The whole purpose of a settlement is that a party pays damages to rid themselves of liability, and the amount they pay (and “pay” can include the cost of reforming their conduct) is less than what they expect to suffer if they were sued and lost the case (otherwise, it would make more sense for them to fight).

But in the topsy-turvy world of cream for the banks, crumbs for the rest of us, we have, in the words of Scott Simon, head of the mortgage business at bond fund manager Pimco, in an interview with MoneyNews, lots of victims paying for banks’ misdeeds:

“A lot of the principal reductions would have happened on their loans anyway, and they’re using other people’s money to pay for a ton of this. Pension funds, 401(k)s and mutual funds are going to pick up a lot of the load…

“Think about this, you tell your kid, ‘You did something bad, I’m going to fine you $10, but if you can steal $22 from your mom, you can pay me with that.’”

So not only is the settlement designed to shift the costs of the banks’ misdeeds onto already victimized investors, but taxpayers will also be picking up some of the widely touted $25 billion tab. Shahien Nasiripour tells us in the Financial Times that banks will be able to count future mods made under HAMP towards the total:

However, a clause in the provisional agreement – which has not been made public – allows the banks to count future loan modifications made under a 2009 foreclosure-prevention initiative towards their restructuring obligations for the new settlement, according to people familiar with the matter. The existing $30bn initiative, the Home Affordable Modification Programme (Hamp), provides taxpayer funds as an incentive to banks, third party investors and troubled borrowers to arrange loan modifications.

Neil Barofsky, a Democrat and the former special inspector-general of the troubled asset relief programme, described this clause as “scandalous”.

“It turns the notion that this is about justice and accountability on its head,” Mr Barofsky said.

BofA, for instance, will be able to use future modifications made under Hamp towards the $7.6bn in borrower assistance it is committed to provide under the settlement. Under Hamp, the bank will receive payments for averting borrower default and reimbursement from taxpayers for principal written down..

….people familiar with the matter told the FT that state officials involved in the talks had had misgivings about allowing the banks to use taxpayer-financed loan restructurings as part of the settlement. State negotiators wanted the banks to modify mortgages using Hamp standards, which are seen as borrower-friendly, but did not want the banks to receive settlement credit when modifying Hamp loans. Federal officials pushed for it anyway, these people said.

Alys Cohen, an attorney at the National Consumer Law Center, said that if the arrangement increased help, then it was ”good for homeowners in the long term”.

“But in the end the servicers are not really being punished. They’re getting off easy,” Ms Cohen said.

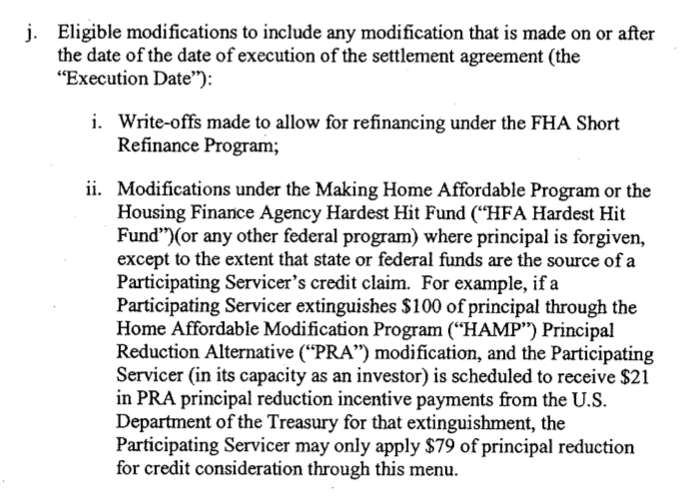

Although, as we all know, there is no final agreement, this appears to be the section of a January 19 term sheet published by the Wall Street Journal that sets forth how HAMP mods were to have been handled as of that date:

A separate story by Shahien explains how the HAMP credits work:

But in allowing the banks to use taxpayer-funded Hamp to meet their obligations under the settlement, the government presented the banks with an opportunity to reduce their losses, experts said.

“If the banks are doing something under this settlement, and cash flows from taxpayers to the banks, that is fundamentally an upside-down result,” said Neil Barofsky, a former special inspector-general of the troubled asset relief programme.

Last month, the Treasury department announced it was tripling the incentive payments to owners of mortgages who agree to reduce loan balances. By reducing those balances under Hamp, investors – including the banks who agreed the settlement – now will receive cash payments of up to 63 cents on the dollar for every dollar of loan principal forgiven. They also will receive additional funds when borrowers keep current on their restructured mortgages.

In certain situations, thanks to US taxpayers, the banks could suffer minimal losses where the Hamp-assisted principal cuts occur within the first year after the foreclosure accords are finalised. Incentive payments for successful loan restructurings could then turn a profit for the banks, according to people familiar with the settlement terms.

“How can the taxpayer be paying these servicers for a programme that’s supposed to ensure accountability, be punitive and right past wrongs?” asked Mr Barofsky…

More writedowns through Hamp are likely to follow. The largest US banks are increasingly routing principal reduction modifications of their own mortgages through Hamp, according to quarterly data to September 30 from the Office of the Comptroller of the Currency (OCC), a federal bank regulator.

Since Hamp’s principal reduction initiative launched in October 2010, 82.5 per cent of principal writedowns at banks including JPMorgan, Wells Fargo, BofA and Citi have occurred under Hamp. In the four quarters preceding the initiative’s start date, just 25.3 per cent of banks’ principal writedowns on portfolio loans occurred under Hamp.

Principal writedowns by banks on their own loans have fallen by more than a third since the principal scheme was launched, OCC data show.

Congressional aides familiar with the settlement’s terms said the administration has set out to use the accords as a vehicle to boost the number of Hamp modifications. Less than 1m homeowners have been granted permanently restructured mortgages. Mr Obama said in February 2009 that the initiative would help 3-4m troubled borrowers avoid foreclosure.

For investors in mortgage bonds, the banks’ use of Hamp to fulfil their borrower-relief obligations under the settlement could further increase the odds that they end up footing the bill for the banks’ alleged wrongdoing.

There is nothing wrong with also using HAMP to try to get more principal mods. But the incentives in HAMP, as Shahien points out, were already enriched to get the banks to play ball. They should have remained separate from this deal. But instead, banks get to game HAMP payments as part of the settlement.

This episode also illustrates the danger of agreeing to a deal where the terms were not final. We and AGs still don’t know where the settlement will shake out. Any negotiator or attorney will tell you there is a world of difference between an agreement in principle and a definitive agreement. Rest assured will find more instances of the AGs being baited and switched before this pact is inked.

Sounds a bit like DeMarco: “We’re saving billions for the taxpayers.” Quelle vomit.

Kamala Harris might come away from this with an SC nomination. So let’s look on the bright side of forward, and not the dark side of back.

Hat tip reader Kravitz for the link.

I thought she caved, after drawing attention to herself. Seriously, we have no idea which direction “she will lean”.

(which in itself is a ludicrous description) A case like Harris usually “leans” into the Gov’nor’s mansion or some beligerent 500 corp.

Harris for SCOTUS in a quid pro quo?

That would be terrible, and just one more reason to view the federal government as illegitimate.

Hopefully she doesn’t get nominated.

Or if she does, let’s hope GOP obstructionism is in the cards on this one. Her record in SF is atrocious, she was taking heat from many constituencies on numerous issues and with no actual judicial experience, and none in academics… she’s basically the Democrats Harriet Miers.

Kamela reads newspapers. Or Yves and Dave.

Calif. AG to review findings on SF foreclosures

http://www.sfgate.com/cgi-bin/article.cgi?f=/n/a/2012/02/16/state/n174042S58.DTL&type=business

“California Attorney General Kamala Harris said Thursday that her office was reviewing a new report that found most residential mortgages in foreclosure in San Francisco are missing documents or signatures or otherwise violate the law.”

“The allegations are deeply troubling and, sadly, no surprise to homeowners and law enforcement officials in California,” Harris said.”

Well before she was able to do no investigation at all and thus feign ignorance. Now that someone else has done her homework for her and dropped it on the teacher’s desk she has to at least pretend to have read it.

Let’s appreciate any signs of right thinking and right actions where we can find them within the general gloom, shall we?

Paul Jackson, of Housing Wire, is also trying to debunk the SanFrancisco audit which appears to be gumming up the settlement’s reason for being…

The curious case of the San Francisco foreclosure audit

http://www.housingwire.com/blog/curious-case-san-francisco-foreclosure-audit

Yves, put down your coffee NOW!!!!

“Our standard at HW is and always has been very clear: Do our best to get the story right.”

For the rest of you, check out what happened to HousingWire’s story on the audit. That vanished into cyberspace…

http://www.nakedcapitalism.com/2012/02/quelle-surprise-san-francisco-assessor-finds-pervasive-fraud-in-foreclosure-exam-and-paul-jackson-defends-his-meal-tickets-yet-again.html

Such a world.

A seat on the SCOTUS? That’s a completely ridiculous. She has none of the bona fides to sit on a local appellate court, much less a state supreme court. That’s some pie-in-the-sky trial balloon.

Besides, once people really understand the particulars of this bailout… er, “settlement” I don’t suspect it will bode well for the future of the AG.

And how are people going to find out, let alone understand, “the particulars of this bailout”? Who in the corporate media is covering the settlement like Yves, David Dayen, and Randall Wray are? Do you expect the corporate media to take on Wall St in any substantial way?

My own unsubstantiated hunch is that Kamala’s deal is that she gets the nod for DiFi’s seat.

part of why I noted that it came from HousingWire. and not the LA Times or SFChronicle or SJMercuryNews.

motive, perhaps….

And, don’t forget that Harris may have been promised the position of US Attorney General by Obama if he wins again. AG Eric Holder will honorably go back to his previous employer Law firm now that he succefully fulfilled his mission by not investigating or prosecuting clients of his firm, the banks.

“So let’s look on the bright side of forward, and not the dark side of back. ”

Assuming you forgot the /sarc, Lambert ?

Thanks for continuing to post about this structural failure in our system of social governance.

It forms an interesting observation on the state of the legal profession. Here we have obvious transgressions that are not being prosecuted in a business sector. What are the lawyers in the others business sectors telling their clients?

If we don’t have rule of law, what do we need lawyers for? Hey lawyers! Clean your house, it stinks!

But *trial lawyers* work for Big money, and you know where that is.

But we do. And the rule of law is cash talks, bullshit walks. Same as it ever was, minus all the academic horseshit.

Time for a “New American Century” regarding recognition of our TRUE AMERICAN values. I, personally, have no problem whatsoever in declaring our national values to be purely monetary, just so long as we declare it openly in the interests of fair disclosure. Not that it’s any great secret anyway.

We’re whores for money and power! There, I said it. I feel better already. Now, if I could just wash all this ugly blood off my hands as well!

FUCK! Maybe in the next life! Here’s hoping!

“Hey lawyers! Clean your house, ”

Cleaned of whistleblowers.

YVES, “it’s beginning to look a lot like *Bleak House*” — sing-along.

“Rich London, poor London – a tale of two cities by David Hewitt, 7 Feb 2012, at “New Internationalist Magazine” at:

http://newint.org (my full link doesn’t work, sorry).

I guess the .01% succeeded in returning us all to the Golden Age of Capitalism, from Nixon-Kissinger until now: George H.W. Bush’s/Hitler’s *New World Order*.

And this time the German banks have been taught some manners, lol.

If “corporations aren’t people”, why aren’t the Democrats pushing to prosecute the *people* behind these guilty corporations?

So……… in other words, lenders are getting incentives to write down loans equivalent to 63 cents for every dollar they write down? Why aren’t they scrambling to write down all their underwater loans immediately? That seems like a no-brainer, at least from the lender’s point of view, since any portion of a loan that exceeds market value is not only unsecured, but the loan is at higher risk of default.

Well, they would be losing money that way.

Good point. Remember bulldozer man who decided “I’m gunna knock ‘er down if I can’t keep ‘er.” ?

He had offered, after engaging in expensive litigation to give the effers da’ money. The bankster still taketh away.

They still have to recognize 37 cents of losses. Can’t have that. And if they hold out, the Administration might improve the offer!

Any claims the banks might once have had to be viewed as respectable, or as businesses, are a dim memory.

I told you that HAMP was the bigger scandal than the settlement, and surprise surprise, HAMP is being used to leverage the settlement. Here’s the thing: at the end of the day there are still massive mortgage losses to be realized. The question is, and always was, who pays for those losses? Increasingly it looks like the taxpayer will shoulder the majority of the losses, whether through HAMP, Fannie/Freddie, the FHA, etc. I think this was part of the plan all along-Geithner knew from the beginning that there was a lot of loss to be borne, the only trick was how to foist it on the taxpayer in an unsuspecting way.

Don’t be surprised to soon hear about principal forgiveness at the GSEs and the FHA. Eventually the taxpayer will swallow a good 75pct of the losses from the housing bubble.

Why settle for .75 when 1.00 will do?

“A lot of the principal reductions would have happened on their loans anyway”

I’m sorry. My eyes went red suddenly with rage, to the point of blindness. So bottom line here is the big banks got bailed out again? Is this correct?

Drink early and often, and let the occasion define “excess.” That axiom’s served me well thus far, although admittedly, I’m on a clear path to early self destruction. WTF, you live, you die, it may or may not matter in the end.

Of course.

The hallmark of an Obama sellout, one that separates it from all others, is its richness, layers on layers of sellouts, sellouts within sellouts, not to mention all the bits and parts that banks will push to change later or contest or get contested in court. An Obama sellout is a sellout that never stops giving. Quelle surprise, indeed.

Indeed. You just may have coined a new lasting term there, Hugh. The “Obama sellout.” I, for one, am down with it.

I link it with my own “Obama tell,” roughly the moment that you know a sellout pol has sold his soul to the devil and that EVERYTHING that comes out of his mouth is bought and paid for by someone, and that that someone’s interest’s are diametrically opposed to the actual bullshit that is coming out of that pols mouth. In short, the moment you know that pol is the embodiment of evil, and not an actual person as you and I know it at all.

Thank God that Ms. Smith is on this one.

I don’t agree with all of the opinions on this website, but in the topsy-turvy world in which we live, I do agree that our system of finance is criminal and should not be tolerated.

Go get’em Yves.

While I applaud your approval of Yves’ work, Yves cannot “go get ’em” all by her lonesome.

She can write and expound and uncover malfeasance until she’s blue in the face, but ain’t nuthin’ gonna change until enough of us start pushing back. Making life uncomfortable – for the Banks, for the Politicians.

Creating what Martin Luther King called “creative tension” throughout society, so that business as usual becomes more difficult and people must face the uncomfortable facts about our financial institutions and how they rule our world.

Yves is performing one necessary part of this path to change, again as defined by MLK, “collection of the facts to determine whether injustice is alive.”

It’s up to the rest of us to insure that her work, as well as the work of other contributors to “naked capitalism” was not done in vain.

Textbook crony capitalism, … assuming of course that textbooks are allowed to write about this dark period of history and that students are allowed to read about it.

Simply appalling.

The prolem starts by what you and everyone else have agreed to call it, “a mortgage settlement”. Perhaps if we used the correct terms to describe the event, there would not be such mis-information. Suggestions include, bail-out, liability capping….By using the government’s new-speak term for what the deal represents the battle is half lost.

OK. How bout “Fraud Exoneration”?

Tim Massad to the rescue!!

weeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee!

/chuckle

Until Americans are willing to get off the sidelines (OWS is a minor distraction), enjoy the show. You’re being looted daily, for well over a decade and then some, only now they don’t even bother to hide it.

There is no fear of consequences, and until that dynamic is changed, thanks to The People’s own hubris & ignorance, you get what you deserve.

Well folks.

Let’s just give the banks all the money and get this over with.

So, the AGs got hosed (they are politicians that used to be lawyers, after all, so no surprise). Investors too (at least they assumed risk at some point). And the people, the poor downtrodden, despised, loathed taxpayers, the biggest chumps in history, take it in the shorts again. God bless America. Let’s nuke Tehran tonight!

The Wall Street Journal gently suggests indeed, banks won’t be affected much.

How the Pact Affects Banks

http://online.wsj.com/article/SB10001424052970203824904577213151410540624.html?mod=googlenews_wsj

“Financially, at least, shareholders likely won’t have to bear new costs for Thursday’s settlement.”

And check out that funky math. Magic number is supposedly $25bn? Really? Not according to this:

“J.P. Morgan’s share of the settlement is $5.3 billion, the same as for Wells Fargo. Bank of America Corp. is bearing the biggest share, $11.8 billion; Citigroup has to pay $2.2 billion, and Ally Financial Inc. must pay $310 million.”

kamala met obama at the airport when he flew into sf for 3 fundraisers yesterday

i guess reading the report comes later

i’m sure she stuck to him like glue to get the limelight

she is good at attaching herself to those who can help her advance politically

just ask willie brown

“kamala met obama at the airport when he flew into sf for 3 fundraisers yesterday

i’m sure she stuck to him like glue to get the limelight ”

The formation of political personas requires assistance.

The “settlement” looks like a bribe to state governments anyway. Please do not sue us, we can give you money! The states will choose to use the money to balance state books, and less of it will go to borrowers. How is that working? Is this the money also coming via HAMP and being used to balance the state books for money borrowed for things like education and transportation, etc. Can’t follow. Anyway HAMP was doomed from the get go; it was useless because of one of two things: 1. successful securitization which gave the banks no standing to do any mods, or 2. failed securitization which eliminated all standing by both the banks and the investors. So the whole thing is such a fudge it’s not funny. It has been said that the percentage of actual bank-owned mortgages – which can legally be modified – is 15%. Out of 60 million or just the troubled ones?

Sometimes I wonder whether our elected officials (President and AGs) know how deep of a hole they can dig for themselves (or, for all of us).

For example, in Los Angeles Beaches:

“Children and other people digging holes in the sand are now limited to 18 inches deep. Beyond that and they will be in violation of the new rules.”

http://www.nbclosangeles.com/news/local/Yes-You-Can-Throw-a-Football-on-the-Beach-but-Dont-Dig-Deep-139331753.html

Sadly, Ms. Webber still does not understand that taxpayers do not pay for spending by a Monetarily Sovereign government. If taxes were reduced to $0 or increased to $100 trillion, neither event would affect by even one penny, the federal government’s ability to spend.

Sorry, “Yves.” You blew it this time.

Rodger Malcolm Mitchell

Oh please. I’m sure it’s really fun to fantasize about a world without politics, in which “mechanisms” simply operate without anyone exerting influence over them, but to do so is meaningless in the real world.

Huh??

Rodger I’ll dumb it way down for you.

Regardless if your statement is a case of T / F, it is still subject to the total mass of other peoples beliefs and by that, their actions, and its consequences.

Skippy… Huh??

Skippy and Foppy,

Thanks for making it simple for me. I have just one question: What does any of this have to do with my original statement, upon which you were commenting: ” . . . taxpayers do not pay for spending by a Monetarily Sovereign government”?

Rodger Malcolm Mitchell

“Sadly, Ms. Webber still does not understand that taxpayers do not pay for spending by a Monetarily Sovereign government.”… Rodger.

Skip here… First your projection is unwarranted. Next “tax payers do not have to pay”… better inform the IRS. Rodger on paper you may be correct, but, the reality on the ground is a different matter. What about giving fiat value by taxing et al.

Skippy… pot shots at Ms. Webber in your opening statement, which has zero bearing to your point, is bad form. With the addition of a theoretical view point not actionably observed. You chide Ms. Webber for not sharing your pet theory? We don’t have to go to war, but, we do.

But Skippy, that is the whole point. She doesn’t understand that taxpayers don’t pay for federal spending, and if she did, she could help educate the public, so we wouldn’t have to follow nonsensical policies.

The fact that the IRS collects taxes doesn’t change the fact that taxed don’t pay for federal spending.

I’m puzzled about why anyone would prefer to go along with popular mythology, rather than to try to change things. In essence, you are upset that I have announced the emperor has no clothes.

Monetary Sovereignty is the basis for all economics. Monetary Sovereignty is to economics as arithmetic is to mathematics. To understand economics, you must learn Monetary Sovereignty.

Rodger Malcolm Mitchell

Rodger,

“The fact that the IRS collects taxes doesn’t change the fact that taxed don’t pay for federal spending.” …RMM

Why would they give up such a strong social engineering – economic tool?

“Monetary Sovereignty is the basis for all economics. Monetary Sovereignty is to economics as arithmetic is to mathematics.”… RMM

Sadly this is not an academic endeavor but, politics of power and domination.

Skippy… heck look at the Rule of Law and lets not forget even if hes naked, he still has an army and can us it… cough 3 wars with one in the wings. Cheers.