By Hugh, who is a long-time commenter at Naked Capitalism. Originally published at Corrente.

On June 7, 2001, HR 1836 the Economic Growth and Tax Relief Reconciliation Act was signed into law. This was the first and largest of several tax cut bills passed during the Bush Administration. It was estimated to cost $1.35 trillion with most of its benefits going to rich. So this should have spurred job creation. Give money to the “job creators” and they will create jobs, no?

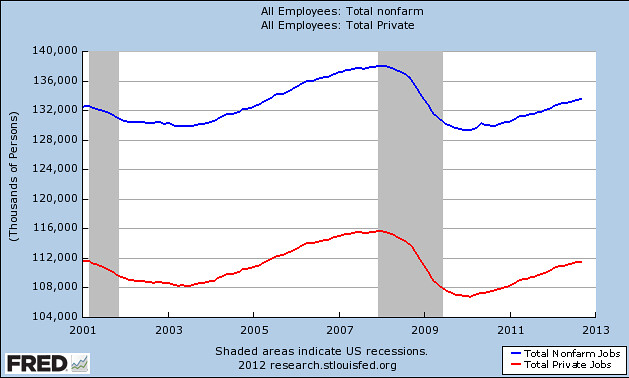

The graph below (from the BLS’ Establishment survey) covering the Bush and Obama years shows, in fact, what happened.

The blue line represents all nonfarm public and private jobs. The red line, jobs in the private sector. The difference between the two lines is public jobs. Though the scale is large, it is easily seen that public sector job number remained fairly stable during the period. It is the private sector which drove the overall changes in jobs numbers. [For those interested, the slight notch in the blue line in 2010 represents hiring for the Census.]

What we see is that the Bush tax cuts had little effect on the trajectory of job losses from the 2001 recession. We also see the effects of the housing bubble taking off in mid-2003 and its collapse into recession (December 2007) and meltdown (September 2008) with jobs falling below their 2003 lows. Here you could argue that the rich do create jobs, but these bubble jobs aren’t stable or permanent and are created at great cost to the non-rich. And while there is a recovery in private jobs from 2010 onward, we need to keep two things in mind. First, the quality of these post-bubble created jobs is generally poor. One sign of this comes from the Household survey where the growth in involuntary part time employment has increased from 3.332 million in January 2001 to 8.613 million in September 2012. Second, after 10 years of turning our economy over to the “job creating” rich, we are only just back to the level of private jobs we had in January 2001. In other words, the job creators in exchange for their trillion dollar tax cuts gifted the rest of us with a lost decade.

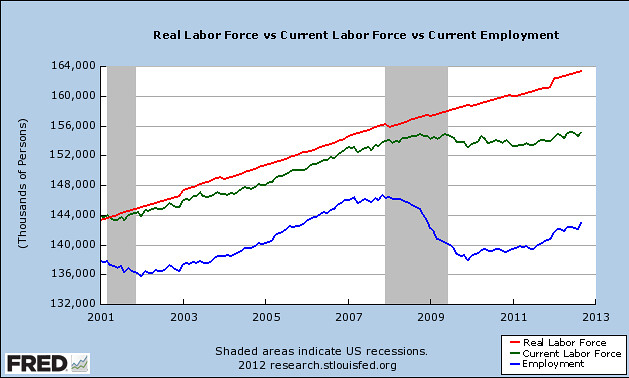

Actually, it is worse than a lost decade. Jobs are not people, and the chart above does not reflect 10 years of growth in the US working age population. To see this, we must look at people, the employed (from the BLS’ Household survey).

The blue line is the number of employed and is similar to the blue jobs line in the previous graph. The green line is the labor force (employed + unemployed as defined by the BLS) seasonally adjusted. The red line is my calculation of where the labor force should be, i.e. 67% of the working age population (non-institutional population over 16). This is based on the participation rate from October 1996 to June 2000 which for 44 of 45 months was at or above 67%. Notches in the red line come from annual revisions applied in January.

The difference between the green line (current labor force) and the blue line (current employed) represents the unemployed. We can see this has increased markedly after the onset of the 2007 recession. Also from this time, the green line of the current labor force went flat. The difference between the green line and the red line represents the increasing failure of the labor force to keep up with population growth. This area of the graph represents people who are defined out of the labor force by the BLS’ restrictive definition of unemployment but who would, from our experience from 1996 to 2000, work if jobs were available to them.

This graph shows the true magnitude of the failure of the “jobs creators”: bubble job formation, no growth in the labor force, and a 20.352 million gap in September 2012 between the employed and those who would work if work was available. Add in the poor quality of the jobs being created and the increased number of involuntary part time workers, and we have fail upon fail upon fail. It is Orwellian that after a decade of trillion dollar tax cuts and bailouts of the rich, and a steadily worsening jobs and employment picture for American workers, we are told to be kind to the rich and give them even more money because they are the “jobs creators”. With job creators like these, we are better off without them.

The term “Job Creators” is nothing but a myth, a self-chosen euphemism for “destructive money/wealth extractors”. See Matt Stoller’s graph as a perfect addition to your series. They create profits for them, not jobs for us. Especially not if we’d be able to qualitatively identify and separate decent jobs from Walmart garbage.

Indeed.

On decent jobs vs Walmart garbage:

Most white collar workers don’t actually do anything more productive than Walmart workers, in fact many of them less so, than the person working the check out or stocking the shelves at Walmart. Of course they mostly are better compensated, so such jobs do work much better in terms of wealth distribution.

So why do you pay them so much?

If, say, lawyers were so overpriced you have the option to skip their services. People don’t seem to do that though, for some reason.

You also don’t have to pay a penny for the services of software engineers. They get paid upwards of $100,000. So just stop buying Windows, iPads, smartphone apps, Word/Excel, etc. You don’t have to.

You also don’t have to watch movies or listen to music. Producers, writers, and editors get paid hundreds of thousands to deliver the new Bond film to you. But you don’t have to watch it.

Yet millions still choose to.

Why do you do it? If you just stopped using legal services, computer software, movies, music, etc. these people’s wages would go down.

It’s your choice.

Meh! Lawyers represent a mostly captive market. Most people who “choose” to use a lawyer have no choice. Try to navigate the legal racket without one. America, the best legal system money can buy!

Software and all the media examples you gave? Are you kidding? You might be suffering the delusion that any of that shit will continue to produce any lasting value for any meaningful period of time. Many of us are not. I’d say good luck to any prospective future software engineers. They’re definitely gonna need it!

You have no idea what you are talking about. Not all software is as frivolous as Facebook. Software engineers power essentially everything you do day-to-day, from driving your car to buying food to every aspect of your healthcare. Without software the world stops. Period.

Agreed. I would extend the policy to anything that’s not a necessity (food, clothing and shelter).

How did the Bush tax cuts cause the real estate bubble?

How did the bush tax cuts create the real estate bubble?

The real estate bubble was caused by capital chasing higher return. After all that is the nature of a capitalist system.

Capital uses all the power it can mobilize to create a system where it is totally unrestrained, has effectively captured or bought off any regulatory constraint, owns the means of propaganda (the so-called free press), and is not subject to the rule of law. This is the so-called free market that we are conditioned to worship as being ordained by God.

The bush tax cuts are relevant in two ways: 1- They pushed a few trillion more dollars onto the gambling table. After you’ve built your fifth Cowboy Mansion in Jackson Hole, why not throw a few extra million at a hedge fund specializing in 100/1 leveraged real estate derivatives? 2- The ruling class’s success in shifting more of the tax burden to the lower classes signaled “game on” for all the other joys of an unrestrained “free market.”

Very well put Crazy Horse.

What really gets my goat is the fact that about 90% of the top 5% would probably ask the same question.

We’re lost until such time as the majority of the 10% understand how destructive following the lead of the 1% has been to their well-being.

The real estate bubble was already at full term when the Bush tax cuts came into play. So did the tax cuts help? I guess if you go with the story of “It could have been worse!” This story while interesting does not prove the assertion either way for me, but I do lean towards the rich using their money to create more bubbles, apparently in U.S. Treasury bonds, while coercing Main Street to inflate the Student Loan bubble.

Free Market = Free to Rape, Pillage, and Plunder. Same as it ever was. Just another updated pseudo-academic justification for the same old shit.

And to think, American capitalists have imagined that they actually came up with something new. P.T. Barnum was right all along.

Listen to this:

http://harryshearer.com/le-show/may-1/

It will explain it.

Transcript here: http://harryshearer.com/duis-id-nulla-et/

(though inexplicably it’s got David Cay Johnston’s pic and not Bill Black’s)

40% of the homes built from 2004 onward were second homes.

The “job creators” myth is masterful because it uses what people intuitively know to be true: that spending and investment by those with money cause employers to hire.

========

A corrolary to the “job creators” myth, that is now being employed with some success, is that “government doesn’t create jobs.”

“government doesn’t create jobs.”

what a crock.

What would they call “National Defense” (really Corporate Offense) spending?

That is by far the largest portion of Federal spending and

it is the only way “defense” companies get money and a large portion of the oil companies profits as well.

It is amazing how stupid the average fox news watching moron is……. truly amazing.

Fire the job creators, preferably from a cannon. And the rich pricks are whining more than ever (see Thomas Franks’ Pity the Billionaire for instant nausea).

Wasn’t it primarily monetary policy that contributed most to the housing bubble?

Also, this would be a lot more illuminating if the trend lines extended back to the beginning of the 1990s. Then we could compare the trend after the 1992 recession (with Clinton’s economic policies) to the trend after the 2001 recession (with Bush’s “job creation” policies). Of course, it was only in rhetoric that the Bush administration claimed that the tax cuts would be job-creating stimulus (i.e. in the short run). Even their official projections only claimed that it would have long-term job-creating benefits. I’m not saying that there is any evidence at all to support the argument that tax cuts for the rich, particularly when they were already as low as they were under Clinton, actually help to create jobs (and especially good jobs). But, I think this is not the most damning evidence in refutation of the claim that could be produced.

To answer your first question;

No.

As to rest;

Refutation, or damning refutation, what’s the difference, it’s been quite effectively refuted.

The Fed simply backed the action of the bankers. The bankers, not the Fed under the hands off Greenspan, were the drivers. And who of course owned the banks? As this article:

http://www.businessinsider.com/facts-about-inequality-in-america-2011-11#half-of-america-owns-25-of-countrys-wealth-the-top-1-owns-a-third-of-it-2

from 2011 pointed out, the top 1% own 50.9% of US stock, bond, and mutual funds. The top 10% own 90.3% of them. The bottom 50% own 0.5%. The rich made out at all points in the process from land speculation and flipping properties to their equity ownership of banks, construction companies, etc. to the financialization of the mortgage products.

“Wasn’t it primarily monetary policy that contributed most to the housing bubble?”

If you look at how much mortgage rates declined over the relevant period, it’s simply not possible that monetary policy had much of an impact. In some areas, prices went up by many hundreds of percent, but if you use a very simple but useful model for the relationship between prices and rates, the most you’d get is something like a 20% increase in price, IIRC.

The only sense in which rates were a really significant factor is that maybe there’s some weird nonlinearity going on, like a cut in rates “kindling” the bubble. But it seems much, much more likely that a gutting of regulation and the explosion of the shadow banking system are what really kindled things, and kept them going.

I’m not sure about that. If the Fed raised rates in the midst of the bubble it would have popped the bubble. Of course if that happened it would received all of the blame. That’s theoretically their job description though. They’re suppose to be the adults in the room who take the punch away. Not help spike it in the first place.

Already in 2001 global warming was understood. W refused to call it global warming and instead called it climate change. But after Kyoto there was clear consensus, except for the US and China. However both the US and China have worked toward new clean technologies, so they/we acknowledge the problem. This is another piece of proof that not only are self-proclaimed job creators not, it is proof that governments are. And in the case of global warming, just think what could have been accomplished in the last 15 years if we had not been forced to distort our economy in favor of the “free market.”

I think that “climate change” became the term of art not because the proponents of that term wanted to deny that golbal temperaturs were rising, but to recognize the fact that local effects are much more varied and complicated. Some places get notably warmer, some places get notably dryer, some places get wetter and some places may even get colder as global average temperaturs rise. So nobody can really say “it must be a hoax since it isn’t warmer RIGHT HERE, RIGHT NOW. But a change in monsoon weather patterns could radically change climate where monsoons are important, even if the temperature change was minor.

I think you’re right and I think it was a calculated tactic to buy time.

Actually, I took it as just the opposite – just another tactic to muddy the waters. Listen, the only real “strategy” to “climate change” deniers – just like evolution or whatever other controversial scientific theory that might be in question – whatever their political or intellectual stripe, is that they purposely try to obfuscate at every turn. And for VERY good reason. It works! For one, Americans are notoriously scientifically illiterate. For two, Americans love their religion. And for three, Americans love themselves their “progress,” by whatever means possible and by whomever’s authority says they can have it. It’s really time to come to terms with it: for the most part, we’re one bunch of fat-assed, indulgent, indolent rich pricks who think the planet owes us a fucking living. Unfortunately, the time to pay the piper is drawing nigh.

I believe the phrase “climate change” was single-handedly invented by Frank Luntz to confuse and short-circuit language and therefor thinking about global warming.

Individuals can at least make a personal pushback gesture by saying “do you mean global warming?” every time someone uses the phrase “climate change”.

Eventually people might want to start using phrases like global heating, global steaming, and global meltdown climate dechaos decay. Just see which memes fly.

Outstanding post… and really worth reading in conjunction with a viewing of the Econ4 jobs video Yves posted earlier this week:

http://www.nakedcapitalism.com/2012/10/econ4-discusses-jobs-and-job-creation.html

Fantastic post — and the title ought to become a mantra at all levels of government, everywhere because the entire developed world is suffering from the failure to grasp this simple concept: concentrated wealth chasing higher returns, particularly in a deregulated environment, creates bubbles.

Will re-read later, as this is the kind of post that I need to mull over more than once.

Hugh, thank you for this superb essay. From the title right through the final sentence, clear as crystal and crucial. I hope this circulates widely. I will do my part in my small circle of not-yet-awake friends.

STOOPIDITY

OK, but so what?

The Romney guy is a blatant liar and yet the race is going down to the wire. Quick, somebody please explain how half the American population can be duped by this guy.

My answer: Sheer political stoopidity. Those who vote for him deserve the dork.

Euhm, since when does 100% of the population vote? Stop blaming voters for elite corruption.

I will continue to do so because we, the sheeple, still vote the Congressional seats that permit such “elitism” – particularly since we stayed home in droves during the last mid-term elections to let the T-Party (T for Troglodyte) into control of the HofR.

Only 38% of American voters bothered to show up at the polls.

Perhaps the other 62% had already adopted a posture of learned futility.

As if the other guy is so much better. The election consists of being offered a choice between aweful and aweful, giant douch and sh*t sandwich, and you blame people for stupidly choosing one of the other, for wavering on whether or not giant douche is indeed the lesser of two evils. I don’t think so. It’s the system and it is the elite’s system.

Some of those who vote for Romney might be tactically voting, hoping that the DSenators will withhold from Romney the victory over Social Security which they wish to hold in reserve for Obama or the next DPresident.

Excellent work, Hugh.

In a capitalist system, jobs are a byproduct not the objective.

In a sane system leisure NOT JOBS is the objective, with just enough drudge work to make the world function, because yes the trash does still have to be collected.

Although, there DOES need to be a feedback loop to prevent human overpopulation. Which is where we’re at now.

When a corporation had the owner’s name on the sign, and that owner was the ceo and direct leader, that was a job creator.

Most small businesses are run on a similar model. They are job creators.

A plutocrat owner of a large amount of finacial assets/stocks/bonds is not a job creator; trading in securities on the aftermarket creates nothing.

The capital gains tax cut, taxing dividends at capital gains rates, tax exempt muni bond interest, stock swap pools for CEOs that are paid in stock, carried interest, etc. are all means of diverting value from “investments” that have no direct creative effects beyond an IPO.

I advocate increasing capital gains taxes up to 30 or 40 percent on all capital gains in any given year over a million bucks.

Set the estate exemption level at five or ten million dollars. That eliminates the farm and business sale & inheritance meme’s that plague this discussion. There is a freaking reason to tax plan your estate, and no excuses if you have that much and got nailed in taxes.

Eliminate the tax exempt status of municipal bonds. With average returns around 5-6%, wtf are they getting another tax break? Dear god, people might actually have to pay attention to the financial condition of their cities then.

Dividends can be taxed at the capital gains rate between 30-40%.

Eliminate stock swap pools. Thats where a CEO can contribute ten million or more in stock into the pool, and receive a distribution out of an eqivalent value of stock. And guess what? The exchanged stock has a long term capital gain basis, ninja’ing the tax rate from 35% to 15%. Inna you face!

And let me be a bit passionate here: Fuck carried interest.

Last, and this might make heads explode, eliminate income taxes on income under 250,000. Bring on a national sales tax. Want work to be meaningful? Then remove ordinary income tax below the threshhold and make work valuable. Leave payroll taxes and such, eliminate almost all deductions and exemptions, and then you have a tax system that builds wealth in the working classes, and extracts rents from the accumulated asset crowd. Tax their income, their capital gains, and their consumption.

Not going to happen, of course, since they control the government.

Well if you eliminate the prefferential treatment for capital gains, the resistance to the “carried interest” treatment would abate considerably.

now we can’t have any of that…that would be much too simple. the “job” losses would be monstrous, from the top down.

bluntobj,

Love your suggestions. Let’s not become disillusioned about whether or not this can come to pass. Remember, the robber barons of the Gilded Age paid no income tax. By the 1950s the highest nominal rate was above 90% on big incomes.

Things can and do move in cycles. Granted, we’re in the hurt zone now, but a few more people become aware of the inequity of our situation every day. I’ve no idea when it comes, but we do approach a tipping point to a better world. Alternatively, I can cite some thoughtful doom-sayers making a good case for the exact opposite. (wink)

IMF revised the fiscal multiplier to 1.7 from 0.5 last month. Enormously under-appreciated shift that essentially repudiates Austerity policies. And from the Kings (and Queens) of Austerityland, no less. Raw ideology, and wealth transfer and resource concentration policies determined by the few, are continuing to drive this bus; not economic initiatives that are in the interest of We the People.

The monetary, fiscal, globalization, deregulation and environmental policies of the kleptocracy have repeatedly shown themselves to be socially and economically bankrupt, both in the U.S. and internationally. The only bankruptcy remaining is their political demise.

This is true actually.

Also several papers exploring behavior near the ZLB suggest pretty large multipliers (upwards of 2x) and that additional government spending would be self-financing at this point.

To be frank, I havent had time to read all of them but skimming their results does suggest now would be a good time for the opposite of austerity.

As always, with reservations.

I keep hearing a bunch of jackjaws flapping their gums about government tyranny, but this seems to prove there is such a thing as economic tyranny.

http://the-small-r.com/2012/10/18/are-free-marketers-blind-to-tyranny-part-1/

http://the-small-r.com/2012/10/19/are-free-marketers-blind-to-tyranny-part-2/

Noam Chomsky basically said the same thing about vulgar libertarians way in the past.

A related story. ADP’s private nonfarm payroll report for October is the first one that applies the “new methodology” and “larger sample” which ADP has collaborated on with Moody’s Analytics. According to sources cited in the WSJ, the purpose of this change in methodology was to bring ADP’s nonfarm payroll predictions more in line with BLS’s. Note. Under the old methodology, new jobs number was @ 160,000 and under the new methodology, that number is halved to approximately 80,000.

According to the new ADP report, the economy added 158,000 jobs in October. Which is causing some MSM to cheer about the “slow but sure” “recovery.”

http://blogs.wsj.com/marketbeat/2012/11/01/new-adp-report-looks-good-right-no/

A separately reported statistic is that planned layoffs in the private sector are UP @ 41%.

Very good post, Hugh, but I have one quibble:

Your def’n of working population as being all non-institutionalized persons over 16.

It would be better to define it as 16-65, to properly account for the aging trend in the population. Your argument would lose little of its force from such an adjustment.

capital cannot create capital. capital only creates make-work to prolong the status quo. The middle class built a prison around itself and capital. It took a lot of bricks over a long period of time.

Labor has no interest in belonging to the “99%.” Being a laborer is like moving a mountain with a teaspoon, while the middle class reloads with a 980 cat, which labor built, waiting for the empire to run out of gas.

That’s just the way it is.

NY/NJ politicians are licking their chops, waiting for all the electronic money to flow…It worked so well for VT.

Um, how was capital created in the first place? “Capital” in this context is not just money.

universe, nature, labor

“NY/NJ politicians are licking their chops, waiting for all the electronic money to flow…It worked so well for VT.”

ABSOLUTELY agree with you here. The payoffs and juicy contracts to come just boggle the mind….

Hugh – great article. You might find the following study by the Congressional Research Service (CRS) to be helpful: “It’s Official: Cutting Top Tax Rates Doesn’t Grow the Economy, it Only Grows Income Inequality”.

“A new study by the non-partisan Congressional Research Service (CRS) using data from the past 65 years found that there is no correlation (PDF) between top tax rates and economic growth. But it doesn’t stop there. The study also found that there is a correlation between the reduction in top tax rates and the increasing concentration of wealth toward the top of the income distribution. The report, Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945, is also clear that this is not only about tax rates on regular income, and points out (PDF) that “changes in capital gains and dividends were the largest contributor to the increase in income inequality since the mid-1990’s.”

http://www.ctj.org/taxjusticedigest/archive/2012/09/its_official_cutting_top_tax_r.php

Thanks, I read about this report and the attempt to suppress it. Wealth transfer upwards is a feature of neoliberalism, not a bug. All the initiatives that have been variously called supply side economics, Reaganomics, trickledown, Washington Consensus, and most recently “job creators” are just intellectual cover for it.

The Rich don’t create bubbles the Fed does. A better discussion would be to focus on quantiative easin and interst rate cuts which did little to create jobs but has raised asset prices at the marin and possibly new asset price bubbles.

How do you know that?

Or, the rich create bubbles after the fact…

Agreed.

How about looking into bubble-dependent jobs

vs. bubble-independent jobs?

What happened to all the Countrywide employees?

What happened to all the real-estate agents?

(post-housing-bubble).

You sure? Remember Matt Taibbi’s story about Goldman Sachs? “The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” Title of story: The Great American Bubble Machine.

Also, I tried to follow the Great Keen-Krugman Debate a few months ago — and wasn’t one of the points on Keen’s side that the Fed can be used like a puppet by Wall Street to create money when Wall Street creates loans? Wall Street is the driver, not the Fed.

The Bank of International Settlements debunked that, and one of the two co-authors had been warning of a global housing bubble since 2003, so he has some cred.

http://www.bis.org/publ/work346.pdf

The crux of the matter is that economic growth is not always a rising tide that lifts all boats. While government policy can generate economic growth through tax policy, none of that means it will be evenly distributed. Thus it won’t be sustained. The previous decade as well as the 1920s should have proven that by now. Both ended with a “Lost Decade” of growth.

The Mellon tax cuts enacted in the 1920s had the same effect that the Bush tax cuts did. Which saw an increase in income at the top levels. While the economy experienced a short burst of credit driven economic growth that quickly fizzled into a deep recession when credit growth could no longer be sustained. As the Cato Institute noted in 2003 this was the government’s first experiment with supply-side income tax policy. What they didn’t realize is how badly it would end when they were cheerleading for it.

Everything old is new again.

Actually, it was HARDLY just the previous decade. Our current slide began in 1980, and I don’t say that just because I’ve got a political ax to grind. Bush II econ policy was NEVER more than Reagan redux on steroids. I would be amazed that could POSSIBLY come as news to anyone.

Andrew Watts: “Everything old is new again.” Behold: As Before So Now:

http://en.wikipedia.org/wiki/Crown_Agents — Pertinent Excerpts:

//The Crown Agents for Oversea Governments and Administrations Ltd is a Greater London, UK based company. Prior to 1979, the Crown Agents was an autonomous body working for the British and other governments, and for multilateral development and funding institutions. Between 1979 and 1997, Crown Agents was a UK public statutory corporation, overseen by the British Ministry of Overseas Development.[1]

. . .

/Crown Agents is an international development company providing direct assistance, consultancy and training for public-sector modernisation, particularly in financial management, banking and supply chain management. Crown Agents works with clients in more than 100 countries, major multilateral agencies, such as the World Bank[2], European Commission, United Nations agencies and bilateral donors such as DFID, KfW, SIDA, CIDA and the Danish, Japanese and U.S. governments.

. . .

/Members of the foundation are organisations with a keen interest in international development and include firms, non-governmental organisations and international bodies.

/These include: British Expertise,The Aga Khan Foundation, The Chartered Institute of Building, The Chartered Institute of Purchasing and Supply, Christian Aid, International Business Leaders Forum, International Chamber of Commerce, The Royal Commonwealth Society, and the Japan International Cooperation Agency. The British Department for International Development is represented among the Foundation’s members.

. . .

/Crown Agents and its subsidiaries work across a large range of industries, providing Public Financial Management, Humanitarian and Crisis Response, Engineering, Procurement & Logistics, IT consulting and training, and International Recruitment and training. Subsidiaries include the Crown Agents Bank and Crown Agents Investment Management.

. . .

/Crown Agents originated as a body conducting financial transactions for British colonies. Agents were first appointed in 1749 to transfer and account for grants made to colonies from the British Treasury.[8] These representatives were known as ‘crown agents’ from at least 1758, and were accountable to colonial governments, though selected on the recommendation of the British government.[9] A single body was created in 1833, when the crown agents’ business was consolidated under two Joint Agents General for Crown Colonies with an Office of several staff.[10] In 1861, the Office was renamed Crown Agents for the Colonies.[11]

. . .

/As decolonisation accelerated, the Office was renamed Crown Agents for Oversea Governments and Administrations in 1954, and the rules were changed to allow it to take on projects for independent states.[13] Crown Agents expanded its activities to include more international development projects and investment management. It was brought to the brink of bankruptcy in 1974 by the secondary banking crisis, and had to be bailed out by the British government.[14] Its anomalous status as an autonomous body with close links to government came into question, and in 1979 Crown Agents was brought under government control as a statutory corporation.

/From 1987, shifting attitudes to state ownership of business and changes in British international development strategy led the government to support FULL PRIVATISATION OF CROWN AGENTS. It became a private company in 1997, ending its formal ties to the British government.[15] [caps mine]

. . .

/Crown Agents describes itself as an invaluable aid to international development, having been a counter to corruption and inefficiency when in government, and now “it is promoting transparency and probity across the entire globe.[16].//

—————-

Maybe they’ll help brother Bloomberg out with FEMA’s money.

For further Centralization+Privatization of Global 1% Power/Control/Profit:

http://www.eu-facts.org/en/background/dark_roots_europe_lecture.html

Please COMPARE:

http://www.counterpunch.org/2012/10/24/the-dark-age-of-money/

//Monetary Fascism, as conceived by Friedman, uses the powers of the state to put the interest of money and the financial class above and beyond all other forms of industry (and other stake holders) and the state itself.

/In democracies and first world nations this is achieved through lobbying, campaign donations, financial incentives, revolving door regulators and through other means. As such, the state is coopted into altering regulations / legislation, diverting investigations / prosecutions or creating tax loopholes for the benefit of the financial class/ industry. Ultimately these actions undermine states sovereignty.

/For the rest of the world state interests and sovereignty are undermined through the IMF, The World Bank and other global monetary agencies.//

—————————————

Did Rockefeller’s UChi Shock Doctrine Team: Friedman-Kissinger have anything in common with Crown Agents? Are they in common cause?

Everything old is new again:

http://www.youtube.com/watch?v=bH3HsZHe_AI

and don’t forget:

“If we can’t be free at least we can be cheap”

I every time emailed this website post page to all my friends, as if

like to read it after that my links will too.