Sometimes, when you’ve dug yourself a really, really deep hole, the only option is to keep digging in the hope you’ll somehow come out the other side.

We’ve been perplexed for months with the persistent PR push to pretend that the formerly “50 state” attorney general mortgage settlement negotiations were going anywhere. And bizarrely, in true zombie fashion, the press push continues unabated even as the talks are effectively dead.

As we pointed out, the departure of Kamala Harris, the California attorney general, last Friday means the state AG participation is pretty much moot. Enough important states have abandoned the talks that even if all the remainder were to go forward, it wouldn’t buy banks the desired protection from litigations.

But these talks were destined to fall apart; the only question was how quickly. Both Dave Dayen at FireDogLake and your humble blogger pointed repeatedly to the disconnect between the story that kept being pumped out every three or four weeks since January that a deal was mere weeks away. Yet every leak contained enough substance to demonstrate that the two sides were hopelessly far apart, and thus no pact was imminent.

Now of course, this wasn’t and isn’t a state AG effort. The DoJ, HUD, and various Federal banking regulators are also at the table. The participation of the AGs was important to disguise the fact that the Obama Administration wants to say it got a deal as proof that it is taking concrete steps to address the housing crisis. But these negotiations were clearly Son of HAMP: presented as a way to help homeowners, but since anything that might inconvenience the banks was off the table, the program likely did more harm that good (many consumers lost their homes as a result of being misadvised by the banks as to how the program worked, particularly that they’d be assessed late fees and expected to make up the payment shortfall if they were give a trial mod but not a permanent mod).

The persistent effort to promote the idea that the mortgage settlement talks were moving forward has the hallmarks of a concerted PR effort. And there’s further reason to suspect the hand of the Treasury Department in this effort, since there is no reason to believe that Tom Miller’s office would have the savvy or the contacts to orchestrate a national campaign. Our Tom Adams noted that stories were repeatedly fed to reporter who weren’t on the mortgage beat (like Ben Smith of Politico) who would be certain to lack the expertise that would enable them to ask tough questions. Matt Stoller pointed out nearly two months ago that it was silly for reporter to keep repeating the officialdom’s party line that a deal was nigh when it was obvious no such thing was happening.

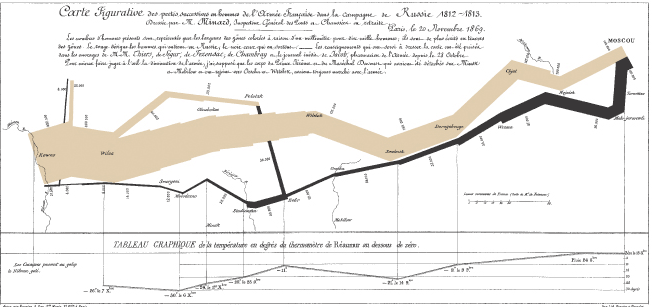

So what do we have today? The preferred outlet for securitization industry stenography masquerading as news, Housing Wire, trumpets that the settlement talks are moving forward! Yes, and so did Napoleon’s 1812 Russian campaign. Remember, the Emperor of France actually took Moscow but then abandoned it, at huge cost in men and materiel.

We suspect this campaign will prove to be equally successful for Tom Miller.

Jon Prior of Housing Wire, to whom fell the sorry task of painting lipstick on this pig (the article is titled “Iowa AG forges ahead in servicer settlement“), seemed unable to recognize headline-contradicting information in his account. From the article (hat tip Matt B):

Iowa Attorney General Tom Miller said he would forge ahead with the mortgage servicer settlement talks despite losing two key states in recent weeks, California and New York.

Yves here. Two states in recent weeks? New York has been out for months, and the tally of states that have withdrawn from the deal is much larger than two. Add Massachusetts, Nevada, Kentucky, Delaware, and Minnesota to the list.

Now get this part:

She [Harris] was the only other AG office in attendance at a meeting between the multistate coalition and mortgage servicers a week ago to settle an investigation into how widespread faulty servicing practices had gone. In her letter, Harris said the latest proposal between the two sides wasn’t good enough.

Huh? The only other AG motivated enough to show up at the latest session was so turned off by where the negotiations stood that she withdrew? If someone who was willing to deal decided the banks were being unreasonable, it isn’t hard to imagine other AGs who have been unwilling to play a visible role feel the same way.

Readers may think we are making overmuch of this example, but this is an important case study of how the Obama Administration has tried to use messaging to fool the public into believing it was acting their interests when its first priority was and continues to be to prop up the biggest banks. We believe that the more people understand how these con games work, the less effective they will become.

My comment is a bit unrelated to this item, but it regards BofA so I thought some people reading this article might have thoughts. The recent BofA debit card fee hike seems on first read like an insanely stupid PR move, especially considering the only thing keeping BofA afloat right now seems to be the implicit belief that the white house will not let another systemically important bank fail (at least a “disorderly” failure like Lehman). But, could the fee hike actually be a means to get depositors to move accounts out of BofA without the panic of a “bank run,” thereby at least setting up the scenario for a more orderly BofA failure in the near future (or at least the strong possibility of such a failure)? Maybe too conspiracy theory-esque, but I can’t understand why else the bank would take such a big PR hit for an insignificant increase in profits.

I’m sorry here Yves but I keep waiting for word of a congressional “solution” to this problem.

If the current build of pushback from us 99% is not enough to bring change I am confident that some sort of negotiated memorializing of the mortgage mess into “compliance” by Congress will occur.

Congress can’t fix this. Real estate is state law, there are over 150 years of Supreme Court decisions to that effect. That’s why the banksters have been unable to get a fix in. There are too many moving parts.

Which is, of course why the 50 AGs were invited to sign off and attend the party afterwards. It truly isn’t practical to have that many actual negotiators in one room, so signing on the dotted line after others did the negotiations was all that was expected of most of them. Turns out, that they’re harder to wrangle onto message than cats. They have different goals, political parties and aspirations, and the problems in their respective states aren’t any more uniform that the laws are. The wonder isn’t that the talks broke down, but that anybody thought that they ever had a chance in the first place.

50 state attorneys general were never negotiating. Because of the number of states, there were originally 13 state AG’s appointed to the team to handle the negotiations. I’m not sure how many are left (NY was one, IA, NC, OH who left for CFPB, AFAIK), but its mighty curious that none of the other 13 negotiators attended the meeting.

Does the only reason that anyone listens to Mr. Miller derive from the fact that his state hosts the first presidential caucus each election cycle?

Nah, I’m convinced it’s because the Treasury is helping with his messaging efforts.

And doesn’t everyone know that IOWA is an acronym for “Idiots Out Walking Around?”

The outlines of Kamala Harris’ character have been drawn by the issues with this settlement and I’m wondering if she backed away largely because it was becoming an embarrassment. Apparently, Harris is first a politician and second, perhaps a distant second?, an AG.

I have to remember to call my Attourney General and support/congratulate her. (I’m from MN).

this process sure has been instructive.

it also shows the merit of having differentiation between Federal and State governments.

I’ll be more supportive of the state AG’s when I see them actually going after some of the banksters. The crisis has been going on for about three years now. They’ve had plenty of time. It is their state laws that have been broken and their property laws that are not being enforced. So far, NY, and to a lesser extent, NV, are the only ones that have put forth a significant effort.

True. I checked into NJ AG’s efforts. So far she’s gotten several “settlements” with offending banks, but no one’s been prosecuted. At the top of the pyramid, cash has replaced jail as the penalty for breaking the law. Just write a check and go on about your business.

Let me guess. Beige is the size of Napoleon’s army on the way to Moscow and black is the size on the way back?

Yep, one of the best maps ever drawn.

Yves I think you’re right. The big “O” admin has been using the “spin cycle” all along IMHO to reward the Banksters (remember Goldman Sucks was his biggest donor), while at the same time “appearing” to “do something” for the little people.

The HAMP program was/is a total disaster. The gov let the banksters use it as a tool to foreclose on even more homeowners rather than provide any relief.

I think we’re going to arrive at a point where Americans will just chuck paying their mortgages entirely until something is done to correct all the injustice. That’ll get their attention!

as chris whalen has mentioned more than once in recent months, in 1933 the states began instructing people not to pay their mortgages–just their property taxes. going forward, with municipalities going bankrupt, this could be one way for them to try to keep themselves together. unfortunately, with the level of state governments’ capture by corporate power nowadays (e.g. health insurance and energy corporate interests), it seems like it might be a riskier step this time around.

It would be lovely to think that if people just stopped paying their mortgages the banks would come around- but in case you haven’t noticed, millions of people DID stop paying their mortgages. What happened? They got foreclosed on. Apparently it’s going to take a good deal more than that to get their attention.

http://www.americanbanker.com/issues/176_192/survey-risk-managers-credit-card-delinquencies-rise-1042772-1.html

We met with NJ AG senior staff several months ago, making the case that NJ home-owners have been severely damaged and need the government’s protection.

We calculated NJ is owed $87 million in recording fees and $2billion in transfer tax. We also tossed in legal fees to cover NJ home-owners Quiet Title Action – $1 billion.

All tolled, NJ should hammer these firms for far more than the $50 million they expected from share of reported $2 billion.

God knows NJ needs the dough.

We shared our data and workbook with a number of AG’s in the hope that they would sharpen their pencils and use these numbers to justify walking away from the table.