By Paul De Grauwe, Professor of international economics, London School of Economics, and former member of the Belgian parliament, and Yuemei Ji, Economist, LICOS, University of Leuven. Cross posted from VoxEU

Eurozone policy seems driven by market sentiment. This column argues that fear and panic led to excessive, and possibly self-defeating, austerity in the south while failing to induce offsetting stimulus in the north. The resulting deflation bias produced the double-dip recession and perhaps more dire consequences. As it becomes obvious that austerity produces unnecessary suffering, millions may seek liberation from ‘euro shackles’.

Southern Eurozone countries have been forced to introduce severe austerity programs since 2011. Where did the forces that led these countries into austerity come from? Are these forces the result of deteriorating economic fundamentals that made austerity inevitable? Or could it be that the austerity dynamics were forced by fear and panic that erupted in the financial markets and then gripped policymakers. Furthermore, what are the implications of these severe austerity programs for the countries involved?

The Facts: Austerity and Spreads

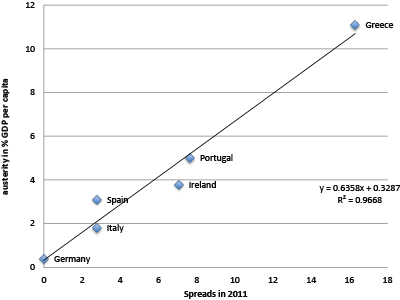

There is a strong perception that countries that introduced austerity programs in the Eurozone were somehow forced to do so by the financial markets. Is this perception based on a reality? Figure 1 shows the average interest rate spreads in 2011 on the horizontal axis and the intensity of austerity measures introduced during 2011 as measured by the Financial Times on the vertical axis. It is striking to find a very strong positive correlation. The higher the spreads1 in 2011 the more intense were the austerity measures. The intensity of the spreads can be explained almost uniquely by the size of the spreads (the R-squared is 0.97). Note the two extremes. Greece was confronted with extremely high spreads in 2011 and applied the most severe austerity measures amounting to more than 10% of GDP per capita. Germany did not face any pressure from spreads and did not do any austerity.

Figure 1. Austerity measures and spreads in 2011

Source: Financial Times and Datastream.

There can be little doubt. Financial markets exerted different degrees of pressure on countries. By raising the spreads they forced some countries to engage in severe austerity programs. Other countries did not experience increases in spreads and as a result did not feel much urge to apply the austerity medicine.

Two Theories About Spreads

The next question that arises is whether the judgement of the market (measured by the spreads) about how much austerity each country should apply was the correct one. There are essentially two theories that can be invoked to answer this question. According to the first theory, the surging spreads observed from 2010 to the middle of 2012 were the result of deteriorating fundamentals (e.g. domestic government debt, external debt, competitiveness, etc.). Thus, the market was just a messenger of bad news. Its judgement should then be respected. The implication of that theory is that the only way these spreads can go down is by improving the fundamentals, mainly by austerity programs aimed at reducing government budget deficits and debts.

Another theory, while accepting that fundamentals matter, recognises that collective movements of fear and panic can have dramatic effects on spreads. These movements can drive the spreads away from underlying fundamentals, very much like in the stock markets prices can be gripped by a bubble pushing them far away from underlying fundamentals. The implication of that theory is that while fundamentals cannot be ignored, there is a special role for the central bank that has to provide liquidity in times of market panic (De Grauwe 2011).

The decision by the ECB in 2012 to commit itself to unlimited support of the government bond markets was a game changer in the Eurozone. It had dramatic effects. By taking away the intense existential fears that the collapse of the Eurozone was imminent the ECB’s lender of last resort commitment pacified government bond markets and led to a strong decline in the spreads of the Eurozone countries.

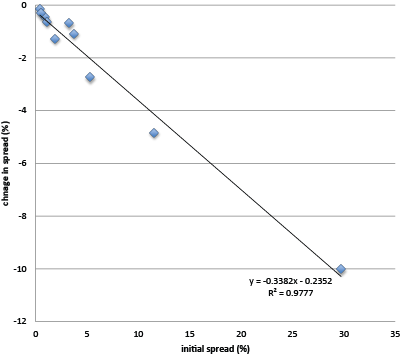

This decision of the ECB provides us with an interesting experiment to test these two theories about how spreads are formed. Figure 2 provides the evidence. On the vertical axis we show the change in the spreads in the Eurozone from the middle of 2012 (when the ECB announced its program) to the beginning of 2013. On the horizontal axis we present the initial spread, i.e. the one prevailing in the middle of 2012. We find a surprising phenomenon. The initial spread (i.e. in 2012Q2) explains almost all the subsequent variation in the spreads. Thus the country with the largest initial spread (Greece) experienced the largest subsequent decline; the country with the second largest initial spread (Portugal) experienced the second largest subsequent decline, etc. In fact the points lie almost exactly on a straight line going through the origin. The regression equation indicates that 97% of the variation in the spreads is accounted for by the initial spread. Thus it appears that the only variable that matters to explain the size of the decline in the spreads since the ECB announced its determination to be the lender of last resort is the initial level of the spread. Countries whose spread had climbed the most prior to the ECB announcement experienced the strongest decline in their spreads – a remarkable feature.

Figure 2. Change in spreads vs. initial spreads

Source: Datastream (Oxford Economics).

In previous research (De Grauwe and Ji 2012) we provided evidence that prior to the regime shift made possible by the ECB a large part of the surges in the spreads were the results of market sentiments of fear and panic that had driven the spreads away from their underlying fundamentals. Figure 2 tends to confirm this. By taking away the fear factor the ECB allowed the spreads to decline. We find that the decline in the spreads was the strongest in the countries where the fear factor had been the strongest.

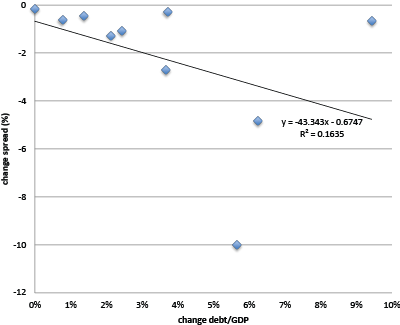

What about the role of fundamentals in explaining the decline in the spreads observed since the middle of 2012? Figure 3 provides the evidence. We selected the change in the government debt-to-GDP ratio as the fundamental variable as suggested by many studies (Aizenman and Hutchinson 2012, Attinasi, et al., 2009, Beirne and Fratscher 2012, De Grauwe and Ji 2012). We observe two interesting phenomena in Figure 3. First, while the spreads declined, the debt-to-GDP ratio continued to increase in all countries after the ECB announcement. Second, the change in the debt-to-GDP ratio is a poor predictor of the declines in the spreads. Thus the decline in the spreads observed since the ECB announcement appears to be unrelated to the changes of the debt-to-GDP ratios. If anything, the fundamentalist school of thinking would have predicted that as the debt-to-GDP ratios increased in all countries, spreads should have increased rather than decline.

Figure 3. Change in debt-to-GDP ratio vs. spreads since 2012Q2

Source: Datastream (Oxford Economics).

From the previous discussion one can conclude that a large component of the movements of the spreads since 2010 was driven by market sentiments. These market sentiments of fear and panic first drove the spreads away from their fundamentals. Later as the market sentiments improved thanks to the announcement of the ECB, these spreads declined spectacularly. This was predicted in De Grauwe (2011), Wolf (2011) and Wyplosz (2011).

We can now give the following interpretation of how the spreads exerted their influence on policymakers and led them to apply severe austerity measures. As the spreads increased due to market panic, these increases also gripped policymakers. Panic in the financial markets led to panic in the world of policymakers in Europe. As a result of this panic, rapid and intense austerity measures were imposed on countries experiencing these increases in spreads. The imposition of dramatic austerity measures was also forced by the fact that countries with high spreads were pushed into a liquidity crisis by the same market forces that produced the high spreads (De Grauwe 2011). This forced these countries to beg ‘cap in hand’ for funding from the creditor countries.

The Effects of Panic-Driven Austerity

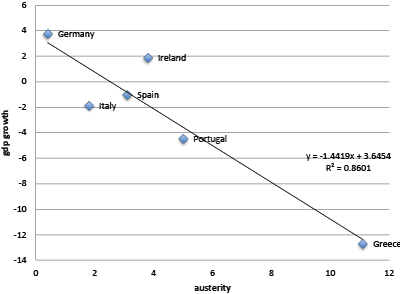

How well did this panic-induced austerity work? We provide some answers in Figures 4 and 5. Figure 4 shows the relation between the austerity measures introduced in 2011 and the growth of GDP over 2011-12. We find a strong negative correlation. Countries that imposed the strongest austerity measures also experienced the strongest declines in their GDP. This result is in line with the IMF’s recent analysis (IMF 2012).

Figure 4. Austerity and GDP growth 2011-2012

Source: Financial Times and Datastream.

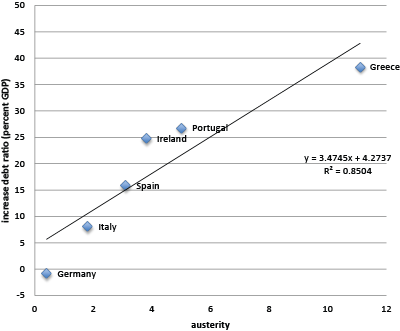

Some will say that this is the price that has to be paid for restoring budgetary orthodoxy. But is this so? Figure 5 may lead us to doubt this. It shows the austerity measures and the subsequent change in the debt-to-GDP ratios. It is striking to find a strong positive correlation. The more intense the austerity, the larger is the subsequent increase in the debt-to-GDP ratios. This is not really surprising, as we have learned from the previous figure, that those countries that applied the strongest austerity also saw their GDP (the denominator in the debt ratio) decline most forcefully. Thus, it can be concluded that the sharp austerity measures that were imposed by market and policymakers’ panic not only produced deep recessions in the countries that were exposed to the medicine, but also that up to now this medicine did not work. In fact it led to even higher debt-to-GDP ratios, and undermined the capacity of these countries to continue to service the debt. Thus the liquidity crisis that started all this, risks degenerating into a solvency crisis.

Figure 5. Austerity and increases in debt-to-GDP ratios

Source: Financial Times and Datastream. Note: The Greek debt ratio excludes the debt restructuring of end 2011 that amounted to about 30% of GDP.

Conclusion

Three conclusions can be drawn from the previous analysis.

• Since the start of the debt crisis financial markets have provided wrong signals; led by fear and panic, they pushed the spreads to artificially high levels and forced cash-strapped nations into intense austerity that produced great suffering.

They also gave these wrong signals to the European authorities, in particular the European Commission that went on a crusade trying to enforce more austerity.

Thus financial markets acquired great power in that they spread panic into the world of the European authorities that translated the market panic into enforcing excessive austerity. While the ECB finally acted in September 2012, it can also be argued that had it acted earlier much of the panic in the markets may not have occurred and the excessive austerity programs may have been avoided.

• Panic and fear are not good guides for economic policies.

These sentiments have forced southern EZ countries into quick and intense austerity that not only led to deep recessions, but also up to now, did not help to restore sustainability of public finances. On the contrary, the same austerity measures led to dramatic increases of the debt-to-GDP ratios in southern countries, thereby weakening their capacity to service their debts.

In order to avoid misunderstanding, we are not saying that southern European countries will not have to go through austerity so as to return to sustainable government finances. They will have to do so. What we are claiming is that the timing and the intensity of the austerity programs have been dictated too much by market sentiments of fear and panic instead of being the outcome of rational decision-making processes.

• Financial markets did not signal northern countries to stimulate their economies, thus introducing a deflationary bias that lead to the double-dip recession.

The desirable budgetary stance for the Eurozone as whole consists in the south pursuing austerity, albeit spread over a longer period of time, while the north engages in some fiscal stimulus so as to counter the deflationary forces originating from the south. The northern countries have the capacity to do so. Most of them have now stabilised their debt-to-GDP ratios. As a result, they can allow a budget deficit and still keep their ratio constant. Germany in particular could have a budget deficit of close to 3%, which would keep its debt-to-GDP ratio constant. Given the size of Germany, this would allow for a significant stimulus for the Eurozone as a whole.

The intense austerity programs that have been dictated by financial markets create new risks for the Eurozone. While the ECB 2012 decision to be a lender of last resort in the government bond markets eliminated the existential fears about the future of the Eurozone, the new risks for the future of the Eurozone now have shifted into the social and political sphere. As it becomes obvious that the austerity programs produce unnecessary sufferings especially for the millions of people who have been thrown into unemployment and poverty, resistance against these programs is likely to increase. A resistance that may lead millions of people to wish to be liberated from what they perceive to be shackles imposed by the euro.

____

For references, see original article at VoxEU

IMHO, the premise of this eminently nuanced and respectable post is wrong. The real economy does not exist for the purpose of validating the expectations of financial markets. Financial markets do not exist to support the life of states and their populations, but rather to strip mine them and capitalize on their weakness whenever possible. And the spreads on the PIIGs or whatever you call these desperate countries these days haven’t narrowed because lenders stopped panicing. They narrowed because the shorts started panicing for the very good reason that they feared losing their ass in consequence of ECB bond buying.

The peripheral countries continue to play this idiotic Euro game solely for the benefit of corrupt elites, whose strategy continues to be looting as much of the loan proceeds as possible and leaving the populations holding the bag.

I think your point that governments are not meant to serve the whims of the market is actually another conclusion that can be drawn from this analysis: By catering to the “signals” from the “market”, the EU and national governments have been committing economic suicide.

This also suggests still another conclusion: The idea that “markets” function as some sort of analytical engine is a joke. Keynes was right, the market price is mostly a reflection of the estimations by the traders of what their colleagues will pay for a stock; not some magical or mystical conjuring of a “correct” price. We need to restore markets to a functional role in society, one in which they are used as a medium for trade and exchange, not an oracle of scientific truth.

Jake,

Your point is validated in historical documentation-it is financial sector itself

who games this advantage. I have told many, many friends, when IMF steps in to loan $$$$ to AmeriKa, it’s long past time to leave..(“K-Street” AmeriKa)

Historically, there are several steps prior-check South-Central American historical, 70’s-80’s..Milton Friedman-Chicago boys..

“when IMF steps in to loan $$$$ to AmeriKa, it’s long past time to leave..”

And go — WHERE? As Yves pointed out in a response to some other post, for those of us “of a certain age,” there are precious few countries that will take immigrants unless they are rich, and can buy their way in.

So far, a few Central and South American nations, along with some in SE Asia, remain possibilities. The European countries, Canada, Australia and New Zealand are out. You really have to be loaded to land anywhere in what was lately called “the first world.” Bet that moniker won’t last long…

Your point has merit. It could be argued that after the ECB reduced interest rates to rescue banks, certain financial players artificially inflated the spreads to generate large revenues despite low interest rates. The euro has been quite profitable for them.

“The real economy does not exist for the purpose of validating the expectations of financial markets.”

Yes, it does. That’s called “confidence.”

[rimshot. laughter]

Except not?

I can demonstrate an alternative explanation with a simple question; even if the spreads on Greek debt were still very high would you be willing to invest your own money in public and/or private Greek debt?

If you would be unwilling to throw your money away in Greece, what makes you think other investors would be willing to invest in Greece? The country has to get onto solid ground before investors are willing to return and austerity is the only way for that to happen …

John Dizard of the Financial Times has in fact at various points recommended Greek debt. The rule of finance is everything can be solved by price.

Was he the guy recommending Lehman Bros stock in 2008?

Greek Debt has a value only so long as the ECB supports it. Buyers of Greek Debt are merely placing bets on what the ECB will do next. Thus the market tail is wagging the economic dog, and the Greek population is paying the food bill as the tail gets bigger and bigger and bigger, and the dog shrivels up to a whimper.

“The country has to get onto solid ground before investors are willing to return and austerity is the only way for that to happen.”

Perhaps echoing Yves’s point somewhat, I disagree: Investors will be willing to invest when they expect other investors will be willing to invest. In other words, “solid ground” isn’t that important; it’s the willingness of the traders to take a risk on future return, which, as I mentioned above with reference to Keynes, depends on the estimation that other traders will want to buy in the future.

Now, that will likely include some consideration of whether the financial state of the country; but that’s not the whole conclusion, and I suggest, often is not even the chief conclusion. If you think back to the dot-com boom, many companies that had huge valuations had lousy fundamentals and even poorer future prospects; yet the market supported sky-high stock prices. Similarly, those of us how saw the 2007 crash coming knew for years that the real estate prices could not be sustained by any economic fundamentals; yet again, the market ignored the reality and kept bidding up prices.

My own view is that what has been happening has less to do with economics than with sociology: The elites, the wealthy and their technocrat handmaidens, want to transform Western society into their uptopian vision, a vision which makes them all-powerful and crushes the “lazy” and sick. The elites believe in the dogma of the Chicago School and the infallibility (as in Papal) of the “market”, which, of course, just happened to make them rich in the first place. The crash of the markets then was just the sort of “shock” to justify not a re-evaluation of the silly ideas that have taken over modern economics, but a re-engineering of society to destroy the social welfare state and return society to a aristocrat-peasant social structure.

David Sir,

An excellent post – really enjoyed reading your comment and thoughtful insight.

As an aside to this issue, its clear to anyone from a non-economics background that our socioeconomic system currently in place has both a political component, and economic component – it being impossible to take the politics out of economics, regardless of what the neoliberal’s would have us believe, i.e., in our present kleptocracy it is those with the wealth/money that have all the power and hence influence political outcomes that best serve the status quo – democracy being but an illusion if no change occurs regardless of whom one votes for – this being the present ‘Washington Consensus’ driven by neoconservatives and aided and abetted by our neoliberal friends of most political persuasions – this can be witnessed all across the EU, USA, Canada, Australia and New Zealand.

So, by drawing on parallels gleaned from proper sociological enquires, it is actually more than possible to outline in detail all failings of the present socioeconomic setup, than to rely on supposedly unbiased economical assessments, the outcome of which usually screams ‘austerity’ of one form or another.

Indeed, from a economic history perspective, all gains made by the ‘commons’ from the 1870’s through until the mid 1970’s are being dismantled by those with the economic power under the guise of austerity – this being strange in countries who’s monetary systems remain sovereign, i.e., the UK, USA, Canada and to a lesser extent, Australia, all of whom engage in fiat currencies – the Euro Zone countries being the exception to the rule presently.

Again, looking at matters via the lens of economic history, we can see that the gains made via the advent of democracy in the Western hemisphere have been rather short lived, and here I see parallels with the gains made by labour in the aftermath of the Black Death in the fourteenth century that culminated in the Peasants Rebellion in England – such was the emboldenment of the ‘commons’ which desired more than just economic or monetary gains – obviously, said peasants rebellion was ultimately turned back by the dominant socioeconomic powers of the day and the leaders mostly killed by the authorities.

So, yes, sociological enquiry can explain a lot, but lets not forget economic history, and, as the old saying goes, whilst history cannot predict future outcomes, it can certainly inform them, particularly if we are willing to learn from past mistakes.

Regrettably, such an analysis would indicate that only an actual revolution can return some semblance of power back to the commons, particularly given the fact that present money concentrations suggest we are moving back to a medieval system, with corporations taking the place of Guilds.

Chris,

“It has a political AND economic component”….but further, ECONOMIC component has 2 parts-economics of daily life, markets, AND “financial sector”

driving speculative profit$…which is where the world is, at the moment, driven..

@nonclassical,

You are indeed correct, perhaps we should call the financial element found within present day economics what it actually is: GREED, and it is this greed which is the ruination of most nation states presently, particularly when it applies to the commons – austerity in Europe and the USA being directly correlated with out and out greed – that our political masters not only allow this, but actually foster it is the most shocking thing at hand, as indicated in my OP, our present political systems mirrors the economics of greed pursued by those with great wealth and with this, power, which is a good definition of the neoconservative nightmare we presently find ourselves in.

1. The people writing at VoxEU are obviously so afraid of being called out to the truth, that they dont allow direct comments.

2. Grauwe has the timing and therefore cause and result wrong, as always and as it suits the agenda of eurointelligene.

To the day exact, http://www.bloomberg.com/quote/GBTPGR10:IND long term rates dropped on 7th of September,

one day after the ECB announced http://www.ecb.int/press/pr/date/2012/html/pr120906_1.en.html that

“A necessary condition for Outright Monetary Transactions is strict and effective conditionality attached to an appropriate European Financial Stability Facility/European Stability Mechanism (EFSF/ESM) programme.”

“The liquidity created through Outright Monetary Transactions will be fully sterilised.”

“Following today’s decision on Outright Monetary Transactions, the Securities Markets Programme (SMP) is herewith terminated. ”

That means that without and prior to a programme agreed upon by the ESM, where Germany has a blocking VETO, not a single cent of bonds could be bought anymore, effective immediately.

3. Further relief (first time under 5%) came, when the Supreme Court (Bundesverfassungsgericht) made it clear, that the liability limit of the ESM could not be expanded without a vote of the sovereign, the Bundestag.

Why otherwise has Rajoy shriekd back from applying, when he now has to admit, that the Spanish debt went from 63 to 84% GDP in 2012, if getting the money printed would be easy now?

in further contrast to the blantantly false statements of Paul de Grauwe and friends,

– not a single Euro country has run a budget surplus in 2012, according to “The Economist” and the CIA World factbook

– The Stability Pact is in place and that means, that the excess debt has to be reduced and not extended. There is no ZERO legal room for the proposals of de Grauwe.

– Over the last year Grauwe and friends, (INET, eurointelligence, Soros, etc. ) have engaged in a systematic campaign demanding crimes of the most severe, capital nature against the fundamental Euro treaties.

– A lot of people here are very curious, how much Soros and other speculators pay their agents, to abuse their university positions for doing his bidding.

People feel better, after it is now clear, that the ECB is not criminally abused to transfer giant amounts of money from poor German tax payers to rich tax cheaters in other countries. Germany had marginal tax rates of 60%, when the country needed the money.

Italians are on average richer than Germans, and we should take property tax at 500k in Germany to subsidize 3000 k mortgages in Ireland?

What is your solution proposal, given you might have some empathy somewhere in your heart for the distress of ordinary people in the Eurozone periphery ?

Cry me a river. You are all Europeans until the bills fall due and then suddenly you all turn back into Germans, Greeks, Spaniards and barely know each other.

As for poor Germans bailing out profligate Southerners, give it a rest. Why should either the German 99% or the Southern 99%s be on the hook for the bad loans of German banks? German politicians are simply using the South as a convenient whipping boy.

Didn’t some guy once say, “The only thing we have to fear is fear itself?”

http://m.youtube.com/#/watch?v=amNpxQANk0M&desktop_uri=%2Fwatch%3Fv%3DamNpxQANk0M

It’s all just a rehash of Divine Right of kings, this ‘rational market’ notion. It says, “God is perfect and infallible. I have been born as the king. Therefore God ordained I should be King. Therefore I am perfect and an instrument of the divine will.”

Again a fine analytical piece by Paul De Grauwe – who is one of the European economists we should listen to – and Yuemei Ji. But unfortunately the analysis is incomplete, and therefore the advice too.

Even more than from government debt and cross-country imbalances which have to be internalized in due course by transfer payments and other mechanisms, the Eurozone suffers from a declining labour share of income for more than 30 years.

Some labour share changes 1980-2013, as pct of GDP (AMECO 10/2012):

Austria: – 8.9

Belgium: – 5.0

Finland: – 7.1

France: – 7.8

Germany: – 5.5

Greece: -12.4

Ireland: -21.2

Italy: -12.4

Luxembourg: -10.2

Netherlands: – 9.1

Portugal: -12.6

Spain: -15.4

What the economic doctor should prescribe is mainly: considerably higher wages and higher tax collection from multinational corporations (fight against tax avoidance and evasion), as well as some higher taxation of high income earners and the ueber-wealthy.

Such a program would go a long way to correct the fundamental imbalance, relieve the pain, create growth by increasing aggregate demand, share the wealth we are able to produce, avoid rising debt and negative real interest rates.

However, the most important short term economic policy goal in the Eurozone should be to help the unemployed, and give the young people in the periphery countries a life perspective.

@ Gerold,

1. please take a look at the first graph in

http://conversableeconomist.blogspot.de/2013/01/wealth-income-ratios-in-long-run.html

there is plenty of wealth to be taxed in Spain and Italy.

According to your german name, I assume that you know,

that the German Green party & social democrats want to tax German wealth by some cumulative 15%, to make ends meet.

I see plenty of more room in Italy and Spain to wipe out all their national debt, before they become “as poor as Germany”

2. raising marginal income taxes to prior German levels

There is still substantial room for raising that in most GIPSI states. Portugal just did it, begin of this Year.

3. In Ireland public wages are still higher by at least 10%, compared to Germany. Issining mentioned that, when he left office last year. Why should German public employees, who certainly didnt get pampered the last 15 years, subsidize this?

4. Budgets and laws are national budgets. The rest of the EU also didnt pay, when we had hard times. And Finland (20% unemployment in the mid 90ties, Sweden, NL)

This German victim mentality is getting very tiring. The fact is that the European taxpayer is subsidizing and on the hook for the stupidity of German banks:

“… Here’s how it worked. When German banks pulled money out of Greece, the other national central banks of the euro area collectively offset the outflow with loans to the Greek central bank. These loans appeared on the balance sheet of the Bundesbank, Germany’s central bank, as claims on the rest of the euro area. This mechanism, designed to keep the currency area’s accounts in balance, made it easier for the German banks to exit their positions.

Now for the tricky part: As opposed to the claims of the private banks, the Bundesbank’s claims were only partly the responsibility of Germany. If Greece reneged on its debt, the losses would be shared among all euro-area countries, according to their shareholding in the ECB. Germany’s stake would be about 28 percent. In short, over the last couple of years, much of the risk sitting on German banks’ balance sheets shifted to the taxpayers of the entire currency union. ”

This exactly what happened with all the bailouts, which were in fact bailouts of German (and to a lesser extent French) banks and not of the countries receiving “solidarity” (read: austerity and misery). Read the facts and learn:

http://www.bloomberg.com/news/2012-05-23/merkel-should-know-her-country-has-been-bailed-out-too.html

@ Alan

How do you know Bloomberg is running baseless propaganda, like your link?

When the post is “By the Editors”.

In general they are very picky to have their full names on it.

Just not when they are afraid of getting sued for lying.

How about you show me their claim of 704 billion, German banks lent to the GIPSIs? I scanned the pdf for 704 and didnt see anything associated with Germany.

But maybe you are more clever and back up YOUR allegations,

with specific references, calculations and not just some link to 150 pages pdf.

And why should the German taxpayer be responsible for one cent, you want to go bankrupt over to private banks?

If you default on the ECB “The people of Europe” bailing you out, you are a criminal bankrupter, and you fully deserve the consequences.

Yeah, it’s obvious that the Bloomberg editors are lying since they are signing as “The Editors”, which shields them from getting sued for lying!

And the BIS data (“some link to 150 pages pdf”) must be wrong because you can’t read it and couldn’t find the magic number “704” in isolation!

Congratulations. You got me, and Bloomberg, and the BIS. Too bad you can’t sue any of us!

You wrote:

“there is plenty of wealth to be taxed in Spain and Italy. … I see plenty of more room in Italy and Spain to wipe out all their national debt, before they become “as poor as Germany”.”

Comment:

True for Italy, false for Spain. Have a look at sectoral balances in Eurostat. Finacial wealth as pct of GDP is very high in Italian and very low in Spanish households.

You wrote:

“I assume that you know, that the German Green party & social democrats want to tax German wealth by some cumulative 15%, to make ends meet.”

Comment:

High wealth inequality originates from a system which distributes income unfairly, and from inheritance. Wealth inequality should be reduced based on what we the people want (see e.g. the work of Dan Ariely and Michael I. Norton which should be replicated for the Eurozone).

Interestingly you don’t comment my main proposals: higher wages and higher tax collection from multinational corporations. Why?

@ Gerold

I think it is the whole household wealth, and not just the financial, which is available and applicable for taxation.

I looked at the eurostat portal. Could you give me a hint, what variables there you have in mind? They have those variable names like “tsdec230” there. Since that portal leaves some desired to find your way around, a most precise link where you find it there, would be also nice. I am very interested in this, because the OECD Annex 58 provides that only for the G-7 nations.

I am all for a more efficient and higher tax collection on multi-nationals, LOL, even the G-20 recently went for that, at least in wording. A quite relevant link: http://ftalphaville.ft.com/2013/02/21/1394862/tax-avoidance-its-close-to-home/

I also invite everybody to show me, where German corporations, which are quite globally, are accused of something into this direction. And Hearsay is good enough for me for specifically this, at this early point of the discussion!

For wages, I have to disappoint you. The Euro is at 1.32 to the Dollar at present, not far away from the 1.25 “fair value” most people aggregate around, closely.

Wages have to be in line with the value produced, and most people say, that the main problem of the periphery is, that they are not competitive at the present wage level. Ergo, the new jobs they have to create, will be often at lower wage levels.

Did I miss anything, you want me to comment on?

Lord, what a load. It’s like conservatives and tax cuts in this country. No matter what the question is, the answer is tax cuts. With De Grauwe, no matter what the question is the answer is austerity. I assume De Grauwe would like to be considered liberal for advocating austerity lite. The notion being that while the beatings should continue until morale improves, they should not be so severe as to spark revolt among the slaves. Like I said, the sentiments of a true liberal.

I have to say I enjoyed De Grauwe’s use of impressive looking graphs to put over what is, after all, a real exercise in BS. We didn’t need markets to tell us that Greece was a basket case. But let’s face it if “markets” had really panicked there would have been no market for Greek debt. However we know that hedge funds were out there vacuuming about Greek debt on the cheap. So while some parts of the “market” were panicking, others clearly were not.

This whole trope of “fear and panic” is pretty lame to start with. One moment De Grauwe is talking about market fear and panic, the next he talking about the market making a judgment. I mean which is it? fear and panic or a judgment. If somebody freaks and jumps off a cliff, we usually say their judgment was impaired or absent. Not so for De Grauwe. In an acrobatic logical disconnect, he passes immediately to how accurate the market’s judgment was.

As others here have noted, markets did not care about the condition of Greece. What they were interested in and reacted to was what the ECB, Germany, and the rest of Europe was going to do about Greece. So far from markets driving policymaking they were following it.

Leaders in the periphery did not get caught up in the “fear and panic” of markets. There is no causal connection between fear and panic, on the one hand, and austerity, on the other. They adopted austerity because A) the core was pressuring them into it as a backdoor means of bailing out its own banking sector and B) the local wealthy classes whom they served favored austerity because it dumped responsibility for their failures and miscalculations on to the 99% and afforded them the opportunity of buying up public assets at fire sale prices.

De Grauwe also doesn’t distinguish between Greece and countries like Spain and Ireland. These governments would have been far better off if the sovereigns had not backed their insolvent banks. Both governments were doing rather well up to that point, and Spain in particular probably could have gotten good terms for its banks from the ECB, the core, and the international community in order to avoid contagion to their institutions.

I am willing to grant De Grauwe a fair degree of intelligence. So I can only ascribe pieces like this to malice.

Excellent comment, especially this paragraph:

“They adopted austerity because A) the core was pressuring them into it as a backdoor means of bailing out its own banking sector and B) the local wealthy classes whom they served favored austerity because it dumped responsibility for their failures and miscalculations on to the 99% and afforded them the opportunity of buying up public assets at fire sale prices.”

Any analysis of the crisis which doesn’t take into account the German (and to a lesser extent French) banks’ humongous exposures and their subsequent stealth bailouts is hogwash. Even Bloomberg has broken that story using BIS data for god’s sake.

http://www.bloomberg.com/news/2012-05-23/merkel-should-know-her-country-has-been-bailed-out-too.html

please back up your claims with specific numbers,

page x, column y, line z

You are the one who insists the Bloomberg editors are lying, and your only argument so far is that they sign as “The Editors” so that they can’t be sued! I guess in your world that’s an argument, but if you are going to disagree with Bloomberg, you need something a little stronger.

How about you try harder and look at the BIS data Bloomberg uses, the interpretation of which YOU disagree with, and tell us, what were the real German banks’ amassed claims on Greece, Ireland, Italy, Portugal and Spain by December 2009 if not $704 billion?

Please back up your claims with specific numbers,

page x, column y, line z.

I’ll be waiting!

Alan,

it is you, who is spreading false claims, made by anonymous “editors” on behalf of their hedge fund clients. If you could read carefully, you would see that there is no evidence to that in this document.

genauer just exposed his inner troll. It is a favorite troll tactic to treat topics which have been discussed and written about for months as suddenly new and unsubstantiated and needing verification. The tell is rather than googling the topic, doing some research, and coming back with a substantive critique, the troll tries to push this responsibility on to the rest of us. Of course, nothing would change if we did go get the data. The troll would just deny it, talk past it, or change the topic.

Did those who held high-coupon Greek debt prior to the ECB action make money when the ECB announced it guarantee? I am pretty certain they did. I have no qualifications to make investment advice, but if past practice is a good indicator for the future… As long as Greece in in the Eurozone, it would not be allowed to default. Period. Why? Because the large financial institutions (and now, the ECB) hold or guarantee that debt. Hence savvy investors who picked up Greek bonds with coupons in the high teens were confident that Greece would not default. The Greek parliament should consider this fact and reduce austerity. But really, the solution for Greece is to leave the union, default on its debts, or pay them in freshly minted Drachma, and spend like mad to bring unemployment back below 5%.

As regards this analysis, I object to this line: “Since the start of the debt crisis financial markets have provided wrong signals.” Suggesting the market was wrong here is imprecise. Actually it was the ledership’s reaction to market signals that was wrong. The market was responding to the high debt to GDP ratio, by driving up borrowing costs – a rather rational market response. The government response was to institute austerity to reduce the growth in debt. But what actually happened was that the rate of decline in the deficit was dwarfed by the decline in GDP, hence the government action was pro-cyclical – exacerbating rather than helping the problem. Very good post, however, it demonstrates in simple linear regression the arguments Yves and others have been making as regards austerity for years. Well done.

This is an interesting take (although with so few data points, and with correlation not being equal to causation, one might quibble with the logic behind some of the conclusions, even though I still think that the core arguments are correct).

However, I would respectfully submit that there is one massive whopper of a mis-assumption here: the assumption that there is in fact such a thing as a “financial market”. In a true market, private investors who make bad investments lose money. That did not occur here: the investors are being bailed out with public funds. Thus, what we have is not in any conventional sense a “market”, and it should not be analyzed as such.

Also, I think that we need to be careful in using the term “austerity”. Greece and Portugal etc. are most definitely NOT practicing austerity, these governments are spending money in massive amounts. It’s just that they are spending in on bailing out creditors – but they are still spending it. It’s always a bad idea to use the terminology of the enemy. Let’s not call it “austerity”. Let’s call it stripping the real economy to subsidize finance – I can’t think of a catchier phrase, help anyone?

I am more of a Keynesian than anything else, but still, if European governments were REALLY practicing austerity – cutting government spending across the board, and taxes as well – I’m not saying that we would have a libertarian nirvana, but it might have been a lot better than what we have now.

http://www.newstatesman.com/economics/2013/02/how-austerity-was-based-market-panic Another summatio …

Left unsaid in this piece is that, facing fear and panic, traders, ruling elites and their administrative proxies responded with the default program of intensified class warfare.

I don’t think austerity measures are effective when way more concerned economic agents or stakeholders are reluctant to embrace them. Well, it is productive when at least a sufficient number of economic players agree to them.

http://theglobalecon.com/economic-spending-is-a-massive-pro-to-the-global-economy/

@ Hugh

A lie does not become true, just because it is repeated often.

If you discussed this for many months it should be very easy for you or Alan to provide evidence, if you ever had any. The Bloomberg link certainly is not. And don’t forget to subtract equivalent liabilities from the assets. And it would not justify to demand money from “The people of Europe”.

Instead YOU resort to slander.

I provided above very specific, and immediately understandable evidence, when I called out De Grauwe on his false claims of timing of the rate drops and the budget manoeuvring room of northern Euro states.

Honest an careful people provide references that other can go to, if needed much later, to see whether that really shows, what is claimed.

De Grauwe has now repeated his demands to commit the serious crimes of breaking the Maastricht treaty and the stability pact.

De Grauwe is working for Soros’s INET.

Soros is a very famous speculator, still active, he just made a billion betting on the yen. This is not some benevolent philantrop.

Even the Financal Times just brought a piece

http://ftalphaville.ft.com/2013/02/20/1393492/when-choked-gold-responds-to-hedging-demand-and-soros/

laughing about the people Soros takes to the cleaner, because they follow his “news”.

“Better to remain silent and be thought a fool than to speak out and remove all doubt”.

The evidence is by the BIS. It has been used by countless analysts to see what the exposure of German (or whatever country’s) banks was to the periphery or anyone on the planet- and to extrapolate any kind of such data, including assets, liabilities, by country, and so on. The Bloomberg article provides the link to the report:

http://www.bis.org/publ/qtrpdf/r_qa1203.pdf

The BIS site has all the past reports plus tools to extrapolate data as needed. If you were really interested, you would have found it yourself.

But since you can’t read it and can’t add the numbers to get to the magic “704 bn”, I did a one minute google search to find for you something easier to read than a 150 pages pdf, and guess what, here is seekingalpha with lots of simple graphs with even more damning evidence: German banks’ exposure was even higher before Dec. 2009, and at its peak in Q1 2008.

**************

“Lending by eurozone core to the periphery

As you can see in figure 1, German banks have retrenched their lending to the PIIGS from a peak of €917 billion ($1,218.63) in Q2 2008 to a €383 billion ($ 508.956) in Q2 2012. The German exposure was about 37% of its GDP at the peak in Q1 2008 compared with the 15% at the end of Q2 2012. Similar has been the case with French as well as the Dutch banks too (see figure 2 and figure 3). In the case of the French banks, the exposure dwindled from 52% of the GDP at the peak to 22% at the end of Q2 2012, while the Dutch banks’ exposure dwindled from 63% of the GDP to 19%. With the year-over-year declines in the banking exposure to the PIIGS hovering between 25% and 35% in these countries, the periphery has been experiencing the classic case of “sudden stop” with inter-bank lending virtually coming to a halt. As a result of the “sudden stop,” the slack in private lending has been picked up by ECB, the lender of last resort, the sovereign governments in the periphery, the duo of European Commission and IMF, and the bloated TARGET2 balances. The total exposure of banks from core eurozone countries Germany, France, Netherlands, Austria and Belgium to PIIGS dropped from €2.6 trillion in Q1 2008 to €1.0 trillion in Q2 2012 (see figure 4).”

http://seekingalpha.com/article/1072841-exit-of-the-periphery-from-the-eurozone-is-inevitable

***************

The graphs are so simple, even a child could understand them.

Here is figure 1 which is the whole story:

http://static.cdn-seekingalpha.com/uploads/2012/12/533843_13558561303087_rId5.png

Here is another very thorough article, by Forbes, coming to the same conclusions and the same numbers:

http://www.forbes.com/sites/richardfinger/2012/06/28/germany-and-their-dirty-little-big-secrets/2/

Now you have two choices. You can disappear, or you can try to argue that seekingalpha, Forbes, Bloomberg and pretty much anyone using the most comprehensive data there is, the BIS data, and coming to the same conclusions, is a hedge funds or a Soros agent or whatever who tries to slander the poor German banking sector by fudging data available to anyone!

In any case, I think you should take the quote at the top of this link seriously. Actually, let me repost:

“Better to remain silent and be thought a fool than to speak out and remove all doubt”.

Adios

@ Alan

it is not “adios” for me, just starting.

Excellent! Thank you very much. Now we are talking!

This is getting much better than I actually expected.

First, you really did your homework, this is much more than is usual the case, and came up with 3 sources:

1. Bloomberg

2. SeekingAlpha

3. Forbes

I estimate, that your financial knowledge and insight is in the upper 1%, and it also shows your diligence, and patience.

But I am pretty sure, that you are still substantially, and let us go into the details here:

1. Bloomberg

If anybody succeeds, to construe a number reasonably close (+/- 5%) to the 704 bn claimed by anonymous Bloomberg editors, from the BIS r_qa1203.pdf, I am still interested, because I can’t. It is not necessary, that this is a correct construction, just how you would do that.

Until around this time, June 2012, I also believed, that the Bloomberg folks know what they are doing, since they cater to people moving huge amounts of money around. Unfortunately not anymore, and I also lost trust in their integrity.

2. SeekingAlpha

Interesting work, your reference. In former times I also read this “investor porn”, so no “holier than you” attitude here, not at all.

Nice graphs, over a sufficiently long period of time, much better than average.

But what does “Exposure” mean? Is this “assets”, or assets minus liabilities? Or the plus sum of assets, plus notional futures, plus notional CDS, and forgetting nearly equil, offsetting liabilities?

The post remains very silent on that.

I hope that I can provide a substantially more detailed analysis very shortly, I had actually a discussion last summer, but it doesn’t help here fill many pages with wildly formatted tables.

3. Forbes

They discuss there mainly the famous (Sinn vs. Whelan/Buiter) “Target 2” accounts. But those are not liabilities some private individuals or corporations/banks in Country X have to similar establishments in Germany, but “The people of Ireland” towards “the people of Europe” (ECB) , and then those, by 25%, to “the people of Germany”, via their Central Banks.

This would have very different, and way more serious repercussions, than a private entity going bankrupt on another private entity.

I am very aware, that the paying customers of Forbes, Bloomberg would like to have the very solidaric and that way milkable taxpayers of Germany on the hook for the obligations of other people, but we took care that it isn’t that way : – )

aaargh,

“substantially” has to be “SUBSTANTIALLY wrong”

test

@ Alan and all,

The Update, I promised:

1. I am able to reproduce the Bloomberg „704“ from BIS accounts, just not from the pdf they and Alan referenced

2. I am able to reproduce the plot from “Seeking Alpha” from BIS queries like:

(the blog apparently doesnt like such long references)

I am willing to help her people in the same way, I was helped then there.

5. NET exposure of German banks to GIPSIs is as of 2012-Q3 now down to 58,474 m$, or 1.7% of GDP $3.367 trillion. When Germany was not sure about how crazy some of our neighbors could be, Soffin II was reactivated, with a 24/7 loaded gun of nearly 500 bn Euro, to cover the complete German bank sector 1:1, if necessary.

I can plot, table data for further discussion, on slideshare etc., if somebody is interested here.

I have so far no idea, why this blog blocks certain stuff, which is text-only

so I try this here in some weird piece meal fashion, to

3. But the numbers, presented there are highly misleading, because they are “assets”, and not NET = “assets minus liabilities”