We’ve been mystified with the housing bull argument that things really are getting better. While real estate is always and ever local, and some markets may indeed be on the upswing, there are ample reasons to doubt the idea that an overall housing recovery is in. For instance, the recent FHFA inspector general report stated:

Further, general distress in the housing sector will likely continue to result in elevated REO inventories. For example, the Enterprises’ financial data indicate that, as of the end of 2011, more than 1.1 million mortgages held or guaranteed by the Enterprises were “seriously delinquent,” i.e., were 90 or more days past due. At that time, the volume of seriously delinquent mortgages was more than six times the size of the Enterprises’ REO inventories

Reader MBS Guy noted:

My rough calculation of their REO and delinquency numbers would indicate that they will have about 300,000 new REOs (acquisitions, in their parlance) per year for the next three years, assuming their isn’t a surge in new defaulters from their portfolio (ie – just using the loans currently seriously delinquent). They also report 179,000 properties currently in REO (end of 2011).

If they maintain their 2011 rate of REO dispositions at 353,000, the pipeline would be largely cleared in about 3 years. If they are able to increase the pace a bit, perhaps the inventory clears in 2-2.5 years.

Either way, it is very likely that about 1 million REO properties will be disposed of by the GSEs over the next 2-3 years. Over the last 3 years, they have disposed of about 833,216 REOs.

What will the impact on home prices be in the rate of REO disposition in the next 3 years matches or exceeds the rate of disposition of the last 3 years? I’d expect that it will be pretty negative.

Remember, that’s ONLY Fannie and Freddie mortgages. Recall that 1.1 million figure, serious delinquencies in their portfolios. Top housing analyst Laurie Goodman puts the total across the market at 2.8 million.

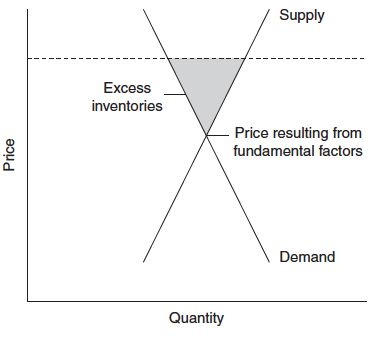

So why are we seeing so much housing cheerleading? One big “proof” is that housing inventories are supposedly shrinking. If you recall the classic supply/demand chart, if a price is higher than the market price, you expect to see big inventories somewhere. Conversely, if inventories are falling below a “normal” level (there are always some buffers in a system), that’s a sign of strengthening demand.

But we’ve seen so much evidence that the inventories that the commentators are looking at are misleading it isn’t funny. Banks were attenuating foreclosures even before the robosigning scandal broke. In the states with real housing distress, banks will take foreclosures up to the stage of actually taking title from the owner, and let it sit in limbo for a protracted period. But in addition to delays in real estate being taken into REO, there is also evidence of banks simply not putting real estate owned by securitizations, the GSEs, or the banks themselves, on the market, thus keeping it out of visible inventories. For instance, numerous NC readers report they see vacant homes, want to make an offer, and can’t find out who to contact to do so. That is a pretty strong sign that those homes are also not in official REO inventories.

And let’s consider the implications of that chart, again: if there ARE large inventories, that’s means supply is being constrained and the resulting “market” prices are above where they’d be based on fundamentals. So any price improvement is based not on improving conditions, but the manipulation of supply.

We finally have some official confirmation of our thesis. From AOL’s Real Estate blog, “‘Shadow REO’: As Many as 90% of Foreclosed Properties Held Off the Market, Estimates Suggest“:

As many as 90 percent of REOs are withheld from sale, according to estimates recently provided to AOL Real Estate by two analytics firms. It’s a testament to lenders’ fears that flooding the market with foreclosed homes could wreak havoc on their balance sheets and present a danger to the housing market as a whole.

Online foreclosure marketplace RealtyTrac recently found that just 15 percent of REOs in the Washington, D.C., area were for sale, a statistic that is representative of nationwide numbers, the company said.

Analytics firm CoreLogic provided an even lower estimate, suggesting that just 10 percent of all REOs in the country are listed by their owners, which include mortgage giants Fannie Mae and Freddie Mac as well as the Federal Housing Administration. As of April 2012, 390,000 repossessed homes sat in limbo, while about 39,000 were actually listed for sale, said Sam Khater, senior economist at CoreLogic.

Daren Blomquist, vice president of RealtyTrac, said that he was surprised by his company’s finding, especially since a similar analysis in 2009 found that banks were attempting to sell nearly twice as much of their REO inventory back then.

And the article presents the obvious conclusion, that keeping homes off the market is leading to higher prices than you’d see if they were put up for sale:

In fact, if lenders turn their REO release valve to full blast, the deluge of foreclosures cascading onto the market could plunge the country into a recession, said Thomas Martin, president of consumer advocacy group Americas Watchdog.

“If they let the dam essentially break. It could be a catastrophic disaster for the U.S. economy,” he said, predicting that some major banks would fail and home prices would nosedive by 20 percent.

That doomsday scenario has many industry professionals supporting lenders’ tactics of holding onto most of their REOs. Otherwise, they would be “causing the floor to fall out from underneath the entire market,” Faranda said. He added that banks don’t have the manpower to push the paperwork required to put all their foreclosures on the market.

Of course, the discussion focuses on how much price manipulation is justified, as opposed to the real problem: we have had, and continue to have, far too many foreclosures and far too few mortgage modifications. But the solution seems to be to zombify the housing market rather than make servicers change their ways.

A rising tide (Steve Keen’s universal bailout) would ironically refloat underwater mortgages and provide renters and the homeless the cash they need to buy a foreclosed house.

But hey, let’s not do that. Let’s let those vacant houses rot instead. Why increase demand when rot will decrease supply?

Isn’t that the operating system for the economy generally?

+1

;)

Sure is. It’s called Machine-thinking-Subordinated-Mediocrity-With-a-Capital ‘M’-for-M e d i o c r i t y.

Conservative Mike Shedlock (Mish), who had been critical of Keen’s jubilee idea, is now having a discussion with him. Keen explained to Mish the accounting entries for reserves and said he welcomes Mish’s suggestions. Mish concluded the post:

“I appreciate these discussions with Steve Keen. He has taught me a lot. I welcome the opportunity to present views to the public about what needs to be done. It’s easy enough to tear down ideas without presenting an alternative.

I propose we start by addressing the root cause of the debt problem which I state is fractional reserve lending”

Predictably, there is confusion about credit creating money in the comments:

http://globaleconomicanalysis.blogspot.com/2012/07/notes-from-steve-keen-on-lending.html?x#echocomments

Who cares what “Mish” thinks about anything?

I wonder for how long they are going to continue ignoring Keen. I think their egos are very badly hurt by the fact that it was SUCH a spot-on, academically rigorous prediction.

Now, it also appears that Keen’s remedy would clearly outperform any of the weaselly underhanded scheme they currently drag out there… but how could these fevered egos’ arguments ever be brought to enough “mainstream daylight” scrutiny to be weighed against Keen’s alternative ?

Steve says he’s pretty damn busy these days, I suppose it’s a good sign…

Definitely not an efficient waste of resources.

It blows me away at how much waste there is in this economy.

Efficient use of resources. FFS I need to wake up.

you mean how little economy there is in this waste

I have no doubt that this is true, it seems to me that Truth and Real estate are mutually exclusive

Truth and County Title Records, as well.

I would love to know if this is true in Phoenix as it is around the rest of the country.

In Phoenix, inventory is a fraction of 2010 (<1/4) and investor sales are now 47% of total, with bidding wars reminiscent of 2005, albeit at lower volume. Investors are banking on rising rents and house prices have jumped more than 10% the past year as a result.

But absent collusion (like LIBOR, incl gov't) so much controlled inventory doesn't seem to make sense. I understand banksters' license to mark asset prices to myth (extend and pretend) (and DrHousingBubble has noted many non-payers squatting up to 2-3 year as a result) but how long can banks hold inventory without a dime of cash flow and still pay taxes and maintenance for years? How can they carry non-performing assets for years? It seems a stretch when, absent a conspiracy, one bank or another would dump when supply is so far down. This could be a mother of a supply-fixing conspiracy.

All those payments are being sucked out of the Fed.

The banks aren’t holding these properties in THEIR inventory, the properties are being held in the inventories of MBS trusts. The losses incurred as a result of delays in selling REOs are being allocated to pension funds, etc., in the case of private MBS, and the taxpayer, in the case of Fannie, Freddie and the FHA.

I too have been wondering why so little REO inventory coming on the market. I’ve suspected somebody is holding up the process but haven’t quite grasped the “who” that is holding them.

Sounds like you may have a grasp on things, but would be interested if you could elaborate a bit. Not sure how an “MBS trust” holds on to these? Would that be banks neglecting to foreclose?

I would assume that all foreclosures have to go to the courthouse? So do the properties that get foreclosed, but not auctioned off go to Fannie and Freddie?

I’d assume that fannie and freddie is going t stockpile homes, then give the stuff away to Bain Captial, Blackstone, and the rest of the good old boys club at pennies on the dollar with rock bottom interest rates.

Of course the average Joe will never get a shot at the deals….

Actually anybody can comment.

Doug,

That’s a rational conclusion but the policy response hasn’t been rational. Banks aren’t forced to liquidate as I understand, maybe incorrectly, that accounting rules have allowed the banks to refrain from marking these assets to market. Therefore, they don’t have to acknowledge the actual value of the homes they carry, not recognizing these losses allows them to appear stable and pay exorbitant bonuses to executives, traders and have the discount window avail. Also, QE3 has decided to buy hundreds of billions of dollars in MBS to continue to help mask this insolvency. The fed needs the fiction of stable housing prices to justify purchase of MBS under guise of liquidity/growth provision. Its further institutional cover for the secondary markets insolvency grenades. So with no downside banks will liquidate slowly to maximize the value of housing assets and not crash their own balance sheets. All the suckers who own home get no appreciation and are slowly bled by property taxes. As I don’t have kids yet I don’t plan to buy a house for at least 2 more years. in the meantime the baby boomers will keep downsizing and new home sales expand and the market will slowly drop and then move sideways for 10 years as banks trickle supply onto the market. This is what passes for economic policy in america, enjoy.

Your slow, sideways descent sounds optimistic. These banks must be hopelessly insolvent, and if the Fed is printing fictitious payments, as Jake suggests, to pay off immediate creditors, then this crisis is being exponentially re-leveraged into an unmoored, runaway Ponzi balloon.

I wonder how long they can keep it aloft and how much of these machinations are orchestrated in secret, smoke-filled rooms. I have no doubt whatsoever that the Bank of England and the Criminal Reserve were entirely on board in the LieMore crimes (not “scandal”) involving 16 banks. Their deniability over so many years is absurdly implausible.

>> But absent collusion (like LIBOR, incl gov’t) so much controlled inventory doesn’t seem to make sense.

Proposition: Collusion isn’t necessary, because the more-important bank employees are bonused on recognizing profits and are thus incentivized to avoid recognizing losses.

But how can they withhold non-performing assets for so many years without cash income? Who is paying county taxes, MBS investors, and dividends meanwhile? Is it just a Ponzi scheme—is FED QE money being passed through to investors and pension funds instead of real income? Is this new math, or smoke and mirrors?

The servicers make advances, which they in theory recover from the foreclosure. And they recoup those advances before a dime goes to investors.

In actuality, the servicers greatly abuse investors and I am pretty sure they pay some of these costs from principal repayments on good loans (refis and sales).

And remember funding costs are super low these days, so it does not cost servicers much to finance advances. But yes, it is a cash drain. Servicing is a money losing business in a portfolio with a lot of delinquencies.

In addition, deferring the foreclosure on mortgages owned by investors allows them to defer wiping out any bank-owned second liens that sit behind those firsts. In many cases, they’ve persuaded/harassed borrowers into paying the second when they’ve defaulted on the first. So in those cases, the bank has a very strong motivation not to foreclose (they do have to impair, meaning write down, the second when they start FC and I’d assume whack it again when they take it into REO, but I assume they don’t take the full loss until the house is sold).

The housing cheerleaders have only one real objective: to keep those somehow managing to service their under water mortgages continue paying. The cheerleaders are like the deficit hawks, the terrorism hawks, the inflation hawks, part of the elite propaganda machine. Its all bullshit, 24, 7, but if they let up for two or three days we could have an army of homeowners turning in their keys. I listen to one clown after another telling us we should be optimistic and what I never hear is a single good reason why. If you want evidence of what the economy is really like just watch the price of Alcoa (AA) stock. It has shrunk to half its high for the past 12 months and you could buy two month calls exercisable at 10% above market for about $0.20 the last time I looked.

As a retiree who at last may no longer be underwater, I’m looking to sell during our local upswing in prices. Here’s hoping the banks keep their sphincters tight; I’ve been shit on enough by them already.

wow…isvestia and pravda must be proud of their former alums and their new job at aol dot spam

self serving mush…the real estate agent quoted in the article in briarcliff…claims in his wonderous websites to be THE short sale expert…but he doth sayeth a bit with forked toungue…the home he is describing is 178 Holbrook Lane, not exactly 6 doors down from his home…the woman who bought it on sept 15, 2009 died on october 10, 2010, hardly more than a year after she bought it…the property is not and has not been in foreclosure…only in dec 2011 did the mers countrywide loan have a robosigned assignment recorded in the westchester county records. the property was for sale with a competitor in his home town until november 2011…oh…and the only property with a foreclosure filed against it in that neighborhood in the last 4 years…is the home this EXPERT is living in…seems he borrowed money in 2007 and could not pay it in 2009…so HE is the one who is being foreclosed on…and his second mortgage seems to have just filed at the end of 2011…also seems to owe the IRS money…wow…takes some nerve to complain about some mystery problem that aint…18 months he suggested as if the property were just sitting there…so this is where the retired isvestia writers ended up…stalinizing history…egads…what nerve to complain that a family who lost their wife and mother at age 60 did not get pushed out fast enough…ouch…and corelogic…the kick in the door and ask questions later company…there is no shadow inventory…realtysmack, core logic and LPS all know that they have mostly DOUBLE COUNTED foreclosures to help their budz make money convincing people that the problem is worse than it is…they do not adjust for the fact most homeowners in trouble have a FIRST AND A SECOND MORTGAGE, which historically was not the case…reality, what a precept…much like traders who discuss timelines going back to the stoneage before dark pools and computer driven trading…the markets in five minutes trade more than a whole day back in the 90’s…much like most stats…

oh my god, they scream…we have 15 million+ empty homes in america…well…how many empty homes did we have in 2003, 2004, and 2005, at the HEIGHT of the market…oh…dont ask such obvious questions…you might notice that it was more or less the same number…see…these “empty” houses are almost all second homes that are not properly accounted for…just like this notion that the US ECONOMY is a $15 trillion dollar animal…GDP…but what about true Gross Economic Product…meaning annual sales of US based companies…oh…thats $30 Trillion…so…the federal deficit looks HUGE when compared to the lower 15 trillion dollar number…but…shoosh…we need to keep the phony fear factory going…oh…and buy gold…hurry hurry…it is running up to 3000 bux…which explains why all those mines in south africa are closing down…too expensive to run…or do they know something you dont…if they were able to make money when gold was at 800…why are they closing down…how is there a production cost problem if they are “in the know”…why would you shut down mines and let them sit if gold is going to a zillion dollars an ounce…ah…isvestia…my little darling…

good luck and be well…and dont let the fear mongerz keep you up at night…

There are so many holes in this rant, I don’t know where to start!

In our community, REO sales have declined by about 30%, but have been pretty much offset by short sales. This could also be occuring nationwide due to the tightening of documentation rules on foreclosure. If this is the case, then there may not be any significant change in the number of distressed properties offered for sale.

That being said, I think the author is fundamentally correct about banking institutions controlling the rate of release of distressed properties to the market.

The Paulson-Geithner plan has always been to avoid recognition of bank losses long enough that eventually they would earn their way back to solvency. Of course, this earning as consisted of using ZIRP for gambling and stiffing their customers with fees in every way they can imagine. Because rates are so low, they can’t make it back with new loans that is if there was even a big demand for new loans, which there isn’t.

It also means the recovery will take forever. And banks will still have to write off a lot in the end. After all, who wants to buy a house that’s been unoccupied for any length of time?

Dear Phil;

Speculators and small time rentiers, that’s who. We see a steady trickle of “Hundredthousandaires” come through our DIY Boxxstore doing renovations on distressed properties they have bought ‘on the cheap’ to rent out. However, the way this economy is lurching along, I don’t know how long these rents will stay this high before demand deficiency will force a retrenchment. Extended ‘family’ rental occupancy is becoming more visible around my neck of the woods. I’m wondering if squatting will catch on here in the US? The conditions are right for it.

“Speculators and small time rentiers, that’s who. We see a steady trickle of “Hundredthousandaires” ”

Ah, yes — I know several would-be Buffalo Billionaires picking off as many cash cows as they can in order to rent them back to the dispossessed. Good times.

Now how’s that gonna work Hugh? Firstly, those banks keep the cow bled dry on an annual basis. There’ll never be anything there but skin and bones. Secondly, what do you suppose is keeping the commodity market pumped to the moon? Its Fed money that the banks get for nothing and then buy contracts with it. After all, there’s an unlimited supply for them and hardly anyone to lend it to as you say. Reality will never hit home for the TBTF banks until we see a huge bear market in commodities. Their trouble is they’re on the long side and there’s probably no traders big enough for them to turn into the bagholders. So its to the moon with energy and food prices until demand falls out from underneath it. Lots of truth to Alex’es post above about the south african gold mining. It really doesn’t matter what the price of gold is, (or anything else for that matter) if you cant sell it to somebody.

So, we have an artificially rare commodity. It kinda reminds me of my buddy Ray who runs a used record store; his rationalization for busting still sealed copies of, say, Pat Benetar’s Crimes of Passion over his knee (junk that usually comes in bulk purchases of otherwise useable collections): “Hey man! I’m making ’em rare!”

Yves, I have wondered how much inventory is being held for “personal reasons”. Like banks holding for community control. Or, local investors who bought at low prices and expected to see a recovery in 2-3 years and then they would dump the property for a 30% gain. So there wasn’t an intention to remodel/refurbish and then rent, it was a quick flip.

Or, say a friend of mine has 200 foot of lake michigan water frontage, sanding beach, 4 bedrooms, 2 baths, the works. Well, he gets foreclosed on. Instead of letting such a highly sought after property go to the general public, maybe a local bank, broker, or whatever entity holds that property until favored persons show interest. Maybe the governor was looking for a place, but not until after term is over. So it’s held in foreclosure, but not released to the average joe.

What’s happening with the Mortgage Task Force?! Nothing realyy – it doesn’t exist!

It’s been almost three months since we sent this letter to the Office of NY Attorney General (http://boston67.blog.com/state-attorney-generals-failure-or/). We never got any response, not even their usual form “thank you” letter! These people are in charge of running the Mortgage Task Force, but so far they were only able to change the name of this “force” to the Residental Mortgage Backed Securities Working Group This name sounds more like a fancy investment vehicle, as it used to be presented!

http://boston67.blog.com/state-attorney-generals-failure-or/registers-of-deeds-request-to-ag-tom-miller/

Oh goody !

“Soft”-centrally-planned-weaselly-hypocritical-fascism…Thank god we’re free !

They’d rather deprive people of what has been built into existence, let the thing rot, than to alter the numbers of a resource allocation system–a system whose goal should be but a mundane administrative task.

Hey Europe! Here’s you’re way out — More Regulatory forbearance !

An engine with 99 times more friction than function…this system is full of shit; I’m amazed and perplexed that it could somehow still crash this slowly…don’t know for how long they can keep this up though…

“For instance, numerous NC readers report they see vacant homes, want to make an offer, and can’t find out who to contact to do so.”

I have seen a similar situation in my neighborhood, West Los Angeles. The people who used to live their and the dog disappeared over a year ago. I look every day but have seen no sign of anyone living there except that someone is getting paid to keep the outside of property clean. General search does not show whether it is in foreclosure or who the owner is.

I just saw this interesting video. A sheriff is actually going after mortagage companies for crimes they have committed.

http://warisacrime.org/content/sheriff-decides-mortgage-fraud-crime-too

Regarding manipulating home inventories….

I’ve noticed a quirk or something with zillow.com. The quirk is zillow does not seem to display fire-sale prices for homes with a little yellow icon like other sales in the neighborhood. I don’t know how often it happens, but I have noticed many times. Enough to possibly distort appraisal values. Be interesting to know what is going on to cause that, and if it some kind of a software glitch or something more.

I think the difference now, as compared to a year or two ago, is that rents have been rising, and the rent/own cost ratio is back near historical averages. Granted the market will probably overshoot, and the down economy has made it impossible for many people to muster the up-front money to buy. But I don’t see how prices can fall 20% without inducing a lot of people to switch from renting to buying. I can believe Calculated Risk’s argument that prices will go sideways (steady in nominal terms, declining in real terms) over the next few years. Places like Las Vegas have already seen a decline in prices of over 60%, despite still having growing populations.

CR has declared a bottom, and says prices are rising. It’s Bob Shiller who says prices will go sideways for a long time.

That’s inaccurate. CR claimed that units sold had bottomed, and that prices WOULD follow, but that shadow inventory would limit the pace of price improvement.

http://www.calculatedriskblog.com/2012/04/housing-long-bottom.html

“It appears housing starts, new home sales and residential investment have already bottomed and will increase in 2012. All three had a “long bottom” of several years.

I think house prices have “bottomed” too, but this is just the beginning of the bottoming process. I agree with Ms. Zelman that the “shadow inventory” will probably not push prices down further nationally (it probably will in some judicial foreclosure areas), but I think the “shadow inventory” will limit any price increases for some time.”

Do your homework. I really should slap you harder for this sort of thing

CR called a housing bottom in February:

http://www.calculatedriskblog.com/2012/02/housing-bottom-is-here.html

And reaffirmed his call in May:

http://www.calculatedriskblog.com/2012/05/house-prices-from-bold-call-to.html

If you read the articles, you find the following statements:

“And this doesn’t mean prices will increase significantly any time soon. Usually towards the end of a housing bust, nominal prices mostly move sideways for a few years, and real prices (adjusted for inflation) could even decline for another 2 or 3 years.”

“CR: As I’ve noted before, this is just a possible bottom for nominal prices (not adjusted for inflation). We could see further real price declines, as Professor Shiller noted”

And this is you: “CR has declared a bottom, and says prices are rising. It’s Bob Shiller who says prices will go sideways for a long time.”

Al,

You are pretty desperate. The first para of his second post is positively self congratulatory. He and you can’t have it both ways. He puts in his February headline that he was calling a bottom and took a victory lap in May. Saying that the upside from his supposed bottom might be weak does NOT obviate the fact that he called a bottom and REITERATED IN A HEADLINE that he called a bottom.

This is spurious argumentation.

“I think the difference now, as compared to a year or two ago, is that rents have been rising, and the rent/own cost ratio is back near historical averages. ”

I honeslty think todays rents are an anomalous byproduct of the unusual housing landscape and not a new normal. Remember two or three little years ago when all the headlines were about how the renter was king? How you could negotiate on asking rents, and ask for this-n-that perk? We are now seeing the opposite in 2011-12. The reason is that there are so many more defaulters and otherwise credit wrecked would-be owners looking to rent that landlords/property infestors are enjoying something of an open season. This is why I think rent v own as a metric for whether buying an equivalent structure is not a very sound metric right now — at least not for anything other than the very short term. Things are scrambled right now.

“fears that flooding the market with foreclosed homes could wreak havoc on their balance sheets and present a danger to the housing market as a whole”

I’m still with Dr. Housingbubble on this one: the housing market will be out of danger when aggregate house prices total about three times the aggregate income of house buyers. And not until. And regardless of anything else. Am I wrong?

Once upon a time a business connection got us in for a chat with someone at the Real Estate Board. Prices were at a historical high, everyone was interested in a little profit on their property, everything was on the market … nothing was selling. The Real Estate Board was going broke; they had a *HUGE* MLS catalog to maintain, and no commission income to maintain it with. They were in bad trouble. As it happened, we couldn’t think of any good ways to help them.

So even though the evening news, the Nightly Business Report, etc. like to tell good news about high market prices, these are just noises in the air. A market that does deals is a healthy market. Buyers and sellers meeting and coming to terms. Anything else, pffft.

Obviously, Dr. Housingbubble is correct. How could he not be?

It’s a sign of how debased by propaganda mass discourse has become that we even need to have a discussion about a banally obvious fact: sans bubble, home prices have to be in the historically established ranges that people can afford to pay before they’ll pay for them.

the pensions are bankrupt, holding cash negative paper myths…in a circle of leverage gone MAD…

San Bernardino was much more significant than many realize…

No one can fix the chain of title on an REO. No one can guarantee that the buyer of a foreclosed house will actually own the title. No title insurance company will write a policy without a long exception for title problems associated with MERS and foreclosures, all of which are lawless procedures. Add to this the fact that we are not dealing with a population boom so demand is not raging and the fact that many people have lost their jobs and this causes the market to be deeply depressed to approximately half, in sales, that it was in 2006 and 2007 and the banks can see that it won’t help to put the “foreclosed” properties on the market because they won’t sell anyway. If these properties are “foreclosed” on, regardless of the illegality of it, then the bank trusts for the MBS is off the hook to the various investors. So the best thing they can do is fake a foreclosure and then just let the property rot. And don’t forget that real estate is no longer a good investment because inflation has been wrung out of the system so all it’s good for is depreciation.

I don’t get how the banks are bundling their foreclosures and selling big packages of REOs to big investors who do not plan to resell them but to rent them. I’d love to read those sales contracts. And the accompanying title insurance policies. What a scam.

In my mom’s good neighborhood in suburban RI, I recently saw something I have never seen there in 45 years of frequenting the area: multiple houses with overgrown weeds instead of lawns. This has always been a coveted Norman-Rockwell-type area with an excellent walkable grade school smack dab in the center. There are NO “For Sale” signs on these obviously abandoned properties, however.

Prices are shooting up here in San Francisco because inventory is way down.

I bought a condo in 2010. The number of units on the market then was more than twice what it is now.

Sorry, and apologies to sound so blatantly bold, but … once i see an ‘X’ as the overall data plotting depiction of a graph (especially when of an x|y axis’).

To wit, it’s time to get rid of X|Y graphs, ….and i don;t think adding the Z-plane would help either, since X and Y data points are almost always pre-contrived in pre- | mis- conceptions to begin with .. so adding a Z-plane would just add to the stinking, rotting, dead and bloated corpse.

Love