 20 years ago. Collectively, we refuse to learn the lesson.

The eurozone was doomed from inception, as it created a group of monetarily non-sovereign nations with no source of income. There are two and only two long-term solutions for the euro nations:

1. Return to Monetary Sovereignty by re-adopting their sovereign currencies

or

2. Form a true United States of Europe, in which the EU supplies euros to its member nations, as needed.

There are no other long term solutions for monetary non-sovereign nations.

Rodger Malcolm Mitchell

Malcom — your number 2 solutions reminds me of a couple having really bad maritial problems. There solution is to have a baby thinking that will fix things.

Recently I was speaking to a German doctor friend of mine. A very educated person with both an MD as well as a Phd. I was surprised by the let us just say extreme dislike for the French and that even after she has spent over half her life outside of Europe. Besides what does a German have to dislike the French about.

There are real strong emotions between these countries going back centuries.

Exactly. You express it well.

> Besides what does a German have to dislike the French about.

Some of the highlights between these two nations if you assume a German point of view:

* 30 years war

* France creeping land seizures while the German states were busy elsewhere (e.g. Alsace while the Turks were besieging Vienna)

* Napoleonic wars

* Treaty of Versailles and Weimar hyper inflation

>There are real strong emotions between these countries going back centuries.

Exactly. Every European nation has some historical axe to grind with everyone else which isn’t explicit but still implicit in the psyche of the people and which will reemerge once there is a crisis necessitating some form of wealth redistribution. You could say the only reason why the US worked is that it started with a clean sheet.

Great comment. Add on-

Asia is even worse than Europe in this regard.

Wow if these people are angry about something that happened in the 1600’s I should be really pissed at Yves for being a Yankee and a white women since my ancestors make up three Indian tribes as well as living in the south since 1660 and my great great grandmother died walking the Trail of Tears. Long time to hold a grudge.

There is one other solution: The EU informs the Greeks, etc. that there are no more bailouts, they Greeks, etc. are broke, and each nation will do what it sees fit to protect its own banks, or will execute bankruptcy processes. The Greeks are then free to try to borrow money — at last report, for 1 year bonds, something around 50% interest.

Update, George — to be fair, perhaps from a couple of hours later than your post. Greek 1-year yields at 82%:

http://static.safehaven.com/authors/mish/22434.png

When is the default going to be officially announced?

*checks watch*

Mr Haygood;

Yikes!! 82%? Are there any serious takers even at this rate of ‘return?’ Plus, how’s the ‘divestment’ of the Greek public sector going? Now that the good assets are slipping away, how’s that 82% going to be repayed anyway?

In June of ’14, after Archduke Ferdinand received a nick in his jugular vein from a passing .380 slug, he remained upright in his seat and declared several times, “It is nothing. Drive on.”

Followed by his passing away where he sat, followed by the crowned heads and grey beards of every European state failing to make the necessary negotiations soon enough (or at all) to avoid being at complete loggerheads for decades thereafter. Two world wars and the Cold War were the palpable results.

Ahh, but it is an inspiration to this day to think of the Archduke sitting upright and stoic unto his very death rattle, and even beyond. It’s just so . . . European.

I know not what course others may take, but I’m buying stock in little folding shovels. The grey beards of Europe have been digging ever deeper into the hole they are in, since ’08 now. The hole is simply deeper. The only change to expect is that they will turn to digging parallel slit trenches again at some point.

What else, mon ami? They respond on all sides with, “It is nothing. Drive on.” We know what follows, oui?

Pick any of the TBTF banks of Europe. Rename it Ferdinand, and wait for its death rattle. Ferdinand has been shot, and we are “driving on.”

It’s just so . . . European.

Nice story and well narrated, Antifa.

Just that Ferdinand was irrelevant, an iconic circumstance of a war that was pre-determined by the crash course of the then historical first power (Britain) and then new first power (Germany). It could have blown in Morocco or it could not have blown with Ferdinand… but it would have blown anyhow.

Still I do not think that EU will become Yugoslavia-2. At worst USSR-2 (peaceful divorce with long persistent economic depression). The problem is that a divorce is not a solution and that most states want a common currency, common markets and greater integration. What they do not want is that, because of a German-style overvalued euro, their economies cannot anymore compete with China, Russia or the USA (or even Poland and Britain) in equal terms.

The agreement must be revised to be less German. Germany is dragging its feets and forcing all the Union into collapse for that reason. They enjoy the support of the Anglosaxon imperial propaganda machinery but propaganda cannot solve real problems, just make them worse.

If the Germans want to leave, I have no problem at all. The Germans are the ones to have problems in fact.

But they won’t leave: they’ll make the Irish pay their broken cutlery, they demand half Greece in exchange of a small favor and they go around insulting everybody else as “lazy” and “pig”.

And then we get to know that it’s the Germans who are the lazy ones and the overpaid ones if anyone. Just that they have a peculiar high tech economy and can do with that (but the rest cannot). Greece does not produce aspirines, nor modems, not even cars last time I checked… Their economy is much more like that of Turkey than that of Germany, even if there has been some convergence in the last decades. And like Greece is most of the EU.

So what needs to be done is to design the EU and specially the euro for Greece and not just for Germany. And if Germany must leave for that reason, let it be.

Dear Antifa;

How European indeed, but how narrowly focused. Does anyone, even then, show compassion for the other victim of the Serbian gunman, Sophie, Duchess of Hohenberg, wife of the Duke? The powerful and famous get all the press, how European. What about all the wives and husbands who will have their lives ruined and degraded because of the misdeeds of an elite of crooks? The same old story, alas.

RE to Roger M Mitchell,

RE to Roger M Mitchell,

Although, yes, the Euro currency was a very bad idea made worse by inept implementation–and although it’s almost certainly on its way out one way or another, sooner or later–the best answers to various current urgent economic troubles do not include going further with plans to make a sort of “United States of Europe”. Europe is not a nation and much less a cohesive culture. For all the claims people make about their “feeling” (identifying as) “European”, this is mainly a very vague feeling with little in the way of practical devotion behind it. Just as it is now less and less clear what (if anything) still binds Americans (i.e. U.S. citizens) together as a people (I’d contend that Americans were once a people and today very much less so), there are serious and still-unanswered questions about what does or could realistically bind disparate Europeans into a popular public which can make a continent-wide international representative government work in practice rather than in theory only. For Europe, this is truer still. The nations have histories with baggage and this includes still-vividly felt attachments or repulsions about the rest of the continent. Simply installing continent-wide institutions in the expectation that actual popular opinions and, more important, deeply felt sentiments, will sustain them is very risky and unrealistic. Each nation’s governments act and react with their various electoral constituencies constantly in mind. The needs and interests of these people are not necessarily in harmony much of the time. And, even when they are in harmony, other powerful factors–such as the selfish and contrary interests of corporate and financial actors, can thwart putting what Europeans do agree on into practice.

The more Europe emulates the neo-liberal (i.e. neo-conservative political and economic dogmas so popular with the ultra-extremist reigning Republicans and others, more outside that extreme-stream such as Ron Paul and Tea-Partiers, the worse things are going to (continue to) go.

From scanning your referenced webpage, I suggest that you (and Ron Paul) are living in a dream world and acting on nonsensical beliefs which are producing nightmares in the real world.

“From scanning your referenced webpage, I suggest that you (and Ron Paul) are living in a dream world and acting on nonsensical beliefs which are producing nightmares in the real world”

“Scanning” must be the operable word. RMM and Ron Paul do not even remotely believe similar things about money. I’ll let RMM defend himself, but “reading” might be better than “scanning” if you want to understand the thrust of the argument.

Nations without sovereign money will eventually end up with sovereign money, but the path is always painful

Schadenfreud is a useful thing. Is it just me or has anybody noticed the significant uptick in reporting on “the crisis in europe” just as things in the U.S. have gotten worse. Back say 5 and even 3 years ago, you had to go to the FT or El Pais to see what was up in Europe. Now coverage has increased in the U.S. and every other person here will tell you now: yeah but its just as bad or worse in Europe. Instructive yes, but a large part of this sudden interest by the MSN in Europe has other motivations beyond informing us peons. I don’t mean Ives of course but when CNN is droning on about things in Europe (most of their Anchors could not name 10 european leaders if their lives depended on it or find many countiries on a map….

The European Monetary Union is kaput, it is so because there is no European political union. A federal europe is a possibility with very long odds against it ever occuring.

From an economic point of view, it will come to repudiating a lot of debt that cannot be serviced coupled with a creep to a moderate degree of balanced budgets.

Everyone gets a lot poorer in a hurry.

A partial solution would be to issue amortizing bonds to replace the debt that cannot be immediately liquidated.

Or, current bond holders take a very big haircut.

Err, I am a econ newbie. One stupid question:

why are Euro and US banks permanently on the verge of bankruptcy whilst they receive copious amounts of money and instant profits basically for free from their governments and central banks?

The article implicitly affirms that the ECB remedy (printing money) IS “sustainable” economically: “The problem that makes this mess into an historic moment is the simple fact that the ECB’s actions are unsustainable politically, and perhaps legally.” But they do not raise political/legal scruple in re the EFSF; their problem with it is its underfunding. So, in the spirit of their marvelous Fig. 1, which resembles the Monopoly board game of yore, why not simply have the ECB use the EFSF as cover, i.e., have the ECB fund the EFSF (by buying EFSF debt) and let the EFSF spread all the funny euros required to ease the immediate crisis? This would mollify the harshness of the austerity measures, but promises of same in a misty future could be extracted in hopes of a “soft landing.” Europrinting would also improve the Euroland export picture by devaluing the euro, which might help the Germans get over their aversion to Quantitative Easing. –All in all, the authors seem optimistic that the Europeans will get their act together when they realize that the theater is on fire . . . .

The ECB is NOT printing money at all. That would be a good idea (even if it comes too late) because everybody else is devaluating systematically but us, and we are suffering for that reason.

But at the moment all the ECB is doing is buying some state treasuries, what is something all central banks do.

Also the ECB does not and cannot print money (cash). Money is printed by the Eurozone national mints (under the agreements of the Eurogroup).

Actually most of the money is printed by,

IIRC, 1-3 printing companies on behalf of the national mints. The coins are minted by less than 5 mints, mostly on behalf of others.

I should look up which countries have their OWN mints and printing presses and can physically print their own Euros. I think this will become relevant.

This nitwit lost me when he mentioned austerity. He didn’t speak out against it, instead he suggested it was necessary that they don’t do “too little too late”.

AUSTERITY NEVER WORKS! It CAN’T work. It is putting the foot on the accelerator of economic collapse and mashing it to the floor. It is also a GREAT way to generate some juicy social unrest. But then again…social unrest and violence against the state and moneyed interests is something I’m all in favor of so part of me hopes they go all in for austerity. Crash the whole thing and eat the rich.

Did anyone get any actual information from that diagram?

I hate to confess, part of why I decide to cross post this piece was the utter bizarreness of that diagram.

the more I looked at that chart, trying to follow the arrows and imagining what they might mean, the more I began to see an affinity with Marcel Duchamp’s world famous sculpture “Bride Stripped Bare By Her Bachelors”:

http://en.wikipedia.org/wiki/The_Bride_Stripped_Bare_By_Her_Bachelors,_Even

As I reflected upon this, I realized this visual aid isn’t a mere chart, but an exquisitely evocative map of a set of economic forces so complex that they very nearly defy illustration of any kind.

It begins and ends wherever you want it to, and it takes you on a journey of thought that requires you to participate, not as a mere viewer, but as a co-creator.

If it were more lucid, it would be less successful. In its inherent mystery we find its genius, and in its superficial clutter we see the very depths of complexity that any cogent analysis of economic logic will ultimately lay bare.

I would not call it a work of art, per se. It is both more and less than that. It defies categorization. It is a one of a kind phenomenon.

Haha that is great. I am having flashbacks to my MFA getting days.

I did my usual blink and just passed it by. As an experienced flow charter it is obvious that way too much info is included in that chart to understant it at all.

I normally get more info from diagrams, maps, charts and images in general than from text. Not in this case certainly.

But what had me blinking was the phrase “Lehman Vortex”. I was like what the heck… and eventually decided I would not know what the author meant. So I focused on the text, which I did not like either – too conventional and also talking about solutions but never mentioning them in any clear way.

Either he is many levels of knowledge ahead of me or, more likely, he’s just talking empty.

Dear Ackermann;

There is a lot of information there if you treat it as a Mandala. Sort of Zen Economics.

I believe the new solution is going to be:

1. Suspend mark to market for EU banks (not that they have been doing it.

2. Let countries default as appropriate. No mark to market no equity problems. Carry on as if nothing happened.

Problem fixed.

Up here in Canada, we once upon a time had a very wise radio talk-show host by the name of Rafe Mair, who was let go by his corporate masters because of his tendency to tell the truth. He had three political axioms. Here are two of them:

I. You make a serious mistake in assuming that people in charge know what the hell they’re doing.

II. You don’t have to be a 10 in politics, you can be a 3 if everyone else is a 2.

(I.) pretty well blows up Trichet, Lagarde, and all the other money mavens who would have everyone believe they know what they’re doing.

(II.) takes care of Sarkoczy, Merkel, Papandreou, et al, solid 3’s in a

political world filled with 2’s.

Thank you Rafe for your axioms. Words to live by.

In that case, I am afraid tomorrow morning I’ll have to put on my walking shoes, take a stroll over to my neighborhood friendly Societe Generale on Rue Dauphine, and rudely cash out my account with that crooked bank.

And while at it, I think later in the day I’ll get in my car and drive east to Vienna, to cash out my account with Raiffeisen Bank too. Yeah, I’ll pick up some Swiss francs on my way back — thank you Swiss National Bank for making your currency so much more affordable to me today — you’re a true friend to the little guy…LOL

a wonderful post, which simplifies what Europe’s actions can be. or rather, what Europe won’t do. Print money and bail everyone out, or choose austerity which will starve the economy and hurry up the eventual collapse.

maybe that is the “Lehman vortex. America is not far behind if the Republicans/Democrats continue on with present policies of stealing from the poor to give to the Rich.

what seems likely is the Euro crash will affect the American Dollar and our kleptocratic society. Welcome to 1984, American Style. lol

how much longer can either Europeans or America feed the monster/deviant capitalism our societies are collapsing from. the time frame is what is most fascinating and elusive to pin down.

the collapse of the Euro is easier to follow than the collapse of America due to the Banksters/Elites who control America today.

Thanks a lot, Yves, for this space and conversation, even from up there in Maine. lol

So the solution is to conjure a virtually infinite balance sheet based on “credible commitments” and pray nobody has a memory?