By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Anyone who has been following my European commentary for any length of time will know that I have been running a number of risk themes on Europe due to what I consider to be misguided and one-sided policy which will ultimately be counterproductive.

These themes come under the major trend that I see in the Eurozone:

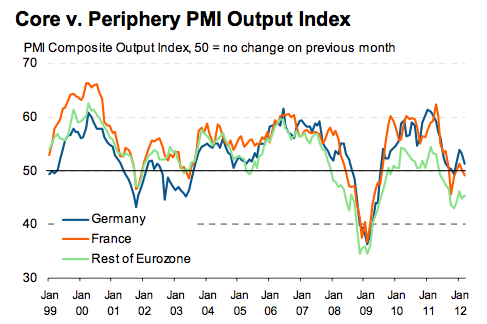

.. Periphery nations weakening, France in the middle, Germany outperforming, but the whole ship slowly sinking.

This analysis is based on the sectoral view of the European periphery which I explained on Monday in a discussion of the Australian economy:

As we have seen from nations like Greece and Portugal, a country with a long running current account deficit and a private sector with a desire – or no choice to save (austerity) – has significant problems trying to reach a government surplus. Once you understand that the external sector and the private sector are a net drain on national income it isn’t hard to see the problem. Under these circumstances there is simply no room left in the economy for savings in the government sector and attempts to reach government surpluses become counter-productive as this simply accelerates the decline.

If a country’s current account deficit is structural ( I’ll explain this later ) then these efforts are very dangerous because this can easily develop into a damaging feedback loop. The loss of income through the external sector leads to a loss of income in the private sector, this then drives the stronger desire to save, meaning government revenues fall further. This inevitably leads to calls for higher taxes, which once again drain income from the private sector … and around we go. The result of this dynamic is a rise in unemployment, therefore national production and income, meaning once again the government sectors revenue decline while private sector spending and investment fall further.

And the story is the same if you look at this from the perspective of national income. A country with a long running current account deficit has been borrowing goods and services from the rest of the world. In order to support this the non-external sectors of the economy will have expanding debt positions and due to this an economy structured around consumption over production. Because the external sector is a net drain on capital from the country, the government and/or private sector must continually expand their debt in order to maintain economic growth.

In many cases this debt accumulation leads to asset bubbles, because the expanding debt drives asset prices which attracts speculation and in doing so accelerates the external borrowing. This in turn drives up national income, which in turn drives higher prices and further speculation. If a sector’s debt is accumulating faster than its income then at some point in the future a limit will be reached and the rate of debt accumulation will fall. This leads to falling asset prices and national income, which ultimately leads to a crisis as accumulated debts start to sour.

This is what we have seen across the European periphery, although the debt has accumulated in different sectors of the economy across different countries. Ultimately, however, once a European country falls into crisis the debt has ended up in the government sector, even if it didn’t start there, because Europe has chosen to keep banks alive at all costs. This ideology, however, is the major issue with the “Austerity” plan.

After a financial crisis the private sector tends to have lost significant amounts of wealth which leads to both the loss of demand for, and ability to support new borrowing. The debts to the rest of the world still exist which tends to mean the external sector is still in deficit even with lower demand for imported goods. This means that in order for the nation’s income to remain at the previous level the government sector must go into deficit to offset the fall in private sector credit creation. If this does not occur then the economy will shrink until a new balance is found between the sectors, which basically means the economy will try to find equilibrium at some lower national income, and therefore GDP.

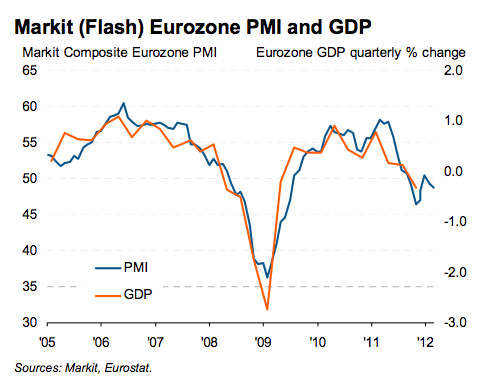

This is the sort of deflationary policy that Europe is endeavouring to implement in the European periphery. There is just one BIG problem. At a lower national income the country has no ability to service the debts that it accumulated on its previous income, yet that is what Europe expects to occur. This is simply delusional, because it is a mathematical impossibility and in trying to break these basic laws of arithmetic Europe is slowly destroying the economies of the European periphery which will, in turn, bring down the stronger economies.

Which brings me to last night’s Flash PMI data.

Flash Germany Composite Output Index(1) at 51.4 (53.2 in February), 3-month low.

Flash Germany Services Activity Index(2) at 51.8 (52.8 in February), 4-month low.

Flash Germany Manufacturing PMI(3) at 48.1 (50.2 in February), 4-month low.

Flash Germany Manufacturing Output Index(4) at 50.5 (53.9 in February), 3-month low.

Flash France Composite Output Index(1) falls to 49.0 (50.2 in February), 4-month low

Flash France Services Activity Index(2) remains unchanged at 50.0

Flash France Manufacturing PMI(3) drops to 47.6 (50.0 in February), 4-month low

Flash France Manufacturing Output Index(4) declines to 47.0 (50.8 in February), 7-month low

Flash Eurozone PMI Composite Output Index(1) at 48.7 (49.3 in February). 3-month low.

Flash Eurozone Services PMI Activity Index(2) at 48.7 (48.8 in February). 4-month low.

Flash Eurozone Manufacturing PMI (3) at 47.7 (49.0 in February). 3-month low.

Flash Eurozone Manufacturing PMI Output Index(4) at 48.8 (50.3 in February). 3-month low

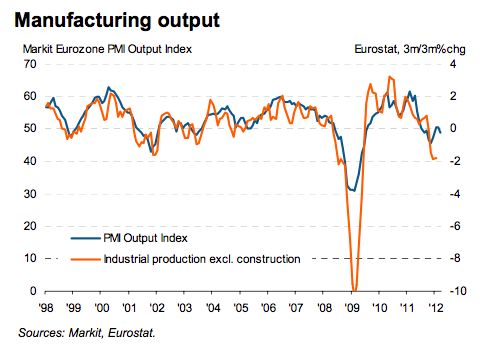

And so you can see that the major theme continues. Stemming from that major theme ,and associated analysis, I have had some major expectations.

1. That Portugal would follow Greece.

This now appears to be occurring in ernest:

Portugal’s core public deficit nearly tripled in the first two months of 2012, showing a deepening economic slump is denting tax collection and stoking concerns the country may miss its budget targets and follow Greece in requiring more rescue funds.

The gap widened to 799 million euros ($1.06 billion) from 274 million euros a year earlier, when the deficit had slumped by more than 70 percent, the finance ministry’s budget office said on Tuesday.

2. Spain was a large unrecognised problem that would return to the spot light:

The country has seen its yields tumble since December on the back of the ECB’s 3-year LTRO but there hasn’t been anything in the economic metrics of the country to support such action. Spain has 23% unemployment and still rising, the banking system is under-capitalised and still has unknown exposure to the country’s housing market collapse. On top of that the rising unemployment rates is pushing up bad loans in the banking system to 7.4%, a 17-year high, and they are still rising.

Since I made that statement bad loans have risen further, house prices have continued to fall and the government’s debt position has worsened.

3. Italy could grow out of its economic slump but was unlikely to owing to history, structure and demographics:

The real problem in Italy is that its economy has been stagnant for nearly the entire decade. According to the IMF, among all countries in the world between 2000-2010 Italy only grew faster than Haiti and Zimbabwe. In 2010, Italian GDP was only 2.5% higher than in 2000. This problem is actually made worse by the fact that this is such a long term trend. Italy’s per-capita GDP growth was 5.4% in the 1950s, 5.1% in the 1960s, 3.1% in the 1970s, 2.2% in the 1980s and 1.4% in the 1990s. Since the new millennium the country has hardly moved forward and if we extrapolate out that trend Italy will spend the next decade in contraction.

On top of stalling growth, Italy has a demographics issue. With a debt to GDP ratio at 120% along with a population with a median age of approximately 45 Italy really does look like the Japan of Europe. The only problem is Japan is competitive, runs a trade surplus and is sovereign in its own currency. Italy has none of these things.

The latest stats from Italy appear to show that the economy continues to weaken and GDP continues on its long running downward trend.

4. Although the ECB’s emergency response to the crisis may have averted the crisis in the short term, it is likely to lead to a zombification of the periphery banking system and therefore add to the downward pressure on periphery economies.

The jury is still out on this one because we need to wait for the ECB’s Quarterly bank lending survey to get the results. This was noted by FTAlphaville overnight:

The effectiveness of the LTROs, and other extraordinary operations of the ECB, can at the moment be judged by some metrics (and general sentiment) positively. However, it seems a bit rash to call them an “unquestionable” success until the liquidity is actually shown to improve bank funding markets, and ultimately land in the real economy.

So we will just have to wait and see on that one. Overnight we also saw news that Ireland, the strongest of the periphery in terms of export potential, fell back into recession due to falling trade volumes.

In total, it is fairly clear to me that Europe’s troubles are far from over because the area continues to meet my predictions. That, however, didn’t stop Mario Draghi from trying to convince the world otherwise:

European Central Bank President Mario Draghi has said the worst of the eurozone crisis is over. In an interview with Germany’s Bild newspaper, he said the situation in Europe was “stabilising”.

Mr Draghi also said that some economic data, including inflation and budget deficits, showed that Europe was doing better than the United States.

The European crisis and the associated delusional rolls on.

I am no fan of the European social democracy system, but it is perfectly clear to me that “austerity” will not solve their problems. The only real way out is through solid, sustainable growth; and that involves a whole multitude of factors, including the birth rate, immigration (and integration), ease of capital formation, labor force competitiveness, education, flexibility in monetary policy, etc., etc.

Of the European countries, the only ones that I can see that are even beginning to think seriously about such issues are the Scandinavian countries (and to a lesser extent Britain); and while even they do not have good solutions for such deep problems as the ongoing demographic contraction, they at least recognize the need for growth, and are falling into reactionary policies that focus obsessively on balance of payments.

Another commenter below says Europe needs to export goods to gain resources because it doesn’t have enough resources per person within its borders. You say Europe needs to import people (for the all-important “growth”). Something doesn’t add up between those two prescriptions.

I suggest that “growth”, defined by the asset-owning minority as increase in wealth per dollar of existing wealth, is a false goal, and increase in wealth per average person is what should be the goal.

You don’t need to import people to do that, you need to first, stop importing cheap labor because the existing labor is too expensive (if you think labor makes too much money, you might in the labor-employing minority) and second, redistribute the wealth from the minority sinks into which it flows (through no merit on the minority wealth sinks themselves).

Agreed. I boggle about economists continuing to use bogus measures such as GDP, which then leads them to focus on growth, totally forgetting the whole point of the game. But maybe I’m naive. So I ask: What is the possible end goal of using a measure such as GDP as opposed to, say, median income? I mean the latter seems to be a better aggregate measure of the happiness of the citizenry. But only if you care about such things. I know economics isn’t a science, but I’m starting to think it really is just a branch of politics.

If European leaders had been on the Titanic, they would have been all for knocking holes in the other side of the ship, preferably in steerage, to let the water out.

While the analysis is technically correct it is largely unnecessary. You don’t need training in economics to understand that countries living on borrowed money and asset appreciation because they import far more than they export soon reach a day of reckoning on which the loans cannot be renewed. This time it happened after the asset bubble collapsed. Since these European countries are not currency issuers they have no choice but default and autarky on the one hand and austerity on the other. No amount of blathering by politicians can change this, although continued browbeating of Germany seems to be producing some effect in the short term, probably because Germany sees its prosperity tied to continued exports to the periphery. The most logical thing to expect might be an end to the growth fantasy of Eurocrats and a return to multiple currencies. Deeply imbedded in all this is the CDS exposure of major banks, notably top tier American banks. Would a default by Portugal (or Spain) make any of these explode absent another Fed bailout of staggering proportions? The truth seems to be that nobody knows.

Deari, It i Socialsim that is the problem in the EU.

All of what you have outlined are at best ssymptoms–at worst they are psuedo-intellectual claptrap meant to shift blame and deflect from that problem.

We are but a little bit behind. This is the “Structural” problem. All else follows from this.

The solution is to dump socialism, the EU and the Social Democratic, neo-communist Nomenklatura.

What a laugh you are toofunny. Socialism — is that what you see when you look at Europe? Because I see things were moving along pretty well until these bankers worked their “magic” and dumped their worthless “assets” onto the nations’ balance sheets. I see kleptocracy and lemon socialism on a massive scale.

Its amazing how many people feel the urgent and irrepressible need to convince themselves and the world that there is no way we can ever possibly provide enough food, shelter, healthcare, education and well-being for the entire populace. What is that drive? Its a strange desire, and I can only imagine it comes from some deep need to see someone, somewhere suffer. I guess unless someone suffers you don’t feel happy, or something like that. Its perverse is what it is. And ugly.

Agreed YF except it is toosad not toofunny.

Where is the Psychiatric Industry on this?Why isn’t there a standard definition of someone who is a belligerant,self-righteous punisher of the modest(and who generally belongs to the same section of the community).And a Treatment.

Unfortunately, the answer to your question is to follow the money.

If you can create a social organization that has a whole group that obfuscates the underlying structure called economists then it is not much of a stretch to understand how hard it is for the mental health folks to point out our leaders are sociopaths in the hire of puppet masters.

Inheritance at the scale of the global inherited rich is not about money but about absolute social control. The fact that they control the world’s money supply indicates the extent of their control.

Psychopath or Sociopath – take your pick!

Definition: a person afflicted with a personality disorder characterized by a tendency to commit antisocial and sometimes violent acts and a failure to feel guilt for such acts.

I think that covers all the usual suspects in the current system of power.

But we see exactly the same problems in America so how can you blame EU government policy?

And let’s not try the it’s governments screwing up capitalism, at last count the US government has loaned or backstopped $29 trillion to bail out or prop up Wall St and TBTF capitalism. I’m not letting the US government off the hook, but I just follow the money and it ends up looking like the banksters have bought the politicians.

“Socialism” is the boogie-man of the unthinking libertarian. Never defined, but it sure is scary. Can’t have any of that “socialism”. Every man for himself, that’ll make us tough. Competition, winners and losers, and no obligation of winners to losers. Die, loser! I keep wondering when the Tea Party is going to follow up on its “let him die” cheers in the GOP debates. Stupid motorcyclist, got in an accident and smashed his head, doesn’t have health insurance or a really big bank account, let him die. Baby with a fixable heart defect but poor parents, let him die. He wasn’t going to be one of the 1% anyway. Old person, no money, you get the idea. Matter of fact, that 99% — well let them eat cake! Nice world, huh? None of that socialism stuff, people working together, helping each other. I’m sure you’ll never need any of that. Just don’t ride a motorcycle.

Yes PLEASE dump the socialism that I am suffering under here in Germany.

Man it’s AWFUL to have 6 weeks of paid vacation.

It’s really HORRIBLE to have public health insurance that provides medical, dental, chiro, theraputic, and convalescance (Kur – up to 6 weeks, with the kids if necessary) coverage for less than 15% of my gross income (and administrators are trying to figure out what to do with the surplus that has developed – in my opinion rates should be dropped by a percent).

And man can you BELIEVE it – if I get sick, really sick and have to stop working I can continue to receive my full pay and benefits for up to 6 weeks (3 x 2 week intervals), and then after 6 weeks the shitty health insurance takes over and pays me up to 60% of my pay until I am recovered. Imagine if you break your leg playing softball – man you’re covered!! What a crime!

It’s DREADFUL living in the middle of one of Germany’s larger, more diverse cities and going for walks at night during which the thought that I could be mugged is laughable.

It totally SUCKS sending my kids to the good public inner-city school around the corner and planning their future education without having to save more than 100k in the next 10 years (for each kid) to be able to pay the tuition at a warm and furry baby-Harvard (their really great kids but sadly they’re not geniuses who would be able to score full scholarships at a real Harvard).

And man I don’T have to drive my car to work – there’s a gigantic public transit system of buses, trams trains, and highways (the AUTOBAHN – totally sucks anyway). Call it the tyranny of functioning public planning and services. Horrible.

Shall I go on?

Thank you, bmeisen! As an expatriate American, when I say the same things (and I do), it can simply be taken as the ravings a disgruntled old turncoat. I now live in northern Italy. Of course things don’t work quite as well here as in your neck of the woods, but the same discourse still holds. I can only conclude that those who knock western Europe’s social democracies (far from any textbook definition of “socialism”) are looking only at the numbers — if they look at any facts at all — and have never actually lived here “on the economy.”

The purpose of any economy is (or should be) to provide a productive but humane environment in which ordinary people are prepared to — and can — thrive both economically and socially. It is NOT simply to maximize GDP, CEO pay, or the 1%’s sense of their innate superiority. In my experience (about 50 years living and working as an IT professional in the USA and 15 in Germany and Italy in invervals over the last 30 years), western Europe still comes out way ahead of the USA by this measure, and I am confident it will continue to do so despite its current very real economic problems.

Europe’s “one percent” are working with America’s “one percent” to destroy the social order and its mutually co-payed-for benefits which you live in and describe. Part of the reason is to destroy Europe as a “better example” which Americans might look to once enough pain wises them up. The other part of the reason is to destroy the European economy and society as thoroughly as the Soviet-zone economies and societies were destroyed . . . so that the inhabitants would be helpless to resist the total and absolute ripoff-privatization of every public good and asset. I believe the secret goal of the “austerity” measures is to achieve the Yeltsinization of as much of Europe as possible, including eventually Germany itself if the Euro-leaders succeed in making Germany-the-country as poor as Greece is today.

Is my tinfoil hat screwed down too tight? In twenty years we’ll both know.

yes, please do continue! and repeat, over and over because it’s the only way we get it. I wish we could put you on teevee and am talk radio 24/7.

There are in fact a lot more things. There is not however euthanasia. When I heard Santorum telling an audience that 10% of the Dutch are euthanized each year, I lost it.

The ‘sectoral view’ seems very close to the MMT approach. But while sovereigns can opt to ‘print money’ in order to balance the sectors and maintain growth (or at least avoid contraction) members of the quasi-federal Euro community cannot. They are neither fish nor fowl; apparently sovereign nations with an inability to save themselves from ruin built into their acceptance of membership.

The sectoral view, if I understand it correctly, means that there are always going to be some nations in deficit – there simply has to be if others are in surplus. That just seems a law of nature, like thermodynamics, and basic common sense to boot. The global economy is a closed system and for every plus there must be a minus.

If that is true, how is it that intelligent people cannot see that trying to shoehorn debtor nations into surplus while maintaining the surpluses of the already solvent is a mathematical impossibility? If they have gone too far piling up debts buying your exports, then surely you have to realise that any correction of the trend must involve your expenditure as well as their belt-tightening.

‘The only real way out is through solid, sustainable growth; and that involves a whole multitude of factors, including the birth rate, immigration (and integration), ease of capital formation, labor force competitiveness, education, flexibility in monetary policy, etc., etc.’

I’m leery of ‘labor force competitiveness’ – does this mean wage freezes for workers, and a free market for ‘professionals’ such as, I don’t know… bankers? How can you expect ‘growth’ if the spending and investment of the majority of your populace is hog-tied by low wages? All you are creating is more debt peonage, not exactly a recipe for a vibrant economy. Productivity has zoomed in recent decades and wages have remained stagnant. Where do you think those gains ended up, and how well do you think that dividend has been invested?

‘Flexibility in monetary policy’ worries me a bit too – there has been so much ‘flexibility’ already that there isn’t much left in that locker. It is about time ‘flexibility in fiscal policy’ was given a run. It could hardly do worse, and in alignment with MMT and sectoral views, it might even do a whole lot better.

‘probably because Germany sees its prosperity tied to continued exports to the periphery’

Well, even as they browbeat the Greeks for their deficits, they continue to insist on selling them great piles of weaponry and munitions, which cannot contribute to any growth effort and which I imagine could only plausibly be used by an enraged Greek military uprising to invade the country they came from.

These reasonable points were addressed by — among others — Keynes’ ‘bancor’ plan at the end of WWII, as you may know. See forex —

“Why White, Not Keynes? Inventing the Postwar Monetary System.’

http://www.imf.org/external/pubs/ft/wp/2002/wp0252.pdf

“How Keynes’ Bancor International Trade Currency Would Work”

http://prosperityuk.com/2003/05/how-keynes-bancor-international-trade-currency-would-work/

Then, as now, plans like Keynes are shut down because those who currently have systemic control would have less of it in any new system.

Money is only the index of the sum resources available to a civilization. And in Psychohistorian’s words elsewhere in this thread: ‘Inheritance at the scale of the global inherited rich is not about money but about absolute social control. The fact that they control the world’s money supply indicates the extent of their control.’

Nice article DE.

Once there two competing theories.

One said that the recession could be ended through austerity-led growth.

The other said that the recession could be ended by raising aggregate demand through public deficit spending creating full employment that is also great enough to compensate for demand leakages caused by current account deficits and private sector savings uncompensated for by expansions in private sector credit.

The first was tried in Europe and in other economies over the past two years. The facts everywhere conflict with the predictions made using the austerity theory. There is not a single case in which austerity policies have not created a fiscal drag on an economy.

But in the face of these facts, the proponents of Austerianism will not refute the austerity theory but insist on its truth. In this way they show that austerity isn’t an economic theory for them, but an article of religious faith or perhaps a theory that allows its proponents to benefit from its practice, while others are impoverished, because they are positioned to do so.

Meanwhile the second theory about deficit spending, job creation, proper sector financial balances has yet to be tested as formulated anywhere. Nations sovereign in their own fiat currencies that have accepted at least some deficit spending, have recovered to a greater extent than nations practicing austerity, suggesting that the second theory may be closer to the truth than the first and has certainly not yet been refuted by the facts.

But the bottom line is that the second theory has not yet been tested, while the first theory is failing everywhere. So, what are our leaders waiting for? When will they acknowledge that austerity is refuted, and test the second theory?

Do it or, in the name of God, go!

The current system of kleptocracy works quite well for the kleptocrats and their paid minions. Why would they choose an option that would reduce or eliminate their opportunities to loot?

Other options will only be tried when the 99% take back the country and its political process.

Indeed.

Why is there always only two choices?I’ve never seen a constant,un-interrupted period of growth in history or in my lifetime.And I don’t see one in the future.

We’re going to have to have a system that manages periods of stability(or stagnation) that come when asset bubbles take off

(or instead of) and when bubbles collapse or technological change runs out of steam or needs time for the Practical World to catch up.

History has spent many centuries with relatively stable social conditions so it has been done.We now have to be able to manage it.

I agree that the key problem is “…an economy structured around consumption over production”. Such an economy has to be turned around to at least be in long-run balance. To turn it around will require an increase in national productivity. If easy money has fostered a consumption-based economy, it is quite unclear how ballooning fiscal deficits will fix it. In my view, such deficits are merely enabling of a consumption-oriented mindset. This is why I think austerity is the only thing that *may* work – if the situation becomes too intolerable, there is at least some chance people will recognize the problem and make the efforts to address it. An independent currency will equally have no effect because the problem is one of underproductivity (relative to consumption).

I am not disputing the accounting truths, but accounting identities have no intrinsic motivation and have limited explanatory power. Motivation drives people to act and these actions in turn influence the accounting terms. I am also not trying to deny that austerity may cause further economic declines. However, austerity may lead to useful pruning of malinvestments (and debt write-offs). But, most importantly, austerity may beneficially alter entrenched mindsets. The motivation to change has to come from somewhere. Austerity, via the attendant suffering, may be the only thing at this point to elicit the required motivation.

“However, austerity may lead to useful pruning of malinvestments (and debt write-offs).”

100% wrong. If you’re in a country like Greece, austerity *as a policy* does not get you there. The implication of austerity *as a policy* is that Greece can “save” enough enough money to plug the hole left by elite mismanagement. There is just cause to think that policy will not work.

Default *as a policy* will get you there. The austerity is only “productive” to the extent that it drives some out-of-power political actors to assume control of policy making in Greece in order to default. ie., it is only productive to extent that you *repudiate* it, once it is imposed upon you.

The current policy makers in Europe who are forcing the austerity policy on Greece know that they can’t save their way to wholeness. They are forcing austerity on Greece because they have a predatory neo-imperialist agenda. It’s the new Latin America.

Dear Yeevs,

All of what you said is right. But there is a fundamental factor that has to be put into the discussion.

Here in Europe we must be able to export. I repeat we must be able to export, because we do not have enough primary commodities in energy, material, food.

To export something we have to be competitive.

Now the only way to be competitive is to reduce the wastes of the public sector.

I do not mean social security or healthcare but just wastes this is our thief of our competitive capabilities. So we have to put austerity measures on the spendings of a mostly non productive or even anti productive sector of the economy which account for a 20 plus percent of our economy.

But we are. The Eurozone as a whole has balanced trade. Which makes this an internal problem.

Ergo, the solution is obviously fiscal union.

Note: Between China and the US the trade is “internally balanced”…

So, according to you the solution is… a monetary and fiscal union of China and the US? Obvious nonsense.

The solution is again separate currencies (as they are) and balanced trade via scaled tariffs, import certificates, or whatever.

See, sound economics works every time the same way – like real science.

The solution is default, separate currencies and balanced trade between the entities involved.

It’s insane to give taxing powers to the same people who botched the monetary union. It’s like poring gasoline into the fire.

In effect the Central Europien countries used their legal bribery and rule-setting status to exploit the periphery. Deprived by industry, the periphery have to sell themselves for peanuts. They are even forced to buy the nasty German and French weaponry, as if the rest of the corruption isn’t enough.

Fiscal union? You want to give the same crooks tax-collecting powers? Then the periphery will never recover, they will be completely and legally enslaved – a neoNazi colonialism.

In fact Hitler made plans for an unified Europe which look very similar to what we see today. Everything is on the record for those who have eyes to see.

More and more corrupt legislation only increases corruption. Thus, first the corruption pathways must be severed by placing national boundaries on currencies and mandating balanced trade and scaled tariffs. Only then things will start to improve.

The structure of the Euro is real the problem that needs to be solved. Uncontrollable Debts and Deficits in member countries are merely symptoms of an ill though out currency union that was fatally flawed from day one.

Massive monetary and fiscal stimulus will be required to lift the periphery out of depression along with huge reforms to improve the supply side of their economies. The alternative / currency policy of Austerity will lead the entire periphery to the same situation as Greece and probably drag the core down as well.

I seriously doubt the change in policy will happen until the periphery economies have already been destroyed beyond repair. The hope for the rest of the global economy is the ECB etc will do what they seem to have done successfully with Greece and keep the depression within the border of the Eurozone.

Calling it a choice between austerity and growth is nonsensical. Any previous growth that has led to imbalance is false growth. So the choice is really austerity v. false growth. And that actually helps to define austerity more accurately as good growth. Good growth v. bad growth. Good growth has yet to be defined. Defining good growth will be the remedy. What is it? One thing to consider, while we decide what we want to be when we grow up, is that false growth created the illusion of wealth due to the velocity of frenzied trade. And whatever panic is ruling reason right now is confusing the issue. One emergency measure, which could last for a decade if necessary, is to flush the system with cash. Enough money to compensate for the lack of money being circulated by all the previous nonsense. We actually need the opposite of deprivation-austerity. Who knows, we might all naturally learn to prosper without trashing the planet. But we need time and a new accounting attitude to do it. An austerity of correct thinking.

Talking of heartlessness and a desire to punish others here’s a moral in a story:-

http://www.npr.org/templates/story/story.php?storyId=127888976

If support for austerity measures is equated with a desire to punish others then despite any sociopathic gene possession human psychology suggests it is bred into Austerians as children.

Of course it’s not about austerity, it’s about growth. But the big question is GROWTH OF WHAT?

The answer is, growth of productive capacity. However Germany and France don’t want to see that happening in other countries. There is a conflict of interests. The union is uneven, only balanced trade inside EU can fix that – separate currencies, scaled tariffs or import certificates.