Yves here. This is a crisp writeup of a clever little study. I hope it prompts more work in this area.

By Simon Luechinger, assistant professor in economics, University of Lucerne and Christoph Moser, post-doctoral researcher at KOF Swiss Economic Institute, ETH Zurich. Cross posted from VoxEU

The presidential election campaign is in full swing in the US. Whoever wins the presidential race will face the challenge of filling top positions in the federal administration. Since some political appointees traditionally come from the private sector, allegations of conflicts of interest will emerge. But are connected firms really expected to profit? This column sheds light on this issue.

The presidential election campaign is in full swing in the US. Whoever wins the presidential race in November will face the challenge of filling top positions in the federal administration with political appointees. Inevitably, he will tap the reservoir of private-sector experts. And with that, allegations of conflicts of interest will emerge since some appointees come from firms that fall under the regulatory jurisdiction of the respective agency or from firms that may hope to win procurement contract awards. For example, on the very same day that President Obama tightened anti-lobbyist rules, he nominated Raytheon executive William J Lynn III as Deputy Secretary of Defense. The revolving door between industry and government is an old phenomenon but evidence on its consequences is surprisingly scarce. Whether and to what extent firms benefit from the political appointment of one its members largely remains a matter of speculations and anecdotes. This column sheds light on this issue.

Preferential Treatment Against All (Institutional) Odds?

Political appointees can treat their former employers preferentially in procurement, regulatory and oversight, or merger and acquisition decisions. Indirectly they can favour their former employers through long-term strategic planning or through better access to decision makers and information. At the same time, there are various institutional safeguards against conflicts of interests, ranging from specific provisions embodied in ethic codes to congressional committees and a vigilant free press. However, it is unclear how effective these safeguards are. Often, political appointees get waivers or simply fail to adhere to the rules. Time and again, political appointees were involved in decisions with immediate consequences for their former employer. For example, Senator Al Gore complained that Gerald Cann was responsible at the Navy for selecting a weapon system that he developed at his former employer General Dynamics: “It is a little wrong to be involved with a weapon system [in industry] and then be put in charge of deciding [at the Department of Defense] what system will replace the one that’s performing the mission now” (cited in Aerospace Daily 1991). Therefore, it is ultimately an empirical question, if firms benefit from political connections.

Assessing the Value of the Revolving Door

How can we assess the benefits of the revolving door for affected firms? The benefits of political connections may come in many forms and materialise slowly. Further, political connections are but one among a myriad of factors of firm performance. Finally, successful firms are likely to attract the brightest people who also make attractive nominees for government service. Thus, analysing the effect of political connections is fraught with all sorts of endogeneity and measurement issues. One approach to avoid these problems is to look at stock market reactions to announcements of political appointments. Stock-market reactions are immediate, which makes it easier to relate cause and effect and abstract from confounding factors. Further, stock market reactions are a comprehensive measure of potential benefits. In this vein, Fisman et al. (2006) investigated stock market reactions to news about Cheney and his health of firms with either Cheney or other Halliburton directors on the board of directors. They find no evidence for connections to matter. In contrast, Acemoglu et al. (2010) find large stock market reactions to the nomination of Treasury Secretary Geithner for firms connected to Geithner through his positions as the head of the New York Fed or for firms with personal ties to Geithner. Thus, the previous evidence on the value of political connections in the US is conflicting. More importantly, the two studies are not primarily concerned with the revolving door phenomenon, and mainly analyse other forms of connections.

New Evidence

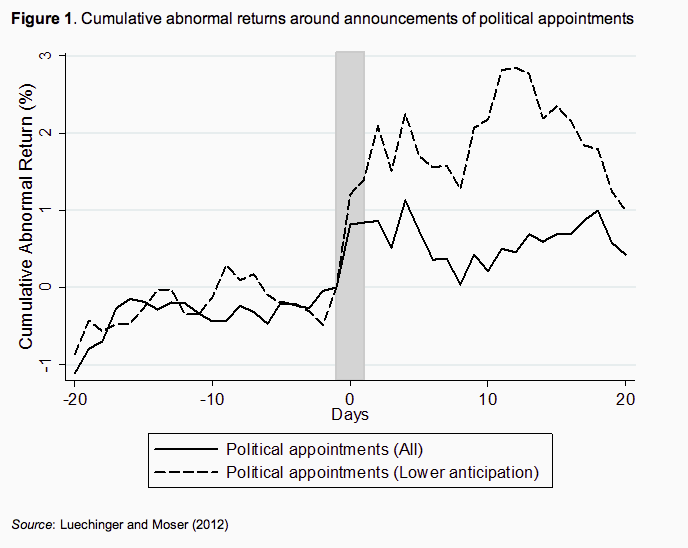

In a recent study (Luechinger and Moser 2012), we explicitly look at the value of the revolving door by using unique data on corporate affiliations and announcements of all Senate-confirmed US Defense Department appointees of six administrations. According to the results, investors clearly expect firms to profit from their political connections. The one- and two-day average cumulative abnormal returns amount to 0.82% and 0.84%. These estimates are not driven by important observations, volatile stocks, or industry-wide developments, and placebo events yield no effects. Effects are larger for top government positions and less anticipated announcements, i.e., announcements for which the actual nominee was not rumoured to be the main candidate. Figure 1 below displays the baseline results and the results for the less anticipated events together with the temporal pattern of average cumulative abnormal returns for the four trading weeks prior to and after the announcement day.

Figure 1. Cumulative abnormal returns around announcements of political appointments

Source: Luechinger and Moser (2012)

Conclusions

Overall, our results suggest that concerns over conflicts of interest voiced by politicians, the press, and government watchdogs are not unfounded. However, our results do not imply that recruiting political appointees from the private sector is necessarily a bad thing. Our results highlight one important cost of doing so but they are silent about potential benefits. Neither do our results suggest that tightening ethics regulations is worthwhile. Already now, they entail substantial compliance costs. But this is unlikely to happen anyway. Whoever wins the presidential race this time, neither of the candidates campaigned on the promise of closing the revolving door.

References

Acemoglu, Daron, Simon Johnson, Amir Kermani, James Kwak, and Todd Mitton (2010), “The Value of Political Connections in the US,” mimeo, Harvard University.

Aerospace Daily (1991), “Navy Official Denies Conflict of Interest with Tomahawk Variant,” June 10.

Fisman, David, Ray Fisman, Julia Galef, and Rakesh Khurana (2006), “Estimating the Value of Connections to Vice-president Cheney,” mimeo, Columbia University.

Luechinger, Simon and Christoph Moser (2012), “The Value of the Revolving Door: Political Appointees and the Stock Market,” KOF Working Papers No. 310 and CESifo Working Paper No. 3921.

It’s been a number of years since I read a particular article describing one of the ways Halliburton operated – finding companies with products useful to the defense industry and purchasing the company, I never verified the details of this article and at this point I have no way of proving the truth of the following.

It appears that many companies with very innovative products could not get any kind of evaluation. Not so surprisingly, once they had been purchased by Halliburton (or similarly connected companies) the doors swung wide and unmarketable products suddenly became very valuable to their new politically connected owners.

I recall thinking at the time that this was not the way “free enterprise” was supposed to work. If you invented something unique and valuable, you shouldn’t have to give away most of the profits to a crony system.

Funny you bring up Halliburton. I think IIRC, that Halliburton owned the subsidiary that was like the ONLY place where the government obtained its various vaccines for service people. And remember – the forces of Halliburton are so overwhelming, that regulations were built into various pieces of legislation so that anyone injured by any required vaccines could not hold the vaccine producer liable.

I have long believed that the difference between two companies getting on the Stock Exchange and one succeeding and one failing is that whichever one has the more military industrial contacts will zoom ahead.

Originally, Bill Gate’s Microsoft product was not all that tasty – but his dad helped with getting it established among various military procurers. So a fifty thousand dollar loan became the start of a massive fortune.

For those who are acronym challenged IIRC = If I remember correctly.

I just use AFTWAAC when I condescend to include the acronym-challenged. AFTWAAC, IIRC=…

OCTYGIIARL*, having to explain AFTWAAC.

*Of course then you get involved in a recursive loop.

“… but his dad helped with getting it established among various military procurers.”

Carol — that’s a lightbulb-moment fact that explains so much about how such an inferior product (toxic junk) came to dominate our economy and destroy so many trillions of productivity hours (“units”?).

Do you have a link or non-internet reference for that factoid?

As the authors remarked, there is a serious measurement problem. The authors measured ‘potential benefit’ via market sentiment a few days after nomination. What really needs to be done is to measure ‘realized benefits’ over the mid term: number of new contracts, size of contracts, duration of contracts, regulatory oversight, etc; actual, realized benefits for companies and individuals.

1. You are never gonna get that level of disclosure from these companies.

2. I had a defense contractor as a client back at Goldman. The basics haven’t changed. Selling defense contracts is a multi-year process. Once you get a contract, it is a very long tailed sinecure. Your “duration of contract” issue isn’t germane, they are ALL long term. You think you have a measurement process with stock prices:? You have it in spades with the military industrial complex (and that’s before you get to the multi trillion black hole that no one has accounted for….)

3. These companies have lots of bench depth in ex government folks. So how are you going to metricize THAT relative to the extremely long sales cycle?

Honestly, your “solution” is less workable than this quick and dirty proxy.

I agree with you that the proxy gives a good idea and that companies would not disclose that much info. But, isn’t it possible to get the direct info via the other side of the deal, the gov’t? I am not familiar with the disclosure procedures of the US gov’t but I think it is much more transparent that, say, the Spanish gov’t that I know about a bit more.

It may not be that difficult really in the defense industy. Most defense systems go thu competitive development (could be 5-20 years depending on what) but usually once they get awarded a production contract they are single source (rarely duel sourced) thru the life of the the system. That means all annual production, spares, replacement parts plus the hammer to assemble them with, and logistics support.

So if they read the news and find corelation between an industry connected “closer” and the award of the first production contract, then you have some proof.

I think the revolving door is harder to figure out in other industies – banking for instance.

No, you’ve proved my point.

Given 1. long long sales cycles 2. multiple contracts being pursued in parallel and 3. no way to find out which ex gov’t employees are spending time on any particular contract (or how much time), I don’t see how can begin to do this analysis well.

And what is your hypothesis re what matters? What probably matters most is influencing the contract specs to favor your firm. When and how does THAT happen? You’d need to do a ton of field work before you could even form intelligent hypotheses.

I thought I was proving your point. The critical time is choosing the winner of a very long competitive development.

This is long after specs are developed and involves testing of the actual prototypes, not to mention all the projected contratual cost info.

Once you are past that point, it just ramping up the price of future production.

So it’s the guy that awards the first production contract.

I just thought some more about how defense systems are developed from very basic concept level. It happens basically two ways. The DOD has some vague idea of what it wants, or the other way is a defense contractor has some idea of a neat gizmo it can make that the DOD may like and tries to sell it to the DOD. They talk to each other directly, tho the contractors may also invoke political support, like a local senator or congressman.

This is how specs are developed.

Having been long in the trenches of government contracting and consulting I have to agree with you Ives. The only case of breaking up big influencers and firms was interestingly at HUD where a lone procurement officer went and hired a lot of small 8(a), women and minority owned firms. The large incumbents were furious and now have successfully gained control. Its a very long sales cycle and then contracts are also quite long. Firms formerly known as private sector consulting and accounting firms now are huge contractors. Another tidbit–there are fewer non defense federal civilian employees now than in 1970. Contractors, contractors, contractors. Look up MObis schedules Ives–we will admin assistants who in fed service earn 40k at 75 an hour–you can do the math…..

What exactly was HUD procuring from those women and minority owned firms? Do you think procurement based upon sex and race is an advance over procurement based upon influence? Are you aware of any Federal procurement based upon cost or competence?

Parenthetically, I recall my accidental experience at the SEC in 1967-68. No contractors in those days. In my seven person group we had one idiot son of of the Country’s most droglodyte Congressman, one idiot son of a partner at a major Washington law firm, two accountants simultaneously drawing full salary and attending full time MBA programs (whose contribution to our efforts was limited to doing their homework and watching the telephone ring- you couldn’t mute it in those days). Our chief and his top assistant took lunch from 11:30 to 2:45 every single day. We were instructed that in dealing with the public we should never make any effort to recover monies of which they had been fleeced, not even to the extent of making a telephone call in those cases when one call would have been sufficient. On the other hand our relations with prominent law firms were limiting to genuflecting and scraping our knuckles on the floor in the presence of their august partners and snide associates. This is known quite accurately as ‘government service’.

I wonder how much of the bleating for expanded government employment emenates from people who have ever experienced one day of it? Folks, there isn’t any answer to these problems which fails to take human chicanery, sloth, greed and stupidity into proper account. That is why I continually reread and recommend Veblen. You need a sense of humor about this stuff.

@Jake… you’ll love this comment.

http://www.nakedcapitalism.com/2012/09/quelle-surprise-mortgage-settlement-monitor-advocates-going-easy-on-servicers-since-we-dont-dare-ask-them-to-spend-money-to-meet-their-contractual-obligations.html#comment-828950

Skippy… the scary thing is Jake, that there is no plan, was no plan. Its just rampant opportunism, smoke them whilst you got them, plain old embezzlement on an epic scale, a worlds future facially de-gloved, so some could live – their – twisted psychotic reality.

@jake – I need to give Veblen another try. Found him kind of hard to get into at first go-round.

Your comment somehow brings to mind the short novel “Lucky Jim” though – which was about sloth, chicanery, etc. in academia. Written by either Kingsley Amis or Martin Amis – I get them mixed up.

Jake — would you please write a book about your time at SEC? It would sell out. I would buy at least 10 copies!

Sounds to me as though you might have a lot to chat about with Edward Siedle — he was an enforcement attorney at SEC. After leaving in disgust he became one of the few (only?) articulate voices about the corruption of SEC, NYSE, the markets, and, more specifically, the pension and 401(k) frauds involving fiduciaries and conflicted money managers. If you haven’t already, check out http://www.benchmarkalert.com

If I still had posters of my heros and idols on the walls I would have one of him. He’s been ahead of the curve for nearly 20 years in these fields that nobody touches with a 1000 ft. pole.

Maam;

Given that the “best and brightest” argument has fallen flat numerous times in the past, (think Vietnam War,) is the desirability of those ‘chosen’ for the revolving door based on work skills, or ‘Old Boy Net’ connections? In other words, can the persons’ value ever be quantified? I’m thinking Art vs. Science here.

I remember my Dad once remarking about an average executive he knew that: “He gets the contracts through his contacts. He deserves his pay.” I guess a cynic would say that the compensation package is all the quantification anyone needs. Oh well.

I agree. There are many viable candidates for the revolving door jobs that get filled by cronies. The lie is that most of these jobs require some super-special genius that is so rare we just have to hire the guy with all the conflicts of interest. Hogwash. We could actually instead hire qualified candidates who have no conflicts of interest. The Brits have the right idea — the heads of our bureaucracy should not be political appointees at all, but should be career civil servants.

The pomposity and arrogant incompetence that the corrupt bribers and cronies display with their excuses for rampant corruption and conflicts of interest is pathetic. Nobody, except those paid to cheerlead (which apparently includes 98% of the media), believes any of it.

“The lie is that most of these jobs require some super-special genius that is so rare we just have to hire the guy with all the conflicts of interest.”

In theory yes. Unless the “core competency” required for the revolving-door job (though obviously not listed on the posted job notice) is precisely “having inside contacts in government that will slip us the contracts and jobs after martinis at the club.”

It is difficult to imagine any reason other than potential influence for corporations to care about a choice between politicians who rarely amount to anything but hot air balloons. Moreover, the big ones give handsomely to both sides and thus end up benefitting regardless of which candidate wins. Further, in every election since 1968, at least one Presidential candidate has been such a preposterous choice that it can be argued the election was deliberately thrown. Sometimes, you don’t need data to reach sensible conclusions, but I suppose the author’s research might be useful for stock speculators, so I will gratefully keep it in mind.

Stock is an indicator of revolving door but contractor premiums for doing work forermly done by federal workers is the real money maker. Contractors will often sit next to a fed and be billed at 3 to 4 times what a fed earns for the sake of efficiency–oh and for less vacay time and skimpier benefits…..Lots of former fed appointees work as principals or “business development executives”

Look at the rates–all of the roles are done by actual fed employees for a fraction fo the price….Forget costly airplanes–its billing $80.00 an hour for clerks thats lining pockets.. Look and marvel……

https://www.gsaadvantage.gov/ref_text/…/GS10F0246L_online.htm

from jesse

As you know money market funds are savings vehicles with a fixed unit price that pay dividends, like a savings account. They arose as alternatives to bank deposit accounts because they were able to present higher returns than the regulated banks.

The Banks, and their regulatory friends who have been mostly among the Republicans want the money markets to have a floating price like a stock, opening the possibility for negative returns on savings. Turbo Timmy G. came out today calling for reforms in the money market funds, and a ‘floating price’ for the money market fund.

Et tu Timmy? All day long. The young man is getting ready to leave Washington after the election and take a lucrative trip through the crony capitalist revolving door, and probably into the banking sector.

The increased uncertainty, the chance of negative returns on your savings if the funds are allowed to fluctuate below one dollar per unit, is sure to drive quite a bit of risk adverse money out of the money market funds. And it opens the door to price manipulation and fraud, doing nothing to help promote transparency and confidence.

The Banks have always hated the money market funds, and are hoping capital will move out of the funds to them in the form of cheap, insured deposits.

I think quite a bit will go into gold and silver as people sicken of the financial repression of the Banks and their friends.

Hire unemployed accountants and pay them a 20 % bonus for every dollar of over-costed (actual vs contract price) inventory items they can find in an inventory audit and a contract audit with 20 % of the amount of any executed contract that contains pricing that exceeds that of the the lowest bid or fails to meet open bid guidelines.

All amounts earned by accountant’s audits are paid by company executive salaries (executive contracts must contain agreement and authorization for such as a condition of employment).

They’ll be careful about their billing and costing then.

What I find to be the saddest thing of all is that someone like Obama WORKS for his appointees, rather than the other way around. And no one is working for the middle class, at least not above the level of dog catcher.

I’m increasingly of the opinion that “brightest” is a modern euphemism for “devious”, as by my reckoning most of these people are actually pretty dumb, and poor at what they do.

In any case, I’m also increasingly of the opinion that there will need to be a rule preventing public servants from working in industry—possibly from working at all—for say a 5-10 year period after they leave office. It’s drastic, but so is the present revolving door situation.

“In any case, I’m also increasingly of the opinion that there will need to be a rule preventing public servants from working in industry—possibly from working at all—for say a 5-10 year period after they leave office.”

It is the Only real solution. But since the “problem” benefits the .01% and harms the 99%, it is a feature not a bug. Therefore, that solution will Never be implemented.