By Michael Hudson, a research professor of Economics at University of Missouri, Kansas City, a research associate at the Levy Economics Institute of Bard College, and author of “The Bubble and Beyond,” which is available on Amazon.

The pace of Wall Street’s war against the 99% is quickening in preparation for the kill. Having demonized public employees for being scheduled to receive pensions on their lifetime employment service, bondholders are insisting on getting the money instead. It is the same austerity philosophy that has been forced on Greece and Spain – and the same that is prompting President Obama and Mitt Romney to urge scaling back Social Security and Medicare.

Unlike the U.S. federal government, most states and cities have constitutions that prevent them from running budget deficits. This means that when they cut property taxes, they either must borrow from the wealthy, or cut back employment and public services.

For many years they borrowed, paying tax-exempt interest to wealthy bondholders. But carrying charges on these have mounted to a point where they now look risky as the economy sinks into debt deflation. Cities are defaulting from California to Alabama. They cannot reverse course and restore taxes on property owners without causing more mortgage defaults and abandonments. Something has to give – so cities are scaling back public spending, downsizing their school systems and police forces, and selling off their assets to pay bondholders.

This has become the main cause of America’s rising unemployment, helping drive down consumer demand in a Keynesian nightmare. Less obvious are the devastating cuts occurring in health care, job training and other services, while tuition rates for public colleges and “participation fees” at high schools are soaring. School systems are crumbling like our roads as teachers are jettisoned on a scale not seen since the Great Depression.

Yet Wall Street strategists view this state and local budget squeeze as a godsend. As Rahm Emanuel has put matters, a crisis is too good an opportunity to waste – and the fiscal crisis gives creditors financial leverage to push through anti-labor policies and privatization grabs. The ground is being prepared for a neoliberal “cure”: cutting back pensions and health care, defaulting on pension promises to labor, and selling off the public sector, letting the new proprietors to put up tollbooths on everything from roads to schools. The new term of the moment is “rent extraction.”

So having caused the fiscal crisis, the legacy of decades of property tax cuts financed by going deeper into debt are now to be paid for by leasing or selling off public assets. Chicago has leased its Skyway for 99 years to toll-collectors, and its parking meters for 75 years. Mayor Emanuel has hired J.P.Morgan Asset Management to give “advice” on how to sell privatizers the right to charge user fees for previously free or subsidized public services. It is the modern American equivalent of England’s Enclosure Movements of the 16th to 18th century.

By depicting local employees as public enemy #1, the urban crisis is helping put the class war back in business. The financial sector argues that paying pensions (or even a living wage) absorbs tax revenue that otherwise can be used to pay bondholders. Scranton, Pennsylvania has reduced public-sector wages to the legal minimum “temporarily,” while other cities are seeking to break pension plans and deferred-wage contracts – and going to the Wall Street casino and play losing games in a desperate attempt to cover their unfunded pension liabilities. These recently were estimated to total $3 trillion, plus another $1 trillion in unfunded health care benefits.

Although it is Wall Street that engineered the bubble economy whose bursting has triggered the urban fiscal crisis, its lobbyists and their Junk Economic theories are not being held accountable. Rather than blaming the tax cutters who gave bankers and real estate moguls a windfall, it is teachers and other public employees who are being told to give back their deferred wages, which is what pensions are. No such clawbacks are in store for financial predators.

Instead, foreclosure time has arrived to provide a new grab bag as cities are forced to do what New York City did to avert bankruptcy in 1974: turn over management to Wall Street nominees. As in Greece and Italy, elected politicians are to be replaced by “technocrats” appointed to do what Margaret Thatcher and Tony Blair did to England: sell off what remains of the public sector and turn every social program into a profit center.

The plan is to achieve three main goals. First, give privatizers the right to turn public infrastructure into tollbooth opportunities. The idea is to force cities to balance budgets by leasing or selling off their roads and bus systems, schools and prisons, real estate and other natural monopolies. In the process, this promises to create a new market for banks: lending to vulture investors to buy rights to install tollbooths on the economy’s basic infrastructure.

Elected public officials could not engage in such predatory and anti-labor policies. Only the “magic of the marketplace” can break public labor unions, downsize public services and put tollbooths on the roads, water and sewer systems while cutting back bus lines and raising fares.

To achieve this financial plan, it is necessary is to frame the problem in a way that rules out less anti-social alternatives. As Margaret Thatcher put matters, TINA: There Is No Alternative to selling off public transportation, real estate, and even school systems and jails.

Dismantling Public Education and Police Departments to Pay Bondholders

Local tax policy used to be about education. The United States was divided into fiscal grids to finance school districts, along with roads and bus lines, water and sewer systems. Municipalities with better schools taxed their property more, but this made it more desirable to live in such districts, and thus raised rather than lowered real estate prices. This made urban improvement self-feeding. Lower-taxed districts were left behind.

This no longer is the American way. Education in particular has been demonized. California’s formerly great school system is the most visible casualty of the state’s Proposition 13, the property tax freeze enacted in 1978. The Los Angeles Apartment Owners Association employed its political front man, Howard Jarvis, as a lobbyist to promise voters that little would change by cutting back education and libraries. He claimed that “63 percent of the graduates are illiterate, anyway,” so who needed books. Education and other parts of public spending was frozen as property taxes were slashed by 57% – from 2.5 or 3% down to just 1% of assessed valuation, and were frozen at 1978 price levels for owners who have kept their property. The result is that California’s school system has plunged to 47th rank in the nation.

For neoliberals, the silver lining is that downgrading education makes citizens more susceptible to the Tea Party’s false consciousness when it comes to how to vote in their economic interest. Back when Prop. 13 was passed, for instance, commercial investors promised homeowners that across-the-board tax cuts would make housing more affordable and that rents would fall. But they rose, along with real estate prices. This is the Big Lie of neoliberal tax cutters: the promise that cutting tax will lower costs rather than provide a windfall for property owners – and also for banks as rising rental values are “free” to be capitalized into larger mortgage loans. New buyers need to pay more, raising the cost of living and doing business.

Back in 1978 on the eve of Proposition 13 commercial owners paid half the real estate taxes and homeowners the other half. But now the homeowners’ share has risen to two-thirds, while commercial taxes have fallen to one-third. Bank loan officers have capitalized the tax cuts into larger mortgages, so housing prices have risen, not fallen. Los Angeles Mayor Antonio Villaraigosa exclaimed ruefully last year that “the time is now to address the inequity of Prop 13 that allows large corporate interests to get a windfall meant for homeowners. We are not funding government. We are just decimating government and the services it provides.” He proposed a two-tier property tax, restoring higher rates for commercial and absentee investors.

School teaching is an exhausting occupation. That is one reason why teachers are one of America’s strongest labor unions. Their wages have not risen as fast as their expenses, because they have agreed to take less income in the short run in order to get pensions after their working days end. These contracts are now under attack – to pay bondholders. States and cities are now insisting that bondholders cannot be paid without stiffing their labor force.

So we are now seeing the folly of untaxing property and replacing tax revenues with borrowing – paying tax-exempt interest to the nation’s wealthiest bondholders. Cutting the property tax base thus finds its twin casualty in the wave of defaults on pension promises.

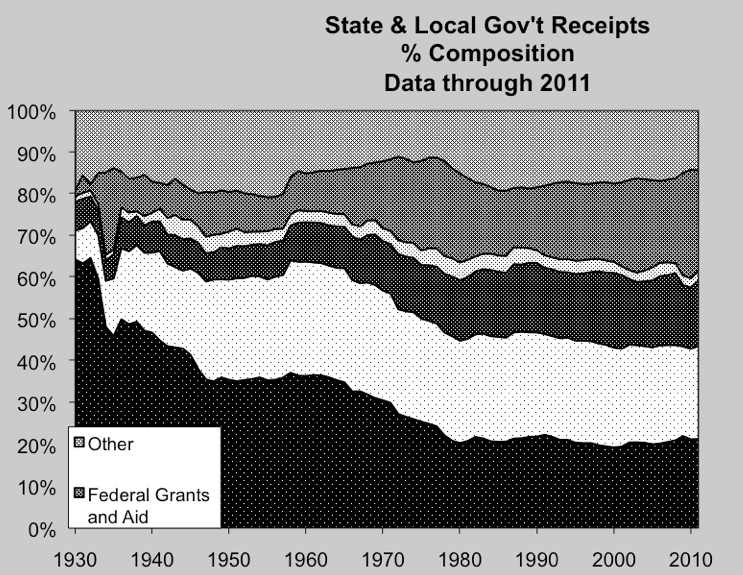

Real estate taxes have plunged from two-thirds of urban revenues in the 1920s to just one-sixth today for the United States as a whole. Federal grants-in-aid also are being cut back, and state aid to the cities is following suit. But instead of making housing more affordable, these tax cuts have “freed” rental value from the tax collector only to end up being paid to the banks.

Here too, California has led the way. In 1996 its voters approved Prop. 218, requiring any new tax, fee or property assessment to be approved by two-thirds of voters. (A few exemptions were made to keep local sewer and water systems viable.) This stratagem “starves the beast,” with the “beast” being public infrastructure and social services. Police forces are being downsized and social programs are cut back. And as urban poverty increases, crime rates are rising, imposing an “invisible” cost of living.

The most important economic fact to recognize is thus that whatever the tax collector relinquishes tends to be capitalized into mortgage loans. And by leaving more rent available to be paid as interest, cutting property taxes obliges homebuyers to go deeper into debt. Lower property taxes thus mean higher housing prices – on credit, because a home or other real estate is worth whatever a bank will lend to new buyers. So by capitalizing the after-tax rental value into a flow of interest, bankers end up with the rent – and hence, with the property tax cuts.

That is what a free market means today – income created by public-sector investment, “freed” to be paid to banks as interest rather than to be recaptured by government.

Most urban revenue is a free lunch created by taxpayer-financed roads, schools, sewers and water systems. But neither real estate speculators nor their bankers believe that this investment by taxpayers should be recovered by taxing the increased site values created by providing these public services. Instead of making the public sector self-financing as it expands public services to create wealth, private owners are to get the benefit – while banks capitalize the gains into larger mortgage loans, which now account for 80% of bank credit.

The core of the bankers’ “false consciousness” – the cover story with which Tea Party lobbyists are seeking to indoctrinate U.S. voters – is that taxes on land and financial assets punish the “job creators.” Going on the offence, the beneficiaries of this public spending claim that they need to be pampered with tax preferences to invest and employ labor, while the 99% need to be kicked and prodded to work harder by being paid low wages. This false narrative ignores the fact our greatest growth periods are those in which U.S. individual and corporate tax rates have been highest. The same is true in most countries. What is stifling economic growth is the debt overhead – owed to the 1% – and tax cuts on free lunch wealth.

The Public Pension Squeeze is Part of the Overall Debt Crisis

Republican Vice Presidential nominee Paul Ryan and Texas Governor Rick Perry have characterized Social Security as a Ponzi scheme. This is true in the obvious sense that retirees are supposed to be paid out of contributions to new entrants. That is how any pay-as-you-go system is supposed to work. The problem is not that the system needed to be pre-funded to provide the government with revenue to cut taxes on the 1%. The problem is that new contributions are drying up as the economy buckles under its expanding debt overhead.

Social Security can easily be paid. After the 2007 crash the Fed printed $13 trillion on its computers to give to bankers. It can do the same for Social Security – and for federal grants-in-aid to America’s states and cities. It can pay state and local pension obligations in the same way it has paid Wall Street’s 1%. The problem is that the Fed is only willing do what central banks were founded to do – finance government deficits – to give to the banks. The aim is to save bondholders and the banks’ high-flying counterparties, not the 99%.

The problem is that the financial system itself is rotten. This has turned today’s class war into a financial war, with the major tactic being to shape how voters perceive the problem. The trick is to make them think that cutting taxes will lower their living costs and make housing cheaper, rather than enabling banks to take what the tax collector used to take. That is the key perception that needs to be spread: cutting taxes leaves more “free lunch” income available for banks to lend against, loading the economy deeper into debt.

Here’s why the present track can’t possibly work. State and local pension funds are $3 trillion behind because they are only making 1% returns these days (the only safe return), not the 8+% that they were told to make in order to pay pensions by “capital” gains (that is, the bank-financed free lunch). The Fed is keeping interest rates low in an attempt to re-inflate real estate and other asset prices back to the happy decade of Bubblemeister Greenspan. If interest rates rise – by enough to enable California, Chicago and other localities to obtain enough interest to pay retirees what they promised – then banks will see the collateral for their mortgage loans fall.

So the Fed has locked the economy into low returns. Neither Democratic nor Republican politicians are willing to raise taxes on the finance, insurance and real estate (FIRE) sector. They vote in line with what their campaign contributors are paying for – to make Wall Street rich.

At issue is the old Who/Whom choice. Given the mathematical fact that debts that can’t be paid, won’t be, the question is who should get priority: the 1% or the 99%?

Debt-ridden austerity and downsizing government is being urged as if it is inevitable, not a policy choice to put bondholders and the 1% over the 99% – a reward for the lobbying money it has spent on buying politicians and misleading voters to believe that cutting property taxes and cutting taxes on the rich will help the economy.

But if America still lets the 1% write the laws – or what turns out to be the same thing these days, to contribute to the political campaigns of lawmakers – then the economy will get much poorer, quickly. The era of America growth will be over.

Something has to give: If bondholders won’t be paid, states cannot pay labor’s deferred wages in the form of pensions, and will have to cut back public services.

So it’s time to default. Otherwise, Wall Street will turn us into Greece. That is the financial plan, to be sure. It is the strategy for today’s financial war against society at large. In Latvia, I spoke to the lead central banker, who explained that wages in the public sector had fallen by 30 percent, helping push down private-sector wages nearly as far. Neoliberals call this “internal devaluation,” and promise that it will make economies more competitive. The reality is that it will up the internal market and drive labor to leave.

So it’s time to default. Otherwise, Wall Street will turn us into Greece. Michael Hudson

Why default? The US is monetarily sovereign, unlike Greece.

The US could Federalize state and local pensions and debt service but that’s a top-down solution. How about a bottom-up solution instead? Steve Keen’s “A Modern Debt Jubilee” would give money directly to the population, including non-debtors. Who could complain? And if the bailout was combined with a ban on further credit creation then it could be metered to just replace existing credit as it is repaid for no net change in the total money supply (reserves + credit).

For $40 trillion in private debt at 3% APR, I estimate that the entire US adult population could receive $1100/mo each for the next 15 years without increasing the total money supply.

Is honest 100% reserve lending such a high price to pay for a debt-free US population and to end this depression?

What’s the 3% APR for?

It’s just an estimate of the average APR on US private debt. 15 years (180 months) is also an estimate of the average remaining duration of US private debt.

Monetary sovereignty we are not … the privately owned and operated Federal reserve holds the keys to our currency and credit.

Until we take back our right and responsibility to manage our monetary system the interest on our national debt will be used to disable our social programs …

The Fed is the US Treasury’s pet bank. It will do as ordered.

But I agree that the Fed should be nationalized. It should then be turned into a fiat storage and transaction service for ALL US citizens, not just the banks.

Competing currency?

Let the FRN$ hyperinflate while the Treasury spends US Note $ into existence.

This might be the tightrope walk that allows existing debt to hyperinflate away while maintaining the reserve currency.

There’s no need to hyperinflate debt away. The debt can be paid off with dollars of equal value IF we ban further credit creation and IF the entire population is given new fiat at a rate metered to just replace existing credit as it is paid off.

It is remarkable that he (Jefferson) had this forsight 210 years ago. In the death by a thousand cuts execution that is underway, where is the tipping point moment, when the great body of “we the people” stand up and stop this madness in its tracks?

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…I believe that banking institutions are more dangerous to our liberties than standing armies… The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

“And if the bailout was combined with a ban on further credit creation” -F. Beard

Mr. Beard, you seem to have missed the primary requirement of capitalism, namely neverending growth. Pruning the tap root of capitalism will not yield an improved version, it will leave a dead version. What sort of economic system will fill the vacuum left by that death is interesting to contemplate, but not to contemplate living through. Alas, that transition is coming regardless of whether or not we rush its arrival.

you seem to have missed the primary requirement of capitalism, namely neverending growth. Christophe

Common stock as a private money form allows unending growth but does not require it.

Also, honest (100% reserve) lending of fiat would be an option. The interest to service that debt would come from perpetual Federal deficit spending (but without borrowing!) including perhaps a “Citizens Dividend” to evenly distribute the new fiat.

Pruning the tap root of capitalism will not yield an improved version, it will leave a dead version. Christophe

Nonsense. Capitalism can certainly finance itself ethically or at least without a government backed/enforced counterfeiting cartel.

That beats a chicken in every pot by a long stretch. Run for President, F., you have my vote. Seems like a win-win situation for the rich and poor alike. All of the spending ends back up in the hands of those who own the productive assets of the country, that is the wealthy and Wall Street, so they should buy into it, and what average American wouldn’t love to have an $1100 bump to their monthly cash-flow?

And once we reached full-employment and experienced full capacity on existing productive capital, we would once again begin raising our living standards with new capital investment and heavy demand for labor. And for all of you lefties out their, we could probably insist on accomplishing it in an environmentally friendly manner, and still grow the economy.

You the man, F. Beard.

All of the spending ends back up in the hands of those who own the productive assets of the country, avg John

Not quite. Debt repayment would cause a lot of that new money to go where it properly belongs – to backing deposits 100%.

Of course the bankers will see that as a huge waste – all that unembezzled new money just sitting in their Federal Reserve accounts, no longer as “excess reserves” but as REQUIRED reserves! But not for long since after the bailout period and the banks’ books have been properly balanced then the US Government itself should provide a risk-free fiat storage and transaction service for all US citizens and then ABOLISH government deposit insurance.

– to backing deposits 100%. FB

Some escrow mechanism at the Fed would probably be necessary to ensure that all new bank loans were 100% backed by reserves lent to the bank for relending. That would eliminate the possibility of pseudo-demand deposits where a bank customer might agree to conditional or limited withdrawal rights in exchange for interest.

Great idea a Jubilee-type solution (which in 2007 seemed to me the only real fix), but martial law would have to be imposed, along with a huge re-education, er, “marketing” effort to counter the massive push-back of the 0.1% and their lackeys. Jubilee AND nationalize the media and jail the opposition. Otherwise the media lackeys will have a thousand little militias and tea parties up in arms defending their right to be slaves to the sociopathic banker/inherited wealth class.

All of the spending ends back up in the hands of those who own the productive assets of the country, avg John

But yea, the rich (and poor pensioners?) would get their interest in a non-depreciating currency as loans were repaid.

No one would have legitimate cause to complain though some would anyway – the Potters of the world.

The Henry F. Potter(s), that is.

“Why default? The US is monetarily sovereign, unlike Greece”

I believe there is some confusion revealed with that statement

The article is about municipal bonds, that is, bonds created at the behest of cities, counties, school boards, etc and financially overseen by the state government. None of those entities are able to issue currency as sovereign states. They have limited choices when coming up against the inability to pay back loans

1. Borrow more money in the way of taxes;

2. Strike a new agreement that forces a ‘haircut’ on the bond holders (unlikely)

3. Default on the loan and tell the bondholders to fly a kite.

In no case can municipalities ask bond holders to take payment in ‘money’ (script) backed by the entity; they can’t create money. Would you take ‘dollars’ backed up by the authority of Detroit, or New York City, or the Elgin Community Schools? Besides, those entities can’t issue money for one simple reason-that would be highly illegal and would make them to be counterfeiters.

None of those entities are able to issue currency as sovereign states. Ray Phenicie

True but the universal bailout would go to all US citizens. From there it would “trickle up” to help their states and local communities by restoring the local economy and thus tax revenues.

There was a lot of weeping and dire predictions of doom when Iceland told their bankers to take up kite-flying as a hobby.

Now the IMF is openly saying Iceland’s approach (“debts that cannot be repaid will not be repaid”) was far and away the right way to handle the crisis.

I advise Peoria, Santa Monica, and every other illegally impoverished municipality in America to follow the IMF’s epiphany and default.

The 1% will still be insanely rich after their haircut. Pensions and the social safety net will be fundable again.

You guys are deluded.

After you have told bondholders to go suck eggs, who finances public infrastructure. Will you just keep printing money, what happens when you get hyper-inflation – picture people pushing heaps of money in wheel barrows.

I agree with Hudson’s conclusions, but you cannot ‘fix’ the system, it needs to be replaced.

Okay, you never default on bonds. Who pays off these bonds?

What if instead, some of these cities default because they are bankrupt and that is what bankrupt entities do, they default? The reason an investor is paid interest is to cover the risk he won’t be repaid. All investors are aware of this risk, or should be. All experienced investors have lost money on investments. I have. If this is hard for you to swallow, perhaps you should go chat with the friendly bankers who crashed the housing market. They’re doing just fine, so they should be in good humor (but that will change if cities start using eminent domain, forcing them to book their losses).

Then the taxes that would have been collected to pay off the bonds could be saved and used towards infrastructure, even paying in cash perhaps.

@F. Beard

Why default? The US is monetarily sovereign, unlike Greece.

Hudson is talking about states, cities, and counties, not the federal government. States, cities, and counties cannot issue their own currency; they can default.

Of course but see my reply to Ray Phenicie just above yours.

$1100 per month per person! every loser forced into a minimum wage job to make ends meet would immediately quit work. You’d shut down the retail and fast food industries overnight. LoL,

And for those that don’t quit working would they really have the restraint not to spend ALL that additional cash flow into the economy inducing old school inflation, enriching the business/asset/equity owners?

Not saying it couldn’t work but it is not without its major pitfalls either.

Don’t forget that those in debt would still have to pay it off. The money used for that purpose would effectively just disappear into the banks’ Federal Reserve accounts where it would be needed to back an eventual 100% reserve requirement.

As for low wage jobs, automation is eliminating those anyway. Soon you’ll just be able to drive your shopping cart through the checkout stand, swipe your card and be done.

Some would quit their jobs for a well deserved break but there are unemployed people who have a psychological need to work and would enjoy the higher wages too.

And for those that don’t quit working would they really have the restraint not to spend ALL that additional cash flow into the economy inducing old school inflation, Tim

Well, real interest rates would increase to an honest, free market level so that would greatly encourage people to save. Also, don’t forget that the bailout would be metered so that the total money supply (reserves + credit) would not increase so significant price inflation should not be a problem.

The US is monetarily sovereign…

Here’s the proper response to that thought:

http://www.kpfa.org/archive/id/83610

I’ll take Steve Keen over goldbug Max Keiser any day.

But in Max’s and especially Stacy’s defense he/they can and are learning. Not so much can be said for their followers in many cases.

It is remarkable that he (Jefferson) had this forsight 210 years ago. In the death by a thousand cuts execution that is underway, where is the tipping point moment, when the great body of “we the people” stand up and stop this madness in its tracks?

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…I believe that banking institutions are more dangerous to our liberties than standing armies… The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

Brilliant article on current state of affairs. Wish we had a media that could handle an article like this. I am finding it very difficult to get information on bonds owed by my county. I realized some time ago that bonds were probably the root of the problem. That was before the tea-party Supervisors began giving our parks to their friends and supporters for free and allowing them to do whatever with the prime land.

Indeed Michael Hudson has captured the situation to a tee. Good luck with your investigation into your county’s affairs.

NYC Mayor Mike wants to privatize OUR parking meters. I could go on and on (don’t get me started) but the lowdown is all there in “Mike! Wall Street’s Mayor” by Neil Fabricant.

My family hyas 100= years here and along comes this guy, from where?

I agree. This article needs to get out to a lot of people.

The best method is to Google on your county’s name, and “bonds” or try “securities” and various bank names which they’ve associated with in the past (JPMorgan, usually, etc.).

As far as the media, I heard former Bush sec’y of state, Kindasleazy Rice prattle on about how more free trade agreements with China are needed (as long as there’s one remaining American job which they can offshore to there), and the very next day, on NPR’s To The Point, two crazy types, one a delegate to the R-can convention, and former Bush admin. appointee, O’Brien, states that unless we enter into more free trade agreements (jobs offshoring) with China, China is perfectly justified to ram Filipino and Japanese ships in international waters, and hack into the Pentagon, etc., and the guy from the Obama administration, Cohen, essentially agrees with this suicidal nuttiness!

I kid thee not!!!!

this is exactly why Warren Mosler has proposed a federal $500 per capita aide to the states. Somehow we need to get the word out the the banksters who caused the problem are the ones who are benefitting. don’t know how to do that.

Thank you Prof. Hudson. As far as I can tell the (big) banking corporations, both domestic (if that exists) and international deserve no consideration. On the contrary, they should pay damages and restitution for the duration of their incorporations and the new spawn of their incorporations. No hiding. Right now there is a good RICO case for fraud and extortion – and 7 years of lost opportunity.

Even a blind man can see all they intend on doing is welshing on the Baby Boomers because the thieves that invested their money actually spent it.

Federaize debt? That means forcing the taxpayer to assume the debt of irresposible local and state governments (go0vernements that in vast majority of case are Democrat governments).

These governments overspent and very often on idiotic programs. These governemnt bought union votes (and cotrinutions) with the taxpayers money. No one, and I repear NO ONE, held a gun to their head. They took on this debt themselves. They must be held accountavle

This is merely an attempt to bail out a major Democrat special interest group: Unions. Given that unions are ma major source of cash to the Democrats, as well as an source of illegal non-cash election contributions, this amount to racketeering.

You Leftists have no decency whatsoever. You cannot be trusted to govern frugally;you cannot be trusted to pay your debts.

When cornered you are always a “victem: of some “evil” conpsiracy.

It is you that are feckless and irresponsible. Nothing shows this more than this bizaare proposal. What they need to do is renegotiate those ludicrous union contract. What they really need to do is de-certify all government unions.

Such moral and economic hazards as these stem from such nonsense. Default on those blls and they will never raise a dollar in capital again.

$500 dollar percapita aid toi the state? what economic illteracy. Wherever do you think that money comes from, Santa Clause?

The only way to rein back the prfilgate bulle state governments is to force them to live in the real world.

Such enonimic illteracy. Such childish irreposibility. Such latent criminatiy. An you sut there are morally posture about “banksters”. Shame on you.

‘Such enonimic illteracy.’

Heh. Quite, you scum.

Maybe it’s not for prime time but it’s supposed to be funny. Hell, it got to you before you got the joke.

I would support federal assumption of city debt ONLY IF the state in question allowed the federal government to consolidate a set of cities/towns within that state. No reason for threea adjoining suburbs to each have a school superintendent or police chief earning in excess of 200K per year. Instead, the feds would retire three layers of excess adminsitrative staff and appoint young staffer, none earning more than 50K a year, and all leaving within 3 years.

Tea Party Trolls just cannot get it through their thick skulls that debt on a nation state level is not the same as Joe the HVAC guys credit cards.

Such tripe about “mostly democratic” profligate states. Like what, Alabama?! I say give the Neo Confederates their independence to set up a country run by snake handlers and Ayn Rand mavens and see how long it lasts before it crashes and burns. I’d say about ten years.

The bondholders made a mistake pure and simple – they bought into the wall street promotion scam and value claims – they deserve to be beat – the bonds are worthless – write them down and start over and stop complaining and take responsibility for your own stupidity – everyone knew a long time ago that it all was a scam – face the music!

Wherever do you think that money comes from, Santa Clause? getyourfactsstraight

Haha! Where do you think money comes from? A gold mine?

Money currently comes from debt created by the banks (including the Fed) and has been used to drive the population into debt slavery with their own stolen purchasing power.

The debt is thus morally invalid.

But yeah, the US Treasury could act as Santa Claus to end that debt slavery and this Depression too.

Aren’t alot of these bonds managed by the firms run by 1% types but owned, ultimately, by union and state employee 401Ks & pensions and general 401Ks & pensions of the 99%?

I’m not sure it’s quite as Manichean as Professor Hudson’s post suggests.

It seems like part of the 99% owes money to another part of the 99% — while the 1% wins no matter who pays who, because they are the door through which the money flows, and they take a cut each time it flows.

We dig for gold, and they get rich. So gold isn’t money is it? But the digging for it, that creates money waves that localize in gold, making it money. That’s what Profeser Delerious Tremens told me anyway.

It seems like part of the 99% owes money to another part of the 99% — craazyman

Excellent point which is why we should go for a universal bailout instead of defaulting or loan forgiveness.

Right, you noticed that too. Let’s say what the rich don’t own outright they effectively control. Grease this palm, contribute to this candidate, buy this alderman, hire this slick $1000 per hr lawyer, put your guy on this board, buy controlling interest in this company or become their sole customer. Control is effective ownership. You try that as a pensioner of a state pension fund.

I get sick of people calling Social Security an entitlement as if it’s a welfare program. Social Security is only an entitlement in the sense that people are ENTITLED to get back the money they were forced to pay in by gov. to begin with. Soc. Security holds more of our debt then any foreign entity and they are bound by LAW to pay it back. Thus they want to raise the retirement age rather then fix it in the hopes that more people will die and they can pay less. SS is an entirely self funded program paid for by employee’s/employers & it doesn’t add one cent to the deficit by law it can’t tax nor can it deficit spend.

Politician’s want the younger people to misunderstand S.S. by fueling young people’s rage. I cannot begin to tell you how many people even older people don’t understand that. SSI is an entirely dif. prog. as is medicare btw. The only way S.S. funds even come into play in gov. spending is when the fund cashes in it’s IOU’s and that would be the same with any creditor yet people are worried about paying back China and want to throw the senior’s who paid into the program to the wolves. They rant about boomer’s in reality the boomer’s who are just NOW starting to collect were not even born when S.S. was enacted and they will be the first generation in history to get back less then they paid in.

The TRUTH About Who Really Owns All Of America’s Debt

Read more: http://www.businessinsider.com/who-owns-us-debt-2011-7?op=1#ixzz253oaUYDr

Social Security is a social insurance program, not an entitlement.

As is well known, the financial sector periodically crashes the economy. If your retirement money is private, bad luck to you if you need to retire in the midst of a crash. Social Security insures against that.

Retirement with dignity is a public good that the private sector can’t provide.

Succinctly said!

Libertarian types argue that the surplus in the SS trust fund doesn’t exist. They first argue that it’s gone, Congress spent it. They then attempt to say that the bonds, being special issue bonds, aren’t “real” bonds. Finally, they say that repaying the bonds requires additional taxing of taxpayers.

Not that any of these arguments hold any water on closer inspection, mind you. Ideology always trumps facts anyways. “It’s my money. I built it. If granny was too lazy or stupid to take care of her retirement, throw her off the cliff.” Make sure you tell the younger generations that granny is living high off the hog on a program they’ll pay into but will be insolvent long before they collect. Spout off double digit trillion dollar figures as representing unfunded liabilities for additional shock and awe value.

As a measure of comparison, does anybody know what our unfunded liabilities going forward forever is for our defense budget?

Finally, they say that repaying the bonds requires additional taxing of taxpayers. LucyLulu

I’ve come to the conclusion that the game is to protect the real yields of debt holders of monetary sovereigns (e.g. the US). Deflation does not increase the default risk since there can be none on the debt of a monetary sovereign but it does increase its real yield.

The irony and hypocrisy is that the debt of a monetary sovereign is itself a form of welfare since a monetary sovereign has no need to borrow in the first place!

“It is the modern American equivalent of England’s Enclosure Movements of the 16th to 18th century.”

More people need to learn about the Enclosure Acts and the Scottish Highland Clearances.

Past examples of state-sanctioned takeover of public goods by elites. History is repeating itself and most people don’t care.

Aren’t pensions getting better because the rebound in equities the past few years? (http://www.reuters.com/article/2011/06/08/us-usa-states-pensions-survey-idUSTRE75755T20110608)

Sure there are a few places that are still kind of screwed, but for the most part all the people screaming about pensions were just judging the financial prospects of a pension fund in the middle of a historic economic crash which is a dumb thing to do. I also do not understand the author’s focus on interest rate policy as the return on equities is not being depressed by low interest rates as far as I can tell.

While the distributional effects of cutting programs that benefit lower income people to pay wealthy bondholders are galling, calling for a default on bonds is a bad idea. State infrastructure projects are almost always financed by borrowing. A default would make those borrowing costs go up for future projects. The better solution to just have the federal government finance the revenue shortfall at the state level until the economy recovers. That option is mentioned in this piece, but pretending the default option is anywhere near as attractive is something I don’t agree with.

Two questions.

(i) What property tax rate as % of mkt value is appropriate. Personally, no one should ever pay more than 1.5% of mkt value.

(ii) Michael Hudson argues that teacher’s salaries have not risen that fast. I ask, how much have teacher’s salaries increased over the last decade, compared to the median wage?

Let me qualify point (i). Why not hav Dems propose a progressive property tax, with the very wealthy paying 15% or more of their property value to the city/town each year?

Totally unworkable, in practice.

Here’s why:

Basic principle of property taxes is “Equity” (think: “Fairness”) regarding similar properties being taxed the same, based upon location.

The fastest way to have enraged taxpayers popunding on your door is to have inequities in having dissimilar tax assessments on similar properties. Not good.

That would be what you are promoting with your approach.

Secondly, you will have created the mother load of administrative nightmares. Basically, you would be applying (grafting) the principle of graduated income taxes onto property taxes, which is a totally different taxation structure, operating in a totally different fashion.

Thirdly, you are now exposing all the ‘dirty little secrets’ which exist in property taxes. Most of which are centered in highly urban environments (say, someplace like Cook County, IL). Which, btw, just happens to be highly Democratic. You would probably single handedly encourage much of the owership of expensive housing in places along the North Shore lying south of the Lake-Cook County boundary line to relocate outside of Cook County. Not to mention all the high priced lakefront properties, like in say, Hyde Park.

Also, if the same rules apply to Commercial and Industrial properties, there’s some more of your tax base saying “Bye Bye” as they relocate to more taxation friendly environments.

Don’t think it’s going to fly – except into the dumpster.

California already has inequal tax payments for similiar properties because of prop 13. It’s extremely common to have a neighbor pay 10% as much as another simply because of when they bought the house. And I don’t see prop 13 going away any time soon, since the ones paying the least, are the ones that vote the most.

I couldn’t believe it when I first heard about proposition 13 in Cali. It’s an inherited tax privilege for property owners. Sounds like pre-revolutionary Europe.

Its the sort of thing people’s great-grandparents moved to the States to get away from.

“I ask, how much have teacher’s salaries increased over the last decade, compared to the median wage?”

A better question might be, why has the median wage not increased over the last decade?

“why has the median wage not increased [in the last decade] since 1974?”

fixed it for ya!

We always used a figure of 2.67% of the FMV (Fair Market Value) of your property was the MAXIMUM property tax burden that could be applied to a property. This percentage would work for a highly reliant property tax state like Illinois, but the percentage will vary depending upon how much of the tax burden is carried by property taxes.

So, if you have a property that was (pre 2008) worth $350,000 then, and is currently worth about $225,000, you are talking a maximum of right around $6,000.00

That percentage was considered to be the trigger for Prop 13 back in CA back a long time ago.

FYI, figuring the percentage burden is done as follows:

1) There’s usually a tax rate. It is so many dollar/cents per hundred, or thousand, etc.

2) There’s an Assessment (statuatory) percentage. It may be 100%, or a lesser percentage. Iowa (I remember) is 100%, Illinois is one-third (.333)

3) Tax rate / Assessment percentage = Percent of RE Taxes.

Ex.: $8.00 tax rate / .333 = 2.666%, rounded to 2.67%

Thanks for the data (the 2.67%). Detroit missed the memo. Many are paying 5%+ on recently purchased homes.

Property tax in CA is based on 1% of purchase value. It goes up a very small amount during the life of the loan. For example my son’s home was purchased for $500,000 or $5000 tax per year 11 years ago. The bank is trying to sell the home that had a value of $700,000 for $300,000 or the tax will be $3000 per year. Sadly they will not sell the home to my son for $300,000 which is the only way he could lower his taxes to $3000. It also means he loses the improvements he made on the home. I bought my home 32 years ago and my taxes are $1200/year. My neighbor pays $500. Another neighbor pays $3000 for the same home. Proposition 13.

Sentence from the Hudson article: “That is what a free market means today – income created by public-sector investment, “freed” to be paid to banks as interest rather than to be recaptured by government.”

Sentences as such are neither true nor false.

Furthermore, it should be clear by now that in general there are no criteria for distinguishing the real from the not real, or the true from the false.

In general, true sentences are those uttered by the 0.01 percent. All other sentences are false, unless we agree with them.

Michael Hudson is not a member of the 0.01, and last I checked, he’s not on our payroll. Therefore the sentence quoted above is false.

However if the same sentence had been spoken by one of us, or if Michael Hudson was on our payroll, then that alone would make it a true statement.

The nice thing about being a member of the 0.01 is we don’t have to be rational, nor do we have to make any sense. We are the bailed out job creators, if we say so.

If you disagree with us (and you’re important enough so your opinion matters), then we’ll send in a team of stone-humorless, faceless predators, wearing uniforms and packing guns, and they’ll help you to see things our way.

We are the Peter Pinguid Society, we are the 0.01 percent.

Well said, PPP.

A+

Michael Hudson’s truth is stark. No B.S. Not for sissies.

Total bank assets as a share of GDP are up from 50% in ’80 to 85% today, including 130% of private GDP and nearly 200% equivalent of public and private wages.

Moreover, total cumulative compounding interest to term for total US credit market debt owed is now equivalent to GDP.

No growth of (un)economic activity is possible hereafter in real terms per capita.

Given the size of bank assets to private GDP, wages, and gov’t receipts, the banksters effectively have virtual 100% claim on all US labor product, profits, and gov’t receipts in perpetuity.

It is not a stretch to assert that the US is now for all practical purposes a bankster-owned corporate-state dictatorship.

Re-evolution’s callin’ . . .

BC, and how much cash “disappeared” in Iraq did they pocket moreover?

“put the class war back in business” ??

im sorry but when was the class war in america out of busines?? At times(like now for instance) they have been more openly aggressive,less openly aggressive at other times, but always, constantly grinding us down into the serfdom they have in store for us.

This is just a new chapter of the Shock Doctrine. The financial elites already knew it was profitable to crash the economy in boom-bust bubbles due to extracting earnings as bonuses before the crashes and the various ways the fed and government would prop their businesses back up.

What it seems they finally realized is that the bigger the economic crash the bigger the shock, and the more “opportunities” there are for them to pillage.

Its a feedback loop. Those always accelerate.

John Perkins: “Confessions of an Economic Hit Man” shows How It Works.

IMO, Professor Hundson needs to spend more time in the field seeing how government really functions, and less time in his ivory tower thinking ‘great thoughts’.

There’s a lot of good in his treatise, but there’s also a lot of bad. I say that from experience. Few observations from the ‘real world’:

1) F. Beard has it right regarding Professor Steve Keen’s ideas on a universal debt jubilee/holiday. The overriding principle is “That which can’t be paid, won’t”.

But, understand, that same principle is also going to end up applying to public sector pension plans and current retiree benefit packages. Everybody’s going to take a hit.

Reason is that if you look at many of the pension plans, the ‘backstory’ is that a substantial percentage (varies by plan) of their investments are in investment grade bonds.

Are the financial elites guilty of a lot of things? – Oh, yeah. That’s why we need a replacement for Eric ‘Place’Holder like yesterday – somebody who will get serious about all the financial fraud (from Wall Street & the Banksters) that has created such damage in our society.

Regarding public sector unions, IMO, they have to dial it back in. When most local governments have at least 80% or more of their total operating expenses in labor and everybody knows that we’re going to have less money (when you have a 33% to 40% overall drop in property values, you’re going to eventually end up with a lot less money), well, you are going to have to seriously change the way you are doing business. That means massive influx of technology, it means program/task outsourcing (not ‘Crony Capitalism’ like the Chicgo parking meter deal), it means contract work, etc. – it means competition.

That’s simple, commonsense reality. But I can tell you, the public sector unions aren’t having any of it. And that’s going to eventually be a loser for them.

Professor Hudson disparages the “Starve The Beast” concept. Well, from practical experience, when a union’s every response in budget and contract issues is “You’re just going to have to add more people” or “pay more overtime” – and that’s a practical impossibility in this economic climate, then that’s when the “Starve The Beast” mentality comes into play.

Professor Hudson needs to wake up & see what it’s like out here in the real world.

Professor Steve Keen’s ideas on a universal debt jubilee/holiday. The overriding principle is “That which can’t be paid, won’t”. Small.Business.Guy.1

I don’t think you get it. Steve Keen’s “A Modern Debt Jubilee” would give money to the population, including non-debtors, so debts could be paid:

A Modern Jubilee would create fiat money in the same way as with Quantitative Easing, but would direct that money to the bank accounts of the public with the requirement that the first use of this money would be to reduce debt. Debtors whose debt exceeded their injection would have their debt reduced but not eliminated, while at the other extreme, recipients with no debt would receive a cash injection into their deposit accounts.

The broad effects of a Modern Jubilee would be:

1. Debtors would have their debt level reduced;

2. Non-debtors would receive a cash injection;

3. The value of bank assets would remain constant, but the distribution would alter with debt-instruments declining in value and cash assets rising;

4. Bank income would fall, since debt is an income-earning asset for a bank while cash reserves are not;

5. The income flows to asset-backed securities would fall, since a substantial proportion of the debt backing such securities would be paid off; and

6. Members of the public (both individuals and corporations) who owned asset-backed-securities would have increased cash holdings out of which they could spend in lieu of the income stream from ABS’s on which they were previously dependent.

Clearly there are numerous complex issues to be considered in such a policy: the scale of money creation needed to have a significant positive impact (without excessive negative effects—there will obviously be such effects, but their importance should be judged against the alternative of continued deleveraging); the mechanics of the money creation process itself (which could replicate those of Quantitative Easing, but may also require changes to the legal prohibition of Reserve Banks from buying government bonds directly from the Treasury); the basis on which the funds would be distributed to the public; managing bank liquidity problems (since though banks would not be made insolvent by such a policy, they would suffer significant drops in their income streams); and ensuring that the program did not simply start another asset bubble. from http://www.debtdeflation.com/blogs/2012/01/03/the-debtwatch-manifesto/

Actually, I’ve been following Professor Keen’s ideas for some time now. A breath of fresh air for fixing the problems.

Note that Steve Keen’s plan is a one-time injection of new reserves. Thus Keen says that banks and owners of MBS would suffer a loss of income from the foregone interest payments because of loan prepayment.

However with a metered bailout, the ability to prepay would be much more limited.

Steven keen’s idea is good, but how will our population, and the people and elites of foreign countries react? We should remember that the bailout of the banks( which was done in a highly irresponsible manner), inflamed the anger of the 99% on the Left and Right of the spectrum? How would we sell this program . What would convince the population that this program will be implemented in a responsible manner and not result in people becoming afraid of using and keeping US currency? And remember, this program would probably need to be implemented globally OR it will be opposed globally.

Any thoughts from anyone?

We should remember that the bailout of the banks( which was done in a highly irresponsible manner), inflamed the anger of the 99% on the Left and Right of the spectrum? Heretic

The difference is that Keen’s plan would give money to the victims, the general population, instead of the villains, the banks.

Small.Business.Guy.1 wrote: “When most local governments have at least 80% or more of their total operating expenses in labor”

80% or more in labor??? Where did you get this number? According to the published budget, the city where I live spends 44% on “personnel costs”.

Exaggerating labor’s role in the fiscal problems faced by local governments has become quite fashionable.

Uh, “starve the beast” is not a consequence it is an ethic manifesting the guiding principles of the oligarchy. An ethic indistiquishable in the real world from sociopathy. When plutocrats find something that empowers workers or puts wealth beyond their reach and they are unable to buy it, they are going to do their best to “drown it in the bathtub”.

But Keen’s solution saves the rotten System. Hudson is “One of Us” (“Freaks”).

We should abolish credit creation at the same time.

Please explain how higher taxes have been capitalized into mortgages, thereby shifting tax burden into homeowners and away from commercial property holders, this was not explained well by the author, thx.

Municipal defaults are coming, but they will be used to break union contracts and pensions. All to give more money to the 1%. A promise to the people is worthless, a promise to a banker is sacred — they literally use that word. “The sanctity of contracts (to US, not YOU)”.

Another sign of the times: Camden, NJ got rid of its police force. In its place, non-union county police. Gov. Christie loves it!

I see Small.Business.Guy.1 wants nobody working for local gov’t to make more than $50k/year. I guess that will make it even easier for business owners to bribe local officials. Keep working life as precarious as possible — no benefits, no retirement, no college for your kids. What a wonderful country this will be!

“….nobody working for local gov’t to make more than $50k/year.”

That’s just stupid. You don’t put high tech tools in the hands of drones and expect long term positive results. But when you have public sector unions that come across as ‘brain dead’ because they won’t consider any other alternative than “adding more bodies” regardless of the financial situation, don’t be too surprised if the folks on the other side of the table end up taking the “Starve The Beast” approach.

You want to know why Camden, NJ got rid of its unionized police force?

Because they just didn’t have a choice. The medium and long term numbers just didn’t work. The real problem is that Camden, NJ is anything but a special case.

Or to squeeze the middle-class.

A couple o days ago, a judge mandated that Harrisburg, PA must increase the income tax by 100%, from 1% to 2%.

An unelected judge decreeing fiscal policy!!!!!

**********

http://www.businessweek.com/news/2012-08-27/harrisburg-council-must-hike-tax-pennsylvania-judge-says

Harrisburg’s City Council must double an income-tax rate on residents to help pay for essential services in Pennsylvania’s capital, a state judge ruled.

The tax would climb to 2 percent from 1 percent for a year under the ruling yesterday by Commonwealth Court Judge Bonnie Leadbetter. The move was sought by William B. Lynch, the state receiver trying to fix a financial crisis in the insolvent city of almost 49,700.

**********

More from the same story:

“The city, where 30 percent of residents live in poverty, owes more than $300 million on debt tied to an overhaul and expansion of a trash-to-energy plant that doesn’t produce enough revenue to cover the obligations. Besides boosting the tax, which would yield about $5.1 million in 2013, Lynch’s plan calls for the sale of municipal assets, including the incinerator.

“We’re in dire straits here,” said Cory Angell, a spokesman for Lynch. “We need that funding source to help the city provide basic services.”

City creditors aren’t bending to do their part, according to Dan Miller, the city’s controller. “

Is the additional tax revenue, triple the amount the city normally gets (if you exclude the 0.5% that is dedicated to the schools), needed to pay to continue city services or to pay creditors? One assumes most is needed to go towards debt service. What’s wrong with this picture, if half or more of revenues is being used towards paying debt? Wouldn’t it be more appropriate for the receiver/judge to declare bankruptcy? Or at least to force creditors to take haircuts?

We need an amendment that prohibits the sale of public assets to private entities. Leases could be permitted under limited, specified circumstances that would serve the public interest.

In some ways that’s a breath of fresh air, because it’s an income tax. Most cities are being ordered to sell off their water systems, and so forth — really genuinely bad ideas. Raising the income tax is pretty harmless.

According to the article, they were ordered to sell their incinerator. If I’m not mistaken though, this is the same thing they have all the debt on. Either they’d have to sell at a large loss, or incur a steep hike in fees for its use, if I understand correctly that revenues from the incinerator aren’t close to adequate to cover the debt.

From Salon:

It might sound like David Axelrod’s fever dream, but it all actually happened, according to FDIC documents obtained by Rolling Stone’s Tim Dickinson through a Freedom of Information Act request.

Bain is central to Romney’s origin myth, as is the notion that he built it with nothing but his wits and handiwork, and no help from Uncle Sam, thank you very much. But in the end, Dickinson reports:

The FDIC agreed to accept nearly $5 million in cash to retire $15 million in Bain’s debt – an immediate government bailout of $10 million. All told, the FDIC estimated it would recoup just $14 million of the $30 million that Romney’s firm owed the government. It was a raw deal – but Romney’s threat to loot his own firm had left the government with no other choice. If the FDIC had pushed Bain into bankruptcy, the records reveal, the agency would have recouped just $3.56 million from the firm.

Mitt Romney, you didn’t build that.

Link to Salon article referenced above:

http://www.salon.com/2012/08/30/bains_secret_government_bailout/

And originally reported here:

http://www.rollingstone.com/politics/news/the-federal-bailout-that-saved-mitt-romney-20120829?page=2

Thanks, interesting article, sc.

The FDIC could have done rather better if our federal court system weren’t totally corrupt.

Before the corruption of the court system, Romney could have been arrested and removed from his position of influence over Bain Capital and its subsidiaries for his threat to loot the company. Every penny he had received from Bain could have been recovered as ill-gotten gains.

But our courts have decided that laws are for the little people, so the FDIC couldn’t just do this.

This is the sort of criminality-and-getting-away-with-it which makes me want to see folks like Romney brutally ax-murdered; it is unlikely to happen but he would sure deserve it.

Many municipal bond investors are not ,the wealthy, but hard working middle class and professional people who eschew stocks in favor of something more conservative. It’s not accurate to stereoptype and lump together all fixed income investors in the tax exempt market.

And many are not. And the few how enjoy 99% of the rents are banksters and 1%ers.

To “lump together all fixed income investors” as “hard working middle class and professional people” is at best propaganda.

who eschew stocks in favor of something more conservative. Conscience of a Conservative

You mean more exploitative, don’t you? Nothing like a sure thing at the taxpayer’s expense?

These economic crises are all on paper. Nothing’s been burned down or bombed flat. It’s all a big wealth and power grab by the 1%. Back to aristocracy, and maybe oligarchy or monarchy.

Seriously. Even in Israel the march from egalitarianism to oligarchy moves apace, with just 16 families now owning, overnight!, about 60% of equity.

The Kochs and their peers around the world are making their move, perhaps. Will they wear crowns this time?

Also, would Mitt REALLY oppose the oligarchs of Russia and China, or would he see them as rightful ruling class fellows?

Well, if Webster Tarpley is a sound guide then Mittens the Mormon is a solid Anglophile and thus a solid Russophobe.

Ironically “what New York City did to avert bankruptcy in 1974: turn over management to Wall Street nominees”…decided my Calling. After being ‘excessed’ 3 times from my public school teaching job, i saw the writing on the wall, and went to work on Wall Street. Strange destiny.

While we talk about all these potintial problem, fixes and reforms, none of it will happen without one big reform, campaign finance reform. Politicians have to serve those who pay there bills and the pay they get from the citizens, in yearly salaries, does not begin to cover their bills.

They have to serve their masters and their master are not the american public.

http://republic.lessig.org/

Absolutely true. The key issue. We do not have a democracy now, and that’s how revolutions are born.

Z, read “The Last Hurrah” (also film): TV advertising would transfer patronage from the little guy to the TV “sponsors.”

Check out Doug Henwood’s “visionary” book “Wall Street” (1996). In one of the final chapters he talks about the 1974 financial crisis of NYC that Ford refused to help. I had read Klein’s “The Shock Doctrine” and realized when I read Henwood’s book that this grab by the bonds holders and attempt to deregulate, privatize, and cut social services was the first serious attempt to try the Shock Doctrine in the U.S. Klein said that Nixon had spurned Miltie Friedman and so they moved to try it on NYC. Particularly awful comment at the time was

“Whether or not the promises…of the 1960’s can be rolled back…without violent social upheaval is being tested in New York City…If New York is able to offer reduced social services without civil disorder, it will prove that it can be done in the most difficult environment in the nation”. He then concluded “the poor have a great capacity for hardship.”

Here’s the analysis by Henwood: “these fortunate uses of crisis first appeared in their modern form during New York City’s bankruptcy workout of 1975. This is no place to review the whole crisis; let it just be said that suddenly the city found its bankers no longer willing to roll over old debt and extend fresh credits. The city, broke, could not pay. In the name of fiscal rectitude, public services were cut and real fiscal power was turned over to two state agencies, the Municipal Assistance Corp. (MAC, chaired by [Felix] Rohatyn), and the Emergency Financial Control Board, since made permanent with the Emergency dropped out of its name. Aside from the most routine municipal functions, the city no longer governed itself; a committee of bankers and their delegates did, Rohatyn first among them. Rohatyn, who would later criticize Reaganism for being too harsh, was the director of its dress rehearsal in New York City. Public services were cut, workers laid off, and the physical and social infrastructure was left to rot. But the bonds, thank god, were paid…

The first quote was from an op ed by L.D. Solomon.

MM, good info. But surely this is also “ritual trauma” to the middle class.

The boomers screwed up? Our parents — the Greatest Generation — are the ones who made out like bandits. We are getting squeezed now and our children will be out in the cold.

Sorry, wrong thread.

Great Hudson clarity. It looks like that Italian “Gomorrah” custom of kidnapping prime beef of the .01% is going to be all that’s left for the desperate 99% to do. In addition to playing “gather round the guillotine” with or without the knitting.

LOOK how many people have commented on this post. Wow. I would like for folks to compare the frame Michael presents to the just completed, Republican National Convention. Did you hear terms such as “class war” or “the 99%” uttered by anyone at the convention? I have to admit to being nauseated by the ridiculous American Exceptionalism spouted at every turn to have actually paid close attention, but in the snippets I have seen, those terms were far from the convention. The convention wasn’t just in another frame, it was in another universe. I expect the same from the Dems.

WE ARE AT WAR! Yet, even while our enemies are hacking us to bits, you will hear, not just Romney, but Obama state, plain as day, that there is no class war in America. They are lying. The problem I see, so often with fellow Americans is that they cling to myths – particularly the myth that America is a classless society. Turn off your TVs, re-read the Great Gatsby. Think more like Shakespeare (Neither a borrower nor a lender be) and less like Donald Trump. Donald Trump is an anachronism, an artifact of easy credit. Fire him.

Look, I know much less about economics than Dr. Hudson, but I do understand one thing – wages pay all debts. I watched as GDP grew far faster than wages for the last 30 years. How could this be? It worked like this – high paying jobs in manufacturing were off-shored to increase corporate profits (a plus to GDP), then wage-earners were encouraged to use credit to maintain their lifestyles while their wages stagnated. Corporate profits soared. Asset values were inflated by easy credit and folks used HELOCs to buy cars, send their kids to school, live large, etc. This encouragement into using credit to maintain life-style reduced the pressure on wages and trade policies. It inured the 99 to the rapacity of the 1%.

Unlike most, I ardently hope for an all-on collapse of the global financial system. Why? Because we need to rethink it. We need to be forced out of easy credit to actually recognize our own realities, not the myths corporate media spoon-feeds us. Keen’s jubilee and Hudson’s wealth tax ideas would only gain serious traction if the current system collapses and the 99 wake up to see who it is that wants them in chains.

I agree that bondholder should get stiffed on their bonds. but this is the end result of socialism and voters being seduced into living off the system by lenders/investors who exploit them. voters should know better than to become dependent on promises of retirement funds and other entitlements being there years after they voted and paid into them! Of course the gov’t looted the payments and left worthless bonds. what do voters think would happen to that booty just sitting there, like a forbidden fruit. everyone loses in the end, but voters are EVEN MORE GUILTY for expecting open ended programs in exchange for their small premiums years in advance. i hope everyone learns about self reliance after this debacle! you never get something for next to nothing! especially when you think others are supposed to contribute more than yourself. tough nuts!

So how do we go about not paying the bondholders, when they have the full force of the law and the state on their side? Don’t tell me marches.

That’s the important thing. Now, to be really persnickety, is it true that property taxes are being cut all over the place? I know where I live in Allegheny county, property taxes are technically frozen at a “base year” but in reality are falling because of all that ignored property appreciation (which everybody loves when selling their homes, nobody loves when paying taxes.) But we may be modestly special in that sneaky regard. In general, out there, I’ve gotten the impression that property tax rates are slowly going up.