By Philip Pilkington, a writer and journalist based in Dublin, Ireland. You can follow him on Twitter at @pilkingtonphil

I expect to see the State, which is in a position to calculate the marginal efficiency of capital-goods on long views and on the basis of the general social advantage, taking an ever greater responsibility for directly organizing investment.

– John Maynard Keynes

One of the main concerns with implementing economic policy in developing countries is inflation. Many of these countries do not have sufficient productive capacity to ensure that their population is able to consume the goods and services they desire when their living standards rise. This often leads to rising imports, currency devaluation and inflation when policy is geared toward rising incomes.

These are some of the problems that Randy Wray dealt with in his recent post on a jobs guarantee program as it might be implemented in developing countries. Wray says that in order to overcome inflation from higher incomes, the program should be implemented very gradually. While this seems like a sensible approach I think that Wray is being slightly too modest about what sort of policies Modern Monetary Theory (MMT) can facilitate to ensure both full employment and price stability.

Functional Finance as a Tool for Development

MMTers make the claim – following in the footsteps of Abba Lerner – that the government budget should not be subject to any sort of arbitrary balancing constraint. Instead Lerner and the MMTers advocate that the government budget balance should be conceived of strictly from the point-of-view of real economic variables. Thus, if there is unemployment the budget should be unbalanced, while if there is high inflation due to output capacity being outpaced by demand the budget should be moved closer to balance or even, in certain cases, into surplus. Lerner referred to this approach as ‘functional finance’.

The reason that both Lerner and the MMTers feel confident in making this case is because they hold that a government that issues its own currency and allows their exchange rate to float is not subject to any budgetary constraints. They can essentially issue new money – together with government bonds, if they so wish – until they begin to see inflation. Inflation, then, is the only real constraint to a government that issues its own currency and maintains a floating exchange rate.

However, if a developing country tries to spend up to the point of full employment while maintaining a floating exchange rate they are, as stated above, likely to see devaluation and inflation take place as the weakened currency chases more and more imported goods that the country’s own domestic industry cannot produce. As incomes rise through government spending programs (and potential rises in real wages) people will be more inclined to seek out goods and services that were previously thought of as only available to a small stratum of the population. Devaluation and inflation are then almost inevitable.

But think about this for a moment; if we adhere to a purely functional view of finance then we have far more options available than might appear at first glance. We can actually use government fiscal policy to guide domestic investment decisions and ensure that the goods and services people desire as their incomes rise are produced at home rather than abroad. Then we need be less concerned with currency devaluation and inflation as these goods and services will be denominated in the domestic currency. This supply-side planning can then be coupled with demand-side policies aimed at raising income – the jobs guarantee program being the most important of these – to produce rising living standards and full employment while maintaining stable prices and a stable currency.

Developtopia

Let’s take a simplified hypothetical example. A developing country – let’s call it Developtopia – is seeking to implement full employment policies and raise the standards of living for all of its citizens. The government and policymakers of Developtopia are all MMT-oriented and allow the government budget to be manipulated in a ‘functional’ manner. They’ve also agreed to maintain the currency in free-float.

The government of Developtopia then start by gradually implementing a jobs guarantee program. MMT economists working for the government then run surveys of shops and consumers to see what goods and services people are buying with their newly issued pay checks. They find, let’s say, that citizens of Developtopia are buying higher quality furnishings for their houses and that these are being imported from Scandinavia.

This is a problem because every time a citizen buys a high-quality piece of furniture downward pressure is (theoretically) put on the currency of Developtopia. As the currency depreciates the Scandinavian furniture, together with other goods and services, become increasingly expensive. The government then face a rising rate of inflation that could undermine their policy efforts.

Now, if the government and policymakers are good MMTers they will see that there is a clean and efficient way to solve this problem through the further use of the functional finance paradigm. The government can move to incentivise and subsidise high quality furniture companies to set up shop in Developtopia. They can massively cut taxes on these companies and provide once-off fiscal transfers to entrepreneurs who want to start such companies up. They can also build carpentry and other training programs into their jobs guarantee scheme.

Within a short period of time the stars will align for the new domestic high-quality furniture industry. Entrepreneurs will get a kick-start from the government together with extremely high-rates of return over the medium run. They will also be able to hire out a newly trained pool of semi-skilled workers.

Obviously, the real world is a bit more complicated than this simple example and these changes could take time. But the fundamental principle is sound.

This is a type of approach to economic policy that has a long and interesting history. It was extremely popular in France after the Second World War and came to be known as ‘dirigisme’ – which is derived from the French for ‘to direct’.

Dirigisme in France after WWII

After World War Two the French economy lay in ruins. In addition to this many of the former leaders of business were compromised due to their collaboration with the Nazis and the Vichy government. De Gaulle’s centre-right government decided that they had to do something about the mess and so they began to initiate dirigistic economic policies.

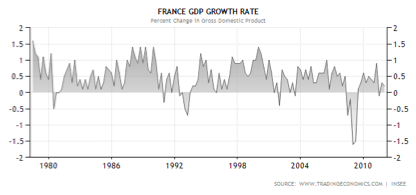

Basically the state formed a planning agency that determined what needed to be produced and the government then incentivised the market to produce the desired goods and services. The experiment was a remarkable success and the French economy flourished. The period of dirigisme in France after the war became known as the Trente Glorieuses (The Glorious Thirty) and was characterised by high productivity, high real wage gains and a strong rate of GDP growth (averaging 4.2% a year).

The project was disassembled by a Socialist government under Francois Mitterand starting in 1981 and the slowdown in GDP growth that resulted speaks for itself.

The post-dirigisme period – which was characterised by market liberalisation and other neoliberal nonsense – was one of low growth and high unemployment. A malaise with the French political system itself set in soon after and the far-right Front National party began its gradual and disturbing rise. Basically, the French political system put a gun in its mouth and pulled the trigger – this was the sacrificing of a competent government on the altar of neoliberalism.

Clearly dirigisme is a workable method of economic governance. It allows markets to continue to function but at the same time channels investment into needed channels quickly and effectively. It does all this without the need for complex bureaucracies. All that is needed is good researchers and planners and a sensible government willing to incentivise investment that serves the public purpose. Coupled with the functional finance approach as laid out by Abba Lerner and the MMTers the possibilities for developing countries (and developed countries) are endless.

Realising National Potential

Countries that might be good candidates for a policy mix based on dirigisme and a jobs guarantee program – that is, a simultaneous supply and demand side MMT policy mix – might include: any developing country experiencing high rates of inflation (Argentina, are you listening?); Eastern and Middle-Eastern countries that already run their economies in a somewhat similar fashion to a dirigisme system (Egypt, Kazakhstan, Iran etc.); those countries that are currently trying to realise a new type of socialism for the 21st century (Venezuela, Bolivia, Peru etc.); and, of course, those countries making the transition away from centrally planned economies (especially Cuba which, with its pre-existing institutional structure, might provide a very interesting test case for such a paradigm).

In order to start this process MMT should explicitly endorse dirigistic policies as a counter to currency devaluation and inflation. MMTers should recognise the planning opportunities opened up by a proper understanding of what it means to operate one’s own currency in a floating exchange rate system.

After the war France was left with the possibility of inflation and even rationing because its domestic economy had been torn to pieces. The French were able to channel investment in such a way that their economy grew at record levels and produced a Golden Era of development. There’s no reason that other countries cannot follow a similar development model while integrating the demand-side jobs guarantee approach that MMT already advocates.

Keynes correctly predicted that after the Great Depression governments would have take far more responsibility for investment than they had up to that point in historical time. Today, if we are to avoid global economic stagnation, this appears to be equally true. But on the supply-side we can ameliorate potential downsides of governments raising employment and aggregate demand by recognising the planning potentials opened up by operating a sovereign currency under a floating exchange rate system.

The key task now is to elaborate on such an approach and make it saleable for both businesses and governments in the developing world.

Excellent article.. I like the practical emphasis it gives to MMT and also the French experience.. Also seems to jibe well with Stiglitz’ book Freefall..

“Economics is a social science. I soon realized that my colleagues were irrationally committed to the assumption of rationality. Robert Putnam has emphasized the importance of our connectedness with others.””

“”It has become a cliche to observe that the Chinese characters for crisis reflect “danger” and “opportunity”. We have seen the danger. The question is, Will we seize the opportunity to restore our sense of balance between the market and the state, between individualism and the community, between man and nature, between means and ends? We now have the opportunity to create a new financial system that will do what human beings need a financial system to do; to create a new economic system that will create meaningful jobs, decent work for all who want it, one in which the divide between the haves and have-nots is narrowing, rather than widening, and, most importantly of all, to create a new society in which each individual is able to fulfill his aspirations and live up to his potential, in which we have created citizens who live up to shared ideals and values, in which we have created a community that treats our planet with the respect that in the long run it will surely demand. These are the opportunities. The real danger now is that we will not seize them.””

I think this sounds practical enough. But, given the current economic climate of globalization via market liberalization (which essentially just makes developing countries into economic slaves), does this plan risk charges of protectionism? What would the WTO make of it?

If dirigisme were used to guide economies there would have to be a rewrite of WTO policies so that conflict did not arise. Just look at the Solyndra fiasco. It was really a tragedy. The question becomes how to combine dirigisme with rational trade policies. If dirigisme produced a high level of self sufficiency in any/all countries, rational trading would follow. And rational finance. Finance freed from the need to speculate on absurd levels of growth. Fighting over natural resources, aka war, has always distorted economies. That needs to stop. That is the first step in global cooperation. If we are going to have successful globalization we need to guide our own economies and, to keep a steady state, we are going to need a global resource trust

“All that is needed is good researchers and planners and a sensible government willing to incentivise investment that serves the public purpose”

That’s all? ;-)

The problem in most countries comes down to the rule of law. If you can’t depend on the government to enforce laws, then there will only be businesses operated by the cronies with access. The resulting oligarchy only has interest in enriching themselves–with inflation becoming a symptom of the disease.

The article, though of some interest, really only represents mental master**tion.

I think it is okay to spell ‘masturbation’ on the interwebz.

Also, don’t all policies start out as theory? I think the more appropriate caution would be to contextualize approaches given local political, social, environmental, and economic circumstances. The idea that this approach could be applied universally is silly, of course (because there is no such thing as one approach good in all situations….and this, I find, is a real problem that many economists share. They think in terms of Universal Truths)… But, the emphasis on improving self-sufficiency is not.

Here Here

Here Here for John F, pshaw for Stephanie.

There is a problem with MMT called inflation or debasement of the currency.

If there is a universality to be found in the politcal economy it is that the capacity of people, which includes politicains, to cheat and steal is unbounded. Abrogate the rule of law and you get precisely the corrupt oligarchy that John F is referring to.

Why do I get a ‘pshaw?’ Where did I say anything about rule of law?

From what I gather you made the mistake of thinking that the idea of applying theory is not completely useless.

If you think inflation or currency debasement is a problem, then I suggest you read the MMT literature more closely, or at least explain why you believe the boundaries put forward by the MMTers would not work in practice.

Otherwise it just looks like you don’t know what you’re talking about.

What the hell is ‘debasement’, we are not on gold standard any more and money multiplier theory is wrong so there is no such thing as ‘debasement’ of the currency’ by increasing bank reserves (“base money”), and there is no other base to speak about.

Inflation is a problem yes, but this has always been the case, inflation is the only real limit to consumption, spending, or whatever. No big insight there, just aknowledging reality.

Now how inflationary is our current environment is an other thing, with so many unemployed/underemployed, and such huge output gap etc. we would have to look how real inflation is (housing falling prices included, other thing is that is not transmitted to pending household debt to equity ratios, as mortgages stay basically the same).

Basically pushing oil and oil-derived (a big deal of the economy) consumption is gonna make inflation higher, we need more spending on energy efficiency and investments to try overcome this real problem. But that’s about it, everything else pretty much has deflationary pressure (falling rate of profits is something that can be only offset by some external entity spending money into the economy too).

“The problem in most countries comes down to the rule of law. If you can’t depend on the government to enforce laws, then there will only be businesses operated by the cronies with access. The resulting oligarchy only has interest in enriching themselves–with inflation becoming a symptom of the disease.”

Exactly the case for the USA, right?

Stop masturbating.

“The problem in most countries comes down to the rule of law. If you can’t depend on the government to enforce laws, then there will only be businesses operated by the cronies with access.”

John F., this is cliched nonsense. I could name at least 30 countries which developed quickly in recent years with very poor legal frameworks, at least by ‘western’ standards. Britain and the US themselves experienced rapid economic growth without good laws.

Contracts are often enforced informally, at the social level, having built up over the long-term via networks of trust. In many countries recourse to the courts almost never happens. It may not be how we do things in Europe or the US, but it suffices.

Dear Dan;

I think you are mising the ‘economy of scale’ issue here. “Informal” enforcement can only ocur when the parties are of similar size. The problem with TBTF banks is their size, hence the name. Previously, the only institutions capable of ‘enforcing’ against the big corporations was the government. With the phenomenon of regulatory capture now a feature of the system, there is no ‘organized’ countervailing force to bring balance to the equation. We are entering systemic ‘internal regeime change’ territory here. No matter what method you choose, America will not look very similar to the ‘Shining Beacon on a hill” it once was.

Great, the imposition of yet another Western “theoretical” straight jacket for developing countries now that neo-liberalism is no longer viable.

“The key task now is to elaborate on such an approach and make it saleable for both businesses and governments in the developing world.”

STOP THE F*CKING MEDDLING ALREADY!!!!!

What is so difficult for Westerners to understand about not messing with the other people’s countries?!!!

Witnessing the West’s track record over the last 30-40 years, one would think that a dollop of humility might have crept in somewhere but alas, now we have a really super-duper, sure-fire economic thingamabob to roll out and “sell” to the heathens.

And I’m sure PP will give us the tired old shibboleth that his theory will in effect raise the living standards of all of the heathens just as neo-liberalism has been telling/selling us of 30 years.

Hey, maybe would could give them some more military aid and training, too, right PP?

Adopt our newest economic model and get a year’s free Blackwater/Xe/Academi contract to strengthen your secret services and torture sites, huh?

Enough already!!!

JSmith,

It’s interesting to note that although we all know you cannot create wealth by printing papers, it seems all these theories (although very sophisticated and highly complex) end up with the same solution. More government intervention, more devalution of the currency (isn’t this what caused the stealing of wealth/surplus??). But this is supposed to make the populus good.

I thought that if the government took a cow from someone via either taxes, or devaluing the surplus you gained by selling a cow – it’s still a tax?

France is probably not a good example to use in this scenario, wasn’t France destroyed during WWII with need/demand/whatever you want to call it to rebuild? So, was it this theory at work, or was it the incredible demand to rebuild at work? Was the government involved in the rebuilding? Of course the government was involved… But the point is that the government cannot create a job. The market does… The US has not been destroyed.

I think the comparison between Dirigisme should be the American minimal intervention system. It’s also interesting to note that as the years went by, more and more intervention has been used in the US, the more intervention used, the worst the economy became, the more intervention these “economists” asked for. When the policy complicate matters just state we are not doing enough and ask for more intervention. Those who disagree are “nuts” that want all to suffer.

It makes perfect sense that nobody can tell us how many government jobs/cost it takes to create a job.

Dirisgime is 180% from a free market system. It’s total government intervention in the markets. It’s like taking the fastest computer out there, move operations to a manually run government system and expect much better results.

You wrote:

“It’s interesting to note that although we all know you cannot create wealth by printing papers, it seems all these theories (although very sophisticated and highly complex) end up with the same solution.”

Yes, we know that. That’s why the MMT policy in Phillip’s article advocates that the printed money must be spent on investing in the industrial capcacity that the people of the nation need. Whether the government manages operations, or provides incentives for supply development and regulates operations of private industry, depends on the assessment of the market forces and national goals in that particular situation.

The point is that the(a) government can help to provide some direction, has in the past in ways that have proven to be successful, and that the libertarian or neo-liberal idea that nothing government touches ever comes out right is a lie designed only to “get government off the backs” of those kleptocrats who are determined to pillage everyone else.

In a TRUE democratic society, governmental institutions are the representatives of the citizenry and therefore it is nonsense to claim that government is the cause of all evil. If the government doesn’t serve its purpose the source of all evil is the citizenry that doesn’t fix the problem. Government was created by the people for the people and if we don’t experience that it is because we stopped to be a TRUE democracy. In true democracy, government by the people for the people has to intervene to serve the interest of society as a whole and the contracted individuals and for that purpose it has been created as a public institution – create stability in an unstable world. Leaving existence to pure chance will bring us back to the stone age.

It’s interesting to note that although we all know you cannot create wealth by printing papers, Defiant

Even if that were true, and it isn’t since SOME money creation is undoubtedly good, money destruction DESTROYS wealth or do you think EVERY lost job and closed business during a Depression is a “purged malinvestment”?!

And what do the stupid Austrians think? That digging gold out of the ground is legitimate money creation? How is that different from “printing gold” except that the latter is far less wasteful of human effort and the environment?

What you think “we all know” is propaganda from fascists who detest that they do not absolutely control all money creation OR who are opposed to ANY money creation so they can sit on the hoards and enjoy risk-free returns at everyone else’s expense. They are contemptible.

Beard,

Yes some money creation is good when it reflects underlying assets. In other words, if I have a cow and you have a horse, and we believe they are worth the same, than we can make an exchange without need for currency. But we can also agree that my cow is worth $1000 dollars and your horse is $2000. In this case, we can settle the differences by using currency – I can give currency with value of $1000 to make up the difference. That $1000 dollars represents the value of a cow/capital/wealth/surplus. In a market free system, you have gained purchasing power and can now use that spending power to purchase other goods and services or for a rainy day.

Not necesarily do we need dollars, we can use gold, silver, wooden sticks, rocks, iotas, leaves, rocks, or whatever makes you happy, as long as we both agree that it holds a value of the cow.

Unfortunately you cannot print gold as you state (if you can I have business for you), but you sure can print dollars – as much as you want. You cannot print the cow nor the horse. So the $1000 paper dollars that represent the cow today will not represent the cow a year from now. Do you know why? Because more the Fed has issued more credit (essentially stealing by devaluing existing money/capital/surplus) to 1) support government spending in theories like MMT and exponential theory of blahhh 2) finance bank profits.

This is a tax whether you realize it or not and it is exactly what has caused the issues we face today. Can you tell me how many government jobs are needed to create a job?

Of course giving money to the banks isn’t the solution; it should be given to the victims, the general population.

As for government money, the government should issue as much as the market will bear so long as it is not de facto legal tender for private debts.

Of course there is no chance that the government will use the power to create currency to make a group of people happy, essentially buying votes, would there?

We haven’t seen politicians sleep in the same bed as unions – have we? Perhaps GM and other unions with gross benefits tax payers cannot not support accross the nation (i.e. education system is falling apart), unaccounted $$, duplication of jobs, useless projects for the purpose of “creating jobs”, etc are not good examples (being sarcastic)… I’m sure they won’t attempt to pick winners and losers like on the Solyndra case. Every penny will be efficiently used if only the US can take charge of it’s currency. Wait… if we can’t do that now – how do we expect this if they did have charge?

How about neither the Fed nor the government in charge. Let the market (the people) set the value of the currency, the cost (interest), how much is needed and pick winners and losers. Note that irrespective of what MMT wants to believe, the Fed follows the market anyway, but it’s intervention/and gov intervention cause bubbles. Removing the manual intervention of the “geniuses” will remove these inefficiencies in the market.

Actually I am replying to Defiant. Defiant wrote:

“Let the market (the people) set the value of the currency, the cost (interest), how much is needed and pick winners and losers.”

You mean, let the currency speculators and the hedge fund managers in the employ of .01% control the currency, and the cost of interest. As for how much is need and ‘picking winners’…let the .01% buy all the key industries (via credit which only they can access, of course) so that they can enjoy monopoly pricing power and the power to exclude others from the market. (ie buying electrical transimission lines and the rights to urban areas). In this way, the rich can only get richer, and the ordinary person will live at their behest.

Heretic,

Let’s not try to make fuzzy what is as clear as water.

Is speculators the best thing you can come up with? Come on…

Well than perhaps you can answer this – who is ultimately decides the direction of prices, the Fed or the Market? Who is bigger, speculators or the market?

Are you suggesting that the fluctuation in oil rises are due to “speculators” or perhaps it has to do with the excess liquidity being thrown out there by the same Fed you defend. Is the Fed the speculator or is the market the speculator/manipulator?

You are telling me that a hedge fund with a couple of billion in assets is moving the prices of items in a multi trillion dollar world economy. It’s like a drop of water moving the ocean. Perhaps it is possible after all.

Heretic,

One final thing, this is not “my” suggetion – this is the market/the people speaking. See below.

http://www.rasmussenreports.com/public_content/politics/general_politics/july_2010/75_say_free_markets_better_than_government_management_of_economy_political_class_disagrees

Perhaps the economists and politicians know better than the market does. It sure has been proven to work for so many years (being sarcastic)…

Someone has to “pick winners and losers” since the libertarians like to put it that way. I imagine that the government does about as well as anyone. The Solyndra (sp?) case is a typical libertarian red herring. With new and emerging technology many of the attempts are bound to fail relative to the ultimately successful ones. If we don’t provide somewhat bountiful support to the whole industry (I mean alternative energy here) as we can count on China and others doing who aren’t crippled with libertarian ideals by their kleptocratic elite, we’re pretty well bound to lose the industry completely as we have the entire electronics industry.

Is that what you advocate? I sure don’t. The Solyndra episode’s part of the “cost of doing business” in developing an alternative energy industry.

jonboinAR,

Looking at the government’s latest history it sure sounds as if they are are doing an excellent job in picking winners and losers. Can anyone point me to a “success”.

No the government does not do as well as anyone. Would you care if you lost 100 million that were not yours and you know you will get another 100 million from tax payers anyway? But you sure would mind if the 100 million were yours. Perhaps there are other non-tax-payer braking insentives that can be used to stimulate industry growth?

Solyndra is not a red herring, it’s what we can expect when the government gets involved. Perhaps automobile, housing, stocks, medical are better examples of successful government supported industries (I guess higher costs is what the population wants after all)?

We lost the electronics industry? If that’s why electronics are still affordable/increased wealth (unlike the others above), than perhaps we should lose the other industries as well.

Your elected officials don’t care about any alternative energy industry. It’s all about their pockets and making some group happy to gain votes. If your representatives were so concerned about oil prices, than we would they would not allow the Fed to devalue the currency driving up costs, they would not deficit spend, they would not be in the middle east fighting a war that the same Democrats condemned at a time. Now it’s all good.

In fact the same president that in your face told you he has reduced dependency in foreign oil, lied and in fact has increased that dependency. It’s not only the Dems, it’s all of them and it won’t stop until people demand this stop.

@Defiant:

“Looking at the government’s latest history it sure sounds as if they are are doing an excellent job in picking winners and losers. Can anyone point me to a “success”.”

Auto bailout. Next?

“No the government does not do as well as anyone. Would you care if you lost 100 million that were not yours and you know you will get another 100 million from tax payers anyway? But you sure would mind if the 100 million were yours. Perhaps there are other non-tax-payer braking insentives that can be used to stimulate industry growth?”

Conjecture. Please provide evidence that this has happened.

“Solyndra is not a red herring, it’s what we can expect when the government gets involved. Perhaps automobile, housing, stocks, medical are better examples of successful government supported industries (I guess higher costs is what the population wants after all)?”

Good government intervention is good, and bad intervention is bad. Social Security, WPA, Medicare, GI Bill, Auto Bailout, Civil Rights Act, Emancipation Proclamation are good. Iraq War, Japanese Internment Camps, Oil Subsidies, Bank and Shadow Bank Deregulation are bad.

-Auto industry is a good example and a success story.

-Housing industry was ruined by bank deregulation and declining to clean up after the crash.

-Where is the direct Gov involvement in the stock market?

-Medical industry is terrible wherever government is absent. Medicare works great. Private insurance and fee for service is terrible.

“Your elected officials don’t care about any alternative energy industry. It’s all about their pockets and making some group happy to gain votes. If your representatives were so concerned about oil prices, than we would they would not allow the Fed to devalue the currency driving up costs, they would not deficit spend, they would not be in the middle east fighting a war that the same Democrats condemned at a time. Now it’s all good.”

Please provide evidence that high Oil prices are caused by devalued dollar, especially since oil is priced in dollars, and since the dollar is not being devalued. (I’ll give you a hint: you can’t)

“In fact the same president that in your face told you he has reduced dependency in foreign oil, lied and in fact has increased that dependency. It’s not only the Dems, it’s all of them and it won’t stop until people demand this stop.”

Please provide evidence that President Obama has increased dependency on foreign oil.

General note: Please stop spamming these threads with unsupported assertions.

Of course there is no chance that the government will use the power to create currency to make a group of people happy, essentially buying votes, would there? Defiant

If you’d think a bit instead of parroting Austrian dogma you realize the answer is no, not to any significant degree.

Let me tell you. I USED to be an Austrian so when I say they are fascists, I know what I am talking about. When I discovered they were fascists and not libertarians, I left them behind.

Amanasleep,

Here is a chart depicting dependency on foreign oil and showing increase after Obama came into office (note that he lied about this same item):

http://globaleconomicanalysis.blogspot.com/2012/03/president-obamas-lies-regarding-us.html

The automobile item is not worth arguing at this point.

Yes, bank de-regulation implemented by the same politicians you support as well as Fed induced (Greenspan induced the housing bubble??). On top of it, government agencies promoted housing “affordability” and for loans to everyone. That sure worked out well. Cleaning up after the mess means allowing prices to drop to prices were buyers could buy. Although I’m sure you would never support that.

No government involvement in the stock market, but the Fed has openly stated they are supporting stock market prices, inculding purchases of securities. Who is allowing the fed to do this?

In regards to medical costs, have we forgotten about EMLATA passed in the 1980s. You want prove, the cost of federal health care spending was 53 billion in 1980, last year 820 billion. Much more than 10 fold. So yes.. the government has been involved in health care.

Although I agree that there is no possible way to link the rises in oil prices to Fed policy (just like you can’t any other prices for that matter) this is besides the point. Why don’t you enlighten us and let us what adding new liqudiity will do to assets?

Are we saying that these policies had nothing to do with the Tech bubble, with the housing bubble, etc?

I am not here to bash nor defend any political party – my statements are my opinions and the truth.

Perhaps we should all follow the advise on spamming..

Mr. Defiant, you wrote:

‘Are you suggesting that the fluctuation in oil rises are due to “speculators” or perhaps it has to do with the excess liquidity being thrown out there by the same Fed you defend. Is the Fed the speculator or is the market the speculator/manipulator?’

It is true, the Federal reserve has printed trillions of dollars in the past three years, loaned it out at almost 0%.. But who was the recipient of this largesse? Was it the homeowner of the US? Clearly no. Was it the US government? In small part. The largest portion of money was funneled into the banks, who moved the garbage assets from their balance sheets and the garbage ‘collateral’ from their favored hedge funds and othwr finanacial institutiions, onto the Fed’s balance sheet, and funneled the fresh money into their propriety trading desks and the balance sheets of various financial institutions. Thereafter, these financial institutions then used the money for speculation, and behold, the price of stocks, bonds, and commodities rose.

I do not like what the Fed has done. The federal reserve has acted to protect the corrupt and the feckless speculators from the consequences of their actions. There are other solutions to the financial crisis that protects the financial payment system, protects the deposits, protects small investors, without protecting the large speculators and the traders of financial system.

@Defiant:

The Solyndra “failure” was, from all I’ve read, a perfectly good attempt to support new technology. It was not predictable that the one technology would lose out to the other. If indeed, the Chinese have deliberately swamped competition, then, IMO, we should have supported Solyndra even more and not allowed that to happen. But perhaps the Solyndra tech was indeed the less practical one. I believe we should have divided a few billion tax dollars into both the Solyndra tech and the thin film and begun a new industry in the US. We’ve wasted a couple of thousand billion more than that in the last ten years fighting two wars for nebulous returns.

As far as I can tell the auto bailout is a raging success so far.

I am much less insouciant than you about losing industries. Our electronics ARE cheaper till we find ourselves without jobs. I think a service economy is destined to be a third world one.

“Can you tell me how many government jobs are needed to create a job?”

Every Government Job is also a regular job. Please explain why working for the government is any different than working for private industry.

There is no magic to government creating jobs. Government either is providing incentives to industries that need it, or directly employing people where private industry declines to do so.

“devaluing existing money/capital/surplus” and other garbage.

Please provide evidence of this devaluation. Inflation rates are stable and low, despite massive “money printing”.

Everything you say would be true if it weren’t lies.

Defiant is working off faith: “Money printing bad – gold digging good” so facts don’t phase him.

Btw, his “faith” was mostly concocted by atheists and agnostics who appear to have worshiped gold.

Hi there Amanasleep!!

I’m all for government jobs – when they are needed and when they benefit society as a hole. Working for government is different than private industry for the same reason I stated on my previous post. A government has the ability to hire and keep payroll irrespective of productivity. Productivity and return of investment to the tax payer is not the primary concern (perhaps not even a concern??). If the government loses money on a bad project/blah and needs additional funds to operate, well, taxes can be increased and if tax payers don’t like that, well let’s borrow a couple of billion/devaluing the currency. Not to say this happens in every public office around the country, but the risk of losing “your own money” is not there for the government.

Now, if you are a private institution you will need profits to survive and you better get productivity out of your employees. If not, you simply go out of business, UNLESS, you are a buddy of the federal reserve or Solyndra.

Calling this “creating job” is dubious at best. When you have to tax $100 out of someone, waste $90 in administrative costs, pay another $10, it’s not creating a job, you are actually killing jobs. You are not killing a job, you are killing many jobs. Especially when the job you created is to move papers between a bucket and another. But “saving a job” does have a catchy sound and people eat it up like hot cake.

Based on our previous discussions, I am 100% sure you are well educated and know exactly what inflation I am talking about. Have you heard the law of 72? Why dont you try it on the Fed’s inflation rate target of 2% and tell me how long it will take for the money supply to double? I don’t think we need any additional evidence to prove that – do we?

You state that there has not been massive inflation (of course you incorrectly refer to it as a measure of price instead of money supply to confuse the readers) although there has been massive money printing.

Good you ask this question and I will offer an answer that many have even provided in these boards (your buddies) and I know you are full aware of. Have many on these boards not stated that if we dont print we would enter a deflationary spiral as credit supply is erased from the system via defaults?

Of course you have – and that’s exactly why you have not seen differences in the money supply and prices have been somewhat stable. The Fed is pumping liquidity in via one side, while credit contracts on the other – offsetting the added liquidity and more. I mean – how many more housing bubble suckers are still left?

Creating 1 trillion of credit in a 50-75 trillion economy does not do much when credit is collapsing at a faster rate on the other end. The fed can create liquidity, but it cannot change the fact that banks are insolvent and that people’s attitude towards spending is slowly shifting.

@F. Beard:

Understood. It is a little maddening. In general, most of Defiant’s obfuscations come from:

1. Ignorance of inflation and currency dynamics (he thinks inflation is caused by money printing and not by lack of supply of goods).

2. Belief that valuations are fundamentally objective (“a Cow is worth $1000” is wrong. “I agree to sell you my cow for $1000” is right).

About the intersection of faith and economics: I was wondering if you wouldn’t mind elaborating a bit on your own personal outlook. Is your economic doctrine principally developed from your reading of the scriptural opposition to usury, or are there other components?

Is your economic doctrine principally developed from your reading of the scriptural opposition to usury, or are there other components? amanasleep

I started early on with just attempting to make banking ethical while keeping it profitable. I had scarcely began to read the Old Testament then. Eliminating usury was not my goal; eliminating fractional reserves was. Eventually, it occurred to me that common stock as money requires no fractional reserves, no usury and no profit taking – ALL of which are problematic in the Bible. Nor does common stock as money require intrinsically valuable money such as PMs. The last major revelation was that coexisting government and private money supplies per Matthew 22:16-22 would keep both government and private money supplies honest since both could be used for the payment of private debts.

And, of course, the Parable of the Talents (Matthew 25:14-30) clued me to what the gold standard advocates were about: risk-free hoarding of an easily cornered scarce metal so as to be able to free-ride off the risk taking of others and so as to be able to exploit the money-poor.

It’s no wonder, btw, that the Jews became wealthy with such a guide as the Torah but ironically their Biblically granted permission to charge the Gentiles interest has caused them grief.

@Defiant:

“I’m all for government jobs – when they are needed and when they benefit society as a hole. Working for government is different than private industry for the same reason I stated on my previous post. A government has the ability to hire and keep payroll irrespective of productivity. Productivity and return of investment to the tax payer is not the primary concern (perhaps not even a concern??). If the government loses money on a bad project/blah and needs additional funds to operate, well, taxes can be increased and if tax payers don’t like that, well let’s borrow a couple of billion/devaluing the currency. Not to say this happens in every public office around the country, but the risk of losing “your own money” is not there for the government.”

The government’s function is not “profitability”. Please explain why you think the government should be profitable. The goverment’s role is to provide precisely those things that are public goods and that private industry declines to do (because there is no “profit”). I am not opposed to asking that the government refrain from waste, but roads, schools, armies, and laws will never be provided more equitably by the private sector.

“Now, if you are a private institution you will need profits to survive and you better get productivity out of your employees.”

Precisely. You can be certain that the benefits of that productivity will not go to the employees that produced it if government is deregulated out of existence.

“Calling this “creating job” is dubious at best. When you have to tax $100 out of someone, waste $90 in administrative costs, pay another $10, it’s not creating a job, you are actually killing jobs. You are not killing a job, you are killing many jobs. Especially when the job you created is to move papers between a bucket and another. But “saving a job” does have a catchy sound and people eat it up like hot cake.”

More unsupported straw man assertions. Please provide evidence that this is so.

“Based on our previous discussions, I am 100% sure you are well educated and know exactly what inflation I am talking about. Have you heard the law of 72? Why dont you try it on the Fed’s inflation rate target of 2% and tell me how long it will take for the money supply to double? I don’t think we need any additional evidence to prove that – do we?”

Nope. Don’t know what you’re talking about. Thanks for the flattery though.

“You state that there has not been massive inflation (of course you incorrectly refer to it as a measure of price instead of money supply to confuse the readers) although there has been massive money printing. ”

Inflation is a price measure. You are wrong. Wikipedia (citing many econ textbooks):

“In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.”

If you want to assert that increases in the money supply can CAUSE inflation, then fine, but I’m not going to be rubbished by the garbageman.

“Good you ask this question and I will offer an answer that many have even provided in these boards (your buddies) and I know you are full aware of. Have many on these boards not stated that if we dont print we would enter a deflationary spiral as credit supply is erased from the system via defaults?

Of course you have – and that’s exactly why you have not seen differences in the money supply and prices have been somewhat stable. The Fed is pumping liquidity in via one side, while credit contracts on the other – offsetting the added liquidity and more. I mean – how many more housing bubble suckers are still left?

Creating 1 trillion of credit in a 50-75 trillion economy does not do much when credit is collapsing at a faster rate on the other end. The fed can create liquidity, but it cannot change the fact that banks are insolvent and that people’s attitude towards spending is slowly shifting.”

Then you admit there is no inflation, despite all the money printing?

“I started early on with just attempting to make banking ethical while keeping it profitable. I had scarcely began to read the Old Testament then. Eliminating usury was not my goal; eliminating fractional reserves was. Eventually, it occurred to me that common stock as money requires no fractional reserves, no usury and no profit taking – ALL of which are problematic in the Bible. Nor does common stock as money require intrinsically valuable money such as PMs. The last major revelation was that coexisting government and private money supplies per Matthew 22:16-22 would keep both government and private money supplies honest since both could be used for the payment of private debts.”

The coexistence of private and government money supplies seems difficult to pull off to this extent. I am aware of alternate currencies coexisting with government scrip at various times in extreme and limited circumstances (mining towns out of Fed jurisdiction, casinos today). Can a general coexistance work today without rampant instability in the stock currency market?

“And, of course, the Parable of the Talents (Matthew 25:14-30) clued me to what the gold standard advocates were about: risk-free hoarding of an easily cornered scarce metal so as to be able to free-ride off the risk taking of others and so as to be able to exploit the money-poor.”

Agreed. I’m no bible scholar, but I knew this one and it puzzled me how you could read this and be a Christian gold advocate.

“It’s no wonder, btw, that the Jews became wealthy with such a guide as the Torah but ironically their Biblically granted permission to charge the Gentiles interest has caused them grief.”

Alas, the choice here is to be an outcast and poor pariah people or an outcast and wealthy one. Abstaining from charging interest never helped the Gypsies. The Torah is generally a guidebook for a lonely tribal community to navigate a seething world of unbelievers without trying to kill everybody they meet, and to ensure the prosperity and survival of that community without having a state (or money) to call their own. In the old world, where liquidity was constrained by ancient hard money principles, the existence of a source of lending was useful to all. And when there were finance crises the Jews were promptly scapegoated. After a few thousand years it became a sad tradition to scapegoat the Jews regardless of the crisis.

It is an irony that today, the Banks are every bit as powerful and malevolent as the ridiculous antisemitic conspiracy theorists always claimed that the Jews were. Most modern Jews fled banking to the safety of the professional classes long ago.

You don’t think it was God’s plan for his Chosen to run CitiBank, do you?

and it puzzled me how you could read this and be a Christian gold advocate. amanasleep

Where did you ever get the idea that I was? I most certainly am not. Still, the gold-bugs should be allowed to play with their shiny metals but for private debts ONLY and ONLY if all other money forms are also allowed for such on a level playing field wrt government. I have in mind common stock, in particular as a usury-free money form.

Most modern Jews fled banking to the safety of the professional classes long ago. amanasleep

A very wise move. Yet haven’t 9 or 10 of the last 12 Fed Chairmen been Jewish? I honestly think Ben Bernanke means well unlike that Ayn Rander, Alan Greenspan.

You don’t think it was God’s plan for his Chosen to run CitiBank, do you? amanasleep

God’s plan was to gently pacify and convert the Gentiles by economic means, imo. But the Jews turned out to be more of a problem themselves than He thought they would be, it seems. Not that He is not up to challenge, mind you! :)

Can a general coexistance work today without rampant instability in the stock currency market? amanasleep

I think it is the current money system that promotes the instability. Example: Buying on margin with newly created money – so-called “credit”. Example: Driving consumers into unserviceable debt and thereby creating a balance sheet recession.

Plus people could always use fiat for all debts if they wished. Private monies would have to go the extra mile or two to gain the trust of the public.

@F. Beard:

Apologies on the gold comment. I misspoke. I should have said “How could ONE read this parable and be a Christian goldbug?”.

I never meant to imply that of you, as you comments here and elsewhere are clear on the topic.

Haha! It serves me right. No problem. I’ve made the same mistake. I should have not have been so quick to take offense.

“How could ONE read this parable and be a Christian goldbug?”. amanasleep

No doubt they would lend much of it out for usury since the Lord clearly indicates that was an acceptable option. However, it would have been understood that the lending for usury was only to be to non-Jews in accord with Deuteronomy 23:19-20. So how would Christians handle that? Open a credit union and only make loans at interest to non-believers? And make interest-free loans to believers? But aside from that even a Christian credit union would violate “Thou shalt not steal” unless all lending was strictly from savings set aside for that purpose.

I can appreciate your comment. But how ’bout applying dirigsme right here in the USA? Any objections to that?

“Making it saleable” does not imply imposing it, ala the way of neo-liberal reforms, e.g. SAPs. To me, it sounded like coming up with an alternative to the dominant paradigm, which is destabilizing countries the world round.

oops…that was supposed to be in response to jsmith.

Thus, if there is unemployment the budget should be unbalanced, while if there is high inflation due to output capacity being outpaced by demand the budget should be moved closer to balance or even, in certain cases, into surplus. Lerner referred to this approach as ‘functional finance’.

—-

What would you do when there is unemployment and high inflation simultaneously, like in the late ’70s and early ’80s?

MyLessThanPrimeBeef,

How about doing the opposite. How about stopping the devalution of the currency and thereby theft of wealth/capital and slashing taxes to leave more capital/wealth/surplus in the hands of the people. Isn’t that what we all want – more wealth in the hands of the people?

Perhaps this will not be enough to pull the economy out of this mess, but it would sure put us on track. Putting it off and off will only complicate matters and when we hit the wall, the fall will be much more worst. The government spending theory has proven not to work time and time again, but here we are after years and years of the same.

I was wondering if the budget can be both unbalanced and balanced at the same time.

If you live in fantasy (theory), sure it can. Of course the real world is a pain and does not like playing fair..

Why can’t we have government deficits, high bank profits, devaluation of the currency, taxes, wealthy consumers, and full employment all at the same time.

Can we just have one discussion on economics and monetary issues not be dominated by you libertarians and your pie in the sky theories? Just one where we don’t leave reality and enter into the alterntaive Rothbard universe you people inhabit? You have nothing but dogma and are not saying anything original, you aren’t saying things that people here haven’t heard a zillion times. Not only is it nonsense, utopian, the understanding of actual monetary dynamics is shallow.

Look, credit money has existed for thousands of years. The vast, vast majority of inflation comes from private banks creating money out of thin air on their keyboards. Fractional reserve banking (I realize MMT’s alternatve explaination, I am talking about the banks creating credit money out of thin air) has been around for centuries. Centuries before the Fed. Credit money and the inflation it causes was around when there was a gold standard too. The worst four letter word in the Western world, MARX, talked about this in the third volume of Capital. How one dollar created many, many dollars in the credit system. He wrote that in the 19th century. It seems that libertarians haven’t gotten caught up to Marx in that regard. Long way to go to get to the 21st century.

Stop posting the same thing, over and over again, only using different wording. We get your point. Can the adults now have a conversation?

This is replacing belief in one system – markets – with belief in another system – state. Both belief system rely on endogenous rule enforcement (those subject to the rules create and enforce the rules), and have exactly the same weaknesses to being subverted by special-interests, and thus are prone to positive feedback loops in exactly the same way. In other words, there’s nothing fundamental that makes one belief better than the other. One relies on commercial competition, the other on political. If we believe that commercial markets fail (as they do), why should ideas markets (aka politics) be any better? I could point to a number of democracies where there are free elections (free as in minimal voting fraud and no-one being told “vote X or!!!!”), yet the populace elects politicians that are provably bad for them (for example by the said politicians happily looting the countries, comparably to CEOs looting their companies, in the process transfering wealth from their voters to themselves).

Also, using France to ilustrate the example is irrelevant at best, misleading at worst – the real comparison should be between a country that did not implement dirigisme at the same time and one that did (controlling for any other differences). Otherwise it’s propaganda (picking something that fits my theory), not science (looking to isolate causes). 50s and 60s were good to quite a few different countries, not just France.

I see it more like an attempt to the private/public mix right.

Vlade, you wrote a very valid point:

“This is replacing belief in one system – markets – with belief in another system – state. Both belief system rely on endogenous rule enforcement (those subject to the rules create and enforce the rules), and have exactly the same weaknesses to being subverted by special-interests, and thus are prone to positive feedback loops in exactly the same way….I could point to a number of democracies where there are free elections….yet the populace elects politicians that are provably bad for them.”

I agree with you. Corruption of any institution, (or lack of institution) is the cancer that is part of the DNA of all societies. All individuals want to have freedom to choose, and if we want to build a society where people have freedom to choose, this means that there will be situations where people will have the incentive and opportunity to choose to act in a corrupt or deceitful manner. In nature, entropy and decay is spontaneous, where order and growth always requires energy and organization. However this should not deter us from building a society that is foresighted, compassionate and just. For the government to be honest and good, the honest and good must to govern. But we must accept that we are all flawed (some worse than others mind you…) Since all people are flawed, citizens need to develop active systems of governance, not rely on the lazy trust in their politicians. Just as entropy is spontaneous, but order is not, conversely complacency and corruption of our institutions is spontaneous because of inherent human fallibility, but benevolent vigiliance over our institutions must always be cultivated.

Freedom is never free…Thomas Jefferson. Good civilizations are not free either.

I disagree with your implied view that MMT are choosing state, while NEO-liberals choose market. Neo-liberals beleive markets should be allowed evolve under its own internal forces and to set its own paths. Communists and Fascisits beleived that markets should abolished or fought against with strict controls. The MMT policy that Phillip writes about, and that I espouse, requires understanding of the real market forces in the economy, (real needs of the citizemns, real supply constraints and industrial capacity), and then setting policies that would involve both the governement direct investment while incentiving private entreprenurship and inniative. The mixture of governement action and private action must studied, and depends on the context of the situation. The goal of MMT policy is compassion and benevolence on the citizens of its nation.

It would be important to ask, would a true free market system outperform a MMT/mixed market system. Evidence favours mixed market systems…Japan, Germany, France, Taiwan, Singapore, Hong Kong, Sweden, Finland etc…Most nations that exhibit high level of prosperity and good technology development, are not laissez faire but governments exert strong influence on the action of market players. The US from 1940 to 1970’s had a high degree of government involvement and good social outcomes as well as excelent industrial development. The problem was that Government spent in excess of the economies capacity to produce (vietnam war(bad and wasteful)…space race to the moon (good but consummed alot of resources, but people were happy). Hence MMT would have predicted inflation. I do not know of any economy that was succeessful with Laizez faire policies and where its citizens enjoyed a good level of prosperity.

Heretic,

I agree on that there hasn’t been any succesful market with free market policies – there hasn’t been any. The closest thing was the US and it has turned into a European type government run “free market”.

In terms of the goal of MMT being compassionate for citizens, I will venture and say that all economic theories profess the same – happiness, riches for all. One thing is certain, when people are in charge of impacting the wealth of citizens, it surely looks easier on paper than practice.

Can it be that a true free market system would remove the power from the few wealthy enough to make it into office?

Can it be that a true free market would remove the power from a concetrated few that allow banks to devalue the currency, while the government borrows to support vote buying programs?

I am not sure – but I am 100% confident that government intervention will never, ever work.

“In terms of the goal of MMT being compassionate for citizens, I will venture and say that all economic theories profess the same – happiness, riches for all. One thing is certain, when people are in charge of impacting the wealth of citizens, it surely looks easier on paper than practice.”

Policies like the ones favored by libertarians and many neoclassical economists don’t get rid of central planning, or picking winners and losers. You don’t mean to, it isn’t your plan, but you none the less hand over central planning to private financial interests. Look at how large finance has grown relative to the real economy, then look at the extreme consolidation amongst the financial interests and the banks in the market. Taxes have been lowered on rich folks and corporations, we have far more financial and trade liberalization, the removal of the old price and capital controls, unions are weaker, many government services have been eliminated and/or privatized. So has this resulted in a booming economy dominated by small, competing mom and pop stores and producers? No. Deindustrialization, massive wealth and income inequality, the financialization of the economy, the complete takeover of the government by moneyed interests. It has been a disaster. Central planning is now in the hands of the banks and the policies that people like yourself are in favor of are the reason. This has happened everywhere, to greater or lesser degrees, and we see the same results. So what do people like you do in response? Call for more of it! I have been told by a number of you theologians to just read Hayek, which I have, and it will all make sense. Naturally.

Policies like the ones favored by libertarians … PleaseStop

If only they were true libertarians! Instead many (most?) of them seek government privilege for PMs as money. That’s fascist, not libertarian.

“Good civilizations are not free either.”

I totally missed this seemingly minor / but definately dangerous thought. Who decides what a good civilization is? What are the parameters/definitino of “good”? What does “not free” mean.

Could this be analogous with – “We (the geniuses) are stabbing you for your own good”.

I honestly think we are going the wrong path here. Hopefully this ends soon enough…

Heretic,

Re point one. I agree with you, mostly. A quote I’d use there is “You cannot win over stupidity. But if you stop trying, you WILL lose”. In a comment to another thread I wrote that liberal systems are less stable than rigid ones – because you have to invest much more effort to get the benefits. You get out what you put in.

Re point two – the problem is, that state/private mix tends to very easily slip towards situation where there’s little distinction between state and private. When you have clear distinction, it makes people more aware of the slip – say accusations of GS “being” the government are something that attracts attention to that. When state/private starts getting mixed up and is considered normal, the cancer is much harder to spot.

Again, it can work better – say Singapore is a good example, but it depends on the governing class and again the effort being put in.

The fundamental problem with the “effort being put in” is that that’s a self-defeating stuff. If someone puts a lots of effort in, and the system works smoothly, it seems that you don’t have to put anymore effort to keep it going smoothly. So even when people would be willing to put in the effort (which is often dubious – people like other people do that stuff more. I don’t blame them, it’s part of our nature and hard to overcome), they say why bother – the system runs smoothly. It’s when the system runs smoothly that one should be concerned, for then you get complacency and the inevitable detoriation.

I agree that mixed state and private involvement In a industry can become obscure to the outside observer….so is this not the challenge then? To make the involvement of government transparent, obvious, understandable and correctable, to any concerned citizen observer who detects corruption or deception? How we do this, I don’t know, bu this is the work at hand.

I also agree with you, any system that does provide good governance and peace to its citizen will also engender complacency in its citizenry. This is the curse of the human condition. I think we must accept that any human civilization will always fluctuate between periods of good health, lucidity, evolution and creativity, and stagancy, and periods of delusion, decay and corruption. How do we maintain the active citizenry necessary to keep civIlization healthy, in the hope of avoiding either a multi generation stagnation like during Ching Dynasty in China, or a complete collapse like in Rome, or a biolent revolution like im China or Russia, this is the multi-trillion dollar question! Nonetheless, we must act.

Most countries have little or no oil. There are ways to use less of it, but burning oil is fun. Has any country reduced oil use with carrots rather than sticks?

Oh my God. Such a bright mind, wasting itself in theorism.

Mr. Pilkington

All eastern europe + USSR applied infinite MMT, 30+ countries, something like 400mill – 500 million people.

What you are theorizing about, we did it, we ended up with food stamps and we starved.

Imagine, for 45 freaking years, MMT, MMT, MMT, MMT. Nobody’s pension ever failed, everybody had a guaranteed job.

It just doesn’t work, sir.

It comes down to trade – real goods trade. Nobody will exchange their resources with your electrons in a bank infinitely.

Too bad, sir, too bad.

MMT is 1/2 the solution. The other 1/2 is the allowance of genuine private currencies for private debts.

What part of Matthew 22:16-22 don’t people get? I thought the Orthodox read the Bible?

:)

“Allowance” is the key word.

If humans could allow each other a lot of things, religion would have not existed.

It comes down to trade kris

Banker fascism has been successful; there is no denying that. But now the whole world is adopting it. What will the West do to stay ahead?

– Get back to work

– Extend pension age to 78 or 80 or abolish pension outright. It’s everywhere and always a Madoff Scheme

– Abolish the tax code and introduce flat tax and project related taxes. Let’s say a highway will have to be built, fine, let’s vote and pay parts of paychecks to build it. This system already exists for school construction in USA and works perfectly.

– In engineering is called the KISS concept – Keep it Simple, Stupid.

Extend pension age to 78 or 80 or abolish pension outright. kris

You disappoint me. So pensions should be cut so usury can be paid on non-existent debt?

It’s everywhere and always a Madoff Scheme kris

Life is a Ponzi scheme. The young support the old till they become old and are supported by the next generation of young.

I do not disagree, but I did not mean it as an actual solution. I misunderstood your question.

– As actual solution there is only and only one:

DEBT FORGIVENESS by law or Debt Destruction by Revolution.

There is mathematically no freaking way around it.

– On a longer term structure, we should be talking about voluntary savings pools, but not guaranteed pensions, because simply nothing is naturally guaranteed.

– I disagree with you about Life. Life is so, so, so beautiful. The past is gone, the future hasn’t happened yet; let’s enjoy God’s day today.

There is mathematically no freaking way around it. kris

But there is!

1) Ban any further credit creation. This would be massively deflationary by itself as existing credit is paid off with no new credit to replace it.

2) Send equal bailout checks to the entire population, including non-debtors, metered to just replace the credit repaid (destroyed) in 1).

Since the total money supply (reserves + credit) would not change then neither price deflation nor price inflation should be expected except perhaps for a temporary price bump from increased velocity till output caught up.

Steve Keen has suggested something similar.

We are saying the same thing in two different ways.

What Steve Keen said is basically debt forgiveness by law.

Debt forgiveness would destroy financial assets; a universal bailout would prop them up.

Also, debt forgiveness does nothing for non-debtors even though credit creation has cheated them too.

Human solutions are always flawed. I think debt forgiveness is the one with the quickest pain and quickest rebound economically. Sharp pain, but it goes….

Right now, any proposal is about Death by a Thousand Cuts, to quote Warren Mosler.

I think debt forgiveness is the one with the quickest pain and quickest rebound economically. kris

We should be concerned with justice, not inflicting pain.

Anyone who thinks innocents must suffer because of mere money is not thinking hard enough and is dangerously close to believing that evil is stronger than good. It isn’t.

There is no painless solution. I am for death and resurrection. It seems to me that you are for death with a thousand cuts? Are you?

Do you think there is a painless solution?

There is no painless solution. kris

Says who?

I am for death and resurrection. kris

No you are not. You are simply for the bust cycle of the crooked boom-bust cycle.

It seems to me that you are for death with a thousand cuts? kris

The relief would be instant. Debtors would have significant help with paying their debts and non-debtors would have a significant amount of real money (not-credit) to honestly lend, invest or spend.

Do you think there is a painless solution? kris

It’s only money so practically speaking it is painless. It’s not like “We liked to help but there is no money” since the US Government is monetarily sovereign.

It’s quite a pleasure debating with you.

Let’s think very carefully about why MMT did not work in soviet countries.

1. MMT /=command economy. Soviet denied private enterprise, stifling innovation in consumer industries.

2. No private property laws. No chance of ownership means no aspirational innovation.

3. Terror state. Soviets were totalitarians controlling all aspects of citizens lives. No innovation could happen outside of the narrow focus of Soviet “non-bourgois” industries like military and pig iron production.

The differences are huge. Besides, from an economic perspective MMT worked for a while in soviet countries as GDP spiked dramatically. But the injustice and corruption of a totalitarian dictatorship will destroy the economic dynamism of any people.

So, to make MMT wprk in the US requires no more than what Beard says, so long as the state remains somewhat democratic and broad freedoms are preserved.

Agree with your last paragraph, if the state remains democratic. However, when everything gets guaranteed by the burocracy, democracy vanishes.

Any kind of GUARANTEE, is a UTOPIA, since it’s UN-NATURAL.

Nothing is guaranteed.

amanasleep says:

“Let’s think very carefully about why MMT did not work in soviet countries.”

It was never tried. If you think it was then you simply don’t understand MMT and are merely arguing from ignorance.

You can beat all the strawman you like, but it won’t get you even one small step closer to actual reasons.

In the debt-money system the central banks don’t ‘print money’: currency increases as government securities are exchanged for at-par loans from the bank. The loan from the bank becomes currency in the hands of the government. In a fiat money system the government issues currency without offering security or borrowing. Because the government is the issuer, security is presumed: consider Abraham Lincoln and the ‘Greenbackers’. What matters is that the government survives the individual’s claims: if it can do so without question during a war of secession it will certainly do so the rest of the time. Unfortunately, governments choose not to issue fiat currencies. Otherwise the massive overhang of dead-money debt could be swiftly reduced, there would be no generalized increase in the money supply (inflation) as applying currency to existing debt would extinguish both.

Dead-money liabilities that exist on ledgers are phantoms: taken on as collateral they do not exist in any meaningful form. Companies borrow trillions to buy hydrocarbons. Where are these hydrocarbons so that they might be repossessed by the lenders? In the atmosphere in the form of CO2 and nitrous oxides. Let the bankers repossess these gases. More accurate liability is the damage CO2 does to the atmosphere and the life support system, let the bankers possess these liabilities as well.

Any banker stupid enough to make pointless and destructive loans is well deserving of ruin and much worse.

The bankers would see this as a form of repudiation as it indeed would be. Issued currency would be no different from the loans themselves, created with a push of a button on a keyboard: printed money for printed loans! It is the force of the lenders’ habitual oppression combined with reflexive cowardice on the part of governments that sanctifies the bankers and their ‘money’ over everything else.

Here is more from Modern Monetary Theory and Philip Pilkington:

“MMTers make the claim – following in the footsteps of Abba Lerner – that the government budget should not be subject to any sort of arbitrary balancing constraint. Instead Lerner and the MMTers advocate that the government budget balance should be conceived of strictly from the point-of-view of real economic variables. Thus, if there is unemployment the budget should be unbalanced, while if there is high inflation due to output capacity being outpaced by demand the budget should be moved closer to balance or even, in certain cases, into surplus. Lerner referred to this approach as ‘functional finance’.”

“The reason that both Lerner and the MMTers feel confident in making this case is because they hold that a government that issues its own currency and allows their exchange rate to float is not subject to any budgetary constraints. They can essentially issue new money – together with government bonds, if they so wish – until they begin to see inflation. Inflation, then, is the only real constraint to a government that issues its own currency and maintains a floating exchange rate.”

If the government issues currency, why would it issue new bonds? To provide a risk-free asset that can ‘finance’ activities (healthcare and pensions) that would be otherwise costly to fund directly. The economy would escape the ZIRP trap: the central bank would have no need to defend ultra-low interest rates as the demand for near-money would keep excess currency from entering the economy.

“However, if a developing country tries to spend up to the point of full employment while maintaining a floating exchange rate they are, as stated above, likely to see devaluation and inflation take place as the weakened currency chases more and more imported goods that the country’s own domestic industry cannot produce.”

Agreed …

“As incomes rise through government spending programs (and potential rises in real wages) people will be more inclined to seek out goods and services that were previously thought of as only available to a small stratum of the population. Devaluation and inflation are then almost inevitable.”

Subsidizing waste as resources shrink is bankruptcy in a can. Analysts are stuck with the assumption of credit-stifled demand for consumer goods such as cars and tract houses. The problem is insufficient supply of the inputs needed to run that demand.

When the market-driven price for energy inputs decline it is because demand has been bankrupted somewhere within the system. In the ‘good old days’ of the early oughts, the demand was local, now the destroyed demand is entire countries, swept away in the matter of weeks.

The high-priced crude strands economies and trillions of (borrowed) ‘investments’ that were made assuming $20 crude in perpetuity. The higher the crude price is over $20, the longer this price holds, the more destructive the outcome is.

At the same time, a price low enough to allow increased demand on the waste side is too low to bring new oil to the marketplace.

“But think about this for a moment; if we adhere to a purely functional view of finance then we have far more options available than might appear at first glance. We can actually use government fiscal policy to guide domestic investment decisions and ensure that the goods and services people desire as their incomes rise are produced at home rather than abroad.”