By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

There seems to be a pattern emerging as stressed Eurozone nations struggle against the austerity based policy that slowly strangles them. The first stage is a denial that anything is wrong, the second is that there is some problems but with renewed vigour the issues will be solved and the third stage is when reality finally begins to sink in that the country is in serious trouble and some form of external “help” is inevitable.

Given the recent denials by the Spanish economics minister I would suggest we are somewhere between stage 2 and 3 for Spain:

A European bailout for Spain is not on the table and would be the worst possible outcome for the country’s debt troubles, Economy Minister Luis de Guindos said in an interview with state radio late on Thursday.

…

De Guindos blamed the sharp rise in spreads on general market nerves about the lack of growth in European economies and said the issue was not restricted to Spain. Borrowing costs for countries and the private sector were not sustainable at these levels, he said.

“These spread levels are not sustainable for long,” de Guindos said. “It makes it hard for Spain or Italy to finance themselves, it makes it hard for the private sector, namely the banks, to finance themselves. It’s a situation that must be turned around.”

Overnight statements from the Spanish authorities became a bit more direct as they politely asked the rest of Europe to keep their mouths shut about the country’s economic issues:

Spain urged its EU peers to be “prudent” when making comments about its economic woes on Wednesday following criticism from France and Italy, even as it got praise for its reforms from across the bloc.

“We all have our problems and we are working to find a solution to ours and also to help the eurozone. We expect that other countries should do the same, that they be prudent in their statements,” Prime Minister Mariano Rajoy said.

Rajoy did not specify exactly to whom he was referring in his comments to lawmakers from his conservative Popular Party, saying only that he was talking about “statements made in the European Union on the part of certain leaders”.

I can only assume those words are in response to Mario Monti and Nicolas Sarkozy who in recent weeks have both criticised the Spanish government’s handling of the economic crisis. Although I agree it would be prudent, and possibly a case of rock throwing in glass houses to boot, I do think that this request is far too late. Although there appears to have been some temporary blindness in Q1, the financial world is now fully aware of the trouble the country is in with much of the focus on the banking system:

Spain’s banks are fast joining the ranks of the most unloved in Europe just as many need to raise capital urgently, deserted by investors who believe the country is on the brink of a recession that many lenders will not survive.

The government has ruled out more state aid for a sector that comprises a motley mix of international lenders and heavily indebted local savings banks. That leaves two options: raising private capital or turning to the EU for bailout funds.

Prospects for a private sector solution are poor. Nothing on the horizon looks likely to persuade foreign fund managers to invest, such is the fear of the banks’ growing bad loans, their holdings of shaky sovereign debt and the worsening economy.

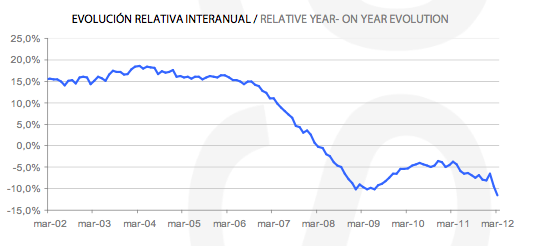

And you only have to look at the Spanish housing market to get an understanding of just how much trouble the country is in:

The General IMIE Index recorded the highest year-on-year decrease in the historical series during the month of March, with a drop of 11.5%, leaving the index at 1631 points. Since peaking in December 2007, house prices have seen a fall in value that now stands at a cumulative figure of exactly 28.6%.

As I have spoken about previously, in the face of mounting balance sheet stress caused by private sector deleveraging, government austerity and pending European capital requirements the Spanish banking system has little choice but to shrink. One of the easiest ways to do that is to simply close up shop and shed staff:

Spain’s banks will have to close another 10,000 to 12,000 branches to adapt to a reduction in demand for loans, Banco Santander SA’s (STD) head of Spanish retail banking said Wednesday, but the country’s top two banks see such a move as an opportunity to boost their market share.

“The banking business just isn’t profitable now,” Enrique Garcia Candelas said at a roundtable meeting during a banking conference in Madrid.

Faced with shrinking demand for credit, difficult financing conditions and a fast-growing pool of bad loans, many of Spain’s lenders have been forced to merge in recent years, and the weakest ones were nationalized. As a result, the number of lenders in the country dropped to 17 from 53 five years ago.

However, banks have so far only closed 5,000 branches–or 12% of their overal capacity–since the financial crisis began in 2008, lowering the total to roughly 40,000.

The big Spanish banks are putting on a brave face due to their non-Eurozone exposure, but 5 years CDS contracts on both BBVA and Santandar are up sharply over the last month showing they are in no way immune to the fallout. The core of the ongoing problem, as we have seen in the case of Greece and Portugal, is that the one-sided austerity becomes counterproductive as it leads to a retrenchment of the private sector’s economic output and therefore national growth. It became more apparent overnight that this is now occurring in Spain:

Spanish industrial output plummeted in February, official data showed Wednesday, as the recession took tighter hold on the unemployment-scarred economy.

Production by Spain’s factories and power generators slumped 5.1 percent in February from a year earlier after smoothing out the impact of seasonal factors, the National Statistics Institute said in a report.

Factories hit the brakes on output of metal parts for making cars, basic iron and steel products and building products such as concrete, cement and plaster.

Overall, it was the steepest fall in industrial production since November last year when Prime Minister Mariano Rajoy’s conservative Popular Party won a landslide election victory promising to fix the economic crisis.

Spain is sliding back into recession this year, with the government forecasting a 1.7-percent contraction in gross domestic production after meagre growth of 0.7 percent in 2011.

Given February’s output numbers and March PMIs those government forecasts are now looking extremely optimistic. That is, I think we are approaching stage 3 rather more quickly than many people recognise.

In other news, just a quick note that after many months of political and economic turmoil Greece appears to be going to the polls shortly:

Greece will call a snap election for May 6 on Wednesday, government officials said, opening a campaign that may produce no clear result and threaten implementation of the international bailout plan that saved Athens from bankruptcy.

Make the date in your calendar, it should be interesting enough.

Finally, before I go today I would like to give a hat tip to Adam Carr who sent a tweet yesterday to remind me about the importance of MacroBusiness:

The new Thatcherite government in Spain made draconian cuts in social security and such (as well as an extremist labor rights’ demolition) but did not dare to cut in any of the following: monarchy, Catholic Church (not just direct subsidies but also subsidies to private schools), military, police, politicians’ salaries. Also the subsidies to the mainstream labor unions remain in place in the hope that these will contain public rage and turn it manageable. Other irrational expenditures like the most controversial high speed rail in the Basque Country are also being paid.

Certainly the Spanish government could cut much more but it should cut where it is possible like in the costly monarchy or a useless army that fends off no enemy. But that’s not what Monti means: he wants Spain to dismantle even more the few social assistance left, even where it is more needed than ever.

As a side note, the author seems misinformed about which are the big banks of Spain: a few weeks ago La Caixa (a semi-private savings bank led by Isidro Fainé) became the largest bank of Spain after absorbing a number of other savings banks from Navarre, Castile, Andalusia and Canary Islands: http://forwhatwearetheywillbe.blogspot.com.es/2012/03/navarre-loses-500-million-with-its.html

Maju, to be fair Banco de Santander financial group is the largest financial entity followed by BBVA group. Those banks have big assets outside Spain. If we only count assets held in Spain, La Caixa is larger.

Santander owns Sovereign Bank, which HQs in Boston, and is only in the New England and NJ and Eastern PA markets. It is reportedly about to change its name to its Global counterparts. Does its S American and US diversity provide a margin of safety?

As long as you consider they can sell those entities, yes, it provides some margin.

To be fair Ignacio you are right and that means I was wrong by quite a bit: Santander’s global assets are €1.2 trillion, BBVA’s are €553 billion while Caixabank’s (La Caixa) is only in the €51 billion level. The operating income is somewhat less marked in the differences but still follows this pattern: 23.5, 12.0 and 2.1 billion euros respectively.

It also means, I guess that if Santander, for instance, collapses, and provided no bailout by Spain (hopefully!), the resulting problem would be very scattered around the World.

If you count only spanish assets, La Caixa wins although not for much. Total spanish assets are €342 billion for La Caixa, and about €320 billion for BBVA. It is difficult to say for Banco de Santander since they account “continental europe” altogether and that includes assets in Portugal and Poland. My belief is that Santander would be in third position very close to BBVA. So, you were rigth if we considered exclusively spanish assets.

Has anyone actually looked at the polling numbers in Greece? My feeling is that we might well see a communist/hard-line socialist government. Things are about to get crazy!

http://www.spiegel.de/international/world/0,1518,816598,00.html

Public opinion is shifting abruptly all around Europe. Take a look at the first results released on the 2011 autumn eurobarometer:

http://ec.europa.eu/public_opinion/archives/eb/eb76/eb76_first_en.pdf

Now, only 31% europeans think that the EU conjure up as positive while 26% believe it is negative. Remember that until 2009 about 50% europeans were positive and only about 15% were negative about the EU.

I’m wondering just how Socialist these so called hardliners in Europe really are? And would wager a fair amount that they are as inherently beholden neo-liberal as many American Progressives.

… “not very” in the case of Mr. Tsipras given the fact that he wants to stay with the Euro. Egads!

Philip:

The communists in Greece are unfortunately utopians, and not interested (so far) in any sort of left coalition. This leaves the Greek left fragmented, much as it is across the rest of Europe. Strength in numbers is insufficient without common purpose.

Yes, thanks for mentioning, Philip. The figures of Der Spiegel are anyhow quite favorable to the ruling coalition, I looked at the matter also in February (http://forwhatwearetheywillbe.blogspot.com.es/2012/02/forecast-for-greece.html, sources at bottom) and the ruling coalition (including the fascist LAOS party, which broke away months ago) may only muster 40.5% (average of February polls), while the three main “true left” lists (KKE, SYRIZA, DIMAR) will probably get 41.5% (again average) and may even be as much as 47% (enough to rule if they can come together).

Most importantly the main “survivor” of the coalition is ND (conservatives), with 24% (not 31% as Der Spiegel claims, which is the top of their hopes and nothing else), making harder for the “democratic socialists” of DIMAR to join them in coalition instead of their former partners of SYRIZA.

However my bet is that DIMAR will betray the hopes of the Greeks and will join ND and PASOK in a Papademos govenrment version 2.0.

Howevr if DIMAR could stay true to their alleged socialist program, then they could rule together with KKE and SYRIZA and decide to declare bankrutcy, intervention of all banks and major companies and follow the Cuban way (or something similar). This would of course trigger many conflicts pushed by the IMF, NATO and the major European powers, which would want to stop such a radical dissidence.

But the options are most probably those two: (1) continue the self-destruction dictated by the Capitalist International or (2) assume the risks and decide take control of their own nation for good. I dream of #2 but I rather expect (and fear) #1. In any case DIMAR will have the key most probably.

Spain will blow up, sooner than later.

Just look at the top 100 companies in the country. If you discount the banks (Santander is not Spanish, really, they are a Latin American bank with Spanish roots, less than 20% of their business is in Spain), Spain’s economy is

not very encouraging for long term growth.

Petroleum and utilities (fuel and electricity), some car assembling, and some construction, and some agriculture. The rest are non-Spanish subsidiaries peddling their products (Sony, etc).

You can’t build an economy on something like this, not after the real estate and credit bust. Spain needs to think about what they want to do in life as the train already left the station.

You’ve just described the economy of most every country in the world – from Denmark, to New Zealand, to Chile, to Thailand. No need for Spain to “blow up”, just to regain an independent currency.

Yes, I did.

But the difference with Spain is that, if they return to ESP there would be very little they could devalue to get the economy going, while their imports would immediately increase, which they wouldn’t be able to fund. Besides, exports is only about 1% of GDP. The trade gap today is about €70 billion.

They are stuck with a bad business model. Like Greece, just bigger numbers.

Given that Spanish exports are actually between 20-25% of GDP not 1%, I can’t help wondering where you get your information from. Perhaps you meant the trade deficit was 1% of GDP, a very different statement.

There seems to be this internet meme going around that the peripheral Euro countries should just take their medicine like good little soldiers because they wouldn’t like the alternative if they returned to their own currencies – devaluation, inflation, fuel shortages, third world status, yada, yada. Vaguely plausible, in the case of Greece. Ridiculous, in the case of Spain and Italy.

Sorry, yes, I did mean the trade gap was the lower figure. My error.

I do agree Spain needs to regain control over their own currency, just like Italy should to, and every other country that needs to. My “issue” is whether returning to the ESP will be enough, and I doubt it. The energy and other import costs will immediately rise which will severely hit their export markets (cars and agri) which are very energy-intensive for such low-margin business. Companies like VW will probably be better off increasing production in Poland and Slovakia (or even high labor cost land Germany for that matter).

Then again, not returning to ESP doesn’t seem like an option either!

That’s not real: there are many small and middle-sized companies, specially in certain areas (Basque Country and Catalonia notably) producing all kind of stuff: from electrodomestics to airplane engines going through textiles and machinery. The Basque Country for example has one of the largest GDP per capita of all Europe, even if (or maybe partly because) the salaries and hence the standard of life is quite low, almost as in Spain proper.

However it is true that if you remove the two secessionist countries, the rest of Spain has a rather weak economy, with a few exceptions (notably around Madrid).

“The rest are non-Spanish subsidiaries peddling their products (Sony, etc)”.

That’s pretty normal. Specially when you consider that because of EU’s and Breton Woods criteria much of the national industry (metallurgy and shipmaking, dependent on institutional support) was dismantled in the 1980s: essentially could not compete with Polish salaries. Back in the day, the ones like you would have argued that national industry was a burden and that globalization and liberalization was the way to go.

Globalization and liberalization means that Spaniards make Wolkswagen and Opel cars instead of the Germans, who basically get the royalties instead.

But, well, your analysis is extremely shallow in any case.

Interesting insights.

Isn’t it interesting as more and more regions demand autonomy (in Spain, as you’ve mentioned, in Italy as well), the geniuses in Brussels cling to their belief in a United States of Europe. It’s as if they’re oblivious to the march of history (Soviet Union and Czechoslovakia).

Well, most Basques and Catalans are strong supporters of the concept of “united” Europe, not the least because thanks to it the artificial borders imposed by France and Spain across our countries have been removed and now we can (most of the time) travel freely within our respective countries without need of passport or changing currency.

Also reclaiming devolution from Spain and France does not mean we opposse a democratic European confederacy (for some a democratic and socialist European confederacy) that respects the rights of the member peoples (rather than states).

In India also, states have been divided according to popular sentiment, ethnic composition and historical roots, often without such thing threatening the Union at all (there are states like Kashmir which want to secede from India but that’s a different story). India in fact approaches much better the complex ethnic reality of Europe than the USA or Brazil, which are states (federations) built on newly forged creole identity.

The “stages of grief” model may not be the best way to understand what is unfolding because it leaves out the sociological dynamics. For instance, the description of how elites and vested interests are protected at the expense of less powerful or powerless groups fits the basic world systems observation that elites will sacrifice the periphery to preserve the core. This is akin a person freezing to death: the limbs are cut off by the person’s autonomic nervous system to keep the core going a bit longer. It’s futile, of course. But the analogy breaks down here because there is a way out: a paradigm shift in understanding the nature of the problem -hitting the limits to growth- coupled with political action based on this shift. Far easier said than done, of course -and it assume humans can control -or at least work with- the forces of nature.

Thank you for a thought-provoking post. Denial is presented as the end phase for Spain before that nation moves on into acceptance of their fait accompli. I question this outcome as I believe the leadership of Spain and that nation’s citizens are grappling with catastrophic loss and resultant shock, just as have the Greeks and citizens of other nations.

I have found the “Stages of Grief” model to be helpful in understanding what has occurred and is likely to occur going forward in terms of the range of responses among the people, including both the rising level of public anger and the heightened rates of suicide stemming from depression. [Wikipedia.org has a summary of this model that I have found to be helpful: http://en.wikipedia.org/wiki/Kübler-Ross_model%5D

I believe each society, just as among individuals, will ultimately respond differently to what is occurring.

As Dan B insightfully noted above, the rentier class has employed effective tactics and presently controls the political outcome and resource allocations that arguably make the Kübler-Ross model moot in the near term. However, the duration of their control is highly questionable.

None of this excuses the behavior of a small segment of humanity that has damaged so many.

Denial by Mr. de Guindos, the Ministry of Economy (and former Lehman Bros. directive) must be seen in its political and historical contexts:

1) Mr. de Guindos was, supposedly, the financial expert that would wisely navigate the financial crisis and about 100 days after his appointment the situation is exploding in his hands. Blaming the previous government is no longer a valid excuse. The LTRO parenthesis on spanish has been too short, and by next summer the government may really face money shortages.

2) Denial is what the spanish financial entities have been doing since 2008. By then, they asserted that the spanish financial system is the strongest of the world. Overconfidence of the spanish financial system has its roots in the 1992 crisis, when some myths were created i) In Spain, house prices always rise above inflation regardless the economic stress ii) due to particular mortgage rules,spanish households always pay their mortgages timely regardless the millions of families with all members unemployed. iii) as a consequence, real-estate backed loans are infalible in Spain.

Spanish banks are still doing their best to keep the last 2 myths alive by using forbearance extensively and not recognicing they are doing it.

Adding to the article, I have recently seen the latest data on bank lending and it is horrible. I have monthly data since 2003 on net bank lending to households and corporate sector. February lending data confirm that, so far, 2012 data are the worst on record well below previous 2011 record lows. There was some recovery on corporate lending at the end of 2011 but the early 2012 data show that the downward tendency has resumed.

Nothing is working. The LTROs are notbringing confidence. Reintroducing housing subsidies is not stimulating home sales at all, although reducing government revenues. The recipes of the conservatives don’t and won’t work at all.

Ignacio, (or anyone familiar with Spanish banking) do you think that the sr mgmnt team at STD and BBVA expanded outside of Europe as a hedge against a possible Eurozone implosion?

I realize that they’ve been in Mexico for over a decade. But many of their other investments were much more recent.

Ignacio is better informed than I am, it seems, but AFAIK, BBVA and other Spanish multinationals (Santander, Repsol, electric companies, Telefónica…) have been not just in Mexico but all Latin America and other places (Morocco for example) since more than a decade or even two. By other investmentes I guess you mean those in the USA and Britain, right? In any case, I presume it’s harder to sink a big bank with so many distributed investments, even if locally the investments in “the motherland” are weak.

Also in relation with the previous discussion, I’d say that there are some key sectors in which the Spanish economy is particularly weak: biochemical (including medicine, genetics…) and informatics. In all the rest they (companies with see in the state of Spain) have some meaningful presence.

I think that the explanation is more simple than the hedging strategy: spanish banks were expanding their assets so fast that suddenly they discovered they could easily expand geographycally buying entities that had become relatively smaller. Of course, geographical diversification is always interesting for banks as a way to diversify risks.

As maju writes, the “natural” place to initiate spanish banks and corporate expansion was South America. Energy companies and banks engaged in geographical expansion because local expansion was or would become limiting unless these companies expanded their business to other activities unrelated with their core business. Instead of sectorial expansion they chose geographical.

The Socialists have run out of other peoples’ money.

The only solution is to have the Central Bank “create” some more. The question is, will the Germans permit the ECB to print money on such a massive scale? I believe the answer to that question will ultimately be “No”. Thus leading Germany to be the first country to exit the Eurozone and “temporarily” re-instate the Deutschmark as the national currency.

If Germany exits the euro, other countries would likely devalue. But then Germany would own a lot of credit in a devalued currency, while Germans would need high value Deutschmarks for wages, retirement benefits etc.

Thus Germany would only lose by exiting the euro for first, IMHO.

Also I don’t think that Greek problems were caused by “socialists”, since the big run-up in debt happened (if I remember well) with the center-right party in power.

You are dead wrong. It was not “socialists” but Spanish households and companies who “ran out of money” after borrowing too much against overinflated real estate assets. Government debt increased for two reasons: 1) similarly to the US, government revenues falled sharply after the crisis but spain “socialists” were running surpluses before the crisis. 2) rescue of the financial system has also inflated government quite a lot (although not as much as Ireland since spanish government did not decide to guarantee all private debt.

A German exit from the Euro would be a very good thing, a win-win for everybody, and if only one country leaves the Euro suicide pact soon, Germany should be the one. The Euro debts it holds would become more payable, albeit in Euros devalued against the mark. Increased German imports would lower German inflation, while boosting demand in the rump Eurozone and the German standard of living. The Bundesbank and the government could contain any damage to the banks, and Bunds would become much safer investments. Marshall Auerback had an article on this at NEP a while back.

Denial is the modus operandi since 2008, not only in Spain but all of Western Society. No longterm solutions have been offered but simply delaying tactics in the hope that miraculously all goes away and we wake up one morning and everything is fine.

I am Mark smith, a legitimate, tested and trusted as well as a reputable money lender. We are company with financial assistance. We loan funds out to individuals in need of financial assistance, that have a bad credit or in need of money to, do you need a loan or you want to refinance your home, expand your b pay bills, to invest on business. I want to use this medium to inform you that we render reliable beneficiary assistance as I’ll be glad to offer you a loan. Loan minimum of $2000 and maximum of 5million with and agreeable interest rate of just 2%

Services Rendered include

*Refinance

*Home Improvement

*Investment Loan

*Auto Loans

*Debt Consolidation

*Business Loans

*Personal Loans

*International Loans.

INFORMATION NEEDED ARE:

Name Of Beneficiary:………

Country:………….

Sex:………….

Occupation:……..

Amount Required…………

Purpose of the Loan……..

Loan Duration:…………

Phone Number………….

Please: All replies should be forward to the company E-mail: sun_loancompany@yahoo.com

Thank you

Regards.

Contact Name : Mark Smith