Another blow to what credibility is left in the futures brokerage business in the US may have come in the form of the failure of midsized commodities and foreign exchange broker PFGBest, which claimed to have roughly $400 million in customer assets. Although details are sketchy, the firm was may have been falsifying bank records; the founder of the firm tried but failed to kill himself.

Customer accounts were put on hold today and the firm is being liquidated. Per the Wall Street Journal (hat tip Deontos):

“What this means is no customers are able to trade except to liquidate positions. Until further notice, PFGBest is not authorized to release any funds,” said PFGBest in its statement…

The NFA said it has taken “Member Responsibility Action to protect customers because PFG has failed to demonstrate that it meets capital requirements and segregated funds requirements.” The group also said it “has reason to believe” the firm doesn’t have enough assets to meet obligations to customers.

One commentator tried putting a happy face on this:

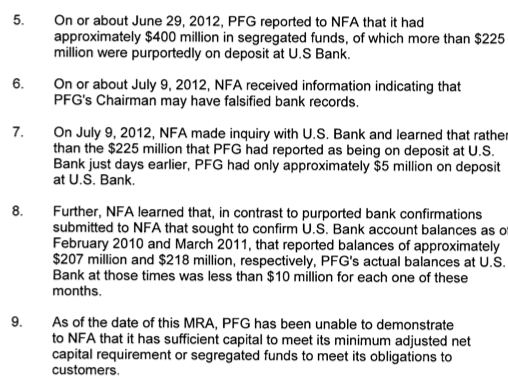

Lauren Nelson, director of communications for Attain Capital Management, an introducing broker, drew a contrast with the MF Global situation, saying that if client accounts were at risk at PFGBest, its clearing broker, Jefferies Group Inc., would have issued a “notice that obligations were not being met.” No such notice has been received, according to Ms. Nelson.

I welcome comment from readers who are familiar with commodities regulations, but I’d not be so certain. One of the things that made the MF Global failure so shocking was the freezing of accounts which not only denied customers access to funds, but the inability to trade also meant they had limited ability to mitigate any losses. By contrast, when Refco failed, the businesses were sold to Man Financial, and customers had a smooth transition.

One key difference is MF Global was put into Chapter 11, as opposed to being liquidated under Chapter 7. This move was widely criticized (the CFTC’s Gary Gensler curiously approved this action before recusing himself). Not only did it give considerable advantage to creditors like JP Morgan. From MFGFacts:

In other words, when the SEC threw the liquidation process to SIPC for a Chapter 11 securities liquidation, and with the CFTC’s immediate agreement (under the conflicted Chairman Gensler who had not yet to recuse himself from MF Global issues), a framework of law was chosen where customers were — for the very first time ever — made creditors and their assets thrown into the entire MF Global estate. Many say what! And the industry is now asking how?….

Citing the exemplary record in the futures industry in the event of bankruptcies, former CFTC Director of the CFTC Division of Trading, Andrea Corcoran writes in a January 1993 issue of Futures International Law Letter “As early as 1980, however, concerns were expressed about the ability to retain this record in the event of the bankruptcy of a dually-licensed firm – that is, a firm registered as both a futures commission merchant (FCM) and a securities broker-dealer.”

To rectify this, the CFTC then drafted rules we find under then now famous Part 190 where Corcoran writes, “In the final rules, the Commission noted that Section 7(b) of SIPA (read Securities Investors Protection Act) …proved that a trustee in a SIPA liquidation shall be subject to the same duties as a trustee in a commodity broker bankruptcy under Subchapter IV of Chapter 7 of the Code.”

So in other words, the use of Chapter 11 is much less favorable to commodities brokerage customers than Chapter 7, and the reason for choosing a Chapter 11 seemed to be the result of (at best) shocking ignorance at the CFTC (in that a Chapter 7 would have protected the commodities customers and not put the securities brokerage customers at a disadvantage). By contrast, for a pure futures brokerage, there would be no reason to consider a Chapter 11 (save maybe the intent really was to reorganize the firm, or the liquidity crisis was at the holding company, not in the brokerage unit). The fact that the word “liquidation” is featured so strongly in the Wall Street Journal account is consistent with the expected use of a Chapter 7, which also means that in the end, the PFGBest customers might come out less badly than MF Global customers did.

However, it needs to be stressed that this is not how a regulated broker is supposed to fail. As many seasoned traders stressed at the time of the MF Global collapse, customer accounts are supposed to be sacrosanct. And as a result, it is normally possible to have fairly smooth transfer of customer accounts out of failed firms. If it turns out that twice in a relatively short period that customers had their funds pilfered under regulators’ noses, it means that investors should vote with their feet until they have some assurance that these failings have been rectified.

Update 11:00 PM: Per the statement of the National Futures Association, it looks like half the customers’ money, or roughly $200 million of $400 million, has gone missing:

And of course, as with MF Global, there is the JP Morgan connection (see link above).

The pedigree of money

Does not concern JP

Or B of A or Goldman Sachs —

Banksterocracy!

My favorite poem of yours ever Emily! It even had a dash.

Forcing the MF Global matter into Chapter 11 (rather than Chapter 7) was controversial from the outset and seen by some media commentary as another example of regulatory capture (Gensler/CFTC sanctioning the Ch. 11 course).

There is currently a motion to convert the proceeding from Ch. 11 to Ch. 7. http://news.yahoo.com/mf-global-clients-bash-fat-fees-seek-quick-232641902–finance.html

One of the arguments in the conversion motion is that parties involved had actual knowledge that there was not a hope in heaven that MFG would be able to restructure — i.e., it was past melt-down and unsalvageable. There would have been no good faith basis, therefore, to proceed under Chapter 11, which applies when restructuring is possible.

Here is a link to NY Congressman Michael Grimm’s statement regarding the questionable circumstances surrounding MFG’s petition via Chapter 11 rather than Chapter 7. Grimm suggests that the decision was made jointly by CFTC, SEC, SIPA and MFG. The advantages for certain parties (not the commodities customers) were/are obvious.

http://grimm.house.gov/press-release/rep-grimm-questions-regulators-mf-global-bankruptcy-decision-putting-victims

The whole thing is STUNNING. it’s theft.

Theft, surely. Stunning??? These days???

Hardly. We live in the age of lawlessness.

Time to use RICO to go after these criminal enterprises the banksters have set up….RICO broke the Italian mafia, it’s worth a try with the criminal organizations known as “wall street investment banks”. For good measure, I’d also throw in some senior executives from the rating agencies.

Can you explain the difference between a SIPA and CFTC Chapter 7 and 11 and a normal business chapter 11 or 7?

Do the regulatory agencies have a say over what chapter the entity files under? Normally isn’t the decision of the corporation/bank makes? And then the creditors or interested parties or whoever can complain, but it’s up to the judge to decide?

I guess I’m just confused about why people say the agencies are somehow at fault, or that they made a “deal”, and realize it may be because this is a weird bankruptcy rule or something.

And banks are going to be subject to receivership, I guess, so these commodities firms probably don’t qualify as banks. And I guess they have this weird classification and bankruptcy law because of the quasi-banking function it serves.

So maybe we would be better off using receivership for these institutions or changing their weird bankruptcy laws to better wind them down.

Frankly, I say let’s do a Nationalization Act where we take by eminent domain the 14 largest banks and liquidate all the derivatives contracts they have. Or most of them. Let’s conduct that by fire sale (that way it will be cheaper when we have to pay them just compensation for taking their banks). Then we can use the good parts again.

A Chapter 7 isn’t weird, it’s a liquidation. You sell everything and close the business. A Chapter 11 is supposed to be a restructuring, you cram down the creditors according to seniority (in theory, but the creditors have huge pigfights) and then the business exits 11 to prosper or fail again. A 11 can turn into a 7 if the business deteriorates or the creditors get really piggy and won’t agree to a plan.

Since I am not a BK expert, I infer from the comments that in a 7, the customers would get whatever there was in the customer accounts and I guess (stress guess) they’d have a senior claim to the extent they came up short and there were any funds elsewhere in the company. But I gather that in a 11, the customer assets are throw in with the other assets (!). And I believe JPM and other secured creditors would wind up senior to customers. But this is a guess. All I know for sure is the customers were screwed by the choice of Ch. 11.

I understand the distinction between a restructuring and a liquidation.

The “weird” part I don’t understand is the implication by some that the agency heads made a deal or had a say in what chapter to file under. Some customers have already objected to the chapter chosen and have tried to force a conversion but the judge said no–which is probably a typical result.

I can see how a liquidation could have prevented the disappearance of the funds . . . . although the big wigs moved the funds pretty quickly in this case, right? Weren’t many of the missing funds moved even before they filed for bankruptcy?

I guess I separate out the two issues of taking customer funds and how best to wind down these entities. I’m not sure if default forced liquidation of these types of enterprises is wise . . . but I am inclined to agree with you but winding down slowly also makes sense especially when people’s jobs are at stake.

The SEC and the CFTC both had to approve the MFG BK. I’m not certain as to why, perhaps because it was jointly regulated.

What I don’t understand is why there is this belief that in the case of a brokerage in futures commission merchant that there is a choice. A restructuring demands that there be some amount of salvagable equity. In either case, if the firm can’t statisfy settlements and margin calls, there is nothing around which a restructuring can be created. The only asset the firm has is it’s book of customers and those accounts will go where the individual broker will go.

A liquidation gives the best treatment to the customers. And incidentally, it is highly improbable that there are some ‘clients’ who are affected by this latest fiasco. If you read the contract for account, it is clear that when you open an account with a futures commission agent and/or a brokerage, you are a customer.

What happens when a Chapter 11 is invoked, well the customers get screwed in that they have to get in line behind the so called secured creditors, the banks who lent the firm the money it extended as the offset to the margin accounts extended to customers.

Cedar Falls Iowa is a nice place, no appreciable traffic, lots of nearby corn fields and a quaint little teachers college that has grown like topsy with a unidome, a regular mouse that has roared. marion Iowa is also a nice bucolic place and if you want to live where world class medical treatment is available in Iowa City or Ames, the poeple are friendly and welcoming, just bring a bit of money and few jobs and you’ll be the biggest whale in the pond.

Siggy,

Can you explain why it’s worse in these situations to carry on rather than liquidate?

Say you have 100 customer accounts who are owed $100,000 each. The firm has enough to pay only $80,000 to each customer or it can owe the customer and continue operating and maybe one day pay back $90,000 or even the full $100,000.

Don’t know the answer here but shouldn’t it be a case by case decision? As a practical matter for business bankruptcies (at least large ones) it seems the default is to reorganize or at least try to.

Siggy,

I agree they are not gonna use Ch. 11. That wasn’t the point.

One of the big reasons customers have fared badly in MFG was the use of Ch. 11, which will not be operative here. But to the other issue, no money is no money. If the funds have vanished and there aren’t other assets to make up the shortfall, yes, the customers will suffer serious losses.

And it might have something to do with what you reported on before, the sweet indemnity deals the executives at MF Global had and the kitty reserved from the company’s operations for their defense. Seems like there is a big potential for shenanigans there.

And maybe you didn’t report on it but I think I saw it here.

Anyway, this is the under reported part of the story imho.

Regulators had to approve the bankruptcy filing. Without their approval first, the filing could not have been made.

BTW, regulators, including the Department of Justice, were present at the initial hearings on the filing when MF Global legal council told the court that there were no customer funds missings. Had he not purgered himself by telling the Judge “All funds can be accounted for” and told the truth, MF Global never ever would have gone into a Chapter 11, where the executives of the Holdings could roam free without an immediate appointment of a Receiver or Trustee.

http://mfgfacts.com/2012/05/11/at-the-court-of-kanagroos/

the court transcript can be downloaded.

Thanks Nick. It’s nice to see the rule clearly stated.

But do you have a citation? I’m still not seeing the requirement that either agency head “approve” what chapter an entity files under.

But, it does look like SIPC has the ability to intervene in a Bankruptcy Code bankruptcy of a “stockbroker” and conduct its own liquidation under SIPA. http://www.willkie.com/files/tbl_s29Publications%5CFileUpload5686%5C2574%5CSummary_of_Key_Bankruptcy_Code_and_SIPA_Related_Issues.pdf

So I guess that was where the agency got to “decide” what chapter to use? SIPA could have intervened but chose not to. It doesn’t look like SEC or other regulatory bodies have the same power here, but the law is very confusing on this subject.

And the author(s) of that piece seems to think the special rules for “stockbrokers” under the Bankruptcy Code (which is different from “normal” business bankruptcies) requires a Chapter 7 rather than Chapter 11. That’s a little hazy to me from reading the article and could be explained better.

WWM, SIPA: “I prefer not to” (“Bartleby the Scrivener”).

Walt,

Only the SEC can order a bankruptcy proceeding under the Securities Investor Protection Act, which is called a SIPA proceeding. Without the SEC order, it cannot happen.

You can look all up on the DOJ web site if you are really interested.

MF Global had 318 securites accounts and over 38 THOUSAND futures accounts. MFGI (belonging to MF Global) had a dual registraion as an Futures Comission Merchant and a Securities Dealer. With the dual registration, the CFTC had the power to file an objection. They did not. Instead, Gensler sat in his bathrobe at 2:00 Am and said “sure, ok….”

This filing was rigged by fist breaking it into a Chapter 11 and a SIPA -Chapter 11. The CFTC (Jill Sommers) claimed under oath that it was required to her “understanding.” Of course this is not true. It was a choice. But a choice that gravely damaged futures customers. (Even the SIPA trustee — same one as the LBH bankruptcy — muffed up in his orders in the first weeks as he did not have understanding of the industry.)

The logic of this convoluted filing has never been justified. But the result is obvious. One of the largest bankruptcies was thrown to the bankruptcy industry and hunderds of millions will be earned by a club of SIPC lawyers, and JP Morgan can hold onto as much dough as possible.

The bankruptcy guidlines are quite clear and not “wierd.”

Under the Banckrupcy code for an FCM:

“In the absence of specific statutory treatment of the subject and any case law in point, the CEA was concerned that customers’ segregated funds at all times be deemed a trust fund, free of funds belonging to anyone else. The BRAct appears to have resolved any questions with respect to the bankruptcy issue. The definition of customer property contained in Section 761(10)9 of the BRAct, together with the special priority of distribution accorded to such property under Section 766(h) thereof, would, in the opinion of the Division, preclude any claim by a non-customer creditor of an FCM against securities in a segregated account until all claims for customers’ equities had been satisfied. “

Will MFG legal counsel be thrown in jail for perjury? Or will he claim he was deceived by the corporation’s officers? What’s gonna be the excuse this time?

For where I stand, it seems like US financiers ALWAYS have excuses that allow them to wiggle out of any meaningful punishment!

I feel dumb about the end of that last paragraph. If investors do vote with their feet as prescribed, where pray tell are they supposed to walk with them?

Not to put too fine a point on it but if the regulators have been captured and there is no longer any broker dealer who can be trusted to keep customer funds sacrosanct as you put it, what is to become of investing in general?

Is every investor now expected to know not only the financial prospects of his investment but also evaluate the liquidity of all counter parties? Sounds inefficient at best and possibly unworkable for most except (voila) the most privileged players.

That is basically what I am saying. Remember, these are commodities futures accounts. The problem is that there are bona fide commercial users (farmers are the prototype). But for any “investor”, particularly the retail type (and this was a retail FCM), I’d say forget about it.

I may have had the good fortune (in retrospect) to have been burned early. I made money on my first futures trade, and on my second, the broker gave me an execution price that was clearly $3000 off (which was a lot to me at the time), of course in their favor. I raised holy hell and got less than half back. This was at a major firm, mind you, and I had been referred by a big customer. The fact that they’d rip me off so quickly led me to decide to have nothing to do with futures ever again.

Well that’s a very particular incident. The vast majority of us do not experience this. I am, however, concerned about the liquidity. On the other hand, maybe after PFG the industry will straighten up liquidity-wise, otherwise the entire futures trading industry will dissapear…I don’t think they want that.

the futures industry will not disappear. It will rely on its new customers ability to forget or to have never known history over time.

New participants that enter the field over the next 3-10 yrs will likely have no knowledge that FCM’s have the capability of expropriating their customers funds and obliterating the meaning and intent segregated accounts. Segregated accounts are like treaties the US government makes with Native Americans. They are promises made to be broken.

For those wanting to open an account with an FCM and IB somewhere, they should vet their prospective FCM and IB through the NFA website. There you can at least look up any company or licensed person’s prior illegal activities. That will not guarantee you much, but it will help.

It is important to bear in mind that these FCMs would not be failing if it were not for the Zero Interest rate policies, as these FCMs used to be able to make really good coin off the float. Not so anymore. Hence, they turn to criminal activity to chase yield as in MF Global’s case, not sure what PFG’s excuse is yet

There is no such thing as a segregated account. It’s a pure fiction:.

The whole post is very much worth a read.

My, cutting some special cloth already,

Guidance to Members Carrying Accounts for, or Transacting Business with Persons Exempt from Registration

http://www.nfa.futures.org/NFA-regulation/regulationNotice.asp?ArticleID=4055

http://www.nfa.futures.org/basicnet/

Yes JB, we know, with time, it should heal… right?

But, what if the past histrionics are inapplicable, the world is far – far from what it was even a handful of years ago. The actual physical is transforming without regards to our warmed over attempts, old ways of making bread.

It seems as a matter of national security and national pride that the Street and MIC are all that really matter anymore. Even with in these paddocks the knife is out, people that have grow up together, when to school together, were blooded together, are eying each other off, weighing how much flesh they have, if the need should arise.

Skippy… “Hence, they turn to criminal activity to chase yield as in MF Global’s case, not sure what PFG’s excuse is yet” – JB.

Pleaseeeeeee’ssss… turn to criminal activity… to chase yield. Pedophilia is about praying on children for a variety of reasons, none are valid, no matter how strong the desire.

Ok so… what should I think about my 401K? It’s managed and controlled by an entity my employer chooses. I have a limited ability to move the account without incurring major tax liabilities for another 8 years.

And unlike Mitty Mitt the poor little rich governor mine hasn’t mushroomed into a size much larger than the allowed legal yearly contribution.

Maybe it will be a rice and bean retirement.

Think cat food. The 401K is another wicked contraption of Wall Street that bolsters TBTF. There’s never the option of an FDIC-insured allocation, and of course no physical gold, only stocks and bonds. And don’t even think of it as your money, even in an emergency and even apart from the 10% penalty, there are hurdles and vault doors in place to prevent you from seeing any of it. I assume some of these bars were put in place since the 08 GFC to prevent people from resorting to your mattress or a private vault.

401(k)s were a scheme cooked up by private and public finance sectors — think of it as a giant mousetrap to lure real cash from people working for a living (usually on W2s and paying full tax freight). It was never intended to yield real benefits to the cash-mice, except as an accidental side effect of particularly roaring (bubble) times. It was intended as a giant cash-machine for money managers, mutual funds, banks with proprietary mutual funds, 401(k) “advisors,” middle-men who brought 401K plans and fund managers together. This “sell side” made off consistently and with no risk ever to the tune of . . . . the amounts are too big to count. Fees, fees, fees, more fees and then hidden fees, hidden fees and more hidden fees.

As for the cash mice? Well 1999-2009 has already been called a “lost decade” for 401K investors. 2010 – present and going, looks to be more of the same.

Unless an employer is matching contributions (giving you free money), with current volatility and fraud being the main movers of equities and bond markets, I consider it insane to put any money in one of those vehicles. Caveat emptor. Especially now with the new vogue of “Timeline” funds which are another less transparent working-person cash-looting via hidden fees (and crappy performance) scheme.

Basically, 401K accounts = Bag Holders.

Your “pension” is in captivity, Q.E.D.

Recall: “Merchants of Grain” by Dan Morgan. Top Dogs always win.

http://www.amazon.com/Does-Your-Broker-Owe-Money/dp/0974876305

securities attorney Daniel R. Solin

“I feel dumb about the end of that last paragraph. If investors do vote with their feet as prescribed, where pray tell are they supposed to walk with them?”

Guns, seeds, livestock and (well-watered) land?

Better be careful about the last of the four. Real estate titles in this country ain’t what they used to be either.

Come to think of it, better be careful about #2 and #3 as well. Stay away from that Frankenstein stuff, if that’s even still possible.

But thank the gods, you can still trust guns in ‘Murca. This is the land, after all, of the Second Amendment.

Now that it’s happened twice, it’s clear that the futures industry is a badly-regulated cesspool that’s incapable of cleaning itself up.

Much of what used to be possible ONLY with futures now can be accomplished with commodity ETFs. ETFs don’t offer the 20-to-1 leverage of futures, but triple-levered ETFs still generate plenty of bang for the buck (as well as a horrifying level of volatility drag, which comes as a surprise to some retail customers).

Despite having traded futures for more than 20 years, I would advise not touching this broken industry with a ten-foot pole, as long as a corrupt dick like Gary Gensler continues to disgrace the CFTC with his greasy presence. Run, don’t walk, to the exit!

Gollum that he is, Gensler probably plays this to himself nightly, with his own voice, and a pillow speaker.

“Despite having traded futures for more than 20 years, I would advise not touching this broken industry with a ten-foot pole, as long as a corrupt dick like Gary Gensler continues to disgrace the CFTC with his greasy presence. Run, don’t walk, to the exit! ” Gollum

“So in other words, the use of Chapter 11 is much less favorable to commodities brokerage customers than Chapter 7, and the reason for choosing a Chapter 11 seemed to be the result of (at best) shocking ignorance at the CFTC (in that a Chapter 7 would have protected the commodities customers and not put the securities brokerage customers at a disadvantage)”

This was a deal struck between the SEC, Treasury and JPM, at JPM’s behest as it greatly favored their claims as a creditor. Gensler acquiesced when it was presented to him as a fait accompli.

And it probably did not hurt in getting Gensler to say “ok” to a fait accompli given that Gensler and Corzine are part of the G Sachs brotherhood?

[delete “given”]

… and substitute ‘mafia’ for ‘brotherhood’

No. Just a comma missing: “fait accompli, given that …”

Merci LBR!

But wasn’t the basic problem that someone stole the money?

It’s correct that “freezing” operations may have prevented further theft . . . but we don’t know for sure. Even if they were to file under Chapter 7 and freeze assets funds could have been moved before then.

But normally doesn’t it make more sense to wind a business down rather than conduct a fire sale? Doesn’t this normal rule of business bankruptcy make sense? That you are going to get more out of the company by restructuring or at least conducting an orderly wind down?

I mean I’m willing to challenge this status quo rule if it makes sense . . . and maybe it does make sense to abruptly wind down banks and financial institutions.

The lawyers and professionals do sometimes end up making so much it’s better to simply conduct a fire sale. Maybe this is one of those situations.

Plus, with the big 14 banks or whatever it is, maybe it’s best to simply wind them down and that would consist mostly of wiping out derivative contracts, right? I guess you would want to keep operating while you wound them down but if you bring all the big boys down at once seems like you could do it quick.

The other rules we need to change is we need to make pensions and theft from customer accounts the first to be paid back. This should be guaranteed personally by the directors and executives. We need to change bankruptcy law to put people before corporations.

Plus, might as well enforce the criminal laws. Really, that’s what should have happened here. Criminal prosecutions would have facilitated clawing more of this money back too.

There’s your free market, boys. How ya like it now?

It’s all about Teh Freedom in ‘Murca, you know.

FDR’s Four Freedoms:

1) Freedom of speech;

2) Freedom of religion;

3) Freedom from want;

4) Freedom from fear.

The Capitalist’s Four Freedoms

1) Freedom to buy elections;

2) Freedom to turn “free enterprise” into a religion;

3) Freedom from limits on greed;

4) Freedom from fear of prosecution no matter how brazenly you rip people off.

Who says politics haven’t progressed in this country?

First, FDR never valued freedom of speech (for other people)…and the other three are taken from Mussolini, aren’t they?

My understanding is that SIPC insurance doesn’t apply to Futures accounts, so no matter what form of bankruptcy is involved I don’t understand how PFGBest customers will get their missing money back. Could someone explain?

I’m not sure they will. I’ve had previous commentors allude to industry compensation, but that appears to be incorrect. Prior to MFG, my understanding is no customer ever lost money from the failure of a commodities broker. Any losses came from the failure of a clearing firm. It isn’t that the funds disappeared but that the traders lost money because could not close out open positions and/or had no say as to when open positions were liquidated.

pfg is allowing for the liquidation of open positions only. Otherwise, the accounts are entirely frozen,

Strike that: PFG is now liquidating their customer accounts. I could be wrong, but this is unique, as I do not recall this being done with the customer accounts of MF Global

From PFG – Tuesday, July 10, 2012 7:01 am:

“As referenced in a customer email sent on Monday, July 9, NFA and other officials have put all PFGBEST customer funds on hold. PFGBEST’s clearing FCM will liquidate all open positions still held by PFGBEST customers.”

MFG liquidation was “finessed.”

Really? Do they smell tar and feathers? Are guillotines being shipped over here, affecting the “Dry Baltic” numbers?

How can a position exist, if there is no money there in the first place? Isn’t the position as much a work of fiction as the reported assets?….how would one have established the positions if the money was vaporized by the head cheese for

his own (or his tribe’s) purposes?

They can sue the individuals for fraud. If they were promised that these funds would be sequestered and then the officers/directors dipped into the kitty when they knew they shouldn’t then maybe they can get their money back from these officers/directors.

Does anyone know what the rules are for sequestering these funds? I’m sure they aren’t supposed to gamble these funds on derivatives or put them in certain markets, right?

And maybe the prohibition on insurance is more of a factor that the entity has a fiduciary duty and must sequester customer funds and insurance runs counter to that obligation and may give the entity and incentive to be loose with customer funds . . .

Everybody knows “ya cain’t fight City Hall” when Boss Tweed, Tammany, etc. rule.

If the regulators follow their own rules this time, customers will first receive what is left of their segregated funds. Upon liquidation of PFG (which is inevitable) they will be first in line.

Under US Bankruptcy law, brokers may not file under anything other than a chapter 7 proceeding for liquidation. This assures that the provisions of chapter 7 are applied, making brokerage customers first in line.

Now, one might ask why wasn’t MF Global filed under Chapter 7? Our regulators obviously did not care, as they approved the filing, which only benefited the major creditors, such as JP Morgan.

And those with an interest in this, convinced the judge that MF Global Holdings is not a brokerage. (The fact that all funds and it’s entire revenue was brokerage based, did not seem to sway the Judge.)

“And those with an interest in this, convinced the judge that MF Global Holdings is not a brokerage. (The fact that all funds and it’s entire revenue was brokerage based, did not seem to sway the Judge.)”

And don’t be surprised if the rules of Chapter 7 Bankruptcy don’t sway the big boys from riding rampant over any senior claims by investors/customers. Dimon’s henchmen are cleaning the gold out of the vault as we type.

To Corzine: “The money or your life” and he didn’t have to think about it.

Thank you, Nick, for being out bankruptcy expert and clarifying the differences between Chapters 7 and 11 bankruptcies that some of us (including me) were confused about.

It sounds like the CEO had a refreshingly unusual sense of shame for a Wall Street exec. I still wonder why Corzine is walking free.

This will certainly not be the last PIGFest broker to fail. It’s likely the beginning of a very large snowball. But it’s a hopeful sign, because until more of the investor class are screwed by their own classmates, until the pain moves into the upper 10%, there will be little force for real change (versus the rhetorical kind from the hopium peddler).

“It sounds like the CEO had a refreshingly unusual sense of shame for a Wall Street exec.”

Yes.

Well, Doug, that’s two (2) “run up the flagpole” with impunity. Why stop?

Exactly. Once other elites are affected by the blatant criminality, then we may see some movement afoot to corral a financial sector run amok.

These vermin aren’t even hiding it now. It’s out in the open…” we own the world….” It’s like the old 1970s Everready commercial with Robert Conrad when he dares the audience to knock the battery off his shoulder.

Perhaps Mr. Corzine has not been indicted because the Feds are working on a more comprehensive RICO indictment of a criminal enterprise of banksters in which Mr. Corzine is one party…..on the other hand, Mr. Corzine has given a lot of $$$ to the Emperor, so that might also explain his freedom in spite of being involved in grand theft and criminal conspiracy.

Gary Gensler should resign tomorrow.

USA Today managed to run an op-ed piece today titled “Prosecuting Executives Is Not Sound Policy”:

http://www.usatoday.com/news/opinion/story/2012-07-08/prosecutions-corporate-executives-fines/56099126/1

We slip further and further toward our “Let them eat cake moment.” Or perhaps it’s “L’etat, c’est moi”.

Heh. There is a voting widget to the left of that opinion piece you linked in USA Today, and 71% of 470+ voters strongly disagree and 22% merely disagree with the viewpoint expressed. The other 7% are clearly the only informed subset of USA Today readership. Silly philistines want corporate criminals prosecuted like the rest of us. Silly sillies.

Don’t you see the eloctronic anklet on Gensler? He knows where the bodies are buried, and he *must* finish the job, whatever it may come to.

If he doesn’t help Boss get away with it, Blackfriar’s Bridge awaits.

He does work with Mary Shapiro, you know, the one who carries herself like a concentration camp guard ?

At this point, one wonders what kinds of ‘assurances’ would even be enough to lure people back into the futures markets. And I’m not sure ‘markets’ is the proper term… ‘cesspits’, or ‘gaming tables’ might be more apt?

Hoocoodanode? Looters looting looters? Is there no honor among thieves? Do any of us need to ask?

.. and do the looted looters even need to publicly complain ?

There ‘ya go.

I love it when they try but fail to kill themselves!

They wouldn’t let him succeed with his personal Ctrl-Alt-Delete of flesh, silly. The need him to do yet dirtier work. As Machiavelli told us (from Fra Timoteo in “La Mandragola”), once you put your finger into the dark pool, next comes the arm, etc. Gotta pay to play.

The nub of this problem is that client funds should be segregated. If they are effectively ring fenced then whether the BK is Chapter 7 or 11 doesn’t really matter — the clients get their funds. Because, well, they’re seperate and immediately realise-able.

However, as soon as you find that the client funds account(s) have lost their cherry, all bets are off. In tihs instance it doesn’t actually matter that much if it’s a Chapter 7 or Chapter 11. As Yves rightly said, under a chapter 7, everything gets realised — then and there — no if’s, no but’s. With a Chapter 11 everything is in play and the company is in a (potentially) “living death” scenario which can drag on for years with all the parties trading horses. The client’s monies have to fight their battles — while the pecking order is defined in Chapter 11, it’s all up for grabs what the assets are, what the liens are, what is a creditor in what capacity etc. etc. etc. So a Chapter 7 is quicker and cleaner.

But… but… but… if there’s no money, there’s no money. Thus the only benefit of a Chapter 7 is you get to find out quicker just how badly you’ve been screwed.

It beggars belieft that the auditors, the management, the regulators, Uncle Tom Cobley and all can let client funds get thrown under a bus by failing to ensure effective segregation.

Oh, wait, no, it doesn’t actually.

The markets are broken…we all know this now, correct?

To fight HFT, as of Aug 1st, we get the “Retail liquidity program” [aka two tiered market] instead of fixing the problem, they dim the lights on the market further. And, at the same time created a way to measure retail order flow in real time . . . this will be gamed folks.

Money market accounts that can be frozen at will per rule change 3 years ago – and, now, SEC talk of a TRUE floating NAV. So, hypothetically, what happens in a crisis, when MM funds are frozen and NAV drops 25-40%

Flush your funds to FDIC accounts folks – its time. The two larger brokerage houses have changed policy and allow this now.

gs_

And Diamond’s Barclays claimed to be “flow” champion.

No, the PFGBest CEO is not a wall street exec. The firm is based in Iowa. Perhaps there is still a sense of shame in the mid west.

Zero interest rate policy is wreaking havoc with futures brokers, destroying their ability to earn money by lending securities.

The FT piece on the story has an hilarious quote:

“How does this go on year after year and you don’t find out?” said one longtime lawyer for the futures industry. “The regulators need to be held responsible.”

Would that be the industry’s sweetheart self-regulators, the NFA, or would it be the CFTC, the folks the industry fights over every customer protection rule and lobbies Congress to keep on a short leash?

Fool me once, shame on you. Fool me twice, shame on me. But fool me three times?

What will the “seriously rich” do when the last of the “merely rich” have decided to start buying only necessities and leaving the rest of their cash stuffed in their mattresses for safekeeping?

Another example of the ‘Highlander’ model of modern capitalism: just as in the old TV series, there can only be one. They destroy others and then each other until there is one left. The rip-off started with labor, moved to professionals, now the lower rungs of the investing class. It will continue until the system is overturned or there is only one capitalist with all the chits. How’s that free market thing working out for you America?

As I understand it, PFGBest is/was a futures commission merchant, an order taker and filler. If you are a customer of such a firm, if you read your contract of account, you are very foolish to leave any money beyond required margin and collateral in support of any open position you may have.

If it comes to pass that free customer balances are not disbursed in full, then a theft has occurred. Now it is important to recognize that there are open customer positions that must either be transferred to another firm or closed out. Those closures could result in losses to the customers and ther recovery of open balances reduced.

Chapter 11 will impair the orderly dissolution of this firm and there will be losses due to the closing open positions.

It’s time that the new Consumer Protection Agency act to force the revision of the bankruptcy code to recognize the need for a receivership chapter that operates to protect customers from agent fraud.

This is unfortunately becoming routine. As pointed out the CEO did attempt some form of Hara Kiri which speaks to a sense of shame largely absent from the CEO class.

The next mega scam which Ives should turn to is:

http://www.alternet.org/story/156112/dick_durbin%3A_for-profit_colleges_%22own_every_lobbyist%22_in_dc/

If there is a bigger scam exploiting poor peoples hopes and aspirations it the for profit colleges. Its a bit depressing really, every social good from housing to health and higher education have become rackets. A tool to manage farmer risk if of course not surprisingly a racket. Next child care and formula. Food of course……Uggh. Human race does indeed call for new management. Can’t call this entire state of affairs anything but psychotic.

Why is the issue “shame” and not “ruinous loss” and mafia punishment to you and your family?

You may be right.

History shows they’s rather die than be poor.

That may explain the smirk, the mirth Jiabao lets past.

“Next child care and formula. Food of course……Uggh. Human race does indeed call for new management. Can’t call this entire state of affairs anything but psychotic. “

“the founder of the firm tried but failed to kill himself.”

Finally, at least, we have a finance executive who knows a highly recommended course of action that a number of them should be taking. However, like other corrupt finance/ bank executives he proved his incompetence by failing to succeed in this self-imposed but simple course of action.

Jesse, has the date of Bastille Day changed? “Quatorze juillet” – 14 July.

I don’t understand why anyone traded futures thru FCMs after MFG failed. There are plenty of stockbrokers who allow you trade both stocks and futures in a “universal” account that carries SIPC insurance. Not the FDIC, I know, but seemingly better customer protection than what we’ve been seeing with the FCMs.

Interactive Brokers started this and I believe Fidelity and the Think or Swim brokerage (part of Ameritrade, which is in turn owned by TD Bank) have followed, among others.

Cash with a bank is the easiest item to verify in an Audit and most difficult to falsify (as the auditor gets a third party verification). Are these FCMs not required to get their books audited by CPA firms? How can regulators miss $190 million dollars unless the audit was a complete sham (signed off without any examination).

On a personal level, I moved some moneys I had @ OptionsHouse and Zecco (not the coconut water :-) just because of the Penson clearing firm being in trouble. I moved to TD Ameritrade and Vanguard. Q: How sound are these firms? Any comments?

Sean

The SEC is completely corrupt.