Readers who missed the post over the weekend entitled “Schneiderman MERS Suit and HUD’s Donovan Remarks Confirm That Mortgage “Settlement” is a Stealth Bank Bailout” are advised to read it first, since it provides important background and context for this piece, which clarifies some issues I skipped over.

To give a brief recap of the post: both a small group discussion with Shaun Donovan (reported by Dave Dayen of Firedoglake and separately by Shahien Nasirpour of the Financial Times) and the Schneiderman MERS lawsuit on Friday confirm our previously-stated hypothesis that the settlement is really a transfer from mortgage investors to banks. That is why the banks remain willing to participate as the release has been whittled down to appease the formerly dissenting attorneys general (remember, the old reason for the banks to go along was that it was a cash for release deal: the banks were willing to pay hard money to get a significant waiver of liability).

The reason this settlement amounts to a transfer is the banks will be given credit towards the total reported value of the settlement for modifying mortgages that they do not own, meaning that economic loss will be borne by investors. Servicers have an obvious incentive to shift losses onto other parties whenever possible, and so the only principal mods they are likely to do of loans they own are one they would have done anyhow.

In addition, default rates are higher among borrowers with second liens, and second liens are almost entirely held on bank balance sheets. Which banks? Oh, the ones that happen to be the four biggest servicers: Bank of America, Citigroup, JP Morgan, and Wells. And those second lien holdings are collectively in the hundreds of billions. Were they written down to the degree that some mortgage investors argue is warranted, it would reveal that these banks were seriously undercapitalized.

As we stressed, this plan is a serious violation of property rights (not that that should be any surprise at this point). The creditor hierarchy is clear: second liens should be written off in their entirety before first liens are touched. Yet we also linked to evidence in the post from top mortgage analyst Laurie Goodman that servicers were already doing everything they could to favor their second liens over firsts. This settlement would give official sanction to this practice.

I also want to flag, a second time, an appalling throwaway comment in a New York Times update tonight:

The settlement, if all states participate, will also include $3 billion to lower the rates of mortgage holders who are current.

Huh? The banks have an explicit obligation to service the loans for the benefit of the certificate holders, meaning the investors. There is NO economic rationale, none, for reducing interest charges to borrowers who are current (unless they are under financial duress and at risk of delinquency/default). This is a bribe to prevent complaints by borrowers who pay on time and are in “beggar thy neighbor” mode.

I did want to clarify a possible misimpression I suspect I created in my Sunday post. By inveighing against a transfer from first lienholders (investors in mortgage bonds not owned by banks) I may have left reader thinking the Powers That Be will not touch second liens at all in the agreement. That isn’t true. We highlighted in an earlier post on Nevada attorney general Catherine Cortez Masto’s letter which raised questions about the pact that there were some provisions about second liens. I didn’t discuss them in detail because it is a bit of a Plato’s cave exercise. But as we indicated, anything short of wiping out the seconds before the firsts is simply not defensible (the second liens, which are overwhelmingly home equity lines of credit, got higher interest rates precisely because they were higher risk). And from what we can infer, the provisions in the agreement, at least at the time of the Masto letter, are smokescreens to cover the goring of investor oxen.

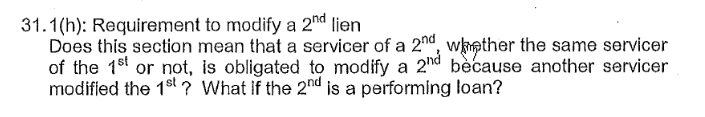

Let’s look at the questions Masto asked related to second liens:

This suggests that there is a requirement to modify (note modify rather than extinguish) a second lien when a first is modified. Given the desire to assist banks while trying to maintain a fiction of “fairness,” I’d expect this provision to set forth some sort of parallel treatment, for instance, that a 10% principal mod on a first mortgage must be accompanied by a 10% reduction on a second. Since the dollar amounts involved in first mortgages considerably exceed those in seconds, the first lienholder would still take the bigger writedown in dollar terms, and the second lienholder will benefit by the borrower having greater ability to pay.

I’d assume the answer to be “yes” unless the provisions regarding second liens meant to be a joke. Virtually all of the bank-owned second liens are home equity lines of credit.

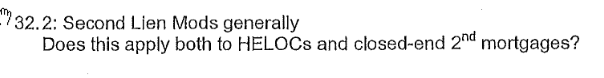

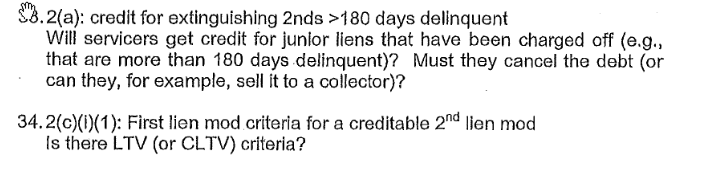

I can’t infer the implications of 34.2, so if you have any good guesses, please pipe up in comments.

On 33.2, the point in the settlement, of writing off second liens more than 180 days delinquent, is largely meaningless. As we indicated, banks keep insisting that their seconds are current, and that’s because they can make them so.

First, as we have recounted, these liens actually have a lot in common with credit cards, in that banks will allow stressed borrowers to pay only the interest due and amortize the loan. We’ve even been told banks will reduced the payment on a loan about to go delinquent, take a token payment, and deem the loan to be current. Banks can also increase the home equity credit line, which means borrowers can simply borrow more to make their payments.

The result is that the banks report a much larger portion of their second liens are current than would actually be categorized as current if they were required to define current on a fully amortized basis. Moreover, they are not required to write down these loans, which are mostly held in their “held to maturity” books even when the first lien is defaulted or in a significant negative equity condition (remember, unless there is equity in the house, an uncured default on the first means foreclosure, which means the second is wiped out. One of the reasons bank foreclosure timelines have become so attenuated is to avoid taking losses on seconds). Not surprisingly, the supine OCC contends there is nothing it can should do, to force the banks to behave otherwise.

Before you say, “Gee, is all this so unreasonable?” let’s contrast this conduct with how regulators treated small bank commercial second liens recently. Bank expert Josh Rosner tells us that during the height of the crisis, certain primary prudential regulators forced the other regulators to make sure that the community banks with large commercial exposures had to have those loans reappraised and written down those exposures to fair value. This took place even when the loans were held in the held to maturity books of the banks. Keep in mind that the accounting rules were that loans in these books did not have to be revalued unless there was a credit event (such as a delinquency). Even then, they would normally be required to test the loans to see if the impairment was temporary or whether a writedown was warranted. Yet even in cases when these loans were paying on a fully amortized basis, the regulators forced these small banks to write them down.

A final point: some readers questioned my comment that the current version amounted to a transfer from retirement accounts to banks. That was overly broad, but more refinement (I hope to get to when I can get my hands on market share and expected loss data) does not make the picture much prettier.

I focused on private label securities, since they have and still continue to experience a much level of defaults than prime (Fannie and Freddie) mortgages. The latest data I have seen (which was a while ago) was 40% expected defaults, which would produce losses of 30% (as in you’d get 25% recovery form the foreclosure). The 75% loss on foreclosure is a valid number historically, but I expect loss severities to rise to much closer to 100%, between servicer delays, greater scrutiny by some judges in judicial foreclosure states, and more borrowers fighting foreclosures.

While not all deals were total turkeys, on most deals, the lower tranches are already wiped out, and the top 3 AAA tranches are also gone due to refis. So what is left are the fourth and 5th once-rated AAA tranches and some of the lower tranches. While foreclosures distribute losses to the lowest-credit-rated borrowers first, mods are distributed pro rata across all tranches, and with the bulk of the value of the deal originally and still in what were originally AAA tranches, they will take a hit. Mind you, most investors are not opposed to mods IF any second liens were wiped out first; they are still better off taking a 25% to 50% hit than a 80% loss.

So the investors that will be most affected are AAA investors, if nothing else because originally and now they represented the bulk of the value of the securitization. I’m not certain precisely who were the targets for AAA RMBS, but in general, AAA bond buyers are pension funds (particularly defined benefit funds, but bond funds that marketed themselves as “AAA” or high credit quality would also be targets, and those are often an option in 401 (k) plans, either offered directly as an investment option or bundled into a “balanced” fund) as well as insurers, who for regulatory reasons also tend to hold some of their portfolios in AAA rated assets. The appeal of private label MBS was investors got a better yield than for corporate or government bonds, supposedly in return for bearing some prepayment risk (no one thought they were eating credit risk too).

But….I managed to miss the biggest investors in the former AAA private label MBS: Fannie and Freddie, which hold large exposures to private label securities. So it is both taxpayers and investors that will pay for this stealth bailout.

So even with this hopefully helpful clarification, the overall picture remains the same: the deal as now constituted is a victory for the banks, shamelessly marketed as a win for repeatedly victimized ordinary citizens.

– the OCC has taken the position that there is nothing they can do, or should do, to force the banks to behave otherwise.

My take away from all mortgage discussions taking place is that everyone deserves a lower rate. Fannie & Freddie are being bad guys by not allowing more refinancings, so the logical conclusions should be 0% loans for everyone and no guidelines….

Sounds awfully attractive for investors. Sign me up!

But seriously this the sort of bad medecine, that will preclude any real interest in private lending for mortgages and means that the tax payer liability will be much higher than expected going forward.

I do see in all this a new finance model and it’s not good.

The gov’t insures all mortgages and we have four big banks that capture half the profit of mortgage origination. Chris Whalen has written that very few banks have the infrastructure to deliver a loan into a new pool forcing the originator to give up substantial profit.

So the new model is JP Morgan, Citi, Wells & Bofa take on no new 1st lien ortgage credit risk and capture all the up front profit while dumping loans onto the gov’t while extending 2nd liens to those same borrowers giving them nice spreads, low duration and comfort that 2nd liens are now better credits than secured 1st liens.

It is a shrewd analysis, but sounds very plausible.

For investors, going forward what’s the learning? … It’s a better contract if aligned with power and a worse deal if aligned against it. Of course it is all up in the air if power concentration changes of is mis-identified. What other reasoning can there be left upon which to argue business contracts?

With title to property confounded and chain of default confounded, what else have we got but an ever growing pool of suckers? Consumer and investor financial protection is a farce all things considered.

The way it appears to be unfolding is more damaging to equity rights, rule of law and justice than it should have been. While investors and taxpayers were doomed to take a hit, it might have been done more explicitly. RICO orgs should be broken up. I expect it would have been done that way except for politics, raising money to run for politics.

All the mainstream media is owned by corporate concentrators and the kind of widely communicated muckracking needed just isn’t present. The country continues led by the ring in its nose.

The economics merely reveals the true problem.

What investors would be happy with a zero coupon? Look, I could get about 3.5% in dividends on equity on blue chips like P&G – why would anyone take less than that on MBS which are way riskier. The true chumps in this settlement are the investors in MBS. They will suffer write-downs and lower coupons. It kind of blows me away that the AGs and feds are working toward a deal in which the interests of investors (like say CalPers) without seeking the input of said investors. Anyone heard of the 5th Amendment – or the 14th for that matter? A note to the negotiators – polish up your Constitutional law – you’ll need it.

I could get about 3.5% in dividends on equity on blue chips like P&G – why would anyone take less than that on MBS which are way riskier.

We have truly entered the Twilight Zone of finance when a common stock dividend is assumed to be safer than the coupon on a mortgage-backed bond.

Just proves further that “the end of credit” is soon to be upon us. Private capital wants absolutely nothing to do with the US mortgage market. Slowly but surely, other forms of secured and unsecured debt instruments will be added to the “Do not touch, even with Other Peoples’ Money” list, with US Treasury debt being the last one.

I find the comparison between a mortgage and a stock investment(equity) deeply flawed. Stocks have unlimited upside potential and represent residual cash andownership in the company. Lending on a credit(under-writing a mortgage) represents no upside and only downside. In other words, I lend you money, I can’t get more than the interest on that investment along with principal returned, however you could choose not to repay me. That’s not the case with stocks. The risk profiles and returns are not comparable.

In other words, I lend you money, I can’t get more than the interest on that investment along with principal returned … CoC

You ignore that banks use leverage to make many loans from a given amount of reserves.

The mortgage bond is SECURED by the underlying properties themselves. If the mortgagees stop paying, they forfeit tile to the properties.

Common stocks pay dividends solely at the discretion of the board of directors. They are frequently reduced or suspended for any number of reasons, since common stockholders sit at the VERY BOTTOM of the capital structure.

Please do not try to convince anyone that common stock dividends are “safer” than mortgage-backed bonds.

I am sorry I didn’t check this string earlier. I was only trying to make a point. Nobody who invests expects zero return on investment. Those ultra-safe, never goes down, triple A rated MBS became a mirage around 2001. Some of you readers are savvy investors. If you had to get 4% on your money – where would you put it? MBS or high dividend stocks and funds? Oh, I forgot, now that Uncle Timmy is guaranteeing FNM bonds, maybe, just maybe that would be safer.

It may be silly to bring this up, but I have lost confidence in more than the MBS market and this government’s lackadaisical attitude toward fraud makes me more cautious than I otherwise would be. I don’t think I’m alone and I don’t think that’s good for recovery.

with US Treasury debt being the last one. Bam_Man

I doubt that. US Treasury debt IS money; far more than gold or any other money form since US Treasury debt is backed by the taxation authority and power of the US government. Plus it pays interest!

The deal is a very bad deal in almost every respect. But I would like to address the point about refinancing first mortgages that are current.

In my opinion, this is perhaps the single good and consumer friendly part of the deal. Many homeowners who were current but struggling and barely making it or who would have made it had they been given a legitimate modification were pushed into foreclosure by the requirement of many modification programs that the homeowner had to be in default before the modification could be processed. So, these homeowners were pushed, not jumped, from the ledge into the actual foreclosure process by the servicers. Modifying mortgages that are current will go a long way to eliminating the “dual tracking” problem of foreclosures being pursued when a modification is in the works.

Of course real oversight would also solve the same problem – a regulation issued for the banks and servicers that states if they pursue a foreclosure while a modification has been requested, that they are subject to a one million dollar fine per instance. Of course that would require that someone actually monitor and enforce, which no one in any capacity in our government seems willing to do.

As to zero percent mortgages for everyone, why not? Why not give American consumers the same free money that Bernanke is shoveling to the banks with his secret Trillions For Them But Not For You program? At least if the money were given to American consumers it would flow like a broken dam into the economy and not be spent solely on room freshener for the miscreants to cover the odor of the banking s!@t hitting the fans.

From a “fairness” perspective, I would have to agree with you – those are current in an underwater mortgage deserve some relief. My question is: Who pays? It is my view that the banks that originated the loans, investors who purchased the securitized mortgages, and yes, Uncle Sam, share the responsibility for the bubble and should share the costs of providing the mortgagee the opportunity to build equity. And the lion’s share of that responsibility should rest with the originators. My concern is that even if MBS investors are willing to take a haircut on a currently performing security, the originators won’t be, even if they currently service the trust. You see, unless the originator holds a substantial portfolio of MBS that might go south, they don’t have much skin in the game – they cashed in, made their money, paid dividends and bonuses, and they, not the investors are at the negotiating table. Guess who’s gonna pay? Hello MBS investors, I know you are playing with OPM, but they are going to want it, eventually. Why aren’t you screaming bloody murder?

Modifying loans which can be paid, and justifying that by pointing to mods on loans which can’t be repaid shows the moral hazzard and idiocy of the current approach. The point of modification should be loss mitigation where the lender or representative of the lender believes the loan is in risk of not being repaid, it can be repaid under different terms, and the costs of liquidation exceeds the cost of modification. This everyone deseserves a mod or lower cost mortgage comes off as a mis-placed sense of entitement and loses sight of how mortgages are created and how risk is assessed and passed along.

Attorney General’s Office

State of North Carolina

9001 Mail Service Center

Raleigh, NC 27699-9001

Mr. Atterney General,

I’m writing to express my concern over settlement for release of liability of the banks for forging documents, “robo signing”, and servicing impropriety.

The State of New York is suing these same banks over the use of Mortgage Electronic Registration System (MERS). In addition, these same banks are producing false documentation, or robo signed documentation in foreclosure cases.

There is an article today from Yves Smith of Naked Capitalism which provides further analysis of the settlement, and makes the point the Mortgage Settlement is merely another bail out for the banks (http://www.nakedcapitalism.com/2012/02/more-on-the-role-of-second-liens-and-the-mortgage-settlement-as-stealth-bank-bailout.html).

History will show that shifting private sector losses onto public treasuries will destroy a notion’s economy. Bailouts of the banking cartel were wrong in 2008, and they are wrong today. Japan still suffers from allowing banks to continue to operate after suffering massive losses. Glass-Steagall should be re-enacted and these banks should be forced to realize their losses and not pass them on to private investors.

Sincerely,

[Name Withheld]

Raleigh, North Carolina

“will destroy a

notionsnations…”opps… “

notion’snation’s economy…”Yves: the first sentence is missing a few words, along the lines of “are advised to read this first”.

Hasten the end. Either we all becomes servants of the few, or, like the French did. . . . . . . . . . . . . or will the Military step in?

Yves,

A very interesting series; thank you.

I have what is no doubt a newbie question: do the servicer agreements typically grant the servicer the right to reduce principal on these first lien loans independently of what happens with second lien loans? Or in other words, how is it that the servicers have the right to effectively give away the property of the owners of these first lien securities? Did the owners inadvertently give away those rights to the servicers, or are the servicers violating their service agreements?

Thanks,

Mike

Quick question: I am no apologist for Obama (at all), but people, including on this site, have been clamoring for principal mods and foreclosure relief for years. Now this may not be the best way to get it and is unfair since banks largely get off without taking any sort of hit. But at the same time, this will hopefully help a large number of people who can’t afford the house they are in (frequently through no fault of their own), will reduce foreclosure activity and, therefore, hopefully improve the economy overall, and specifically in those areas that need it most. If it’s taxpayer money that gets used, this just sounds like a potentially successful version of HAMP (the way HAMP would ideally work if it resulted in mortgage mods).

So despite the legitimate handwringing over banks being back door bailed out by investors and taxpayers, if it results in more principal modifications, less defaults and less foreclosures, isn’t this a positive (especially compared to what we’ve had to date which is banks being bailed out by investors and taxpayers without the foreclosure relief)?

How long will it take till we elect politicians who will break up the TBTF banks, remove their Boards and management and prosecute both civilly and criminally where possible?

If the answer is never… then give up your fantasy of living in a free nation or world.

BTW, one of the reasons given for why we ‘need’ these behemoths is so they could compete with huge banks in other nations…

Oh yeah! Right! Like the great job the behemoth banks in Europe have done with the economy over there!

Whatever happened to common sense?

http://www.linkedin.com/jobs?viewJob=&jobId=2451542&trk=rj_em&ut=29HgEzE3S9Tl41

Chief Compliance Officer

Lender Processing Services, Inc. (LPS) – Jacksonville, FL (Jacksonville, Florida Area)

Job Description

Role and Responsibilities within LPS: The Chief Compliance Officer (“CCO”) is responsible for the development, implementation and day-to-day administration of the LPS Compliance Program, including:

· Overseeing the development, implementation, communication and enforcement of policies and procedures necessary for the effective operation of the LPS Compliance Program and its related activities.

· Ensuring that those same policies and procedures are aligned with LPS operational objectives, legal and regulatory requirements.

· Identifying potential areas of compliance vulnerability and risk.

· Establishing a compliance policies and procedures management framework for LPS that is aligned with the LPS Compliance Program.

· Providing leadership and direction to the Business Unit Compliance Officers

.· Overseeing the institution of all applicable enterprise-wide compliance training which fosters a strong risk management and compliance culture throughout LPS.

· Acting as an advisor for LPS strategic business initiatives (e.g.; new products and services, etc).

· Identifying resources and staffing needs for the Corporate Compliance and Business Unit Compliance Departments, and for collaborating with other corporate departments to obtain proper resources and staffing.

· Establishing corrective action plans and preventative controls to minimize identified compliance risks.· Implementing and monitoring effective change control policies to ensure that compliance staff formally reviews and evaluates procedural, product, or service changes for compliance impact.

· Presenting compliance risk management reporting to the Board and to the Enterprise Risk and Compliance Steering Committee.

· Interfacing with internal and external advisors, and other internal control groups on regulatory and compliance related matters. Organization and Reporting Relationships:

· The CCO has a direct reporting line to the LPS Chief Risk Officer.

· The CCO will provide reports directly to the Risk and Compliance Committee.

· The CCO has the following direct reports:

· LPS Business Unit Compliance Officers, who have additional reporting lines to their respective Business Unit Managers,

· Staff as necessary to support an LPS wide compliance function.

· The CCO has performance management responsibility for all direct reports.

Membership of Governance and other Key Committees:

The CCO is a member of the executive management team and serves on:

· The Risk and Compliance Committee.

· The Executive Enterprise Risk Management and Compliance Steering Committee.

· The New Products and Services Committee.

Desired Skills & Experience

Minimum Qualifications:

· Seasoned risk management professional (10+ years in a senior leadership role) with relevant compliance risk management and/or regulatory experience within a large complex banking organization anchored in the commercial banking and /or investment banking sectors and/or relevant legal and compliance experience in a large business organization.

· A minimum of a Bachelors Degree

· Proven ability to lead with authority within a large, complex organization.

· Extensive experience and thorough understanding of the compliance risks faced by LPS with respect to its business activities, regulatory environment, and marketed products and services.

· Skilled in interacting with executive management and Boards, including committees.

· Ability to communicate and negotiate in a knowledgeable and credible fashion with the full range of LPS internal and external stakeholders, including all levels of management, appropriate management committees, the Board of Directors, and regulators.

· Ability to provide well reasoned compliance management solutions and recommendations.

· Ability to work collaboratively and dynamically across the entire LPS organization to leverage available resources and talent.

Desired Qualifications

· Legal Experience

EEO/AA Employer

Company Description

Lender Processing Services (LPS) is the nation’s leading provider of mortgage processing services, settlement services, mortgage performance analytics and default solutions. The company’s high performance technology, data and services empower lenders and servicers by providing them with the solutions they need to achieve their business goals and succeed in today’s competitive marketplace. A majority of the 50 largest U.S. banks rely on LPS’ comprehensive offerings and award-winning services and support to power their businesses and sharpen their competitive edge

Additional Information

Posted:January 24, 2012Type:Full-time Experience:Executive Functions:Legal Industries:Real Estate Employer Job ID:OPE0001NJob ID:2451542

sorry, didn’t realize that was quite so long a job description. i just thought some NC commenters might like to apply. LOL

One thing that is curious is how the IRS has gone missing. What will our dear tax collectors do when OIbama fails to resolve the conflict in regulation between banking and shadow banking? Not to mention trust-trustee things. Or property titles. The banks have almost erased the difference but the laws haven’t been changed. The only way law can work and trust can prevail will be if all banking is sunshine banking. I just read Ellen Brown’s latest article and I can’t help but conclude that our banks were operating under an impossible business model in the 90s, when they went into mortgage bundling so aggressively. And for the purpose of overnight repos. Their purpose was never to securitize anything. So again, where has the IRS been?

http://www.theatlanticcities.com/housing/2012/02/foreclosure-crisis-centered-around-cities/1137/

Looking at the graphs, cities are taking it on the chin. The Chicago urban area represents over 80% of all IL foreclosures. The political damage to these areas for not fabricating some public display of justice coming forward are very bad for any politician in that state, as well as many others to ignore.

Even if your home is not a direct hit, foreclosures are the block busting event, with one or more abandoned houses and all of the trouble it can attract in a densely populated neighborhood. The damage is rippling out, not in the economy, it is rippling out into 10s of millions of lives, with little recourse for losing years to wasted efforts of dealing with material loss and the inevitable emotional damage to relationships with our relatives, friends and neighbors. We are becoming a populace of more broken people with the syndrome of refugees from a disaster, a man made, wall street driven mis-investment of capital.

The issue here is what the 2nd lien lender’s position would be post-foreclosure without the settlement, versus what their position would be via this settlement. Let’s say the property’s in California. Let’s further say that the first mortgage is kept current, while the borrower elects to default on the home equity line of credit since it is so far underwater. In California, if a second lien holder forecloses, the lender gives up his right to pursue a deficiency action against the debtor. And if there is no value above the first lien position to recover anyway, why would the 2nd lien holder bother foreclosing?

Hence, the best course of action for California borrowers with deeply underwater home equity lines of credit or second mortgages, would seem to be to simply walk away and not pay, since the 2nd lien holder would have no further recourse against the debtor and there is presumably no value above the first mortgage lien to recover. The settlement as being contemplated, would essentially improve the second lien holder’s position from a potentially written off, uncollectable, unsecured position, to a potentially secured position at the expense of the first mortgage lien holders (MBS investors and taxpayers on GSE mortgages). No wonder that getting Kamala Harris, the California AG, to sign on to this boondoggle is an issue.

Who should absorb the the loss in the instance of default?

First, the borrower is evicted, then the CMBS holder loses the income stream, then the issuer of the CMBS loses the diffrential between the loan balance and the sale of the REO. If the property is sold for more than the loan balance the ultimate profit accruses the CMBS holder.

What the banks are fighting is the fact that the market value of the property is some 30% to 40% below the loan balance, in some instances even more. When the REO is sold it is treated to distressed asset priceing which cuts the price even lower so that recovery is on the order of 20% of replacement cost.

The effect of market corrections is that holders of RMBS have an empty bag. Those who own the notes have paper that will probably command not more than 20 cents on the dollar and in that instance their retained earnings are gone as well as most of their original equity.

What’s worse is that the people who created this mess have not been brought into court to answer for the frauds. The clock is ticking and most frauds evaporate after five years, some have a ten year life. Todate, the US Attorney General has not deemed it a worthy course of action to pursue. Bear in mind that US Attorney General serves at the pleasure of the President upon the advice and consent of the Senate.

This all began some years ago with the worst of it being initiated during the Bush administration and now carrying foward into the Obama administration.

These frauds are not hard to comprehend, contary to the canard that it is hard to prove fraud. Bushwah!

– bringing this proposed settlement to the public’s attention in a loud, long way,

– labeling it as another bank buy out

– labeling it as a shift in costs toward investors

– labeling obama as chief protector of banks

would force obama to dump this whole idea, at least until after the election.

obama drops political hot potatoes in a hurry.

so why is there no move to do this, i.e., to challenge obama loudly and publicly, on his bank settlement deal, anywhere in this country?

where are the organized voices of opposition?

the pension funds?

the investors attorneys?

the savvy political organizers?

there are dogs that aren’t barking in this story.

why?

Because the strings go everywhere and if people knew the true extent there would be mass panic and economic collapse as people pulled their money out of banks, stockpiled food and guns, and otherwise went Twilight Zone apewire. Every deal is hedged and the hedges are insured and counterinsured and the pea simply has to be under one of the cups, doesn’t it?

To Bravo – But wouldn’t the 2nd lien holder just keep that nonperforming 2nd on the books over several years until the 1st was paid off, or paid so far down, that the 2nd is now has equity to secure it? Is there some legal or other reason why that would not be an option for the 2nd lien holder (or servicer)?? Thanks.

These are typically 30 year mortgages, originated in 2004-2006. You don’t see any principal paydown for quite a few years. The amortization schedules are set p so it’s all interest in the early years, and then you start getting some, not much, principal paydown. It’s backloaded so as provide for the same payment every month.

Enzica:

Given that many of the second lien positions are so far underwater, without the settlement, it will be a long time before principal paydown will accrue on the firsts to make the seconds worthy of foreclosure. Worse yet for the banks, a default would be the qualifying credit event that would require them to take the write down now on the loan. Mass strategic defaults on second liens could eventually lead to an institution being dissolved because it had way too many of these loans to Californians. The FDIC would ultimately take control of the 2nd lien loan and would likely be willing to settle with you for pennies on the dollar down the road, unless there is a miraculous market recovery between now and then.

I am surprised you are so focused on the settlement. The changes to HAMP that Obama announced last week do more to favor second lien holders than anything this settlement could contain.

Note the change to include second lien debt in DTI payments. Essentially what this does is make first lien modification required for more borrowers who have both first and second liens.

And, worse than the settlement, under HAMP the taxpayer pays to have the first lien modified.

HAMP is voluntary and the servicers went through the motions last time. Not all that many “permanent” mods were made. The big inducements to do mods, but the servicers lack the systems to do that, and they still have economic incentives in many cases not to (seconds).

I see HAMP as a side show. By contrast, there will be penalties if the banks don’t do mods under this deal.

If the banks are so motivated to preserve the second liens they hold on their own books (vs. investor-owned first liens), perhaps a good strategy is to stop paying the second lien in order to get a good mod on the first?

Disclaimer: I have no second lien. Maybe I should get one?

when do all these second lein losses hit the banks’ P&Ls and how do I make money from it?

Is SKF a buy in here?

Or do the Big Zero and Timmy G have a few more tricks up their sleeve until November 2012?

This whole topic seems like a freight train running at the car on the tracks — in the movies. It comes and comes and comes, you can look up and see the wheels almost on your eyes, and then it keeps coming, more and more. But sometimes, it never hits, depending on the plot. You can lose your shirt and your pants and your mind betting on it.

It should now be obvious that this mess is far too complex to explain to the public.

The solutions or at best political cover stories suggested are also too complex.

The truth probably is to do nothing and let the mess go where ever it may.

Lots of folks and entities will be hurt but it will end at some point.

i think the best thing to do is to determine the market value of each properties. if the value is underwater and the property has a second loan such as(e.i line of credit, Heloc and etc.) then the second should should be eliminated. it is simple as that. most of the second mortgagees were sold to a junk debt buyer and debt collectors. they are buying this debts are lower prices.

if the property is not underwater, then the homeowner cannot get a debt reduction period.

I focused on private label securities, since they have and still continue to experience a much _______ level of defaults than prime (Fannie and Freddie) mortgages.