By Matt Stoller, the former Senior Policy Advisor to Rep. Alan Grayson and a fellow at the Roosevelt Institute. You can reach him at stoller (at) gmail.com or follow him on Twitter at @matthewstoller. Cross posted from New Deal 2.0

The data — both anecdotal and otherwise — was out there, and the Fed even discussed it internally. Let’s not let it off the hook.

I noticed something odd about the recent release of the 2006 Federal Reserve Open Market Committee transcripts. Binyamin Appelbaum has a characteristically good article about the inept chatter at the FOMC meetings that year, where the various participants missed the housing bubble completely. And there has been suitable mockery of the Fed.

What I’m finding, though, is a bit of an apologia for these folks in the form of “no one knew.” This is just not true. I remember in 2002-2003 I heard crazy stories about housing, where people would list their home and get 15 bids in 24 hours. It’s why I didn’t consider buying a home. It wasn’t just anecdotal, but the data was out there.

And it’s clear, from going into earlier transcripts of FOMC meetings, that the Fed actually knew there was a housing bubble as early as 2004. Or rather, it had the data, both anecdotal and quantitative, and even discussed the possibility of a bubble internally. Ryan Grim and Calculated Risk picked this up in 2010.

Here’s Grim:

Federal Reserve bank president from Atlanta, Jack Guynn, warned that “a number of folks are expressing growing concern about potential overbuilding and worrisome speculation in the real estate markets, especially in Florida. Entire condo projects and upscale residential lots are being pre-sold before any construction, with buyers freely admitting that they have no intention of occupying the units or building on the land but rather are counting on ‘flipping’ the properties — selling them quickly at higher prices.”

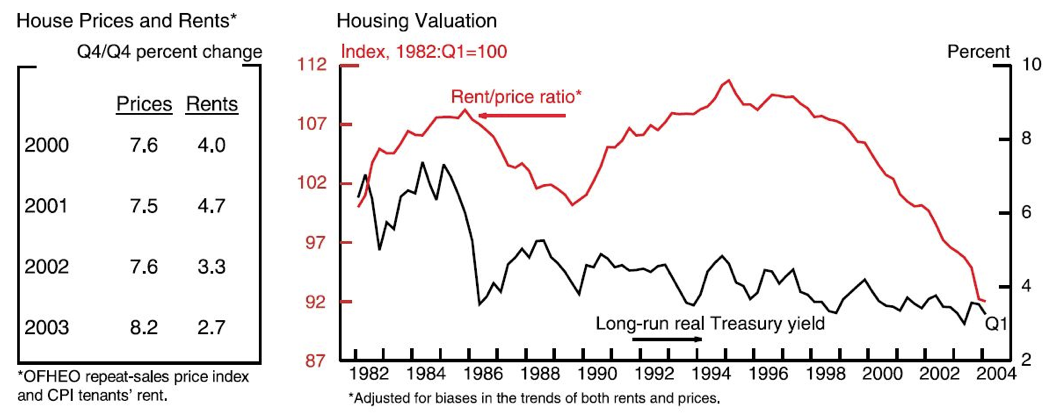

And Calculated Risk found that the Fed discussed the rent-to-price ratio that Dean Baker relied on for his accurate diagnosis of the bubble.

MR. FERGUSON [Roger Ferguson, Fed Vice Chairman in 2004]: The other question I have deals with chart 3, on housing prices. My question is about the footnote, which says that the rent-price ratio is adjusted for biases in the trends of both rents and prices. Is that where you pick up demographics and lifecycle factors? What are these biases in the trends, and how does one think about changing demographics and the relative attractiveness of owning a home versus renting? Give me some sense of whether or not the shape of the curve that you show here is likely to reverse, as you imply, or likely to stay relatively low.

MR. OLINER [Stephen Oliner, Fed associate research director]: The biases referred to in that footnote were really technical biases in the construction of the two measures shown here, the rent measure and the price measure. Had we not adjusted for them, the rent-to-price ratio would have been much lower at the end point. So it would have looked more alarming. In part we think the published data have some technical problems that need to be taken care of before this analysis can be done in a way that is meaningful. With regard to the question of owning versus renting, it depends to some extent on what is happening to interest rates because that changes that calculation at the margin. So it’s really important to plot any kind of valuation measure relative to an opportunity cost. Just showing the rent-to-price ratio I think would have been somewhat misleading; it’s really that gap that we think is the meaningful measure of valuation. And it looks somewhat rich, taking account of the fact that interest rates are relatively low and income growth has been relatively strong. I don’t want to leave the impression that we think there’s a huge housing bubble. We believe a lot of the rise in house prices is rooted in fundamentals. But even after you account for the fundamentals, there’s a part of the increase that is hard to explain.

Alan Greenspan understood very well the importance of withdrawing equity from homes as a driver of demand, which comprised 6-8 percent of all disposable income from 2003-2006. There was an enormous amount of chatter about a possible housing bubble (see this Google trend search.) It wasn’t just heroic figures like Dean Baker and Josh Rosner who were warning of a bubble (and the possibility of a severe recession when it burst) since 2001; there were books coming out in 2003 with subtle titles like The Coming Crash in the Housing Market. Read the reviews of that book, and you’ll see discussions by normal people in the industry pointing out how creepy the market had become.

That the Fed engaged in extreme groupthink is not a surprise. But let’s not pretend like no one knew there was a bubble, or that no one knew that it could become a deeply serious problem. Many normal people knew. Non-corrupt policymakers and thinkers got it. And the Fed saw the signals; its officials even discussed the possibility internally. It simply ignored the pricing signals the market was sending. Funny, that.

The Federal Reserve knew before 2004. Read the testimony given by Shelia Bair back 2010. http://www.counterpunch.org/2010/02/02/bair-s-damning-testimony/

shoot, I KNEW IT…afraid of what could transpire, and with no other visible recourse=protection, we paid off ALL DEBT…

and now are “bankers” to relatives who did not…

Of course the Fed knew there was a housing bubble. They knew before anyone. And they also knew that their cheap credit policy was partly responsible. But the bank profits were just too fantastic. So let the fed let it ride until the crash. Then the fed bailed the banks out, so they could start the whole process of blowing up new bubbles all over again. That’s capitalism, totally insane.

I’ll be gone, you’ll be gone.

sold my house on the coast in 2003, took the profit, moved inland, and bought with cash.

by 2004 the housing bubble was as subtle as the nose on Greenspan’s face.

I also wonder how much the Bushies were pressuring Greenspan not to take away the punch bowl.

He didn’t need to be pressurized. He was the architect of the entire scheme. Plus when your motto is “see no facts, hear no facts” then you don’t even see the punch bowl.

As noted, this was discussed on Calculated Risk a while back.

The CR commentariat was especially amused by Greenspan’s sly manipulation of the record. Immediately after the presentation, IIRC, Greenspan called for a break (for coffee or lunch) and when the meeting recommenced, there was NO DISCUSSION regarding the presentation. Greenspan had, essentially taken it all “off-line.”

An icon of Greenspan’s face was then created to be used in association with inconvenient truths (with a tag that was something like “let’s break”).

Papa Bush blamed Greenspan for the loss to Clinton: if only Greenspan had eased and the economy had improved then Poppy would have won. At least by the late 90s Greenspan was easing his brains out to save the financial industry when it got in trouble in Asia (and elsewhere?). And soon thereafter Greenspan touted the wonders of derivatives. He was all for them because they made everything function better in the market, etc. Greenspan never met a derivative he didn’t like. Anything written on any debt in the universe was good. But Warren Buffett couldn’t even understand them. And, it turns out, nobody can. Nobody except Greenspan that is. And that confidence is why Greenspan didn’t sit down and drool on at congressional hearings about a derivatives bubble. No; he warned about irrational exhuberance mostly in housing. And maybe a little in the stock market. But that was probably Fedcode for “you can’t use derivatives to insure against a crash.” When 400 trillion in derivatives hit the wall, Greenspan kept up the pretense that it was only a “housing bubble.” At some point, did the Fed cut back credit to the banks to try to slow down the economy? Or was it only the Banks that cut off credit to each other? That information would be interesting. Was it 2006? Just before the deluge?

And another thing. Bernanke just said that no big bank was going to go under on his watch. Clearly he is now keeping BAC on life support; as well as Citi. So then, why did he let Lehman implode? Was Lehman a US bank? Or was its charter so mixed up with the UK that it could have been a foreign bank? Or was it to emphasize the expendable nature of mortgage backed securities investors? They were sacrificed to salvage other investors? The Fed does triage.

“They were sacrificed to salvage other investors? The Fed does triage.”

Very well said. I have often wondered about this lost page of history-but remember Bear Stearns went down too-I guess as far as I can tell because the wild life style (hookers, fur coats for the hookers, Godiva Chocolates, etc) the culture engendered was disliked by others. Supposedly at Lehman Brothers folks were indeed sipping champagne out of satin slippers. Ah well, vengeance is Mine, sayth your God (the Fed?) So a collective few in the mighty priesthood decided to bring down the whole house of sin. But more importantly, the impending Obama Presidency had to be shown that there could be no pussyfooting around when the cats on Wall Street said “Meow-Meow” the next resident of the Oval Office would not hesitate to facilitate opening the cans of Tender Bits.

Just thought of this while reading this editorial: maybe Team Obama made an ‘October’ deal in September of 2008

http://campaignstops.blogs.nytimes.com/2012/01/14/whats-race-got-to-do-with-it/?hp

–Despite a general revulsion against George W. Bush and his policies, despite John McCain’s lack of ideas and his remoteness from contemporary American problems, the Republican ticket was ahead of Mr. Obama by several points in September 2008. Then came the fall: Lehman Brothers, the stock-market plunge and skyrocketing unemployment (not to mention Sarah Palin).

By the iron law of elections, the country threw the bums out and rejected anyone even remotely tied to them. The result? America’s first black president.–

1. It was politically unacceptable to have another rescue after Bear. That was widely telegraphed. I could see it as a mere blogger.

2. The Administration convinced itself it could cudgel the other banks into doing a rescue, a variant on LTCM.

3. Fuld was a real screw up. The Sorkin Too Big to Fail makes it clear that he undid some possible deals. The one with the Korean Development Bank probably would have gotten done.

Susan,

good stuff..Lehman was leveraged (after PAULSON deregulated “leverage” 2003

at SEC-had been 10 or 15-1) at a level of 100-1, with phoney “securitized mortgages” as the 1%, when it failed…

Also, Lehman was Goldman-Sachs primary competitor…all Bushit insiders were

Goldman, according to my info..

more importantly, Chris Hedges has now filed legal suit against Obama…for un-Constitutional legislation…seems he believes there is another economic shoe to drop in near term, and it will cause taxpayer revolt…

According to Steve Keen and maybe Rodger Malcolm Mitchell, even a reduction in the rate of credit creation will create a recession, if I recall correctly.

And according to Alan Greenspan, the boom-bust cycle is NECESSARY for progress.

BTW, wasn’t the reciprocating engine (boom-bust) made obsolete by the turbine (smooth power)? But we can’t do better with our money system?

Indeed we can.

Dammit Stoller, would you please spell it out. The Fed encouraged the bubble. Why? Well, it took the tech stock crash pain away – it kept the country from experiencing a strong recession. The question then is, was this decision in the public interest? The answer, today, is obviously no, but the decisions to keep interest rates low were made a decade ago, before the crash. Basically, the Fed opted to keep the party going and increase the risk of a severe crash. Also, I think the Fed was pretty ignorant of the size of the shadow banking system. Yves has shown that even CEOs of the big banks were stunned when their risk managers explained the scale of the problem. And I would assume that as FOMC directors also serve on the boards of the big banks, they knew that the banks wanted that gravy train to keep on rolling.

Finally, given high unemployment and idled productive capacity the IS-LM model is redlining low rates (see Krugman – http://krugman.blogs.nytimes.com/2011/12/14/interest-rates-inflation-and-the-way-the-world-works-slightly-wonkish/), hence the fact that the Fed is generating serial bubbles, placing the value of the U.S. dollar at risk and setting the stage for future crashes, no lesser luminary than a Nobel laureate is continuing to provide cover for the Fed’s risky behavior. Matt, I very much agree with you, but these issues are no longer mere science – the Pope of the Fed has many bishops and a economic theologian from Princeton who asserts that those who fear bubbles are part of the right wing. Got that Matt? You are part of the right wing. Oh, that’s right, I forgot, you think Ron Paul has a few worthwhile ideas. Obviously you are a winger. Keep it up.

Not only did the fed know there was a bubble- Greenspan actually wanted a bubble asw a matter of policy. It was seen as a way to avoid the deleveraging that would have occured in 2001 after the dot com implosion.

While some may see this a a ‘conspiracy theory’ its really quite logical and people were actually commenting (Krugman specifically) during the bubble buildup.

The big fat prescription part D drug program in 2004 and the tax cuts were not a conspiracy, but just a cooincidence too I guess. :o)

Indeed. You can find on record several prounouncements from Dick Cheney in the 2004-6 period that “Alan Greenspan is a great American patriot.” At the time, I took that fairly clearly to mean that in the face of the dotcom bust of 2001 and of the perceived need by the Cheney-Shrub administration to fight a global war on terror, Greenspan was doing his patriotic duty and helping to manufacture another bubble.

I am a simple but educated man who is not of means. I had to explain to my partner in 2004, essentially using the economic equivalent of finger puppets, what was going on and why we needed to refinance our ARM at a 30 year fixed. Yes, we got in on a liar’s loan and a second, refinanced to a single ARM as soon as the bubble upped our equity on paper before we got a 30 year. If I could see the wall approaching the train at speed…

We got an appraisal last month to refinance again at a lower rate, the value went down $100K since the last time we refinanced last year, from $600K and change to $500K and change, on a modest period Edwardian condo in San Francisco’s Mission District. And I thought that Asian and internet capital would sustain demand here.

Good thing we treated our ARM like a hand grenada.

Ironic that by the time President Obama accepts the re-nomination in Bank of America Stadium that Bank of America likely will be gone..

yves send me an email should you want any further details on what the regulators knew.

So “nobody could have predicted” is just a lie? Say it’s not so, Matt! Say it’s not so!

They were confronted with the facts. As elites, they should have known what those facts meant. But they did not because this would have contravened their beliefs and class interest. As they defined their interest as identical to the best public good, their actions, from their perspective, were both reasonable and public spirited. Besides, reality is vastly overrated.

Bush and congress in 2003 passed the downpayment act wherre zero down was encouraged. He then got the big banks to put up $1trl to finance the buyers. Then Hud and fanny and freddy would buy these mortgages. This was to continue until 5 million homes were built by 2010. Does anyone swonder how the gop is still around. My wonder is why dont the dems bang this on the heads of gop in the coming election. if you dont know about this it never has been played up much.

Tax cheating wonder boy Timmy G had just paid over a million for a 4BR. Of course they wouldn’t admit to a bubble!

H:\Economics\FRB Testimony, Greenspan–The economic outlook–June 9, 2005.mht

“Although a “bubble” in home prices for the nation as a whole does not appear likely, there do appear to be, at a minimum, signs of froth in some local markets where home prices seem to have risen to unsustainable levels.”

….

“Speculation in homes is largely local, especially for owner-occupied residences”

…..

“The apparent froth in housing markets may have spilled over into mortgage markets”

….

“Although we certainly cannot rule out home price declines, especially in some local markets, these declines, were they to occur, likely would not have substantial macroeconomic implications.”

The Maestro…

The housing bubble has many causes at its origin but the main caus ewas Wall Street, not the fed, not the specultors, not the defaulted loans. The government allowed the leverage of wall street to ruin the economy because they all are short term shallow minded and self absorbed. they were ok because they winning. we have turned into a bank run country and the adminstration and the banks are one in the same and it will continue because there are not enough people with the fortitude to stand up against the criminal elite. Always makes me laugh to hear the lower middle class fighting on the side of the super elite because they think they have a shot at the american dream. It is such bull shit that it is hard to believe. people have their heads in the sand as regards to the truth still today after all these years of wealth destruction. People still buy the bs of the elites and the oligarchs without question. we have been milked by the government and the banks and we seem to like it because the same bull shit is going on in Washington and nothing is being done to put criminals in jail.