By Lambert Strether of Corrente.

[Patient readers, I had an early morning Internet and phone fail, followed by an RL fail, and Yves was kind enough to cover the financial aspect of the Italian elections here because I could not cover the post. I’ve extended this post to cover the political aspects here. –lambert]

Even though, as the headline shows, I have little Italian, and less Italian politics, I’m so chuffed that Beppe Grillo did well in yesterday’s Italian elections — even though he was neither a wizened, permanently tanned, and shamelessly unrehabilitated whoremonger nor a Goldman Sachs alumnus (sorry for the redundancy) — that I thought I’d do a wrap-up before conventional wisdom completely congeals. Alert readers will, of course, correct and amplify this post in comments!

|

|

Appendix I: Mr. Market’s mood swings

Italian bond yields yesterday, courtesy the Guardian:

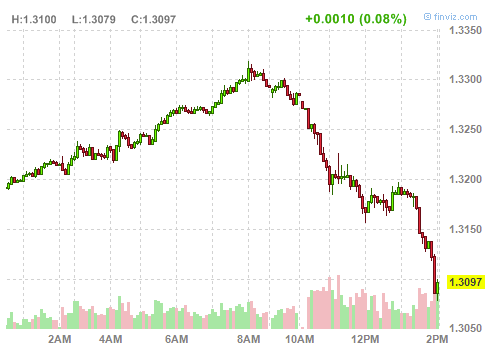

This was how the euro took the news yesterday, courtesy Clusterstock. It’s now at 1.3097, per Bloomberg:

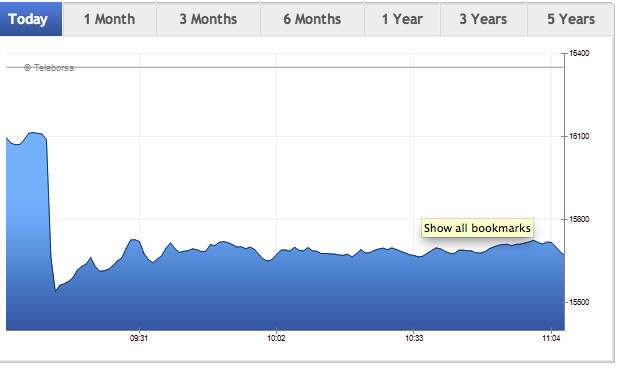

The Italian stock market so far today, courtesy the Italian Bourse, showing a further 4% or so fall:

Appendix II: V-Day

Well Lambert, you may have been chuffed, but Ezra Klein today (now yesterday) was not chuffed. He was dismayed, tsk, tsk, that the Italians failed to do the responsible thing and vote for austerity.

I know his opinion on such matters is soooo important to you. /s

It’s great to see that fine nation of Italy doing what Greece was (quite understandably) too small, too afraid and too vulnerable to do which is to say, collectively, “up yours” to austerity, technocracy and cronyism. Viva Italia !

We’ve got a saying in the UK which is (there are variants) “If you owe the bank £1,000 that’s your problem. If you owe the bank £100,000,000 that’s their problem”. Well, if you have Euro 407bn outstanding sovereign debt, that’s your country’s problem. If you have Euro 1.8trn outstanding sovereign debt that’s the world’s problem.

So, three cheers for Beppe and even two cheers for Uncle Silvio. Sorry Lambert, you’ll be horrified at such a notion I know, but you have to admire/despise Berlusconi in the same breath because he is nothing if not an absolutely masterful politician. By falling on his sword in exchange for the 2011 bailout, allowing Mario Monti to run the country into the ground, then at just the right moment pulling the plug he couldn’t have timed things better for maximum impact. Sometimes, you just have to grit your teeth and say, as I do where Berlusconi is concerned, “my enemy’s enemy is my friend”.

Oh, I’ve been cheering Berlusconi. It probably takes a pig and scumbag of his order to outfox the bankers and Eurocrats. As I said a while ago, when Berlusconi is the most sensible guy in the room, you know it’s bad. But it looks like he wants to live and be powerful in a semi-functioning country, which means his interests are much more aligned with the public’s than the other pols. And Beppe is enough of a wild card that Berlusconi might have to walk his talk more than he thought he might have to.

Berlusconi is a piece of sh*t, and a crooked pervert, who owns most of Italy’s media. He’s been in charge for 14 of the last 20 years, and in that time his country has grown faster than Haiti and Zimbabwe. But no-where else.

Italy has disgraced itself by giving that f*cker 30% of the vote. The Italian left has disgraced itself by missing yet another open goal.

The Italian “left” is left like PASOK of Greece, PSOE of Spain, or The Democratic Party of the US.

In other words, they are about as bad as it gets.

Yeah, but at least those other parties sometimes get to win elections, something parties are supposed to do. They keep the right out of power, and perhaps shift the pendulum back a little. The Italian left can’t even do that properrly.

Even when they win, their victories are so narrow, and their coalitions so unwieldy, they never get anything done.

They’re shitty campaigners, poor strategists, they invariably pick crappy leaders and find a way to wrench defeat from the jaws of victory.

Allowing Berlusconi to pretend to be a Keynsian, while embracing austerity themselves, is a perfect case in point.

What he wants most is the exemption from legal pursuit that an office in government would avail him. Why does anyone think he ran for office – last time up at bat (as PM) he got the Italian parliament to time-limit any legal process. Court cases in Italmy are extremmmmmmmmely long to undertake, so now he can easily outrun the time limits.

He has two court cases on his back that are thought would finally do him some real harm. Of course, he has called the prosecutors all “politically motivated sharks”.

Right, Berlu, and you are the Italian Befana … especially to Escort Girls.

This is about breaking the leaded crystal ceiling.

Austerity? Taxes?

Who cares. This is about implementing moral hazard and taking control away from the banisters and their bought and paid for politicians.

4 years without a budget? Screw both the republicans and democrats and the horse that brung’em

Italy’s neoliberal government is identical to Mexico’s neoliberal government in that it is confronted with a rapidly escalating crisis of legitimacy. The neoliberal government has so little legitimacy that, given the choice betweeen government by the neoliberals or government by the drug cartels, vast swaths of the population will choose the cartels. Here’s how Grillo put it (from the above video):

The mafia has more legitimacy than Italy’s neoliberal government.

I don’t believe that the capitalists can come up with another team like FDR and Keynes to save themselves from their grotesquely stupid and greedy selves. There was this link on a thread yesterday, and I am very much in agreement with Wallerstein that what we are seeing now is the last and final crisis of capitalism:

Wallerstein is far more optimistic than John Gray about the possible outcome as capitalism “hits the buffers,” as John Gray puts it. Wallerstein gives it a 50-50 shot that what will emerge will be something better than capitalism, whereas Gray believes what will emerge will almost assuredly be worse.

Substitute plutocracy and plutocrats for capitalism and capitalists and your argument is much improved.

Why? Are you afraid to tell the truth about Capitalism?

Capitalism leads naturally and by necessity to plutocracy. Einstein explained how that happens back in the 40s.

How can a theory that unconditionally and uncritically accepts the self-interest axiom lead to anything but plutocracy?

Any truly radical change is at least as likelly to come from a neo-fuedalist, corporate right as from the left.

They’re better organised, and more ruthless.

…and the neo-feudalists have all the $$$$…

Unless the Enlightenment Fairy sprinkles self-awareness dust on this nation, my money is on our veering further to the overt fascist right; right off a cliff.

Wallerstein rejects historical determinism, and thus hits a nice balance between the overly optimistic historical determinism of Marx and the overly pessimistic historical determinism evangelized by the neoliberals. Thus he comes up with the 50-50 shot, and his philosophy falls prey neither to the active nihilism of Marx nor the passive nihilism the neoliberals are attempting to engender.

He explains in more detail in this talk he gave to the Occupy movement:

http://www.youtube.com/watch?v=__o3z-N_R0o

Marx never said that the relation between the economical infrastructure and the ideological superstructure was a unicausal one.

This remark is so pathetically wrong as to be laughable. The Italian police have been all over the local Mafias.

There is one fact, however, that is pertinent to Berlu and the Mafia; which is the manner in which he became super-rich wheeling and dealing real-estate around Milan in the 1960s/70s.

He got the money from … guess where?

Bravo, Silvio! ;^)

Ain’t democracy a wunnerful thing? The ballots are barely assembled in neat piles, and all the German poobah overlords immediately and simultaneously intone that the Italian “program” must continue, those silly voter-peons notwithstanding. What a stark reminder of pervasive bankogarchy.

I was discussing this charade with one of my lender contacts yesterday. Watching the comedy unfold was pure joy! Certainly helped precipitate a drop in mortgage rates. I find it encouraging that the people of Italy realized a comedian was likely a more genuine ally of their collective interests than the technocrats trying to force austerity down their throats.

I think this is one of the reasons Richard Wolff maintains a sense of optimism. Great interview by the way, if you haven’t watched it. People are stil largely in that shocked, deer-in-the-headlights phase, but they are slowly realizing they’ve been lied to and robbed in a systematic way, and they know there is a better way forward. That change and progress starts with a collective realization that there are real alternatives to simply throwing money at crooks and failed institutions.

Its kind of embarassing that Italy had no viable Left alternative.

Apparently, Bersani is a former communist… And pushes Austerity anyway.

Makes perfect sense!

Bersani’s a really grindingly boring, un-charismatic guy to boot. Practically the entire leadership of Italy’s left couldn’t get laid at one of Berlusconis parties.

Is the left alive anywhere?

Do tell, my bags are packed.

Come to France, my dear chap, and enjoy the beauty of the left running an otherwise lovely country to the ground!

Yeah because Sarkozy and the right weren’t. Hollande’s problem is that he is too similar to what proceeded him, not that he is an actual leftist.

I’m not sure these happy clowns won’t be crying before too long. This election result might have been anticipated (if not precipitated) by Monti et al.

I won’t reiterate much of what is in the press – as all the commentaries all say the same thing –it’s highly unlikely there will be a majority in either House or Senate – so no outright majority. As a result, there will be a protracted political stalemate, plenty of theatrics and finally (when ‘dall’impasse’ is acknowledged between the political pugilists) the president has to dissolve parliament and call for new elections.

However, there is just one problem; as President Napolitano is now in the last six months of his presidency, he can’t dissolve Parliament. He would have to resign, the Parliament would have to elect a new President and only then could the new President dissolve Parliament and call for new elections. (Though, a properly constituted parliament could dissolve itself, it’s unlikely before all the horse trading is over, a new President is elected and the technocrats have bought more time). The outcome of this election, then, aligns with the aims and objectives of the ECB, Berlin and the Technocrats.

This means that much of the austerity measure Monti and the ECB technocrats initiated and set underway cannot be stopped. Why? Dates (2013-14) and Italy’s ffiscal year: 1st July through 30 June.

In the final parliamentary session of the Monti government it introduced the ‘Planned Fiscal Adjustment Budget’ that amounted to a cumulative €48bn – a close-to-balance budget by 2014 (focused around the retirement explosion due to occur 2016 – especially, women reaching the age of 60). Additionally, it introduced a supplementary fiscal package – a cumulative fiscal adjustment to €55.4bn but frontloaded the adjustment to 2012 and 2013. The Upper House then upped the ante with a fiscal adjustment that amounted to a cumulative €59.8bn – the equivalent of around 3.4pc of GDP.

On the 2013-2014 expenditure side, cuts included:

•A wage freeze in the public sector until 2014 and reductions in social security spending by means of a payment delay in severance pay for pensions.

•As from calendar year 2014, the statutory retirement age of women working in the private sector will be gradually increased from 60 to 65 so as to align it with that of men by 2026.

•An automatic mechanism for deferment of early (and old age) pensions as well as old age allowances (presently, linked to the statutory retirement age and previously scheduled to start in 2015), is brought forward to 2013.

•For pensioners retiring earlier with 40 years of contributions, regardless of the age eligibility, it means a further postponement of the so-called “exit window mechanism”, by increasing the contribution period by one month in 2012, 2 months in 2013 and three months in 2014.

• Pension benefits five times above the minimum will not receive any indexation to price inflation for the part of the pension exceeding three times the minimum. Up to this threshold, the indexation to price inflation will be reduced to 70pc.

•In short the elderly can retire early but don’t receive a minimum pension until they reach statutory retirement age and then a full pension and entitlements until 70 (The average life expectancy is 77.)

• In addition, for 2013, there is an increase in the ordinary VAT tax rate from 20pc to 21pc. Taxation on financial assets is set to 20pc (with the exception of public debt instruments which remain taxed at 12.5pc), and the increase in taxation on oil products, which had been introduced on a temporary basis, is now permanent (which drives up cost for the vast majority of consumer goods. The direct ownership of public utilities by local authorities is limited, with local government and private business tax codes coming into effect to incentivize privatization of publicly-owned companies. Oh, and a whole swathe of measures related to “flexibility” of labor contracts.

I suspect Monti resigned in December 2012, with Napolitano’s understanding, because they knew that the president couldn’t dissolve the newly elected parliament in the last 6 months of his tenure (and Napolitano has been an ardent supporter of the technocratic approach to austerity, so it’s unlikely he’ll resign any sooner than he needs to). Which takes us to May 2013 and the Italian Fiscal budget which, because there is no one to stop it, will come into effect June 2013. And, well, untangling that plate of cooked spaghetti is no laughing matter.

You may be on to something there.

It’s a pretty Goldman-y trick to pull.

You call it austerity, I call it common sense.

Many people do not understand what austerity is about. It’s dead-simple:

*Countries borrow to meet operating expenses in the goodtimes (rather than reducing their national debt).

*They depend upon national tax revenues to meet the debt-maintenance payments.

*The economic fit-hits-the-shan and tax revenues tumble – so they find it ever more difficult to maintain their budgets.

*They have got cut somewhere, and that usually comes out of social services since (unlike the US) they do not have large Defense Budgets.

*People on the long-term dole get Very Angry and the level of venom rises – because they have never felt such hardship before. (Good-time Hubris had set in.)

*But government must make (legally) their debt-maintenance payments at the flexible rates stipulated by markets. So, they must show that they are making an effort to bring down total debt levels. (Which never should have exceeded 3% of GDP according to the Maastricht Treaty of 1992, btw.

*Indebted EU countries have governments that find themselves between a rock (money market rates that may increase their debt-maintenance payments) and a hard place (a very angry constituency that is not used to hardship).

What would you do … ?

Well, austerity is what it is. I wasn’t attempting to either support or condemn austerity, but simply say that that Napolitano has been an ardent supporter of the technocratic approach to austerity; which is correct.

Nevertheless, the process you outline of countries borrowing money is, generally, correct but, the part you missed out was that these loans, by and large, were not sovereign

loans – Germany loaning money to Italy or even excess Government issued bonds to raise cash for public spending (irrespective of the limits set by the Maastricht agreement).

These are, predominantly, privately funded loans, under commercial terms made between German and Italian banks. No doubt, the respective counterparties charged interest

by to reflect the degree of security/risk. And, no doubt the banks also hedged these loans by taking out credit default swaps, etc. The Italian banks then loaned the money out, much as banks do.

So, when the ‘fit hit the shan’ it was the banks that were defaulting – not the governments. At least not until the Italian government began bailing them out (as did most European governments with their own domestic banks – Ireland being the poster child) by effectively taking public ownership of a private debt. Now, in order to now support this onerous commitment, the Italian government is cutting back its public spending. The Italian (French, Spanish, Greek……) tax payer is paying, through austerity measures, to make good very bad commercial decision made by German banks.

I know that when I make an excessive bet on a losing horse the tax payer doesn’t make me whole again. Nor will my house insurance cover my mortgage payments when I can’t pay my mortgage, because I gambled all my money on losing horses.

As a result I would be, most likely bankrupt, and need to restructure my finances. So, I would let the German banks do the same.

In the sense that they were taken out by Sovereign Nations, yes, they were “sovereign” .

Soveriegn debt is issued by national central banks on the money-market and the bids determine the price. Yes, anybody can buy them, even you and me. They were not bought uniquely by any one or two banks or any given party in any given country in particular.

And it is the market-makers who determine the premium over or below the German price of bonds, which is the “marker price”. Most usually, of course, it is above the German bond rate.

That just aint so.

Like with a house, when you take on debt and you default … well they foreclose on your house. Instead, a bank cannot foreclose on a “soveriegn nation”. So, what happens is that a defaulted loan simply shuts down that window, meaning the defaulting country issues no more debt whatsoever.

Ireland, by bailing out the private banks more than doubled its national debt (to 32% of GDP). Spain, France and the Britain did the same to some degree or other…. The Irish government asked for external support from the EU (and the International Monetary Fund) to pay down its increased national debt….. Spain, France, Italy, Portugal, Greece, all increased their national debt in the same.

Each bailout initiated a series of emergency packages and austerity budgets as governments sought to balance the books.

Had they allowed the banks to default on their own, it would be private investors taing the losses, not the taxpayer.

Yes, but so what?

A Sovereign Nation must not and cannot default on its debt, whether national or accumulated by banks. It must bail-out the banks because they are, indeed, TooBigTooFail.

Meaning, should they fail, the consequence is irreparable further damage to an already weak economy that will only bring the mass misery of unemployment beyond the 25% it is already amongst the young.

It would start extreme Civil Disobedience on a very, very large scale. No government wants to take that risk.

So, bailout is the only alternative. Because we have not learned, either in Europe or the US, that (as regards Finance Markets) an “Ounce of Prevention is worth a TON of cure”.

We need a V-day in this country! After all, laughing is a lot better then crying. Perhaps then, the people here will get the courage to get off the couch and do something other then take it in the . . . . . . !

from Mexico says:

February 26, 2013 at 7:48 am

“How can a theory that unconditionally and uncritically accepts the self-interest axiom lead to anything but plutocracy?”

Well exactly! How is it that with some human beings selfless and selfish can’t run simultaneously in their brains? You know like walking and chewing gum at the same time! Time to construct a society on the basis that such simultaneousness is not automatic let alone axiomatic!

I don’t see a lot of hope for Beppo, unfortunately. The Italian Mafia… whoops, I mean Gov’t, is a club, and Beppo ain’t in it.

(It’s too bad George Carlin isn’t available to run in this country.)

Why Monti Lost – “Don’t be mess’n wit de peoples bro!”

see:http://www.i-italy.org/bloggers/35479/why-monti-lost-don-t-be-mess-n-wit-de-peoples-bro

Rumor Mill: [unconfirmed]

Inside buzz says, signalling a dramatic move to the left in store for Italian politics, Beppo intends to name Chico, Harpo, Groucho and Zeppo as economic advisors.

I don’t care for Zeppo.

http://1.bp.blogspot.com/-gKiOQtXrpuI/TooFHMIsHEI/AAAAAAAAAGg/sEFAGwFYC1Y/s1600/Marx%2BLennon.jpg

ALL HAIL MARX AND LENNON!

More about Beppe Grillo from Ilargi, last week:

http://theautomaticearth.com/Finance/beppe-grillo-wants-to-give-italy-democracy.html

Explains “V-Day” if you don’t know…

We are witnessing another episode of the political battle of Markets vs Citizens in Italy. It is apparent that Mr. Market has been defeated but my opinion is that these results indicate that the balance is still equilibrated and italian politics are sitting in the edge of the coin. I would like the oppinion of an italian, but I see Berlusconi as a representative of the extreme free-market, tea-party like politics, in italian version which is of course has a strong comical sense. I appreciate very much the Italian comic bias but one should not ignore the xenophobic/ultra-free market trend of the coalition that Berlusconi represents.

As I see it the results show a tie in this struggle that another comedian, Mr. Grillo could help to untie. An important outcome is that the italian elections are spurring a reaction from Mr. Market, who is acting not only against Italy, but also trying to preemptively cause fear in other periphery countries that migth react in the near future. See how spreads are climbing again…

OK, so Italy went full Pat Paulsen and elected a comedian/accountant (an oxymoron if ever there was one). We here in the U.S. elected a matinee movie idol – twice, a frat boy – twice, and now, a glib liar twice. Here at NC we learn that the rational actor model in economics is a fiction, but it took the Italians to show us that politics and rationality may not be closely related.

BTW Lambert, I couldn’t care less about Italian politics – but your opening sentence hooked me so hard I had to read your script and watch that video. Nice opening.

We actually elected Gore in 2000, but the Supreme Court did its part to award the Presidency to Bush and Gore and the other DemSenators refused the last minute chance to reject the Florida Electoral Delegation which the Congressional Black Caucus tried handing them.

And there are questions about who was actually “elected” as against “Diebolded for” in 2004, as well. But Bonesman Kerry took a very swift dive for fellow Bonesman Bush, so we will never totally know.

Watching Grillo’s speech closing the electoral run up in piazza San Giovanni gave me chills. Here is a man who truly understands the forces arrayed against the common man and woman and isn’t afraid to describe them as they actually are in brutally honest terms. I have my points of disagreement with him on policy, but he has given us a roadmap to implementing disruptive electoral change on a shoestring budget by utilizing the potential of the ‘net as a detour around the captive and corrupted MSM. I think this model can work in almost any democratic system, the measures in place to prevent such a workaround all at their heart rely on controlling people’s perceptions through mass media progaganda–convincing them that such an attempt is futile, and the ‘net is structurally and fundamentally too fluid, interactive, multiplexed and chaotic for the tried and true control methods to reliably filter.

Neoliberal austerity and the needless pain and suffering it ladles out necessarily pushes societies under its control toward tipping points in popular perception and I don’t think the people pushing it realize that controlling the major TV networks and newspapers can no longer guarantee that more compelling competing narratives won’t be heard.

While we should all be wary of the charismatic leader model, it may be that we psychologically require such totems to assemble around and the seductive leaderless OWS model was simply unsuited to the way we are hard wired.

Because of close family connections in Italy I’ve been watching the Grillo/M5S phenomena unfold for a number of years. It is heartening to see its rise from a fringe movement to a major political force in such a short time. I don’t think (supposed implacably two party system notwithstanding)there is any reason something similar can’t happen in the US. If fact the biggest obstacle is simply the perception among those who would be predisposed to join such a movement that it isn’t a feasible undertaking.

Imagine what could nucleate around a charismatic Obama-like figure–albeit one who wasn’t a con man and a phony like Obama but a real change agent.