Skeptics of China’s economic model have looked like hopeless gloomsters for years. Even though they are correct when they point out negatives, such as the fact that no large economy has ever had 50% of GDP coming from investments and exports for a sustained basis or has managed the transition from being export driven to consumption driven gracefully (the US’s and Japan’s deflations are prime examples) seemed irrelevant as China was able to maintain attractive growth rates in the wake of the financial crisis by providing massive stimulus (aka more investment). Even worrying signs, like the fact that it takes more and more debt to produce incremental growth (the ratio was worse for China in 2009 at 6:1 than the US on the eve of the crisis, at 4 or 5 to 1, and it’s deteriorated since then) and oft reported on spectacle of cities full of high end housing that sit vacant, haven’t dented the widespread faith in the ability of Chinese leaders to navigate, at worst, a soft landing if the world economy ratchets down into a lower level of growth thanks to austerity in Europe and the US.

GMO, in a compelling analysis (hat tip MacroBusiness), not only confirms the skeptics’ case but provides reasons why the Chinese growth model faces an end game. While it may not be nigh, it seems to be closer than most people think.

While this new report provides useful (and scary) updates about established China bugaboos, such as the ginormous investment in real estate, the role of local government lending vehicles in funding these boondogles ventures, it fingers other culprits that may be new to many readers such as:

The growth of a shadow banking sector, which includes products that resemble structured investment vehicles and CDOs, which our crisis showed allowed speculators to take risks with far too little in the way of equity behind them.

Rampant evidence of Ponzi finance, in many cases short term financed, which subjects them to rollover risk

Overly tight coupling due to the use of credit guarantees

Possible self-imposed constraints on Chinese government spending if another financial crisis occurs. The Chinese government has reached a government debt to GDP ratio of 90%, which a widely cited study by Carmen Reinhart and Ken Rogoff found is correlated with lower growth. I’ve criticized this study, in that it mixes actual and de facto gold standard countries with fiat currency issuers, and also suggests causality (as in higher debt leads to lower growth) whereas in many cases, the cause is more plausibly that a financial crisis caused debt levels to blow out because tax revenues collapsed and impaired growth permanently. Nevertheless, if the Chinese think increasing debt levels further is a bad thing (as in they buy the Reinhart/Rogoff thesis), they might not respond as aggressively as the did in the wake of the global financial crisis. (Note this is my take on the GMO 90% government debt to GDP ratio; the report raises it as a concern in and of itself).

Capital flight. Flagged by Victor Shih as a serious risk years ago; it’s finally happening.

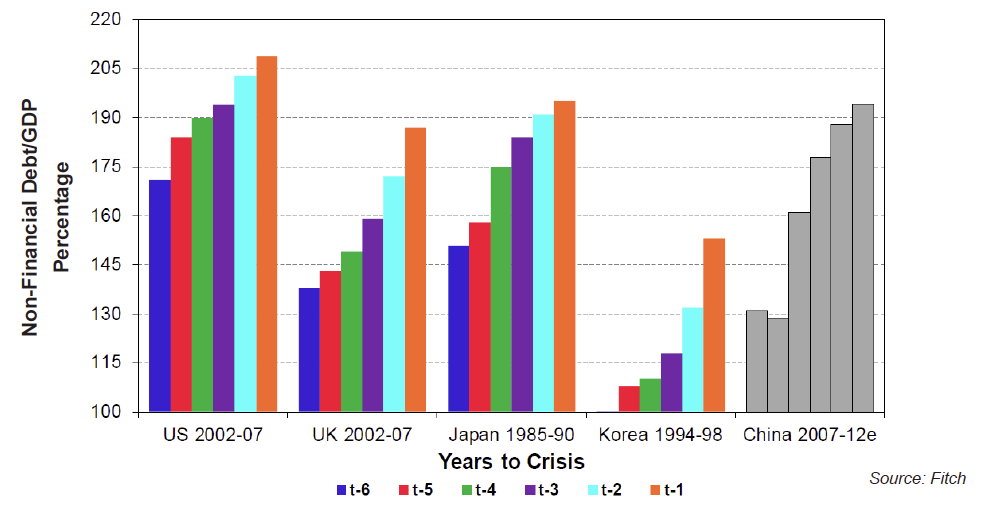

And if that didn’t get your attention, this chart might:

Read the report. It’s short and compelling.

Any American who believes he can make money by investing in China will have only himself to blame when the economy implodes. Consumers shouldn’t worry, however, because our corporations will seemlessly find another source for all the manufactured dreck upon which China’s rise to what passes for financial power has been based.

What do you suppose the Chinese Government will do about all those US Treasury Bonds it has swallowed to support the growth fantasy? More importantly, who will buy those Bonds when China no longer can? Those who think they can see the future on this might reconsider Keynes’ considered opinion on risk: that the future is unknowable.

Jake… China has more will… yet the ecological devastation is the key… america exports this tax via treasury’s.

Skippy… The end game[?] smiley poker… who’s blowing who under the table and who will have to drink… too many… eh.

China will be a poster child for the consequences of destroying the environment for increased profit. It is much more profitable to operate with lawless regulation and to dump waste en masse than treat.

There are around 15,000 petrochemical plants that dumped untreated waste into the Yangtze, China’s second largest, and the Yellow Rivers.

Reportedly 40% of China’s lakes and rivers are seriously polluted or cancerous and too polluted to come in contact with.

Along with the deadly air quality and urbanites chocking on smog, the long term cost to this meteoric temporary gain is beyond calculation.

All of china’s pollution comes straight over to us.

One world baby.

“Reportedly 40% of China’s lakes and rivers are seriously polluted or cancerous and too polluted to come in contact with.”

The Cuyahoga river burst in flames in 1968. 4 years later we had the Clean Air Act and the Clean Water Act. So maybe China is only a few short years away from its environmental about-face.

china may be many years away from a real rule of law that would enforce regulations for pollution.

China has rule of law, make no doubt about it. The laws may not be the exact ones on the books, but people are very adamant about equitable enforcement, which is the essence of rule of law. When it is decided that pollution is a problem, an entire province at a time will start passing and enforcing anti-pollution laws simultaneously. Something like this is happening with the workers’ rights laws already.

Chinese legal tradition is a bit odd from an Anglo-Saxon point of view; they had what I can only call Judge Dredd style “judge, jury and executioner” judges for centuries.

I remain as yet unconvinced about doomsday collapse scenarios for China; at least, not in the fashion described above.

China’s problems (broadly and simplistically) are inefficiency and income inequality. Inefficiency (in the sense of inefficient investment) will materialise as inflation (stoked by a currency peg) whereas income inequality will be a barrier to Chinas move to an internal consumption driven economy.

Therefore expect inflation first before you expect collapse.

As for jake chase’s points about US treasuries: i don’t see it for a moment. China can choose to hold USD in cash (yielding 0) or bonds (yielding slightly more than zero). As for new auctions: if China doesn’t buy, plenty of other funds and banks will happily slurp up the risk free return that tsys provide. Corporate welfare, really, which is why it may not be a bad idea to just get rid of them altogether and create USD as spending requires.

Free marketers crack me up… China is MMT personified… they care little about more than abating the machinations of the west… en fin.

Skippy… they don’t have to support global hegemony… just find counter party’s willing to take their currency.

I agree with you skippy, China is MMT personified.

What will grievously hurt China are lack of water, environmental destruction, declining agriculture yield, and labour population unrest due to horrible work conditions and low real Income and rural unrest due to government/corporate cooperative corruption.

These factors are growing, but it may take a while. China may go for a limited war with Japan to bolster nationalism and suppress internal dissent.

China is MMT personified like the Federal Reserve is MMT personified. Easy money at taxpayer (saver) expense. Combining the best of both world’s for the benefit of big corporations.

IOW, “MMT for me but not for thee.”

There that word comes up again. What is it with this skirting discussion that fetishises the “saver” as some kind of a moral paragon that must be protected against everything, and for whom the system must be designed. What makes the person who saves money so supremely pure and deified that no inflation at all can be allowed, if only to ensure that no amount of their savings will become less useful?

Isn’t this just worshipping old money in favour of new, that is, in other words given our circumstances, giving a huge blowjob for the rentier scum?

‘China is MMT personified.’

Yup. Glad to see a few conscious minds grasp that aspect of it.

The thing about China is that it has an authoritarian, oligarchic government… which is nominally communist.

So if the bubble pops, they kick out and execute a few troublemakers, expropriate and redistribute the wealth, change the rules, and move on. They can do this in months.

Capital flight? Capital controls!

In short, the Communist Party mandarins are likely to be able to perceive more options than the governments of the West are able to perceive. As such they (well, the ones who don’t get executed) will be better able to survive a collapse.

There are advantages to a lack of the rule of law, if it is sufficiently comprehensive.

There is one problem: the *committee* in the Central Committee may have become too ossified to do this; they may have become as mentally defective as our corporate elites and politicos.

It is generally better to have a dictator rather than a junta, because the dictator is more likely to be able to adjust to circumstances quickly than the junta. It’s not clear to me whether China has a dictator or a committee right now. It may be a committee.

The US central bank will buy the USG bonds if no other purchasers are available. After all, they’re doing it already.

From the US ruling class point of view, economic downswing in China, whether cyclical or structural, is all good. The Chinese will not have any choice but to keep producing cheap real goods for export, and the US can keep paying them with paper which the USA’s own central bank can create at will and loan without limit to their government and financial sector.

Meanwhile Chinese competition keeps American workers from getting uppity. Endless cheap credit for both the private and public sectors keep the American workers endlessly consuming, and ever-deeper in debt and dependency, since their wages can never keep up. The American worker, the American student, even the American pensioner, are all repressed into debt.

Quite beautiful to behold, if you’re a connaisseur of comparative ruling class schemata.

It’s fascinating to see how the principles of finance capital expounded in Lenin’s pamphlet “Imperialism,” remain valid, once one has done the necessary modifications for a soft money system. i.e. under a hard currency regimen, as described by Lenin, the finance imperialist tries to sustain a large and constant surplus, while under a soft currency regimen the finance imperialist tries to sustain the largest possible deficit.

Agreed. Imports exchanged for pieces of paper are a real benefit to the nation receiving them. The unfortunate point is that instead of adjusting our fiscal mix to account for this influx of real goods, it is instead used to prevent full employment, which has after all been the most important goal of the ruling class in the post industrial era.

maybe it won’t collapse in a ‘fashionable sense’

maybe it’ll just fall over

http://cache.gizmodo.com/assets/images/4/2011/11/fc12e3794b091a73be7474c03f4256a7.jpg

China’s main problem is the value of its currency. Beyond that I find it unlikely that the government won’t step in and clear up any mess that occurs. The stakes are too high for CCCP officials.

China’s main problem is the value of its currency? Surely you’re joking?— although that might contibute as a catalyst to its real main problem, which is its abhorrent human rights record:

http://www.hrw.org/world-report-2012/world-report-2012-china

Your optics are so skewed its absurd. The west has a track record like shite, pot calling kettle black.

“The West” is a pretty generic term. The US has a particularly awful human rights record, and so does Russia, but I’m not aware of Iceland having a bad record (for example).

@nathanael

WIthout saying….

@Phillip,

I think you mean that China’s main ‘risk’ is its currency. The risk that all developing nations face is that of devaluation and capital flight. China, being keenly aware of it, has chosen to (arguably wastefully) stockpile many trillions of forex reserves to protect itself against this risk. Yves referred to Victor Shih’s point that capital flight was a risk. Could the capital flight somehow be enormous enough to wipe out the forex reserves? Seems unlikely, no?

‘Rampant evidence of Ponzi finance, in many cases short term financed, which subjects them to rollover risk.’

In Taiwan in the late 1980s, a couple of island-wide unlicensed deposit schemes promised fixed returns ranging from 2 to 4 percent per month. Taiwanese stocks were roaring, so the operators might have been relying on leveraged market gains to pay ‘depositors.’ But everyone knows that 2 percent a month is not a sustainable return.

In 1990, the TAIEX bubble crashed with an almighty bang (artfully chronicled in a book by Steven Champion, who was managing the ROC Taiwan Fund at the time.) Its 80 percent decline nearly equaled the NYSE’s awful smash in the 1930s.

Amazingly, Taiwan’s sub-2% unemployment rate barely wiggled. Day traders who’d been quaffing imported champagne with their friends in private party rooms in the bucket shops on Nanjing East Road just went back to work. So did victims of the wildcat deposit schemes.

Of course, Asia was in the midst of a huge secular growth wave in the 1990s. But maybe it still is. Like the U.S., China probably will enter secular decline when delusions of grandeur finally lock it into grandiose value-subtraction schemes like our musclebound pax americana military empire.

This scheme can go on for quite a while if/when the US recovers. Then it will simply be business as usual.

I don’t think china can wait till after 2025 for USA to recover.

This article seems to help explain how things work (or not) in China. “Accounting discrepancies”…

http://qz.com/45662/caterpillars-china-accounting-scandal-is-all-too-common/

I always thought that it was China’s political model that would collapse before its economic model did, fully acknowledging that the two are inextricably intertwined.

Economic, political, and ideological corruption — all which fuel rapidly growing political and economic inequality — is probably even greater in China than it is in the United States. And that’s saying something.

The Guardian provides the following example of what a family that hails from China’s provincial political elite can earn:

Now compare that to the plight of someone who doesn’t have political connections:

Ameliorating economic inequality isn’t even on the ideological agenda anymore in China, as it was in the old days of Communism. And in order to enforce this sort of inequality, China of course has a brutal and oppressive totalitarian political regime.

I’m fond of the theory of society put forth by Peter Turchin in War and Peace and War, which is that a society with the level of political, economic, and ideological corruption — and concomitant political and economic inequality — that one finds in China is an unsustainable society. Economic and political inequality destroy cooperation and social cohesion, what Turchin calls asabiya. Societies with high levels of asabiya always outperform societies with low levels of asabiya. Societies with low asabiya are plagued with high levels of civil war and conflict, which are economically devastating. Ultimately, it is political instability that will be China’s Achilles’ heel.

The researchers in this article from ScienceDaily, however, argue just the opposite of what Turchin does, that stark economic and political inequalities in a society make it more adaptive. Cultural evolution specialist Deborah Rogers, lead author of the study, said:

Herbert Spencer would be proud. Long live social Darwinism.

“Instead, it appears that the stratified societies simply spread and took over, crowding out the egalitarian populations.” (Rogers et al)

I don’t think the results of this study need be taken in a “Spencerian” sense. Of all the handful of early high civilizations, the only egalitarian one — the Minoan Civilization — was also the one which developed in ISOLATION, insulated by the sea from barbaric or imperial encroachments. There may be a profound metaphorical lesson there for the 99% in its battle for equality.

China’s actually much better about not stealing people’s homes than the US is. :-P

There’s a very long and strong tradition of the “rule of law” in most of China and people are very serious about corruption. That tradition is actually a lot weaker here in the US. We certainly have a stronger tradition of democracy, but we have a major strain of “just do it, forget the rules” as well, which is not something I saw in China, which was pretty orderly.

Well said Skippy !

http://www.parapundit.com/archives/007122.html

Ooops forgot to add look for the NotProgressive Comment:-

http://www.parapundit.com/archives/007122.html

Whom do the Chinese owe all their debt to? Isn’t that important, if they owe it all to their own central bank, wouldn’t that make them less vulnerable?

As mentioned above China has somewhat of an MMT model. But MMT just isn’t about creating debt free currency. The money has to be used for productive investment not empty cities and real estate pyramids.

The “descriptive” or the “prescriptive” aspect of MMT – STM the “descriptive” aspect has no implications as to how the money is spent …. and the “prescriptive” aspect is purely a political decision ….

The basics of MMT as I understand it is the combination of debt free currency creation hand in hand with trying to achieve full productive employment. This is an attempt to diminish the financial/rentier class in the industry/labor equation. So it is essentially pro industry and pro labor and anti FIRE sector. It wants to see money used to increase output and increase labor capital (education) and industry capital (research, infrastructure, factories) rather than seeing money leveraged to increase assets (real estate, stock market).

Further NotProgressive comments on China and money creation:-

http://www.parapundit.com/archives/007561.html

http://www.parapundit.com/archives/007840.html

Thanks for the links.

From NotProgressive:

“Henry C.K. Liu says that when people figure out that money doesn’t have to be debt, that will be a human event akin to discovering the world is not flat.”

Understanding money creation? By design, it will never be allowed in the neo-liberal West, where ignorance* is power, and enlightenment equals a fast ticket to nowhere.

In the US, if you’re are not a card-carrying member of the Flat Earth Society, they run you out of Washington. Beijing, on the other hand, not only accepts that the world is round, but uses that knowledge –debt free money– for the greater benefit of the nation-state, and that’s why China will continue to utterly dominate the dissolving West for the remainder of the 21st century.

*Whether it’s feigned or real. Hard to tell these days, who’s genuinely stupid (Obama?), and who’s “in on it.”

Just my opinion and, really no back-up except my opinion.

China’s economy may well collapse but, it will not make much difference to the Chinese. They have corruption in many places and those in the corrupt sectors will be the ones that pay, possibly with their life. I do not believe China has gone full-off into the short term cultural ism that promotes short term gain at long term expense. Only a small segment is playing the short term gain and they will be hauled off and dispensed with pronto – made an example for the rest of the population – they will show these folks as being the wrong way to go politically and economically. I still see China playing the long game. They know their economic injury will be a band-aid event compared to the bleeding the rest of the world will undergo and will be the first to recover and lead on their own internal path forward.

Tom said:

That’s what I’ve been hoping would happen in the United States, but so far just the opposite has happened.

With folks like Bush and Obama, Paulson and Geithner, Greenspan and Bernanke at the helm, fraud pays handsome dividends in the United States, with nary the thought of punishment. Both the incidence and the severity of political, economic and ideological fraud have skyrocketed into the blue empyrean. It’s a renaissance of fraud that even the titans of the Gilded Age and the Roaring Twenties would be envious of.

Agreed about rampant corruption. I think the rulers of China are not blind to our folly, nor do I think they are incapable of using their knowledge of the global folly to advance their politics, ideals, symbolism, history and global autonomy.

paddycbrown says:

“Whom do the Chinese owe all their debt to? Isn’t that important, if they owe it all to their own central bank, wouldn’t that make them less vulnerable?”

Precisely!

This report is typical prejudiced nonsense, another effort by prejudiced Western economists to show that China is really a failing state which is of course nonsense. The prejudice against China in America and Britain is always startling.

Development planning in China has allowed for 3 decades of the startling general growth and a bettering of the lives of hundreds of millions of people. The unwillingness to recognize and understand this by Western economists is a shocking prejudice and limits the ability to suggest methods that could be of fine use in other relatively poor economies.

We only understand sanity by its absence. Here as in China. “The most notable feature of the credit boom has been the rapid expansion of non-bank lending…(in the form of) wealth management products… (creating) asset price bubbles.” Too many people chasing easy profits in China? Oh, but we don’t consider this shadowy stuff here in the US to be “non-bank” – we blithely bail it all out. I wonder if the Chinese have a land title registry and if they do if they copied our banks’ MERS so they could pool investment money to avoid accounting. It will be interesting to watch how China controls all this; will they protect the “banks” and totally rip off both investors and buyers like we did? Or will they match the credit bubble with a new population ponzi? Recent blurb about China now considering retracting its one-child policy. Mao is smiling.

There is no chance they will ditch the one child policy. They might try different means towards that end, but if they don’t deal with population, there is no chance for the country in the long run, and I don’t want China or its people to fail. I know its a controversial subject but it is an issue. Sticking your head in the sand about population growth, especially in China, is insane. Go on a public bus in one of China’s big cities or go shopping on Sunday and tell me they can ignore the population question. Having said that, there is no way to deal with population without dealing with inequality. The two would have to go hand in hand, in China and elsewhere.

I lived in China, in more than one city. In Hangzhou I lived in the middle of a whole number of apartment complexes. I am guessing there were about 1,000 units. All were empty. I lived near an amusement park too, which was empty. This was late 2009, so maybe things have changed, but it was eerie.

China’s model is complex. There were market reforms in the late 70’s under Deng but what the CCCP calls the “commanding heights of the economy” (heavy industry, telecommunications, finance, energy) has never left state hands. 68 or 69 Chinese firms were listed in the Forbes 500 in 2011. If I am not mistaken, all but two were state owned enterprises. Even parts of the economy in private hands, while not owned by the state, are still controlled by the state. There have been conflicts recently between private energy producers and Beijing over price controls, for example. I don’t see the state controlling the economy to that extent as a problem really. I would argue it saved China from the East Asian Financial Crisis and it has helped them to have a logical, coherent plan as far as development.

I would argue that the increasing inequality IS a result of the market reforms, seems beyond contention really. Look at the share of the central government’s spending on health care for an example of this. Or its investment in education, literacy and the like. Without that investment in human capital during the Maoist years it’s unlikely China would have grown and developed like it has. It is the state stepping away from these responsibilities and the corruption (which goes with the ideological change that has taken place within the Communist Party in recent decades) which has resulted in massive inequality.

I don’t think the market reforms are sustainable themselves and if the situation doesn’t get reversed soon, the growing social movements can force the CCCP to do something. The government admitted that there were over 100,000 “mass incidents” in the country last year thanks to government policy.

The biggest challenge though is the environment. The World Bank says that about 10% of China’s GDP is lost to environmental damage, which is pretty massive. Having lived there, I’d guess that it is a vast understatement.

It isn’t easy, or realistically possible, to place a monetary value on environmental and ecological services.

Giving the massive environmental and ecological destruction, the lack of water availability (especially in the north) and the huge population and population growth, THIS is China’s biggest challenge. China is facing now what everyone else will be facing shortly in regards to the environment and ecological system.

I hope the country doesn’t implode into civil war, I hope the social movements can push for the needed change. What is needed to fend these crises off is fundamental change and a reversal of the market reforms, at least to an extent. That isn’t likely with the current Party leadership though.

Joseph Stiglitz has a good recent article on our environmental problems

http://www.project-syndicate.org/commentary/global-warming–inequality–and-structural-change-by-joseph-e–stiglitz

The Post Crisis Crises

Joseph Stiglitz

1/7/13

“”The market will not, on its own, solve any of these problems. Global warming is a quintessential “public goods” problem. To make the structural transitions that the world needs, we need governments to take a more active role – at a time when demands for cutbacks are increasing in Europe and the US.

As we struggle with today’s crises, we should be asking whether we are responding in ways that exacerbate our long-term problems. The path marked out by the deficit hawks and austerity advocates both weakens the economy today and undermines future prospects. The irony is that, with insufficient aggregate demand the major source of global weakness today, there is an alternative: invest in our future, in ways that help us to address simultaneously the problems of global warming, global inequality and poverty, and the necessity of structural change.””

The problem, as usual, is economics itself. Neoclassical economists, because they only accept market based policies, need to use instruments that are highly subjective and biased. What discount rate is choosen matters if you are going to use market methods. Are people willing to place monetary values on environmental and ecosystem services? Can you place a monetary value really on a species, a human life or an ecosystem? Even if you can, what methodology are you going to use? Are you going to use silly ideas like Coasian negotiations? If so, how do you get around the unrealistic assumptions needed for them to work (like little to no transaction costs, perfect information, no massive differences in power between the negotiating groups, etc)?

On every level, when you look at so called market based solutions, even IF they could solve the problems we are facing (and I think there is no chance they could) they create huge problems elsewhere.

The right’s idea, as usual, is to privatize everything, I mean everything and to place a monetary value on everything. Total nonsense, but that is all we are allowed to discus thanks to the neoclassical nitwits whose ideas are always horrible in practice.

They also have no way, within the market economy, to deal with scale. We do live in a world of finite resource and the environment can only take so much as far as wastes. How do you deal with the limits to growth within market economies when they are structured to grow without end? They claim technology will save the day, but it hasn’t to this point done anyhing about the scale of the economy in the aggregate relative to the environment. Jevon’s Paradox, something Herman Daly and John Bellamy Foster have talked a lot about.

http://monthlyreview.org/author/johnbellamyfoster

Excellent article! Thanx for the citation …

Everytime I see an article like Stiglitz’ I feel the frustration intensify – his prescription for what ails us was actually available to be “picked up” at the ballot box, and we blew it, again ….

When the Green Partyists did things like claiming Bush and Gore were the same, and when they did things like running McGaw against Wellstone to defeat Wellstone in order to elect his Republican opponent (Coleman or whomever), they destroyed much trust in themselves among some people and poisoned the “third party well” for all third parties for some time to come.

So while I am disappointed that so few people joined me in voting for Rocky Anderson, I am not surprised.

I am not a fan of “parties” mainly because of the “party” mentality that rapidly devolves into factions, intrigues, personalities, strategies and all that other crap (I am a registered “indy” myself) .. but as frustrated as i get with a lot of this stuff, I try to take the longer view – I look at the candidate, re the “content of his/her “character” as much as i can and the worth of the platform …

IME the Green platform was way above the others, was headed in the right direction and, I thought, was a platform that OWS would have had if they had one … It sounded so like what Stiglitz , and others, have talked about, it was about a New Deal for the 99% wedded to the planet on which 100% of us depend … I heard the debates – Stein and Anderson had the same damn platform, but Stein had the better field organization ..

We have to get over these petty squabbles and stop nursing those remembered slights – we can’t afford them anymore – that is why I am soo frustrated – we have the ideas and some damn good candidates – and time is running out ….

McGaw versus Wellstone wasn’t a slight, it was a vicious and sinister betrayal which the Republican-funded Green Party was happy to perpetrate. I won’t get over it. Others can if they want to. Perhaps I will be the Last Grudgeholder Standing. On that day the world can point at me and laugh.

So in China, the State owns the Companies. In the US, the Companies own the State. I wonder how different those two really are in practice. Seems to me in both systems if you’re near the top of the State or the top of the Company, you’ve got all of the advantages sewn up, no problem.

I have some serious issues with this kind of analyses. I think it gives to much attention financial side, while ignoring what really matters for growth?

I though that, given sufficient spending is available, growth rates depend on labour force growth, or productivity growth. Something real, not financial. Why not focus on that to determine future chinese growth? No need to involve financial ratios.

Part of this analyses does look spending growth. To me, it seems the standing committee decides about spending growth. So it all comes down to “self-imposed constraints on Chinese government spending”. This is really political decision making. Again, no need to involve shadow banking or anything related.

Lastly, I don’t get why you keep focussing on the investment ratio. What even is “investment”? I am curious, since I never saw this term being qualified on this blog. Same with consumption. Anyway, I don’t think it matters. Spending matters, and if it feels more comfortable, just call all that spending on empty real estate “consumption” (perhaps it even fits that definition better).

As I remember, we in the MidWest objected, rejected, and obstructed Free Trade in general, inCLUding MFN for China; as best as we could.

Since the Pacific Coast people (Pacificans or Cascadians or Ecotopians or whatever beautiful name they care to flatter themselves with) all supported MFN for China, it is only just and fair that pollution from China affects the Pacific Coast first and worst.

Of course there was that famous Battle in Seattle in ’99 …

That “pollution from China” also includes CO2 – and methinks the Midwest is suffering its own CC woes ….

Yes, thats certainly true. Well . . . we did our best to stop it.

Battle of Seattle? Unfortunately that was a minority of people. A majority of PacifiCascadians voted for Reps who voted for MFN for China and NAFTA too as far as I know. So they are getting the mercury fallout they voted for. And we are all getting the CO2 they voted for.

This NASA view shows China’s airborne filth largely goes to Alaska and Canada. Lots of burning rainforest activity in Africa, Brazil, and Indonesia. Sahara dust. The “clear” message is: we’re all in this together

http://www.youtube.com/watch?feature=player_embedded&v=oRsY_UviBPE#

Well, perhaps the mercury fallout from that filth will enter the pacific fish which are eaten up and down the pro-Free Trade American west coast from Seattle to Los Angeles.

Finance is one thing, but the intersection of geology and compound interest is the real issue.

China made a deal with its people back in ’89: trade democracy for prosperity. So far the government has kept its promise with 7-10% growth rates. Problem: a 7-10% growth rate means that the size of their economy doubles in 7-10 years.

Right now China uses 50% of the world’s cement and 35-45% of the world supply of commodities like iron, copper, aluminum, lead, and other minerals. Its oil and coal use are growing as well. There’s no geologically realistic scenario for China to double its consumption of these commodities in 10 years. That is, unless the rest of us go all Amish.

There is the equally unrealistic scenario of China doubling its energy efficiency and switching to industries that favor design and intellectual effort over raw material use in the next decade. I wouldn’t bet on it.

China (and the world) is charging into a resource bottleneck and resulting price spike and economic slowdown, with all the joy and charm that implies. The masses will not be happy.

There are several people on the Left who deny resource bottlenecks. To them, what seems like a growing disparity between supply and demand in global markets is perceived as greediness from the wealthy. In addition to that, these people tend to think that a Green Economy will solve the current economic problems of developed countries. It seems like they believe that a Green Economy will salvage the current economic and political systems in the United States. They can’t see the flaws in the notion that the world can power modern civilization, keep modern technology, or sustain anything close to its current population with renewable energy.