By Mark Ames, the author of Going Postal: Rage, Murder and Rebellion from Reagan’s Workplaces to Clinton’s Columbine.Cross posted from The eXiled

This article was first published in the Daily Banter

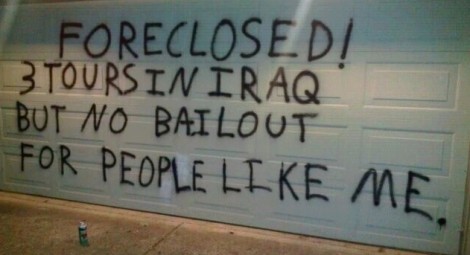

Every week, it seems there’s another tragic story about a suicide or murder-suicides linked to foreclosure trauma. Some of the more spectacular murder-by-foreclosure stories the past few years have been collected by a blog called “Greenspan’s Body Count”—others, myself included, have been writing about these terrible stories of class warfare being waged by the only side fighting it, and winning it, as Warren Buffett rightly said.

Before the 2008 crisis, the media paid little attention to the death toll taken on Americans by the decades-long class warfare waged against the 99%. Now they’re impossible to ignore. Stories like the US soldier in Iraq who committed suicide so that his wife could collect life insurance, and save their family home from foreclosure. Or the courtroom-suicide in Phoenix, in which a Yale-educated banker-swindler swallowed a cyanide capsule after being found guilty of setting his 10,000 sq foot McMansion on fire as a way of collecting insurance and evading mortgage payments he couldn’t afford.

Despite the somewhat increased media attention given to these tragic stories nowadays, there is one suicide directly tied to foreclosure fraud that has been completely ignored by the media. Her name was Tracy Lawrence, and for a brief moment last year, between the moment she turned whistleblower and her untimely and bizarre suicide, Tracy Lawrence’s testimony threatened to blow the entire fraud-closure criminal enterprise wide open, with repercussions that could have easily reverberated all the way up to the major banks and GSEs complicit in one of the greatest crimes this country has ever experienced.

In the months since Tracy Lawrence was found dead in her Las Vegas apartment at the age of 43, her story has only taken on more significance—even as her death has been forgotten. This is a story that demands our attention, a story we must not allow ourselves to forget.

First, some background to Tracy Lawrence’s suicide: On November 16, 2011, the attorney general for the state of Nevada, Catherine Cortez Masto, announced a major first-of-its-kind 606-count criminal indictment against two Orange County, California-based title officers working for Lender Processing Services, the country’s largest mortgaging servicing company and the worst of the predatory “fraudclosure mills.”

Foreclosure fraud had been devastating America unabated for a few years, laying waste to untold hundreds of thousands of American families. The Nevada attorney general’s criminal case against the two LPS title officers—Gary Trafford and Geraldine Sheppard—represented, for a brief moment, the first time in years that American justice threatened the predatory lending class.

What happened to the bombshell indictment of these LPS supervisors?

Yves Smith at Naked Capitalism was among the first to report the Nevada AG’s indictments, rightly pointing out the significance of going after mid-level officers in the foreclosure mill firm as a way of launching a full-scale takedown:

“[A]s mob prosecutions have shown again and again, you start by going after the foot soldiers in the hope that they roll people higher up on the food chain. And at a minimum, this action says that the law and due process matter, and violations, particularly large scale, systematic violations, can and will be punished.”

This marked the first time that bigtime bank fraudsters faced serious jail time—Attorney General Masto’s criminal case sent shockwaves throughout the mortgage lending world. More importantly, her criminal case threatened to finally change the way America deals with the bankster class that has been plundering with impunity for years. Politically, Nevada’s criminal indictment could have enormous repercussions; economically, the case could lead to invalidating tens upon tens of thousands of fraudulent foreclosures conducted in the Las Vegas area over the past few years.

The next day, the Los Angeles Times reported on the scale of the fraud:

In what appear to be the first criminal charges to stem from the fracas over improper foreclosures last year, two Southern California title loan officers have been indicted by a Nevada grand jury for allegedly filing tens of thousands of improper documents related to Las Vegas-area foreclosures.

The Clark County grand jury charged Gary Trafford, 49, of Irvine and Geraldine Sheppard, 62, of Santa Ana on 606 counts, alleging that the two headed up a vast “robo-signing” operation that resulted in the filing of tens of thousands of fraudulent foreclosure documents.

The documents were filed with the Clark County recorder’s office between 2005 and 2008, according to the indictment. The two title loan officers worked for the firm Lender Processing Services, a foreclosure processing company based in Florida that has been used by most of the largest banks in the nation to process home repossessions.”

Just a few months after the Nevada AG’s 606-count criminal indictment against LPS, Missouri’s attorney general filed a 136-count criminal indictment against a unit of Lender Processing Services, called Docx, as the New York Times reported last February. That meant two major criminal cases.

Given the sheer scale of the crime committed—a plundering so brutal and devastating you’d only expect such a thing from a conquering barbarian horde—what amazes me is how underreported this crime still is, and how few Americans in the Establishment know any of the details, beyond perhaps the word “robo-signing.”

One of the rare exceptions was the excellent reporting done on my friend Dylan Ratigan’s Show, as well as the unforgettable 60 Minutes segment aired last year on foreclosure fraud and “robo-signing” mills. The 60 Minutes investigation focused on the fraud perpetrated by Lender Processing Services unit, Docx, which used blatantly fraudulent “robo-signing” foreclosure documents to dispossess Americans of their homes on behalf of the Wall Street banks. Like the way peasants in a banana republic are treated, hundreds of thousands—if not millions— of Americans have been illegally and fraudulently evicted from their homes. And all the while as it happened, the Obama Administration stood by and wrung its hands—and that’s the kind, whitewashed way of putting it. Another way of looking at what the Obama Administration did with the mass foreclosure fraud crime—the true and honest way of putting it—is that the White House actively provided political and legal cover for one of the largest crimes perpetrated against Americans in modern history. Sorry, but that’s the truth—and the sad thing is, as horrible as the Obama Administration has been on housing, a President Romney will almost certainly find a way to be even worse, even if that worseness has to be invented. That’s one of the lessons we’ve all had to learn these past few decades.

“Obama Lied, Hope Died” should be the slogan

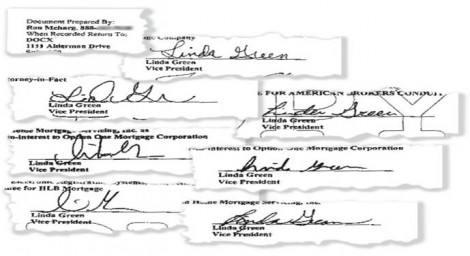

The 60 Minutes segment zeroed in on what is now the most infamous fraudulent-signature of our time: The infamous “Linda Green”—whose signature appeared on an impossibly large number of foreclosure documents. A single fake “Linda Green” was officially listed as a “vice president” at some 20 different foreclosure mills, this same “Linda Green” signing untold thousands of fraudulent documents evicting Americans from their homes.

Among the worst of the foreclosure servicers abusing the fraudulent “Linda Green” signature was Docx, the unit of Lender Processing Services which has since been shuttered.

60 Minutes tracked down the real “Linda Green” whose name was fraudulently abused to destroy the lives of countless Americans, and it’s worth quoting what 60 Minutes found:

We went searching for “the” Linda Green and found her in rural Georgia. She told us she has never been a bank vice president.

In 2003, she was a shipping clerk for auto parts when her grandson told her about a job at a company called Docx. The company, that was once housed in Alpharetta, Ga., was a sweatshop for forged mortgage documents.

Docx, and companies like it, were recreating missing mortgage assignments for the banks and providing the legally required signatures of bank vice presidents and notaries. Linda Green says she was named a bank vice president by Docx because her name was short and easy to spell. As demand exploded, Docx needed more Linda Greens.

“So you’re Linda Green?” Pelley asked Chris Pendley.

“Yeah, can’t you tell?” Pendley, who is a man, replied.

Pendley worked at Docx at the same time and signed as Linda Green.

So you have now a sense of just how vast the foreclosure fraud crime was, and how it involved not only the largest mortgage servicer in the nation, LPS, but also all the major banks that used LPS’s services to throw Americans out of their homes illegally and take possession of them.

No fraud here folks, looks like 1 authentic “Linda Green” to us!

Let’s rewind again to last November 16, 2011, the day that Nevada’s attorney general Masto announced her indictment against the two LPS title officers—two weeks before Tracy Lawrence took her life. Nevada’s case against LPS rested primarily on the testimony of a whistleblower, Tracy Lawrence, who worked in Lender Processing Services’ office in Las Vegas. Her testimony threatened to unravel tens of thousands of fraudulent foreclosures in the state of Nevada between the years 2005-2008, and the criminal activities of the entire mortgage servicing industry. Nevada has suffered the worst foreclosure problem of any state in the union.

In return for turning state’s witness, Tracy Lawrence plea bargained her charges down to a single misdemeanor charge of falsely notarizing a signature, which carries, in the worst case scenario, a maximum of one year in prison and a $2,000 fine. However, her testimony could put her two LPS superiors behind bars for decades—which is why many believed Nevada’s goal was to turn those two LPS officers into state’s witnesses against LPS’s senior executives.

On November 29, 2011—just two weeks after the Nevada attorney general announced the landmark criminal case—whistleblower Tracy Lawrence was supposed to appear before a judge for her sentencing. It should have been a routine appearance, but she didn’t show up. Her lawyer grew anxious, called police to check on Tracy Lawrence’s home, and that’s when they found her dead.

The timing of her death was suspicious, to say the least. Immediately, before any investigation had been conducted, Las Vegas police officially “ruled out homicide” as her cause of death.

Tracy Lawrence’s suicide was given scant coverage in the national media. Here is one of the few national media stories about her death, a short piece on MSNBC’s website:

Foreclosure fraud whistleblower found dead

By msnbc.com staff

A notary public who signed tens of thousands of false documents in a massive foreclosure scam before blowing the whistle on the scandal has been found dead in her Las Vegas home.

NBC station KSNV of Las Vegas reported that the woman, Tracy Lawrence, 43, was scheduled to be sentenced Monday morning after she pleaded guilty this month to notarizing the signature of an individual not in her presence. She failed to show up for her hearing, and police found her body at her home later in the day.

It could not immediately be determined whether Lawrence, who faced up to one year in jail and a fine of up to $2,000, died of suicide or of natural causes, KSNV reported. Detectives said they had ruled out homicide. [So quickly! And we thought only Russian police solved “crimeless” death scenes within minutes of arriving!—M.A.]

Lawrence came forward earlier this month and blew the whistle on the operation, in which title officers Gary Trafford, 49, of Irvine, Calif., and Geraldine Sheppard, 62, of Santa Ana, Calif. — who worked for a Florida processing company used by most major banks to process repossessions — allegedly forged signatures on tens of thousands of default notices from 2005 to 2008.

Police said at the time that the alleged scam had thrown into question the legality of most Las Vegas home foreclosures in the past few years, leaving many people living in foreclosed-upon homes that they unknowingly don’t actually own. [Good thing there’s no motive to make a detective suspicious here or anything!—M.A.]

I recently called the Clark County coroner’s office to find out if they had determined her official cause of death. A spokesperson told me that Tracy died from “intoxication” of a combination of Xanax (Alprazolam) and two antihistamines: Benadryl (Diphenhydramine) and Hydroxyzine. Officially, her death was ruled a suicide.

Though there has been little public discussion about Tracy Lawrence’s suicide, in private forums, her death sent a chill. Although there have been reports that Lawrence was depressed and stressed from her role as the key whistleblower, no one I know who reports on the housing disaster unquestioningly accepts the official version, that Tracy Lawrence’s suicide timing just happened to come at the most convenient time imaginable.

The stakes could not have been higher: As MSNBC reported, Las Vegas police said that her testimony threatened to “throw into question the legality of most Las Vegas home foreclosures in the past few years.”

As one commenter darkly quipped on the site 4closurefraud.org:

I bet Linda Green signs the coroners report….

But seriously,Now people can’t question the validity of the documents she attested to authentic because she is dead.

When they are alive you can challenge the presumption of authenticity. It’s nearly impossible to succeed if you can’t get the notary on the stand and cross examine them. Now there are 25000 properties that are pretty much a lock to be legitimized.

One only has to remember that Las Vegas’ gambling industry was created by mobsters like Meyer Lansky—who is also credited with helping invent modern offshore banking in the early 1930s in Switzerland. In this world, deaths ruled “suicides” are not unheard of. One of the most spectacular examples involved the “suicide” of Roberto Calvi, chairman of Italy’s largest private bank, who in 1982 was found hanging from London’s Blackfriars Bridge with bricks stuffed into his pockets along with $15,000 cash. The day before Calvi’s “suicide” his secretary “jumped” out of the bank headquarter’s fourth floor window and died—her death was also ruled suicide.

It took over two decades for authorities to overturn the “suicide” verdict and state the obvious: In 2003, Italian authorities ruled Roberto Calvi’s death a murder.

In the meantime, the fallout from Tracy Lawrence’s suicide has been worse than predictable: In Nevada, the case against Lender Processing Services appears to have all but fallen apart. With the Obama Administration foisting its foreclosure fraud settlement on all the states in January—a deal that left bankers happy, and everyone else screwed— and the key witness to the LPS case dead, the writing was on the wall.

Masto essentially fired her deputy AG, John Kelleher, who headed up the once-aggressive Nevada mortgage Fraud Task Force. With Kelleher gone, the Task Force looks like its work is all but over, as reported in local Las Vegas Channel 8 News:

“Nevada’s mortgage Fraud Task Force — arguably among the most aggressive in the country — has undergone some dramatic changes in the last few months. The changes prompted its former chief to question whether those responsible for Nevada’s housing collapse will ever be brought to justice.”

In the report, Kelleher told Channel 8: “It’s my personal opinion that there was some kind of deal cut, involving signing the multi-state (agreement) for whatever reason: financial, political, you can speculate all day long and back off criminal.”

Along with Kelleher, several other Nevada prosecutors and investigators have since been reassigned or transferred out to pasture. In the courts, a Nevada judge all but gutted the AG’s criminal case against Lender Processing Servicers.

Over in Missouri, the state’s criminal case was recently quietly settled for a paltry sum, and forgotten about.

Meanwhile in LPS’s headquarter state of Florida, the attorney general Pam Bondi has done everything to protect LPS, even firing two of her office’s attorneys who made the mistake of investigating LPS fraud.

Hugh Harris, CEO of Lender Processing Services, recently named “One of the Best Places To Work In Northeast Florida”

In a recent celebratory conference call that Lender Processing Servicers held with financial analysts, Hugh Harris, the CEO of Lender Processing, could barely contain himself as he gloated to analysts from Barcalys, Goldman Sachs and other financial institutions:

“First, let me just say we are very pleased to report strong second-quarter operating performance…we’ve gained greater clarity over the potential resolution of legal and regulatory issues related to the past practices.

“First, we announced yesterday, we’ve settled all our legal issues with the Missouri Attorney General’s office. This settlement includes a dismissal of all criminal charges filed against DocX. Second, an motion to dismiss in the Nevada Attorney General’s case was granted in part which resulted in the scope of the suit being significantly narrowed.”

So Tracy Lawrence’s highly suspect suicide is another major victory for the bankster class, and another giant loss for the rest of us. No matter what the circumstances of her suicide—that is, even if she was driven to kill herself in despair, after turning whistleblower and facing the pressure of confronting one of the biggest criminal fraud scams in history—that doesn’t make her death any less significant, or infuriating, or disturbing. Either way, the criminal lending industry drove a lone and lonely hero to her death.

All we can for now—while this country is still controlled by a rank oligarchy— is remember Tracy Lawrence’s suicide, so that some day we can learn what drove this hero to her terrifying early grave.

Doesn’t the Mittster own a big chunk of LPS?

Head on over to Gawker – big Bain doc leak in the works.

Yet, yet, yet many wish to merely regulate banking instead of KILLING IT!

The banks are the pet counterfeiting cartel for the rich. Why is that tolerated? Because the non-rich are allowed to steal purchasing power from their neighbors too (except at a higher interest rate)?

“Ya can’t cheat an honest man.” If true then what does the fact that we are being cheated reveal?

My heart bleeds for the rich guy who lost it all, and committed suicide in the courtroom in front of his friends and family.

He truly was one of us.

Glad to see this look back at Lawrence’s death. Just the other day I was thinking about this case and how it had apparently been forgotten. The telling thing is how Kelleher’s unit was disbanded while the national “settlement” was being forged.

Lawrence may have committed suicide — perhaps from an overwhelming fear of prison, but the way the state AG’s have folded indicates massive behind-the-scenes pressure. Reading Neil Barofsky’s new book, that kind of bullshit is all too familiar.

Y- Thanks for running some Ames content. He needs a bigger audience than he gets at The eXiled. He is a little long winded, but there is no mistaking his POV.

When there’s a lot at stake there is motive to kill. Sophisticated murders are often disguised as suicides.

That’s a circumstantial case right there.

Throw in the timing.

You have to careful if you’re crossing the banksters.

We need our own professional-quality studio-based TV station. Most Americans don’t have patience to read excellent blogs like this.

Repeat:

We need our own professional-quality studio-based TV station. Most Americans don’t have patience to read excellent blogs like this.

But make it online TV, of course. Not old school.

I think that probably defeats the point of reaching new audiences in middle America.

Not that it matters. I don’t think there’s going to be a real sea change for another generation at least.

But how will the sea change? All of our institutions – which had the regulations, the laws,the resources, and the mandate – to have prevented these abuses much less prosecute them after the fact have been corrupted and turned against the very people they were intended to protect.

Your optimism is false.

Those who are young now will learn to live differently than the baby glut generation did. You have no room for optimism because you want to return to a past that is not coming back.

My Father’s and Grandfather’s generation wrote laws, passed legislation, and created institutions that could’ve and should’ve prevented the wars in Iraq and Afghanistan, stopped 911 before it happened, prosecuted torture crimes at the highest level, never have allowed proprietary trading for commercial banks, deflated the housing bubble long before it’s danger point, prosecuted fraud at every level, never have allowed or excused massive surveillance of Americans, or the unthinkable: the assassination of one, the poisoning of the Gulf of Mexico with 200 million gallons of oil (plus the same in toxic dispersants), the drowning of a major and historic American city…I’m sure many NC readers could put together a more complete list. but the one that bothers me the most – because it has done the most good – at the least and most shared cost – and it is being brought down with the most pernicious, choreographed and orchestrated lies is SOCIAL SECURITY!

(There is one other issue that equally as troubling as destruction of Social Security and that is the complete dismissal of POVERTY as an issue that merits any attention at all, much less as a consequence of all the preciously mentioned poor policy choices. Please read Peter Edelman’s: SO RICH, SO POOR.

Amen. Suicide indeed. Anyone even thinking of the possibility of suicide has a problem with cognitive dissonance. Not at all localized to Nevada either.

I remember the report of the Soviet general involved in the coup against Gorbachev who committed suicide by putting three bullets in his brain.

I don’t think this is the same kind of thing. An overdose of Xanax by a woman under a great deal of stress is tragic and should have never happened. But I just don’t see it as murder.

One of the best places to work in Northeast Florida? Says a lot about what a pit Florida has become. Its always been a bit of a dump but its sure gotten worse…

I have long thought that whoever we stole Florida from, we should give it back!

The Spaniards have enough problems! :)

The Seminoles you mean. cf Andrew Jackson, it still matters:

The “[such-n-such] place is a pit” narrative is boring, and alienating. Manhattan is a wondrous, exhilarating place, but not where the revolution will be staged. To the contrary … anyway, there’re nice things about Florida. Tupelo honey, for instance, and freshwater springs. And Apalachicola Bay, where the oysters come from. Not as good as Georgia oysters, but the latter are not widely commercially available.

Florida is a horrible place. Not a narrative but a fact. Some people like it but some people like Vegas too. I will take Georgia over FLA any time–has history, charm, its own Georgianess. Florida started as a real estate scam and remains one today….Its a pit.

Geesh when I give complements to Georgia and point out its superiority to Florida its a sad state of affairs (a very lucky Virginian). The revolution will not be in Florida–they will want to figure out a way to live rent and mortgage free forever….no vacations and no real estate–what will Floridians do? Back to cocaine!

Great work! I know that at times it feels like “they” are winning. I think that in end this might blow up on “them” yet. I have been working in this area for the past three years and find it amazing. I am sure that the people who did the early tobacco cases felt like this. Lets just keep going…never give up. Thanks for all you are doing.

AGREED!!!!

Everyone focuses on the fraud in the housing market, but the commercial real estate market frauds by banksters and their minions damaged far more innocent victims by not only taking out the borrower, but many tiers of businesses and jobs, from developer to contractor, to subcontractors, suppliers, manufacturers and on through consumer goods, wiping out 100s at a time, most of them oblivious that they were even at risk and without legal recourse.

The number of suicides and deaths from medical events precipitated by the swindles and frauds of banksters and their big-law law firms is impossible to determine. Most are the innocent victims and their families who have been wrongfully stripped of their small businesses, jobs and livelihood by fraudulent legal means covered up by big money.

In large part, the civil legal system of this country has become nothing more than the equivalent of the Salem witch hunts, with swindles by crooks in power easily conducted through false allegations and protected by big law without ethics. The lawyers have a license to lie, and are skilled at making false allegations lawyer-to-lawyer to bankrupt the innocent, to prevent their access to courts, and to keep them from even knowing what is being alleged. As one bankster told one of his innocent business victims: “You have the facts on your side, but we have the money. You lose. We’re going to bankrupt you and you’ll never see the inside of a courtroom.”

Government regulations make it easy for the swindlers in the banks, and the fraudsters’ lawyers, with their “owned” judges in the courts, to destroy the innocent while they amass a fortune in valuable property for pennies on the dollar. One such case is being investigated in St. Louis by the FBI now. Any bets as to whether any “crimes” will be charged or the depth of the crimes will ever be uncovered? Will there be any real convictions? Even in the rare cases where there are such convictions, the usual punishment is a 2-5 year sentence for “lying” or “wire fraud,” with most of it suspended.

These frauds and the means Big Law uses to defraud and steal for their bankster clients have been rendered “legal” by our government and the courts. Indeed, a federal judge in Chicago in one case ruled that a bank acted in bad faith and without cause, refused to hear evidence of verbal fraud, and stated that the bank “had the right to do so” (foreclose without cause).

Thank you for reporting your loan issue to the Office of Mortgage Settlement

Oversight. We appreciate your time and willingness to help inform the

settlement’s monitoring process.

As the Monitor, I cannot intervene with the servicer on your behalf. However,

the information you have provided is very important because it allows me to see

firsthand how servicers are treating their customers. If a number of consumers

are experiencing similar problems with a particular servicer, this may represent

a pattern or practice in violation of the agreement that I need to investigate

further.

With your participation, I can better enforce the mortgage servicing standards

outlined in the agreement, which helps make the settlement more meaningful for

homeowners across the country.

Thank you again for your help.

Sincerely,

Joseph A. Smith, Jr.

==============================================

Office of Mortgage Settlement Oversight

301 Fayetteville St.

Suite 1801

Raleigh, NC 27601

Our telephone:

919-825-4748

GMAC’s parent, RESCAP has declared Chapter 11 bankruptcy in U.S. Bankruptcy court in Manhatten. They have been given a stay by Judge Martin Glenn which prevents homeowners from persuing claims against GMAC. GMAC is using bankruptcy to maximize its position in litigation. It will proceed with foreclosures, but for any borrower with a claim against GMAC, they are saying, “sorry, go to New York and file a motion”.

This bankruptcy may also be a method for more than one trillion dollars in taxpayer money to disappear. This is done by listing the loans that were securitized by Fannie Mae and Freddie Mac as “assets” in the Rescap bankruptcy. Perhaps Judge Glenn could explain how over one trillion dollars in loans could appear as assets on Rescap’s financial statements when they were paid in full by the investors that provided the money for the securitizations. These loans should not be listed as Rescap’s assets. They are assets of the retirement funds that provided the money.

They are about to be Corzined (disappeared) much like Tracy Lawrence’s fraudulent foreclosures in Las Vegas. This is Obams’s version of hope and change.

Remember a guy by the name of “Spitzer”????

You all know what happened to him!!

The bankers are criminals. There is no question about it. They will not hesitate to lie, cheat, thieve, and even kill to protect the massive “profits” of their induustry.

One wonders how no crazed american gunman has yet attacked a major bank. Of course, if they ever did, the place would be bristling with more firepower than a columbian drug lab, and they would find themselves fed to the greyhounds by nightfall. Pity no-one has tried though.

The Mark Ames blog is truly revealing of the cancer USA Capitalism. All empires implode as the contradictions inherent in the system become revealed. As much as we can detest the inability of Obama to act, there remains the total failure of the corporate media to meet its obligations to the citizens in a democracy to investigate and reveal the criminality.

FOR IMMEDIATE RELEASE

August 22, 2012

Contact: Home Owners For Justice

CJ Holmes 707-578-5727

cjholmes@cjholmes.com

KPFA/PACIFICA Friday 8-24-12 at 10am Premieres Real Estate Foreclosure Show

to ‘Stop Foreclosures’; May be First Show of Its Kind in Nation

BERKELEY, Ca. – CJ Holmes, a leading foreclosure analyst and critic of the government’s response to the foreclosure crisis, will host what may be the first show of its kind in the nation beginning Friday (Aug. 24) from 10-11 a.m. on Pacifica Station KPFA 94.1FM and KPFB 89.3FM and live streamed at http://www.KPFA.org. Call in numbers for the show are 510-848-4425 and 800-958-9008.

“How to keep your home off the chopping block, and what we can do to stop the fraud perpetrated by the banks,” is the first show of its kind, I believe, in the nation,” said CJ Holmes, host of the “CJ Holmes” show.

Homeowners, landlords, landlords’ tenants, their neighbors, and now virtually all property owners are victims of the catastrophe called the “Housing Crisis,” which has turned out to be a giant swindle designed to transfer citizens’ money and real estate to the coffers of the banks and mortgage companies. In other words, the housing crisis is a crime perpetrated against society at large for the enrichment of financial institutions that are already fat from years of shady dealings executed in broad daylight because of feeble and unheeded government regulation.

The illegality of this foreclosure-eviction-seizure process is its weakness. While legislatures and politicians dawdle, a few informed citizens, lawyers and institutions are pushing back hard. C.J. Holmes is at the tip of the spear in this take-back-your-house movement. What she prescribes is not just hysterical defiance but thoughtful, step-by-step coordinated actions to hold your house against the rip-off artists.

Holmes, founder of Home Owners For Justice (www.hofj.org), will promote activism we can do as individuals, as groups, and as a nation to achieve the reforms we need. The show will also touch on the hot foreclosure issues of the day, including eminent domain and ‘REO’ bulk sales to hedge funds plus answer callers’ questions as they come in.

Other Pacifica Network stations are located in Los Angeles, New York, Houston and Washington D.C.

-end-

Press Release Link – please forward to everyone you know

I look forward to answering your questions on the air! Thanks, cj

CJ Holmes

Housing Policy Director

Real Estate Analyst DRE 01234197

(707) 235-1381 c

cjholmes@cjholmes.com

Home Owners For Justice

http://www.HOFJ.org

(707) 578-5727

(707) 578-5873 f

818 Mendocino Ave

Santa Rosa, CA 95401

Bizarre. Some guy told me a show like this would be coming on TV soon.

His version was reality TV, where the people were actors and some of the stuff was staged.

His other catch was to sue the banks with all the victims recruited through the show.

Re the Obama Fraud poster — reminds me of the Obama Liar posters:

Here http://my.firedoglake.com/ubetchaiam/2011/10/07/what-color-do-you-think-symbolizes-a-liar/

and here http://skydancingblog.com/2011/09/01/during-transition-obama-signaled-endorsement-of-bush-secret-programs/obama-liar/

It’s one of the best comments on the current state of the USA that Tracy Lawrence’s murder still has barely garnered any attention. This story is at the heart of where America is heading in the future. I would love to see a town hall type forum where questions about an issue such as this one is blatantly asked as part of the presidential debate, but I’m pretty sure most of the people willing to ask, will be sequestered from the discussion. So so so sad.