By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

As I talked about yesterday the outcomes of the failing policies enacted by European leaders in the face of the economic crisis boil down to a lose-lose struggle between international creditors and national citizens. This struggle is increasing political and social tensions across the Eurozone and is likely to continue to break open old wounds.

There is no better example of this than Spain where, as I mentioned two weeks ago, regional tensions are rising. Yesterday an anti-austerity rally outside the Spanish parliament building in Madrid became violent with 60+ people injured and in the last 24 hours the president of Catalonia has called a snap election in an endeavour to forward his agenda for regional independence:

Artur Mas, the president of Catalonia in northeastern Spain defied calls from Spain’s government for unity in the face of the deepening economic crisis and announced elections for November 25.

The vote is widely seen as a de facto referendum on his demands for greater independence for the region after Prime Minister Mariano Rajoy last week rejected proposals for a new fiscal pact which would grant Catalonia greater taxing and spending powers.

In the face of 25% unemployment and what the Bank of Spain called overnight a “significant decline” in the economic activity Mariano Rajoy’s party is expected to announce further economic reforms today, although at this stage the exact details are a little vague:

The Spanish government will restrict programs that allow people to take early retirement as part of overhauls to rein in the country’s debt and shore up its shrinking economy, Prime Minister Mariano Rajoy said on Tuesday.

..

Mr. Rajoy said measures to be unveiled Thursday would also include the creation of an independent agency to monitor compliance with budget targets, new job-training programs and legislation to sweep away many onerous government regulations.

The latest data from Spain showed the budget deficit grew to 4.8% for the first 8 months of this year and the overall goal of reducing the government deficit by 2.6% over the year looks in doubt. Adding to Spain’s troubles was a joint statement issued by German, the Netherlands and Finnish authorities which appears to have effectively unwound the June European summit outcome in which it was agreed that the ESM could be used for a direct Spanish bank recapitalisation independent of a sovereign program:

Regarding longer term issues, we discussed basic principles for enabling direct ESM bank recapitalisation, which can only take place once the single supervisory mechanism is established and its effectiveness has been determined. Principles that should be incorporated in design of the instrument for direct recapitalization include:

1) direct recapitalisation decisions need to be taken by a regular decision of the ESM to be accompanied with a MoU;

2) the ESM can take direct responsibility of problems that occur under the new supervision, but legacy assets should be under the responsibility of national authorities;

3) the recapitalisation should always occur using estimated real economic values;

4) direct bank recapitalisation by the ESM should take place based on an approach that adheres to the basic order of first using private capital, then national public capital and only as a last resort the ESM

It’s little wonder the Spanish 10 year bond yield moved back up above 6% on the realisation that once again Spain is directly on the hook for its banks, and let’s not forget the mess about who owns some of that “private capital”.

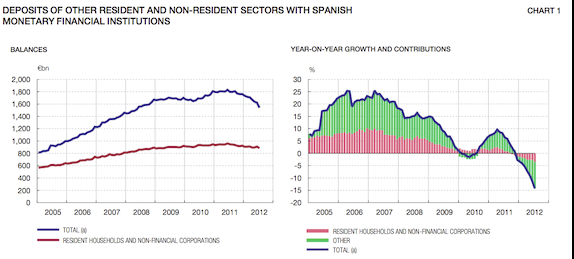

In other dour news, the Bank of Spain released its September economic bulletin which continues to show significant weakening across both the economy and the banking system. The documents also contains a set of extremely scary charts on Spanish bank deposit flows:

That looks to me to be a pretty solid acceleration.

Full reports below:

Note that out of 14 Spanish banking groups, 6 are in a solid position even in the worst-case scenarios, and out of the solid six, 2 are in a very solid position. The two fully private Spanish banks, BBVA (Basque, North), and Santander (Cantabrian, North) are actually growing thanks to their investments in Latin America.

Note also that to speak of Spain in general is very misleading. It is the south that is in big trouble. The Basque country, Euskadi, in particular, is holding on, investing, exporting machinery, carrying out scientific research, innovating. See:

http://uk.reuters.com/article/2012/06/28/uk-spain-economy-basque-idUKLNE85R01O20120628

Ruben, I think you’re a little naive to take BBVA and Santander at their word. Perhaps you’ve been asleep the past 5 years?

Banks and politicians have consistently talked tough up until the moment of the next bailout.

Dear Bryan, (with annoying condescending tone) trust me … all right, I am not taking their word for it. It will be in the report of independent consultant Oliver Wyman

http://www.oliverwyman.com/index.html

Who pays him?

I bet they would get lots of future consulting business if they published a report saying that the Spanish banking system was totally insolvent.

Ruben:

Right, the situation in the Basque Country is better than that of Andalusia and Valencia, but, but … bankruptcy and unemployment in Euskal Herria continues a relentless upward path and accelerating.

Much of the Basque industry is directed to sectors where demand (not only in Spain) is minimal. Profits are clearly declining and investment is almost non existent.

Sorry, not a bright future over here. This is not Arcadia.

Did you read the Reuterns article that I linked? Yes, there is deterioration in Euskadi as well, but it is by far not the same as in Spain. Euskadi will get through fine thanks to investments in industry, scientific research, infrastructure, and its people, and also, and this makes a great deal of difference, because of more honest politicians (although admittedly, ‘honest politicial’ may be an oxymoron; we are talking about degrees here).

No, i didn´t read it. My information comes directly from the balance sheets of over 100 small and medium basque (from the province of gipuzkoa) enterprises that i advise on tax and accounting issues.

In regard to the honesty of the basque politicians, i disagree; the level of our politicians is almost as pathetic as elsewhere.

“En el reino de los ciegos, el tuerto es el rey”

well shut his mouth!

You need to see the big picture.

Anyways, sorry about the businesses you deal with, there is certainly deterioration, but not, by far, at the same scale as in southern Spain.

Here’s the problem, Ruben: when there is lack of trust between counterparties, it starts hurting even previously-viable businesses. When there is deflation and lack of consumer demand, it hurts previously-viable businesses even MORE.

So unless macroconomic policy is fixed, even the *healthy* banks are going to crash and burn.

I think you have to careful to understand the details of these “worst case scenarios”. As has been noted repeatly in this blog, both US and EU are using very generous, to put it euphemistically, assumptions to guage bank stress. And don’t forget that even if this argument is reasonable, does it account for the further deterioration of the Spanish economy caused by the austerity programs and the effect it will have on the “bad banks” and the ripple effect to the “good banks”? As noted above, I doubt it.

I think the better money is on the view that the whold system of guaging bank risk is built on rosy assumptions that are now coming truly unglued. Stay tuned.

David, Oliver Wyman’s methodology assumed significant stresses in the Spanish business, such as increases of unemployment to 27% up to 2014 and three more years of recession. You’ll have to make your opinion once the report is released. The one big assumption is stability in Latin America.

Unemployment’s already 25% and every proposal so far in Spain has been to increase it. An estimate of 27% in 2014 is *rosy*. An estimate of 30% might be a fair “gloomy” scenario — but it might still be too optimistic.

You wish, to prove your point.

Instead of doubting the results of the consultant and wishing for total doom what needs to be done now, that the weak has been sorted out from the strong and that there is a sufficiently large line of credit from Europe to help the weak, is to find solutions for the families suffering foreclosures and for the small and medium businesses under stress. If the needs of the weak banking groups are actually smaller than previously feared then may part of the 100 billions euros open line to Spain be used to ease the pressure on families and working peoples, to stimulate the hiring of young workers, a population fraction enduring over 50% unemployment? How can the seven weak banking groups be ‘incentived’ to pass the ‘quantitative easing’ to their customers instead of to bonuses, dividends, party coffins? Are they viable at all or should they be absorved by the seven healthy groups?

The two fully private Spanish banks, BBVA (Basque, North), and Santander (Cantabrian, North) are actually growing thanks to their investments in Latin America. — Ruben

Yesterday Bloomberg reported that Santander sold a 24.9% stake in its Mexican unit, raising about 3 billion euros in capital.

http://www.bloomberg.com/news/2012-09-25/santander-mexico-share-offering-said-to-price-at-31-25-pesos.html

Santander México may be doing well, but the Spanish parent had to shed a quarter of its stake because it needs the capital. Coincidentally or not, the 3 billion euros raised in the Mexican share sale about equals the 2.78 billion euros which Santander added to loan loss reserves in July.

http://www.bloomberg.com/news/2012-07-26/santander-profit-slumps-on-spanish-brazilian-bad-loans-purge.html

We all wish Spain well. But like banks everywhere, Santander and BBVA are highly leveraged. If the Spanish economy carries on shrinking, they can get into trouble in a hurry. Even a 10 percent capital base that meets Basel III requirements can be wiped out by a 10 percent drop in asset values … while the Spanish property sector has dropped more than 30 percent.

“We all wish Spain well. But like banks everywhere, Santander and BBVA are highly leveraged.”

I think you are missing my point. Speaking of “Spain” and “the banks in Spain” is misleading. There is too much heterogeinity amongst the regions and amongst the banking groups.

Ruben,

Quoting from your Reuter’s article: “Basque Country is Spain’s fifth largest regional economy, with a gross domestic product of 66.1 billion euros, meaning it accounts for around 7 percent of national GDP”.

What percent of BBVA and Santander’s balance sheet is Basque? 7%? Look at the leverage of BBVA and Santander.

I certainly seek out differing viewpoints (as does I think the NC community) but even based on the article you’ve cherry picked your argument simply isn’t credible.

What argument? That the situation across Spain’s regions is highly heterogenous, that the situation across the Spanish banking groups is highly heteregeneous, that BBVA and Santander have very solid positions thanks to their Latin American expansion while other 4 Spanish banking groups are in quite good shape, that by investing in industry, research and innonavation instead of housing and tourism Euskadi is the most per-capita productive and solid region of Spain?

If your are focusing just on the banks (btw, you seem to believe that Santander is a Basque banking group) then don’t take my word for it, you will have to examine the Oliver Wyman report, when it is released.

This may be slightly O/T, but I’m curious: Is there a corresponding independence movement on the French side of Catalonia?

I know that the basque in France also want some kind of independence or self rule but I’ve never heard of French catalans, a very interesting question

Even as Spain faces a significant independence movement, the “small group of far sighted statesmen” in Brussels insist on the inviolability of the Eurozone.

Then again, Brussels doesn’t care about democracy.

I wouldn’t be shocked if Brussels sends shock troops to Catalonia to let it know that it, and not Rajoy, is in charge.

Brussels Is ROTHSCHILD they dont give a damn about democracy

they only care about Central Control of europes banking to put them like they got us in the US.

Daughter rothschild hand delivered the paperwork for the european countries that wanted a bailout MUST sign over sovereignty. ANd because the right goldman sachs guys were in place they DID. Simple as that! jonkirby2012.wordpress.com watch what you eat! GMO’s are tumors in the rough.

Curious here, the picture has been painted, yet, the outcome is still in doubt. The banks created the problem, the government doesn’t correct that problem, (ideology aside), so what is the answer? Can it be achieved, or does the world just collasp, because the corruption/greed is just to much to handle?

If left to the banks to continue with business as usual yes, eventual calamity.

As Einstein famously said insanity is “doing the same thing over and over again and expecting different results”.

There will be blood.

The banks didn’t create the problems in Spain.

Aznar created the problems in Spain, the moment he had Spain join the EuroZone.

With the peseta, Spain would have enjoyed manageable growth and a mild recession.

Today, it would be growing 4% a year.

In my opinion George Washington had the right answer .

He didn’t Negotiate with the SAME FAMILY he shot them.

Rock and a hard place. If Spain did the right thing and deficit spent (if they could get cheap credit) then they could turn this around on their own, but they can’t and they won’t so they have to demand more austerity so that when the austerity crushes the economy even further, they can ask for the bailout they are anticipating and say “look, we have implemented all of your conditions already.” And then the same result, a crushed economy, full of very angry people with no political rights. All sovereign debt; no sovereign wealth, aka power. And all the anticipated bailout money will just do a U-turn and head right back to Germany and France. This riot will look tame when all that unfolds. And this riot was distinctly uncivil on both sides. They say in Greece one in three businesses are out of business.

According to Bob Pisani this morning, his Spanish sources tell him the 25% unemployment rate is inflated, as many Spaniards apparently work under the table. Yeah, and apparently the tax savings is so great the free time it affords via fewer hours one needs to work in order to get by evidently allows the typical Spaniard time to develop their moral fiber to dissent and demand the state fairly tax their wages I guess. Can you believe these hacks?

I am not going to say that everything is bright in my country, but given your mention to bank deposits, I must say that in the same source you use for the “pretty solid acceleration” (Bank of Spain), there is a Briefing Note to journalist precisely to avoid any interpretation as the one you mention:

http://www.bde.es/f/webbde/GAP/Secciones/SalaPrensa/InformacionInteres/Notas%20informativas/en/notabe19.09.12en.pdf

To sum up, as the figure you post shows, the deposits by households and firms have a different evolution from those deposits by “others” (financial institutions).

In the case of the “accelerating” decline in Others, is more an accounting trick that any fall in banks financing. When a Spanish Bank originate MBS or ABS, they are not allowed to remove the loan from the balance sheet. Therefore, they include both the loan AND the ABS in the assets side of the balance sheet. To balance the increase in the asset side, in the liabilities side they include a deposit from a “financial institution” (the ABS). Since the begining of the crisis they have not sell a single ABS, but stock them to use it as collatral with the ECB. After several regulatory changes, they no longer need such a trick, and they have decided to cancel, both the ABS and the deposit, to reduce the total size of the balance sheet.

In fact, these operations imply no money outflow (as the issuance of the ABS had not money inflow).

In the case of households, most banks has offered their clients to change deposits to short term bills, in order to reduce the amounts the banks had to pay as deposit insurance. Nevertheless, there have been changes in the regulatory framework this summer, reducing the advantage of such practice, and you will see an increase in deposits as the bills mature. The later will imply not money inflow, as the previous one has not mean any money outflow for the banks.

Trouble is a GOOD thing you don’t want the populous to roll over and play dead to the NWO banking cabal i wish our people fought so gallant we should get our chances soon as AUSTERITY is coming unless you have a change in leadership in washington. But since that is DICTATED by the same oligarchy that owns the FED their Programs of Eugenics seems to be doing well As GMO kingpins surround obama and

neurotoxins are everywhere else in our cosmetics and shampoos and laudry detergents while florine has taken over new stories. I’d say the elite will keep munching on organics while policy is otherwise for us. Good for the citizens of Spain!! MORE FORCE.

It’s not just the banks, they were conduits for overseas credit to enable non-productive Spanish industry and consumption. Without the credit the Spanish would have had little industry or consumption, Spanish would have lived a very modest life(styles) with a very small finance economy … like the one Spain had in the 19th century.

It’s hard to be stylish with a 19th century economy in the late 20th so it was (and is) ‘Borrow, Baby, borrow!’ … now it’s ‘Bankrupt, Baby, bankrupt!’

None of the crap that Spain borrowed to buy ever offered a real (or even a fake) return. Driving a car is a dead loss x ten million drivers, buying the car is a dead loss (unless you drive a taxi or use the car for deliveries). There are no-doubt a million ad-hoc taxicabs in Madrid right now all of the looking for a fare.

Industries don’t offer any return either, they need credit to be formed, and continuous credit for their customers to afford to buy the goods (bads) that are produced. Credit is needed in the way of ‘profits’ diverted to the ‘entrepreneurs’ who stuff it into their pockets, demanding that the ordinary citizens make good on the debts. This demanding is underway right now everywhere in the world, the rats are fleeing the sinking ship of waste and capital destruction.

The entire bit of industrialized business is ruin embodied. Not only is the business a failure out of the box but the businesses together cannibalize capital: the natural services needed to keep this human science experiment functioning.

Others … who have more insight and experience than I … suggest that the human race teeters at the edge of extinction. For this to be so … in order that a handful of criminals might have a borrowed surplus of an industrial good called ‘money’ … is unspeakable.

As for Spain, she’s gone baby gone along with the rest of Europe. You just sit back and watch and see what happens, there is nothing anyone can do to stop the process. Bankruptcy by automobile, collapse and total ruin.

Coming to a town/suburb near you …