By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Lambert here. Yves comments: “A nice explanation of why austerity in Europe isn’t working (even though the writer is weirdly defensive about saying it in those terms).”

As the signs of social unrest continue to grow in the southern peripheries of Europe, highlighted again by the over night action in Spain, I thought it was timely to take a step back from the day-to-day and re-assess exactly what we are witnessing in the Eurozone from the longer macro-view.

If you’ve been reading my near-daily pontifications about Europe for any length of time you should be aware that I consider the policy approach being taken in the Eurozone to be the makings of a real disaster. I have been accused by some of being anti-austerity but that isn’t my real issue with the policy at all. My major concerns has been that policy targets of internal devaluation and export driven recovery in the absence of debt forgiveness on a near-contintent wide scale will fail because:

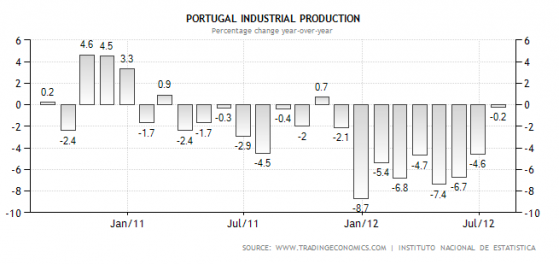

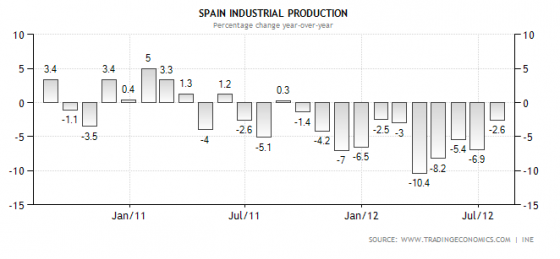

a ) the initial outcome will be a rapid decline in industrial production and national incomes which mean existing debts will become unserviceable

b ) external surpluses require a counter-party external deficit

c ) structural adjustments require investment

So basically, the three targeted outcomes for the existing policy a) service existing debts, b) lower government deficits c) become export competitive are incompatible because the expectation that falling internal demand will quickly be replaced export driven production is a form of utopian economic fantasy.

Over the last two years Greece has been held up as a ‘outlier’ for what should occur but the reality is, as Spain and Portugal are now demonstrating, that this outcome is the most likely and, as I have been discussing , completely predictable.

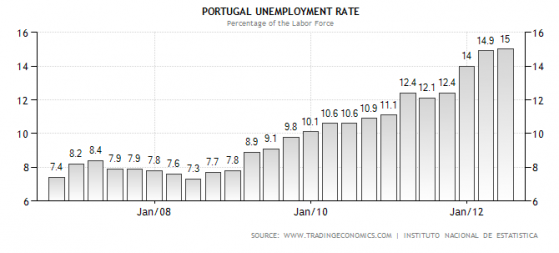

As I mentioned a few weeks ago, Portugal, the poster child of austerity, is failing to meet its targets even though it appeared to be on target over the previous 18 months. What we see in Portugal is a country bouncing off the limits of the current policy.

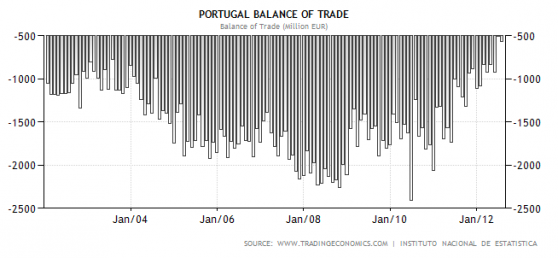

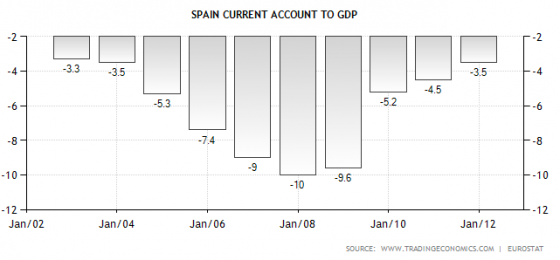

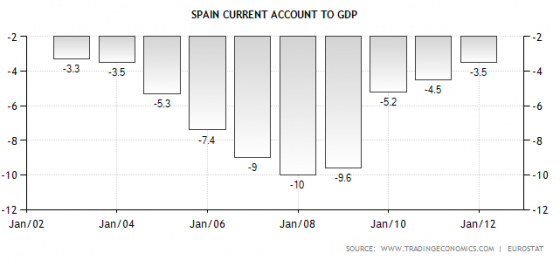

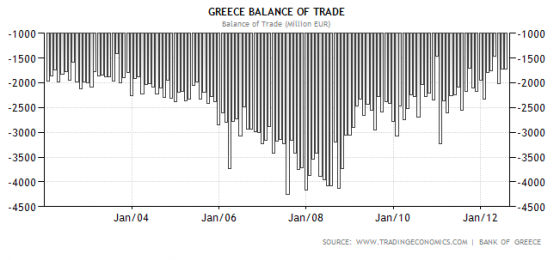

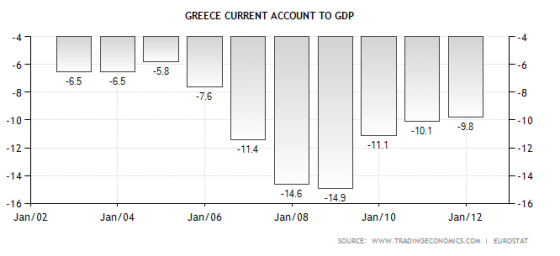

The basic premise of European policy is to tighten government budgets in an effort to drive down deficits. In the absence of a current account surplus in order to maintain a level of national income this requires an expansion of private sector balance sheets. If this does not occur then the most likely outcome is a slowing of internal demand and therefore a slowing of imports. This in turn should drive the balance of trade towards positive territory, but at the same time lower overall GDP.

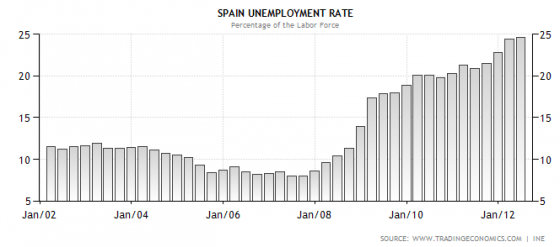

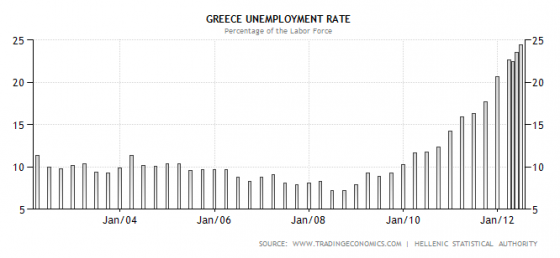

Falling GDP leads to falling national income, which in the absence of real across the board wage deflation means more unemployment and therefore slowing government revenues which, as I’ve said previously, leads to a self-defeating process of re-newed cuts to government budgets.

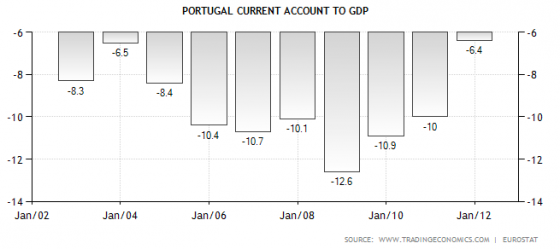

So in essence this whole process becomes a struggle between the balance of the external sector, real wages and unemployment and this is the dynamic we have been witnessing in much of the periphery over the last 18 months. What I have noticed recently is that the adjustments in periphery nations balance of trade has been seen by some as a sign of recovery, which in part it is, but ultimately what is required is a sustained current account surplus.

The counter-weight to these external sector adjustments is on-going social retrenchment that occurs as unemployment rises. This is why the existing debt and lack of currency devaluation are such barriers because without them it is likely to be impossible for struggling nations to reach a current account surplus, especially as they are all trying to enact the same policies all at once.

In short, much of the economic framework that allowed the periphery to get into this situation in the first place is now making it far more difficult for them to get out and it would now appear we are reaching the limits of the social and political systems within these nations to deal with the stresses. Obviously it’s not to much of a stretch to realise this situation could escalate quickly, and I have warned previously that political capital was likely to be tested over the next 12 months as the continuing deterioration in the Eurozone economy frays the remaining goodwill. I see the back-track from the Portuguese government and the growing tension in both Madrid and Catalonia as recent examples of just this.

Below are some corresponding charts of the metrics I have discussed above.

Portugal

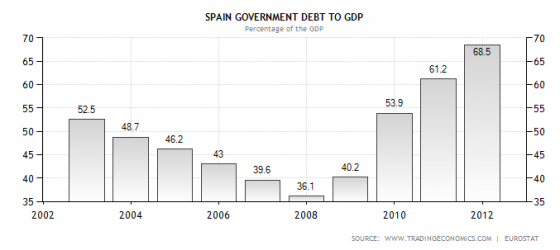

Spain

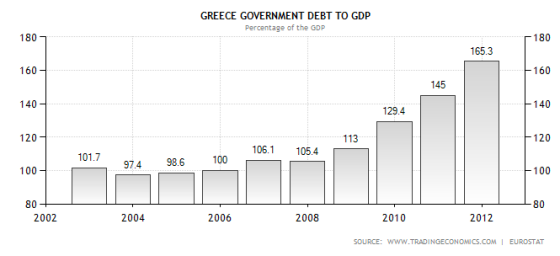

Greece

Greg Palast argues, and credibly, that the intent of the Eurozone experiment all along was the wholesale rollback, if not destruction, of the social democratic programs that flourished in Wesstern Europe over the last 60 years. A power play against democracy. A financial elite coup d’etat. So, all is well and right on track.

Palast offers a cogent explanation for the otherwise confoundingly stupid policies of the troika. And US right wingers have seized on the Eurozone as a justification for their austerian effort to repeal the New Deal. One cannot go a day without hearing “the US will wind up like Greece”.

Apparently, the dumber the argument, the easier the sell here.

Gil-

I don’t think the founders of the EU intended to destroy social democracy. I’d argue the impetus for the generous European welfare state came from two goals: preventing communism from taking hold from the left, and keeping fascism from gaining support on the right. Remember that the Bolshevik slogan in the October Revolution was “Peace, Land, and Bread”, and probably the biggest reason for the Nazis’ initial rapid rise was the economic deprivations of the Weimar Republic.

It’s hard to overstate how influential those two events (along with the world wars) were in shaping EU policy. And a generous welfare state was the main bulwark against either force.

That said, their *current* actions leave much to be desired, and indeed will likely contribute to the rise of the very forces the EU was supposed to prevent (e.g. the New Dawn party in Greece).

I would argue that it was indeed the intent of the architects of the EZ to destroy democracy. Twenty years ago, this “small group of far-sighted statesmen” in Brussels realized that a monetary without fiscal union was destined to fail. But they also acknowledged that the votes were not there for a US of Europe.

So they gambled. They bet that by the time a crisis made a fiscal union necessary, that Germans and Greeks would willingly cede citizenship of their motherland in favor of a nebulous adhesion to a US of Europe. They gambled that by the time the 2016 World Cup came, the “Spaniard” would prefer to cheer for a team from the US of Europe instead of a team from the “province” of Spain.

They gambled, and lost.

But they had Plan B. Even if the voters of Germany and Spain didn’t want a US of Europe, this “small group of far-sighted statesmen” were going to impose it by dictate.

And that’s precisely what they’ve begun to do via the debt monetization carried out by Draghi and the ECB.

Quite sad, actually, that so many progressives who would not tolerate such machinations in the US are nonetheless cheerleading this usurpation of democracy in the continent of Europe.

I can assure that what currently governs in Italy (and I would suspect Greece, Spain, Portugal and … ) is a distant cousin of democracy. What has reached boiling point in Greece, Spain and increasingly in Portugal and Italy (certainly fueled by financial hardship) is less a sign of rebellion against austerity measures than one against the systems and representation of governance. Although the press will NEVER present it that way … people are confronted daily with the impropriety of public officials, and the corruption of a self-regulating system, stacked with well-fed mooches.

The Italian parliament is a self-regulating body, and they are the only ones who can pass or amend laws. So … citizens can indeed vote for a different party but not for individual representatives. The political parties choose MPs and candidates for elections at regional and local levels. In order to ensure votes will follow party discipline, and often black-mailed by the risk of outgoing PMs divulging shananigans to the press, parties re-instate the old class … who in turn may switch party allegiance as needed. We have sitting MPs who were “voted” as left-leaning progressives, now in conservative parties and vice versa. It is this parliament who pass laws that govern public funding for political parties, and choose their own supervisory bodies. Of course in case of legal indictment, the suspect is immune unless a parliamentary commission agree to his guilt.

Prime Minister Monti (unelected chief architect of Italy’s austerity) is actually trusted by a thinning majority of Italians, and polls give him double digit advantages over any political candidate.

“Democracy must be something more than two wolves and a sheep voting on what to have for dinner.” ~ James Bovard

A rebellion against a political system, however, only happens when the political system is failing the people economically.

When Pharoah is providing everyone with good, rich lives, people don’t rebel against Pharoah. When there’s a grain shortage, *then* people rebel against Pharoah.

Here from Spain, I absolutely agree with you, brazza.

Europe was created by the TRI-LATERAL COMISSION MADE IN USA /MR.ROCKEFELLER in total Idea of control and One World Governance

One cannot go a day without hearing “the US will wind up like Greece” Correct. Our real fear should be ending up like China– an economy run by a corrupt elite.

“Our real fear should be ending up like China– an economy run by a corrupt elite…” ummm…. isn’t the USA already there? :(

That is a nasty and not very smart statement.

w

Wrong blog, Mr. Troll.

That’s doesn’t make any sense. The social state is still going strong in France, Germany, Benelux, Scandinavia – and in keypoints (maternity leave; unemployment support) is better than the portuguese or greek ever was.

I would it find it more believable that it was allowed for southern to go deep into debt, even though EU heads knew it as going to end badly, because it would favor the german economy. And, of course, profligate politians in the south were only too happy to oblige.

Also, the current shape of the EU happened over decades, with national interests and ideological lines constantly battling it out, politians shifting all the time, etc. It was too chaotic, in my view. I find it hard to believe that a small elite managed to direct the whole process. It would be far easier in the US, where a few families hold most of the power (eg, the Bush family managed several terms, and politians are usually chosen among a small group of families with ties to one another, like Kerry, I think).

Disclaimer: I am portuguese

Select programs remain intact, but for how long? And who gets to make the call on whether they continue or not?

The Euro was/is an extension of various unifications: first liberalized trade, then the dismantling of internal borders. Now a common currency and soon (perhaps) something close to a fiscal union.

Maybe in time a single federal structure will emerge and national parliaments will be subordinated to it and handle “local” affairs only, but as long as the people feel themselves as different from their neighbours, these cultures will survive and Europe will remain heterogeneous.

Has not having a state of its own destroyed the cultural identity of the Basques? Did living within Czechoslovakia destroy Slovak culture? There are still Scots and Welsh, proud of their heritage, living within a commmon state. Quebec’s unique culture has survived for a few hundred years within a federalist nation state.

The cultural identity of most of the ethnic groups will not be threatened by the emergence of a strong federalist state.

But perhaps a truly federal Europe will function better than a Europe of three dozen states. If so, it should be embraced, for as long as cultural autonomy for the regions is secure there will be no threat to any ethnic group.

If what you’re saying is true, perhaps the US and Mexico should scrap the Dollar and the Peso, and introduce some time of hybrid currency.

After all, the US and Mexico have FAR FAR more in common than Germany and Greece, and if those two made a go of it, certainly so can the US and Mexico.

The graph of Spain’s debt-to-GDP ratio doesn’t support the “profligacy” idea. Before the financial crisis, Spain’s debt was 36% of GDP and falling. Perfectly manageable, I should think.

That is well known. Spanish gov’t debt started to surge when the State has to bailout some banks in the first round of the crisis. However, those banks, most of them large coops, had to be bailed out because they served as the primary source of funds for corrupted gov’t officials, mostly from the currently governing party, but also for the socialists and the left.

Politicians ruined those ´cajas´(the largest of which is currently known as Bankia) by stealing too much, they went far, far, too far, not just petty money. So as a matter of fact, despite the data shown in the plots, the Spanish State was in fact the origin of the private debt. Two examples. 1) Almost all the new highways built around Madrid are insolvent because of (intentional) miscalculation of traffic. 2) A large proportion of the new airports in the south don’t have any flight (ghost airports) because of (intentional) miscalculation of traffic. The projects went on because gov’t official got sizable brives for approving them; they approved them for their friends, for their party comrades. The previous right-wing gov’t started the ‘fiesta’ by changing the law to make it easier to approve those projects. For how this weidespread corruption was used to fund political parties, do a search for “Gurtel site:es” as an example (there era more).

Iam sorry to inform you that inEurope the families are also very POWERFUL /Rothschilds /Queens etc..much more than stupid Bushs.wake-up he is a puppet! the politicians do not run the show for a long time !!in the CORRUPT WESTERN WORLD THE BANKSTERS are the ‘BOSS’!Rockefeller /Tri-Lateral funded Europe!AND THEY RUN BARROSO.VAN ROMPUY /MONTI &THE DERIVATIVE FRAUD CDS THAT CAN BREAK COUNTRIES LIKE MAGIC!!

A very good book you might be interested in about the Euro and the Union is The Tragedy of the Euro by Philipp Bagus.

It looks like the Euro was never meant to succeed but rather fail and give the technocrats who created it an excuse to further centralize the economy.

Just a thought but, could it be the social democratic model in European countries was never sustainable in the first place and now the chickens have come home to roost?

@Dave: Oh dear. You won’t supposed to note that.

Of course it’s the fundamental problem. Shrinking demographics means that the system is fundamentally unsound…without bankrupting the middle classes of Europe. Same story in the US, but instead of shrinking demographics, growing demographics, but with so much waste/corruption/incompetence that it amounts to the same thing.

Nonsense. The system was perfectly sound in Europe — there were no “shrinking demographics”. The retiring population was being tidily replaced by waves of immigrants.

Of course, that has created its own social problems — problems of integration — but it really is true that immigrants have been replacing the “natural birthrate” quite sufficiently to maintain the European welfare states.

With the economy collapsing, that may no longer be the case, the immigrants may stop coming, and NOW the welfare state may become unsustainable, but that’s a different matter

Nonsense? Correct me if I am wrong but, most immigrants work in low wage paying jobs. A large portion of those also rely on the welfare programs for survival, thus providing a further strain on the country they come to.

Your choice of dismissing my comment as nonsense is mildly annoying, as it shows a lack of effective communication. These problems we are facing today are multidimensional and require looking at both sides of the ledger to come to a fair and responsible model. Too often I see those on the right who want to destroy social safety nets, and those on the left that turn a blind eye to the severe shortcomings(fraud/abuse/mismanagement) of the social safety nets.

In the end I guess it does not matter, as there is only so much money to go around. Pay now or pay later but I assure you the bills will come due…..unless of course you are an investment banker in a TBTF with well connected friends in the government, in other words all the investment bankers!

“the absence of debt forgiveness on a near-contintent wide scale will fail because:”

What we are seeing is the replacement of private losses with government debt. The public is making good on private banks huge losses. We are seeing the largest transfer of wealth, public to private, in the history of the world.

This is compounded in the EU in that many of these losses are in English, German and French banks. It is the populace of the southern tier and Ireland that is making good these private losses.

What should have happened is these private banks taking these losses. Worse these same players are now using their rescue proceeds to buy distressed assets for pennies on the dollar.

What needs to happen is the implementation of Public Central Banks that will print money without debt and hold all other financial institutions to account … Instead the banksters are quashing national sovereignty and even installing their own governments.

“Worse these same players are now using their rescue proceeds to buy distressed assets for pennies on the dollar”

Just what is happening here in the U.S. as Goldman Sachs and others line up to buy massive portfolios of foreclosed homes from the government.

Yep.

Of course that is the policy prescription of Alexander Hamilton in troubled times. Recall he paid 100% on revolutionary war bonds including those from the states, all be it they had changed hands for less just a bit before. So this issue is not new and has been around at least as long as the current US Constitution.

Sort of 100% — the Continental dollar had already been severely devalued.

It’s easy to pay off the bonds AFTER inflation. During deflation, it’s impossible to pay ’em off.

Ireland, yes. Spain, sort of. Greece and Portugal, no. Ireland clearly is paying as national debt for liabilities transferred from private institutions to the nation. But since a democratically elected government did this, this portion of their debt is not likely to be considered odious. Spain is going to pay for big debts at the regional cajas, but describing them as private is stretching it. These are quasi-public and subject to huge amounts of pressure and even corruption from public officials on behalf of their political sponsors. Greece and Portugal really are not paying for private bank debts. Describing debt servicing on non-odious debt, even if such servicing is exceptionally painful, as a loss doesn’t make sense. Is the argument that anyone lending to Greece was crazy and should take a loss, so if Greece ends up paying them back it should be considered as a loss to Greece?

You inability to step away from the “logic” of capitalism’s allocation of fictional financial obligations makes it impossible for you to see the real-world developments, no matter how egregious or on how massive a scale.

Exactly correct …

Our friend drinks heartily from the Kool Aid punch bowl …

Sorry kids, if the problem was financiers vs. public the problem would be solved by executing creditors as monarchs were wont to do …

… back in the ‘Good ol’ days’.

It’s rather like humans vs. machines. The gluttonous machines require 20x or more the caloric intake of humans: Europeans cannot afford their fuel bills.

Meanwhile, the precious automobiles do not pay for themselves by way of the operation. The fuel, the autos and all that go with them — infrastructure, freeways, factories, military machines, FIRE concerns, governments PLUS the prior rounds of credit financing must be paid for with endless, increasing debt financing. The insatiable needs of machines is ‘why’ all that debt was/is taken on in the first place.

To make the European economy more ‘productive’ so as to service debts, machines/technology is not deployed as these require more debts to be taken on. Instead, pensioners and the countries’ future generations are thrown casually into the fire, to free up funds to be used to subsidize more mechanized waste.

Pensioners-into-the-fire is the only tool the Europeans possess … plus trickery and witch-doctoring. Better to sacrifice the bankers on a stone altar by cutting their hearts out with a Swiss army knife.

Best would be to sacrifice all of the cars instead of sacrificing the countries which is underway right now. When the countries fail there will be no more cars anyway.

Keep in mind, children … what is underway right now is permanent. There is no ‘better’ here.

The gluttonous machines require 20x or more the caloric intake of humans: Europeans cannot afford their fuel bills. steve from virginia

Germany synthesized 40% of its liquid fuel needs in WWII. Are the Germans less knowledgeable now?

Energy shortages are a red herring. There’s enough thorium for the next couple THOUSAND years! That thorium could be used to produce energy to pull carbon from the air for carbon-neutral liquid fuel production.

It may come too late.

I read someone de-bunking thorium claiming that it to makes a nasty long lived isotope or two. Don’t know who’s right, but I won’t need to worry about it until I’m re-incarnated someday as a rock star.

You replace carbon emitting, coal burning power plants with thorium nuclear ones, it might mean less fuel for plants.

There is no such a thing as a perfect solution, I guess.

MyLess — I believe plants got along nicely before the advent of coal-fired power plants. There is no evidence that plant growth has ever been limited by a shortage of CO2.

http://en.wikipedia.org/wiki/Thorium_fuel_cycle

This article from MacroBz and the 2 Bloomberg articles all on the same subject: the implausibility of debt capitalism. Do we think the riots in Club Med will help or hurt Draghi’s version of ZIRP? Help. Not even diehard bundesbanking can ignore reality. They just want to bleed ’em dry before they do a mod. We know how that works. Except over there it’s government (“sovereign”) debt, not mixed with as much private debt as it is here. I’m pretty sure both continents are also absorbing a hidden war debt, sufficiently laundered and digitized, which is in the double digit trillions. But nevermind all that.

The problem with the way they are doing zirp, giving all the money to the rich, is that they are inflating asset prices at the same time. And there is no such thing as trickle-down wealth. So when this asset bubble pops, there will truly be no place left to invest. Suicide is painless. Debt deflation is an oxymoron the way we are doing it. We either forgive the debt both public and private, or we have to go to sovereign banking. Anything in between is extortion. Or, the more pc word “extraction.”

Oh wait, I’ve got a great idea! Let’s all quit our jobs so we can pay down our debt faster. Let’s stop driving our cars, going to the doctor, eating anything but beans and rice, and paying taxes. And we’ll have that war debt paid off in no time. Who says we need new technology?

It’s not just that all the printed money goes to the rich, but they are very good at taking money, no amount too big nor too small, from the 99.99%.

Interesting post Lambert, thank you. On top of the contradictions and difficulties you mentioned, I would like to add the following observations and questions:

Even free-thinking critics of the European situation, like Nouriel Roubini, if you read far enough, invoke reforms of labor markets, especially for the debtor periphery nations like Greece and Spain. Broadly put that means labor’s share of the national incomes in those societies is too high, pensions included, so it must fall to bring them in line with…what? The contemporary global economy of course, which was the driving force behind German labor market reforms. And yes, you are right this is export market driven, still the dominant paradigm in economics.

But take a close look at what Greece, Spain and even Italy now produce, manufactured good and Mediterranean agricultural products…China, India and Eastern Europe now can meet the industrial side with lower labor costs and rising product quality…and the Middle east can challenge all along the agricultural front. So after the theology is asserted – work harder for longer for less, and expect less in retirement (and later), the question remains: just what are they going to produce that can capture a higher share of world markets? Of course, again, the theological answer is that given cheaper labor, new entrepreneurs will emerge from the shadows, invent new products or produce the same at a lower cost curve. Of course there is no plan for what emerges, that’s the magic and the theology of “free markets,” the new fruits after austerity will emerge, like mushrooms after a wet cloudy stretch.

So now let’s apply the lessons we’re hearing from Middle East foreign policy preaching over the past few days: behave over there, or the foreign investment is not coming from the West. And open up all sectors for foreign investment. Let’s assume the Utopian, though, and Egypt and Libya et al, become fully integrated into the “world market” on neoliberal terms, what then? My interpretation of this success story would be that we would add another billion or so to the world labor market, on top of the forces that Roubini et al have cited in their fine essay outline of the fall of 2011, “The Way Forward,” which I have summarized under its main theme as already declaring that we have a “‘…a world economy beset by a glut of both labor and capital…'”

If this sounds like the dynamic that pulls the European periphery out of its nose dive, good luck with that. And let us not forget the new neoliberal battle cry, announced by both the Republican Right and the Democratic center-right President: “On to Tehran,” with all the economic uncertainty that implies, even if all one has done is listen to the warnings from military analysts from both Israel and the U.S.

Best to you all – and good luck.

The short term way to fix “a world beset by a glut of labor and capital” is not to contract (austerity) nor to beggar your neighbor (export driven trade wars), but to expand markets world-wide. I’m guessing there a number of ways to do that. Here’s one that would be cheap and easy to implement if hard to adopt politically.

We could for example convert some percentage of defense budgets world wide into cash payments directly to people making less than 10% percent of world per capita GDP to bring them up to that 10% level. That’s about $1200 per person (see http://www.indexmundi.com/world/gdp_per_capita_%28ppp%29.html). With that and some food commodity price regulation, I’m guessing that we’d eliminate world hunger and all be so busy servicing the new demand that we could easily look to put this debt episode behind us.

In the long run we’ve got two bigger problems. The current system of production is literally suicidal. It’s going to kill most or all of us if we persist without change, and paradoxically at the same time the growth of automation and new materials is pushing the marginal cost of production towards zero. Long before we actually reach either of those two points, asymptotically or otherwise, labor will not have jobs, capitalists will not have returns, and governmetns will not have tax revenue–we are trapped between a Skylla of poverty and a Charbydis of plenty–maybe both at the same time.

Another way to look at it is that wars are conflicts among the global 0.01%.

By limiting personal wealth, you undercut one of the root causes of war.

Does anyone need a billion to live a happy life?

And this question:

What is the best way to allocate $1 billion worth of resources? I think a capitalist would say, free market! No one person should decide how that billion should be spent – that would be communism. It matters not if the billionaire answers charity – what kind, where area? The simplest is to create a free market of charity ideas and let that free marekt decide how best to allocate the billion dollar strong charity.

Heh. That’s not what capitalists *are* saying. They’re saying, virtually as one man, “Let’s just allocate the whole billion to money.”

That post was very well done factual, useful and with a clever sophisticated metaphor.

The last paragraph especially was good.

As for the political problem at hand, on overlooked solution is more smaller self sufficient polities, not less.

The problem with Europe and the US is they are too diverse, racially, socially, economically and so on. Most of them would be better off as a series of nations based on the actual social identity of the people that live there,

Also with fast moving increase in technology its getting increasingly foolish to keep to industrial models. We need to take the tech inherent in things like automation and 3d printing and push it forward.

Make things based on demand locally in an efficient manner, recycle everything and we’ll have more than enough to meet most demand and export luxuries and regional goods.

The only issues will be income (which could be fixed with social credit) and to some degree food but again there are alternate methods of production.

In this day and age, most nations could produce everything they need at home.

This however falls afoul of the agenda of the globalists/ one worlder types , the people who make a living off trade (trade plummets in such a scenario) and the zero sum game status crazies.

Its however the best solution, build the largest polity that can be independent and homogeneous and work from there.

Austerity doesn’t work is a tautology. Why recommend fasting to the hungry? Why eliminate jobs when unemployment is high? The whole idea stems from religious traditions of fasting, suffering and abstaining from life riches that were devised to keep people in line and meek.

Religion is What Keeps the Poor from Murdering the Rich

Napoleon Bonaparte

Works for me! But it should also scare the devil out of the rich: James 5:1-6

You don’t have to scare 0.01% or the 0.001% per Crazy Horse.

Just tax their money and give to the 99.99%.

It’s all about business. Nothing personal about scaring or not scaring.

These days, consumerism is what does it. I guess that is the new religion, so Nappy remains correct.

Middle Seaman:

Along those lines, I recommend my long essay “Sinners in the Hands of an Angry Market.” In the essay, I quote from Karen Ho’s “Liquidated,” especially her accounts of interviews with Wall Streeters and how they saw what they were trying to do, especially in relation to the rest of American business. The whole “lean and mean,” bloated old corporate America from the social “obligation” days before all was sacrificed upon the altar of “shareholder value,” (this line of analysis served as justification for the worst of the mergers and acquisitions and corporate raiding phenoms) reminded me strongly of passages from Max Weber’s “The Protestant Ethic and the Spirit of Capitalism” as well as Jonathan Edwards infamous sermon. If you can bear to read it today, I invite NC readers to compare Edward’s tropes from the 18th century to those of austerity’s preacher’s today. Once having been “profilgate,” the new divinty, “The Market” will show you no mercy, miserable worm that you are. Clean your plate, study hard (a la tom friedman,for the rest of your life)and be sure to by the latest apps…so that you don’t end up like the Greeks, held over the fires of the bond markets while the ECB and IMF have your confession at hand, ready to sign with wonderful terms!

It seems wildly out of place, given that Daniel Bell wrote so beautifully about the “Cultural Contradictions of Capitalism” way back in the mid-1970’s – the “live for today,” credit card driven marketing trends from capitalism itself – talk about schizophrenia – place that alongside of today’s austerity battle cries – as if the world’s economic system has found a way of clearing off the vast surpluses of goods it produces.

The middle class is feeding on itself, throwing each other under the bus, because labor can be squeezed no more, and it does not want to recognize its participation, collusion, with capital, in delaying the inevitable. Accounting to reversion will occur, whether by production or destruction.

and the search for a scapegoat continues…

What does the magna carta, the fed, current circumstances, and admiralty have in common?

And now back to the “non-profit” middle robot program, the middle class as labor victim road trip, right off the cliff…

Shall we examine the implementing HR policies and that cast of characrers, back up the chain of command?

Bumper sticker: waging war for peace is like s– for virginity.

Kevin:

You Neil, and company keeping stopping around about labor. Until someone defines what they mean by Labor, I will answer it in this manner. Direct Labor and and Direct Labor Cost in the Cost of Manufacturing have always been low since the late sixties. Arguing Direct Labor Cost in a product is futile and silly. Look to Materials and Overhead including SS, Unemployment, healthcare, OSHA etc.This is the defining factor between China and the US.

It used to be that Profit = Capital + Labor.

Wall Street proved Profit can be had solely from Capital in an unregulated market. If you wish to change this than change the paradigm.

I don’t know why the periphery doesn’t just sell all the Bimmers they bought from Germany. They hold resale value really well, and if they exported used cars that would make the “Sectoral Balances Accounting Identity” confirm that algebra works, and they could pay off the National Debt in no time!

That could work! I could use a good, cheap, used car!

If Germans would make underwater Bimmers, then they wouldn’t need to sell.

They did sell those subs to Greece, but maybe Greece could sell them back. But first threaten to sell them to Somalian Pirates, then ask for a good price, of course. The Greeks are good at things like that.

“Falling GDP leads to falling national income, which in the absence of real across the board wage deflation means more unemployment and therefore slowing government revenues which, as I’ve said previously, leads to a self-defeating process of re-newed cuts to government budgets.”

Does this mean that you believe that “real across the board wage deflation” would be a good thing because it would lead to “more employment”?

Another point. is to look at the ‘national income’ as to how it is distributed.

You could have falling GDP but rising 99% income.

Good point. It’s evening and the author has not bothered to enlighten on the question posed.

If the economy isn’t creating enough jobs for everyone, then throw those moochers off of unemployment and let them:

a) starve

b) accept the fact that they’re just debt peons to be exploited by the job creators

c) eat cake.

The interesting thing about that remark is that those who truly don’t take personal responisiblity will not be outraged.

To be outraged is an act of taking personal responsiblity seriously.

There can be no monetary solution to a distributional problem.

So true.

It’s about distribution.

Keynesian’s and MMT might view it differently. But let me add my version: There can be no Austerity solution to a distributional problem.

History has to run its course for some more time until we understand that Eurozone countries have a distributional problem, and it is at the heart of our crisis. It induced increasing debt, and finally created lack of demand and unemployment.

Kleptocracy (a big problem only in a few Eurozone countries) and rising inequality (falling wage rate, rising wealth inequality) are compatible with the assessment above.

Unfortunately people of Eurozone periphery countries suffer most, currently.

Its not debt vs jobs — its the Xtrevilist sociopathic rich against the masses…

http://democracyandclasstruggle.blogspot.com/

Deception is the strongest political force on the planet.

Warren, I found your comment, I think yesterday, about wealth inequality – the maldistribution -, and less about money creation, to be the point.

You seem to have ignored Italy completely, although I suppose it is doing better than the other three.

Super Mario is making an appearance on Charlie Rose tonight, btw.

In 1867, the anarchist writer Bakunin wrote about a United States of Europe;

Hesaid that he wishes to see “…a new organization based soley upon the interests, needs, and inclinations of the populace, and owning no principle other than that of the free federation of individuals into communes, communes into provinces, provinces into nations, and the latter into the United States, first of Europe, then of the whole world.”

But this world view needed to always include the right to secession.

“Just because a region has formed part of a State, even by voluntary accession, it by no means follows that it incurs any obligation to remain tied to it for ever. No obligation in perpetuity is acceptable to human justice…The right of free union and equally free secession comes first and foremost among all political rights; without it, confederation would be nothing but centralisation in disguise.”

Interesting in light of Catalunya, no?

A child receives nurturing, protection and education from the society growing up.

If he/she promises to pay back, and if another country of his/her choosing doest accept, can he/she freely choose the citizenship upon reaching adulthood, if we offer that chance to all kids?

A child receives nurturing, protection, and education because it is a good thing to do. It is gifting something. But it does not demand direct exchange i.e. the child is not bound by some debt to society. The grown up child may freely give protection, education, and nurturing to other children in other places he/she finds him/herself in. This is the hope; of an alternative society neither capitalist nor bureaucratic socialist. Such societies have existed and still do in pockets all over the world.

And, as you say, it’s all about distribution of power. It is about priorities. Our priority should be the nurturing of humans and the earth. Making stuff for those humans is secondary. But we have had it the other way around. We cannot make more stuff and export our way out of this.

That’s true.

Let countries compete for citizens.

If it’s a well-run country, people will flock there.

It all started to go wrong with the birth of the State by brute force in several parts of the world at about the same time.

http://en.wikipedia.org/wiki/Robert_L._Carneiro

Fascinating. Never read much anthropology until Graeber. This anthropologist theorized that the state grew out of one tribe defeating another one and the losing one had no where to run because of geography; either mountains or desert. so the winner had to grow more food for its increased population. Farming seems to cause a lot of strife.

Montanamaven: Yes. Carneiro contrasted two hypotheses for the origin of the State: the voluntary hypothesis, and the coercitive hypothesis. He published his result in one of the two most rsspected scientific journals of the world, Science. He studied the origins of Asian, Middleast, and American States (sorry guys, big picture American, not parochial USA America). His conclusions are pretty clear: in all cases, the State was born by brute force. No one ever built a State because it was convenient to them, it was always forced on free peoples.

On the other hand, coercion seems to be completely unavoidable for the maintenance of a functioning society; it’s present in nomadic herding cultures to a tremendous extent (constant tribal skirmishes) and even in hunter-gatherer cultures.

So, in response to the claim that the state was created by coercion, I say “So what?” In a real sense all societies larger than a family grouping are created by coercion.

And if you study the history of the *family*, you find that for most of *its* history it was created by coercion, ever since male dominance and patriarchy arived on the scene before the dawn of recorded history.

The real issue is what sort of societies people are comfortable living in. The contrast is between rulers who make sure that people are fed and clothed and housed, and have free time and entertainment, and get some form of fairness when they have disputes, have their opinoins listened to and respected, have some freedoms, etc…. versus rulers who are psychotic, sadistic, psychopathic, and/or control-obsessed; versus rulers who are simply incompetent. (The latter two are not exclusive categories.)

My eyes have been bugging out at the mass stupidity of our current elites. The Pharoahs of ancient Egypt understood what their job was, and they went to great efforts to make sure everyone had food, housing, work, shoes, beer, and holidays.

We now have rulers who actually think it *isn’t their job* to keep people fed! Seriously? Seriously?!? Don’t they understand how a ruler remains a ruler?

The Euro Crisis Explained To Grannies: For a very simple (and funny) explanation for the euro crisis, just write on your search engine: wordpress blog The euro crisis explained to grannies

“The basic premise of European policy is to tighten government budgets in an effort to drive down deficits.”

No. The basic premise of European policy is that debt is sacred. The tightening of budgets is the mean to satisfy the basic premise, that debt has to be paid off, no matter what.

I would say that the basic policy is that the rich and powerful are not allowed to lose their money, or even have its value diluted.

The “sanctity of debt” (but not the sanctity of obligations owed by pension funds, union contracts, etc.) is a mere consequence.

“I have been accused by some of being anti-austerity”

You certainly could be!

“But that isn’t my real issue with the policy at all. My major concerns has been that policy targets of internal devaluation and export driven recovery in the absence of debt forgiveness on a near-contintent wide scale will fail because:

a ) the initial outcome will be a rapid decline in industrial production and national incomes which mean existing debts will become unserviceable

b ) external surpluses require a counter-party external deficit

c ) structural adjustments require investment”

That’s a quite reasonable assessment!

Sure! But are we talking an export-driven recovery or a much more modest outcome? The reduction, possibly to Zero, of external deficits.

Anyway do not expect anything like significant investment from a country which is broke, has not done any significant home work in terms of housing-and-assets-pricing (go and check…) and labor market policies (go and check) until austerity has set in. Not matter what!

Private investment can not be printed in such a country. And public investment à la Roosevelt? We are not talking the China 2008 powermill or the US 1932, but a country that had recently destroyed its industrial capacities of the Franco-and-early-EC-times to focus on consumption-banking-and-real-estate…

Anyway this investment will have to come from external source (not broke). We are not talking Asia 1997 with the dreadful IMF policies and neo-con support. But something in the middle with some socialization at EC level.

I am an exporter from the periphery of the Eur zone and one issue that is always overlooked is the ECB policy of maintaining a strong Euro. This really hurts our export potential and yet the core countries fear of inflation always overrides the need to give the periphery a helping hand. This would be one major thing they could do – let the Euro drop by 15% against most major currencies.

Hugh’s comment:

For example, if all of the growth in the gross national product is going to the rich, who cares if it is growing?

“So basically, the three targeted outcomes for the existing policy a) service existing debts, b) lower government deficits c) become export competitive are incompatible ”

You can make them compatible through money-printing (inflate away the debt, eliminate the deficits with seignorage profits, become export competitive through a depreciated currency).

But “no inflation” is the fourth targeted outcome for the existing policy, the one you didn’t mention, so that’s out too.