Happy tax day! Cross-posted from Republic Report.

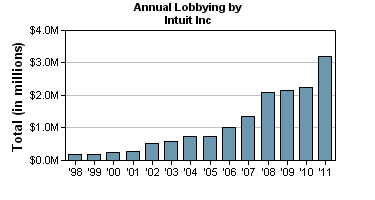

Here’s a chart of Intuit’s lobbying expenditures in Congress, courtesy of Open Secrets. I suspect that some of that nine million dollars of lobbying by that company since 2008 has gone to making it more annoying for you and me to file our taxes.

Here’s what I mean.

In some countries, the equivalent of their IRS sends citizens a form listing what they owe. In California, the state has a program called ReadyReturn that lets you do this for California state taxes. You sign it and send it back, and it takes a few minutes. But for most of us, this isn’t how it works. We gather our tax forms and various banking information, and spend the weekend facing a difficult bureaucratic set of forms, hoping we did it all correctly. Or we use a costly tax filing service or software.

Candidate Barack Obama promised to end this nightmare. He said he would “dramatically simplify tax filings so that millions of Americans will be able to do their taxes in less than five minutes.” The IRS would use information it “already gets from banks and employers to give taxpayers the option of pre-filled tax forms to verify, sign and return.” Experts, he said, estimated this would save 200 million total hours or work and $2 billion.

You can file this under yet another broken campaign promise. And why? Who doesn’t like an idea that is so simple and convenient and just generally helpful? Well, the large software makers, for one. Intuit in fact lobbied incredibly hard to kill the California program Ready Return (complete with attacks from right-wing tax groups). Intuit wasn’t completely successful, but under their pressure, California budgeted only $10,000 to get the word out to residents about the program.

And the risk to Intuit is real – here’s what Intuit said in its investor report, describing risks to its business model.

“Our consumer tax business also faces significant competition from the public sector, where we face the risk of federal and state taxing authorities developing software or other systems to facilitate tax return preparation and electronic filing at no charge to taxpayers. These or similar programs may be introduced or expanded in the future, which may cause us to lose customers and revenue. For example, during tax season 2010, the federal government introduced a prepaid debit card program to facilitate the refund process. Our consumer and professional tax businesses provide this service as well.

In other words, Intuit will lose a lot of money if the government makes it easier to file your taxes. So how did Intuit manage to prevent the implementation of Obama’s campaign promise? Here’s what Intuit had to say about its strategy.

Although the Free File Alliance has kept the federal government from being a direct competitor to Intuit’s tax offerings, it has fostered additional online competition and may cause us to lose significant revenue opportunities. The current agreement with the Free File Alliance is scheduled to expire in October 2014. We anticipate that governmental encroachment at both the federal and state levels may present a continued competitive threat to our business for the foreseeable future.”

What is the Free File Alliance? It’s a coalition of 14 software makers that have signed an agreement with the IRS to provide tax preparation software to the public. You see, the IRS was mandated to provide free online tax prep services to the public, so it outsourced this to existing commercial tax preparers. This agreement was first signed with the Bush administration IRS in 2002, renewed in 2005, and then renewed again under the Obama administration in November, 2009. Even today, despite the Obama campaign promise and demonstrated success around the world, the Free File Alliance indicates on its web page that “Treasury has indicated it does not want the IRS to enter into the tax software business.” And Intuit said on its investor report that this alliance “has kept the federal government from being a direct competitor to Intuit’s tax offerings.”

I’ve been emailing back and forth with White House liaison Jesse Lee over the past few days about this. I’ve asked why the administration has not implemented its campaign promise on pre-filed returns, and I included the information about the Free File Alliance. The agreement with the Free File Alliance does not in fact preclude the IRS from implementing a pre-filing program, so it’s possible this is in the works. Jesse Lee replied, “checking on this’” I’ve sent two follow-up emails, and I’ll let you know what else he says.

Limited separation of Gov’mint and industry – repeat this, know it, learn it, understand it. (Class dismissed)

There’s been talk for years of a GPL free tax software that everyone could use – Intuit and others lobby extensively to prevent this and lobbying money influences the tax code.

Actually…I can do my taxes in 5 minutes (1040EZ)easily…I have none of the special deductions engineered by the Kleptocrats in Washington,and their lobbyist/owners….but,a fair tax system is a complete fantasy…rigging the tax code is one of the special powers our corrupt congress will never give up !

Special interests trump the public interest once again.

On a similar line of thinking, the inherent complexity of the tax code itself keeps legions of CPAs and lawyers employed.

A complex (and continually changing) tax code keeps lobbying dollars flowing to congress too…after all, the ability to write and repeal tax laws is a key lever for extacting campaign funds…but I digress.

Thats a good point. This is an excellent make work program for professionals. Other than the Defense Contractors government programs how many of those are there? I’m only half joking.

The downside is many people at home still try to make it on their own thus performing a non-value added task for no money.

The People’s Commonwealth of PA has its own on line tax prep site. It is remarkably easy to file and it’s FREE. You can get direct deposit of refunds to your checking account or whatever. We have a state income tax that does not present a lot of maze like deductions, does not tax unemployment or workers comp at all. It’s so easy even a cave man could do it. I ought to know.

Unfortunately, any attempts to make reduce the complexity of filing taxes conveniently lead to leaving money on the table. The first hurdle any IRS pre-filled form program will have to overcome is convincing everyone this isn’t the case.

Bingo.

Anybody can pay their taxes in five minutes, and I’m sure the IRS will love it, But you will grossly overpay and miss a lot of possible deductions.

Hence the army of CPA’s and tax attorneys with no shortage of work…

I suppose I should add, if we really want to remove the middle-man from the transaction, we should focus on simplifying the code, not just sending out pre-filled forms. But I guess I’m still pissed the people that pretend to want to help us with our taxes (for a small fee) are lobbying to ensure complexity is baked in the cake.

I would disagree about always overpaying in that strategy. If you do not own a house, and therefore don’t have that bevy of deductions, and are lower income (state and local taxes) and therefore suitable for the 1040a and ez 5 minutes is all it takes. Anyway Turbotax et al take care of the details, and if you have a couple of ws2 and a couple of 1099 it could take 5 mins. (Note that for married filing jointly the standard deduction is 11,600 and in the situations cited above the standard deduction is bigger. Now if you are in Schedule C country its a different issue all together.

I guess it depends on the complication of your returns. In my case, the IRS already has all my income on W-2 and 1099 forms. They know how many regular deductions I’ve claimed on the forms. Next question: do you need to itemize deductions? If yes, then you may need to do your own form. If you’re claiming only the standardized deduction, you’re done in two minutes. My wife and I didn’t bother to itemize before we bought our house; we didn’t have enough deductions to be worth the bother. If you’ve had a significant change of family status during the year, that’s a big complication. But for many, the ReadyReturn would be sufficient.

The tax code and its complexity reflect the complexity of our society. Typical middle class deductions are mortgage interest, alimony, child support, work expenses not covered by the employer (e.g. conference travel) and health care. Personally, I oppose getting rid of any of these deductions. The tough economic recession we live with makes seeking a reasonable alternative improbable. The last persons I want to try to do it are Obama and Geithner.

In a democracy, which is close to what we have, change is typically incremental. Implying that the tax code can be ready simplified is not serious; under the best conditions it’s a mirage.

PS: State income tax is based on the federal income tax breakdown. It’s simple after you do the work. Big deal.

The tax code and its complexity reflect the complexity of our society. Middle Seaman

Unnecessary complexity, I would bet – we attempt to balance theft by the banks and the so-called “credit-worthy” with thefts by taxation. How about abolishing theft? Too simple?

I like Middle Seaman’s comment a lot.

The thing, there is no one right way to try to achieve justice and fairness.

Think about how expensive an actual criminal trial is for both the state and the accused. Why do we do this? Because we think it’s more likely to lead to justice. Of course, the unjustly accused is still out all his time and money from having to endure the criminal trial. Maybe we should eliminate criminal trials so that no unjustly accused man ever has to bear this burden? Of course not. That is preposterous.

It is *always* a balancing act.

Yes, some of the complexity of the code is simply there to assist the rich in looting the state or for CPAs and tax lawyers to charge hefty fees. But some of the complexity is there because the concept of income itself (especially when shoehorned into randomly partitioned amounts of time) is complex.

It’s not black and white, no matter how incapable many people are of seeing shades of gray.

His comment was probably the stupidest I’ve read on taxes all day.

agreed

It represents the wealthy getting out of paying anything. If I could run to a tax attorney, I suppose I could get out of paying anything just like the Oligarchs.

Besides, having a messy and incomprehensible tax structure is guaranteed to keep people ticked off at government. Imagine how they would feel if they had a relatively simple and efficient revenue system to deal with.

Boggles the mind.

Note child support is not deductible on federal returns and is also not income to the other ex-spouse.

I would voluntarily pay more to not have to go thru the BS of generating a tax return.

Taking the ‘Thoreau Option’ again this year. Drone strikes, secret wars and civil rights abuses…not on my nickel, thank you very much.

http://www.todayinliterature.com/stories.asp?Event_Date=7/23/1846

Perhaps they could budget this under healthcare. From my perspective, never having to fill out Schedule A and Schedule D for the rest of my life would surely add years of good health to my life.

As regards the potential for leaving money on the table, I would likely double check the software the first couple times I used it and if there were no glaring (and costly errors), never, ever do so again. Life is too short.

I’ve long maintained that a possible solution is to do this.

First, declare that we have won the war on drugs, decriminalize them, and disband all of the employees that have been fighting this war. With those savings, spend every cent on increased man and woman power at the I.R.S.

Then, second, make it a felony with mandatory prison time of 5 years in maximum security prisons for the offense of hiring someone (like an accountant or whatever) to prepare tax returns for the following people: All members of congress and all congressional staff with incomes of over $100k/year; all Federal employees in all three branches of government (including the judiciary) with incomes of over 100k/year; all registered lobbyists with no regard to their income. Third, remove the government’s ability to withhold taxes at source. Instead, make the tax payable monthly. All of them, FICA and Medicare included. Enforce these tax laws in a draconian fashion. (Identify and plug all the loopholes in the foregoing plan.)

So, what did Jesse Lee come up with? “Check the website”?

Here in France we receive our yearly tax forms pre-filled by the tax office. I just have to verify and execute. Rarely takes more than 30 minutes. If it’s done like this in France, I don’t see how Amerika could ever accept doing the same.

sorry yves, tax accountant here. i would be out of work. i don’t think you want a bunch of well paid upperclass accountants mad about losing money.

of course, think of it this way. this is another attack on good wage earners. with lawyers, it is tort reform. with engineers, it’s h1ab visas. and so too with accountants, take away their bread and butter, taxes.

yves, let me add that i would support reform. maybe not having to file on the 15th of april. give people all year. that would smooth out my workload.

You’ll still have the giant hairball of business accounting.

google taxact to get comprehensive free tax software.

If it was a felony for members of Congress to have anyone but themselves do their taxes, taxes would be much simpler.

Great idea. Too bad it will never happen since Congress would have to vote the law in themselves. Why kick yourself in the shin if there is insufficient stigma forcing you to do so?

A simple first step would be changing the ownership of E-File servers. Currently, E-filing is done via servers owned by the software companies, then forwarded to the IRS. State E-filing costs an extra $10 on the software I use. Why are we compelled to send our complete financial information to Intuit & HR Block, then pay extra for the privilege of E-filing our state returns.

I’m sure they are completely trustworthy and aboveboard in handling that massive stream of data.

“You see, the IRS was mandated to provide free online tax prep services to the public, so it outsourced this to existing commercial tax preparers.”

This is what happens when the oprgans of govenment don’t want to do the hard, messy work of, you know, governeing. Outsourcers add nothing – zip, zilch, zero – of value. Why? Because whenether paid by an outsourcer or paid directly by a department, it’s still the same guys at the bottom of the pyramid doing the actual work. Designing, coding, testing, debugging – it’s the same guys that will have to do it. Outsourcers add nothing.