By J. D. Alt. The post is a continuation of ideas first developed in Alt’s novel, The Architect Who Couldn’t Sing, available at Amazon.com or iBooks. Originally posted at New Economic Perspectives.

Why does it seem like there isn’t enough money to pay for the things we really need? The headlines are filled with stories about our nation’s “debt problem” and dire warnings about our impending “bankruptcy.” As an architect who fills his waking hours thinking up all kinds of wonderful things we could be building, I’m alarmed by the idea there isn’t enough money to pay for any of them. Before wasting more time dreaming, I had to find out: Is it really true? Are we really too poor to put America back to work making and building the things we need to maintain a prosperous nation?

Why does it seem like there isn’t enough money to pay for the things we really need? The headlines are filled with stories about our nation’s “debt problem” and dire warnings about our impending “bankruptcy.” As an architect who fills his waking hours thinking up all kinds of wonderful things we could be building, I’m alarmed by the idea there isn’t enough money to pay for any of them. Before wasting more time dreaming, I had to find out: Is it really true? Are we really too poor to put America back to work making and building the things we need to maintain a prosperous nation?

Searching for an answer, I discovered a small (but growing) group of economists (see here, here, here, here, here, here) who represent an emerging school of thought known as “modern monetary theory” (MMT). These men and women are valiantly trying to make us all understand a paradigm shift that occurred some forty years ago, when the world abandoned the gold standard. Their key insight shocked me: A sovereign government is never revenue constrained when it is the Monopoly issuer of its own pure fiat currency; it has all the money that’s needed to put its citizens to work building anything—and providing any service—that is desired by the public (provided the real resources are available). Even more remarkable, sovereign “deficits” in the fiat currency are just the accounting record of the surpluses that have been injected into the private economy. Eliminating the sovereign currency deficit by imposing austerity will not make the economy healthier; it will, in effect, bankrupt the citizens!

If this seems to defy logic, stay with me for just a few minutes. I’m going to propose a simple exercise that will help you “see” this reality for yourself. The exercise is simply that everyone join me in a familiar game of Monopoly. By the end of the game, I hope to convince you that MMT is correct and that we could be doing better, much better – for ourselves and future generations—if we just understood and took ad vantage of our modern monetary system.

Let’s begin.

Playing Monopolis Monopoly

We’ll play by the normal rules (I’ll suggest some added features as we go along) except this time we’ll pay special attention to certain things that are happening. For example, you’ll recall that before the game can begin, one player has to agree to be the “banker” (a tedious task, but someonehas to do it.) But now choosing this person has a special importance: it must be done democratically, with the players voting to determine who will manage the game’s money. We’ll do this little exercise because we want to pay special attention to the fact that the Monopoly “bank” is an entity created by the players themselves for their mutual benefit. In fact, we won’t refer to it as the “bank” anymore, but instead will call it our “currency issuing government” (CIG). In a real sense, we all “own” CIG together, and taking a minute to democratically choose who will manage it heightens our awareness of this key fact.

To reinforce this awareness, the next thing we’ll think about, as we set up the Monopoly board, organize the Deed Cards, shuffle the Chance Cards and choose our tokens, is that what we are really doing is setting up, and getting ready to operate, a miniature nation-state. Let’s even give it a name: Monopolis. We, the players, are the new citizens of Monopolis. We have just established, through democratic consensus, our currency issuing government, and we are now getting ready to operate our economy. That’s what the game is about.

Issuing the Currency

As we get ready to play, we immediately discover an odd dilemma: CIG has all the money! We, the players, are ready to go but we can’t start the game until we have some of CIG’s money. This is an awkward moment, which is dispensed with so quickly in regular Monopoly we hardly notice it. (The “banker” is instructed to make initial cash distributions in the amount of $1500 to each player). If we pay attention, we can see that this moment raises some interesting and crucial questions.

The first question is: are we not playing the game backwards? Isn’t it us, after all, who have to give our money to government before it has any money to spend on anything? Politicians are telling us this all the time: “Your tax dollars are going to pay for this or that.” And, as will become clear, at the state and local level, this is certainly true. But at the federal level—at the level of the sovereign state—the game of Monopoly provides us with our first clue that something is fundamentally different now from what we habitually imagine it to be.

The CIG we’ve created for our nation of Monopolis, in fact, has exactly the same purpose, and exactly the same unique and special power as any government that issues its own sovereign currency: Its purpose is to issue and manage the money we are going to play our game with, and the special power we’ve granted it is the ability to create as much money as necessary for our game to go on as long as we want it to.

Indeed, the rules of Monopoly specifically state that while players can run out of money (in which case they are bankrupt and out of the game) the Monopoly “bank” itself can NEVER run out. In the event the game unfolds in such a way that all the pink and green and blue and gold bills that come in the box are absorbed by the players, the Monopoly rule book instructs the banker to get out a pencil, paper and scissors and create new money as needed. (This is the definition of “fiat money”—money that gains its acceptance simply by decree.)

So it appears we aren’t playing the game backwards after all. The currency does flow from CIG to the players, and when we give some of that money back—in the form of taxes, or fees, or fines— by logic it cannot be because CIG needs that money. In fact, the CIG could take all the money it receives (in taxes, fees or fines) and simply shred it and throw it away: it has no need for it, because when it needs money it simply “issues” the currency. The first time I tried to wrap my thinking around this set of ideas my primordial brain-stem resonated with knee-jerk objections. (I’m not alone. See here)

Indignant as I might get, however, Monopoly forces me to realize that if I want to play the game, I have to accept the fact that the CIG gets to create the money, and I have to use the money it creates. I could insist otherwise, demanding that each player bring to the table his own private stash of gold and silver. In fact, it was just forty years ago that the real world played the game in exactly this way, and the long history associated with that experience is what implanted our brain-stems with Neanderthal beliefs about what money is and how it works. But as will become evident (if we can ever get started) the game proceeds with much greater efficiency and potential for economic growth (prosperity for more and more people) if we use our CIG’s fiat currency, which has an unlimited supply, as opposed to the player’s “gold and silver” which has a limited quantity.

Monopolis Players have Jobs

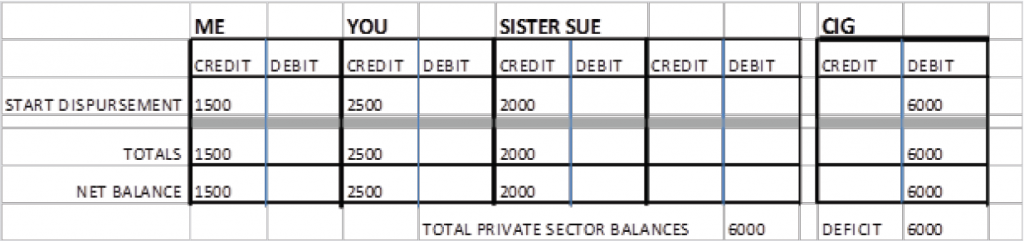

As I mentioned, “plain-game” Monopoly glosses over all these issues by directing the “banker” to simply make initial cash disbursements of $1500 to each player. In our game of Monopolis Monopoly, however, we want to emphasize that people work for a living. So we begin our game by having our government buy something it needs from each of the players.

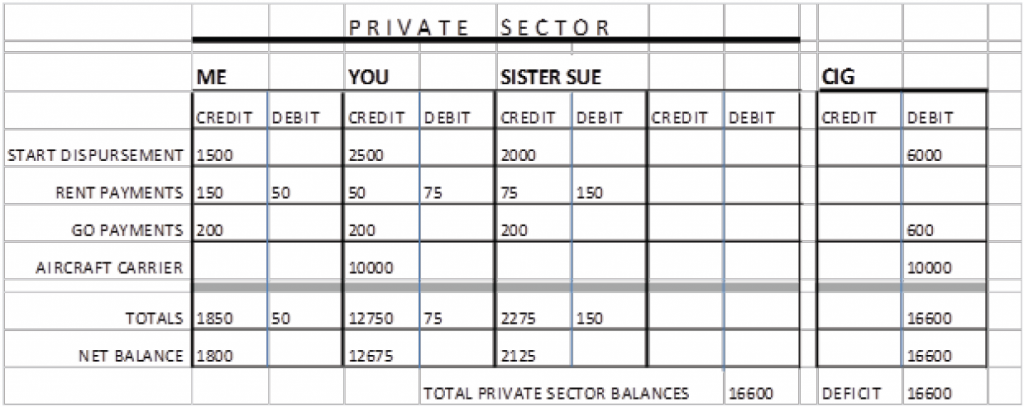

For example, I’m a writer-architect, and the government pays me $1500 to write the Monopolis rules. You are a builder, and the government pays you $2500 to build a network of roads that will allow lumber and materials to be transported to the Monopoly board properties. Sister Sue is an administrator, and the government pays her $2000 to create the Balance Sheet we’ll use to keep track of the game’s transactions. So now we’ve each done a bit of work, have modest cash positions, and we’re ready to begin the game. Before we do, however, let’s look at the Balance Sheet sister Sue has created. Keeping this Balance Sheet up to date, and paying attention to it from time to time, is going to be important.

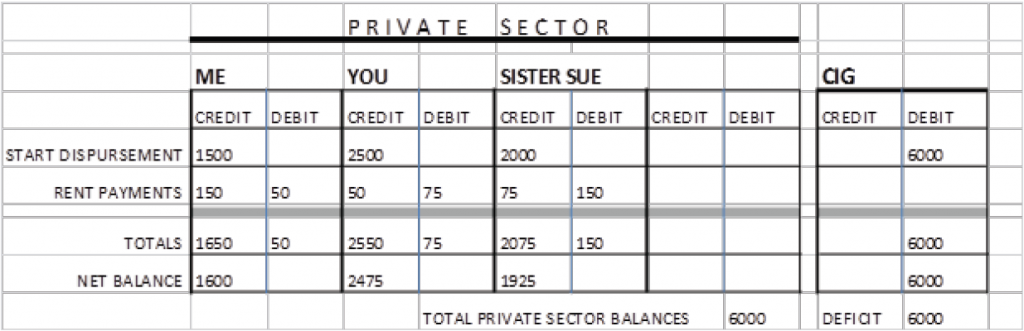

Finally! We’re ready to roll the dice to see who goes first. As we play, we should begin to notice the fact that there are two different kinds of transactions occurring. One set of transactions takes place among the players themselves: I land on your property and have to pay you rent. Let’s say I land on Vermont Avenue and I have to pay you $50; then you land on Baltic Avenue and have to pay Sister Sue $75; then Sister Sue lands on Charles Street and has to pay me $150. Let’s think of these transactions as happening within something we can call the “private sector”, and update our Balance Sheet to look like this:

Horizontal and Vertical Transactions

MMT economists refer to the transactions within the private sector as “horizontal” transactions. These include all transactions between households, businesses, corporations and state and local governments. What they call “vertical” transactions are those between the private sector and CIG.

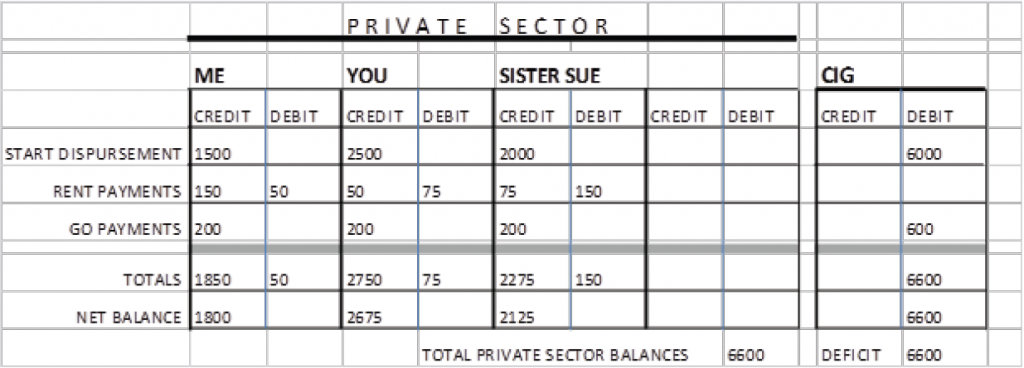

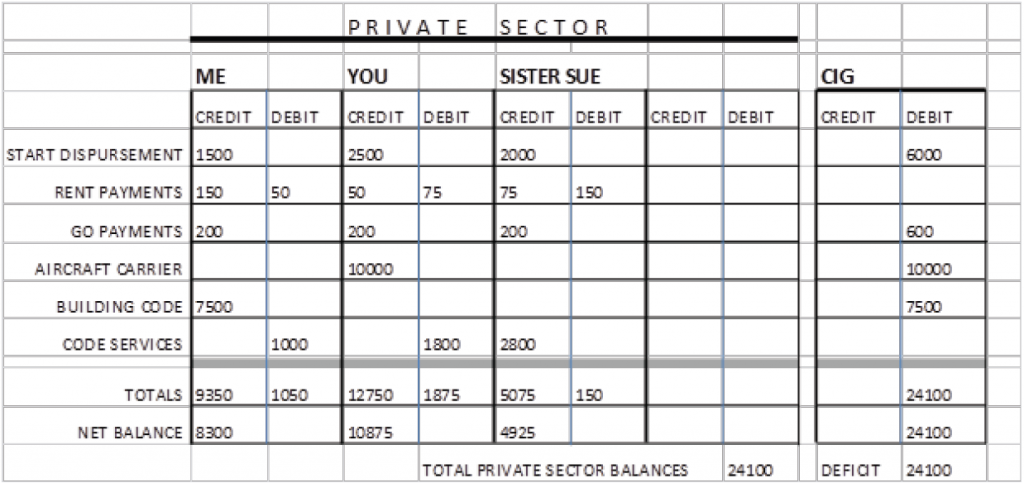

Our government’s initial procurements of services from Me, You and sister Sue were vertical transactions. We can observe another vertical transaction the first time a player passes Go. When this happens, Monopoly stipulates that the “banker” will pay that player $200; it will then continue with the same payment to each player each time they pass Go throughout the game.

We can think of these “Go payments” as being analogous to many different things in the real economy—the federal government paying someone to mow the front lawn of the White House, for example, or sending out a social security check to our grandmother. At this point, it doesn’t really matter. What we do want to notice, however, is what these “vertical” transactions do to the Balance Sheet. Let’s say each player has now passed Go:

What we can clearly observe is that while the Private Sector continues to be a zero-sum game, the “vertical” transactions generated by the “Go payments” have increased the size of that sum. And, once again, the new total of currency assets in the private sector is exactly equal to the “deficit” debit account of our CIG. (Indeed, how could it be any different?)

Expanding the Economy

Now let’s add some “fiscal events” to make our game more interesting. The first “Fiscal Event” I propose is the building of an aircraft carrier. It’s a well-known fact that governments like to purchase aircraft carriers, so it is entirely reasonable to suppose that our little nation-state would like to have one as well.

We can get an aircraft carrier into our game in exactly the same way the U.S. government gets one into its fleet: It goes to the Newport News shipyard and buys one. In Monopolis Monopoly, we’ll simulate this event by pretending that one of the players is the shipyard—You, for example, since you’re the builder amongst us. You give Monopolis its aircraft carrier and CIG pays you for this good by injecting $10,000 into your currency account.

What’s worth noticing here is that this vertical transaction has injected a considerable amount of currency into our game, but that money has been used to build something that does NOT add to the inventory of things that players can buy. Since none of the players in the private sector have any need for an aircraft carrier, our choices of things to spend our money on are still limited to the properties on the Monopoly board and the houses we can build on them—only now we’ve got a lot more money to throw at those things. In one sense, then, the government’s decision to build an aircraft carrier, while it may benefit our common defense, doesn’t really expand the economy of our game. That’s something to think about.

Building Codes and Government Regulation

Politicians argue a lot about whether government regulations are good or bad for the economy. From at least one perspective, however, if we insert government regulation into our Monopolis Monopoly game, the result is a big surprise.

To see this, let’s create a regulation. Since our game involves the building of houses and hotels, let’s have our regulation be a Building Code. Not just any Building Code, but a big, thick, extremely complex and detailed one like the International Building Code adopted by virtually every city in the United States. Once in place, the rule stipulates that players cannot build a house or hotel without meeting the requirements of the Code.

How does the government create such a Code? In exactly the same way it acquires an aircraft carrier: it pays someone to figure out what should be in the Code, pays them to write it, to illustrate it, to publish it. I would venture to guess that the International Building Code likely cost almost as much as an aircraft carrier, so I volunteer myself to be the player the government pays to write it. After I deliver the hefty volume, CIG transfers $7,500 into my currency account.

What we should notice here is that, like the aircraft carrier, the writing of the Building Code has injected a major sum of currency into the game. But something else has happened as well: The Building Code gives rise to a multitude of “services” which the game players now need, and which they can buy with their money. These are the services of professional experts who are trained to understand the Building Code (which is completely incomprehensible to those of ordinary intelligence). In our game, I have volunteered sister Sue to be the provider of Code Services to the other players. As can be seen on the Balance Sheet, both Me and You have paid Sister Sue for some of these services, and will continue to do so each time we add a house to one of our properties.

Unlike the aircraft carrier, then, the Building Code injects currency into the game and creates new things for the players to spend their money on. This particular government regulation, then, actually expands the economy of our game. This also is worth thinking about.

Enabling Structures

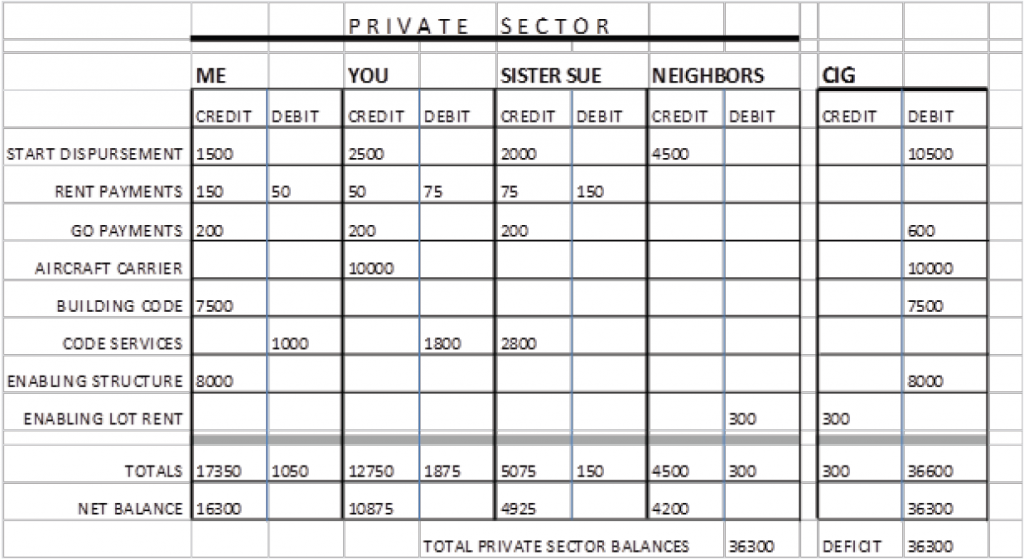

The sun’s been down an hour now, and the room we’re playing Monopolis Monopoly in has gotten pretty dark. Sister Sue turns on a light and—to our great surprise—we find we’re not alone! While we’ve been busy rolling the dice, clomping our tokens around the Monopoly board, and counting our stashes of currency, the neighbors have come over. They’re standing around, leaning against the walls, watching us with keen interest. They’re noticing all our pretty houses and hotels and colorful money, and I can tell from the expression on their faces that they want to join in the fun.

Fine with me, except there’s a problem: You and Me and sister Sue already own all the property on the Monopoly board. If the neighbors join the game there won’t be any property for them to buy, and without property, they couldn’t work with You to build a house, or hire Me to design one, or sister Sue to interpret the Building Code. So there’s really no way they can participate in the game.

But a couple of these folks are leaning forward now in a determined way, hands pushed in their pockets in a manner that suggests they might be coming out of their pockets at any moment, and I’m starting to get worried. There are a couple of kids, hanging onto their mother’s dress, who look like they haven’t eaten in two or three days. Sister Sue is looking at them and getting tearful.

Suddenly, I’m struck by a lightning bolt idea, and I immediately share it with the other players: The government of Monopolis should build a series of structures on the Monopoly board that creates new properties that players can build more houses and hotels on. I suggest calling them “Enabling Structures” because they will enable the neighbors to participate in the game. I quickly design a prototype:

The path of play around the board will now zig-up through the Enabling Structure and zag-down to the lower board, with the players either claiming possession of or paying rent to the owners of the Enabling Structure Lots.

How will the government build the Enabling Structures? Just like it buys an aircraft carrier or a building code, and I nominate myself (it was my idea, after all) to be the Enabling Structure developer. I build them all around the monopoly board, effectively doubling the number of properties and houses and hotels players can now buy in the game. To compensate my efforts, CIG injects the tidy sum of $8,000 into my currency account.

Now the neighbors can join the game, except they still don’t have any money to begin playing with—the same dilemma, recall, we started out with ourselves. Sister Sue proposes that our currency issuing government is perfectly capable of paying each of the neighbors to build a house on the first “Enabling Lot” they land on, and this procurement by our Monopolis government will become their “start-up” cash for playing the game. The new player will then pay “rent” back to CIG each time they pass go, until those payments equal the original procurement, at which point they will own the houses outright.

Whew! Now the neighbors are in the game, and after a few rounds, they’ve acquired property and built some houses, and the game proceeds just as before, except now there are more of us playing. And while the building of the Enabling Structures—and the government’s procurement of the first Enabling Structure houses—has injected a big chunk of currency into the private sector, it’s also created a LOT more things for the players to buy and sell to each other: more properties, more houses, more building services, more design services, and more services to interpret the Building Code. That’s really something to think about.

Here’s where we need to pay close attention

As the neighbors get more deeply involved in the game, building houses, collecting rents, passing Go, our currency issuing government is going to quickly run out of the money that came in the Monopoly box. So, for our game to continue, we have to follow the Monopoly rules (already stated) which instruct the “banker” to get out pencil, paper, and scissors and begin creating more currency to keep up with the expanding needs of the game.

Now there may be some folks at the table who are genuinely alarmed by this idea. They may tell us that the government cannot just “print money” because that will inevitably lead to hyper-inflation; that the government, just like all the rest of us, must “live within its means.” Their heated arguments might persuade other players too, because, well…it’s just obvious that “printing money” and running up the sovereign “deficit” is the road to serfdom.

The question is, should we listen to them? Let’s update our Balance Sheet and see what we think. (To keep the Balance Sheet fitted on the page, I’ve combined the neighbors transactions into a single column; I’ve assumed there are three of them, that they’ve each claimed an Enabling Structure lot, that CIG has paid each of them $1500 to build a house on that property, and they’ve each made one rent payment of $100 back to CIG.)

It’s clear, looking at the Balance Sheet that our CIG continues to run a “deficit”. It is also clear (especially since the neighbors joined the game) that this deficit has been growing at an increasing rate. But in what sense does that deficit become a “debt” that we, the players, should worry about paying back? The balance sheet shows that the CIG’s deficit is not our debt at all, but simply a record of the currency that’s been issued into our game. And where did all that “deficit spending” end up? Look again at the balance sheet: it’s in the accounts and assets of the players themselves.

Maybe we should think of something else to call it

When my personal bank account is in “deficit”, that is something I worry about. When a city or state government has a “deficit”, that’s also something to worry about because we have not given our “local” governments the power to issue the currency (they are users of the currency, just like the rest of the players.) When their coffers are empty, they have to make tough choices and cutback on their spending. But when we say our sovereign government has a growing “deficit”, we are badly misleading ourselves if we use the word the way we do when we think of our own bank accounts. What Monopolis Monopoly is showing us is that our sovereign “deficit” is in fact a balance sheet accounting of our own financial wealth. And why we would want to reduce that is a mysterious thing indeed!

MMT versus Neanderthal Economics

Actually, there’s only one reason we’d want to make ourselves miserable by imposing some arbitrary budget rule or fiscal austerity on our game: because we still believe we’re operating under the rules of what might now be called “Neanderthal Economics,” which go something like this:

“We must adhere to the principles of ‘sound money’ for if we do not, our citizens will lose faith in the currency and begin converting it into gold. To prevent this from happening, the sovereign must spend only what it takes in. If it tries to spend too much, its gold reserves will be depleted and it will be forced into bankruptcy just like anyone else.”

And what if, believing this, we actually eliminated the deficit and began running surpluses? Well, in that case it’s obvious our game of Monopolis Monopoly would quickly come to an end: Our CIG would have all its money again, but the players would have nothing with which to play the game. At that point, we might just as well pack everything neatly into the Monopoly box and put it back on the pantry shelf.

The astute player will object that we’ve left out too many things for our game to really mean anything: Private banking, for example, or managing inflation, or bonds and interest rates (if the Fed doesn’t “need” money, then why does it seem to borrow so much of it?) Next time we play Monopolis we could add those in, but they won’t change the basic MMT truths that our simple version of the game has revealed:

A society with a sovereign fiat currency can build any thing or obtain any service it deems necessary or desirable, so long as the citizens of that society are willing and able to build the thing, or provide the service, in exchange for the fiat money. The sovereign deficit, no matter how large it may grow, is not like a shortfall in your own bank account: it is the balance sheet record of the

money that was transferred to our side of the ledger.

The implications of this, I believe, are simply astounding.

“A society with a sovereign fiat currency can build any thing or obtain any service it deems necessary or desirable, so long as the citizens of that society are willing and able to build the thing, or provide the service, in exchange for the fiat money. The sovereign deficit, no matter how large it may grow, is not like a shortfall in your own bank account: it is the balance sheet record of the”

The above statement is Not 100% true. We still have to respect the constraints of the physical universe:

The achievable rate of raw material extraction from the earth and the rate at which we can convert raw materials to the desired finished product.

more at:

http://aquinums-razor.blogspot.com/2011/11/here-is-how-bankers-game-works.html

mansoor h. khan

Mr. Khan, thank you for bringing this up. The fact that it needs to be brought up at all is a sign of how delusional our global societies are.

An argument can be made that this is the fatal flaw inherent in what we call “civilization”. For a few million years, homo sapiens lived in balance with nature; it’s only in the last few thousand that homo sapiens has sought to control and exploit nature, with increasingly disastrous results. Animism gave way to sky gods. Abstraction became the norm, which leads us to our current and utter incomprehension of what is happening to us. Fidelity to our abstractions has led us off the cliff of the material world which is dying at our hand.

Lidia,

True. But I am not so negative about it. we are also the most creative beings ever created.

Remember:

Effective Utility of our Work (Production) = (1) Raw Materials on Earth (for now) X (2) Engineering Creativity X (3) Management Creativity

Number 2 and number 3 are in our control.

mansoor h. khan

And there is some very interesting work taking place in biotech, and synthetic biology.

http://edge.org/conversationsin/tags/Synthetic%20Biology

These people are zoning in on very specific sequences for traits – successfully. They are beginning to envision plant cells replicating as fast as bacteria to grow crops in days, and organisms that consume CO2, and excrete gasoline – killing two birds with one stone there, and I’m only scratching the surface of what they are showing.

Biotech is going to dwarf all other technology as far as impact. These people are essentially writing software in ACGT.

All praise belongs to God!

Yes, biotechnology may well dwarf all other technology in terms of impact—negative impact: just take a look at the GMO/seed monopoly issues and the extinction of biodiversity. [A contender for “biggest impact” could end up being our nuclear technologies, of course.]

We don’t even understand what makes ecosystems work (see the moose extinction article), yet we have the hubris to tinker with its underpinnings wholesale, and in a reckless fashion.

Can they re-create the 800-year-old giant red cedar that was cut down in Vancouver for roof shakes? Please hurry.

http://www.huffingtonpost.ca/2012/05/17/vancouver-island-red-cedar_n_1525958.html#s=991376

“When we know what God is, we shall be gods ourselves.” – J.B.S. Haldane

I mean, like, what could possibly go wrong with designing a food crop that exudes pesticides, and contains toxic substances even when harvested for food or when the residual is mulched. What could POSSIBLY be wrong with that?

Personally I’m far more interested in this:

http://www.jetpress.org/volume13/Nanofactory.htm

If the promise of personal nanofactories ever comes true, practically all non-resource extraction industries become obsolete overnight, and even those will suffer greatly.

Imagine a world where every human being can build just about everything they want or need that can be realised with physical matter with a mere keypress and a modest input of energy and matter. Most material distribution networks instantly obsolete. Why move stuff around when everything that a normal human being might need can be produced right at home? All polluting and ugly factories, obsolete. All retail, obsolete. Basically it’s the complete death of top-down violence enforced capitalism. And it may be less than 10 years away.

All hail local autonomy?

Lately there is a new ad on CNBC which is terrifying. Someone says that the global economy is a marvel to behold because in the last 10 years we humans have produced 90% of everything that has ever been produced on the planet. And then viewers are encouraged to believe in the world as we know it. I, for one, will not believe in the world as I know it. Not until Deep Water Horizon has been cleaned up. The Oregon coast; Fukushima; all the estuaries and rivers of the Earth; all the garbage in the oceans; all the toxic chemicals; all the poison in our food, air and water. Not until the Forests of Borneo have been restored and the rainforest in Brazil is protected; not until the mass extinctions abate. I will not believe in this world until we come to our senses. It is the coming to our senses that should take priority. Then, I agree, the future looks much better.

I read the 1972 book “The Limits to Growth” many years

ago. Overall, I thought it a reasonable study and

a “warning sign”, in a sense. The American economist

Henry C. Wallich wrote an article in 1982 heavily

critizing the “alarmist” tone of “The Limits to Growth”.

Just reading the first page of Wallich’s 1982 article,

with its dismissive and patronizing style, is enough to

make me cringe.

Susan, I am glad I haven’t seen that ad, because it would make me more furious than I already am. Thanks for being sane and contributing here against the “cornucopians”.

We cannot “engineer” a single thing that is life-giving on this planet, not a single thing.

We can engineer antibiotics and pesticides and cement and skyscrapers, etc. but we Cannot Recreate what these things take away.

One a fishery is gone, it doesn’t come back, eg.

http://www.themudflats.net/2012/05/19/epa-warns-pebble-mine-could-affect-sustainability-of-bristol-bay-fishery/

And yet people will seriously DEBATE the “value” of a gold mine versus a wild salmon run in terms of today’s nominal dollars, like that’s some way to decide the issue.

And you have those who stand to gain from the mine, on the other side of the world, running ads showing a Native woman hiking the area to show how “far away” the mine is from the Bay. [Far away for humans, not animals or fish or birds, whose idea of “far” is quite different from our own.]

Look at the brilliant human “engineering” of the Aswan dam, which has ruined ecosystems both upstream and in the Mediterranean.

http://ocean.tamu.edu/Quarterdeck/QD3.1/Elsayed/elsayed.html

Moreover, it caused most of the population to become infected with grotesque parasites which had been kept under control by the water’s past natural ebbs and flows:

http://www.ncbi.nlm.nih.gov/pubmed/1216315

I could go on and on, of course…

People aren’t smart enough to know how dumb they are, and cannot predict the outcomes of their supposed “genius”. Oppenheimer didn’t know whether, when he pushed the button during the Manhattan Project, whether the reaction would be contained, or whether THE ENTIRE WORLD WOULD BE DESTROYED. He pushed the button anyway! This is with complete annihilation being a 50/50 chance staring him in the face! Not some cumulative effect to be seen somewhere else at a later date…

The money system we’ve devised, of course, is a brick that we’ve put on the accelerator to extinction.

• When all the trees have been cut down, when all the animals have been hunted, when all the waters are polluted, when all the air is unsafe to breathe, only then will you discover you cannot eat money.

~ Cree Prophecy

• Humankind has not woven the web of life. We are but one thread within it. Whatever we do to the web, we do to ourselves. All things are bound together. All things connect.

~ Chief Seattle

P.S. I wish a Native American would run for President. ~ just me

• You have to plant. You can’t just eat.

~ Neil Young

http://neilyoungnews.thrasherswheat.org/2009/10/tweet-of-moment-you-have-to-plant.html

• When all the trees have been cut down, when all the animals have been hunted, when all the waters are polluted, when all the air is unsafe to breathe, only then will you discover you cannot eat money.

~ Cree Prophecy”

@just me — thank you for this. I had it on a T-shirt 20 years ago; the T-shirt has disintegrated.

But could we imprint this on Obama’s and our FOREHEADS????

I think your argument fall under the “able” part of “willing and able to build it”.

Still, unless there is nuclear fission or fusion involved the basic building blocks are still there (for the most part, i understand that helium is leaking out of the planet thanks is lack of density vs gravity and air pressure). It just takes more energy than it is worth right now to recycle most of it.

Energy may well be the real issue, as our demand may hit galactic proportions within a generation or two if it keeps growing. But that again comes under able.

What the HELL are you talking about, “energy MAY BE the issue”!?!?

Energy is THE ONLY issue.

Our demand will never hit “galactic” proportions because will we have destroyed the infrastructure of life far earlier than having exploited all possible energy sources.

The largest source of energy available to humans is the sun’s activity of photosynthesis in plants.

Since we are hell-bent on reducing that activity to its minimum, we will reap the rewards of that.

Oh, P.S., it would not be possible to consume “galactic” quantities of energy, because all of this energy consumption has discarded HEAT. Let’s say we want 3% growth. At an increase of 3% per year in waste heat, we would just cook ourselves in short order, far quicker than even the current, disastrous, global warming.

Excellent point! The 2nd law of thermodynamics is the hard limit for the current growth model. Considering an annual rise in energy consumption about 3% for the last century, within 4 centuries the surface temperature of the Earth will have reached that of the Sun, and a lot sooner inhospitable to human life.

And there are also hard limits to how efficient we can make motors, etc. For instance, in electrical motors we’ve already reached 91-92% efficiency.

So, it’s not about energy sources, but about thermal energy (heat) dissipation.

“so long as the citizens of that society are willing and able to build the thing, or provide the service,”

Emphasis mine. Mr. Strether understands real resource limitations quite clearly.

It’s good to point that out of course.

I wasnt sure what the article was trying to get at. Is this man saying that the US does not have a problem and can print its way out of the crisis ? If that was indeed the point being made with long “mental” experiment with monopoly then a couple of points, firstly the parallel is totally incorrect since the game in the above article is being played within a closed set of ppl who are all in the US including the banker which is the FED that “can” print all the fiat currency where as in the real world this fiat currency is something other countries are being paid for their goods and services eg. all the oil, production effort from china, high-tech from india etc.

And agree with the astounding bit in the end of the article since it is an astounding con that the US has been pulling off since 1972. To use the same example its like one of the players in monopoly having the ability to print money of its own that parallels the global standard and then forcing other players including the bank to accept it and buying things around the board with it.

But really its not astounding considering that in the 70’s there was no one to challenge the US military might including europe which was already weakened at the end of 2nd world war and also scared of the Russia. The US started with the now-OPEC countries, played king makers and forced the dollar on the rest of the world, the rest is history – beginning of a golden age for US.

But all good things must come to an end. Russia is no longer an evil from mainland europe’s perspective. More countries have joined the nuclear club including China and India. With overall imperialisim on the decline after the 1940’s and gone by 1980 (south africa being the last one) no one is going to accept the fiat currency anymore and hence the economic crisis. The 2008 crisis was caused by the rest of the world dumping internal US debt (cloaked as securities and other fancy finacial instruments) which was not a surprise because by then the rest of the world was already trying to dump the dollar itself.

So if the solution is to print more of the fiat currency then rethink it as its not going to work or definately be the cause of WW3.

http://www.exterminatingangel.com/index.php?option=com_content&task=view&id=826&Itemid=662

” There have been discussions and proposals as to how to structure a better monetary system and one popular proposal is to combine the Treasury and the Federal Reserve system and have the government spend money into the economy directly, by paying for public works with new money, rather than this roundabout way of having the Fed buy government debt as the basis of the currency. The fact is that as an obligation, money is inherently a debt, a promise of value to be returned. Even a gold based currency is just debt denominated in gold, as in; IOU one ounce of gold. So unless those commitments are made as viable investments with potential long term return to society, the result will be another form of bad debt and it will also collapse. Governments have an inherent tendency to make more promises than can be kept, so giving politicians the ability to create money by spending it into existence is an idea that should only be considered with the strongest of reservations. The current system seems designed to create excess debt anyway, since it budgets by putting together enormous spending bills, adding enough extras to get sufficient votes and then the president can only pass, or veto it in whole. Budgeting is to list priorities and spend according to ability. If the government actually wanted to budget, these bills could be broken into their various line items and have every legislator assign a percentage value to each one. Then reassemble them in order of preference and have the president draw the line at what is to be funded. This would create a system of actual budgeting, as well as distributing more power over the entire legislature, rather than having most of it accumulate at the top. This makes prioritizing a legislative function, with the president as the one responsible for the level of spending. As Truman might have put it, “The buck stops here.”

This system would result in a smaller money supply and less federal money going to local projects, but if there is a community public banking system, which funneled profits back into the public projects within the community being served, rather than having it siphoned off by big banks, to be lent back to the various levels of government and then spent on those same projects, the result would be a more stable and sustainable civic foundation.”

There cannot be any argument that the present system does NOT create excessive debts.

Excessive debts describe the status-quo, which has grown from the present system which creates all money as a debt burden that is greater than the amount of money created.

Debt-Money-R-Us.

The government money would be created without debt to anyone – being issued to promote aggregate demand and entering the economy as a payment for something of a public good, or it would not be in the budget.

It will NOT result in less money being available for the real economy, only less for the “leveraged” speculators.

The amount of credit-and-debt in the economy will be a matter of commerce.

The Kucinich Bill provides MORE money for public investment than could any public banking proposal.

http://kucinich.house.gov/UploadedFiles/NEED_Act_FINAL_112th.pdf

It does so because the state’s gave up their right to create money to the federal government, and the GUV gave it to the private bankers.

We NEED to change that and give the states more of the purchasing power created annually in the national economy.

For the Money System Common.

Joe,

Money is a promise of value. It is inherently a debt.

There is a fundamental conflict between the short term needs of politicians in charge of government and the long term needs of government that mitigates against giving the politicians in charge of government the unlimited power to spend money into existence.

That’s why I offered an actual budgeting process built into the relationship between the executive and the legislative.

Money is Money.

Debt is Debt.

Better the twain,

Had never met.

There is no reason to have debt in order to have money.

What would be the consequence of having the government issue $359 Billion in NEW MONEY in its budgeting process next year in order to provide for the normal growth of the economy.

And doing so without issuing any debt?

It would also be part of the budgeting process, identifying the goods and services it was purchasing.

Of course, this could only happen in full withdrawal of the private privilege of creating debt-based money, or there would be excess monies and cause inflation.

Why does money need to be a debt?

Thanks.

Money is simply an idea. The idea is codified into law. Money is whatever we decide it is. Nothing more, nothing less.

It is VERY important to a few hundred extremely wealthy families that they control the money supply, and therefore, the entire world economy.

Does this suit the rest of us, numbering in the billions? Well, if not, it’s time to stand up.

Nice post! Thanks.

For those who fear the CIG (Currency Issuing Government) might overspend, the solution is to allow other currency issuers but whose money is only acceptable for private debts. The CIG would retain its monopoly of creating legal tender for taxes but now note that if the CIG overspent with regard to taxation and economic growth that taxes would be EASIER to pay in real terms for the other currency users since government money would be cheaper. To avoid an inflationary spiral the CIG would then have to raise taxes (unpopular and an admission of error) or reign in its spending till economic growth caught up with its money supply. Btw, the solution of coexisting government and private money supplies is implied in Matthew 22:16-22 (“Render to Caesar …”).

I read most of the above article yesterday because of a link Rodger Malcolm Mitchell gave.

your mmt makes money simply a means of exchange and rapidly destroys money as a store of value. try again.

Money is a contract. The value is the implied exchange. Treating money as a store of value creates the illusion that it has some inherent value beyond the trust imbued in it and if we treat it as such, the assumption becomes that the more money there is, the more wealth we have. Which leads to the situation that we have now; Enormous amounts of liquidity, not only chasing limited investment potential, but rapidly destroying real value and wealth in order to create more money.

“Enormous amounts of liquidity, not only chasing limited investment potential, but rapidly destroying real value and wealth in order to create more money.”

RAPIDLY DESTROYING REAL VALUE

Exactly. You get it.

P.S. generally: in all cases, substitute the term DEBT for “liquidity” and it will be easier to see what’s right in front of our eyes.

Public money administration is a matter of public policy.

It SHOULD provide the means of exchange for the national economy.

If people want to have a ‘store of value” and they don’t like Savings Bonds, they can invest their money in whatever store of value they choose.

Buy some gold.

As long as the value of the money ITSELF is sound – that is maintains ITS OWN purchasing power through proper management, it is meeting its store of value requirement as the national circulating media.

A national monetary system’s primary function IS to have a media for exchanging all the goods and services produced in the national economy.

No problem there.

For the Money System Common.

Issuing money “destroys its value” …? (i.e. is inflationary) ….Really….?

According to its first-ever audit, the Fed (that’s the U.S. central bank) issued $16 -$29 trillion to fix the financial markets after Lehman Bros. went belly-up. That was roughly five years ago. Where’s the inflation?

And, more importantly, why do the same fraudsters whose crimes led to the financial meltdown get bailed out, but social safety net programs and revenue sharing for the states get the shaft?

Part of the problem is that the CIG is in the control of the financial sector. After money becomes a tool for people, not bankster, power, then comes the true “golden age.”

“where’s the inflation?” This is a provocative question.

I have seen food prices pretty much double both in Italy and the US over the past decade.

That’s, in one sense, “inflation”. But it has not come about because of an increase in the money supply; it has come about because of REAL SCARCITY. There is no “supply/demand” equation. There is demand. And there is supply. SUPPLY MAY VERY WELL NOT INCREASE DESPITE DEMAND.

Apart from food “inflation” (real resource scarcity beginning to show itself) there is DEflation: a nominal reduction in debt money. When debts are written off or become impossible to repay, money goes to money heaven, creating deflation. The fact that we have both inflation and deflation at the same time just proves how doubly-fucked we are.

What happens to all forms of money when there really is no future value to store?

That is what we are facing: future value WILL BE less than current value.

Future value will be less than current value.

That’s fine. Much of the problem with the current design of money is trying to kill those two birds with one stone. The assets created by availability of money as a medium of exchange (rather than the money itself) is a far more appropriate store of value IMHO.

“The assets created by availability of money as a medium of exchange (rather than the money itself) is a far more appropriate store of value “

WHAT THE FUCK ARE YOU TALKING ABOUT!!? This is the most incoherent sentence I have ever read.

“the ASSETS CREATED by [the] availablity of money”!?!?!?

What assets are those?

How can they be a “store of value”?

Lidia, I think you’re now immunized and free to think !

A pleasure to meet you too Lidia. You don’t think the use of money as a medium of exchange enhances human society?

Or, as craazyman identifies later on, wealth is co-operation and money as a medium of exchange certainly lubricates the process of co-operation. The assets I’m referring to are the result of co-operative [economic] activity: schools & hospitals, relationships, trust. I’m not talking about gold or stocks. Make more sense now?

No. I don’t think so. I don’t see schools and hospitals as founts of trust. I see them as perversities: the schools not educating and the hospitals by and large not making well.

I will pry your gold with it’s ‘stored value’ from your cold dead fingers and throw it into the ditch as useless. Continuing down the path of money as god over all things is the most asinine thing I have ever heard. Your ‘stored value’ is nothing but a number. You can’t eat it, it teaches you nothing, it provides no energy to light your way and it can’t keep you warm. Yes, I know your argument will be, “but I can trade it for what I need.” Ah, but what if others find it worthless because they have discovered that value is created in other ways. Money is simply a tool and should be treated so.

Maude,

Fascinating article, and it’s easy to get fired up after reading it and all the very good critical comments here, but…

I know you mean well from a purely idealistic perspective, but what should be used as “stored value”? Some of us need to over-produce in the summer in order to eat in the winter. Do we use our good looks, charm, and quite-possibly-completely-unearned-trust as stored value?

Or do we all become truck farmers with silos and cold cellars, giving up our building trade jobs in the cold cold north? Do I spend all my time in the summer digging root cellars and building silos instead of growing food? Or do I hire someone using something, gold for example, that I have stored up through excess production in the fields and then traded for some sort of item like the above mentioned gold that can be used as “stored value”.

Whether it’s grain or gold, or good looks and charm, some think it’s important to be ants instead of grasshoppers. You never know when Mother Nature will determine that a drought or flood or a bout of Malaria is this season’s Blue Plate Special.

Hopefully you are not suggesting that savings accounts of any type are a bad thing? If so, then what do I put up to buy the land to build my silo, build my root cellar and grow my food? Stored value, whether gold, $$$, or is necessary for those of us who choose to be ants instead of grasshoppers… I think.

By the way, you are more than welcome to pry any and all gold/$$$/ from any and all cold dead fingers, but be very cautious if they are warm live ones :)

Animal Farm

What about banking and loans and deposits. There’s another character that needs to jump into this story. Piggy Banker.

Piggy Banker sniffs around Monopolis looking for people who want and need things but can’t afford them. Some need them, like a loan to pay for job training. But others only want them, like a loan to pay for a vacation trip to Vegas that you’ll pay for through your gambling profits.

Then he “lends” them money so they can buy these things. But he doesn’t have to have the money first in order to lend it, the way you lend your neighbor your lawnmower when his breaks down, or the way you lend your hardback edition of “A Critique of Pure Reason” to your plumber who needs something to use to hold the door open while he hauls in the new toilet he’s gonna install in your bathroom.

No. Piggy Banker creates the money as he lends it simply by saying “here’s your money” and using his computer to make a bunch of positive numbers appear on your bank statement. Then he has to make sure he has reserves to cover that loan, but he can arrange those later with the Monopolis Central Bank who basically gives him any amount of reserves he wants. Just because he’s Piggy Banker.

So you don’t need the govermint to spend money to create money. Piggy Banker creates money just by walking around and singing “I’ll finance your mortgage, I’ll rummage and pillage, singing I’m a piggy banker piggy banker am I” (sorry Woddie Guthrie). Piggy Banker rummages around sticking his snout everywhere trying to smell opportunity. He’s not all bad, but sometimes his addiction to eating garbage gets him in trouble, and if he eats enough garbage, then all the people in Monopolis say “Oh Man, Piggy just ate himself almost to death again. I guess we have to bail him out one more time.”

So the money comes from Piggy Banker snorting around eating whatever he can and handing out loans. And everything works unless the Pig stuff himself with so much shit you have to put him in the animal hospital before he dies and takes the entire banking system down with him. You don’t need the govermint to spend money into existence.

Then he has to make sure he has reserves to cover that loan, but he can arrange those later with the Monopolis Central Bank who basically gives him any amount of reserves he wants. craazyman

The banks have another way of getting away with their counterfeiting – they can borrow back (via interbank lending) the reserves they would normally have to hand over to other banks as their newly created bank money circulates in the economy. Basically, the banks agree to share the interest from their money-from-thin-air loans. The banks (and I assume credit unions) thus act as one huge bank.

F. Beard,

I am glad you brought up this idea of thinking of the banking system as “one bank”. What makes this “one bank” work work?

1) deposit insurance

2) lender of last resort

3) legal tender laws

The above are government privileges we (the people) give the banks for getting “screwed” with recessions and depressions. This nonsense has to end.

mansoor h. khan

Surely, Piggy Banker is part of the system. By the

tone/content of your comment, I’m thinking that

Piggy Banker might be one of the so-called “too big to fail”

players (though TBTF is ultimately a policy, I believe).

For added realism, I’d add a few geopolitical entities

outside Monopolis. Some ideas would be China, Europe,

Saudi Arabia, Iran, London&UK, Russia, Africa and Japan.

Any mechanism is open to abuse and when abused and broken one needs to avoid the diagnosis that the mechanism itself was faulty. The Federal Reserve worked fine for a long time until it got taken over by the private banks. Economics was a decent subject of study until Milton Friedman and the Chicago School and other money bag sponsored schools started water carrying for the 0.1%. Any system that well meaning honest and intelligent human beings setup is taken apart and shredded by other dishonest greedy neanderthals. This process is overseen and either prevented by good leadership at the top or aided and abetted by corrupt leadership. Good leaders inspire other good leaders, bad leaders inspire other bad leaders. Clinton spawned Blair, Nick Clegg, Obama etc. Clinton it seems was the original bad seed in chopping off government and auctioning it off to the private sector, one wonders if he was inspired by Thatcher. In conclusion, reverting back to our original framework of Glass-Stegall for banking and Keynes but with the change of throwing all private bankers out of the Fed and passing a rule saying that anyone who served any time in Private banking can NEVER be appointed to the Fed in any capacity should take care of things and restore sanity.

The banks created the Fed in the first place, in order to make the government responsible for maintaining the value of the currency, while they retained the profits of lending it out. Prior to that, money was often issued by the banks themselves, which meant they were responsible for maintaining trust in their own currencies. It was only after the crash of the Great Depression and the rules which grew out of that which placed the banks under some obligatory restraints, which they took a long time to overcome. The recession of the seventies created a situation where excess money was getting into the economy and the resulting deregulation of the eighties and nineties allowed the banks to turn finance into a casino, which kept all the excess money floating in a cloud, but it is now grown too large to sustain.

“”The Federal Reserve worked fine for a long time until it got taken over by the private banks.””

That would have been like on Christmas Day of 191, a day or so after the private bankers created the Fed.

The proposal of Congressman Kucinich puts the Fed as a Bureau under Treasury responsible for implementing monetary policy and supervising banks.

http://kucinich.house.gov/UploadedFiles/NEED_Act_FINAL_112th.pdf

Once the private bankers are prevented from “creating” the nation’s money as a debt, the Fed will truly ” work fine for a long time”.

For the Money System Common.

Sorry.

s/b 1913.

I think the MMT has some merit, but it has to be practiced with caution. Creation of new money should be the prerogative of the government, I fully agree with that. However, the power to create new money needs to be constrained by a periodic vote of the legislative branch. Since money is supposed to play two roles, as means of exchange and the store of value, creation of new money without corresponding rise in productive output has a dilutive effect. If money is created in a well known quantity, by a vote which occurs out in the open, and can not occur more often than every X number of months of years, markets will decide whether the effect of new issuance is economically productive or dilutive. All holders of fiat currency can be seen as stockholders in the corporation called the United States. If the government issues new currency irresponsibly, the value of their stock will drop, and they can vote out politicians who increase money supply irresponsibly. The problem we are having now is that the power to coin money has been ceded by the government to private interests, and these private interests have proven conclusively that they can not be entrusted with such power. Private banks are far more profligate issuers of fiat money than the government would ever be, because private issuance occurs through sleight of hand and is potentially unlimited.

The power to create money by the government, and the necessary checks thereon, should happen on an ongoing, annual basis – it is called the budget.

Whereas at present the government must BORROW its non-taxed revenues, under reforms the amount of new money created must be identified within the budgeting process as the balance between taxes and spending.

It must provide for GDP growth potential.

It’s very simple.

It’s ALL in the Kucinich H.R. 2990 proposal for reform.

http://kucinich.house.gov/UploadedFiles/NEED_Act_FINAL_112th.pdf

Just waiting to be discovered by the MMT philosophers.

For the Money System Common.

joe,

With Kucinich gone, who will carry the bill, or even the idea, forward?

I am assured that it WILL be introduced.

Could be Conyers.

It would help if all have their Reps consider signing on.

The fact is that the most revolutionary legislative proposal in a hundred years or more, one that restores true economic democracy, has been written and exists for all to see.

Our inability to use that tool for positive change is at our own peril.

This is probably the best comment I read here.

As you describe this function of increasing the money supply would have to be a part of a electoral process so that the party who promises do expand the money supply must be legally bound to follow on the promise.

The interesting part would be what segment of the population would vote for dilution and what segment for keeping its value but it certainly would involve the population in the affair while presently simply the Fed is serving the banks.

One aspect is not mentioned in the game, namely what happens to those going bankrupt due to investments in items that are simply not liable (malinvestments) or in a wider sense how it deals with wealth and income disparity.

I stopped reading at the very beginning.

Organized work creates money.

If you’re organized and you’re working and you don’t have any money, the people you’re working for have stolen it from you.

We don’t need fancy theories.

We just need to be paid for our work.

“The end of the gold standard changed things.” You believe that? I want to tear my hair out. Thieves are thieves. They like blood most of all. Stop giving them yours.

America is a sucker for this kind of bogus solution.

Dave,

you are missing an important point. Once you get off the land and become labor, you must be able to sell your labor every day to survive. What if you can not find the market for your labor? What do you do if you are born into a situation, when there is nothing you can do to earn money?

If you are born in the countryside and find yourself starving, you move to the city. If you find work but there is no money, the economic system is bogus and you have a political problem.

Don’t you see, isn’t it clear? No matter how you change the system – gold, silver, MMT, who cares!, Jamie Dimon is going to steal all the money. All MMT does is give him lots more money to steal. All your money, all my money. He’s a thief, he’s a cheater, and there has never been a system, and never will be a system, that can’t be cheated. No matter where it comes from, no matter what you call it, no matter how much of it there is, Jamie Dimon going to steal it. A thief is who and what he is. That’s why we have cops. Arrest Jamie Dimon and take back your money.

The system really is just that simple.

‘Our oppressors own the military and the media, and their FEMA camps are waiting for us.’

Dave, You’re 100% accurate with your assessment. Our problems aren’t with how money is created at all. MMT is just another bunch of bullshit and would be gamed exactly as this system is being gamed. Until there’s resolve to put criminals behind bars it’ll never change. Till there is political resolve to limit income disparity, things cant get better. And if there would be that resolve, the system we have now would work just fine. All the MMT’ers, bless their asses, remind me of kids in a playground. Kids that believe little Susie and Johnny will play nice with them, just because. Little do they know those little bastards have been taught to kick them to the curb and take their lunch away. Its been that way since Adam and Eve, so you’d best concentrate the thoughts and efforts into re-becoming a nation of law, not a nation of fraud as it has become. MMT is just a glittery sidetrack to the real show.

Jack, Dave, there’s a big difference between “money” and “things of value”.

Dave, you’re absolutely right that workers create value. Jack, you’re absolutely right that our problem has little to do with money directly — it is political, it relates to sociopaths deciding to rule over other people and getting away with it.

However, money (“medium of exchange”) is a tool the elite use to abuse people. It’s important to understand how it actually works in order to understand how they’re using to abuse people; their scheme depends on people *not* understanding how money really works, and instead believing elaborate lines of bullshit that the elite are peddling.

You may be right, and MMT may be crazy, but one thing it accomplishes is removing the TINA (“there is no alternative”) excuse from the austerians who are fine bailing out the banksters, but can’t be bothered with social safety net programs or revenue sharing with the states.

If the excuse that “we’re running out of money” were not believed, then the thieves have just one less place to hide.

The problem, Adam, is that there is diminishing money because there is diminishing energy and diminishing resources.

That money is a stand-in for energy and resources, few people will argue. But when money goes away because energy and resources are going away… somehow that is incomprehensible!?!?

We are blowing smoke up our own asses (to use a Jim Kunstler phrase).

Sure, we always can decide to “not run out of money”, but we can’t decide not to run out of resources.

Lidia, we are not running out of money “because we are running out of resources”.

The supply of money has been artificially constrained.

Yes, we are running out of certain resources — but we have more and more of another, namely labor (population keeps going up) — and we have plenty of sunlight, too.

We know that the supply of money is artificially constrained because of the number of unemployed people.

If we were only resource-constrained, everyone would be working and we’d just see prices skyrocketing for oil and food. Instead we *also* see mass unemployment, which shows that the supply of money is also constrained.

“supply of money is also constrained.’… Nathanael

Yeah its tied up in the LHC of derivatives and looking for a multiverce to flow into.

Skippy… BTW how much of that binary cash is just delusional imagery, cough…. I mean fraud. You know, accounting lies, BS contracts, expansion of debt never to be repayed, et al.

Well, you just see how much labor you get out of diminishing per capita sunlight, water and soil nutrients.

De-regulation, De-taxation and off shoring jobs have diminished our ability to earn. Wealth has flowed from all economic classes to the top 1%. The cost of living has continued to rise substantially while our ability to earn has declined. Hence, we substituted debt for income and leveraged our most basic asset… our homes.

All of which was by design. It has more to do with government policy then the gold standard. Blaming the gold standard is just one more way to avoid a hard look at the failure of trickle down Reaganomics and supply side economics.

A country that can no longer produce that which it consumes is in deep trouble. Look no further than the fall of ancient Rome. The financialization of our economy is an additional destructive factor that will cause our demise as it has done in the past to other economies like Portugal, and Great Britain.

We need to reverse course and return to a balance between production and consumption. Globalization is adversely effecting us.

“A country that can no longer produce that which it consumes is in deep trouble.”

Yup – what if we decided that a good policy would be to consume only that which we could, sustainably, produce. That would change things considerably, methinks – and render a lot of other discussions on theory rather moot …

John Merryman. Didn’t you get the memo Neo-Liberalism fell like the Berlin Wall in the Debt Crisis of 2008. It is insufficient to merely state that government can’t be trusted to create new money neither can the private banks.

The only work-around to resolve this issue is to add some democratic accountability into the situation and that accountability to be to the ones who matter in the real economy those who produce and consume the goods and services we need and that means a government input also because some of those goods and services are public ones.

This has to mean that the various sectors that you can split the economy into, agriculture, manufacturing, mining, consumers, retirees, etc. would have to be represented on a reconstituted Federal Reserve not just predominantly the financial sector as currently. It’s no good, however, merely calling for representatives from these sectors because there’ll be attempts from the political parties to “capture” the new Federal Reserve board so you have to confront reality and the representatives also be those from the party winning the majority share of the vote at the Presidential elections. At least you’ll be improving matters in that the interests of a broad spectrum of sectorial interests will get to be represented and in more in a more technical and real-world fashion not just a talking shop for ideologues.

Scholfield,

I really don’t see it as a matter of reforming the system as it is, because it is quite obvious the only ones with the power to reform it are the ones most diligently destroying it from the inside. So it is more a matter of understanding the fundamental nature of the process, figuring out what parts of the current social model will still be left standing, when the excrement hits the air circulator, then devise a basic, fairly understandable description of where society needs to go. Such that when the various power centers get back on their feet and try to start controlling the direction of society towards serving vested interests, they will have to contend with a slightly more enlightened and skeptical populace.

The essay I linked to above(http://www.exterminatingangel.com/index.php?option=com_content&task=view&id=826&Itemid=662) is my effort to construct such a manifesto. While I realize there are aspects many people will find controversial, I’m trying to fashion an argument that will have its most appeal when the various political, religious, economic and security power centers are in the greatest turmoil, rather than something which applies to the situation at this moment.

I realize I left a bit unsaid in that comment. Mostly that when the current monetary system blows up and much of the notational value which most people have in the banking system vanishes, either because it amounts to unpayable debts, or falls into the deepest pockets, the single most important criteria for people’s survival will not so much be what sector of the economy they work in, but their geographic location. The global economy is going to break down. As Tip O’Neil so apply put it, “All politics is local.”

I think the first signs of this are the various movements toward forming state banking systems. That is the point about what will be the primary social structure left standing and how it needs to formulate a working economic model. Yes, the Federal government isn’t going to disappear, but it is going to be seriously chastened.

What is interesting in this election is the extent to which the conversation is being dragged to the left, even if for most of those in charge, it is simply an election strategy. While the occupy movement seems about as futile as the anti-globalization movement and Obama’s populist rhetoric is exceedingly hollow, I think we will look back, those of us alive, in twenty years and see it really was the beginning of a tidal shift.

Very nice, BUT.

You did mention resources, but should have given them more emphasis. Certainly Keynes did.

This is not 1940 any more. There no open frontiers. Because of past government policies aimed at maximizing population growth, there are 100 million new mouths to feed each and every year. At the same time crop yields per acre have not increased for over a decade now, and things like fresh water, energy, topsoil etc. are things that we simply cannot manufacture at the needed scale with anything resembling our current technology.

“Green technology”? Replace that phrase with “magic pixie dust” and you will say the same thing. There is the same lack of demonstrated track record for both phrases.

“Conservation”? Why yes, we can become poorer and poorer until chronic malnutrition physically prevents women from having large families – this is happening in India right now – and we can all live lives that are the most miserable that they can be without us actually dying. Not much of a solution.

We are past the phase where we could just dump more fertilizer on the crops and drill more oil wells and as long as the money supply was OK things would be great. We need to spend less time worrying about the rich messing with fiat money, and more time worrying about the rich encouraging too-rapid population growth.

I did advanced mathematics at the universities.

I’m rather awe-struck at the little amount of thought

and debate about the implications of exponential

growth of population. At a 2% annual rate of growth for

a population, the doubling-time is obtained by dividing

seventy years by the percentage points of annual

rate of growth. For a 2% annual rate of growth,

the doubling-time is close to 70/2 = 35 years.

Have you read this http://climateandcapitalism.com/2012/03/29/a-modest-proposal/ ? (or other articles making the same point?)

Just curious for your perspective on it.

It might be worthwhile considering the possibility there’s an alternative (I mean besides certain doom).

See Amory Lovins TED talk for a more hopeful alternative:

http://www.ted.com/talks/amory_lovins_on_winning_the_oil_endgame.html

We know the solution to the population problem; educate women, emancipate women, and supply women with access to birth control.

A few other things help a bit.

Of course, now we have to stop global warming too.

Fertility rates have been plummeting worldwide for many years now.

Large parts of the world, such as most of Europe, Russia, China, Korea, and Japan, have sub-replacement fertility rates. The average woman in those regions has fewer than two children. The next generation will be smaller than the current one.

Even countries with above-replacement rates, such as Egypt or Kenya, have seen massive drops in total fertility. The rate in Egypt has fallen by more than half in just 20 years.

The only reason that world population is still increasing is because of the huge number of the women who were born in the 1970’s and 80’s, who are still in their reproductive years.

But world population is going to peak at less than 9 billion, before 2050. We’re actually going to have fewer people around than experts considered the lowest likely population model.

World population, environmentally speaking, is a good-news story, although it won’t feel that way at mid-century when the world’s working-age people are going to be carrying the biggest ever load of dependent seniors.

I will be blunt, I can’t believe individuals with a brain can actually come up with such a thing as MMT. The thing is really like playing monopoly and should be kept as such.

To be honest, who would not like to live in a world of endless money (with value of course), tell me one person that would not like that guys and girls? One..

Why is it so hard to understand that currency is not the same as wealth/capital. I hope you agree that the purpose of money is for transferring of wealth and storing of wealth and capital.

MMT is the best option if you want to transfer wealth, nothing more. I’m 100% confident that if the geniuses in Washington decide to implement MMT, it wont be too long before our economy collapses. I mean, we already have too much “manual interventions” yet MMTers are asking for more.

In addition to someone deciding how much currency is needed and at what price (which the fed already does and is terrible at best), the government will now decide how much people are paid (easy task ehhh). How do you decide how much currency is needed? How do you decide how much people and companies get paid? Do you take another “democratic” vote (seriously)?

For god’s sake, why are we afraid of a recession? Isn’t GOD telling us to slow down – too much capacity/supply?

Solution:

Let the market manage money supply and the cost/interest (prevent banking corruption), and back currency by the shiny metal that Beard hates, gold (prevent government corruption).

Free markets removes the control/greed/corruption element away from a few men. It avoids “mistakes” from happening, too much money, too little money, too cheap money, too expensive money.

It prevents governments from using the monopoly to enrich themselves, or buying votes, or spending money in useless projects without taxing (which hurts). It allows for the failure of irresponsble corporations or individuals. In other words, it punishes failure and rewards success. It rewards hard workers and punishes lazy ones, thereby creating a more productive society. As society becomes more productive, the prices should drop, benefiting society as a whole and sharing the wealth.

Mole (and an appropriate name too!), you have presented some ideas here that are hard to understand. Right now it seems to me there is endless money floating around the system in derivatives, for example, that we hope will never have to be realized. Why would MMT mean more endless money than the system we already have?

You have a magical concept called “free markets” and it will not solve anything. Markets are run by people (who make mistakes all the time) and there are all kinds of other constraints on markets. You will have to define “free.”

Governments do not “buy votes” but politicians sure do. That is where the corruption is coming from. Money itself is not a corruption, but how it is used can be.

You have forgotten that the politicians are voted into office by the people. That process has been corrupted so that politicians are now doing the will of the corporations and banks that buy them. When politicians are not millionaires; when politicians truly represent the people who vote for them; when money is not used to modify policy then you will see government doing what it is meant to do.

In some ways, we get the government we deserve. The citizens have to be more vigilant. The system that is now in place is not working for the majority of the people. Dear Mole, just try to understand that there is more than one way to view the economy. Be brave and try to understand the benefits put forth by MMT. You will feel better if you do.

Jehr,

The essense of free markets is to accept mistakes.. I would go so far as to say that it is by making mistakes that humanity has achieved so much. But if you make a mistake (just as you should if you make a profit) you should bear the fruit of your mistake, PERIOD. That is what free markets are.

A person making a mistake and going under is ok and won’t kill the economy. A corporation making a mistake and going under is ok and won’t kill the economy. A TBTF bank making a mistake may be a bit painful, but it will be ok and will not kill the entire economy. Free markets allow for these things to clear without harm.

A government (group of politicians or whatever you want to call it) making a mistake will destroy not only the economy, it will destroy our society as a whole. Do you see the difference? Look at the market for oranges for example. If there are too many oranges, prices drop, some competitors are driven out and prices stabilize. If the supply is too tight, competitors are driven in, increasing supply and prices again find an equilibrium. If oranges are in excess in one area of the country, while tight in another, oranges will be demanded from the area with tighter supply and will keep demand high on the area with too many oranges. If you see it this way, and I hope you do, you can see how free trade actually promotes employment – the opposite of what you hear coming from Washington.

I will add that the FREE market is the one giving the pain, and the pain will continue until we revert to the equilibrium whether we like it or not. Whether we have MMT, Austrian or keynesian economics. It is god/nature telling us and it will force it on us whether we believe in unicorns and fairies or not. Unfortunately, currency is just a convinient way of exhange a limited amount of wealth. Wealth does increase with time, but it cannot be created out of thin air like paper can. Now, if you know simple mathematics, what happens when you increase the denominator?

An individual (and we do as we wish for the most part), corporations, governments should be allowed to do as they please so long as they do not break the laws set for by people, the constitution. As you say, the government is elected to enfore the laws and the law should be the same whether you are a company, poor, rich, politician or non politician.

Our government has clearly sold us down the river when you hear stories of a poor person being thrown in jail for helping himself to a damn piece of freaking bread to feed himself, while corporate thieves, politicians, unions, government class steal billions. This should send shills down our spine…