By jimq, who operates the Burning Platform website. Originally published at Washington’s Blog.

Have you heard the news? Auto sales are booming. Total sales for the month of August were 1,285,202 vehicles, according to Autodata Corp, the highest monthly sales figure for any August since 2007, when 1.47 million autos were sold in the United States. Year to date auto sales have totaled 9.7 million and are on track to reach 14.5 million. Between 2006 and 2007, auto sales ranged between 16 million and 18 million. They crashed below 10 million in 2009. The Keynesians running our government have pulled out all the stops to restart this engine of consumer spending. First they wasted $3 billion of taxpayer funds on the Cash for Clunkers debacle. Almost 700,000 perfectly good cars were destroyed in order to keep union workers happy. This Keynesian brain fart distorted the used car market for two years, raising prices for cars needed by the working poor. After that miserable failure, they realized the true secret to selling vehicles is to give them away to anyone that can scratch an X on a loan document, with 0% interest for 60 months, financed by Federal government controlled banking interests. Add in some massive channel stuffing and presto!!! – You’ve got an auto sales boom.

General Motors sales are up 3.7% over 2011. Ford Motors sales are up 6% over 2011. The Obama administration continues to tout their saving of the U.S. auto industry with their bailout in 2009 that saved unions and screwed bondholders. If this strong auto recovery is not an illusion, how do you explain the two charts below? General Motors stock is down 42% since 2011. The highly proclaimed success story called Ford Motors has seen their stock collapse by 50% since 2011. This is surely a sign of tremendous success and anticipation of soaring profits for these bastions of American manufacturing dominance.

This is America, land of the delusional and home of the vain. The appearance of success is more important than actual success. The corporate mainstream media dutifully reports the surge in auto sales is surely a sign the economy is recovering and the consumer has finished deleveraging and is ready to spend again. The government propaganda machine proclaims the surging auto sales are due to their wise and forward thinking policies (like the Chevy Volt). Luckily for them, there are millions of gullible Americans who believe the storyline and are easily convinced that driving a $30,000 new car, financed over seven years, makes them a success. The decades of Bernaysian marketing propaganda has worked its magic on the government educated, math challenged citizenry. There are only two things that matter to the non-thinking auto buyer (renter) – the monthly payment and what the next door neighbor and his coworkers will think. Buying a fuel efficient car they can afford, paying it off in three or four years, and driving it for ten years, while saving the monthly car payment, is what a practical, rational thinking person would do. The fact that only 20% of the 9.7 million vehicles sold this year have been small cars and the average sales price of new cars sold is now $31,000 proves Americans are still living in a delusional fantasyland of cheap gas and monthly payments for eternity.

As gas prices surpass $4 per gallon across the country, somehow 4.7 million of the 9.7 million vehicles sold in 2012 have been pickups, vans, crossovers or SUVs. Three of the top eight selling vehicles are pickups. Luxury vehicle sales are booming, with Mercedes, BMW, Porsche, Land Rover and Audi showing double digit percentage sales gains over 2011. We’ve entered a recession, gas prices are approaching all-time highs, job growth is pitiful, and Americans continue to buy luxury gas guzzlers on credit. This will surely end well.

The average payment on a new car in 2012 is $461. For used cars, the average monthly payment is $346. Today, 77% of new car purchases are financed. About half of all used vehicles involve financing. Of those cars financed, 89% are through a loan vs. 11% with a lease. A critical thinking person might wonder how a country with 4 million less employed people than we had in 2007, median household net worth down 35%, and real wages lower than they were in 2007, could be experiencing an auto boom. The answer is a government/corporate/banker/media effort to funnel taxpayer funds to deadbeats across the land in a fruitless attempt to create a facade of recovery. Our governing elite are convinced that more debt peddled to the masses is the path to recovery for an economy that imploded due to excessive debt peddled to the masses in the first place. Essentially, it comes down to who benefits from the peddling of debt. It isn’t the masses, as they become enslaved in the chains of debt and monthly payments in perpetuity. Debt peddling benefits Wall Street bankers, politicians, and mega-corporations selling crap to the masses.

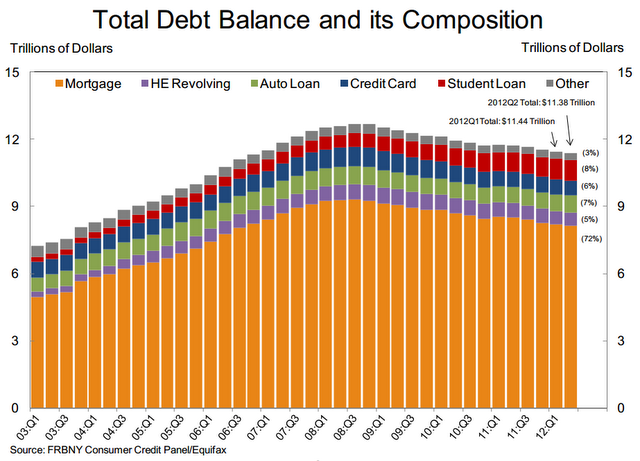

The storyline being sold to the vegetative dupes (watching Honey Boo Boo) that occupy space in this delusional paradise we call America, by the corporate media, is that consumers have deleveraged and are ready to resume their “normal” pattern of spending money they don’t have on stuff they don’t need. Of course, the facts always seem to get in the way of a good yarn. Consumers have never deleveraged. Consumer credit outstanding is at an all-time high of $2.58 trillion. The decline from $2.55 trillion in 2008 to $2.4 trillion in 2010 was NOT deleveraging. It was the Wall Street Too Big To Fail banks taking a big dump on the American taxpayers. They passed their bad debts to you through TARP, the Federal Reserve buying their toxic “assets”, and ZIRP.

Revolving credit (credit card) debt peaked at just above $1 trillion in 2008 and “declined” to $850 billion during 2010. The media storyline is that you buckled down and paid off your credit cards, therefore depressing consumer spending and creating a recession. Sounds convincing except for the fact that it’s a load of bullshit. The Federal Reserve’s own data proves it to be false. Your friendly Wall Street banks have written off $213 billion of credit card debt since 2008 and passed the bill to the few remaining taxpayers in this country. For the math challenged, this means that consumers have actually INCREASED their credit card debt by $68 billion since 2008. The bad news for our Chinese crap peddling mega-retailers is that the significantly poorer average middle class American household is using their credit cards to pay their property tax bills, IRS bills, and utility bills in order to survive.

Credit Card Charge-off in Dollars 2005 – 2011 — Not Seasonally Adjusted:

| Year | Dollar Amount |

| 2011 | $46,017,459,671 |

| 2010 | $75,090,106,350 |

| 2009 | $83,179,901,000 |

| 2008 | $53,506,353,600 |

| 2007 | $38,149,440,000 |

| 2006 | $32,111,934,400 |

| 2005 | $40,634,994,400 |

| Year & Quarter | Dollar Amount |

| 2012Q1 | $8,772,385,443 |

The category of debt that barely budged in the 2009 collapse was non-revolving credit. It stayed in the $1.5 trillion range in 2009 and has since surged to over $1.7 trillion in 2012. What could possibly have made this debt skyrocket by 33% when the GDP has only grown by 12% over the same time frame? You guessed it – your corporate fascist friends in Washington DC and on Wall Street. Non-revolving debt consists of auto loan debt of $663 billion and student loan debt of approximately $1 trillion. Student loan debt has shot up by $300 billion since 2008. This student loan debt is being distributed, like candy by a pedophile, from the Federal government in an effort to artificially hold down the unemployment rate.

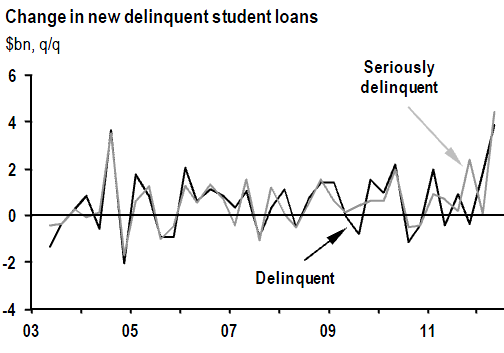

Approximately $500 billion of the student loan debt is held directly by the Federal government, up from $100 billion in 2008. The Feds guarantee the majority of the remaining student loan debt. Can you think of a more subprime borrower than a 40 year old former construction worker getting a liberal arts degree from the University of Phoenix, sitting at his computer in his underwear scratching his balls, and paying with a $10,000 Federal student loan from you? This fraudulent attempt to obscure the true employment situation will end in tears for the borrowers and the American taxpayer. It’s tough to make a loan payment without a job. The student loan bailout is just over the horizon and will cost you at least $300 billion. Delinquencies are already off the charts.

When has offering low interest debt in ample portions to people without jobs, income or assets ever backfired before? The bankers and politicians that control this country seem to be a one-trick pony. They will never admit that debt is the problem and reducing it the solution. The real solution would make them poorer, so their solution is to pour gasoline on the fire with more debt at lower interest rates to more people. The addict will keep injecting more poison into their system until sudden death. The bankers and politicians know we are a car-centric society and appeal to our vanity and poor math skills to keep the game going.

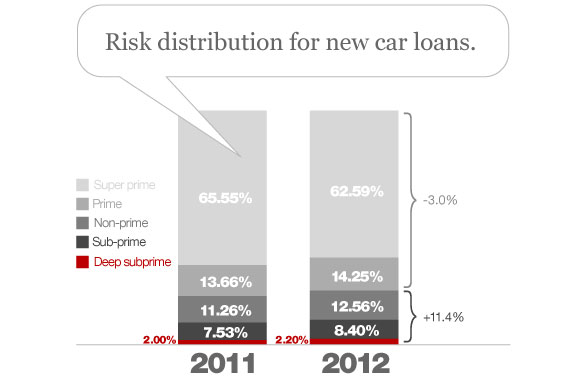

During the first quarter of this year, total U.S. car loans totaled $52.5 billion. That’s 49% higher than the same period in 2009. Also during the first quarter, the average amount financed on new vehicles rose by $589, to $25,995, and for used cars by $411, to $17,050. Furthermore, buyers are stretching out payments for longer terms: The average length of new- and used-vehicle loans jumped a full month during the first three months of this year, to 64 and 59 months, respectively. The surge in auto sales is being completely driven by doling out more loans for a longer time frame to deadbeat borrowers. Subprime auto loans now make up 45% of all car loans and the vast majority of all used car loans. They have even created a category called Deep Subprime. Borrowers classified as “deep subprime” (i.e. those with Vantage scores below 600) account for 10.7% of auto loans. You can also classify them as loans that will never be repaid.

Two thirds of all car sales are for used cars, so the fact that 37% of all new cars are being sold to subprime borrowers is exacerbated by the ridiculous lending practices for used cars. The fine folks at Zero Hedge have provided the outrageous data and a chart that proves beyond a shadow of a doubt what awaits the American taxpayer – another bailout. Zero Hedge has already revealed the GM fake recovery by detailing their channel stuffing over the last two years. Now they’ve dug up more dirt on why car sales are surging. What could possibly go wrong providing loans for more than the value of the asset to people with a history of not paying their debts?

- Subprime borrowers received 56.46% of loans on used cars in the quarter, up from 52.70% a year earlier.

- The average loan-to-value on new cars was 109.55%

- The average used car loan-to-value ratio rose to 126.62%

- 77% of Subprime Auto Loans are for a period greater than five years

It’s amazing how many cars you can sell when you aren’t worried about getting paid. This is the beauty of a fiat currency, a printing press, and a taxpayer available to pick up the tab after the drunken party gets out of hand. The chart below provides the details of our superhighway to disaster. The percentage of used car loans to prime borrowers is now at an all-time low, while the percentage of loans to subprime borrowers is near all-time highs reached just prior to the 2008 crash. When lenders cared about being paid back in the early 2000′s, they rarely made loans longer than five years. Today, more than 77% of all subprime used car loans are longer than five years and average FICO scores are now well below 600. Just to clarify – if your FICO score is below 600 – YOU ARE A DEADBEAT.

When you start to connect the dots, things that didn’t seem to make sense begin to crystallize. This is all part of the master plan concocted by Bernanke, Geithner, Obama and the Wall Street Shysters. The auto section of my local paper now makes sense. Offers of 7 year financing at 0% interest and monthly lease offers of $150 to $200 for brand new cars now are understandable. The newer model BMWs, Cadillac Escalades, Volvos, and Jaguars I see parked in front of the low income luxury gated townhome community in West Philadelphia now makes sense. A pizza delivery guy driving a new Lexus is now explainable.

The master plan is fairly simple. The Federal Reserve lends money to the Wall Street banks for 0% interest. These banks then turn around and provide credit card debt at 13% interest, new & used car loans to prime borrowers at 5% interest, and new & used car loans to subprime borrowers at 16%. When you can borrow for free, you can take a chance that a significant number of your borrowers will default. Essentially, Ben Bernanke is screwing the prudent savers and senior citizens by paying them 0.15% on their savings in order to subsidize the bankers that destroyed the country so they can make auto loans to the same people who took out the zero percent down interest only no doc mortgage loans in 2005. In addition, Wall Street knows the Bernanke Put is still in place. If and when these subprime loans explode in their faces again, Bennie, Timmy and Obamaney will come to the rescue with your tax dollars. Its heads you lose, tails you lose, again.

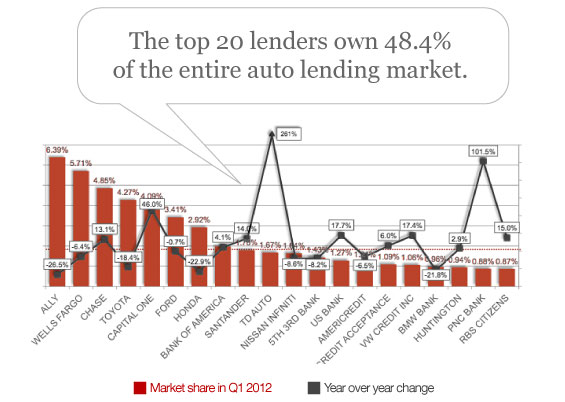

The chart below is like a who’s who of TARP recipients. The top 20 auto lenders control half the market. And look at the leader of the pack. Our friends at Ally Bank are the market share leader. You remember Ally Bank – they conveniently changed their name from GMAC (also known as Ditech – biggest subprime mortgage lender) after losing billions and being bailed out by you. They still owe you $11 billion and are 85% owned by the U.S. Treasury. No conflict of interest there. You have the biggest auto lender on earth controlled by the Obama administration. Do you think they have an incentive to make as many loans as humanly possible to help Obama create the illusion of an auto recovery? The only downside is for the American taxpayer when we have to eat billions more in Ally/GMAC losses. This insolvent excuse for a lending institution has been extremely aggressive in the subprime auto lending market and has forced the other wannabes – Wells Fargo, JP Morgan, Capital One and Bank of America – to lower their lending standards. Does this scenario ring a bell?

We’ve become a subprime auto nation, addicted to easy debt, living lives of hope, delusion and minimum monthly payments. Storylines about economic recovery, fraudulent government statistics showing lower unemployment, feel good propaganda from the corporate mainstream media, and a return to easy money debt fueled spending does not constitute a real recovery. Until the bad debt is purged from the system and saving takes precedence over spending, the country will stagger and ultimately fall under the weight of its immense debt. We are lost in a blizzard of lies. This subprime fueled engine of recovery will propel the country into the same canyon of reality we entered in 2008. The crack up boom approaches.

* * *

Lambert here: I’ve never owned a car, so I found this JimQ’s post especially interesting.

Yeah, cash for clunkers was implemented to “keep union workers happy”. If only we got rid of those damn unions.

The strangest thing about the cash for clunkers program was that most people I know (myself included) looked into it but didn’t qualify because our crappy cars were too old! The only person I know who qualified had a fairly decent car, hardly a clunker. So, as usual, the poor got the shaft and the real clunkers stayed on the road. nice.

El Guapo;

“!Si, se puede!” Now THAT was unionizing!

I agree with you. Getting that money into the pockets of a million or so ‘union workers’ is much more rational than giving it to banks. It gets spent into the economy for one thing. As for having a FICO score below 600, well, what do you expect from mainly poor, uneducated people constantly fed a diet of high consumerism through the media? I wait to see a pundit resurrect the phrase, “Aping their betters.”

Direction;

We had the same experience. So, we bought a semi-clunker and I fixed it up. Is the gentle art of DIY auto repair a dying pursuit?

It wasn’t a program for the poor, that’s just how it was sold. It was a progam to do one thing and one thing only: get inventory off lots where it was sitting and gathering dust.

The poor can’t and don’t buy new vehicles. That’s reality. THe poor buy used vehicles for cash, they don’t finance because they can’t. The people who buy new vehicles are the middle class. Cash for Clunkers was about getting the middle class to upgrade and move inventory. It was a sales stiumulus that was green washed.

We have a consumption based economy and it grinds to a halt if people aren’t spending. So, programs to get people spending are what is needed. Yes, unemployment is high, but the people who still have money and jobs are sitting on their cash and not spending because they are worried about their jobs and the economy.

I’d rather go for “We have a *Hyper-consumption based economy that grinds to a halt if people don’t *waste.”

Because if people don’t spend, it doesn’t really grind to a halt, it shifts in reverse and lands in the shithouse…

So, at least for you, Cash for Clunkers was like HAMP for cars? (Not in the implementation…)

This post is right about Obama and his banker bosses being bad guys, but most of the rhetoric is about villainizing unions and workers.

Blaming the state of the economy on unions and lazy poor people is profoundly right wing framing. I’m very sorry to see it here, especially from Lambert, who should know better.

Fair enough. I’ve seen lots and lots of work on housing, and some work on student loans, but little on autos. So I filtered the rhetoric and thought the finance part would be useful — if only as an object of criticism. Now, I just processed the Republican convention for three days and the Democratic convention for four, and it looks like my filters were way more clogged than I thought!

I’m very sorry to learn that Lambert, who should know better, “just processed the Republican convention for three days and the Democratic convention for four.”

Kudos for manning up on the article though Lambert! It did have a lot of good info in it, and even some nice fire in the writing that caused one to overlook the blaming and berating the ‘addict’ as equally as the ‘drug dealer’ bias.

Xtrevilism is a disease that spreads from the top down. The few at the top control the culture making propaganda machine and the government, and therefore make the masses what they are. Berating the masses for their poor reactionary behaviors to the deceptions plays into the intentional creation of the perpetual conflict and herd thinning that is the true driver of events presently taking place.

There is truth to the fact that many have become; “the vegetative dupes (watching Honey Boo Boo) that occupy space in this delusional paradise we call America”, and it is by design, but the author does not go far enough in explaining his closing, intentionally all inclusive, remedial belief that; “Until the bad debt is purged from the system and saving takes precedence over spending, the country will stagger and ultimately fall under the weight of its immense debt.”

This moronic, simplified, half wit — intentionally opaque — remedial measure does not even come close to rectifying the problems that he does lay out. After blaming ALL for the problems EQUALLY, without pointing out that some few, by virtue of the corruptly gained power that they wield, are far, far more responsible than others, for the conditions that we exist in, he obliquely lumps the victims with the perps in his ‘solution’. This is the ‘Personality Responsibility’ pap, ‘we are all to blame’, in a very deceptive suit.

He is SELLING the Kool Aid of divisiveness as he adds to the divisiveness.

Deception is the strongest political force on the planet.

Nicely laid out, thanks!

This debt cliff we are going over (not personally, mind you) is all part of some master plan by the global inherited rich to enslave folks further.

It is interesting/sick to see how iron fist in velvet glove our government is now brazenly working for other than its rightful citizens.

Of course this analysis is exactly right. The financial health of the pruduent has been ruthlessly sacrificed to support the profligate and enrich the predators engineering their fatuous life styles. The economy is a joke from end to end. There is no product worth buying in any of the shops. The workers cannot live on the miserable stipends they are paid. The students are not learning anything in the ripoff university system which provides the excuse for their lifetime debt enslavement. Medical care is the biggest joke of all, with the insurance companies impoverishing both the insured patients and the captive practitioners who are lucky to recover 10% of the charges billed, while the drug industry collects the largest share of the health care bill for masking symtoms and creating long term dependence and God only knows what unforseen consequences by dispensing inadquately studied and fraudulently promoted nostrums only one largely toxic step removed from patent medicines.

There is no solution to any of this. An individual can try to live sensibly and decently but everything conspires to make that individual a sucker. Virtue is its own reward. That means you don’t get any other rewards.

Yves, what happened to the nakedcapitalism.com I once knew and loved?

This reads like someone’s coke-fueled rant.

Gawd you are hard to please.

Just because the author didn’t tell you explicitly about the delusion that students are under that school is a good place to hide when the economy is bad you think that a drive by blow off is appropriate.

What is suppose to be the tone of a posting about your country fucking you like they didn’t teach you in high school civics?

Yep. It definitely expresses a point of view alright. That’s what you get when you actually strip American capitalism ‘naked’ and view the god-awful awful truth. Kind of like a corpulent out of shape geriatric exposed in the bright light of day for all to see. You can’t bare to look, it’s so ridiculously hideous, even as you can’t seem to look away either. Thing is, we need to look, cause it’s definitely our future coming straight at us all over again.

Wa?

It’s a post [rant] about our government [stat crazed lunatics] using Keynesian stewardship techniques to manage the economy [flog the consumer until they buy something] and stimulate [MMT in your face Mutha] the private sector [GM] and save or create well paying jobs [UAW].

What’s wrong with that?

>>This reads like someone’s coke-fueled rant.<<

A rant that deploys hundreds of points of evidence to support its argument. As opposed to mere impressions, labels, insinuations and adjectives.

The author supplies no links to sources or verifications of those “hundreds of points of evidence.” As one who comes to this site to learn something, it’s disappointing to see space given to a writer who has so little respect for his audience. It’s certainly not consistent with what I usually find at Naked Capitalism.

As far as “labels, insinuations and adjectives” are concerned, from the first paragraph to the last, the piece is pumped full of troll-chum that reads more like what’s found in comment boxes than under banners. Editorializing is one thing, even bias is tolerable, providing the author provides some sort of verification of assertions. Without that, for someone seeking to learn, there is no credibility…only specious rhetoric created to reinforce an all too obvious political bigotry.

Yeah, well most people here have a thick enough skin and critical enough thinking to realize that just because he says bad things RELATED to unions isn’t hating on unions. He just points out that unions IN THIS CASE (UAW) have received preferential treatment by Obama, despite all the other unions he has screwed, which is not fair to everybody else. which is absolutely the truth and entirely appropriate for an article to be shown on NC.

And it absollutely is an issue that our government and a certain large population of our citizenry has learned ABSOLUTELY NOTHING by the subrime housin issue.

Intelligence and wisdom are different things. If being a fool makes you a deadbeat that buys things you can’t afford, then you will indeed get whats coming to you without much simpathy from 99% of people.

I bet your believe NPR and they offer no sources other than hear say and views by corproate sponsored “think tanks”. Lots of points provided–its a blog not an economics journal.

You would lose that bet.

I am surprised this author appears on Naked Capitalism too.

His website is an Obama hating machine filled to the brim with angry rants and bigoted readers.

The phrase “free shit army” is a favorite when referring to the poor.

Oh, and I forgot to mention the misogyny found there too, readers post “big tit” and “nice ass” pictures of women as if the website is a pin-up calendar.

For shame Yves.

Slow news day at NC! The article is filled with less then notable information and the reality is that subprime credit is nothing new.

@Lambert — please exercise some discretion and try to preserve Yves reputation for professionalism! This post is unacceptable for this blog. It’s up to you to have common sense about maintaining a minimal standard, and this post is a huge fail. Keep it up and you are going to start losing readers pretty quickly, imho.

Point of view is fine with me but can we please manage to keep this site away from gross conspiracy theory “You have the biggest auto lender on earth controlled by the Obama administration. Do you think they have an incentive to make as many loans as humanly possible to help Obama create the illusion of an auto recovery?” and sophomoric gutter talk “Can you think of a more subprime borrower than a 40 year old former construction worker getting a liberal arts degree from the University of Phoenix, sitting at his computer in his underwear scratching his balls, and paying with a $10,000 Federal student loan from you?”

http://thingumbobesquire.blogspot.com/2012/09/how-james-fenimore-cooper-foresaw-twin.html

A world where no one is credit worthy… especially the issuers… pop.

Since credit creation in a government enforced monopoly money supply is a form of counterfeiting then NO ONE is credit-worthy. And since the poor are typically the least so-called “credit-worthy”, then credit creation especially steals from the poor.

So if someone built their business or wealth using credit, then “You didn’t build that” certainly has some truth in it wrt them.

Amazing nonsense. To call the Obama gang Keynesian amounts to calling Paul Ryan compassionate. Randian is a much better term for a gang that pumped trillions of $$$ into the financial industry subsidizing the richest people on earth.

“Saving union workers” is a positive even if it costs money. Unless, of course, the scriber thinks that the gang should have forked over the subsidy directly to your Bain at the Caymans.

The stock market as the supreme authority over value is yet another piece of right wing propaganda. In reality, the stock market merges a huge number of weights and balances from a widely diverse universe. This is not the Roberts court.

American live on credit. It isn’t the best way to live and it isn’t the way other developed countries live. Credit as a way of life has started way back and will continue well into the future. The analysis of debt here amount to trying to stitch together two blocks of ice.

We seldom sink that low in NC.

Good critique of post.

Lenders are no longer making subprime mortgages. Borrowers are replacing their mortgages with auto loans. Interesting so many are SUV’s and pick-ups. Are we still a nation of farmers? And where I live, there are no new luxury vehicles parked in low-income neighborhoods. For that matter, don’t see any new luxury vehicles anywhere else either. But when I travel to visit sisters, OMG! Did the author consider the wealthy might be buying the expensive cars? One can surely be wealthy AND subprime, often are. Who says the wealthy pay their bills?

“This insolvent excuse for a lending institution has been extremely aggressive in the subprime auto lending market and has forced the other wannabes – Wells Fargo, JP Morgan, Capital One and Bank of America – to lower their lending standards. Does this scenario ring a bell?”

Wait a minute. How do they do this? If a lender enforces sound underwriting, they’ll lose the crappy subprime market but why would they lose the better credit risks?

The libertarian philosophy was evident in this article. Since the GFC, many credit-worthy borrowers faced extreme short term difficulties that adversely affected their credit ratings. A short sale hurts a borrower’s credit for 7 years, little difference from a foreclosure. If the borrower has recovered from their difficulties, should they still be locked out of the market?

In any case, author found some very good data. 77 month loans for more than value ARE disturbing. Many of these loans are being securitized. Constituents of the dog-food (canines are persons too) commission seeking income to cover the debt payments that didn’t retire with them.

The central delusion in this article is that the “Guvmint” is responsible for everything negative going on in society. While the Fed’s easy money policy may facilitate subprime auto loans, it doesn’t make those loans. There’s nothing “Keynesian” about this. This article’s author is so desperate to defend his beloved “private enterprise” that he must attribute all its failings, greed and corruption to the State.

This is the problem with Paulites, Randians and Propertarians in general. They so willfully blind themselves to Capitalism’s faults that they end up sounding ridiculous when making otherwise valid criticisms of our present circumstances.

There’s plenty of blame to go around. The State finds ever more ways to encroach upon our liberty, while Capitalism invents new methods to steal whatever change it can find in our pockets to save itself.

What state? What union?

the problem with neolibbatardlicans is they they are completly hung up on,(completely stuck on) what kind of hat the capitalist pigs who run the country are wearing.. If they put on an Ike or Doug MaCarthur olive-drab, leather- visored, U.S issue, mailman hat they are oppressive tyrants…if they put on one of those triangular yankee doodle hats with a big ostrich feather in it, and maybe a blue silk ribbon – then they are a founding fathers. Sideways napolean hats move one back onto the big gubmint tyrant side of the room… It matters not one whit that the only difference between “government” and “private” are a few letters and the shape of the hat..libertarians, even after they declare govt illegal, (i encourage you to take some time to try to figure out how that might work)..are still going to get the living shit governed out of them, hard and heavy just as if the bosses were wearing the regulation hats…they can call it “private” if they wish – the fact is the govt we have now is all but private and corporately run. Their stateless society will last about .000000000000000001 seconds,which is the amount of time it would take for a govt. vaccum in the modern to U.S. to be filled..many physicists believe the speed of the inrushing political power would create a small thermonuclear – like explosion, and suck the air out the lungs of opera singers on the other side of the globe!

In case you haven’t noticed, Guvmint and Finans have merged.

Here’s Ally – formerly Guvmint Auto Credit division of Guvmint Motors.

——————————————————

Ally Financial bets on risky subprime car loans

Ally Financial Inc, the United States’ largest maker of car loans, hopes that people have forgotten the time when “subprime” became a synonym for “disaster.”

Ally, once known as GMAC Financial Services, is getting ready to go public this year, and is making the case that subprime loans for used car buyers are not about to produce the same results that they did in the housing market a few years ago — a near-collapse of the financial system.

http://www.reuters.com/article/2011/05/31/us-allyfinancial-idUSTRE74U4FY20110531

“Keynesian” must be a typo; I’m sure he meant “Kenyansian” :^) We are aspiring to the African model of government, serving a shrinking inner circle of kleptocrats.

““Saving union workers” is a positive even if it screws over the entire tax base of america and facilitates millions of people self-destructing their future.”

There fixed it for you. Such simple minded Unions = Good is pretty low brow. Sorry.

The auto data is alarming, that people are buying used cars of between 5-7 years in age and financing them with loans of about similar duration at loan to values above 100% all with the blessing of Dodd-Frank which exempted debt auto debt and pay day lending. And not so ironically, so far, we don’t see any warning signs in auto securitizations or demand for such paper all rated AAA.

And this is why any deflation will be temporary in the USA. Pretty soon, they’ll figure out a way to turn this loan into an ATM, followed by student loan then back to housing, etc, etc. Hyperinflation, here we come.

SubPrime Auto Cash Out Refis, or Line Of Credit!

GENIUS! LoL

But first they will have to figure out how to make cars appreciate in value, so you can build “equity” in one.

But never say never.

They already have, thanks to Cash for Clunkers.

I have been looking at a 2008 Dodge model (the last year they made them), they are going for $20K, the original MSRP was $18.5K. Double thanks to Ben, not only is inflation killing me but as a retiree, I no longer earn any money on my savings (I’m not going to the casino)!

BTW, I remember in the 70’s when new auto loans went from 36 to 48 months, all of the blowback about “irresponsiability”.

My how times change!

Beyond silly.

Don’t stop believin’, Can’t Help It! The Rapture will be here any day now! I can feel it.

Hyperinflation requires a cyclical increase in prices and wages feeding into prices. Wages are not going anywhere but down. That means poverty, not hyperinflation. HTH.

Rapture Index closes up 1 on arms proliferation.

If we get poor enough, everything will be free!

Obama claims to turn around the US auto industry in a time frame you couldn’t turn around your local pizzeria, and no one asks the obvious question: “How is this f’n possible?”.

If you didn’t realize the fix was in at that point, you were sleeping.

Yes the auto thingie destroyed Ireland also…..it became a conduit for the cores waste based industry and they wasted us.

Now its over.

“Can you think of a more subprime borrower than a 40 year old former construction worker getting a liberal arts degree from the University of Phoenix, sitting at his computer in his underwear scratching his balls, and paying with a $10,000 Federal student loan from you?”

He’s probably not getting a liberal arts degree. He’s probably getting a narrowly defined vo-tech degree that will be even more useless.

Last time I checked, literacy still had some residual value.

who is this douchebag “jimq”…oh wait, its a lambert strether repost

“Sub-prime?” Since credit creation in a government enforced monopoly money is a form of counterfeiting then NO ONE is credit worthy.

Also, I note in the Old Testament that the poor were not be charged any interest, yet in the US they are charged the highest interest!

But otoh, it is instructive to see what a mess the counterfeiting usurers have caused.

I think it was Steve Keen who said that if reasonable people won’t solve this mess then unreasonable people will come to power by solving it, at least temporarily. Remember, Hitler was initially seen as a savior by the Germans.

Just, no. The idea that the problem comes down to a stupid government rigging it so that deadbeats can live beyond their means — and “we’re” all paying for them — stinks of proto-teaparty 2008 blame the poor BS.

Sneering at the underemployed and quoting Zero Hedge – wonderful. Thanks for missing the point completely.

Yeah. And what kind of troll has to take pointless pot-shots at Honey Boo Boo? He only wishes his schtick was this good.

http://www.youtube.com/watch?v=CGM_ANQsQ74

Personally, I’m glad Lambo posted this.

I can see from the comments that some are disappointed that the post didn’t give equal time to bank abuses/bailouts nor did it weight the relative effectivness of all these government bailouts and manipulations of the last few years (perhaps the author lacks econometrics skills). And that it was seemily unbalanced in ideologolical slant without the author properly disclosing which one, and provided no references whatsoever to hard data at New Economic Perspectives.

But I must point out that the Title/subject of the post is:

“Subprime Auto Nation”

and not

“F*cked Up Nation”

Well I’d point out too that NC is a bank-abuses website not a deadbeats-taking-advantage website and that of the latter we have plenty, and unlike NC they have their own cable tv networks attached. The intellectual dishonesty of the plutocracy’s various barkers – for example this post – doesn’t need or deserve equal time.

C’mon now.

deadbeats-taking-advantage ????

I’m bet dollars to donuts in about a year there will be a post on NC about the subprime auto loan crisis and at that point it will be characterized as “predatory lending”.

I think the point of this article is that we have “predatory Keynesians”.

Um, you are five years too late on that subprime auto finance crisis thing.

Happened already. Many examples, but just research the past five years for Americredit and Household Auto Finance.

I did programming work for Ford’s subprime unit in 2001, so I know about them a bit.

In this post I mean the next crisis. We don’t stop with just one.

But that is the bank’s decision and the buyers of the ABSs. As long as the goverment does not guarantee thier losses(like in mortgages) it’s just business. The market in action.

And since they did not stop the demise of the largest subprime autolenders when the ratings firms(like S&P) were fraudulently rating the auto ABSs just like they did mortgages, it will not happen.

Amazing, people hear sub-prime and they come up with delusional thoughts. Nothing wrong with it, more risk, higher rates, standard stuff. Problems arise when the banks and ratings firms conspire to sell it, and leverage it, like A paper. That happend in the mid oughts, it is not happening now.

The Ford place told me thay had a 30% repo rate first year and it’s in the biz plan.

The S&P report is on ABS, so that implies there is still issuance.

And we do have a consumer loan protection agency, and if what I saw Ford doing wasn’t preditory, then I don’t know what is.

What’s wrong with a 30% repo rate if it is in the business plan? Why would that be predatory lending? (BTW, I think the 30% is way high, I operated at 16% at my rates were not low).

These people are high risk for a lot of reasons, some their own, some by misfortune. But these loans give them a chance to live and work. The vast majority of them need reliable transportation to keep their jobs; take their kids to day care or school, etc.

I am not saying that some loans are not predatory lending, but the vast majority of people who take out subprime loans have been rejected by many differnt banks. Dealers can actually make more money with A credit people than they can make with b, c and especially d credit people. So there is not the steering you saw in the mortgage markets.

Well, I do remember the ABS market freezing up back in 2006 or thereabouts. I also read that a lot of smaller companies kept their short term cash – cash earmarked for payroll and paying vendors – in ABS paper. They were nearly pushed into bankruptcy when the ABS market finally froze up due to concerns over underwriting.

These had good ratings on the ABS paper, which is what the non-financial world goes by normally. So we could say S&P blew it again. But either way, there are far reaching consequences when they push this securitized crap on the world.

So I certainly wouldn’t say “no problem.”

You almost are there.

” had good ratings on the ABS paper, which is what the non-financial world goes by normally. So we could say S&P blew it again. But either way, there are far reaching consequences when they push this securitized crap on the world.

So I certainly wouldn’t say “no problem.”

See, it wasn’t the paper that did it, it was that the paper was misrepresented to the investor.

Short story.

Back in mid 2005 I am at a tent sale for a large dealership group. I am looking at a deal that the finance manager is pushing me to buy that I do not want, but I might take it(and it would be portfolioed) just to keep him happy with me. I was at 21% interest with a $950 discount fee to the dealer and I knew it was a bad deal.

I am just about to say OK when he walks in with an approval from Houselhold at 12% with a $95 fee, not to mention an LTV 20% higher than me. Stone cold loser deal. And probably for the investor, a loss of over 40% on the loan amount.

I knew what was going on from that weekend on. It was a fraud perpetrated on the investor, and my business could not compete. My business naturally reduced for a couple of years until I stopped originating in late 07. And trust me, I could have closed in 2006.

One good thing. When I saw in 05 what the investment banks were doing, I put all of my investments into gold. I knew it would be bad, just did not know how far the fraud went.

I think this is a very helpful and thoughtful post. The point isn’t that “it’s the government’s fault”, as some seem to conclude here, but that the government has become coopted by the banksters and the 1% generally. But looking at Obama’s rentention of, and genuflecting to, Streeters like Geithner and Summers, and the Dodd-Frank reform sham, should have made that point obvious by now.

What’s new isn’t the corruption but Lambert’s uncovering of the latest incarnation (pun not intended). The important lesson is that Obama’s failure to address Wall Street’s corruption–and the public’s failuire to demand that accounting–along with the TARP–or just letting the whole rotten structure collapse as Andrew Mellon would have advised–meant that the banksters were given license to keep playing their games and the public given liberty to return to their free-market exceptionalist fantasies. This is just the domestic version of the self-delision that we suffer in Afghanistan and Iraq, and with all our other undeclared SPECOPS- and drone-fought wars, in which we ignore the suffering and destruction we cause others in the name of GWOT.

I don’t think this about Keynesianism; it’s about deciding to ignore the results of dereguation in the financial industry while simultaneously bailing out the failures who got rich off of foolishness and lies. Either we return to regulation and greater government involvement in the economy, or we let everyone who sowed the wind reap the whirlwind. Lambert points out that we continue to do neither by sinking into a bailout-nurtured corporatist state that, ironically, is the very nightmare that Ayn Rand’s heros raged against.

“but that the government has become coopted by the banksters and the 1% generally”

Couldn’t we say that that’s the governments fault. Please, please? Y’know those lawmaker guys? The ones that can throw us in jail?

Not really. Most people cannot even conceive of a world without credit creation and usury. “Cognitive capture” is the phrase, I believe.

But we are talking about extending bad credit to bad credit risks as an instrument of government policy to stimulate the economy.

Besides, where all the cries of Neoliberalism?

Besides, Besides

The Fed was our official “consumer loan” protector, and due to the crappy job they did the job was pulled from them and given to a new consumer protection agency.That was Ms Warren, IIRC?

As you requested… cries of neoliberalism…

Some things cut through language barriers http://1.bp.blogspot.com/-R30S8U3IuLs/UDHC0F229LI/AAAAAAAAL1k/3lUOsGTYxQI/s1600/0.jpg

Iconic neoliberalism http://3.bp.blogspot.com/_2YAWR0ytbQo/SqQmDDJAOKI/AAAAAAAAFbo/matOBhpX0qY/s320/Neoliberal.gif

Wisdom of the ancients http://iwrite.es/wp-content/uploads/2012/07/neoliberalismo.jpg

Neoliberalism + neodarwinism = http://gulfofmexicooilspillblog.files.wordpress.com/2011/02/neo_liberalism.jpg

The Neo-aristocracy http://www.zcommunications.org/FCKFiles/image/jan09zmoimages/neolib3-A.gif

” 77% of all subprime used car loans are longer than five years”

I only have thirty years of experience in sub prime auto financing, so perhaps my questioning of this statement is unqualified.

But either the defintion of “sub-prime” is beyond silly or this is a stone cold lie.

And I will not even bother to comment on the total absurdity of “0% interest” advertising.

Man is a moron.

I only spent 30 seconds doing google searches, and I found this on 0 interest loans. They seem to be common from the automakers.

https://www.google.com/search?sourceid=navclient&aq=1&oq=0%25+interest&ie=UTF-8&rlz=1T4GGLL_enUS386US387&q=0+interest+car+deals+&gs_upl=0l0l0l899941lllllllllll0&aqi=g4&pbx=1

Then I found the S&P ABS report which is the source for the 77% of subprime is longer than 5 years data.

http://www.fluidbook.com/references/Special-Report-Auto-ABS/index.html#/26

I cannot read that S&P report. Tried to find it somewhere else, but no luck. So I cannot comment on it.

IN terms of the 0% interest thing, of course it is common, just like all advertsing gimmicks. All it is rebate from the manufacturer that pays the bank(captive)the interest on that loan upfront. You could walk in the door and pay less for the car at the going interst rate and, amazingly!, the payment would be exactly the same.

It is an advertising gimmick.

The S&P site/report is some fancy “flash” thing and will need some sort of addin in your browser.

But in the above post, the “Table 10 – Collateral Trends” is a direct reprint from the S&P report.

I need to see more, but if he thinks 600 is subprime, he knows nothing about subprime. And making something about LTVs is beyond silly.

The value part is wholesale, it does not include the seller’s profit; sales taxes, registration, warranty, etc. And somehow pointing to 111 and 112% as meaningful is beyond me.

The biggest subprime dealers in the mid oughts wer way, way beyond that level. Always have been, always will be.

And as a matter of receord, I take anything put out by S&P with a large grain of salt. Imho, their directors should have been placed in jail and the enitre operation shut down after their role in destroying the economy.

No name calling. You obvioulsy don;t comprehend the article or macroeconimcs.

Credit ratings have been vanity sized for some time. If the people you work for change the defnition of su prime and call it something else it matters not–given reality of comsumer finances and the volume of loans the inescapable reality is that most loans are sub prime. try and read the article again and not think from the perspective of a guy who fills out loan documents in a car dealership but from a citizen trying to understand the world from beyond your little shphere and dull certainties. If LS is a moron–what are you?

penn state, catholicism, the american dream…

when you raise the bar, the mythology collapses, from the foundation up…

how do you expect critters to respond?

Hmmm…..emotive troll-chum and the dilemma of whether to bite or not depending upon how much of a reasoning brain you can actually muster.

Thanks for my morning chuckle!

Guess I’ll pass and go do something……..grin

This is my favorite part, though:

” Almost 700,000 perfectly good cars were destroyed in order to keep union workers happy. This Keynesian brain fart distorted the used car market for two years, raising prices for cars needed by the working poor.”

I am on the fence with the CFC program, can see both sides and I am not sure. But this claim is beyond belief.

I would like to know how he rated these 700,000 cars as “perfectly good”. How many did he personally appraise?

How did he determine that CFC screwed up the used car market for two years? Based on his appraisals?

I personally visited over two hundred dealerships during the CFC. I would guess the total percentage of cars traded in under the program that were safe enough for a dealer to resell(if they could, as under 2%. Just what the poor in the US need: unsafe, unreliable cars that wi;l require more in maintenance than a payment would be on a decent car.

My favorite line came when I walked up to a new manager at a dealership looking at these wrecks, and asked him if he was the used car manager:

“Nah, I am busy running a junk yard right now.”

Agreed that the author went off the deep end on that part.

Pissed that the new “cars” as still half trucks and suvs tho.

Agreed.

No he is not pissed that they are trucks and SUV’s. The point is that as gas prices go up the unthinking buyers will find themselves in tighter times. Yeesh, can you read?

Yeesh!

Do you understand that BertS said he was disappointed with so many SUVS and trucks being sold and I agreed with his thought? That the author was not involved in those two posts at all?

Can’t you read?

I always get in trouble whenever I don’t make my sentences clear enough.

“Pissed that the new “cars” as still half trucks and suvs tho.”

s/b

“I am pissed that the new “cars” [sales volume] are still half trucks[sic] and SUVs, tho.”

Was clear to me.

Only Brainiac there had a problem.

If you are so curios as to what Lambert posed in terms of facts–look it up.

You seem to be annoyed by the piece and want to nit pick.

It was well reported that thousands of cars with long service lives were destroyed by cash for clunkers.

Why don;t you use the google thingy and look it up–i

f he put in the details you would not like it and say it was to long, he puts in well know items (or at least to those of us who have been awake for the last 5 years) and you dispute for the sake of it. Guess what Lambert wrote is hitting you on some emotional level.

I do not have to look up his “facts”, the ones he posts make no sense.

HEre, read this and see if you can figure out the distortion:

“Furthermore, buyers are stretching out payments for longer terms: The average length of new- and used-vehicle loans jumped a full month during the first three months of this year, to 64 and 59 months, respectively. The surge in auto sales is being completely driven by doling out more loans for a longer time frame to deadbeat borrowers. Subprime auto loans now make up 45% of all car loans and the vast majority of all used car loans.”

Now take that and compare it to the S&P numbers he posted in terms of the length of loans, and try to figure out how both are possible.

They’re not.

Aha! Good catch. Uhmm… how jittery can markets get? I’ve been wondering about that, because as some market analysts on CNBC have noted, markets sometimes catch pneumonia.

look at the emotion and underlying false ussumptions…

sometimes a false assumption of false assumptions becomes a true assumption…

I am disappointed in this post. Lines like:

“This Keynesian brain fart distorted the used car market for two years,”

Do nothing to convince me that this is in any way reasonable or useful reading. If I wanted to waste my time with ranting I would watch Fox News. I don’t, I come here.

With respect to the rest of the post’s contents, some of it looks true. The rate of auto loans is a bubble and the attempts to turn GMAC public to deal with it does support that contention. However I wouldn’t call this a government activity. Cash for clunkers was but where is the Fannie Mae and Freddie Mac with a guaranteed buy of auto loans? At best this shows the government simply ignoring the problem or giving thanks for the miracle and not looking under the hood when they should. It is yet another example of the problems with Dodd Frank.

I agree that Cash for Clunkers was not a useful method. At best it was a short-term backstop like so many things that are done lately. But it is consumer focused. Good Keynesian spending is investment in infrastructure that will add long-term value. I don’t see this as particularly Keynesian since it didn’t yield long-term investment only another short-term injection of cash.

I would find this post more useful if it read less like a screed than like an argument.

Outrageous reality must be delivered with aplomb. I suppose you like many others prefer “news” or “reality” delivered in the anodyne cadence delivered by a blow dried celebrity “anchor”. Brain fart is actually a good characterisation of the ideas proffered by the corrupt douchebags in D.C.

If you want style over substance go to NBC or NPR where they will deliver you comforting lies in nice rated G language which is measured, lacks passion and is approved for all audiences

Great post in every single way and totally spot on Lambert.

So like mary poppins a little bit of sugar will make the medicine go down? We are all getting ass raped as a country but you want nice words……Oy.

Good Keynesian spending is investment in infrastructure? How so? Where is that written or demonstrated? What infrastructure is good for long term–canals? Freeways? Bridges to nowhere? How did spending in infrastructure work out for Japan? have you actually read keynes? If you did its clear you did not understand a word of his work.

If I spend money on appropriate infrastructure (say roads) I can make it possible for a market to function and for goods to be distributed. This brings money for the individuals building the roads and, in turn, helps businesses that would depend upon them. As such the multiplier functions and at the same time I invest in something that will last beyond the initial spending.

Cash for clunkers by contrast will only stimulate the car makers as long as it functions and, once the guaranteed spending vanishes the demand will disappear as well.

How is that wrong?

How did spending in infrastructure work out for Japan?

Well, 20 years into a depression they have 4% unemployment, the best high speed trains in the world, medical coverage for all their citizens, number one in longevity, etc. Yes Japan has problems… but we should be so lucky.

I think you miss the forest for the trees and you have an absolutist vision that is not pragmatic or very real-world friendly. Yes, in a credit collapse, you have to reflate. If you can’t reflate with houses, you need a substitute. What’s wrong with saving union jobs, clearing inventory and restoring confidence. That is the only way out. Do you have a better idea? You prefer all three car companies to go under and millions of jobs lost.

Get real.

Saving millions of jobs by propping up via sub prime debt–yes a great solution.

Did you enjoy your time at the DNC? How were the speeches?

He is suggesting we get real–you obviously miss the point of the article and don;t understand the first thing about the real world of credit and finance.

Seriously, do you work for the adminstration or where you a DNC delegate? I say those are among the few types daft enough to make comments like yours.

Brilliant work Lambert

More Obama speeches and money printed from nowhere will restore confidence and allow us to buy cars and save the unions! Oh wait–none of us have jobs. Its o.k., we can get more credit thanks to Obama?

What is the planet you live on New Yorker with car? What is the weather like over there?

New Yorker,

With your logic I suppose we can reflate or flate everywhere! Why not inflate in Pakistan, Sudan and everywhere and end all human suffering? Create a bubble in Haiti and start a auto industry with good paying jobs? Give us solutions so we can raise up all nations. If we can finance cares for the jobless and poor in the U.S. we can do it around the world!!!!

We could reflate safely if we banned further credit creation and bailed out the population at the same rate as existing credit is paid off.

Lambert,

Great post.

Interesting how people are quickly taken in or aback by “tone”. There is a fixation with style and tone and if the tone departs from the bland network or msnbc tone they tune it out. Some show very little interest in the totality of what you are saying and sadly a lot of posters are now evocative of USA today–they cant read, overcome by dependent clauses or thrown off because he said a dirty work and what he has to say is bad…….

You are on target and serious empirical economic and finance research support all of your points. If somebody who filled out auto loan forms or is throuwn off by the word fart disagrees never you mind–they are vegetative ruminants on bland assurances and viewing the world from their little peephole of idiotic certainties.

You sir have no knowledge of finance, and a solid level of ignorance regarding auto finance. Yoy have swallowed this moron’s lies just like you swallowed( I will bet on it) the government caused the financial crisis “Big Lie”.

You don’t know how finance works, so some guy gives you a long post that fits into your ideology, and now you know something?

I did start out “filling out loan applications in a dealership”. Then moved to the other side working for a bank. Then I started my own bank. And I bought and sold sub prime for a couple of decades.

I know the business, you know nothing. And what you cannot seem to grasp is that there is nothing at all wrong with sub prime financing of any kind. Such lending has never caused any financial problems on a large level of any kind.

What caused the problem is banks lying to investors in ratings ABS’s; having them rubber stamped by rating companies and leveraging them far beyond any level they deserved(or should have had by law).

When you find out some bank is leveraging sub prime auto ABS at 60 to 1, then this guy can write some tripe about the business that may be true. Of course he will then blame it on the government, which will just make it more rehashed tripe. And you will swallow it whole.

that there is nothing at all wrong with sub prime financing of any kind. Such lending has never caused any financial problems on a large level of any kind. EMichael

Cause you make up for the increased risk with higher interest rates?

So the banks drive the poor into debt with counterfeiting and then charge them higher interest rates?

there is nothing at all wrong with sub prime financing of any kind

So, you were in favor of the no-doc NINJA loans that prevailed during the bubble years? Your comments could easily be read as supportive of that, and it’s clear those subprime loans caused plenty of problems no matter how they were packaged and resold.

Sub prime is like a financial sun burning iron, going red giant (expansive gas cloud), only to collapse into a white dwarf.

Skippy… time of events is the only variable.

Suns don’t burn iron since making elements as heavy as iron absorbs more energy that it produces.

Ain’t you never watch the Science Channel?

DEATH OF A MASSIVE STAR

Massive stars burn brighter and perish more dramatically than most. When a star ten times more massive than Sun exhaust the helium in the core, the nuclear burning cycle continues. The carbon core contracts further and reaches high enough temperature to burn carbon to oxygen, neon, silicon, sulfur and finally to iron. Iron is the most stable form of nuclear matter and there is no energy to be gained by burning it to any heavier element. Without any source of heat to balance the gravity, the iron core collapses until it reaches nuclear densities. This high density core resists further collapse causing the infalling matter to “bounce” off the core. This sudden core bounce (which includes the release of energetic neutrinos from the core) produces a supernova explosion. For one brilliant month, a single star burns brighter than a whole galaxy of a billion stars. Supernova explosions inject carbon, oxygen, silicon and other heavy elements up to iron into interstellar space. They are also the site where most of the elements heavier than iron are produced. This heavy element enriched gas will be incorporated into future generations of stars and planets. Without supernova, the fiery death of massive stars, there would be no carbon, oxygen or other elements that make life possible.

http://map.gsfc.nasa.gov/universe/rel_stars.html

“it’s clear those subprime loans caused plenty of problems no matter how they were packaged and resold.”

You don’t understand, without “how they were packaged and resold”, not to mention priced, there would have been very little of them, and no problems would have been caused.

You don’t understand, without “how they were packaged and resold”, not to mention priced, there would have been very little of them, and no problems would have been caused. EMichael

Well, we’ve had financial crises long before MBS. Lending on margin was a popular way for the banks to wreck the economy in the 1920s and the borrower did not have to have an income for that, just a down payment.

No, common problem.

Both of you guy are taking the abuses of the financial crisis and equating it with sub prime lending.

There is risk in all lending, the key is charging the appropriate price to offset the risk. That is it.

Now you can look at the rate and say “you are taking advantage of the poor and unfortunate” but you totally miss the point that without that rate, there is no loan. On my average loan the consumer ended up paying an additional $70 or month or so due to the high rate, but without that my investors would not loan them the money.

There are no such things as ninja loans in sub prime auto financing. Docs are mandatory with all banks and the lower down the credit scale you go the more extensive they are. As an example, my loans required(among the usual insurance, license, etc.:

One month of original paystubs

Last two months of phone bill at address

Last two months of one utility bill at address

Five personal references(who were all contacted prior to funding)

And of course all of the credit information was verified. Much, much stricter than regular financing. Additionally, much lower LTVs on loans.

I cannot tell you the number of people who, despite paying $70 a month more than they would if they had good credit, still send me Christmas cards(and I haven’t funded a loan in almost five years). These loans gave them the opportunity to change their lives, and they took advatage of it.

And while I can understand people looking at high rates, delinquecies and repos and thinking predatory lending, don’t forget that over 80% of the customers paid their loans. Rebuilt their credit rating. Kept their job becuase they could get to work on time. Were able to get the kids to Grandma’s at 7 before going to work by leaving the house at 6:30 and driving their car instead of leaving at 5 am and taking public transportation. Not to mention picking them up at night.

Don’t get me wrong, this was a business, not humanitarian work. But the price charged met the risk, and actually helped people.

but you totally miss the point that without that rate, there is no loan. EMichael

I believe you miss the point that “credit creation” (a form of counterfeiting) creates negative real interest rates for savers and thus FORCES them to borrow.

Otherwise, the poor might have a chance to save money.

Come on, loans depend on peoples ability to pay. Instability in the job market increases the risk factors.

Can you with any degree of – certainty – gauge the future in this environment? Wages are going down, job market is going sideways – down, personal financial buffers are being striped mined, more and more people are ONE paycheck away from bankruptcy, etc, etc.

Skippy… the last 20ish years were good too you, remember it fondly.

” Come on, loans depend on peoples ability to pay. Instability in the job market increases the risk factors.”

Sure does, I agree. Always has, always will. You change your matrix and your prices to account for it. If you are right you win, if you are wrong you lose. That’s finance.

The financial crisis happened because of two main things:

Adjustable rate mortgages and ninja loans took debt to income out of the equation. Banks sold these to investors as AAA rated and therefore increased the supply of willing investors immeasurably.

That is the financial crisis in a nut shell.

Some sub prime auto companies used the scam on investors the mortgage industry used in different ways.

Come on, loans depend on peoples ability to pay. skippy

But banks don’t lend existing money; they create money (“credit”) as they lend it. Otherwise, they would have to pay honest interest rates to poor savers.

The financial crisis happened because of two main things: EMichael

Yes. Usury and counterfeiting (leverage) are the culprits. Both are unstable.

Financial crises have occurred many times over the centuries. This time is always different except it never is.

Can you with any degree of – certainty – gauge the future in this environment? skippy

Steve Keen predicts we’ll have another 20 years of this mess unless excessive private debt is dealt with.

F. Beard says:

September 8, 2012 at 7:21 pm

but you totally miss the point that without that rate, there is no loan. EMichael

I believe you miss the point that “credit creation” (a form of counterfeiting) creates negative real interest rates for savers and thus FORCES them to borrow.

Otherwise, the poor might have a chance to save money.”

I did not make the world. Perhaps you can explain to me(other than through some macro) how “the poor” can save money with no job? Cause a huge majority of these borrowers need reliable transportation to get to work. And perhaps you can explain to me how “the poor” can save money when they spend it on inefficient public transportation suplemneted by cab rides? Or how they can “save money” when “good” public transportation means their child has to be in daycare an extra three hours a day?

Live their lives and tell me about “counterfeiting”. They don’t need an economics lesson, they need to get to work and hoime again.

They don’t need an economics lesson, they need to get to work and hoime again. EMichael

Then you should not object to a universal bailout of the entire population? Just to fully back existing deposits with reserves would require about $7 trillion to be given away. That’s $28,000 per US adult. If we considered all US private debt to be counterfeit that would be $160,000 per US adult though I admit that what is owed to foreigners is legitimate so that amount should be lower.

Why would I agree with that?

I no more want to absolve people of their debts than I wanted to absolve the banks of their debts.

I am a capitalist. I am unhappy with the crony capitalism that currently dominates(though it has always been around).

I wanted the banks that perpetrated fraud to go under and criminals to be prosecuted. While I can understand why it has not happened(the cure might be worse than the disease) it does not make me happy.

In the same way I want people to be responsible for their debts, though knowing that shit happens, and sometimes people default through circumstances that are not their fault. That’s the risk finance takes.

And if you think the world can exist without finance(though reined in sharply), you will not have much conversation with me.

I hear these things and it is like George Will talking about the founding fathers; interpreting their thoughts; telling me how we are going astray in this country; and not mentioning that is is 2012 and, oh, btw, there has been a pretty big change in the world since the 18th century.

I no more want to absolve people of their debts than I wanted to absolve the banks of their debts. EMichael

Debt to what is essentially a counterfeiting cartel is not morally valid.

With banking, “loans create deposit” but guess where the purchasing power for those new deposits comes from? It comes from the general population including ultimately the borrower unless he happens to be the last to receive a loan before the bust. And then during the bust, the borrowers are expected to repay their loans in a declining economy or lose their collateral and probably their equity too

since it was an illusion caused by debt.

And of course, the process cheats savers too. Thus the entire population deserves restitution at least to the extent that deposits are 100% covered by reserves.

And if you think the world can exist without finance(though reined in sharply), you will not have much conversation with me. EMichael

Finance can be done ethically, don’t you think?

Of course it can be done ethically, but you are taking your ideology beyond the bounds.

Not one of my investors was guaranteed by any government agency. Their returns were based on their risk. Bad years they made nothing; good years they made as high as 15%.

I think your thought is that you are equating normal savings with investments; then using the bank bailout, which certainly changed the game and socialized bank losses, as being valid then, now or down the road.

You seem to think all credit dollars come from the “general population”. No it doesn’t. It comes from the investors. Granted, the socialization of the banks losses during the financial crisis makes your statement correct to a degree, but that is not the way it should be, nor the way it had been for most of my life.

I am in favor of bank deposits, up to a limit, being guaranteed by the government. I cannot see a solid banking system without it. But I was on the fence regarding the bailouts when they happened, eventhough I believed the loss of the banking system would have devastated the US(and world) economy.

Any banker who allowed this to happen would not change his behavior after being saved. And the last couple of years have shown that to be true.

We should have let them go/

I am in favor of bank deposits, up to a limit, being guaranteed by the government. EMichael

No. There should be a solid distinction between a risk-free fiat storage and transaction service and the lending of money. All US citizens, for example, should qualify for a risk-free account at the Fed (or US Treasury if the Fed is abolished) alongside the banks and that account should be free, as a public good, up to normal house hold limits. And shortly thereafter government deposit insurance for the banks should be repealed. Of course that would cause a massive run on the banks which is why they should be at 100% reserves by then. That’s where the universal bailout with new reserves comes in.

I cannot see a solid banking system without it. EMichael

Credit creation and even the honest lending of existing money is a form of gambling. Why should government subsidize that behavior? It shouldn’t.

As for the needs for finance, common stock as private money is an ethical, stable private money form that does not depend on fractional reserves or usury. It “shares” wealth and power rather than concentrates them.

All in all, good post.

There is such a thing as stupid and wasteful allocation of resources. Especially when incompetent politicians and bankers need to patch giant macro economic holes.

What are they going to patch them with ? –Cotton candy, that’s right, cotton candy.

In all fairness though, that is the system’s main engine: Consumption and vanity projection go hand in hand, especially if you have nothing more meaningful to live for…

back in the day, when it was about work ethic, hard working older people provided hard working young people with a low cost transportatiom solution.

Piggy back rides?

Thirty years ago, or “back in the day”, hard working older families worked 600 hours less a year than young families work now.

For the same income.

My wife and I recently bought a new car because we need maximum reliability and some comfort (my wife has health problems that could make being stranded dangerous and our old car was hard for her to get in and out of). It isn’t the sort of car I would have bought for vanity. I personally would rather not own a car at all but we don’t live in an area where that is possible.

How did this long-winded rant end up on NC? I could barely get past the first paragraph – what was Keynesian about Cash for Clunkers?

There are other irrelevancies–f’rinstance the potshot at “fiat currency,” as if financial shenanigans are the exclusive provenance of paper currency. (It is true that complexity that’s possible with an abstract medium of exchange does increase the size and scope of shenanigans.)

THAT ASIDE, this article is a treasure trove of information, pulling back the curtain on the latest bubble being created to mask the underlying unsoundness of the economy. As such, it’s well worth working past its flaws.

“Take what you like and leave the rest.” That was my approach; at least in the blogs that I check, I hadn’t seen a detailed treatment of this topic. And at the 30,000 foot level, cars… Let’s double down on #FAIL, eh?

* * *

For the tone, I’ve noticed in other contexts that my irony and snark filters have become totally clogged lately, seriously. I think it’s from processing two national party conventions in one week.

I will take this:

“Total sales for the month of August were 1,285,202 vehicles, according to Autodata Corp, the highest monthly sales figure for any August since 2007, when 1.47 million autos were sold in the United States.”

And leave the rest for a sanitizing crew to clean up. Though I should probaly check it, the more I read the more stench comes out.

Just a totally bs summation.

What passes in this country for economic policy are programs which feed a small influential subset of finance and big business in the short term and are designed to create unsustainable, destructive bubbles that place us all at hazard and are incongruent with long term economic growth. Its a political class that operates the same as greedy-short-sighted five years olds or corporate ceo concerned only with the effect their decisions will have on stock options exercisable in the next 6-18 mos.

what you are witnessing is a capital neutron bomb. if you look at it accordingly, you will see your entry point…

It looks to me that the writer is exaggerating in his text but doesn’t back it up with his graphics (unless they are way out of proportion). The auto outstandings don’t look like they have increased that much in the last nine years, and the percentage outstanding looks to be way down. Additionally, the percentage rated prime is high enough to suggest that banks as a whole will not lose on this.

The only ones losing are the poor as usual, and that is the reason Strether must have been posting this. The top 1% are still raking off all the profits with their low wage minions still obliged to borrow at ruinous rates to make ends meet.

OT BTW, I’m watching “Rogue Trader.” It’s pretty good!

Globalization is drawing America into a two-way movement of jobs and workers. Well-paid jobs are being relocated to low-wage countries while at the same time third world workers are coming to America to drive down the wages of the jobs that cannot be moved. The result of this two-way movement is an erosion of wages and the standard of living of the bottom half of the population.

In this headlong rush towards the bottom, credit is the only mechanism available to help maintain the fiction of a First World lifestyle for middle class Americans. The huge profit margins that result from third world workers replacing Americans and working for pennies on the dollar end up leaving plenty of loose capital to throw about. Americans still have access to moronic levels of credit; dispensable countries like Greece have been cut off for some time now. Like amphetamines to a cancer patient, credit will do nothing but prolong the illusion that nothing is wrong in America. In the meantime the cancer of globalization will be free to further hollow out the economy. Will people wake up before it is too late?

I totally agree with the author that one should try to stretch the life of their vehicle as far as possible from the last month of payments. I’m well into my fourth year of payment free driving. But the morally corrosive reality is that it is probably a pretty good game plan to take the loans and the new car and never plan to pay anything back.

And while I am very happy some working class union workers are getting work from all this; I cannot resist the dreadful image that these few surviving windbreakered hardhats are being placed on a sort of public reservation in a vain attempt to try to convince the American people that the ravages of the small pox of globalization have been greatly exaggerated and everything will be OK if we just continue to viciously attack the standard of living of the bottom 60% of Americans.