By Nicholas Levis, who writes for OWS Alternative Banking blog (alternativebanking.nycga.net). Any opinions and errors are his. Originally published at OWS Alternative Banking.

Let us take a look at the careers of two men who live in the incestuous world that C. Wright Mills, in his classic and still-contemporary 1956 study, called The Power Elite. As Mills wrote and many others since have found, the really key people at the rarified heights of American power and policy tend to rise up from a narrow group of universities, enter the same country clubs (like the Council on Foreign Relations), and in their careers revolve seamlessly between high positions in the “private” and “public” sectors. They serve the needs of the far-less-than-one-percent who effectively own both sectors; in the course of which they usually make themselves stinking rich (in those cases when they weren’t already born that way). If you want to see a great film about these meritocrats (a term originally coined ironically in the 1950s by UK political scientist Michael Young), we recommend Lewis Lapham’s terrific documentary musical, “The American Ruling Class” (2005), which also foresaw the nascent rebellion of the 99%.

Now let us meet David S. Cohen of the US Treasury Department and Stuart Levey of HSBC – or is it the other way around?

1) Since June 2011, the Under Secretary for Terrorism and Financial Intelligence at the United States Department of the Treasury has been one David S. Cohen (Yale Law School, 1989). Quoting his bio at the Treasury Department’s website, “As Under Secretary for Terrorism and Financial Intelligence, Cohen leads the Treasury Department’s policy, enforcement, regulatory, and intelligence functions aimed at identifying and disrupting the lines of financial support to international terrorist organizations, proliferators, narcotics traffickers, and other illicit actors posing a threat to our national security. He is also responsible for directing the Department’s efforts to combat money laundering and financial crimes” (all italics ours). Cohen had already been Assistant Secretary for Terrorist Financing since 2009.

2) Based on these portfolios, we would rightly expect Mr. Cohen’s responsibilities during the last two years to have included gathering intelligence on the notorious money laundering entity HSBC. The “too big to fail” megabank recently admitted to laundering billions of dollars for the Mexican and Colombian drug cartels and to violating rules on dealings with “terrorist” organizations in a settlement with the Justice Department that absolved all HSBC executives from a federal criminal investigation (December 2012).

3) David S. Cohen (it’s important to distinguish him from other David Cohens of note) also worked for the Treasury in 1999 to 2001, when he “was involved in crafting legislation that formed the basis of Title III of the USA PATRIOT Act, the 2001 update to the Bank Secrecy Act that provided Treasury new tools to combat money laundering and the financing of terrorism.” Once again, sounds just like HSBC!

4) In between his first stint at Treasury and his current stint at Treasury, Cohen worked seven years for the ginormously influential DC legal firm, Wilmer Hale Cutler Pickering Hale and Dorr LLP, where he focused on “civil and criminal litigation, the defense of regulatory investigations into accounting and financial fraud, and anti-money laundering and sanctions compliance advice for a broad range of financial institutions including banks, broker-dealers, insurance companies, mutual funds and hedge funds.” In other words, in his current job at the Treasury Cohen is supposed to investigate the very same kind of entities that he had spent seven years defending while at Wilmer Hale.

5) The doors for Cohen have been revolving a lot longer than that. In the 1990s, Cohen practiced nine years at the DC firm Miller, Cassidy, Larroca & Lewin LLP, specializing in “white collar criminal defense and civil litigation,” again working as defense counsel for the kinds of firms he is now supposed to be investigating. Miller Cassidy later merged into an even more ginormous DC lawyer-lobbyist entity, Baker Botts LLP of Dallas and Washington (in which the “Baker” is none other than the former Secretary of State and Bush family consigliere, James Baker).

While at Miller Cassidy, Cohen would have surely made the acquaintance of another high-powered lawyer working there in nearly all of the same years. His name is Stuart Levey.

So who is Stuart Levey and why do we care?

6) Stuart Levey (Harvard Law School, 1989), worked at Miller Cassidy (the later Baker Botts) as a litigation practitioner for 11 years before joining the Justice Department in 2001. In 2004, the Bush government appointed him the first Under Secretary for Terrorism and Financial Intelligence in the US Department of the Treasury, a position in which he served also under President Obama until February 2011. In other words, Stuart Levey was the almost-direct predecessor to David S. Cohen as the “top cop” at Treasury for investigations into money laundering, terrorism and the international drug cartels. And this after both men had once worked at Miller Cassidy for nearly a decade in the 1990s.

5) More about Stuart Levey’s intimate connections to both the US Treasury and the Justice Department: “After leaving the Treasury Department, Mr Levey was a Senior Fellow for National Security and Financial Integrity at the Council on Foreign Relations. Prior to his Treasury appointment, Mr Levey served as the Principal Associate Deputy Attorney General at the US Department of Justice, having previously served as an Associate Deputy Attorney General and as the Chief of Staff of the Deputy Attorney General.”

6) Where is Stuart Levey today? Why, he’s on the HSBC Board of Directors as the Chief Legal Officer of HSBC Holdings plc, the parent company of HSBC operations worldwide. We got all this information about Mr. Levey from his HSBC bio page. There we learned that he has been the drug money-laundering megabank’s Chief Legal Officer since January 2012. Thus, he would have been intimately involved in (and legally responsible for) the crafting of HSBC’s December 2012 “Get Out of Jail Free” settlement with the Justice Department. Intelligence from David S. Cohen’s group at Treasury must have also played a role in advising Justice on the historic settlement.

Our last claim is, again, based on Cohen’s portfolio; if he was not at all involved in the process leading to the DOJ/HSBC settlement, then just what is the purpose of his job?

Until now we have been privy to few details about what inside dealings went on in advance of the settlement, other than admissions from the recently disgraced and departed Deputy Attorney General Lanny Breuer that DOJ indeed considered the bank too big to fail. Last week, however, Attorney General Eric Holder reinforced before the Senate Banking Committee that he believes the executives of some banks are impossible to prosecute under criminal law because the possible failure of their institutions would risk a general financial crash.

It gets better. Also last week, David Cohen and officials from other ostensible financial regulatory agencies were called to testify before the Senate Banking Committee on the failure to bring prosecutions of banking criminals. Sen. Elizabeth Warren questioned Cohen about the HSBC case. We’ll let the excellent coverage by Erika Eichelberger in Mother Jones tell the rest of the story:

…it’s not just HSBC—this is a systemic problem. Ten banks have been penalized in recent years for failure to comply with anti-money laundering rules. The Senate banking committee held the hearing in order to interrogate regulators at the Federal Reserve, Treasury Department, and the Office of the Comptroller of the Currency about why they are not doing more to stop these kinds of shenanigans.

All of the regulators said they were working on improving regulations and enforcement and protested that it was up to the Department of Justice—not them—to decide whether prosecution was appropriate. (The Justice Department did not have a witness at the hearing.) They were reluctant to weigh in on whether they thought HSBC should have faced trial, even though they consult closely with the DOJ on bank activities. That infuriated Warren:

The US government takes money laundering very seriously for a good reason. And it puts strong penalties in place… It’s possible to shut down a bank… Individuals can be banned from ever participating in financial services again. And people can be sent to prison. In December, HSBC admitted to… laundering $881 million that we know of… They didn’t do it just one time… They did it over and over and over again… They were caught doing it, warned not to do it, and kept right on doing it. And evidently made profits doing it. Now, HSBC paid a fine, but no individual went to trial. No individual was banned from banking and there was no hearing to consider shutting down HSBC’s actives in the US… You’re the experts on money laundering. I’d like your opinion. What does it take? How many billions of dollars do you have to launder for drug lords and how many sanctions do you have to violate before someone will consider shutting down a financial institution like this?

David Cohen, the undersecretary for terrorism and financial intelligence at Treasury, responded that his department had imposed on HSBC “the largest penalties we’ve imposed on any financial institution.”

Warren got annoyed. “I’m asking: what does it take to get you to move towards even a hearing to consider shutting down operations for money laundering?” she said.

Cohen kept evading and Warren got more annoyed. “I’m not hearing your opinion on this,” she said. “What does it take even to say, ‘here’s where the line is’? Draw a line, and if you cross that line you’re at risk for having the bank closed.”

Cohen said he had views, but couldn’t get into it.

“It’s somewhere beyond $881 million in drug money,” Warren concluded on her own, and went on to spell out the injustice of it all. “If you’re caught with an ounce of cocaine, you’re going to go to jail… But if you launder nearly a billion dollars for international cartels and violate sanctions you pay a fine and you go home and sleep in your own bed a night.”

The claim from Treasury officials at the hearing was that they couldn’t move to pull HSBC’s license to kill to bank as long as Justice had not filed criminal charges. So Treasury and the other agencies couldn’t do nothin’, because Justice was too busy doing nothin’, apparently because Treasury wasn’t advising them to do anythin’.

As we consider this round-robin of abdication from the pretense that the government has either the responsibility or the power to prosecute the World’s Gangster Banks, remember our meritocratic takeaway for today:

HSBC’s top counsel, Levey, preceded Cohen at his present job as the top money laundering “investigator” at Treasury, after both spent nearly a decade together at the same high-priced DC law firm.

Small world!

Lambert here. Levis writes:

So Treasury and the other agencies couldn’t do nothin’, because Justice was too busy doing nothin’, apparently because Treasury wasn’t advising them to do anythin’.

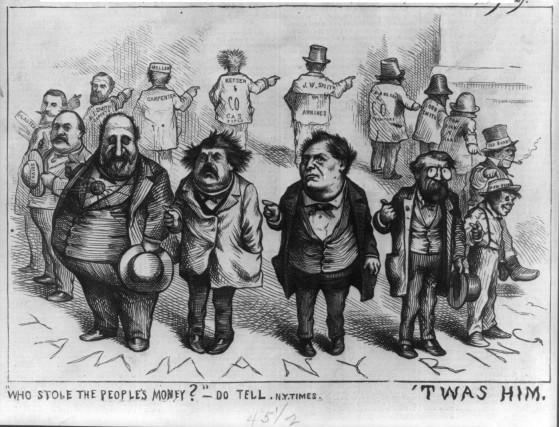

Speaking of Democratic fingerpointing and blame-shifting, this cartoon by New York cartoonist Thomas Nast, of another corrupt regime in the last Gilded Age — Boss Tweed’s Tammany Hall — comes to mind:

Caption: “Who stole the people’s money? Do tell. ‘TWAS HIM!”

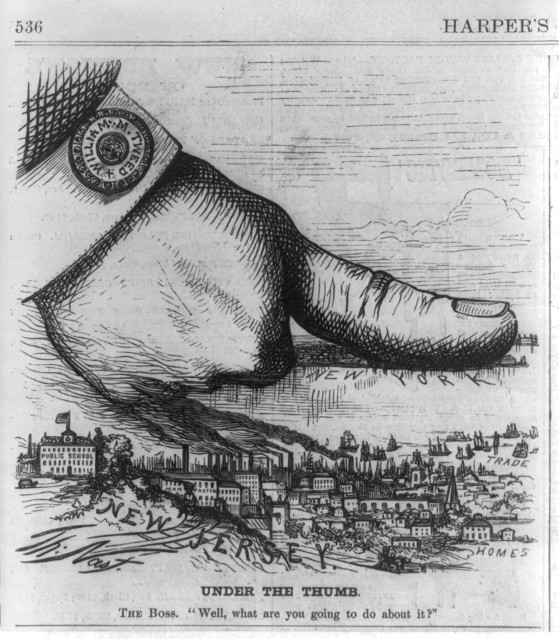

Although perhaps this Nast cartoon would be more appropriate, for the general situation, at least:

Caption: UNDER THE THUMB. The boss: “Well, what are you going to do about it?”

Well, it’s complicated.

Not.

“Obfuscated” is one of my favorite words. It sounds like what it means.

Obscure? Unintelligible? Seems clear to me.

I mean, it’s not complicated; or rather, the purpose of the complication is obfuscatory.

Yes. Like all those foreclosure modifications: theft by obfuscation.

Orders from the Capo di tutti capi.

Yes, and then the new regulations cause even more obfuscation.

Given the pervasiveness of the corruption on display you have to wonder if the fine will even be paid. Assuming it is, will a mechanism be put in place to “refund” it back to HSBC.

My guess is the refund option will be used to make the poor little banksters whole.

Well gee, who did get shut down then, and why?

BCCI – Bank of Commerce and Credit International. It got shut down over 20 years ago for money laundering and other assorted crimes. Allegedly Bush, Sr wasn’t all too pleased but John Kerry made a big stink.

Oh, for the good old days…..

BCCI was shut down. *That* was the *official* story. It turns out that it just got “merged” with HSBC.

(Joke)

How cozy. Levey spends the last decade working at Treasury heading up terrorism and financial intelligence and then just happens to land a job where all the terrorists have long done their banking. Surely it’s sheer coincidence, he was hired solely for his unparalleled talent and expertise, no?

Really this should surprise nobody. HSBC has a long history, not only for money laundering, but almost as long for getting a pass. Here is a brief summary from the last 10 years:

In 2003, anti-money laundering (AML) agreements were signed between the Fed, NY State Banking Comm. and HSBC-US (HBUS) after failure to correct previously identified issues. The following year, HBUS applied for a national charter, placing it under supervision of the OCC instead of the Fed and NY. As condition of the charter being granted, the agreement was required to remain in place. One year later, in 2005, the OCC did its first Report of Examination and found HBUS to be largely in compliance, surprising given the nature and pervasiveness of the problems in 2003. The OCC wanted to check a few more high risk areas and stated they would consider ending the agreement.

Over the next several months, the OCC conducted seven examinations and found multiple serious deficiencies resulting in the issuance of 30 MRA’s – Matters Requiring Attention. They were in the same areas that had resulted in the action taken in 2003 (and penalty imposed in 2012). Stunningly, despite all the deficiencies and lack of compliance, the OCC decided to end the 2003 AML agreement in early 2006. In 2007, the OCC completed 21 examinations, finding similar problems to those cited before.

Read more at:

http://info.publicintelligence.net/HSGAC-HSBC.pdf

Why is anyone surprised at HSBC laundering drug money.

This is the reason the bank was set up in the 19th Century. It is their “raison d’etre”

HSBC were the conduit for transactions between the British opium growing operations in India and their sales organisations based in China

“HSBC’s first wealth came from opium from India, and later Yunan in China. In 1920, bank subsidiaries were opened in Bangkok and Manila. When the People’s Republic of China was established in 1949, the bank refocused its activities in Hong Kong, but between 1980 and 1997 it set up in the US and Europe. It moved its headquarters from Hong Kong to London in 1993 prior to the 1997 transfer of sovereignty to China.”

http://mondediplo.com/2010/02/04hsbc

They should turn the case over the Massachussets U.S. attorney’s office.

They were able to charge a dude who downloaded some public documents one time from university computers with crimes that could carry a 30-year jail sentence!

Can you imagine what money laundering for drug dealers year-in-year out despite repeated government warnings would get? It must be something like 7,989 consecutive life sentences without parole making license plates 76 hours a day in solitary confinement! If not consecutive death penalties.

Boy oh Boy. We’re just not getting the government we’re paying for. Almost makes me think I should be a republican tea partier and pull the money plug on all these dudes. Since it just seems to go into their pockets. Holy smokes.

Levis is on the right track. Someone with more time on their hands than anyone should actually have could do an org chart showing where the financial cartel’s operatives in the executive branch are actually working. A picture might emerge of a government in the deathgrip of a global cartel bent on neutralizing all regulation.

Stuart Levey presided over the U.S.-led effort to shut Iranian banks out of the global payments system, thus forcing Iran to conduct much of its trade with barter or gold exchange.

Levey also enforced the labeling of Gaza’s elected Hamas government as ‘terrorist’ by blocking wire transfers to it, thus assisting Israel’s policy of ‘putting the Gazans on a diet without actually starving them.’

As we all knew already, the definition of ‘terrorism’ is highly malleable and political.

Officials such as Levey and Cohen have no problem with wealthy Americans subsidizing fundamentalist settlers in the West Bank, in direct defiance of forty years of U.S. policy. But wire money to a charity which feeds malnourished children in Gaza, and you’ll likely wind up in a fedgov prison.

As to the selection process which leads to Leveys and Cohens cracking the whip over Palestine … well, the first rule of Smite Club is you don’t talk about Smite Club.

The only way any of this makes any sense to me is when viewed through the lens provided by Peter Dale Scott. Scott is frequently cited in Mexico’s left-leaning press because he provides a plausible explanation for what has become a rather blatant phenomenon: the collusion between elements of the U.S. government (e.g., the DEA, CIA, DIA, NED, USAID, etc.) , the transnational banks, and the drug cartels.

The elements of the US government mentioned above make up what Scott calls the “deep state,” which is closely allied with the finance industry and the war industry. Because the deep state’s activities are often illegal and always secretive, it cannot turn to the state’s democratic institutions for funding. It must therefore turn to illegal activities, such as drug trafficking, for financing. The illgotten money is then channeled to all sorts of nefarious characters, as well as into a broad array of illegal and morally reprehensible activities.

Even though the decisions and activites of the deep state impact greatly on the welfare of the nation, its decisions and actions are all conducted under a veil of secrecy and therefore do not fall under the purview of democratic governance. Constitutionally, the state’s instruments of violence – the police and the military – are controlled and accountable to the nation’s public state, which is made up of the nation’s democratic institutions. Over the past 40 years, however, the deep state has grown progressively more powerful, and the Patriot Act all but gutted the public state’s power.

It is rather obvious that Cohen and Levey are soldiers of the deep state. Other notable soldiers are Zbigniew Brzezinski, Dick Cheney, Donald Rumsfeld, William Casey and Oliver North.

Elizabeth Warren, on the other hand, is a soldier of the public state.

Scott cites The Bank of Credit and Commerce International (BCCI), the creation of Bank of America and Sheikh Zayed bin Sultan Al Nahyan, as the prototype of the sort of bank that engages in the types of illicit activities necessary to fund the deep state. The deep state, however, appears to have grown so powerful and so bold as to no longer see the need to conduct its illegal activities at arms length and through proxies. Now the transnational banks are gettting in on the action themselves, but with the full protection of the deep state.

A far more detailed explanation is available in this interview of Scott:

http://www.youtube.com/watch?v=vVMjIvjZJNM

The trilogy of deep state, the finance industry and the war industry, and its role in the creation and empowering of criminal organizations, harkens back to something which was the topic of discussion on a thread the other day:

http://www.nakedcapitalism.com/2013/03/germany-the-german-view-of-hyperinflation-and-the-ghettoization-of-dissent.html

In the same way that the trilogy of deep state, the finance industry and the war industry created and empowered radical Islam, it also created and fueled the growth of Nazism.

Thorstein Veblen alleged that the intent of the Treaty of Versailles and the League was to make the world safe “for a democracy of absentee owners.” And in order “to make the world safe for a democracy of investors — the statesmen of the victorious Powers have taken sides with the war-guilty absentee owners of Germany and against their underlying populations.” The “Democracy of Property Rights” must be made safe “at any cost,” Veblen asserts, including the reinstatement of “the reactionary regime in Germany” and its erection “into a bulwark against Bolshevism.”

http://www.elegant-technology.com/resource/KEYNES.PDF

The dictatorship of the transnational banking cartel, therefore, according to Veblen, had become the Holy Grail — the alpha and the omega — of the leaders of the Great Powers.

Guido Preparata uses Veblen as a jumping off point then to demonstrate just how inextricably intertwined post-Versailles financiers and war profiteers became with Hitler and the rise of Nazism.

http://www.atimes.com/atimes/Global_Economy/NF30Dj03.html

While I think Preparata goes over the top in attributing intent and motive, his case that the rise of Hitler would not have been possible without the aid and support of the transnational banking cartel and the war profiteers is on solid footing. And as he says:

obama has been admitted to the club he sure ain’t gonna rock the boat

We are being farmed. It’s a big consumer-debt farm. The banksters and racketeers are using us to make their financial system go round and round and deposit all the money in their vaults. Even as they achieve ever more productivity with automation and robotics. The big fly in the ointment is that robots don’t consume. It is conceivable that they could accumulate however. Long term it is a junk yard economy if it stays on this trajectory. If consumerism came to a sudden halt and all profits were destroyed, how would things get put back together? I think that is the only question. There is almost nothing in this “economy” worth carrying forward. Certainly not the big bank industry.

It seems that the finacial cartel is so satisfied with the services provided to it by the US Treasury, that the cartel is now asking the Treasury to export its model of embedding cartel operatives in government to third world nations. Along with Treasury’s superb method of managing the public debt to enrich banks.

You can check this out at FBO.gov:

The U.S. Department of Treasury’s Office of Technical Assistance (OTA) is recruiting individuals on a competitive basis to serve as resident (long-term) and/or intermittent (short-term) advisors, under personal service contracts, in the Government Debt Issuance and Management Program

The Treasury program provides technical assistance and policy advice on sovereign debt matters in an emerging market environment to senior ministerial and central bank officials, as well as to market participants in host countries. Resident assignments are generally for one year and are likely to be renewed. This recruitment is for global assignments and international travel is required.

Qualifications: Applicants should have minimum of 10 to 15 years of experience in domestic government debt issuance and/or management of public borrowing. A background in public finance, private sector investment banking, public sector financial advisory work, government securities trading, state and local government securities underwriting, issuance and sales, securities and/or Treasury operations, or in related areas, would constitute relevant experience. Knowledge of international bond markets is desirable.

Prior overseas work experience in a challenging environment and management experience are also highly desirable. Spanish fluency is required for posts in Latin America and French fluency is generally required for francophone countries. While having requisite technical skills and a background in and knowledge of public finance/government securities are highly important, candidates must also have the desire and ability to work independently and the ability to gain the confidence of host government officials and counsel them about policy choices and their consequences. Advisors are expected to provide sound but realistic technical assistance in the debt management area that will enable emerging countries to strengthen and develop their economies.

Candidates must be U.S. citizens or U.S. resident aliens.

SALARY AND BENEFITS: Salaries will be negotiated in accordance with program regulations based on demonstrated salary history. The salary ranges are from $123,758 to $165,300 per year. Overseas benefits are provided as allowed by federal regulations. Successful applicants must be able to obtain medical and security clearances.

For those of you who think you might just qualify for this position, note the last part about being capable of obtaining a security clearance. Known terrorists, downloaders of research articles, and commenters on NC who have spoken unkindly of the government will likely have difficulty.

If you worked at a bank and helped make it insolvent in a big way while pursuing spectacular returns based on casino type risk taking, you’ll be fine.

Holy Toledo!

The Giant Vampire Squid *is* global; and our very own Treasury Department funds and supports it.

I like the requirement of being able to “gain the confidence” of important people Over There. I would be #FAIL immediately on that one!

It occurs to me. Here is an Obama-sponsored jobs program. Except the only targets candidates are the future lackeys of the .01%. It’s Neo-Liberal New-Dealism.

Ms, you have a point. Not that that is any condolence to me – I’m tasting bile on the back of my tongue. What recourse a decent man or ms? What wine does one drink? What bread does one eat? (Wallace Stevens, in a different context.)

It’s HSBC’s (Richard E. T. Bennett’s) and the CIA’s mess that Stuart Levey is there to clean-up.

And, just to highlight that for HSBC none of this is an accident, look at just one of HSBC’s acquisition for developing its US Global Banknote (money laundering) business.

December 31, 1999, HSBC completed its $10.3 billion acquisition of Republic New York Corporation , including its securities unit and Republic National Bank of New York (known as ‘Safra’s Banks’ – Edmund Safra being the majority owner and founder), which among other things purchased mortgage-backed securities based on high interest rate loans.

As the Financial Times of December 1999 wrote: “Safra’s banks are among the world’s largest bank note traders, a business that lends itself to money laundering. They are also big participants in the gold market — another business where there is a premium on anonymity….” New York magazine wrote in January 1996. ”Republic Bank quickly became known for sending armored cars to pick up large sums from its more secretive customers — no questions asked.’

Republic was most infamous for the ‘Cresvale notes scandal’ – a massive securities fraud. That used “offshore entities to sell $3 billion in securities to Japanese investors, of which large portions were sold” and “because the fund’s assets allegedly weren’t kept in client accounts as required” …(hello Jon Corzine). ….“Republic securities unit served as custodian for the securities that Cresvale was selling to Japanese investors”.

The New York Post (Dec. 4 1999) reported that ‘Mr. Safra was in Monaco to hold meetings with HSBC’s John Bond’ when he was murdered – shortly, after the deal was completed; The Financial Times’ LEX column (Dec. 4 1999) wrote: “Edmond Safra’s violent death is a ghastly personal tragedy”.

Maybe it’s not that nothing changes, perhaps, it’s more Mutatis mutandis

The Lewis Lapham documentary The American Ruling Class can be watched in entirety online for free. Very enlightening.

Finally! Thanks for posting the link.

These are some strong candidates for testing “water boarding”, just keep doing it until they beg for jail.

Is there a modern equivalent to Boss Tweed? A scary thought for me is that the current criminal crisis in civic society is not explicitly lead and directed, but is rather an unconscious response by individual actors. An emergent “steal together complex” of individual — possibly hierarchical — cells, whose only real connection is an unstated understanding that thieves will work together for mutual benefit.

This hydra may have no head at all.

Mr. Michael Ruben Bloomberg has far surpassed Boss Tweed, who had the virtue of just being a local guy with a very small local spider web that was easily brushed aside. The 3-term mayor (and apparently future shadow-manager) of New York City is a far more terrifying incarnation of corrupt power.

I have a friend who used to be a high level guy in a Mexican drug cartel. He has a second wife now and kids he adores, so he’s not in the biz anymore. He said HSBC is the cartel’s bank. He also told me that the last Mexican president, the one after Vicente Fox, was/is married to the sister of the one of the main Mexican drug lords.

Just some Sunday afternoon gossip.

Yikes! I feel like I’m risking being shot or something just for reading that.

I have a close relative resident in Mexico when Fox came to power. The PAN was center-right or something, but people invested hope in the PAN because it promised to break the “boss” (cacique) system in Mexico, whatever the politics. Rotten boroughs and all that. Well, screwed again. Not too surprising, I reckon.

Here is one of those other David Cohens of lesser note. He is a blogger who writes a blog called Decline Of The Empire. Here is the link.

http://www.declineoftheempire.com/

Hi, i feel that i saw you visited my blog thus i came to return the prefer?.I am trying to find issues to improve my web site!I suppose its good enough to make use of a few of your concepts!!