By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Another weekend…. and we are still waiting for an outcome on Greece. The chief negotiators from Institute of International Finance (IIF) have left the country yet we still haven’t heard anything that sounds remotely like a deal. FT reports that the brinkmanship hasn’t ended but there doesn’t appear to be too much wiggle room left:

Private owners of Greek debt have made their “maximum” offer for the losses they are willing to accept, the bondholders’ lead negotiator has said, implying that any further demands could kill off a “voluntary” deal and trigger a default.

Charles Dallara, managing director of the Institute of International Finance, said in an interview that he remained “hopeful and quite confident” the two sides could reach a deal that would prevent a full-scale Greek default when a €14.4bn bond comes due on March 20.

As I said last week, we will all just have to wait and see. There are many unknowns as to whether an initial deal can be struck and even if it can whether that will be enough. Is the rumoured 65-70% loss correct? Do the hedge funds have blocking position? Will Greece need to retrospectively apply a collective action clause to get a high participation rate? CDS triggers then? What about the ECB? Will the rest of the EU agree given they have a post-deal target of debt to GDP at 120%? Will there be any corresponding legal action?

Lots of questions, but no real answers at this stage. What we do know is that Greece has a €14.5bn bond payment on 20 March and to meet this obligation it almost certainly needs another bailout. If the PSI deal is not completed quickly (possibly by the next EU summit on the 30th of Jan) then Greece will not get the additional support it requires and will therefore default in 2 months.

It is true that 2 months is a very long time in European economics so anything could happen between now and then, but the outcome of Greece, either way, is adding pressure on to the other weak links of Europe, such as Portugal:

Greece’s talks with creditors are currently proceeding under the rubric of a “voluntary” restructuring. Yet ratings agencies have stated unequivocally that anything other than the original bondholder terms will be classified as a technical default. Greece, Zervos says, will be “the first example in a developed market for how you deal with sovereign default.”

All of which puts Portugal in a precarious spot. Most private investors have already fled the country’s bonds. But market observers say a Portuguese restructuring or default could still reverberate across Europe’s shaky banking sector, plunging the euro zone’s most vulnerable economies–and perhaps the entire global economy–into financial peril.

I am not sure that “peril” is the correct word, but there is no doubt the outcome of Greece, one way or another, will have an effect on other periphery nations. This year Portugal enters its third year under a bailout and this year is expected to be the toughest with more tax hikes and the elimination of two months of pay for civil servants. The government is already calling for a economic contraction of 3%, but a look at the latest stats from the central bank suggest much worse.

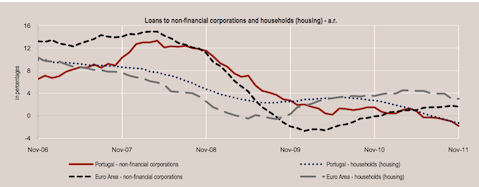

As we have seen in Italy, private sector deleveraging is accelerating led ,in part, by austerity government policy but also due to “zombification” of the banking system:

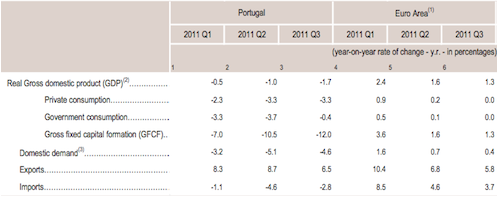

I also note that many economic indicators are heading in the wrong direction:

The Portuguese government did meet its obligations under its bailout agreement in 2011, but only by using a one-off transfer of money out of the banks’ pension funds to the government. In 2012 there is no backstop and therefore targets are unlikely to be met.

Over the weekend the government, with the final support of unions, introduced new reforms in an attempt to boost competitiveness including making it easier for employer to hire and fire staff, cutting holidays and severance pay requirements. It is yet to be seen if these changes can have an effect on the shrinking industrial output, but given the deleveraging environment this seems unlikely. Either way, the last thing the country needs at this point is a break-down in the Greek PSI talks that leads a further deterioration of trust in Europe’s periphery economics.

In other news Croatia wants in, Dexia is suing JP Morgan over mortgage securities and finally, Monti wants a trillion, the Germans want none of it, Draghi suggests something in the middle.

By which they lose the whole kit ‘n kaboodle. Their backs are up against the Wall as well. So, why should they want Greece to default?

Where’s the other side of the story? For as long as we keep quoting FT coverage of this sort of news, should we really expect objectivity in the matter? All it does is continue to heap the negativism that surrounds all such EuroZone sovereign debt and, frankly, makes one wonder if there is not media-manipulation afoot.

What is that the banks want most? The ECB takes on the role of guarantor of future Greek debt auctions … and whilst Ms Merkel is around, that is not going to happen. Ditto her successor, who will likely be from the SDP (Social Democrat Party).

Let’s hope so. Some people must learn the hard-way.

The banks are only slightly less responsible for the profligacy of some EuroZone countries. And, if these companies cannot pay their debts is it due not only to such profligacy but the fact that the economic crisis does not afford them the leverage in terms of tax revenues.

Yes, this should have been foreseen. By the banks, I submit. The CRAs had the opportunity a long time ago to down-rate the Greek debt – but as long as the banks were making money on the loans they said nothing. It was a damn good business.

Now, it’s time to take a haircut. So be it. Their reserve-funding requirements were intended for just such magical-moments. N’est-ce pas.

By which they lose the whole kit ‘n kaboodle. Their backs are up against the Wall as well. So, why should they want Greece to default?

1. To force a credit event

2. Because, truth be told, they aren’t going to get much out of this “settlement” anyway. The IMF and ECB get paid before the other holders. Greece cutting back on what it repays has a disproportionate effect on the ordinary bond holders.

If I could just point out again:

1. The pension funds and insurance companies are going to have some major problems in the event of a default. Somehow, everybody seems to think that only a couple of banks and hedge funds are involved. This is not the case.

2. Collateral must be posted by the CDS writers. A default right now shouldn’t cause that many more problems (beyond what a typical default would create)–the money’s already been posted. It’ll be interesting to see how the swaps react, though

3. If the CDS writers do NOT have to pay out, the interest rates in Euroland are going to go way, way up. Who the hell wants to hold this crap at low single digits (or teens, in Portugal’s case) when you can’t insure against the default? Not paying out, in other words, will cause more problems, not less.

It will also destroy most of the insurance companies in Europe, I think–they are obligated to buy this cra, and their reserves aren’t that good.

The states are already in default, since they are not delivering to their citizens in jobs, healthcare or other public services (only reason why states exist for). Why should the peoples bail out the usurers when they are being defaulted to first of all?

Time to go bankrupt, let the banksters lick their wounds in whatever islands they have bought with our sweat and move on with a different model, a people-centered one in which the economy takes its role as auxiliary of society not as tyrant of it.

Umm…??

How do you think the Greek government got into this position to begin with? It borrowed to pay for services it couldn’t afford, and then didn’t bother taxing enough to cover its spending and borrowing binge.

The conclusion you reach–that the government loses legitimacy once it can no longer run up its credit card–is outright bizarre.

What’s the purpose of the state, the social pact, other that getting people helping each other, at least to some extent? If the Greek (or whichever other state) cannot provide essential services of redistribution, it must be dissolved and a new (non-successor) socio-political entity created instead out of the real social fabric of the Greek People. That’s clear: because the current state is failing its very purpose in life and we do not need states that are mere military machines.

That first and foremost. States are not there to squeeze their citizens to dead in the benefit of foreign companies. That’s against their nature and implies intolerable loss of sovereignty-

In any case, the Greek state came to this situation is because it did not effectively tax the rich, because it keeps an oversized army, navy, air force and police. Per Wikipedia, Greece dedicates almost 4.3% of the GDP to the military (not including police) being the second highest military wasting state in Europe after its tiny neighbor the Republic of Macedonia.

Not a single cent of euro has been reduced, as far as I know, from military waste. Greece is also one of the biggest weapons’ customers worldwide, ranking 4th in 2004.

So how can you legitimately ask your citizens, who are being conscripted to the army (Greece is the only Eurozone state that keeps a conscription army in spite of decades long campaigns of conscientious objection by the Greek youth) to pay to foreign bloodsuckers, who incited and even bribed your political leaders to accept those illegitimate loans, to accept sacrifices if not even the military is reduced (or totally scrapped, why not?), the rich are not taxed as they must, the foreign boodsuckers do not pay taxes locally at all and tax evasion is still normal.

What you need is a regime change and a disorderly bankruptcy.

Two-month pay cut for civil servants : long vacation, I presume. Hahaha. I said to the butcher yesterday, more work, less pay. He nodded, grimly. From Madison to Athens, repression.

Friends;

It looks like we are in for the ‘Mother of Hard Landings.’ The Greek example is showing the way for not only the international financial systems ‘trip to the barbershop,’ but also the ‘realignment of power’ within the global social system.

I just finished a history of the French Revolution, and the correspondences are there: austerity and the publics discontent with it, a corrupt and ‘in denial’ elite, restive social movements, salons, of the Right and the Left, stirring things up… Louis XVI played his own version of ‘extend and pretend,’ and it ended really badly for his ‘side.’ I truly don’t think the modern elites know just how dangerous their situation is. Time will tell.

Not all the unions agreed. The biggest one refused to even meet with the government.

All the talk about soverign default ignores the CDS exposure of the big American banks. The only issue about which the elites are concerned is whether or not the CDS will be triggered. Those who think the ECB offers the only exit are ignoring the Fed, which can do pretty much anything it wants to do and explain itself later. This is all just a game of chicken between a rich uncle and his profligate grandchildren. Either way, the uncle has to win, unless he worries excessively about the affection of the grandchildren. The smart money is betting on more extend and pretend. The details only matter to those hoping for credit on the talkshow circuit. It’s all about electrons and words on paper, both infinitely expandable.

Don’t worry about the known problems; worry about the unknown problems.

A few questions about this CDS exposure.

I see the hedge funds crying foul about taking a “voluntary” haircut, claiming it’s a backdoor bailout of US institutions with CDS exposure like Goldman and AIG. Now AIG may be dumb enough to repeat its past mistakes, but does anybody believe that Goldman doesn’t have its CDS exposure hedged as well? I can’t believe they’d be so stupid as to issue billions in CDS against debt that looked ripe for failure from the get-go. To me this complaint sounds like a bunch of rats fighting over who gets the last of the cheese.

Secondly, I saw the argument that the hedgers didn’t care about the bonds defaulting because they probably had the positions hedged with CDS. Except nobody knows what these funds’ holdings are. So how do we know they even have the bonds in their portfolio at all? Maybe all they have are CDS. With the CDO debacle, there was no requirement to hold the underlying assets before buying the CDS. Anybody know if that requirement is different or has changed regarding CDS covering sovereign debts?

And thirdly, Fitch made the argument that even a haircut would trigger a default. Does this mean that any bonholders who agree to a haircut would still get partial payment and then be able to turn around and cash in again with CDS if they held those as well?

Any clarification would be helpful, because from where I’m sitting, it sure looks like all these rats have the potential to get paid off one way or another no matter what happens, with the Greeks and the rest of us being the ones to take the real hit.

As you said, worry about the unknown problems. Perhaps the reason the Goldies issued CDS against this debt is because they have an explicit guarantee of being made whole in the event of failure by Geithner and the Ber-nank once again.

And once again that zombie lie gets trotted out.

See here and here.

Instead of the zombie lie of the laziness and profligacy of Southern Europe, one might instead look at the current account balances of Germany relative to the PIIGS and perhaps be edified.

Or, to put it in simpler terms: The Euro effectively constituted as MASSIVE trade subsidy to Germany while acting as an export tariff system on Southern Europe.

Much of Germany’s growth after the Euro’s introduction came from export growth driven by the Euro being substantially undervalued for Germany (thus acting as an export subsidy) while being massively overvalued for Southern Europe, destroying their export competitiveness.

And where are the Orks demanding that German pensions be confiscated?

Yeah right, the world prefers German machine-tool automation systems more than they prefer Greek machine-tool automation systems because of the euro.

That’s also the reason that BMW has not located its manufacturing plant in Portugal or Ireland. In fact, the Irish were sooo overvalued that they had to beg American computer companies to set up there.

Try harder ….

AND FURTHERMORE

{Krugman:

And:

Regardless of his GIPSI Debt by GDP ratio trend line, the countries were profligate spending for basically one reason: They did not want to swallow the bitter pill of accepting high unemployment with a cut in either UI amounts or their tenure (often two years or more).

Which is why, before 2007, the line descends (as GDP outraces additional Debt) then suddenly inflects upwards as net tax revenues wilt due to a declining economy, so Debt begins to increase.

So they borrowed to support UI needs. I will remind you that France was doing the same, borrowing willy-nilly to support an unemployment rate that, since the 1980s has rarely been lower than 8/9% and for long periods was above 10%. This is part of their Social Justice system, that the burden be shared by all taxpayers.

This was profligate, given that they did have another alternative. To simply undertake the measures that are now unavoidable, that is,

* the Golden Rule of a balanced budget,

* the raising of tax revenues, and

* the deregulation of their labor markets.

They still haven’t got, after 60 years of the Common Market and the European Union, an agreement on a common Services taxation policy – though most of their GDP is, indeed, in the Service Industries. Such a policy would make more efficient the Service Industries.

MY POINT

The elastic finally broke because it had been pulled too far. The rupture had to happen due to past profligacy and the unwillingness of politicians then to bite the bullet and attack serious budget deficits.

If this is what Krugman means by following “unsound policies”, then he’s right – but there is no reason to differentiate between EU countries. They all were practicing the same policy.

And now it is Time to Pay the Piper with some hardship.

Whatever: bankruptcy is the solution for all EU. Full stop.

Try it yourself. You are probably perverse enough to like it.

Perverse? Me?! You hypocrite!

Perverse is to try to get the “debts” paid from someone who can’t even feed himself or family. Perverse is to try to get paid in form of slavery bondage… perverse is not acknowledging the fundamental right to bankruptcy!

The right to bankruptcy is so fundamental that even an ultra-liberal (i.e. in favor of private property and market economy) constitution as that of the USA acknowledges it as a basic right. So if it is in something so far right and archaic (it’s more than 200 years old!) as the US constitution, how can you even dare question that fundamental right?

Perverse? Yes, you are really perverse and evil and surely work for the bloodsuckers at Goldman.

You really don’t understand economics at all. Try learning some.

I’m sorry, I’m getting quite brusque about this lately. You’re talking arrant nonsense. Start with the fact that money is an illusion, that governments can print money, move on to the fact that governments need never run a balanced budget — then move on to the fact that the core job of a government is to keep everyone fed and busy (i.e. zero unemployment). Now try figuring out what the results of that are.

Dumb question, but why isn’t anybody pointed out the sheer lunacy of the EU’s hope that Portugal will have a “sustainable” 120% debt to gdp level by 2020??

1. Are they really expecting nothing to happen between now and 2020?

2. Since when is 120% debt to gdp considered sustainable??

3. Other than default, how will debt be reduced given that all countries are STILL borrowing money. They aren’t even seriously talking about balancing their budgets for…well..ever…

This is the bizarre thing of the entire charade. It’s not even remotely possible. The market knows it, the governments know it, the IMF knows it.

Since when is it untenable, as long as tax revenues are sufficient to make the payments?

Tax revenues in the EU are tied basically to the Value Added Tax (upon consumption) – as much as 60/70% of all tax receipts.

This tax revenue is far more solid than Income Tax, because of the high content (of income) that is “black” – that is, undeclared. Income is nonetheless spent, so recuperated by tax systems since the VAT is cascaded. That is, each step in the goods/services production process pays the VAT and then recuperates it as the good/service is transferred on – up to the final consumer, who pays the tax (around 20%).

What it means, however, is that tax revenues for upkeep of infrastructure or other expenditure goodies will drop to secondary importance. First will be paying off the debt and then other expenditures. This is unfortunate, but the price that such countries will have to pay. Including the US, btw …

So, pray tell, how is this any different from some American states, which have just about the same GDP as Portugal but only half the consumption sales-tax?

On February 31, 2012, after seemingly endless negotiations with creditors, all international holders of sovereign Greek debt will announce unanimously that they will forgive Greece 100% of her sovereign debt. Their official rationale will be: “If we keep spending all our energies on 3% of the Eurozone’s GDP (without really accomplishing anything), we will neglect the other 97% of the GDP and the cost of that will be much higher than forgiving Greece all her sovereign debt now”.

This means that the central government of Greece will no longer have any foreign debt. The domestic debt of the central government remains unaffected by this. Consequently, Greek banks, pension funds, insurance companies, etc. can remain hopeful that their loans to the central government will be paid.

Some time during March 2012, Greece will discover that things haven’t really changed that much. Even though the government now has to pay much less interest than before, it still requires new financing in order to pay all the bills. They cannot raise this new financing in international markets because part of the 100% haircut deal was that Greece would no longer request financing in international markets until the country had regained creditworthiness.

At the same time, the banking sector begins having severe liquidity problems. Part of the 100% haircut deal was that the ECB insisted on freezing its lending to the Greek banking sector. They would not cancel their outstanding loans but neither would they extend new loans.

The banking sector loses well over 1 BN EUR per month in liquidity because import payments exceed foreign revenues from exports and services by that amount. Also, capital flight continues draining the banking system of another 1 BN EUR per month (or more!).

With new capital inflow from abroad to finance these deficits having come to a halt, the government has no choice but to take dramatic actions: imports taxes and capital controls are implemented and the government issues a new bond whose purchase is mandatory for all domestic savers. This bond serves to finance the continued budget deficit and to provide liquidity to the banking system.

http://klauskastner.blogspot.com/2012/01/default-seems-to-be-approaching-if.html

And then soon there is no more money from anywhere. Break up the Furniture and burn it for heat eat what you can kill or steal!

Welcome to 100,000 B.C.

Yeah, that’s going to happen…on February 31.