Over the weekend, the newspaper Bild released the results of a new poll on German sentiment on the Euro. It found that 51% thought Germany would do better by leaving the Eurozone with 29% saying Germany would fare worse. In addition, 71% of the respondents said Greece should be expelled from the Eurozone if it could not live up to its austerity commitments.

These results aren’t particularly novel; a large cohort of Germans have been vocally opposed to Eurorescues for some time. What is new about this poll is how low the percentage is that sees being in the Euro as good for Germany. And some respondents don’t seem to understand that expelling Greece is probably fatal to the Euro project. While Greece by itself is almost certainly enough to impair the Eurozone, a Greek exit is likely to escalate the crisis in Spain and Italy. Remember, Spain just quietly asked for €300 billion Euros and was rebuffed. And no wonder. The EFSF has less than €250 billion remaining, and the ESM has yet to be launched.

Reuters reports that a separate Bild-sponsored poll found support for Merkel’s handling of the crisis to be cratering:

Only one third of Germans still believe Angela Merkel is making the right decisions over the euro zone debt crisis, according to a survey published on Sunday, pointing to a steep erosion in domestic support for the chancellor over the last weeks.

The survey by YouGov, due to be printed in Monday’s edition of Bild newspaper, found 33 percent in favor of her stance but 48 percent against, a setback for the chancellor who is to seek a third term in a 2013 federal election, which she has vowed to make a vote on Europe.

Asked in the survey whether they feared for their savings, 44 percent of Germans said that they did.

In mid-July, a poll by ZDF-Politbarometer showed 63 percent of Germans backed Merkel’s handling of the crisis, although a majority thought she should explain her policies better.

Another poll at the start of July by Infratest-ARD put support for Merkel’s crisis policies at 58 percent, although 85 percent of those polled also expected the crisis to get worse.

On the one hand, the usual response to crises is for the populace to turn more conservative and parochial. Grand ideals seem besides the point if you are under financial stress. On the other, the increasing hostility of Germans to the Eurozone is a massive failure of leadership and communication.

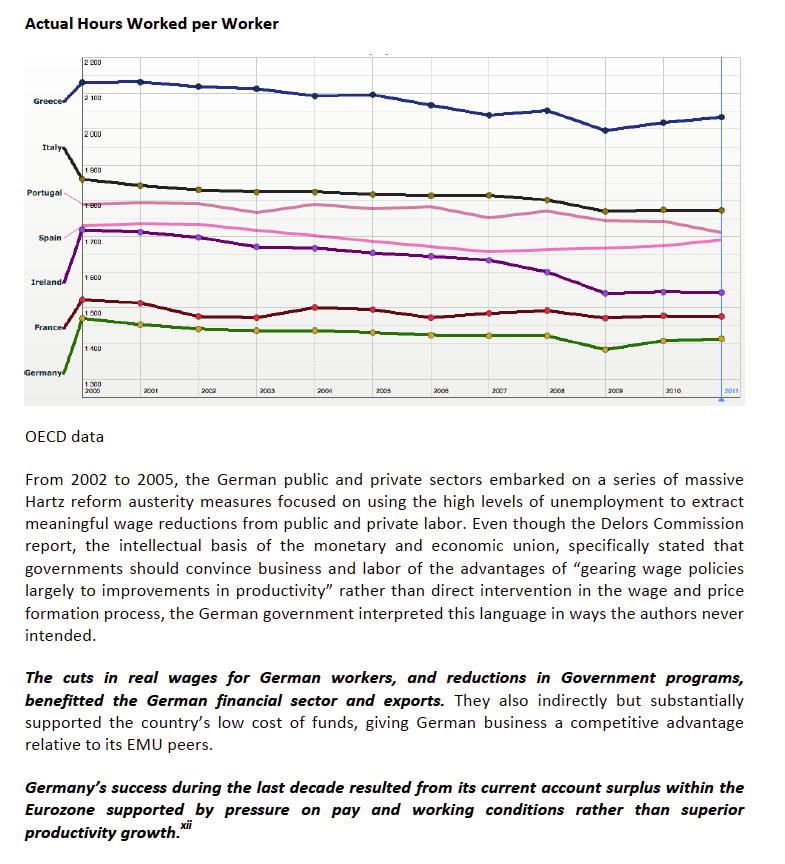

As numerous commentators and economists have pointed out, German is the big beneficiary of the Eurozone. Its large, sustained trade surpluses are to its benefit and are also what is breaking the monetary union. But the problem, as Josh Rosner indicated in a recent paper, the “Germany” that is benefiting is not ordinary citizens, but its corporations. And they prospered by squeezing wages, using the fact that Germany entered the EMU at an overvalued exchange rate as the pretext for labor “reforms”:

Of course, it’s much easier to play to stereotypes and demonize lazy Southern Europeans, rather than ‘fess up that the rescues have been to save the hides of French and German banks. Yanis Varoufakis reminds us that not a drachma of funding from the next tranche to be released to Greece would actually go to Greece:

On 20th August, the Greek government will have to borrow 3.2 billion from one arm of the Eurozone (from the EFSF) in order to repay another (the ECB). Yet Greece is insolvent. The very idea of an insolvent entity borrowing more from a community, like the Eurozone, in order to repay that same community is obscene. All it does is to shift the burden from the Central Bank to the taxpayers of Germany, Holland, Austria and Finland. This is not an act of solidarity with Greece. It is an act of irresponsible kicking-the-can-up-a-steep-hill.

But it’s much more convenient to have Germans mad at Greece rather than their own leaders for throwing German workers under the bus once, by failing to come up with better ways to share the economic pain of adjustment in the early 2000s, and again, by failing to get tough with banks. And the worse is, as Rosner and others have stressed, that while every way forward will impose costs on the German population, a Eurobreakup or German exit will be far more detrimental to German citizens. ING estimates GDP would fall 9.2% in a full breakup scenario, and unemployment would rise to 9.3%. And if Germany were to leave (as some readers suggest), its currency would skyrocket, leading to an erosion of its trade surplus and rising unemployment, as well as losses to its banks on Euro denominated obligations, necessitating more costly bailouts.

So this situation is ugly indeed. And it appears German leadership is unwilling to try to change the hearts and minds of the public because they are too deeply invested in the story they’ve been telling to change course. The German people are almost certain to wind up poorer as a result.

Update 12:40 AM: The Telegraph reports that the ECB and other central banks may take a haircut on Greek debt as a way to finesse the next round of funding. Notice the continued failure to ‘fess up that this “funding” is merely moving money among parties outside Greece. Reader George P. nevertheless anticipates that the Germans will be apoplectic. From the article:

Intensive discussions now under way among EU policy-makers involve the European Central Bank and a number of central banks taking a significant write-down on their Greek bonds as the price for avoiding a eurozone break-up and losing its weakest link.

France’s central bank, the most heavily exposed, may need to be recapitalised because of the scale of its potential losses. The central banks of Malta and Cyprus are also in the firing line, as well as clearing banks and eurozone governments.

The latest rescue package for the stricken Greek economy is aimed at reducing the country’s debts by another €70bn (£54.6bn) to €100bn, cutting the total to what is regarded as a more manageable level.

The Germans have basically been lending money to the periphery so that the periphery can buy product from the Germans.

In that, Greece serves the same purpose for Germany as the US serves for China. But instead of lamenting the fact that eventually the creditors will always get fed up with the percieved free-riders, we should ask ourselves if there is really any point to producing a lot of useless crap that’s going to end up at the bottom of a landfill in a rather short period of time?

This system of industrial production and the subsequent proding people to consume garbage to sustain it is really quite bizarre and stupid when you think about it. Really, the earth’s resources are in fact limited and the human population is still exponentially growing afterall. This system will breakdown eventually whatever the climate change deniers or peak oil deniers or neoclassical economists theorize about the sustainability of geometrically growing systems in a finite universe.

But but but didn’t you know that resource limitations don’t exist! The paradigm demands it. Thus resources are unlimited and will forevermore be extracted in increasin quantities. The holy growth is infinite. There are no limits. There can never be any limits. If there were limits, that would mean that the system would collapse, and the system cannot ever collapse, that must mean there’s infinite resources to keep it going. It must be so! Logic said so!

Gotta love the desperate flailings of braindead idiots extending and pretending. It would be even more lovely if their flailing didn’t hurt me in the end. But such is the story of humanitys decline. Denial, denial denial until there’s nobody left to deny anything. And the saddest thing is that if we only managed to get over the denial we could work together to achieve abundance for all, simply by realigning our system with that of nature. Oh well, happy human extinction century everybody, it’ll be a lovely ride.~

”The Germans have basically been lending money to the periphery so that the periphery can buy product from the Germans.”

this is the most repeated lie in Anglo-saxon media.

The periphery is not among the main trading partners of Germany. Germany has always been an export country, the growth in exports since the introduction of the euro was mainly because of the rise in exports to the developing nations.

The money that was loaned by German banks, and French, and Dutch, and UK banks, to the periphery was not so much spend on German products but malinvested in housing bubbles.

Just forget these polls. Germans are world class in complaining. They dislike Merkel’s handling and, rest absolutely assured, will vote for Merkel in 2013. Germans hate change.

Carl,

actual polls (last election): CDU (Merkel) 35% (34) , FDP (forms the governing coalition with CDU)4% (15), SPD 28% (23), Green 13 (10), Left 6 (12), Pirates 8 (2).

Fat chance for the fat lady :-)

In “Der Spiegel” this morning there’s an article (originally printed in “Bild”), in which Tony Blair is said to be advising Merkel to change course: Austerity is not working.

For normal Germans this surely is something like a red flag: Maybe Merkel is doing a good job? Doesn’t seem like it, but if Blair think’s she’s not, then she must be, right?

—

I do have to say though, that I think history will be very tough on Clinton and Bush’s presidencies. That was an opportunity to reconfigure how the world works after the fall of communism and instead we got morons like Samuel Huntington talking. For an historian, that was an amazing effort– his theory was disproved in about 10 years!!

The lack of theoretical rigor is irrelevant; what mattered for its uptake was that it appealed to an intuition, making it useful for people who were playing politics to sell certain policy choices.

correct!

The title of the article reminds me of an article from a couple of months ago: ‘Support for Sweden becoming part of the euro-zone increasing’, then in the article the data showed an increase from 10% to 12% supporting the idea :-)

I’ve worked in Germany, I’ve recently been contacted about a job in Greece. The difference in income tax rate for those average income jobs? One country had an effective rate of about 30%, the other had about 10%. Guess which country can fund its public services?

Kind of interesting to see that high unemployment & average hours worked seem to have a high correlation but there is an ‘economic law’ ( :-D ) claiming there is NO causation. Could that ‘law’ be nothing more than a theory? Who benefits from this ‘law’?

I’ve been living in Germany for the past 16 years and have a little bit to add.

One thing that’s missing here is Germans’ historical aversion to inflation. Although one could argue such an aversion isn’t entirely a bad thing, it’s so deeply and historically rooted that nobody seems willing or able to openly embrace ANY form increased inflation, which could actually ameliorate the Euro situation. In Germany, this is a NO-GO.

As for the Euro itself: Helmut Kohl, who was in power when the currency union was drafted, was Merkel’s mentor. It is extremely unlikely that Merkel would ever publicly admit how flawed the Euro truly is.

If this weren’t the case – and if there hadn’t been important local (state of NRW) elections back in 2010, maybe Merkel would’ve reacted in a much more constructive way and this whole crisis would’ve been much smaller/more containable. But again, this is politics. Der Tagesspiegel quotes Juncker today as saying (my quick & dirty translation): “… the country continues to engage in local politics when dealing with the Euro”.

Lastly, many Germans are convinced that austerity does actually work. The Hartz reforms made life more difficult for many here, but not everyone was against them, as many felt such reforms were necessary to improve the economy – and the economy did improve. Of course, one reason it improved was increased exports to southern Europe, which had become comparatively more expensive/less competitive – an aspect the German press seems to have largely ignored. Yet the corporations are the only ones in Germany reaping the benefits; some workers are now pointing out that their wages have been stagnating for too long. So when the press reports Greek civil servants retire at 55, etc., many get enraged and invoke moral statements/feelings akin to “now it’s your turn to suffer”. Also: the German press has done very little to explain how Greece’s problems are different from Germany’s – not to mention Spain’s, Ireland’s… – nor do they report the (huge) costs to Germany that a Greek exit or Euro break-up would entail.

Well, considering productivity levels, the Eurozone would be better off without Germany. No worries.

If so, the euro would surely be devalued, the ECB would become a true central bank and everyone would live happily ever (or maybe not but certainly they would at leas be less worried about “Merkel this, the Germans that”, which is kind of annoying and most unhelpful).

Germans could then create a new Eurozone with Poland and Russia and sink them into nothingness until Putin nukes Berlin.

Fare well…

Do the leaders really care what people think? We have seen how easily people accept unelected ‘technocrats’ as rulers.

And when TINA* shows up, they will accept the solution that is offered (with some grumbling from ‘malcontents’ that will be easily ignored).

* There Is No Alternative

================

Germany is likely to pay something if they can continue/enhance their influence while forcing others to live within their means. In this regard, ratcheting up the ‘pain’ is a negotiating tactic. Everything else is noise.

Sporble’s comment is solid. My, much more limited, German experience tells similar tales. As for the Hartz reform, not surprisingly, it was very similar direction wise to the ideas raised here by Simpson-Bowls and our rightwinger in chief Obama. There clearly seems to be a global assault by the rich against the working people.

I’d like to know how much of Germany’s expense for their generous social benefits is ameliorated and paid for by American taxpayers. How much of German military slack is taken up by Americans who have had austerity for the last 3 decades.

Anything that appears to be other than austerity for the American people is a Potemkin Village of propaganda set up by the military, bankers and corporations to operate with impunity to exploit not only Americans but people all over the world. Is their a category of ‘homeless persons’ and families in Germany?

no, there isn’t.

Nobody (important) cares what the German serfs want.

Deutsche Bank – on a percentage of GDP basis – is many, many times larger than ANY of our too-big-too-fail mega-banks. Being that Deutsche Bank is stuffed to the gills with Greek, Spanish, Italian and French sovereign debt, as well as loans to banks in those countries, there is absolutely no way that Germany is going to leave the Eurozone. They are going to stay and continue to impose their Deutsche Bank-approved “austerity” regime on the debtor countries.

Perhaps having a strong currency is not a panacea for the average German, but, were I a German, eyeing retirement, I would far rather have my retirement savings in Deutsche Marks than in Euros and would therefore support leaving the Eurozone. And with the ECB buying peripheral debt, the truth is that Germans are enduring inflation to shore up Europe’s bankster class – not a pleasant prospect, even for the workers.

The Eurozone doesn’t work for the ordinary people anywhere. That said, ordinary Germans are being heavily propagandized into believing that their enemies are ordinary Greeks, Spaniards, Italians, etc. when their true enemies are their own rich and elites. This is classic class war: keep the rubes confused and fighting each other while the rich continue to loot them. So far this has been a highly successful strategy. The result of it could well be that the Eurozone falls apart but that the looting will go on.

What you write is true in the US and Britain. Germany not so much.

1. The German political class is very much running the show as they get ample state financing for parties and television propaganda apparatus. In the US they are lackeys.

2. Germans are not made to believe that Spaniards or Italians are our enemies. Where did you get that ? Greece is described as totally corrupt country which is not too far from the truth. Every Greek will confirm this to you.

3.There is not much class war in Germany right now. It is on the horizon though with a SPD/PDS/Green Government in both Houses. Then it will be a class war started from the left side. Class wars are fought in the US since 1980 or so and in France for 200 years…. Germany is the quiet front for a long time now.

It is generally a mistake to extrapolate Anglo-Saxon constellations into the German sphere. German politics has moved to the left as US has moved to the right. All words and descriptions therefore do not apply properly ….

Hubert, I think you should explain more what you mean by German politics has moved to the left?! Over which period? Give some examples of policies?

That is not so easy to explain shortly. The CDU/CSU, formely a more “bürgerliche” Partei is deeply Social Democrat now. And a big part of Social Democrat SPD has become Socialist again (after moving in direction of Center in the 50ties and 60ties). The PDS has entered politics with a Socialist agenda.

The Greens are 2/3 left, 1/3 bürgerlich.

Now the Pirates show up, probably in the footsteps of the Greens …

Regarding this statement in the post.

“Grand ideals seem besides the point if you are under financial stress. On the other, the increasing hostility of Germans to the Eurozone is a massive failure of leadership and communication.”

Is it not possible that German aversion to the Eurozone is not a failure of communication, but the result of deliberate consideration of a United States of Europe, and the permanent fiscal transfers it would entail.

Also, isn’t it ironic that the ECB and its enablers are trying to put forth a US of Europe, millions of Spanish and Germans are cheering for their respective teams, hoping that they defeat each other. I wonder how a Spaniard would react if told that, were the ECB to be successful in achieving a US of Europe, he would no longer ever be able to cheer for Spain in the World Cup. Instead, he’d have to cheer for the US of Europe team as it competed against the likes of the UK and the US of A.

Is it not possible that German aversion to the Eurozone is not a failure of communication, but the result of deliberate consideration of a United States of Europe, and the permanent fiscal transfers it would entail.

It is not possible that the German aversion is due to a rational consideration of a US of E & “the permanent fiscal transfers it would entail.” Because in the Euro context, the permanent fiscal transfers would redound to the benefit of Germany!

There are 3 choices.

a)Independent Germany, keeping the Mark. A normal country.

b)Europe with those evil “fiscal transfers”. A normal US of E country.

c)Europe monetary union without “fiscal transfers”. Current reality. Insane. Doesn’t work. Can’t work. Will impoverish everyone eventually. A train wreck.

Who knows which is “better”, (a) or (b)? That’s where politics, fundamental choices enter into things. What is and always was clear is that (c) is a catastrophe. No rational non-sadist, could prefer (c) to either (a) or (b). (c), the present Euro system, is Europe torturing itself, with no non-sadistic benefit to anyone. Were I German, I, or any MMTer, would violently oppose the really-existing Euro (c). German monetary sovereignty (a) was infinitely preferable, as is (b). (c) is a monstrous attack of the rich on the poor.

Many Germans balk at (b), which can work, but irrationally do not balk at (c), staying in the Euro. The difference between (b) & (c) is that in (b), relative to (c): the Germans will have more uninflated Euros, while the Greeks will have more real wealth, employment, consumption.

Fiscal transfers are a win-win for everyone. They are a free lunch. They will not cause inflation, as you assume in the earlier thread as a matter of course. Wray makes similar point in his comments here ON THE SUPPOSED WEAKNESSES OF MMT:

“There is no Uncle Sam in Europe to do it; and “transfer” is the wrong word. Uncle Sam issues the currency and does not have to reduce income in one state to increase it elsewhere. That is precisely the problem identified by MMT. … Yes it is “fiscal”, no it is not “transfer”. If we had a fixed economic pie then in real terms we’d be transfering real stuff to the poor regions. But that ain’t true, either, as outside WWII we’ve never operated continuously at anything approaching capacity.”

A Europe with an “Uncle Sam in Europe” (b) could work, and its “fiscal transfers” do not “transfer” wealth & again, do not cause price-inflation. Without them, you have the current endless trainwreck (c).

btw a fact from Charles Gave:

Italian trade deficit with Germany: Euro 20 bn (in 2011 I guess), most of it probably recycled by German tourists.

Italian oil import bill: Euro 80 billion

The energy bill is never mentionned anywhere in Anglo-Saxon media.

Italy as a country is arguably wealthier than Germany (with better weather, food and more seaside). Germans in GDP per person are down from place 1 in 1990 to around 17 now.

The flows into Germany are primarily flight money now, not payment for goods.

Moreover if you vendor finance you customer and the customer defaults – who then has profited? Who cheated whom ? (I do not call it a smart strategy..)

It is true that Germany runs a trade surplus with the rest of Europa but that is maybe 25% of what is going on. That is always taken as malicious. In fact the DM entered the EZ slightly overvalued with a miniscule trade deficit if I remember correctly.

Also there is no general “strategy of Wage supression” in Germany. Most of what Rosner wrote is right but some things are conjecture.

I do not expect much from FT, WSJ and NYT and I generally appreciate NC. But in all things german I find Delusional Economics, Auerback, Yves, Rosner judgements loopsided – maybe Keynesian ideology? Or a slight anti-german bias creeping in somehow? Would be understandable historically….

NOt sure if the wealth measure was GDP/Person. Will try to look it up ….

Hubert, you’re on point regarding vendor financing.

When Cisco’s market value was more than 500B (more than Apple’s today), it was due to Cisco fronting vendor financing to companies that had no business buying Cisco’s goods.

Realizing this, Cisco ceased its vendor financing program, saw its market cap plunge, but remained a going concern.

Problem is, if Germany continues to fund Greece (via Target2), inevitably it will cease to be a going concern, and instead it will morph into 1 of 17 states within a US of Europe. Once this happens, the South will have far more votes than the North (would there be a way to safeguard against this – perhaps by granting Northeners Google/Zynga-like SuperMajority Votes?) in the US of E Congress.

What happens then?

2/3 of “rescue” money “for” Greece is money for banks. France had 80 bn outstanding to Greece at beginning of crisis, Germany 40 bn. Britain free rider, Germany gets the blame.

1/3 for Greece to keep show going on is partly stolen by oligarchs, partly to keep the Greek “state” (or whatever one would call that) “running”.

Greece will default as they always did. Target 2 Greece/Germany comes out of ELA program where flight money gets recycled into Greece and only to flee again to be recycled again ……. It is no longer about Mercedes or submarines vendor financing – that is a Keynesian canard …..

Everyone who knows “Europe” somehow always knew that a common currency within such a diverse zone cannot work long-term.

So the sooner it splits up the less damage. NOt to say there will not be great damage. There are no good “solutions”. Only bad and worse. Who wants to splitt it here and now and get all the blame for the mess ?

My bet is that they will always do enough to keep the EZ running until something happens. EZ Split-up 2-5 years out but who knows ? Will they be able to keep the EU (the more important thing) ?

Hubert, I agree with you about the false interpretation of Germany’s place within Europe, which is currently being publicized in the English speaking press.

But I also remember being sceptical about the currency union way back when, and people just didn’t want to know about it. Remember that old question, which used to go something like, “So, does this mean that a teacher in Spain will be paid as much as a teacher in Germany?” And the answer was always a lot of stuttering and mumbling, followed usually by a “no, not immediately, but maybe at some time in the future…” It was the most unsatisfactory response, but nobody followed up on it. And so, we are where we are today.

The other issue is that the English press seems to think that Germany needs Europe because it needs the European market. This is an incredibly shallow position to take– Germany does need the European market, but it surely doesn’t need Europe, to be part of the European market. German products are not as perfectly manufactured as “made in Germany” would have you believe, but in many of the areas that German products are available, they do indeed represent excellent value, and this won’t change because Europe is somehow reconfigured.

Finally, assuming that it comes to a schism, Germany will not leave Europe alone, I would think. They will leave together with some of the other “profitable” countries. This would, of course be a political disaster for Europe, the cost of which makes this scenario really unlikely. Before that happens we’ll see Greek leave, followed shortly thereafter by a banking implosion, in my opinion.

Greece leaving is not a split up in my view. In fact they may have started to ring-fence Italy and Spain to allow for a Greek exit. Or not and

“Yves domino theory” is also the ECB theory and the charade goes on. We may know in autumn.

Yes, the capturing of merely “national” democracies by international finance — and the intense chasm this process is opening up between system elites and everyone else — is indeed the real story here. Elite messengers are (ironically) stoking the fires of nationalistic resentiment by blaming outside “others” for the sins of insiders.

But I think this is precisely why Germans should want to leave the Euro. It is imperative that democratic voters in Europe retain real power, and the only realistic way this can be achieved right now is through the democratic nation-state. You can pretty much guarantee that any “federal” Europe will greatly dilute real democratic power and open up countless opportunities for the exploitation of ethnic hatred as a means of deflecting blame from those with real power, thus further entrenching the power of international corporate-financial elites. This is, of course, the dream of neo-liberal “globalization” — to completely subdue the laws and powers of nation states at the feet of the (rigged and utterly corrupt) “free” markets.

The short-term economic costs are already baked into the pie. We will all have to face these economic costs over the next few years(and I do mean the vast majority of us living in advanced economies — not just in Germany). But we have to steadfastly guard against even worse assaults on real democratic power and human rights than have already occurred. We have to think long-term about what will safeguard our most basic values.

Yes. I find it strange that people who are critical of US imperialism somehow think that the Gang in Brussels will be a benevolent endeveour. We already see bankers having more influence there than in their nation states. It just puts corruption on an even higher level.

Who really thinks this ESM coup d´état on top is not fishy ……

If this applies to germany think about how it applies to the global trade system, surplus/deficit countries around the world and their various tariff, subsidy, currency and monetary management and political systems…