By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Composite Purchasing manager Index(PMI) data was released overnight for the Eurozone and much like the manufacturing release earlier in the week there was nothing to get excited about. German services collapsed in August to their worst reading since July 2009 and the composite index for the country moved deeper in contraction at 46.3. It now has become clear that the slow-down in economic activity in the Eurozone is biting the export giant.

Aside from Ireland the news elsewhere wasn’t much better as Rob Dobson from Markit economics explains:

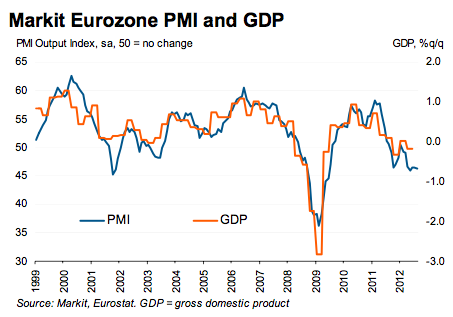

The final August PMI came in only slightly below its earlier flash estimate, leaving the Eurozone economy on course to fall back into technical recession in the third quarter. Sharp declines in new orders at manufacturers and service providers, plus further job losses, mean that there is little prospect of a sustained improvement in economic conditions over the near-term.

Some heart can be taken from the recent recovery in Ireland, which is providing hope to others that a return to growth is possible, and further evidence that the downturns in Italy and Spain may at least be easing. The looming concern is the increasing signs of weakness coming out of Germany, the nation others were looking to as a pillar to prop up growth in the broader currency region. With its export engine in reverse gear and domestic demand faltering this is looking less likely as the year progresses. If the core nations falter, the outlook for the periphery will surely worsen.

To the report:

Eurozone economic downturn continues in August, as output contracts further in Germany, France, Italy and Spain

- Final Eurozone Composite Output Index: 46.3 (Flash 46.6, July 46.5)

- Final Eurozone Services Business Activity Index: 47.2 (Flash 47.5, July 47.9)

Eurozone economic output contracted for the seventh successive month in August. At 46.3, down slightly from 46.5 in July, the Markit Eurozone PMIComposite Output Indexcame in below its earlier flash estimate of 46.6. The average index reading so far in Q3 2012 (46.4), is in line with that registered for the second quarter as a whole.

The downturn in output was again steeper in the manufacturing sector. Although the rate of contraction in manufacturing production eased to a two-month low, it was still one of the steepest registered since the end of the previous recession in 2009. Service sector business activity fell for the seventh straight month, and at a slighty faster pace than in July.

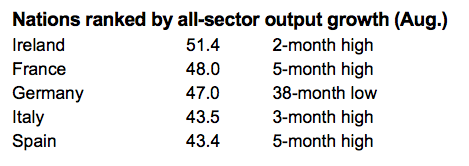

August data signalled a widespread contraction of economic activity across almost all of the nations covered by the survey. The steepest rates of decline were still registered in Spain and Italy, while the modest downturns in Germany and France also continued. Brighter news was signalled for Ireland, with output rising for the third month in a row and at a slightly faster pace than during July.

Services and manufacturing combined:

August data signalled that the Eurozone economy was still being hit by weaker inflows of new business, leading to rising job losses and the ongoing presence of excess capacity.

Incoming new work fell for the thirteenth consecutive month in August, with the rate of decline the second-fastest during that period. Companies indicated that underlying demand for goods and services was being affected by the ongoing debt and political uncertainty in the Eurozone, and by the onset of softer global economic growth. The big-four nations all reported reduced inflows of new business, with the steepest rate of decline reported by Germany.

Further job losses were reported in August, as companies reacted to weak demand and lower activity by cutting excess capacity. Payroll numbers have now fallen for eight successive months.

Employment fell in France, Italy and Spain, but only Italy reported a quicker rate of job losses than in the previous month. Staffing levels were broadly unchanged in Ireland. The German labour market continued to hold up comparatively well, with modest job creation recorded for the third time in the past four months.

Backlogs of work continued to decline despite lower employment. Outstanding business declined for the fourteenth straight month in August, with solid reductions signalled in all of the nations covered by the survey.

Cost pressures rose moderately in August, as an accelerated rate of increase at service providers offset a decline in manufacturers’ average input prices. However, the rate of deflation at manufacturers eased sharply over the month.

Strong competition and weak demand continued to exert downward pressure on average selling prices in August. Output charges declined at manufacturers and service providers alike, with the slightly steeper rate of reduction in the service sector. Selling prices fell across all of the nations covered by the survey. Spain saw the sharpest reduction, whereas the pace of decline was only negligible in Germany.

- German Services PMI report

- French Services PMI report

- Italian Services PMI report

- Spanish Services PMI report

Tonight the ECB president, Mario Draghi, will release his proposal for further monetary stimulus in the face of growing economic trouble across the zone. As far a I can tell from the reports we are looking at a re-ignition of the SMP with an “unlimited” cap on the proviso of a binding fiscal program under one of the emergency mechanisms:

Under the blueprint, which may be called “Monetary Outright Transactions,” the ECB would refrain from setting a public cap on yields, according to the people, and a third official, who spoke on condition of anonymity. The plan will only focus on government bonds rather than a broader range of assets and will target short-dated maturities of up to about three years, two of the people said.

…

To sterilize the bond purchases, the ECB will remove from the system elsewhere the same amount of money it spends, ensuring the program has a neutral impact on the money supply. At the moment, the ECB mops up the impact of its mothballed bond-purchase program by offering banks weekly term deposits that currently return 0.01 percent.

With the central bank’s deposit rate at zero and the euro- area banking system currently awash in about 800 billion euros ($1 trillion) of excess liquidity, a larger bond program may not present the ECB with a major obstacle.

While the ECB doesn’t expect to have to spend large sums of money on bonds, Draghi’s plan calls for no limits to be set, two of the officials said. The ECB also won’t have seniority on any bonds it buys, they said. No yield-spread targets or bands will be set publicly, they said. Two said targets won’t be set internally either and that interventions will be discretionary.

All rumours and hearsay at this point. We’ll get the real story tonight from Mr Draghi which I can only assume will be followed by the response from the European political ranks on both sides of the divide.

Karma is a bitch.

Beyond “rumours and hearsay” is one indisputable fact: hyperinflationary shutdown of the physical and financial economy will proceed unabated and, indeed, accelerate, so long as every attempt continues being made by criminally insane central bankers to but further grow a mountain of illegitimate debt. These one trick ponies are reduced to decimating labor in order to free up capital, and are our modern-day fascist nightmare whose “magic of the marketplace” is about to empty supermarket shelves.

Where do you loonies get this bullshit about hyperinflation?

Various gold-buggery sites, I’d bet.

Hyperinflation will never happen as hyperinflation hurts the top 1% capital class infinitely more than the wage slave labor class. How am I so certain?

Look to early 80’s Volcker. The Powers That Be was more than willing to wring inflation out of the economy via high interest rates. Throwing the Rust Belt under the bus and double digit unemployment and the start of the off-shoring of US mfg. was not even an afterthought.

hyperinflation and deflation are really the same thing – just spaced out on the timeline a bit so economists have something to talk about.

Looks like Bubba rolled over and Draghi gets his plan. At first blush looks like they found some more road to kick the can down – but never underestimate what a continent full of soccar players can do.

But the full 472 pgs. of the plan will take some analysis, and i’m content to wait for other people to do it.

Does have words about conditionality and the ESM – far as I heard German court hasn’t signed off on the ESM thing yet.

Draghi claims this is within the ECB mandate. He says it’s all to do with monetary policy – he has to control the ENTIRE yield curve for sovereign debt for all Eurozone members. That’s news to me. Buying all the debt to achieve that goal has nothing to do with the “b”ailout word.

And what if the economy goes to hell anyway?

Testosteronepit. Hillary and Angela. Hillary went to China this week and talked tough because the role of her country in this new world is that of a military enforcer. Angela went to China and wore flowers in her hair. Hers was a trade mission and she made sales. Fewer than before, but still. So considering that Angela just got through saying Germany would not evaluate Greece’s fitness to stay in the EU (just b.s.) until they had heard from Greece’s “international investors” I think they talked about Greece too. And since Draghi came up with a bond buying plan before the German Courts handed down their decision on that one, I’m also thinking that the significant information here is this (above) “to sterilize the bond purchases the ECB will remove from the system elsewhere the same amount it spends to ensure a neutral impact on the money supply.” OK. How? This means wicked austerity somewhere unless China has agreed to do something. China’s official position on buying EU sovereign bonds is “nein” but China is very cozy with Germany. How can we find out if China has indeed agreed to buy German bonds of Greek debt, and mortgage CDOs thereby freeing up the Bunesbank’s reserves to fund the ECB’s purchases? This would eliminate a trillion in ‘assets’ from the ECB’s balance sheet wouldn’t it?

that’s Bundesbank. And just to carry this out: those Greek obligations might be backed with the full faith, credit and assets of Greece. As in oil and gas. And Hillary is making lots of noise about the encroachment of China into the South China Sea.

I’m also thinking that the significant information here is this (above) “to sterilize the bond purchases the ECB will remove from the system elsewhere the same amount it spends to ensure a neutral impact on the money supply.” OK. How? This means wicked austerity somewhere STO

No, I don’t think so since the debt of a monetary sovereign is ITSELF a form of money but one that pays interest. Since the interest paid is a form of “corporate welfare” the effect might well be slightly inflationary except for the “lower propensity to consume” of the rich.

The ECB is, in effect, saying to bond buyers “We’ll lend to the PIIGS and take the default risk and you’ll lend to us risk-free.”

Also, just remembered stg. About 2 weeks ago Israel won a concession from the Greeks to develop its oil fields. The whole system is banking on our new control of oil development.

Buba just came out with a response to the ECB! The ECB press release was released this morning implying “agreement among ECB members”, but it now looks like they didn’t consult with the one that has the money. Buba re-iterated what it has been saying all along – no sovereign bond buying!

So this is starting to look like one more ECB jawboning attempt that is turning into the same old public argument.

The part about sterilization is of course to make the plan look good to Germans, Arabs, and Gazprom.

The ECB pays interest on bank reserves (that’s where Ben got the idea). So when they say sterilization they will probably try to do it that way. Not that it would work – they can’t pay more that the ECB target short rate of .75%.

So all this new liquidity will end up at banks, then banks will decide whether to take the safe half a percent , or roll the dice and write some juicy complex derivatives, buy a London bank, or maybe invest in a Chinese Ghost City.

Not a good sign… Capital flight from Spain at new high http://euobserver.com/tickers/117452

Capital flight from Spain has exceeded levels reached in Asia during the region’s financial crisis in the 1990s, according to research from Nomura Securities. The overall amount of money that flowed out of Spain in the second quarter was equal to 50% of the nation’s gross domestic product.

The Euro Crisis Explained To Grannies http://ideasforarevolution.wordpress.com/foreign-translations/the-euro-crisis-explained-to-grannies/

The Bible forbids usury from one’s fellow countrymen so the Euro is not such a bright idea for unifying Europe?

My favorite metaphor for the crisis of the euro…

Road Runner & Wile E. Coyote – Zoom at the Top http://www.youtube.com/watch?v=fsD-sePT3tY

I’m always so disappointed whenever I see a Pixar production.

I like these guys:

Eric’s Opera “Happy Feet Two”

I tend to like Australian productions better than American ones. Because the Australians are blessedly “behind the times”?

“To sterilize the bond purchases, the ECB will remove from the system elsewhere the same amount of money it spends, ensuring the program has a neutral impact on the money supply. At the moment, the ECB mops up the impact of its mothballed bond-purchase program by offering banks weekly term deposits that currently return 0.01 percent.”

I need a little help here. Is the ECB offering banks a 0.01 percent (annual?) rate of return on deposits or a 0.52 percent (annual) return on deposits to “sterilize its bond purchases”? Also, how the heck can a weekly deposit sterilize a multi-year bond purchase? And why would banks, that routinely receive about 5% on investments wish to play along? Or is this more of an optical sterilization – the money supply is still growing, but those dumber than stumps bond players won’t figure it out? Either I am too dumb to understand how this works – or it won’t. But what the heck, the market’s up almost 2% on the good news – suggesting that either I am really dumb – or someone else is.

I think you have stated correctly, so we are probably the two dumbest guys on the planet, today anyway.

But I say we give it a few days for the usual clarifications and denials to come out.