Yves here. One of the not-suffiently-discussed topics in the financial media is the tug of war over currency values, with the need to do post crisis damage control as the cover. For instance, after the initial round of QE, Brazil and India complained vociferously about the dual impact of a weaker dollar and higher commodity prices (yes, Virginia, some economists do think financial speculation can influence commodity prices) on their economies. If Europe contracts while growth in the US and China are also decelerating, it isn’t hard to imagine that the currency front will heat up even more.

This piece by Daniel Gros illustrates, surprisingly, that one currency manipulator has managed to operate under the radar so far. It will be interesting to see if his analysis gets traction in Europe.

By Daniel Gros Director of the Centre for European Policy Studies, Brussels. Cross posted from VoxEU

Switzerland has pegged its currency to the euro at a level that helps it sustain a 12% current-account surplus and one of the lowest unemployment rates in Europe. This column argues that the Swiss peg involves currency manipulation that is, as far as Europe is concerned, the same order of magnitude as China’s intervention. It has had a significant impact on the euro exchange rate and a non-negligible effect on the EZ economy.

A current-account surplus is the mirror image of a capital export. A country that is running persistent current-account surpluses is thus persistently exporting capital. An important question to consider is which sector is investing abroad, the private or the public sector? If it is the public sector which invests abroad, in particular if it is done by the central bank via the accumulation of foreign-exchange reserves, this is often called ‘currency manipulation’.

A commonly used indicator of the degree to which a country manipulates its currency is the accumulated stock of foreign-exchange reserves relative to GDP.

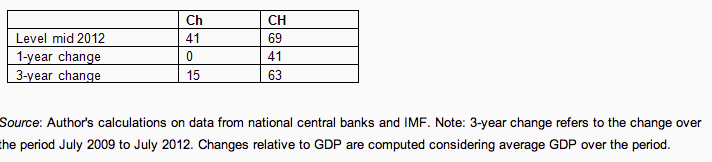

The table below shows the degree of foreign exchange intervention for two countries, which we will call “CH” and “Ch”.

The degree of influence on the domestic currency can be measured in two ways:

• The stock of foreign-exchange reserves as over GDP, or;

• The change in foreign-exchange reserves accumulated over the recent past, again relative to GDP.

Table 1 shows that on all measures CH emerges as the greater ‘manipulator’ than Ch. At the middle of 2012 the value of the foreign-exchange reserves (largely held in euro) of CH amounted to close to 70% of GDP; almost twice as much as the roughly 40% of GDP for Ch. Over the last 12 months Ch has actually stopped intervening, but this might be due to transitional factors. The three year perspective might thus be more appropriate. But even over this longer period, one finds that CH manipulates more than Ch.

Table 1. Foreign-exchange reserves, stocks and flows, as % GDP

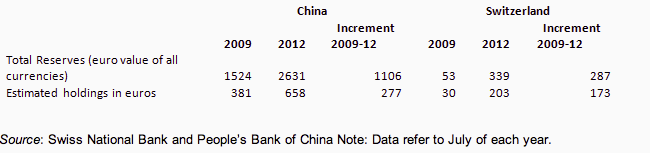

In reality Ch(ina) is a much larger country and the total amount of its interventions are much larger than CH (Confoederatio Helvetica). China has accumulated over €2630 billion ($3 trillion) worth of reserves, about seven times more (‘only’ seven times given the difference in the size of the economy, which is almost 12 to 1) than the about €340 billion ($400 billion) of Switzerland. But this latter amount is not insignificant at the scale of Europe. Moreover most of China’s foreign-exchange reserves are invested in dollars, whereas Switzerland has invested mainly in euros.

In the absence of data disclosure, one can only guess the currency composition of China’s reserves. According to various estimates, about 20-25% of China’s total foreign reserves are held in euro-denominated assets. This implies that over the last three years the People’s Bank of China has purchased about €270 billion, while Switzerland has done it for about €170 billion, somewhat less but fundamentally of a similar order of magnitude.

Table 2. Estimated reserves holdings in euros

Source: Swiss National Bank and People’s Bank of China Note: Data refer to July of each year.

The importance of the Swiss National Bank’s foreign currency interventions for the exchange rate of the euro can also be illustrated in the following way. The Swiss National Bank has intervened in the euro market to the tune of €173 billion over the last three years. If the ECB wanted to neutralise the impact on the euro’s exchange rate, it should have bought an equivalent amount of a foreign currency, say dollars. It is clear that if the ECB had bought $210 billion (€173 billion), the euro would presumably be much weaker today against the dollar. An intervention of the ECB of this scale would surely have been qualified as a real ‘currency war’ and would have led to significant conflicts among the major monetary powers. By contrast, the Swiss intervention caused barely a ripple.

The upshot is that over the last few years the Swiss National Bank has bought a large amount of euros to keep the Swiss franc artificially weak and since September 2011 it has set an official lower bound against the euro. However, this fact has attracted not even a cursory comment by policymakers anywhere whereas the Chinese interventions, which amounted to much less as a proportion of GDP (and which have stopped over the last 12 months) are almost universally condemned on both sides of the Atlantic. The differential treatment is even more surprising if one keeps in mind that Switzerland is running a current account equivalent to over 12% of GDP against less than 3% of GDP for China.

The Swiss Side of the Story

The official version of the Swiss story is simple. For over a decade the country had run large and rising current-account surpluses and kept a stable exchange rate (against the euro) without the need for any intervention, proving that these surpluses constituted market equilibrium. However, with the outbreak of the financial crisis ‘speculators’ started to consider the Swiss franc a safe haven, driving the currency to a level at which the Swiss export sector could not compete any longer. Under this view, the Swiss National Bank’s intervening heavily and then fixing the exchange rate against the euro was entirely justified.

However, this apologetic view does not take into account that the stability without intervention until 2008 was underpinned by a combination of factors that is unlikely to return i.e. Austrian local governments and households all over the new eastern member countries of the EU were willing to indebt themselves in Swiss francs because of its lower interest rates. Moreover, the global credit boom had made investment outside Switzerland appear as safe as a domestic investment. This illusion has now been shattered and private investors have understandably rushed to offload their exchange-rate risk on the Swiss National Bank. The official position is quite simple in its asymmetry.

Capital outflows are considered an equilibrium phenomenon during the upswing of a credit cycle, but capital inflows during the downswing are ‘speculative’ and must thus be neutralised.

The complaint that flows are ‘speculative’ and thus had to be countered does not ring true if one takes into account that even today the foreign-exchange reserves of the Swiss National Bank amount to ‘only’ two thirds of the sum of current account surpluses the country has accumulated over the last twenty years. It is also often argued that an excessive appreciation of the Swiss franc would damage export industries and tourism. Even leaving aside that Switzerland has one of the lowest unemployment rates in Europe, this argument does not make sense. It is clear that a decade of large current-account surpluses leads to an economic structure which cannot survive when capital flows turn around. An exchange-rate policy which seeks to cement an industrial structure which can survive only at an exchange rate which produces a double-digit current-account surplus is clearly beggar thy neighbour.

All in all it is clear that the actions of the Swiss National Bank to keep the Swiss franc low, and thus to perpetuate a current-account surplus of over 12% of GDP, have had a significant impact on the euro exchange rate and hence a non-negligible effect on the EZ economy.

The Swiss franc-euro exchange rate is important by itself given that exports of the EZ countries to Switzerland are about the same as exports to China (both around €90 billion in 2011). Moreover, the Swiss current-account surplus is relevant at the scale of the EZ, being equivalent to close to 1% of the EZ’s GDP, or the deficits of France and Italy combined. Switzerland’s peg to the euro has thus made the intra-EZ adjustment (elimination of current-account deficit in the south combined with lower surpluses in the North) significantly more difficult.

Moreover, most of the euro-denominated investments of the Swiss National Bank have presumably been in bank deposits and securities of the core countries. This means that its interventions have led to an even larger liquidity surplus within the German banking system and thus contributed materially to the huge claims accumulated by the Bundesbank within the TARGET 2 system.

I don’t have very clear that you are too correct in this: Switzerland behaves like a EU member with special status. Only that explains the comparative oversizing of its trade with the EU: because its economy is deeply integrated with its neighbors, Germany, France, Italy and Austria, all of which are EU members.

The comparison in imports with China, a distant country with relatively low purchasing power, which is famous for exporting rather than importing, seems to make little sense. Obviously the EU does not export too much to China but that rather reflects the highly unbalanced trade relation with the Eastern giant, than saying much about Switzerland.

With all that in mind, pegging the franc to the euro makes total sense and is almost as good as if Switzerland adopted the euro in fact.

Much more worrisome is for me all those EU states which are outside the euro and have dumped their currencies like Great Britain or Poland but still enjoy full trading privileges like the rest. Of course I can understand why one would not want to join the hyper-rigid euro but reprehending Switzerland because it did (in a sense) motu propio, sounds a bit unfair.

I don’t say that the Helvetic Confederation hasn’t got some privileges (tax regime specially) but, really, Britain, Poland or Sweden are much more of a problem in terms of unfair competition, inside the European free trade area.

And in general the unfair competition comes from countries that truly dump their products on us, forcing our factories to close (because our leaders have no guts): China and the USA specially, to lesser extent Russia, Japan…

This can also be seen in the new World Economic Outlook, Chapter 1, figure 1.5/4 Central Bank Total Assets – the assets of the Swiss central bank have shot up to the level of China,nearly!

There is one benefit to this if you are a tourist. I was in the area last June, and the rosti price was more palatable. Not to mention it was the Jungfrau centenary celebration.

Hi Yves,

Not everyone overlooked this.

Bruce Kasting is following this regularly. His latest is here: http://brucekrasting.com/snb-in-a-pickle/

No disrespect to Bruce intended, but until a story is reported in a major news media outlet or taken up by a Serious Economist, it does not exist.

How about if some dilettante blogs about it? Does it exist then?

If you’re talking about Kurgman, he qualifies under ‘major media outlet,’ not ‘Serious Economist.’

When is Europe going to get back to shooting rather than this anal stuff they do now like in the good ole days?

Now that the Nobel Peace prize has superseded Time magazine’s cover as the premier contrary indicator, the answer is ‘imminently’ — en garde, mes amis!

Switzerland has always enjoyed a special status. Let’s be frank, when you’re a clandestine banker for the EU/US kleptocracy you get a free pass, and no ones paying much attention to a bit of foreign exchange jiggery pokery.

I don’t want to be so jaded but I agree with Aussie F. and the author of this article.

This post is all bunk. Blame Switzerland for being prudent, making things, selling them. Why not blame savers for the credit crisis, social security recipients for the fiscal crisis?

Yves is not blaming Switzerland, she’s blaming the people that criticize China for not also criticizing Switzerland. It’s metacriticism, see?

Aha. That does make sense.

Jake, while I feel that sometimes this blog does go that way, in this case your comments makes no sense. The criticism is about currency manipulation, which is a fact (the SNB announced the peg). And that is not “saving, producing, selling”. In fact, it is unfair competition to does that are actually doing does things.

Switzerland is not keeping the Swiss franc low. It is already quite high by historic standards and Switzerland is keeping it from going completely stratospheric.

Part of why the Swiss get away with it may be that it is also in the interests of the rest of Europe for Switzerland to buy up euros. It is certainly in the interest of Europeans with home mortgages in Swiss francs. (I am not sure how many of them are in the Euro zone, but many Austrians have such mortgages.)

And perhaps the Euro zone is happy that someone is so eager to buy up Euro assets.

Anyway, I can assure that in Vienna at least, it is if the Swiss stopped this that you would hear the loud howls.

As a long time resident of this fine country, I have to strongly disagree with the sentiment of this post. The ‘economic structure’ as you call it and with it the chronic overvaluation of the CHF goes back much further than the current bubble. The Swiss disease has been a well known term for quite a while.

And then there’s this I don’t understand:

Austrian local governments and households all over the new eastern member countries of the EU were willing to indebt themselves in Swiss francs because of its lower interest rates.

OK, capital exports during the bubble years put downward pressure on the Franc, and the turn of tides is doing the opposite. But surely, a strong apprectiation of the CHF versus other European currencies would be a bad thing for the foreign borrowers. So they’re actually being helped by the SNB interventions. And interest rates ain’t going nowhere neither. Further, I fail to see what measure of value you apply to arrive at the verdict that a currency is ‘manipulated’. The only sensible measure to me is PPP and, unlike in the Chinese case, the CHF is still overvalued in terms of purchasing power despite the interventions.

Switzerland is also not the only country with a peg / floor to the Euro. Denmark has been doing the same for more than 30 years. Are they on the radar? Or does that only go off when they publish cartoons?

You also seem to be arguing that non-intervetion would somehow magically transfer Swiss jobs to Portugal and Hungary. That seems rather a Friedmanite or mercantillist view of the world, to put it mildly. And it’s about as realistic as arguing that residents of Manhattan should stop flooding the Mid West with their funny money and start growing corn instead.

Switzerland is a small country with no natural resources and a very internationally oriented economy – so very sensitive to large SWINGS in exchange rates. The long term trend has been one of latent over-valuation of the CHF, with the temporary exception of the Euro bubble years. It has managed to run consistent current account surpluses DESPITE this. The main reason being not its manufacturing prowess or the particular friendliness of its waitresses (output growth has been more than anaemic since the late 1980s) but the killings it made with its overseas investments (2010 NIIP = 136% of GDP).

See, now this is excellent meta-metacriticism:

“Switzerland is also not the only country with a peg / floor to the Euro. Denmark has been doing the same for more than 30 years. Are they on the radar? Or does that only go off when they publish cartoons?”

You are critical of Yves’s metacriticism because, while she criticizes those who are critical of China, but not Switzerland, she does not also criticize those who are critical of Switzerland and China, but not Denmark. Well done.

Is Denmark off the RADAR – Hell Yes: Discussing the facts about the Danish economy is *definitively* not the done thing in serious media! Might threaten The Recovery!!

Denmark had the 2’nd largest donations .err. Bank Rescue Packages of any of the EU member states … the Danish government has issued 4 more packages since the crisis, signed up for the EFSM, without EUR membership, and now wants to run drones for the US, buy many F35’s, bomb Syria & Iran, e.t.c. Now we also know who lent them the money for the bankers record bonus year.

Again In think the UKs reals goods trade deficit has a much bigger impact then little Switzerland.

It was £100 billion in 2011 and 28.1 billion in 2012 Q2 although God knows what goes on in the hidden Gold market.

ITS THE NORTH SEA DUMMIES

The UK ONS has some mildly interesting documents on capital accounts

entitled

Capital stock, capital consumption and non financial balance sheets, 2003 ,2004 ,2005 etc etc.

The caveats are interesting

These Chronicle the change from a nation state war economy to a extreme market state.

1961 : British telecom & post office reclassified as public corporations

1983 :start of privatisation era (1984 – Uk enters current account deficit ,coincidence ? )

1989 : water and sewage privatised.

1992 : NHS restructured into trusts.

Heres how it works : the UK goes into current account deficit , in particular real goods deficit – the real resourses from these external goods is used to bid up the price of non productive assets such as houses and stuff via credit hyperinflation.

The capital assets of the country appear to increase but the internal productive capacity of the country tanks. (the house price rises are the result of external increases in productive capacity

Eventually after 30~ years of this policey the external resourses from other countries is exhausted , to keep up its “asset” prices it must lay waste to other countries consumption – think Ireland & Spain.

This surplus consumption is directed into UK asset prices ,sustaining the Ponzi for just a bit longer.

It may just be in the UK & US narrow interest to sustain their monetary policey if you are of a zero sum like game disposition given their extreme real goods trade deficit.

The UK for example has got Germany by the balls as so much excess luxury car capacity flows into the streets of London.

This is game theory played at the highest level possible.

Once banks played nation states off against each other , now its playing market states against each other – at its core it is the same Phenomena

http://www.ons.gov.uk/ons/dcp29904_241335.pdf

refer to 1. : A more detailed stat bulletin

The first graph is very interesting.

Residential buildings & financial assets of households forms the bulk of these assets.

But if you think of these assets as claims on external wealth or productive capacity outside the UK the extreme nature of the UK becomes all too real.

This is why the Q2 net drop in income of £5.5 billion is so important for the UK.

It must destroy Ireland and Spain to sustain real goods coming into the UK but this action also destroys its income.

Its a Catch 22.

We are witnessing the failure of the Anglo model ,the Anglo world.

It has stripped Europe of its wealth…….the jewel of the crown , the eurozone is now a deadzone.

http://www.youtube.com/watch?v=MYnGAZl3pjs

Its clearly in the short term interest of the UK to continue its policy of burning every village as long as its internal asset prices rise faster then its loss of external income.

But that is a Malthusian dynamic……in the past it lead to a thing called WAR.

What happens in this world of market states is anyones guess but most states were market states prior to the Great war.

That war was caused by a run on the BoE as America became both China & Saudi Arabia in one monster package.

No such country exists today.

Just because the UK is not in the Eurozone or is not offically “Europe” in some people eyes does not make it go away…

Much of German surplus production flows into the streets of London.

I can’t believe how this is ignored by these “economists”

Its all

“For Christ sake, John. Don’t be scared. Go on and eat your cookies.”

EAT YOUR FUCKING COOKIES

UK sucked in a Net 28.1 Billion sterling or 42 billion Francs worth of stuff and fuel in Q2.

France is also in major real goods deficit…..

Hello – anybody home ?

They are sucking the PIigs dry.

Forget about the claims on wealth which is mixed up in the current account figures – these claims are showing negative figures in the UK anyhow.

Look at the real goods trade balance , and I am not talking about banking “services”

This is a race for real goods.

http://www.tradingeconomics.com/france/balance-of-trade (go to y2000)

Real Resourses are simply crossing the Pyrennes.

http://www.tradingeconomics.com/spain/balance-of-trade (go to 2000 again)

They also did some serious ‘QE’ in Aug 2011 taking the outstanding francs from 30 billion to 80 billion when the US and European stock markets were slipping

Zurich, 3 August 2011

Swiss National Bank takes measures against strong Swiss franc

The Swiss National Bank (SNB) considers the Swiss franc to be massively overvalued at present. This current strength of the Swiss franc is threatening the development of the economy and increasing the downside risks to price stability in Switzerland.

The SNB will not tolerate a continual tightening of monetary conditions and is therefore taking measures against the strong Swiss franc.

Effective immediately, the SNB is aiming for a three-month Libor as close to zero as possible, narrowing the target range for the three-month Libor from 0.00–0.75% to 0.00– 0.25%.

At the same time, it will very significantly increase the supply of liquidity to the Swiss franc money market over the next few days.

It intends to expand banks’ sight deposits at the SNB from currently around CHF 30 billion to CHF 80 billion.

Consequently, with immediate effect, the SNB will no longer renew repos and SNB Bills that fall due and will repurchase outstanding SNB Bills, until the desired level of sight deposits has been reached.

Since the SNB’s last quarterly monetary policy assessment, the global economic outlook has worsened. At the same time the appreciation of the Swiss franc has accelerated sharply during the last few weeks. Consequently, the outlook for the Swiss economy has deteriorated substantially.

The SNB is keeping a close watch on developments on the foreign exchange market and will take further measures against the strength of the Swiss franc if necessary.

http://www.snb.ch/en/mmr/reference/pre_20110803/source/pre_20110803.en.pdf

and

http://market-ticker.org/akcs-www?post=191289

They Only Come Out At Night

I don’t know who this is, but it’s a government.

It takes an insane amount of firepower to do that. The European markets dove on the open, and almost immediately there was some sort of “official” response. Maybe the Swiss National Bank, maybe someone else, but whoever it was, they had a hell of a lot of cash to throw in to move things like that.

The response was immediate. Euro up, dollar down, Swissy down huge, and big reversals almost-immediately everywhere, including in the US futures. We went from down a couple to up 8 in less than 30 minutes, and the Dow futures are now up 56.

It’s not necessarily a government. Governments have relatively little ability to *raise* currency prices, as Soros proved by betting against them.

However, it is perfectly likely that it was the government of Switzerland, which has *unlimited* power to reduce the value of the Swiss franc (remember, they can print), and has declared its intention to keep the Swiss franc down to maintain its export industry.

Some people are up in arms because Switzerland is acting in its own interest. Should we expect something different? It is no secret that Switzerland has been intervening to stop the rise of its currency – nor that China, Japan and the U.S. also regularly intervene to depress the value of their currencies.

When world trade is a zero-sum game it should come as no surprise that some countries will manipulate markets to give themselves an advantage. And Switzerland can hardly invade other countries to give itself markets as the U.S. does.

I’d like to throw out a question here: I had read sometime in 2011 that China was then spending on the order of US$1 billion a day in forex markets to keep the renminbi depressed, but I see in this article a claim that “Over the last 12 months Ch[ina] has actually stopped intervening.” Does anybody have a good estimate of the level of Chinese forex spending?

I have to say, Switzerland is doing the only sensible thing!

It is perfectly possible for other countries to counteract it by depreciating their *own* currencies. But other countries are run by idiots, so they don’t do it.

What can I say? There’s no way to spin this as a criticism of Switzerland!

You can’t say “Look, Switzerland, the rest of us have agreed to a suicide pact, why do you insist on stubbornly refusing?”

That doesn’t make sense.

“Why, the unreasonableness!”

Brilliant.

“And if Jimmy and Billy jump off a cliff are you going to jump off after them?”

Best line in the article! Industries have to borrow, it matters not at all to them where the lenders are. If the industries cannot beggar their neighbors they beggar their customers and beggar the nations where they are located. They beggar their children and their grandchildren. They beggar until they cannot anymore and then they collapse.

Managers believe the current state of affairs is extraordinary and temporary. A few months more of interventions and ‘business as usual’ will re-emerge by itself without anyone having to do anything severe. All the different banks will then unwind their positions. Everything will be ‘sustainable’ without bailouts or stimulus.

With managers, utopians and tycoonish ‘entrepreneurs’ it is always ‘tomorrow’. “Give us until tomorrow and your ship will come in!” they cry. “In the meantime, we must strip mine all of your coal as soon as possible. We need to do this for the children.”

Give us tomorrow or there will be no tomorrow. How can anyone win? Answer is nobody does except the bosses.

Five years into the crisis and nobody is willing to entertain the idea of a sea-change: capital is now too costly, borrowing in order to retire old debts is emerging as the cross too heavy to bear.

If the Swiss allow their currency to appreciate to ‘market levels’ the Eastern Europeans will be bankrupted with franc-denominated service costs. At the same time, the measured worth of the euro would decline proportionately. Euro depreciation would make it far more difficult for the Establishment in the Euro area to bail out ‘special friends’ who would want funds, not scrap paper. As it is now, the secondary trade between Swiss and the Europe is euros for German bunds, depressing yields. Swiss is the pipe between Southern Europe and the North, an enabler for massive … ongoing … accelerating bank runs.

There are more difficulties: China holds almost a trillion euros and euro-denominated securities that it dare not hold onto — for the risk of them falling worthless in an afternoon — yet it dare not get rid of them — for the risk of precipitating these things falling worthless in an afternoon. At some point the Swiss central bank must realize the peg is undefensible and at that point the bank is ruined with its gigantic euro-position. Before the current peg, the partial and half-baked intervention had cost the bank billions in losses.

All of this currency nonsense is more of the same evasions of reality … hoping against all hope that conditions change … by themselves or by magic. That ‘growth’ will start by itself and everyone will then live happily ever after … fat chance o’ that!

Exactly, the US, EU and Swiss QEs are going against basic market fundamentals. Like trying to sandbag a tsunami.

Jim Haygood says:

August 3, 2011 at 8:57 am

Would that they had done so in the last crisis! The Economist’s Buttonwood highlights the exquisite bind that policymakers have ensnared themselves (and us) in:

Britain and America ended up with deficits of more than 10% of GDP, shortfalls that were unprecedented in peacetime. But the “shock and awe” approach to Keynesian stimulus has an unfortunate consequence. Any decline in the deficit, even to a still whopping 8% of GDP, acts as a contractionary force on the economy: either the government is spending less or taxing more.

http://www.economist.com/node/21524886

Thus, this week’s ominous ‘Depression signature’ of panic buying in Treasuries and gold (two safe havens in a depression), while equities are dumped wholesale.

In hindsight, it’s clear that disgraceful pieces of schlock [fill in your own s-word] such as Bank of America, Citibank and JP Morgan should have been permitted to splat against the wall in 2008, annihilating their equity and bond holders while government acted to protect depositors.

Protecting depositors would have entailed a surge in fiscal deficits, too. But at least we’d have gotten something for our money: a restructured financial system, cleansed of too-big-to-fail, maladapted dinosaurs.

Now, in mid-2011, the familiar Depression psychology of 1932 (when both Hoover and Roosevelt ran on balanced budget platforms) is upon us. As fiscal stimulus recedes, the economy will wilt like a cheap suit in a steam bath.

The larger lesson of 2008 is that economic central planning — practiced by central banks worldwide — is a fallacy and a failure. They can only postpone, not prevent, necessary restructuring. Postponed restructuring turns into a teeth-shattering trauma when it finally overflows the central planners’ puny levies (as Europe is about to demonstrate).