April Charney sent me a link to a post which had a condescending explanation of a recent piece by FICO that warrants further discussion. The FICO article attempted to justify its position that someone who enters into a short sale gets his credit score dinged as badly as for a foreclosure. Yes, you read that correctly. One of the reasons many borrowers go to the effort to arrange a short sale, as opposed to the faster and easier process of “jingle mail” is that they assume that the damage to their credit score will be lower.

Here is the rationale, per FICO’s Banking Analytics blog (emphasis theirs):

One of the questions we get asked most often is whether it remains appropriate for the scoring model to treat a short sale in a manner similar to a foreclosure….

…we conducted a study isolating more recent occurrences of mortgage stress events. By studying the subsequent performance of these borrowers on all accounts, we determined the credit risk associated with their mortgage events. Looking at data from October 2009 to October 2011, we were able to verify that short sales and other events of recent mortgage distress continue to represent a high degree of risk. These results closely match earlier studies of the risk associated with short sales and other events of mortgage stress.

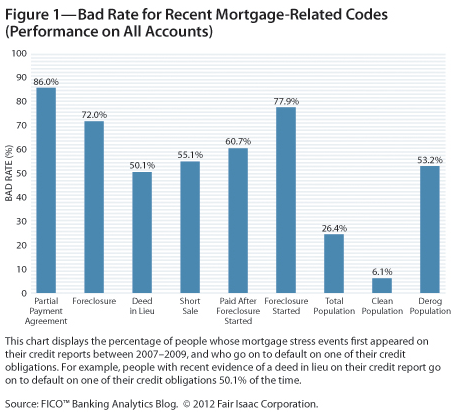

As the graph below shows, short sales remain extremely risky. However, foreclosures have a bad rate of 72.0% while short sales have a better bad rate of 55.1%. Should that lead to less punitive treatment for short sales?

While it is true that short sales represent slightly better risk than foreclosures, they do not perform well enough to merit a more positive treatment in the FICO® Score. Here’s why. In the population we studied, one out of every two borrowers who experienced a short sale went on to default on another account within two years. That is exceptionally high risk. Additionally, the overwhelming majority of consumers with short sales have some other evidence of mortgage delinquency.

From a weighting perspective, all these mortgage events – short sale, foreclosure, deed in lieu – fall into the same heavyweight class, because they correlate with exceptional riskiness. They aren’t alone in that class either. Based on the data, consumers with short sales perform no better than consumers who have a severe delinquency (90+ days past due), a collection, or a derogatory public record (e.g., bankruptcy, tax lien, etc.) on file.

By comparison, only about one in every 50 borrowers with a score in the high 700s will default on one of their credit obligations. This strong separation of goods from bads is what makes FICO® Scores so useful.

Gee, even though there is a big difference between a 72% default rate and a 55.1% default rate (as in 30%), FICO says this doesn’t matter, 1 in 2 is so bad that they don’t care how much worse nearly 2 in 3 is relative to that.

But there is a pretty serious problem with their argument. Go look at the itty bitty print under that table. The people that are counted in this study first started looking wobbly in the 2007 to 2009 period. As readers may recall, that was during the big subprime reset period. Those folks were much less salvageable than the current wave of defaulters, who are being hit by traditional causes of default: job loss or wage reductions, divorce, medical emergency, with more than usual in the first category thanks to the lousy state of the economy.

A second reason that it’s dubious to apply conclusions from that period to now is servicers have changed their posture on short sales. Until very recently, they were uncooperative, to the point that in Los Angeles, homeowners would have state in their listings that they were not looking for a short sale because brokers would not even bother showing buyers those homes. They knew the banks would jerk them around and they didn’t want to waste their and their customers’ time. So anyone who got a short sale during this time period had to very persistent and/or very lucky (perhaps in a home with a mortgage on the bank’s balance sheet, where you’d see more willingness to reduce losses than on a serviced loan).

The “very persistent” part bears directly upon the credit analysis. If someone who was in strained financial circumstances had to spend months longer getting a short sale through (versus either a deed in lieu or a foreclosure), their very act of trying to work with the bank would deplete their funds. Since reports on the ground are now that banks are cooperating, borrowers who pursue short sales should on average get out of high (and potentially unsustainable) mortgages faster, which means with more financial reserves, which means lower defaults.

And if you look at this from the lenders’ perspective, this is a ridiculous comparison, because it ignores the loss severities. A short sale might result in a 40% loss (maximum) on a first mortgage, and is often in the 5-20% range. Loss severities on foreclosures on subprime loans have been well over 70% and on prime, over 50% and both are rising because the banks have been dragging out foreclosures in the markets with the biggest falls in housing prices. Those will show even bigger loss severities that history would lead you to believe (attenuated foreclosures means servicers advance more, which means the investors can have over 100% loss severities when you include foreclosure costs. Contested foreclosures in addition routinely produce loss severities of well over 100%. 300-400% is not unusual).

It’s pretty astonishing that anyone takes FICO data seriously, given how badly it performed as a basis for lending decisions prior to the crisis. As Amar Bhide pointed out:

Statistical models that took no heed of specific circumstances replaced the bankers’ on-the-spot judgments. The use of models also facilitated securitization. Investors could know precisely the values of all the variables (such as the borrowers’ credit scores) for every mortgage that was securitized and didn’t have to worry about the poor judgments of lending officers. Mass production ensured a dependable, high volume supply of the raw material needed..

Advocates of high-tech finance continue to applaud judgment-free lending as an advance comparable to Henry Ford’s assembly line. Models, they say, reduce the costs of making lending decisions…

In fact, the mass production of consumer loans isn’t like the mass production of consumer goods. Robo-lending and the securitization it facilitates lead to the misallocation of capital and economic instability. In models used to assess creditworthiness the income of an employee of an auto plant scheduled for closure is indistinguishable from the income of a federal judge. Moreover, not all lending can be easily mechanized. Arguably small business lending has been neglected because it is harder to mass produce than housing loans.

But bankers always prefer to run off cliffs all together, so no one will blame them individually. And therefore relying on third party validators, even discredited ones like FICO and the ratings agencies, is not likely to go away any time soon.

Isn’t a major reason for the existence of Fico scores the fact that these scores serve as an “objective” measure for determining what interest rate should be charged (so that they cannot be accused of discrimination etc., even while milking dry all the usual targets)? It’s always struck me as at least partly a CYA move, with the additional advantage that it forces people to own and use credit cards to get a fico score in the first place, thus ensuring compliance.

FICO is a tool of enforcement for the banks. And it will stay this way until they get sued out of existence by their victims

I’m wondering if there are grounds for defamation of character. Given the obvious arbitrariness of the criteria exposed above, the malicious intent is pretty obvious.

You should not suggest that credit score is the most important reason for debtors to do a short sale. As an attorney who negotiates these sales I can tell you that the BIGGEST reason borrowers need to do a short-sale rather than allow a foreclosure is that many states allow “deficiency judgments” to be pursued against the debtor AFTER they have abandoned their homes in foreclosure.

The negotiator can demand and often get a release of the Note and covenant not to sue on any deficiency. If the borrower lives in a state like Florida or Colorado that permits banks to pursue a deficiency they ABSOLUTELY should seek to do a short sale and get a release of their debt.

I see a significant and increasing number of 2nd lenders especially who are taking this approach of lying in the weeds for 2 or 3 years for the borrowers to recover their finances a bit after a short sale (in which they did NOT obtain a release of their debt, or a foreclosure) and THEN hitting them with a lawsuit for a 100% deficiency on the 2nd mortgage!

These borrowers are then forced into bankruptcy, because they cannot even hope to negotiate a settlement of a debt that in many cases is $100,000 or more, and it makes no sense to make payment arrangements on a property they no longer even own.

Second mortgagers are doing this because they lose their entire equity in the foreclosure process. Thus, short-sales are critically important in most states — unless you state does NOT permit banks to pursue a deficiency judgment for the difference between the amount they realized at the foreclosure sale and the amount the debtor owes (including fees and interest).

From some very quick research:

Non-deficiency states (i.e. the lender can get the house but then the loan is wiped out):

Alaska

Arizona

California

Connecticut

Florida

Idaho

Minnesota

North Carolina

North Dakota

Texas

Utah

Washington

One-action states (The lender can get the house OR the money, but not BOTH — so if the lender goes after you for the money, you can declare bankruptcy and keep the house, and if the lender forecloses on the house, then the loan is wiped out):

California

Idaho

Montana

Nevada

New York

Utah

(California is complicated because of its ‘deed of trust’ laws instead of normal mortgages.)

If you are not in one of the states on the above list, then it is *very* important to get a release-of-deficiency from the lender, which is a strong motivation for a short sale.

Your comments about non-deficiency states are wrong. You are excluding what a second mortgage might bring to the foreclosure party. For example a second mortgage in Washington state can still bring a deficiency action after a foreclosure initiated by the first mortgage holder.

‘This is a ridiculous comparison, because it ignores the loss severities.’

Exactly. Withholding payments during a commercial dispute over a $200 account can put you in Fico’s ‘derog population’ even if you’re reliably servicing half a million in other obligations (and even if a court ultimately sides with you in the dispute).

To make a market-related analogy, they’re applying an equal-weighted model instead of a cap-weighted model to one’s credit lines. Besides failing to consider loss severity, they use crude one-sided data (which assumes that the creditor is always right).

It scarcely seems possible, but credit bureaus appear to be staffed by people even stupider and nastier than the bankers they work for.

RICO the FICO fuggers!

How right you are. I had a personal experience with that lately. My credit rating went from gold to crap because of a dispute I’m having w/ “health care providers” and a “health insurance” company over $2k. Meanwhile I’ve never been late on a mortgage payment, and have had maybe one or two late payments on a few bills. I have no debt other than my mortgage, and my house payments (mortgage+taxes+insurance) are less than 20% of my gross.

Because this is such a common problem, thanks to America’s brilliant “health care” system, there was a bill in Congress to require that any “health care” related black marks on your credit rating be eliminated within 90 days of the matter being settled, rather than sitting there for 7 years. Needless to say it didn’t pass.

But, Jim, how do you really feel!

You might, if so inclined, visit my new website, “GuillotinesRus.org” The prices will be only higher the longer you wait!

Aw, why did you get our hopes up. That’s not a real website!

The NYT had a good article on FICO a while back. What people miss is that it is not intended as an objective view of how good you are at paying your bills. It is intended to show how profitable you will be to the banks. They are not one and the same thing.

Of course, I object to the whole “credit is the lifeblood of the economy” thing that makes banks the arbiters of the American economy.

http://www.theatlantic.com/magazine/archive/2009/05/the-quiet-coup/307364/

I don’t know what my FICO is because I won’t pay to see it, but my credit card company is charging me 19.9% despite the fact that I don’t owe a dime to anyone. I paid off my first and second mortgages and car loan and never keep a credit card balance.

What is their reasoning?

1) I missed one payment 5 years ago. Without any warning they cancelled my card and issued me a new number due to a security breach, and I didn’t think to update my automatic payment in time. They refused my request to take this off my credit report.

2) I had an online payment that got rejected because I inadvertently erased the account number when I thought I was copying it. My payment was not late, however, because this was an EXTRA payment. This still cost me $39, which is ridiculous enough.

Somehow these justify them charging me 20% for money they get for free. Only of course I will never pay it. I’ll never give them another dime in interest. I only keep the card because they so obviously want me not to.

Because the big banks have repeatedly attempted to claim that they received my payments late or not at all (they have simply been lying; MBNA was criminally convicted of doing this in the 90s, but the big banks still do it), I finally switched my credit card to a credit union which uses a fairly honest provider.

Why do the big banks attempt to defraud me? Because I pay my card off every month, and they don’t like that. They want someone who pays lots of interest and fees.

So watch out for attempted fraud by the credit card provider.

Hey if you can finagle a higher credit score maybe they’ll let you rent in your old neighborhood….. for a price. This was posted here before but i find it particularly nauseating.

A Huge Housing Bargain — but Not for You

http://www.thestreet.com/story/11224917/a-huge-housing-bargain–but-not-for-you.html

Since credit is new money creation (“bank loans create deposits”) that dilutes the purchasing power of existing money then NO ONE is credit worthy unless some, the so-called “credit worthy”, are worthy to STEAL from others, especially the poor.

Also, like a drug, credit creation creates the need for more credit creation.

But how can we live without credit?

1) We all, debtors and non-debtors alike, deserve a universal and equal bailout. That would enable debtors to payoff mortgage debt, student loans, credit cards, etc. and provide non-debtors with compensation for years of suppressed interest rates.

2) The universal bailout could be metered so that the total amount of money in the economy remains constant or grows slightly so that there will be plenty of real money (so-called “bank reserves”) to honestly lend at honest interest rates.

Our money system is fundamentally unjust and unstable. If it could be made to work properly we would not still have these problems 318 years after the BoE was established.

It’s completely appropriate for one’s credit score to take the same hit for a short sale as it takes for a foreclosure. Both instances are financial negligence and both should be rated with the same risk score.

You don’t know what you are talking about.

You buy a home with 20% equity in 2006 in the wrong place, say the Inland Empire or Miami because you got transferred there. The local market is down 30%+ so your mortgage is 10+% underwater.

You are paying on time but need to move. Doesn’t matter why. Spouse in other city, new job in other city, for whatever reason you need to leave the place with your underwater house. So if you sell it there will be a loss on the mortgage.

The person was not imprudent. This is bad luck, being in pretty much most places in America and buying too close to the crisis.

I see. So “financial negligence” is the standard we are judged on? So what is the credit score of citibank, or bank of america, or ANY of the massive slumlords of the American economy since 2008? I suppose they are incapable of committing “financial negligence” because they are corporate people, not people people.

Spouting phrases like “financial negligence” is committing linguistic negligence, as the term is undefined and can mean anything or nothing at all. Presumably just the way FICO, and YOU, like it. You, douchebag, are a corporate shill.

In closing, you sound like someone who has never experienced a negative event in your life that wasn’t your fault. Either that or you are a total hypocrite. My guess is the latter.

Citibank, BoA, etc. didn’t commit financial negligence — they committed criminal fraud.

Their “credit score” should be negative — with a “DO NOT LEND TO THIS COMPANY — IT WAS REPEATEDLY CONVICTED OF FRAUD” notice added.

The fact that it isn’t, well that tells you all you need to know about credit scores

Both short sales and Foreclosure sales are credit induced sales. I would expect both to reduce credit scores. If there’s annectdotal evidence to suggest that borrowers who resolve via short sales as opposed to foreclosures, first I wouldn’t be surprised since a short sale represents more of a dialogue between lender and borrower and if a home winds up in foreclosure the situation is probably more dire, but secondly and more importantly it represents the silliniess of attempting to distill it all down to a single number. As a credit score only shows a past track record on paying debts and not a future capacity to take on new debts I view the credit score as one of the worst metrics there is and the use or mis-use of FICO and credit scores in selling and originating mortgage debt was one of the great enablers of the mortgage crisis. Instead of getting upset at Fair Issacson, I would suggest time is better spent coming up with ways not to use it in the first place, such as documenting assets, doing two years of a thorough income check, a full doc by the book appraisal and looking at front and back end DSCR numbers. You do that and the FICO score loses most if not all of its meaning.

“documenting assets, doing two years of a thorough income check, a full doc by the book appraisal and looking at front and back end DSCR numbers”

Hear, hear! That’s the approach that was used successfully for decades. When I got my mortgage in 1999 I had to show tax returns, employment history, other outstanding debt, etc. I’m not even sure they looked at FICO (though I could be mistaken). All that stuff seemed reasonable to me before the bank handed over what (seemed at the time) like a big chunk of change.

One of the most basic metrics, that was used successfully for decades, was just the ratio of house payments (mortgage+taxes+insurance) to your gross income. For a long time anything less than 27% was good. It got bumped to 33% (in the 80’s?) and that was still ok. I used the old 27% number as personal metric in deciding how much house I could afford.

FICO was just a CYA the banks started using so they had an excuse to give mortgages to people who couldn’t afford them. The old system was proven over decades to be solid and reliable.

Using FICO scores along with automated under-writing was made popular by Fannie & Freddie and was a contributor to the subprime mortgage crisis.

The main goal of using FICO scores was being able to fire the many people who worked in the “creditworthiness checking” divisions of Fannie and Freddie and the banks.

So it was driven by the modern right-wing CEO obsession with firing people, basically….

No, your assumption is 100% wrong. They are NOT necessarily “credit induced” as in a result of borrower stress.

See the example above:

http://www.nakedcapitalism.com/2012/09/on-ficos-dubious-explanation-of-why-it-treats-short-sales-the-same-as-foreclosures.html#comment-827025

That is probably the big reason for the difference in loss severities, that plus the stressed borrowers having been financially drained in the process (as in the stressed ones wind up WORSE off than if they’d just abandoned the house, so you might well see higher default rates on other obligations).

No, in that case you sell period, either taking a loss in using a normal transaction or via a short sale. Taking the bank deal means you couldn’t afford to sell privately , and take the hit when paying off the mortgage in full. In the case of the under-water mortgage that was paid on time, the borrower was unable to pay off the entire mortgage balance and thus had to go to the bank with the short sale proposition.

It is absolutely amazing — and at the same time extremely shameful — that the FICO score, a system of physically and emotionally branding and rating humans for their predatory debt and exploitation potential has become as normalized as it has, and worse, that it is still allowed to even exist.

Developed in the 1950’s (by the ‘Fair’ Isaac Company), it is a good example of the morphing of good old fashioned Vanilla Greed for Profit Evilism into the newer more Pernicious Greed for Destruction Xtrevilism. You know, the fifties, when overt fascism adopted the Noble Lie as its new MO and went deceptively underground. FICO is a publicly traded corporation — yes, they tell you that you may even be invested in it so as to puff your little chest with ‘capitalistic’ wealth adoring complicit pride — just like Moody’s that uses the same scam. But have no doubt about it, the Xtrevilists and their sell shills own and control the show.

Here is the ownership of first, FICO, and second Moody’s for a look and see for yourself, I am sure you will not see your friends and neighbors listed as owners there…

http://stockzoa.com/ticker/fico/

http://stockzoa.com/ticker/mco/

FICO is selectively and secretively administered, used to set the usury rate charged, reveal the debt slave potential and to RED LINE slaves that are deemed unfit for further exploitation.

And here is a look at the smiling sell out shill debt slave overseers who continue to legitimize and validate immoral usury and at the same time apply the branding whip to you and your friends and neighbors.

http://bankinganalyticsblog.fico.com/about-us.html

The FICO score branding and labeling of human beings, is in its administered reality, as demeaning and hurtful as intentionally labeling some one a nigger, a kike, a wop, etc., or tattooing a number on an arm so as to quantify and control them. It is a gross violation of Civil Rights and a hate crime. The irony is that it is the same Xtrevilist bankers who create the conditions that create the societal stratification.

Deception is the strongest political force on the planet

The FICO score branding and labeling of human beings, is in its administered reality, as demeaning and hurtful as intentionally labeling some one a nigger, a kike, a wop, etc., or tattooing a number on an arm so as to quantify and control them. Warren Celli

Yep and if we qualify for credit we get to borrow our own stolen purchasing power! And pay for the privilege!

What do default rates for short sellers look like as a time series? If you were to track default rates over a trailing 12-month period, then I believe your hypothesis is that the rate will decline sharply from a peak in 2009-2010.

Most homebuyers rely upon the banks appraisal to protect them from overpaying for a property. Neither the seller nor the agents handling the transaction have any interest in protecting the buyer as they all benefit from a higher price. Only the lender and the buyer have a congruent interest in not paying/lending too much for a property which is why the bank has the property appraised. If that appraisal is faulty then why should the buyer bear the entire consequence?

Yes. But the real problems started when the lender became completely divorced from the entity writing the loan. DTI, LTV etc became not ways of preventing lender losses, but rather lies to be appended to a loan so that it could be sold, pooled and tranched into a CMBS.

Great piece, Yves.

Distressed homeowners are being sold a bill of goods: if you can’t make the payments (really can’t make them) we will let you out the back door through a short sale or DIL. Helps you, helps us, everyone wins. But it is a huge lie. When everything is treated the same–foreclosure, DIL, short sale, even bankruptcy–you are treating people who played by the rules the exact same as you are people who overspent, gamed the system, and ran out the clock. No time off for good behavior.

We are all Jean Valjean, 25 years in jail for stealing a crust of bread.

Get the word out: burn your house down before you give it back to the bank. There’s no difference for you.

Arson can lead to long prison sentences. I’d rather see concreted in the toilets, carpets ruined, appliances broken and walls smashed than see some poor homeowner get railed for arson.

‘concrete’ in the toilets…

I’d take the toilet off first (replacing it later) and pour it directly down the sewage pipe, speaking strictly in terms of effectiveness. One might first push a sponge ball down several feet to prevent damage to the city sewer system.

I say this not to encourage destruction but to warn the PTB that the American people are NOT short in the innovation department. So why push them to despair?

Don’t forget to strip any copper out of the house too (plumbing, wiring). It brings a good price these days. Sometimes you can even sell ornamental trees and bushes.

I’m not actually sure, not having seen a mortgage contract in a while, whether the mortgage is actually secured by the chattel, or whether you’re allowed to REMOVE IT ALL, including the appliances, the cabinets, etc….

The only rational reason for arson (though criminal) is to get insurance money to rebuild. Someone in my neighborhood did that, wiped out the little frame ranch house and built a 5000 square foot brick fortress with slit windows. The fire dept. is sure he committed arson, but I guess the insurance co. could not prove it. He’s a jerk too, by the way, I had the misfortune to meet him once.

If you’re in foreclosure, just sit and do legal maneuvers to stay as long as possible. Drag it out, and you can accumulate money for yourself during that time, or at least have a roof. This (unlike arson) is NOT A CRIME, NOT A CIVIL VIOLATION. It’s just an exercise of one’s legal rights under the mortgage contract. If you don’t pay, they can start foreclosure proceedings. Fine, and you have the legal right to contest them as normal.

Yves’ article is a good service to people in that tough spot. They should not be fooled into giving away their roof with a short sale, and all the hassle and effort involved, even if the banks “cooperate”. Not once since 2008 have I seen banks cooperate with anything that was not in their selfish best interest. Their hearts for homeowners are as cold as ice. Frankly I’ve been astonished that there is no mercy at all. So there’s no reason for the homeowner to be merciful to the bank!!!

“Not once since 2008 have I seen banks cooperate with anything that was not in their selfish best interest.”

But it’s worse than that. As pointed out in the post, losses from a short sale are much less than on a foreclosure, yet the way the credit score secret police treat them as equivalent gives the homeowners no incentive to go for the short sale. Sounds like they’re screwing themselves too.

All the credit rating agencies are seriously crap. Consumer or Corporate , they are all demonstrably horrible. Astrology or reading chicken innards would be just as accurate.

That’s what a legislative monopoly gets you.

Great rant Yves. Any alternatives? Before FICO came along, you had to know someone who would recommend you to a loan officer. Do you want to go back to those days?

You are correct about the first two points, i.e., the data used was from a time period that is not reflective of current reality. The FICO modelers could have accounted for that.

The FICO scores gives you the odds of default, you can then multiply the loss severity to come up with an expected loss figure.

Jim Haygood, typical models exclude small losses (e.g., $200)from modeling.

The bureaus and FICO have a stranglehold on this. How about a crowdsourcing project to come up with an alternative?

What are the alternatives?

Let’s start with an appeals process whereby mere mortals can get an impartial “judge” to hear why we have been wronged by the system.

Right now it’s about as useful as talking to the Great and Powerful Oz.

Me: “GSE guidelines clearly state that with a DIL or short sale with extenuating circumstances you can get a new loan after two years. It’s been two years, can I have a loan?”

Mortgage Broker: “No.”

Me: “But here are the documents outlining the circumstances. Here is my credit report saying that apart from having to give up the house for well documented reasons we have never missed any payment. Here is my documented salary which is in the top 10% of earners. I just want a loan for 1.5 to 2x our annual income.”

Mortgage broker: “Drop dead. Come back in a couple of years.”

I agree that the mortgage broker and lenders should look beyond the FICO score. That is precisely why there is a manual review. I believe this has more to do with current lending policies than your FICO score.

You probably deserve a loan.

“That is precisely why there is a manual review.”

Right. And during Stalin’s purges everyone got a trial.

Precisely. The mortgage broker allowed us to fax the documentation to his office, but I am 100% sure the pages went straight into the recycling bin (if they were ever even printed).

We have secured a loan. It will be held by the lending bank. It pays to have friends. But the system is broken. I won’t stop until we can fix it.

Honestly, I would rather go back to the days when someone recommended you to a loan officer. It’s a more local approach that makes use of social capital—the only capital a lot of people have. That system has its faults, but look at the FICO-equifax-transunion-experian system. What we have now is an information cartel that is plugged directly into the banks. These agencies distill your entire life into a three-digit number that a growing number of companies use for granting credit, determining insurance premiums and making hiring decisions. The scoring models are trade secrets, so nobody knows EXACTLY how they evaluate risk. So the formula is off limits to people, making it truly impossible to know how a life decision can impact your credit-worthiness. Not knowing exactly wouldn’t pose that big a problem if it weren’t for the fact that more and more corporations are using this rating system in industries outside of banking (see Orwell).

Having looked at thousands of credit reports, I can tell you that the individual with delinquent high balance credit cards living in, say, Greenwich, Ct will have a higher score than someone with modest lines of credit paid on time living in, say, Camden, Nj. In my experience, I would say that the listed employer (if it’s listed at all) is correct on less than half of all credit reports. How can they calculate that most important part of your credit score, the debt-to-income ratio, if they don’t know where you are employed? I really don’t know.

No, I got a mortgage in the early 80’s before anyone had heard of FICO. I had a job and some short history of paying credit cards and rent on time, and that was all that was needed.

I didn’t need any personal recommendation.

“Great rant Yves. Any alternatives? Before FICO came along, you had to know someone who would recommend you to a loan officer. Do you want to go back to those days?”

Providing verifiable documentation of your income, your expenses, and so forth… much like you do for a business loan… along with character references…. that’ll work just fine.

Loan officers don’t HAVE to be bigoted pigs. The smart ones WILL lend to people from the “wrong background” because it’ll be profitable.

Actually, some credit unions and local banks are *cleaning up* by ignoring FICO scores, lending to people with “bad FICO scores” who are obviously excellent credit risks.

How is it possible that you rank a person or business solely on it’s

liabilities and not on a balance of liabilities and assests? It’s an insane system

that is punitive in nature and corrupt in practice. The more people dunned in

this process the more money the banks and credit cards make with higher

interest rates.

“Catch-22 says they can do anything we can’t stop them from doing.”

I’d love see more people opt out. That would do more than anything to bring the system to heal.

why anyone underwater and wanting out would put themselves through the hassle and headache of a short sale as opposed to “riding it out” until the bank forecloses based on this is beyond me. Could it be homeowners are increasingly aware of this which would help explain the vanishing inventory of homes for sale in many markets?

I can affirm the difficulty in getting bank approval for short sales in the 2007-2009 period, at least in the San Francisco Bay Area. I heard about more than a few people who repeatedly jumped through hoops trying to get it done, and yet never got an approval. Perhaps it’s changed now– but I’m seeing fewer people inclined to go through it. Same with the deed in lieu of foreclosure process. A lot of people just aren’t comfortable giving the bank a full look at their financial picture, only to be rejected later. The conventional wisdom previously was that short sales or a deed in lieu would produce less of a credit hit. Now that FICO treats them the same, it reduces the incentive for people to make an orderly exit from their property, and increases the incentive for people to simply let the house go to the trustee’s sale.

It’s almost as if the goal is to push people into foreclosure. But that would be conspiracy theory thinking, wouldn’t it?

When we were house-hunting mid-2009, our agent basically said don’t look at short sales, period. At our closing, the lawyers were making chit-chat about giving up on trying to close short sales; they felt it basically couldn’t be done. So yeah, at that time, if you were trying to make a short sale, you were fucked.

I just think people are getting a bit wiser than they are “supposed” to be. A fair amount of the status-quo is supported by propaganda and people doing the “right thing” as they are told, things that wealthy business oriented people would never THINK of doing because they are stupid in a business sense, and real estate transactions are business.

Hopefully this important fact – that there’s no reason to go for a short sale instead of foreclosure – makes it into OWS’s “Debt Resistor’s Operations Manual”. By not distinguishing between something that causes small losses (short sales) and large losses (foreclosures), and since the latter is easier for the (former) homeowner, the banks and their partners in crime the credit ratings agencies, have given people an incentive to cause them greater losses. Good business practice!

More and more I’ve begun to think that the real purpose of FICO is as an excuse to offer “loss leader” (lower profit) loans in theory, but in practice offer them to very few people. If the real purpose was to estimate the risk of non-payment, it would be absurd not to weight black marks according to the loss they cause the lender. This tactic of denying most people the good rates may be aided by a “you’ve been a bad boy and must pay the penalty” attitude that too many people buy into.

Common, FICO stands for FAIR Issac Corporation. There methodologies have to be fair!

How dare you question their omnipotence!

Only in the era of big and blunt corporations would quants be more important that a person to person interview for determining creditworthiness.

I thought the mortgage crisis would have proved FICO doesn’t work, but they are just doubling down on it.

I’m a quant.

If that’s the work of quants, it’s some pretty retarded ones.

Named after Mr. Fair, mind you.

FICO is basically organized extortion.

If I am overcharged and contest a bill, then my score gets dinged.

How many times do you hear “if you do not pay, your credit will be damaged.”

So, you pay rather than dispute.

The system is broken.

It works on the same principle as the secret police – we have the file on you; so, don’t make a fuss. Listen well and obey.

They say they use FICO to change my rates for homeowners and car insurance, two different companies ….

The state insurance regulators haven’t been doing their jobs. Insurance contracts frequently allow for frankly arbitrary changes in premiums based on stupid, arbitrary stuff like credit scores.

Is it necessarily arbitrary? What if there is a strong correlation between driving habits and credit score?

There isn’t.

There is a more subtle correlation: you’re less likely to maintain your car properly if your credit is poor, and you’re also less likely to “just pay for” minor damage without claiming it at the insurance company. So I understand why *collision* premiums rise.

But it makes no sense for *liability* premiums.

Most short sales are done by people trying to get away from paying their obligated debts. Most can afford to pay their mortgage. There is a very small percentage of people forced to move for legitimate reasons and is the best reason for a short sale. Why should these people enjoy a better FICO score? They should not. Crying about FICO scoring the same for short sales as foreclosures is all about those that have a reason to promote a different scoring. The banksters know that they come out better if they do short sales versus foreclosures and the biggest reason is the real estate industry benefits tremendously if the short sale route is chosen. After examining many short sales I found most sellers were mislead about the difference between a short sale and a foreclosure by their real estate agents. Almost everyone was told that a short sale was much better on their credit report than a foreclosure. These are blatant lies in order to solicit business. If a foreclosure occurs no real estate commission is paid. On a short sale of course the agent gets a commission. Golly, which do you think will be promoted by the real estate agents and the banksters and who is really complaining about treating short sales and foreclosures the same by FICO?

Nice post. Here in sunny Los Angeles I have been going through a loan mod back & forth with BofA/Countrywide for almost two years.

At first, I was worried about the relative impact a short sale vs. a forclosure would have on my credit score. Then, a number of my CPA/lawyer/Real Estate broker/hang around with rich people friends started telling me to “Don’t Worry, Be Happy”.

Allegedly, for about two years after either a short sale or a foreclosure your credit is toxic waste. However, as long as you continue to pay all of your other bills on time, after two years you can go out and buy again! So I guess the folks who sell properties in one of the biggest underwater states have already figured out the when it comes to FICO vs making a buck, they’ll go for the money every time. Capitalism is so droll :-).

Evidently my bank has figured this out too — instead of foreclosing, they want to auction off the home as a part of some big package of toxic CDO waste being fronted by Wells as the Trustee of record.