By Yasha Levine, an editor of The eXiled and co-founder of Project S.H.A.M.E., a media transparency initiative led by Yasha Levine and Mark Ames.

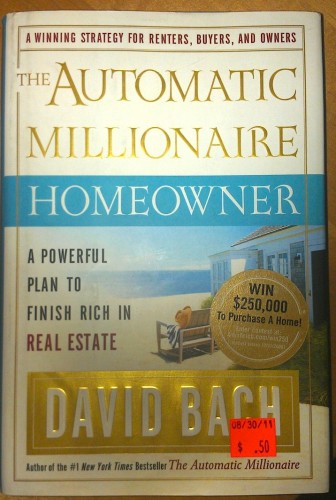

I was passing through the Mojave Desert and by chance stopped by a local thrift store in Joshua Tree. I’m glad I did, because I spotted a book that I just had to own. At $0.50, it was priced to sell. And as you can tell from the title above, the book’s a classic. It’s bound to remain fresh and relevant through the ages—not as a useful guide to homeownership, but as a fossil record of the biggest real estate scam in the history of the United States.

A lot of people still wonder how and why so many millions of people bought such ridiculously overpriced homes and took out mortgages and loans they clearly could not afford?

That’s what I kept wondering when I moved out to Victorville back in the Spring of 2009 to do immersion reporting from the front line of the real estate meltdown. Located about 100 miles east of Los Angeles on the edge of the Mojave Desert, Victorville got higher and crashed harder, in terms of real estate, than almost any other place in California. It doubled its size to 100,000 in just eight short years, growing from an isolated hick outpost into a booming commuter suburb filled with the cheapest McTractHomes south of Fresno. By the time I got there, Victorville was a ruined city filled with empty master planned communities, some of them half built and abandoned, rotting dry in the sun. I spent nearly two years reporting on the real estate swindle out there, and I never could stop thinking about the central question: How the hell were people coerced into moving out here? Why would anyone think that buying a $500,000 house in a desert 100 miles away from Los Angeles be good idea, no matter what kind of loan deal you got or how booming the market. What kind of propaganda were these people subjected to?

That’s what I kept wondering when I moved out to Victorville back in the Spring of 2009 to do immersion reporting from the front line of the real estate meltdown. Located about 100 miles east of Los Angeles on the edge of the Mojave Desert, Victorville got higher and crashed harder, in terms of real estate, than almost any other place in California. It doubled its size to 100,000 in just eight short years, growing from an isolated hick outpost into a booming commuter suburb filled with the cheapest McTractHomes south of Fresno. By the time I got there, Victorville was a ruined city filled with empty master planned communities, some of them half built and abandoned, rotting dry in the sun. I spent nearly two years reporting on the real estate swindle out there, and I never could stop thinking about the central question: How the hell were people coerced into moving out here? Why would anyone think that buying a $500,000 house in a desert 100 miles away from Los Angeles be good idea, no matter what kind of loan deal you got or how booming the market. What kind of propaganda were these people subjected to?

Well, this book provides a part of the answer: people were explicitly instructed to do so.

The Automatic Millionaire Homeowner hit the front bookcase displays at Barnes and Noble in March 2006, at the very top of the real estate market and just a few months before the whole thing crashed and burned. Its main message was simple: If you take out a mortgage to buy a home, you will always make money. There is no way you can lose—no matter when you buy, how much you pay or what type of loan you get. And the kicker is: both the book and finance expert who wrote it were bankrolled by Wells Fargo and Bank of America.

This book is just one of dozens—if not hundreds—of similar self-help snake oil guides promising a sure bet system to get rich in real estate. But it’s a good example of the massive propaganda effort financed by Wall Street that was designed to funnel as many people as possible into the mortgage meat grinder. The book was packed with blatant lies that seem so obvious and even comic in retrospect. The book was not put out by some shady fly by night operation, but by a supposedly credible financial expert who had the backing of the most well-known and respected banks, TV networks and newspapers.

But the whole thing was a fraud, shamelessly boosted by some of the biggest names in news media—none of whom have been held accountable for their role in defrauding millions of Americans.

So let’s take a look…Crack open the book and turn to the introduction, it begins like this:

What if I told you the smartest investment you would ever make during your lifetime would be a home!

What if I told you that in just an hour or two I could share with you a simple system that would help you become rich through homeownership?

What if I told you that this system was called the Automatic Millionaire Homeowner—and that if you spent an hour or two with me, you could learn how to become one? [emphasis mine]

Would you be interested? Would you be willing to spend a few hours with me? Would you like to become an Automatic Millionaire Homeowner?

Interested? Intrigued? Want to know more? Well, turn a couple of pages and you get this:

As I sit here in August 2005, I have no idea when you will be reading what I’m writing. Maybe it’s March 2006 (when this book is scheduled to be published)—by which time the real estate market could be slowing or cooling down to modest single-digit annual gains (or not). Perhaps this book was bought by a friend of yours who passed it along to you—and it’s now 2007 and those once “certain” boom markets are going bust due to speculation. Or maybe the opposite has happened—interest rates have remained at historic lows, and home prices have continued their march upward.

In fact, it doesn’t really matter when you happen to be reading this or what’s going on right now in the markets. This book is not about the boom . . . or the busts. . . . What this book is about is the truth. And the truth is this:

Nothing you will ever do in your lifetime

is likely to make you as much money as

buying a home and living in it. [emphasis in the original]

What’s this sure-fire system? Well, it’s so simple it fits on the inside flap! Here’s how you do it:

What Makes The Automatic Millionaire Homeowner Essential:

■ You don’t need a big down payment to buy a home.

■ You don’t need great credit.

■ You should buy even if you have credit-card debt.

■ You can buy a second home even if you’re still paying off the first.

■ You can get started in any market-boom or bust.

■ It’s easier to be a landlord than you think.

Just a few months after the book came out, the real estate market went into a death-spiral. Victorville and other Mojave Desert exurbs like Palmdale and Lancaster were packed to the brim with people who followed this book’s advice to the letter. They took out no down payment adjustable rate mortgages, bought at the peak of bubble, had horrible credit scores, were struggling to make ends meet and were probably up the hilt in credit card debt. Over the next year and a half, home prices collapsed by 30% and just kept falling. By the time that I packed my bags and fled West towards the Pacific Ocean in 2010, homes that had sold for nearly $400,000 at the top of the market in 2006 couldn’t find a buyer at $50,000 or $75,000. People were kicked out of their homes, lost all the “investment” payments they had made on the loan and had to find other places to live—rental homes if they were lucky; their cars or tents at the hobo camp down on the banks of the Mojave River if they weren’t.

So the Automatic Millionaire was a bust—well, at least as far as the now-former homeowners were concerned. But as we now know, the latest homeownership craze was never meant to benefit the homeowners. The only Automatic Millionaires created by this book were David Bach and the financial oligarchy he served.

See, before David Bach began his bright career as a New York Times bestselling author dedicated to spreading the gospel of homeownership, he was a senior vice president of Morgan Stanley and a partner of The Bach Group, a wealth management outfit started by his father. Yep, he was born into it. Finance runs through his veins!

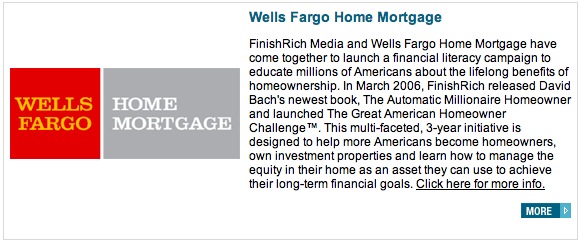

So it’s no surprise that both Bank of America and Wells Fargo sponsored David Bach and his revolutionary Automatic Millionaire Homeowner wealth creation system.

Here’s an excerpt from Wells Fargo’s press release:

Wells Fargo Home Mortgage Joins with David Bach to Promote Shared Vision of the Lifelong Benefits of Homeownership to Millions of Americans

Best-Selling Author, Leading Retail Lender to Encourage People to Build Long-Term Financial Success through Homeownership

DES MOINES, Iowa – Oct. 28, 2005 – Wells Fargo Home Mortgage today announced a three-year agreement with financial coach David Bach, author of several best-selling books including No. 1 New York Times best-seller The Automatic Millionaire. The partnership is designed to increase the number of first-time, second-home and investment homebuyers and help homeowners best manage the equity in their home as an asset to achieve their long-term financial goals.

Yep, Wells Fargo is only interested in educating homeowners for the greater good. And the bank is not alone. Just look at all the smart people who praise and recommend his work. They wouldn’t lie, not with their reputations on the line!

Jean Chatzky, Financial Editor of NBC’s Today, blurbed: “The Automatic Millionaire gives you, step-by-step, everything you need to secure your financial future. When you do it David Bach’s way, failure is not an option.”

Fox’s Bill O’Reilly also endorsed the Automatic Millionaire wealth creation system: “David Bach’s no-spin financial advice is beautiful because it’s so simple. If becoming self-sufficient is important to you, then this book is a must.” Yep, this is the same O’Reilly who bashed homeowner “losers” who took out loans that they weren’t able to pay, and yet here he is endorsing a plan that says there’s no such thing homeowner who loses money. Wonder what kind of cut Bill gets off Bach’s loot?

So what’s up with David Bach today?

The man’s still doing regular TV gigs and giving financial advice to unsuspecting victims, including a weekly appearance on NBC’s Today Show. But he’s changed his racket: Bach’s no longer out to make automatic millionaires; these days he’s motivating debtors to get second/third jobs and convincing them to adopt austerity measures in their own personal lives. He’ll help you pare down your consumption footprint to the bare minimum necessary for physical survival. Yep, Bach’s our debt handler. His job is to make sure we peons keep making those monthly payments to Wells Fargo and Bank of America!

The day that degenerate shysters like David Bach are afraid to show their faces in public and feel the need to flee across the border is the day that we’ll know that we as a country are making progress towards a brighter future.

Read Yasha Levine’s book: The Corruption of Malcolm Gladwell.

Forty-five years around the investment business forces me to conclude that most people are ridiculously easy to scam. They credit any fairy story promising them money, good looks, celebrity, etc. Ordinary life is too dreary, too ordinary. They are easily persuaded that success has a secret. The sensible ones pursue golf in the same way, wasting only their time and a lot less money.

The real estate bubble happened because the banks making the loans had an instant profitable market for them. The real suckers were the institutional MBS buyers who thought the rating agencies were imposing standards. What were they smoking?

“The real suckers were the institutional MBS buyers who thought the rating agencies were imposing standards. What were they smoking?”

Remember, most of the buyers had given their investment funds to *banks* and *professional portfolio advisors* to invest. (This was their big mistake. It’s a stupidly common mistake.) The bankers at those places just collected their percentage and invested in any old thing. They were easy to scam because they didn’t have skin in the game….

A big chunk were sold to European institutional investors, guys who earned maybe half a million Euros, and thought they were smart, savvy, sharply brainy people who were delighted to be hanging out with those brilliant Goldman types.

The truly clever,mega-earning sharkish Wall Street and City folks were able to rip their faces off by flattering them and going monster with their corporate credit cards.

It was Man vs Boys stuff.

Hi,

Could we have a recap someday.

Yves explained in the past that there is one question that is generally unanswered: why were banks so happy to sell crappy loans, knowing fully well they would not be repaid. Who was paying then for this, and how was money made?

Thanks,

Good question. As I understand it, banks create money out of thin air, by tapping a key on a keyboard. Therefore when they make a loan that’s secured by property, such as a house, they win either way — if the homeowner makes payments or if he doesn’t, when the bank possesses the house.

This in large part explains why banks are so reluctant to work out reduced mortgage payments for distressed homeowners. They have a big incentive not to.

The plan was to bundle them into pools of securities and sell them off to suckers…err investors.

And the selling point was, sure, there may be some badly underwritten loans in there, but through the magic of diversity, and different tranches (i.e. the riskiest revenue streams from the securitization would be bought at a discount by specialists who had some say over what loans went into the pool), everybody would win.

And so the entire asset class of real estate became systematically overpriced, and none of the benefits of diversification mattered. (Also, there was the little matter of buying “insurance” via credit default swaps that helped turned the whole thing into a bigger time bomb.)

http://people.stern.nyu.edu/igiddy/ABS/MBStypes.htm

~

And anyone could see that real estate was overpriced, because the borrowers had no way to generate incomes high enough to service the loans. For the same reason, US real estate is still overpriced, regardless of all the feelgood stories retailed by mainstream media.

Jake have you not watched “the Century of the Self” yet.

http://vimeo.com/20861423

Skippy… and hay, this is just a video, not the full spectrum psychoanalysis applied from birth by corporations et al, as is done now days. Hell people watch Fox news…

Skippy,

Thanks for this. Mesmorizing, terrific stuff! Stuart Ewen, who is interviewed in this program, wrote an excellent book about Berneys. I believe it is called Public Relations: A Social History of Spin. I also think the underlying ideas go back further, to Gustave Le Bon. His book was called The Crowd, written about 1900.

And the final aspect of the puzzle is short-term thinking. The bankers expected to collect their bonuses and get out before the shit hit the fan.

(In fact, I suspect the smarter crooks are already out.)

For bankers, the shit still hasn’t hit the fan. And until there are ARRESTS of those at the very top, the fan shall remain shit-less. But hey, who mourns the loss of the rule of law in this country?

Apparently, not enough of us.

Pelham says:

Therefore when they make a loan that’s secured by property, such as a house, they win either way — if the homeowner makes payments or if he doesn’t, when the bank possesses the house

When the savings and loans went under, the FDIC set up an agency to sell the assets. Individuals purchased the houses at big discounts, when they sold them years later the wealth was transferred to individuals. This did not happen with the banks, instead the banks here in Houston, Texas, a hot real estate market are selling at full price and giving 2 1/2% -3% mortgages. We know the Fed is providing these funds at almost no interest. So the wealth goes to the bank not individuals.

Toxymoron writes:

“Why were banks so happy to sell crappy loans, knowing fully well they would not be repaid?” “How was money made?”

The scam had some complexity. Starting from the top, the mega-banks made money by a miracle of financial engineering called the CDO, or Collectivized Debt Obligation. The megabanks figured out that they could pool hundreds or thousands of mortgages into one financial instrument, the CDO. Then they diced and sliced the CDOs into these things called tranches, and sold these pieces of the CDO to investors everywhere. And investors across the globe bought up these things like hotcakes. They looked legit. The CDOs the banks were selling were stamped AAA by the major rating agencies, meaning ultra-sound investment quality. Yes the banks knew fully well that the bad mortgages in the CDO pools were going to go bust. But they raked in vast oceans of money for several years before the CDOs went bad. And the mortgage servicers lower down in the scam chain were also making piles of money. All they had to do was rope in as many sucker wannabe homeowners as possible. No money down, bad credit okay, no verification of income and so on. So long as they got people into homes with their mortgages, their end of the scam worked beautifully. They made money both by scamming whatever they could from the homeowner, and then by selling their mortgages to the banks. Money flowed like a river from the megabanks to the mortgage people. Wall street banks would package any kind of mortgage, good or bad. Everybody in the scam chain made a lot of money. Investors in CDOs and homeowners got royally fleeced.

Hope that brings some clarity about how banks made money on loans they knew were bad.

Oops, make that ‘Collateralized’, and not ‘Collectivized’ Debt Obligation.

Erm, this isn’t correct.

A CDO (the kind under discussion here made primarily from exposures to subprime or Alt-A loans) was a resecuritization.

First you had a mortgage backed security. That was composed of typically 4,000 to 5,000 mortgages. The cash flows from that were allocated in a specific hierarchy, a waterfall, to various investors. These securities were strucrtured so that the overwhelming majority of the bonds created from this cash flow allocation process were rated AAA.

The riskiest bonds, the “tranche” rated BBB or BBB-, was like all the other non AAA trances, supposed to protect the investors in the higher rated bonds. That one would have taken a lot of due diligence since it had a lot of loss exposure (even though the equity tranche was riskier, it had upside the BBB didn’t’, plus it was small in $ terms, so it was pretty easy to sell).

But the BBB tranches were hard to sell, and the dealers didn’t want to wind up stuck with them. So they dumped the BBB bonds, plus some other exposures (over time, more and more related to subprime bonds, so 90% was typically risky subprime exposure) into a CDO. That was tranched too.

But again, no one wanted the low risk tranches of CDOs, so they were dumped into CDOs (even a first gen CDO could have a certain % of other CDOs in it, and they were also used to created CDO squareds and even CDO cubeds(,

So this market was increasingly a Ponzi scheme.

An off-shore ponzi scheme beguiling investors with the promise of tax free income. One CDO I am familiar with was created late 2007 in the Cayman Islands to remove tanking subprime mortgages from US companies’ books and the securities were sold on the Irish stock exchange to avoid the SEC’s disclosure requirements. Big institutional investors purchased these securities despite red flags that it was too good to be true. The Louisiana class action Broyles v. Cantor Fitzgerald offers an in-depth look into how and why pension funds were allegedly swindled.

The banks were happy to make bad loans because they never planned to hold onto the mortgage note. The mortgage originators got paid when they sold the bad loans to Wall Street who was hungry for debt of any kind which could be sliced, diced and repackaged into various types of securities. MBS, CDO, CLO etc.

They didn’t care because they didn’t have skin in the game. The structured credit products of the 90’s and 00’s effectively decoupled risk from lending unleashing a wall of bad faith credit money which inflated the real estate bubble and a number of other bubbles which are yet to pop. (higher education/student loans.)

We need to recognize this wasn’t only an American phenomena. Some, but not all, European countries had similar problems, including countries with a much stronger working class tradition and better functioning democracies: Iceland, Ireland, Spain, Portugal, Greece, parts of Eastern Europe.

What is the similarity between the EU periphery and that North American backwater we all love? Low interest rates created by tremendously large capital inflows. We have to stop the shysters, but we also need to take a page out of Beijing’s playbook and impose capital controls: no hot money inflows into the US! The only money coming into the US should be long term investment tied to greenfield industrial FDI with a strong technology transfer component.

It may take a hundred years, but the real battle is over whether or not the US can adopt East Asian/Israeli/Swiss/German mercantilism.

The great money paradox: 90+% of the people have no money and no sensible to get enough; 1% of the people have too much money and no use for it except speculation. Banking goliaths are being saved by the Fed and using their privileged position to create more money, solely to fuel more speculation. Meanwhile, investment stagnates for lack of opportunity in a world of shrinking demand.

The answer to all this is putting more money in the hands of ordinary people and taxing away the money of those who have too much. Fix the banks by taxing away the phony profits of derivative trading and restoring Glass Steagall. Break up each of the giant banks into 100 small ones. It isn’t all that long ago when commercial bank operations were limited to a single state, and it isn’t coincidental that this coincided with the greatest period of prosperity the US has known.

Yep. The key problem is that the money is in the wrong hands.

Both Woodrow Wilson and FDR knew how to fix that: tax the money away from the million-dollar-a-year men (with tax rates of 77% or 90%, for the respective administrations) and increase the incomes of everyone else (done in many different ways).

As a partner/player in the “GSE Business Model” everyone in the daisy chain makes money, including the investor, who now becuase of the implosion is tapping the taxpayers (follow the money). All the GSE loans are guaranteed by the taxpayers.

The most damage was done outside the “GSE business model”.

http://www.mcclatchydc.com/2008/10/12/53802/private-sector-loans-not-fannie.html

~

This is a misdirection play: “Federal housing data reveal that the charges aren’t true, and that the private sector, not the government or government-backed companies, was behind the soaring subprime lending at the core of the crisis”

Since 1996 BAC alone sold 94% of it’s mortgages on a daily basis to Fannie Mae. It is the 94% that caused the meltdown not the insignificant 6% that has been floated as an excuse.

Agreed, just like an article I read claiming that restoring Glass-Steagal won’t fix anything.

One cannot believe everything one reads. I always consider the source, and what stakes they have in their “memo”.

Even Yves has said it Glass needs to be updated. The answer is not to get rid of it, however. We need Glass 2.0.

I just thought of a name for it. Glass Ceiling.

Are there any studies of exactly who bought the bundles of mortgages? And who sold/issued the CDO’s that “insured” those purchases?

You know, I tried to find out who bought into the trust that my foreclosed mortgage was (supposedly) a part of, only to find that all seven tranches were purchased by the same proxy buyer, forever hiding from me the true buyers of my note and mortgage.

Opacity is a necessary component of any good scam.

BTW, CDOs are not insurance (that, again supposedly, is what CDSs are); they are bundles of bundles, that is to say, they are made up of MBSs. Confused? Me too. Reading “The Big Short” helped me sort some of it out, though.

“Opacity is a necessary component of any good scam.”

And a crucial aspect of the way this dreck was sold as “AAA”.

Magnetar Capital played a huge role in the CDO market in 2006-2007, designing many CDOs that would eventually fail. Yves has written about them extensively on this site.

http://www.nakedcapitalism.com/2010/04/magnetar-goldman-press-flurry-still-misses-the-biggest-point-of-all.html

http://mathbabe.org/2012/01/31/econned-and-magnetar/

http://www.propublica.org/article/the-magnetar-trade-how-one-hedge-fund-helped-keep-the-housing-bubble-going

The Automatic Millionaire: Homeowner is still for sale on Amazon:

http://www.amazon.com/Automatic-Millionaire-Homeowner-Powerful-Finish/dp/0767921208

You can even buy a Kindle edition, so they went to the trouble of digitizing it years after the meltdown.

Amazon’s book cover even has a contest sticker. You can “Win $250,000 To Purchase A Home!” but the contest expired 12/31/2006. I wonder who won, and whether the home they purchased has any equity in it now.

I think I’ll write a review.

How amazing is it that there are loads of positive reviews for the book well after the crash?

It’s pretty much like that with every online review for a product. I guess we can’t trust them when making a purchase. It would seem to me that consumer reports is as neutral as you’re going to get, but I haven’t read CR.

Sadky, no kindle version for this one:http://www.amazon.com/Real-Estate-Boom-Will-Bust/dp/0385514352/ref=sr_1_sc_1?s=books&ie=UTF8&qid=1350922862&sr=1-1-spell&keywords=david+lareah

I have to admit, I also looked up this book on Amazon today and was stunned by the amount of positive reviews from 2006-2007, even after the housing market had peaked. Maybe it wasn’t yet clear to the average person what was happening?

Anyway, I love that the guy’s most recent book is about how to get out of debt. How is it that these people can fuck up over and over and over again, and yet still manage to sell books by the truckload? They just go on like nothing ever happened.

Fascinating thanks. The whole corrupt mingling of the business press with the financial industry reminded me of an earlier echo “instant millionaire” boom – the dot com debacle of the 90s.

True people weren’t taking out mortgages to buy stocks but a lot of people were in some sense betting their futures by allocating 401Ks into some of these insane deals ( this is how I learned I wasn’t a stock picker and resolved to stay with the business I knew and understood).

And the parasitic relationship between the investment banks and popular business press helped things right along just like with housing. The old scams don’t change much do they?

I once bought a Carleton Sheets CD at a garage sale for 25 cents. I think it was the third or fourth CD of his series. In it he outlined how easy it was to make money in real estate and how anyone could do it. His “strategies” boiled down to:

1. Find a house and borrow money to buy it

2. If you can’t borrow the money find an investor to help

3. After buying, take out a second mortgage

4. Sell the house for enough to pay off the loans or investors

5. The only reason everyone doesn’t do this is because they are lazy and would rather sit around watching TV

All of this was and is an obvious scam. Yet there is still no shortage of hucksters selling “get rich in real estate” programs and seminars. The reality is that half the working population of the US cannot earn enough to meet their physical and social needs, and have no route to do so. As long as that is the case, these scammers will have an abundance of marks.

If I saw David Bach’s brains blown out on an amateur video on the Huffnpuff Post I would celebrate with champaigne.

No offense David, I would celebrate the demise of ANY scum just like you in the same way.

Let us not forget that the dot.com debacle was fueled by the venture capital firms like Kleiner Perkins(Al Gore’s backers) who poured money into the pockets of any tekkie with wet dreams of the next greatest invention. The investment banks(for a fee, of course) took the next “Microsoft” public and ran the price of the stock up to nose bleed levels before they and their buddies bailed, leaving everybody else holding the bag. Of course our “ever vigilant” government had regulatory power over this process, but they didn’t regulate shinola as usual. I take the time to point this out because this enriching experience encouraged the securitization scammers to take their scheme to the unthinkable level it eventually reached. After all, nobody could stop them.

“God, let me live to see just one more bubble” was what the boutique investment bankers and the VCs around the Valley said after the dotcom crash. I was there.

You’re absolutely right — 1998-2000 tech bubble was where the financial industry saw what could be done and that Alan Greenspan would lower interest rates and effectively bail them out to create the appearance of a fully-functioning national economy.

They’re getting their wish with Gold and Silver. And it WILL be the last bubble in our lifetimes in the US.

Very interesting Mark. There have as I understand it been subsequent speculative bubbles since the tech and housing bubble which I’d like to hear some comments on too.

In Matt Tabbi’s book on Vampire Squids he identified the commodities boom that sent basic resources like phosphorus soaring as the smart money looked for a new ‘product’ to scam on. The question I’m unclear about is how much the resources scams which included oil I think were the result of limited supply and how much was a product of scams. Tabbi saw it all as scams but there are many scientists I know who say this as evidence of limits to growth. My gut is its a bit of both but I welcome comments and observations on this one which I’ve not seen well analysed to date. (maybe there is an old link Yves).

This book should be admitted into evidence, in every courtroom in the country !!!

as Bill Gross correctly Tweeted today….

Gross: Fed merry-go-round: inflate stocks til 2000. Then inflate housing til 2007. Then inflate stocks til 2012. Now inflate housing again

Legal Gambling

The gloom is fading from the real estate situation. More nibbles during the last few weeks than the last three years. If January brings us good rains, this next year will open the door to the sunshine – a case of rain bringing the sun.

It is to be hoped, however, that there will never be another boom. The crash of the boom of 1923 was due to the same causes that wrecked the wall street stock market. People sold what they did not own. They made a payment down in the hope of getting the property off their hands before it began to burn. Real estate fell into the hands of sharp-shooting gamblers who had no interest in land. To them it was just a pile of blue chips on a roulette wheel.

Note the date 1923

Bush did it ….. Most felt comfortable moving to the berbs in Cali and traveling a good distance to work in 2006 …. but then after settling into the house of the century gas prices went up. The weekly average gas price started the year at $2.28 in February. It quickly rose to an average May to September of $2.90, an increase of .62, peaking at $3.02 in August. 42 percent of Americans thought Bush did it.

Romney chimed in at the time as an incumbent Republican in Massachusetts when Republicans were running congress and the White House.

‘At moments, Romney went so far as to make high gas prices out to be a welcome reality for the foreseeable future, one that people needed to learn to live with. When lieutenant governor Kerry Healey, a fellow Republican, called for suspending the state’s 23.5 cent gas tax during a price spike in May 2006, Romney rejected the idea, saying it would only further drive up gasoline consumption. “I don’t think that now is the time, and I’m not sure there will be the right time, for us to encourage the use of more gasoline,” Romney said, according to the Quincy Patriot Ledger’s report at the time. “I’m very much in favor of people recognizing that these high gasoline prices are probably here to stay.” (Matthew Yglesias)

By August 2006, after having stretched California’s commuters pocket to the max, …. “the orderly housing slowdown predicted by the Federal Reserve (soon) became a full-blown crash”.

The housing bubble was a $10 trillion equity balloon that exploded in 2007 when more than $1 trillion in no-interest, no down payment, adjustable-rate mortgages (ARMs) reset; setting the stage for massive home devaluation, foreclosures and unemployment. The blame for this rapidly-approaching meltdown lied entirely with the Federal Reserve, the privately-owned collection of 10 central banks who cooked up a way to shift wealth from one class to another through low interest rates.

So, how can we blame the Fed for the reckless and irresponsible behavior of the average homeowner?

Well, because they knew the effects of their “cheap money” policy every step of the way.

First of all, the Fed knew exactly where the money was going. Greenspan endorsed the shabby new lending-regime which put hundreds of billions of dollars in the hands of people who never should have qualified for mortgages. They were set up to fail just like the victims in the stock market scam who kept dumping their life savings in the NASDAQ when PE’s were shooting through the stratosphere.

Secondly, the Fed knew that wages had actually regressed (2.3%) since Bush took office, so they knew that the soaring value of real estate was entirely predicated on debt not real wealth. In other words, home values increased because of the availability of cheap money which inevitably creates a buying-frenzy. It had nothing to do with real demand or growth in wages.

And, thirdly, according to the Fed’s own figures, “the total amount of residential housing wealth in the US just about doubled between 1999 and 2006″up from $10.4 trillion to $20.4 trillion”. Times Online.

UP $10 TRILLION IN 7 YEARS! That is the very definition of a humongous, economy-killing equity monster. In other words, the Fed knew the ACTUAL SIZE OF THE BUBBLE and chose to steer it towards the nearest iceberg without warning the public.

This is what Greenspan called “a little froth”.

http://www.counterpunch.org/2006/08/30/the-great-housing-crash-of-07/

“The day that degenerate shysters like David Bach are afraid to show their faces in public and feel the need to flee across the border is the day that we’ll know that we as a country are making progress towards a brighter future.”

Waiting for Godot, are we?

No disrespect to this admirable article or its author intended.

“AFRAID to show their faces in public.” Lee, that is the goal.

testing

It was a failure of politics. We should have had a jobs program in the late 90s. But nevermind. This is going to the the century of punishing people economically for keeping their half-baked politics. Just think, this book was published BEFORE Wells and BAC acquired WaMu and Countrywide. By a Morgan Stanley insider. Whatever. But it does dovetail well with everything that happened, like the above two acquisitions as well as JPMC’s acquisition of Bear with a iron-clad guarantee by the Fed. Because it was logical. Because JPMC had been the buyer of all of Bears “shitty” MBS since 2003. It’s like when the Titanic went down the lower decks were locked so there would be enough life boats.

Please, try to read:

“Wall Street and the Financial Crisis”

(Anatomy of a Financial Collapse)

US Senate Permanent Subcommittee on Investigations. 2011

“….our findings show without a doubt the lack of ethics in some of our financial institutions who embraced known conflicts to accomplish wealth for themselves, not caring about the outcome for their customers….When that happens, no country can survivie and neither can their financial institutions.”

Senator Tom Coburn, Ranking Minority Member Senate Permanent Subcommittee on Investigations, Bloomberg.com, April 13, 2011.

Some of my own notes:

“Immediate Cause”…page 259

“Glass-Steagall”….page 321

(The music plays faster and louder….my notes)

“Look up..Greg Lippman…Duetche Bank”

“CAMELS” (Acronym)….page 167

Look up…”Cosimo Reports” (on financial crisis)

“See pge 171 for ‘basis pt’ profit margins on various loans”

“Risk (WAMU) Management” ….pg 182

“Quants”…..249-253 (This alone requires much more study to understand the mess we go into by “confusing” the pure science of mathematics with the reality of human behaviour)

“How and Why Credit Rating Agencies Are not Like Other Gatekeepers”..Frank Portnoy, University of San Diego Law School Legal Studies Research Paper Series…5/2006…at 67….This note is found bottom page 257 and is well worth exploring.

“Paulson/Goldman” ‘ABACUS’ CDO structuring…’short sold by Paulson Hedge Fund’….565

“Greater Fool Theory” (mine)….309

“CDO MTM values….367-369

“S&P/Moody’s ‘Gemstone’ 7 ratings (!)(my emphasis)….371

“Goldman S. versus Glass-Steagall….378

“Goldman shorting subprime market”….388-392…396

“Goldman and how ABX/CMBX Index worked (to Goldman advantage)….399-400

Bottom line (as so many others!)…..”TRUST” has formally been demolished between contracting individuals (and other business/personal entities) and cannot be restored without a complete restructuring and re-thinking of our largest financial institutions…….

“Trust” is what keeps the system oiled…..

That “lubricant” has been destroyed by outright faudulent, and criminal greed.

But, that’s what makes our system “go”….

Ah…the “contradictions of captitalism”!!

Here’s an interesting list to go along with this article. It’s from The Guardian (2012): “Financial crisis: 25 people at the heart of the meltdown – where are they now?

In 2009 the Guardian identified 25 people – bankers, economists, central bankers and politicians – whose actions had led the world into the worst economic turmoil since the Great Depression. On the fifth anniversary of the credit crunch, what are they doing?”

First up? Greenspan, the author’s (possibly?) more evil twin.

Pushed at B&N in 2006! Right after Hurricane Katrina, this was the_top_of the Ponzi bubble when they were “flipping blueprints” in Florida to beat the band, when Insiders were long, long gold (Peter Schiff’s timing was so spot on, yes?)

The Insiders knew it was “apres moi le deluge” and time to ring in the super-suckers to hold the bag during “Armageddon.” But there was a glitch at the end, there: TARP 2008. The gold bugs had to hold on a little longer, until the Big Boys made the “perfect” gold-to-CDO spread–which we’ve been told is gonna blow the price of gold to $12,400/oz at just the right moment to pull the plug.

These guys are PROS: The Tipmost Top of the Organized Crime Metasystem.

Well yves, from their perspective (and twisted way of thinking), if those home investors were smart enough, they would have known to hunker down as soon as the market took a dip.

Also yves, I think generation X and beyond live in this fantasy shadow of the baby boomers. Boomers were born into a tremendous growth period, where jobs were plentiful and everything grew. Wages exceeded a cost of living. You didn’t goto college and incur tremendous debt just to make minimum wage. Employers hired you from high school then taught employees how to perform the job. And persons didn’t suffer frequent job loss; a period of personal employment boom and bust.

So my point yves is that everyone feels the next generation can only be better than the previous. That if u work hard, all the opportunities will be there. But they aren’t. And post boomers haven’t come to grips with that. The stories of ‘buying a cheap piece of land/stock and sitting on it only to find 30 years later that it’s worth millions’ aren’t going to happen to us. We can’t afford to have an asset sit like that. We lose our jobs. We get sick without health insurance. And when that happens, you have to sell off those investments just to get by.

Three comments here Ep3 about this boomer GenX transition you’ve discussed.

Many boomers you are refering to are now losing too. They gained a great deal to be sure due to early house price inflation – but then they reinvested in well… property believing this wondrous magic puddling could continue to yield dividends. Trouble is values are stagnant – and anway who is going to buy all these mini mansions especially in the future as we get old.

A lot of boomers (like me) tried to reject bourgeois lifestyles. The result was it gave a competitive advantage to many of our very ugly peers who then taught the up an coming Gen X ers all about greed – Remember Wall St. Gordon Gecko played a boomer from the dark side. An interesting case of Yin and yang I guess.

Finally, the future can still be bright, but it will take some serious thinking and system reinvention. I’m not yet seeing it with the younger generation – but if there is one thing the fall of the Berlin Wall in 1989 taught me – its that inconceivably good things can still happen not long after even dark times.

So I wait with some hope.

Thanks for the good info. i have been all kinds of forums on a wide range of topics and its amazing the extent to which the reason for the financial melt down is encapsulated in this short explanation: the government thru the community re-investment act, forced the banks to loan to black welfare queens. that more than 70percent of the sub prime loans to low income people were from mortgage companies who are not under the CRA, that commercial real estate suffered the same bubble is not mentioned, nor is predatory lending mentioned. no doubt this race baiting fallacy is pushed by wall street to get the heat off them and keep it on americas most popular scape goat, the black poor. it appears all classes of people were involved in this debacle, not just primarily one group.

Over the last twenty years, the masters of Wall Street have become almost textbook Marxists in the sense that they are doing everything possible to bring about serious socio-economic upheavals in American society.

I once did business with a rather disagreeable German-South African. One evening at dinner in Cape Town he asked, “why do you think I keep my gold in Zurich but my family down here?”

His answer was that “you can’t take anything away from these people (black South Africans); they don’t even know what they don’t have. But if you take a German or American worker and tell him that he can’t have a decent job, can’t take his child to the doctor or put a roof over his head before too long that German or American is going to be out in the street with a rifle.”

While we may not be there yet in this country, I don’t think we’re too far off and when that day comes the blame will fall just as much on the Clinton-Obama Democratic party that turned its back on FDR’s legacy as the Repbulicans.

Australia’s insanely high house prices are finally starting to crack, so here’s to a crash at home here.

a great post

Some people commenting here really need to read Bill Black’s many posts at New Economic Perspectives–many of which have been referenced here at NC. You don’t need to wonder at how all this disgrace was possible–Black explains it very well.