The cheery view that Europe had moved past its crisis now looks to have been a tad premature. The astonishing weekend revelation that Cyprus had struck a deal for a Eurozone rescue of the island nation’s banks that hinged on a deposit grab, um, tax, of 6.75% of deposits below €100,000 and 9.9% for those above €100,000, sends a message that anyone in a weak bank in a periphery country, particularly a large deposit holder, is at risk. The one thing that America learned in the Great Depression is that to prevent debilitating bank runs, depositors need to be sure their holdings are safe. And if you need to extend government guarantees to provide that reassurance, then government bloody well better keep the banks on a short leash to make sure you don’t have to pay out on those guarantees all that often. The recklessness of letting financiers talk governments out of constraining bank activities is coming home to roost.

Creditanstalt, an Austrian bank that collapsed in 1931, precipitated a financial panic that led to a series of bank failures and a currency crisis, a classic combination of contagion worsened by poor official responses. The Cyprus deposit-seizure scheme has the potential to kick off a similar broad-based financial unraveling, but whether it does depends on both customer and official reactions.

Mind you, it’s not certain this deal will get done. The Cyprus parliament has to approve it, with the vote to take place Sunday. That has been postponed as a result of public outrage and the difficulty of obtaining the needed support. Cypriot president Nicos Anastasiades is trying to restructure the program to take less from small depositors and more from the big dogs. The Financial Times and Reuters both report that the idea of whacking deposits below €100,000 euros, which is supposedly guaranteed by national governments in the Eurozone, came from Anastasiades. The logic was to preserve Cyprus’ standing, such as it is, as an money laundering banking center. But this thoughtful gesture apparently did not go over in some circles. The Greek blog Clockwork Project (hat tip George P) says, per Google Translate:

An angry phone call from Russian President Vladimir Putin received early Sunday morning, Nikos Anastasiadis.

The Putin reportedly said verbatim in-Cypriot President

-Better to put the German flag at the Presidential Palace. Do not you understand that this decision destroy your country?

There’s been a great deal of discussion of how the deal came about, with a particularly detailed account at the Wall Street Journal. The new stance at the creditor nations and the ECB is that there will be “private sector participation” which is bureaucrat-speak for haircuts to the people who funded the banks. And in the fracas over renegotiating the pact so as to make it less unpalatable to the locals, the Eurozone officials have made clear they don’t care how Anastasiades skins this particular cat as long as he comes up with €5.8 billion from local deposits. Banks were due to be closed Monday on Cyprus for a holiday; officials are now considering imposing a bank holiday on Tuesday. Funds have been frozen in the meantime, producing what is likely to be the emblematic photo of this crisis, of a man trying to break into his bank branch:

Note, however, that the Eurocrats have made clear that they are not budging, so the alternative to swallowing some version of this depositor cramdown is no deal at all. And no deal means the biggest bank in the country fail pronto, with others likely to follow fast on their heels. From a Financial Times account of the arm-wrestling, which describes how a deal was retraded:

Cyprus’s new president Nicos Anastasiades did not like the idea of forcing any losses on ordinary account holders….But after receiving what Cypriot officials said were reassurances from Angela Merkel…Mr Anastasiades agreed to a deal that he thought would include relatively modest “haircuts” – a 7 per cent levy on deposits above €100,000 and a 3.5 per cent hit on those below.

With the principle of haircuts agreed, Mr Anastasiades decided to stay for the finance ministers meeting, which was just getting under way. All he asked was that the rates be tweaked: raise the levy on the bigger deposits in order to lower the hit taken by the less well off. Both sides believed a deal was at hand….

However, Mr Anastasiades was left reeling by the response to his request for modest adjustments, according to Cypriot officials. Wolfgang Schäuble, the German finance minister, said Nicosia would immediately have to raise as much as €7bn from depositor haircuts. A stunned Mr Anastasiades decided to walk out…

But Mr Anastasiades soon learnt storming out was not an option. The European Central Bank had another shock for him: the island’s second-largest bank, Laiki, was in such bad shape that it no longer qualified for the eurosystem’s emergency liquidity assistance – the cheap central bank loans that teetering eurozone banks need to run their day-to-day operations.

The message, delivered by the ECB’s chief negotiator, Jörg Asmussen, meant that if no deal was reached, Laiki would collapse, probably bringing the island’s largest bank down with it, and saddling Nicosia with a €30bn bill to reimburse accounts covered by the country’s deposit guarantee scheme. It was money Nicosia did not have. All of the island’s account holders would be wiped out.

Mr Schäuble was not alone. Several officials involved in the talks said he not only had backing from the Finns, Slovaks and to a lesser extent the Dutch. The International Monetary Fund, which had been urging depositor haircuts for months, had won the argument over the skittish European Commission, which had long worried that seizing depositor assets could spark a bank run in Cyprus and, potentially, elsewhere in the eurozone.

So as terrible as this deal is, the alternatives are worse, which means Parliament will probably fall into line after a bout of hand-wringing and finger-pointing.

Ekathimerini reports that the government is trying to sweeten the pot by hainvg depositors receive bonds linked to gas earnings (the government hopes to exploit gas reserves to the south) as opposed to the initial plan to give them bank equity in return for their “tax.” So much for meager sweeteners to help swallow a bitter pill.

Now to the obvious question: why are depositors, the folks most senior in the creditor hierarchy, being whacked? Shareholders and bondholders should be wiped out before they lose a penny. Yes, but this is a case where expediency, unwisely, has been allowed to carry the day.

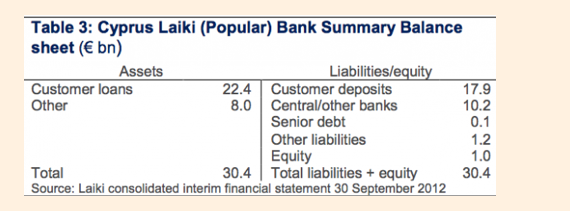

In an excellent and important post, “A stupid idea whose time had come,” Joseph Cotterill of FT Alphaville explains why the axe fell on the depositors. First, have a look at the balance sheet of one of the two big (and about to fall over) banks:

Notice there is pretty much squat in the way of equity and senior debt. The “other liabilities” may be secured. So then we get to liabilities to central and other banks. The liabilities to central banks are not going to be haircut; that is part of the “private sector participation” premise. Remember, banks in periphery countries have been pledging any asset the ECB will take to it, and any stuff the ECB won’t take to their own central bank. In the case of the Cypriot banks, the exposure is almost entirely that of the local central bank. Again from Cotterill:

As of January, the Cypriot central bank was extending around €9bn of secret liquidity in return for collateral no longer accepted at normal ECB liquidity ops. Much of it (it’s naturally difficult to determine how much) was probably going to Laiki.

Now remember, that’s €9 billion of Cyprus loans to the banks, mainly Laiki, which is junior to deposits, versus the €5.8 billion to be seized from depositors. So why aren’t the loans from the Cyprus central bank being written down and the Cyprus sovereign debt investors taking losses? Well, it turns out it is easier to screw retail customers than it is professional investors:

As it is, there were lots of good reasons why a sovereign debt restructuring did not happen. I don’t want to downplay them. Notably, the fact that the bonds that were best to restructure were governed under English law, and were likely held by the kind of investor who’s willing to litigate. I listed the problems here. Around it all was the inability to get write-downs out of Cypriot domestic-law sovereign debt, because that was held by the banks which already bore big black holes in their balance sheets. Again we come up to something that could be raised in the defence of the deposit levy — local exposure was so great everywhere, that any distribution of losses would have been painful. For the widow depositor, substitute the pension fund holding local-law bonds….

Of course, theoretically, Cyprus could have been given a nod and a wink to carry on all the way into June and then suddenly announce a ‘hard’ payments default. You then really get into trade-offs there — would Cyprus want to be regarded as that kind of sovereign? Would it be good for it as a banking centre? You also have to think how deposits would have reacted in that kind of hard sovereign default.

If we get a worse-case scenario reaction, that of bank runs in periphery countries, the European officialdom will wish they had gone for just about any other resolution to the Cyprus mess.

Now the optimists are hoping that depositors in other periphery countries will see the Cyprus deposit-seizure, formally a tax, as a one-off. After all, Cyprus is just an itty bitty country with a banking system full of Russian suitcase money that is seven times as large as its GDP. And those banks were dumb enough to lend heavily to Greece. But the officialdom isn’t even taking minimal steps to limit the risk of contagion by making convincing-sounding, if empty, assurances. In fact, bizarrely, they are doing the reverse. For instance, the New York Times reported (hat tip Scott):

Jeroen Dijsselbloem, the president of the group of euro area ministers, declined early Saturday to rule out taxes on depositors in countries beyond Cyprus.

Ed Harrison explains why the Germans and the Eurozone officialdom are going down such a dangerous path. Germany has kept squeezing the living standards of ordinary citizens and thinks everyone need to take that medicine, even though it is the wrong remedy in the wake of a big financial crisis:

In short, the ideological view that predominates in German policy circles is that a lack of fiscal rectitude and a lax bank regulatory environment was the problem from the start and that fixing these things by further reducing wiggle room for mischief will reduce profligacy and prevent crisis. The data contradict this view considerably. The euro has been destabilising for a number of reasons I can’t go into here but Spain is the perfect example of a country that never should have joined the euro zone. Low government debt and surpluses in Spain and Ireland stood in stark contrast to the soft depression and difficult finances in Germany. Moreover, the interest rate policy of the ECB, geared as it was to the slow growth core, produced negative real interest rates and credit bubbles in Spain and Ireland during the last decade. German banks piled in to those countries as prospects domestically stagnated. None of this matters politically though. There is no sense in telling political masters in Germany this because they see Germany’s recent history as one of severe belt-tightening and an economic success that they believe is a direct result of that tightening. Extrapolating the German model Europe-wide is the goal…

So, as far as German politics goes, the German government doesn’t want bailouts but feels that it has to permit them in order to save the euro. However, in order to get a bailout the pre-conditions are becoming harder and harder as bailout fatigue sets in. At first, it was fiscal reform. But as the crisis continued, policy makers saw this as an opportunity. So it became fiscal and labour market reform and privatisation and pension reform. As German policy makers told Richard Koo last summer, the crisis represented a “once-in-a-lifetime opportunity” to institute real structural reforms like the ones Germany is doing.

Over the weekend, colleagues who are normally of the calm, cool and collected sort have been stunned by this development, although the Eurocrats had been muttering about a deposit haircut in Cyprus in recent months. And the message could not be clearer: you are at risk if you hold money in a shaky bank or country in the Eurozone. One reader’s reaction: “I thought I’d put a prediction on the record: starting tomorrow, the euro payment system really starts to unravel.”

After the PR barrage that accompanied the launch of the OMT, which was a brilliant exercise in smoke and mirrors (all it did was repackage and rebrand existing ECB powers), the quiet deposit run out of periphery countries to banks in the core nations slowed and had even reversed in recent months. Expect it to pick up with renewed vigor. Even if we don’t see hot bank runs of people lined up trying to empty their accounts, anyone who has more than €100,000 on deposit in a periphery country, particularly Spain, has to recognize he is in danger. However, many of the people own businesses (a payroll of meaningful size means you’ll have large deposits at least when you are about to pay staff, and unless you manage cash very aggressively, much of the rest of the time too) will need some time to switch to safer (presumably German or maybe even Swiss) banks, since selecting a new bank and moving a large, multi-serivces account is a big undertaking. And this sort of hidden-to-the-public big deposit run has felled banks; it was the proximate cause of the resolution of WaMu.

Now the EU officials could easily calm nervous depositors by announcing an ECB-backstopped deposit guarantee, instead of the current national system which depends on not-exactly-credible central banks. Germany and its fellow surplus countries have hesitated about proceeding with the necessary steps to further economic integration (notice how the plan to implement eurozone wide bank supervision, which Germany insisted was a precondition to Eurozone-level deposit guarantees, has languished?). Germany is trying to maintain policies that are contradictory: it wants to continue to have large trade surpluses, yet not fund its trade partners; its wants debtors to meet their obligations, yet refuses to allow either enough in the way of fiscal deficits or monetary easing to keep debtor countries from falling into deflationary spirals, which assure default. Germany’s failure to relent on any of these conditions means that what breaks will be the financial system.

It’s not clear that the partes in parliament have the vote – I believe they are one short by the latest count.

Incidentally, the parliament intervention also means that if I was spanish or Greek, I’d take out all the money from the banks I could ex minimun transactional balance I need. And I would not send it to German bank either, but probably shoveled into US/gold/CHF to keep under matress.

To an extent, I wish this was CA 2.0, since I don’t think Europe can get out of this mess w/o a proper crisis anymore. Of course, I’d be careful what I wish for, lest I get it.

The president may keep the bank holiday going until Parliament succumbs.

That’s exactly what is happening: bank holiday now through Thursday, but that’s not the final word…

The banks can remain closed for somewhere between 1 and 2 weeks before the *entire domestic economy collapses* due to a cash flow problem.

At that point it stops being a banking crisis and becomes a crisis of governmental legitimacy. When people with money in the bank can’t buy food, that’s when Presidents are hanged, guillotined, shot, and burned alive.

Cyprus has already extended the closure to one full week. They are playing with fire.

According to CR interest rates in Cypriot banks were up to 11 percent (bottom):

http://www.calculatedriskblog.com/2013/03/cyprus-update.html

Compare this with the modest haircut imposed (nobody is saying that these CDs don’t continue to be active) and you might still be ahead keeping your money in the bank and play the moral hazard game. The question is just, at which point one will have to wash, rinse and repeat? (I have relatives on the Balkans that play this game and I have disagreed with them for the past 5 years. A posteriori they did everything right.)

German government representatives including Mr. Schaeuble deny that they demanded depositor haircuts (any way of coughing up 7B was fine with them):

“But we would obviously have respected the deposit guarantee for accounts up to 100,000,” he said. “But those who did not want a bail-in were the Cypriot government, also the European Commission and the ECB, they decided on this solution and they now must explain this to the Cypriot people.” http://www.reuters.com/article/2013/03/17/us-eurozone-cyprus-germany-idUSBRE92G0HP20130317

I’ve heard a different story, that Cypriot govt wanted lower haircut for under 100k (but still haircut…), but Schauble personally said no.

Incidentally, I’m having doubts on how much it will hit the money launderers. I don’t know how they operate, but I doubt they are lest sophisticated than the tax evading crowd who used low Cyprus tax – but kept close to nil balance in Cypriot banks for last year+. Of course, if your normal bank balance has 8 7-8 digits, than 1m is your “transactional minimum”,and paying 100k is the cost of doing business (and still worth it). As usual, the people who get hit are the people who can’t run (away).

This is an interesting question. The Cypriot banking thing has been bubbling under for a long time now. It may well be that lots of the hot money is so blatantly from russian criminal groups thet they couldn’t put it anywhere else.

I’m not sure anyone has good numbers. Illargi confidently says 37% of the deposits come from offshore Russians, which if true, means contrary to the international PR, it is the locals that are getting whacked (which admittedly includes about 20,000 Russians). The Clockwork Project post (in Greek) said anywhere from €8 to €35 billion, which is a pretty big range, but seems completely credible (as in the authorities have no bloomin’ idea). One of my buddies believe a lot of Middle Eastern money also winds up in Cyprus, and I know of at least one Indian investor who has done deals using Cyprus companies.

I may be dense, but I don’t understand why anyone with 100k or 100,000,000k would have funds on deposit in a Cypriot, Greek, or for that matter Spanish or Italian bank at this point. Panama is a far larger banking (money laundering) center, the fourth largest in the world after London, NY & Switzerland. Funds are denominated in dollars, and blind trusts are reputably untraceable. If that is the case it exists with the full support of the US government because it serves the interests of the US oligarchy and clandestine military operations.

The US under Obama has captured something like 85% of the world’s arms trade, and needs a convenient dollar denominated payments system. Likewise, the illegal drug trade generates a significant portion of the US GDP which needs to be recycled back into the above ground economy. After the US overthrew Noriega for demanding too high a cut, Panama has experienced hundreds of billions of dollars of growth to satisfy these functions.

So don’t pity the poor Gasprom KGB with their Cypriot accounts. They simply failed to perform basic due diligence.

The Panama City Skyline is a thing of beauty. And they are all banks. Brings a tear to your eye, don’t it?

http://www.google.com/imgres?imgurl=http://www.costaricapages.com/panama/blog/wp-content/uploads/2008/06/panama-city.jpg&imgrefurl=http://www.costaricapages.com/panama/blog/worst-elements-doing-biz-in-panama-1014&h=340&w=500&sz=46&tbnid=LUzWKxgHBHbmFM:&tbnh=90&tbnw=132&prev=/search%3Fq%3Dpanama%2Bcity%2Bskyline%2Bpics%26tbm%3Disch%26tbo%3Du&zoom=1&q=panama+city+skyline+pics&usg=__wTD6zxQtP9V85ruVtcz2CnDgPH4=&docid=oqQLDXkiiHVZ_M&hl=en&sa=X&ei=JExHUYn6HIq6qgGypIAg&ved=0CEYQ9QEwAg&dur=0

Many thanks to Thor and Bill Smith for an enlightening colloquy.

I believe Cyprus is used as a “way-station” for companies which operate mainly in Eastern currencies (ruble, lira, rupee) and need an outpost for Euro transactions which won’t charge exorbitant fees. The post-9/11 laws have actually made it a pain in the neck to set up a foreign branch in most of the US and the EU.

Those companies mostly have transactional funds in Cyprus and will be ticked off, though they probably expected that the Europeans to cheat them.

Thanks Bill,

If I’m not mistaken one of those towers is owned by the great free marketeer and Republican Presidential candidate Donald Trump—.

If the depositors have been getting those kinds of rates for a long time, that might explain why there is a willingness to give them a haircut.

Please correct me if I am wrong here. On the counterfactual side if the big Cypriot banks were wiped out the only people that would be made whole were the individuals with 100,000 or less EUR in their accounts via deposit insurance. Everyone with sums above 100,000 EUR would see them disappear pending some sort of legal/civil action. Apparently there is about 27 billion EUR in foreign total including 19 billion EUR in Russian money sitting in these accounts. The moral hazard for the Europeans is obviously bailing out a bunch of foreign oligarchs and tax evaders to save the Cypriot banking system. That would naturally be a public relations disaster. This is actually quite the win for the very wealthy and a loss for those with less assets which would have ordinarily been insured anyways. They are being taxed to protect those at the top.

Good point. I think this concept is called “socialism for the wealthy” or ,alternatively, “privatized profits, socialized costs”.

Jim

The risk of running an economy like a hedge fund (and not having your own currency).

Clearly, Cyprus should never have joined the euro, like Greece and the other Club Meds.

What matters here:

1) Tiny Cyprus can be bulldozed into accepting this when the back is against the wall. If the country’s parliament votes no, it would be collective suicied. I assume that it will vote yes.

2) Germany and the ECB know that other countries, like Spain and Italy, could never be treated this way since their parliaments would never accept. Thus, while unprecedented, the consequences should be limited. (I suppose that the Fin Mins from the other Club Meds voted yes to this, by the way).

This would now never flow in Italy, I’m not so sure about Spain. But how about Portugal?

I would doubt it.

Do not forget that there will be elections in Germany in September and that the likely outcome is a coalition between Merkel and the Social Democrats. The latter want to have eurobonds, a redemption fund, new (real) European Laws on social protection, etc.

Germany’s stance will thus probably change as of October, if not before. This is what the Club Meds are waiting for, in my view.

I’d agree, but that’s why I don’t understand this dumb move, which just open too many possible problems.

Especially since there was a move (extempt all under 100k) that hardly anyone would complain about.

Merkel’s hegemonic rule showing cracks?:

http://www.spiegel.de/international/europe/widespread-anger-erupts-over-bank-account-tax-for-cyprus-bailout-a-889439.html

Domestic German politics determine what is going on in the euro zone.

How I wish that Merkel one day falls by her own sword.

Furthermore,

Germans everywhere, including in the ECB, love telling everybody else that “the agreed rules have to be respected”. Their supposed formalism makes them ganz proud. They view this as a great quality that should be copied by everyone, in particular by the Club Meds.

Except that it is nonsense, of course, as the latest developments in Cyprus show. The law of German formalism really reads; The rules imposed by us should be respected by all until we chose to change them, as we wish.

Simply the law of the strongest dressed up to look like a virtous principle. The system is gamed to the Germans’ advantage although this could snap at any moment.

The system works to Germany’s advantage – it isn’t “gamed” to Germany’s advantage as that would presume that in the creation of the Euro either a) the Germans successfully played the demi-continent’s greatest ever bait and switch game, or b) virtually all other participants chose to flagrantly undermine their own self-interest.

Apparently all saw pie in the sky, the Germans included. It turns out that the Germans were in the best position to avoid the consequences of the shit hitting the fan, in part because Schroeder, the Social Democrat, successfully got the Hartz IV reforms passed in time.

In an interview published in the FAZ yesterday, Reithofer, BMW’s CEO, was asked why the company is so successful. His list of reasons ended with the EU and the Euro. Why the EU is clear: free trade, more efficient logistics. Why the Euro is a little harder.

I see lower transaction costs and wonder if a dollar-like currency makes him happy. But the centripetal consequences of the Euro are I suggest ever more decisive. The fringe states cannot devalue when they fail to compete. There’s little reason for capital to go to Spain if there is little prospect of the Spaniards winning on a level playing field with the GErmans. Their labor costs might be a little less but it is no longer really important.

Part of the shit hitting the fan is that, while labor is theoretically free to move in the EUro zone, effectively it doesn’t, in part because the national authorities refuse to play along, in part because the cultural differences are so intimidating that people with reason refuse to move. This is a substantial difference to the US.

The Euro effectively allowed Germany to export heavily to Spain. (Et al.)

Previously, the fact that the Deutschemark would keep rising and the peseta would keep falling would prevent this.

Obviously, Spanish industrialization could also have counteracted the exchange rate tendency, but for various reasons it wasn’t happening very fast (mostly historical; Germany was industrialized in the mid-19th century, and Spain basically only started after the fall of Franco).

bmeisen-

WRT to your two options: Germany played hardball during the creation of the Euro and the EMU, essentially demanding that the Euro would be run like the DM and thus Germany’s monetary policy would become Europe’s monetary policy, regardless of the nationality of the ECB head. (it’s no coincidence the ECB is HQ’ed in Frankfurt).

So why did so many Euro countries accept it? Actually, they didn’t… The euro and key parts of the EMU (like the Maastricht Treaty) were passed by parliaments even when in many countries public support was tepid. Indeed, the only two referenda held on the Euro (in Denmark and Sweden) failed, while 2 of the 3 referenda held on Maastricht also failed (Denmark then got “special exemptions” that allowed them to pass the referendum in the second go-around).

Now Germany is hardly to be blamed if another country’s politicians are so beholden to their financial and corporate elites that they vote against the interests of the citizens they’re elected to represent. And in that sense, Germany has played by the rules, but please don’t assume that the rules were designed to be fair to all of Europe when from the very get-go they were designed to appease Germany and were approved over the objections of a majority of citizens in many European nations.

To an extent, I’d say that “peaceful” (relatively speaking) outcome of Cyprus would be worst. The lesson Germany & co would take out of that is that the dumb idea works (might need tweaking on edges, but in principle is sound), and believe it scales. Then apply it elsewhere. Of course, the problem is that you can’t have a a half of bank run, and I suspect if (say) Spanish TV started showing queues of people in front of banks ala Northern Rock (or even replying Northern Rock queues but people missing the commentary).

For a nominal effort to remove tail events, EU is singularly capable of creating new ones.

One thing that should be kept in mind (and that Yves, from her dispassionate U.S. viewpoint might not be as aware of) is that Cyprus is seen as a special case within Europe, by the Europeans.

“That scummy little island somewhere out there in the Mediterranean”. Scummy in banking terms, that is – I don’t think anyone has a particular gripe against the inhabitants. But whenever some government corruption scandal has unraveled over the past ten years elsewhere in Europe, odds were *very* high that at least one shell company in Cyprus was involved. For money laundering by the perpetrators, and such. For the last ten years at least, the place was run like a new Liechtenstein, just without the class and all the remaining legal frameworks that might still get in the way of parking and laundering money. The fact that rich Russians also discovered the place at some point is just the icing on the cake, but its notoriety started way before that.

In short, as far as banking and corporate matters are concerned, Cyprus is widely viewed as a corrupt sinkhole of lawlessness.

Which has its positive aspects, in a situation like this. Since it greatly reduces the risk of contagion, and the likelihood of a Creditanstalt 2.0 event. If Cyprus has a bank run, expect a collective shrug. Sure, nasty for those involved. But the reaction of the average European is much more likely to be one of “see, told you so!”, instead of panic that it might happen to them as well.

Charles Wyplosz, in our companion post on Cyprus today, is also European and begs to differ.

Anyone in Spain has to recognize their banks are deeply underwater, and the last round of bailouts didn’t provide nearly enough dough. If I had an over €100,000 account in Spain and had gotten complacent about moving it to a non-Spanish bank, this would remind me to do it. There was already a deposit run underway, which abated after the OMT was implemented. This if nothing else seems likely to start it back up.

And this clearly raises the bid-asked spread on conditionality, meaning the Spanish and Italians will be less likely to submit to the Eurozone yoke if they can escape it. And Italy can credibly leave the Euro, which also makes a hardening of demands dangerous.

Good points, all of them. What is happening in Cyprus is definitely not a good thing, of course. However, I would still wager that a) the comparatively small size of Cyprus, coupled with the outsized balance sheets of its banks, make it a different case than Spain, and that b) the sort people who have more than 100k in an account in Spain or Italy are likely to be aware of this.

There are many factors at play here, from downright Schadenfreude in the rest of Europe (the rest that did not purposely set itself up as a tax haven for money laundering) to a very apprehensive stance about this possibly being the first of such events, all across Europe.

Yes, whatever the motivations, an ex post cancellation of deposit insurance guarantees undermines the credibility of those guarantees everywhere.

I read this morning that Gazprom is offering an alternative takeover/bailout. Could it be that the Europeans are just signalling the Russians that if they want their offshore money laundering operation to remain solvent, they will have to bail it out themselves?

I feel like there is likely way more going on here than I will ever understand.

Here’s a link to the Gazprom story.

http://greece.greekreporter.com/2013/03/18/gazprom-offers-cyprus-restructuring-deal-to-avoid-eu-bailout/

Very interesting. Why would Anastasiades refuse this offer? It probably means all his personal political ties will become useless. It means handing Cyprus over to Russia. So the choice is Russia or the EU? The eastern Mediterranean from Greece to Palestine, must be very rich with gas and oil for all this frenzy. And why would Cyprus threaten to turn to Libya for help? Who is even running Libya now – those sweethearts that just burned down our “consulate” ? Someone tell me again, who are those guys? The Russian participation in the fall of Syria and ring-fencing of Iran is puzzling too. I agree, this is deep politics.

“So the choice is Russia or the EU?”

Or Turkey, but long-standing Greek-Turkish mutual bigotry has prevented that from being considered.

“Who is even running Libya now”

Military men who were former subordinates to or associates Qaddafi, mostly.

The Libyan revolution happened when they finally decided that Qaddafi was just too damn nuts and had to be removed. Of course, he refused to go quietly.

Not sure this is all that deep politics…

Cyprus is the money laundering / offshore banking center of choice for Russia. They’re also a prime retirement / immigration center for expat Russians. So Cyprus has deep ties to Russia.

Gazprom is offering $16bil in exchange for essentially *all* of the gas rights that cyprus may hold in its territorial waters. Some experts estimate those reserves to be worth as much as 300bil euros. They’re basically hoping for a classic firesale of public goods (similar to what happened in Russia after the fall of the Soviet Union). If by doing so, the Gazprom executives also prevent Cyprus banks from being forced to turn over their accountholders to Russian or EU authorities, consider that icing on the cake.

If Cyprus had deep enough ties to America (i.e., if Cypriot politicians were deeply in bed with American corporate / criminal interests rather than Russian), I’m sure Exxon would consider tossing in a similar bid too.

In the end, I doubt Gazprom looks at this as little more than a somewhat unconventional bid for new gas fields. Their offer to “fix” the banking structure probably begins and ends with scrubbing their money-laundering colleagues’ traces from said banks and enabling a quiet and rapid transfer of their accounts to more hospitable environments before allowing the entire edifice to collapse on the remaining bagholders.

I’m actually somewhat impressed that Anastasiades didn’t agree to this wholesale giveaway of his country’s future, since I’m sure it came with an extra billion or two stashed away for him.

They turned it down? Geez. This is what I was thinking. The Ruskies with an investment of about 16b could buy a seat on the board of the ECB.

What’s not to like? Betcha Carl Ican thought of this too.

I remember lots of people like you saying similar things about Greece a few years ago.

“One-off case,” indeed. I wonder how many of that there will be down the line.

At least this way there’s less cause for self-defeating Greek style austerity. Better screwing foreign criminals than cutting wages and pensions.

Oh, I wouldn’t dispute that. That is, this is definitely less bad than the business-as-usual “bailout” nonsense = drowning countries in enormous loans that they won’t be able to pay back.

But Cyprus IS getting a “Greek-style austerity” anyway. That’s why the country will need another “bailout” regardless.

This is simply an improvisation on the same misguided “strategy” (if you can even call it that).

… with the added bonus of breaking the trust between the government and citizens, I must add.

I have to agree with this actually. Cyprus is seen as a special, very bad case, a low rent London City on the Med. Even Greeks won’t go near it, banking-wise.

I reckon most Europeans would be much more outraged if the Russian oligarchs and criminals had been made whole. There seems to be some noise about making the confiscation more progressive, but the Cypriot government were probably the people who wanted to shield the Russians from a bigger haircut in the first place.

Keeping all this in mind, I find it completely fascinating that Putin has taken a personal interest in this. Of course, if there were a large haircut or a possible run on tax havens in the Caymens or Panama, Obama might get on the horn pretty quickly too.

I was wondering too if Putin would be for or against the Russian mob and Russian tax evaders hiding funds in Cyprus.

Isn’t there an honest world leader anywhere on the planet?

An honest politician? bwahahahahaha…

“An honest politician is regarded as a sort of marvel, like a calf with five legs, and the news that one has appeared is commonly received with derision.” — H.L. Mencken

“An honest politician is either a hypocrite — or he is doomed.” — Taylor Caldwell

“An honest politician is one who, when he is bought, will stay bought.” — Simon Cameron

“The politician is someone who deals in man’s problems of adjustment. To ask a politician to lead us is to ask the tail of a dog to lead the dog.” — Buckminster Fuller

“When buying and selling are controlled by legislation, the first things to be bought and sold are legislators.” –P. J. O’Rourke

Let’s see. In America, bank deposits have yielded, essentially, nothing since 2009. That represents a haircut of 20% so far, if one backs up a “normal” yield of 5%, and it should be obvious that the FED intends to continue this fleecing of depositors indefinitely, even if Ben didn’t say so, which he does ever time the stock market goes down 1%.

Over in Cyprus, depositors busy collecting 11% pa are rioting over a one time hit to small depositors of 6.7%, and to Russian mobsters of 9.9%, after which, presumably, business as usual will resume in Cypriot banks, perhaps even at a increased depositor yield.

Just who are the patsies in this international banking game?

I read the main post over and over and over and confess I did not understand more than 15% of the jargon. Finance is a lot like three card monte. We sit here puzzling over the Wall Street Journal, while those working the crowd are picking our pockets.

Why on Earth do you think there’s any such thing as a ‘normal’ return independent of economic circumstances or that anyone deserves a return of 5% simply for holding cash risk-free?

Well, before capital was free to connected bankers, that’s how much 3 month Tbills yielded. Banks had to compete. QED.

I don’t think “should” enters into it, when we’re talking about money.

If the banks aren’t expanding their loan portfolios, they don’t really need to compete for deposits. Free capital for connected bankers or not, the return on cash in a recession is going to head to zero. No growth in the real economy, no return on financial assets.

lolcar: historically, if we go back hundreds of years, 1% was a reliable return which you could get from extremely safe investments, such as British government bonds. It seems to be risky to push savings account rates below 1%. (Note that 1% can be well below inflation and that’s OK.)

In Canada, the banking sector is heavily regulated and as far as I can tell has very little political power – and yet rates on deposits are close to zero (especially after fees are taken into account).

Interestingly enough the arch conservative “Frankfurter Allgmeine Zeitung” concurs with Yves Smith on this one. They believe it is an incredibly stupid move to take money from depositors. Here the link: http://www.faz.net/aktuell/wirtschaft/europas-schuldenkrise/zypern/schuldenkrise-jetzt-auch-zypern-12118541.html

Whom the gods wnat to punish they strike with blindness.

Actually IMHO what is truly scary is if this does not spark an immediate bank run on the peripheries. The powers that be may then be emboldened to engage in the following reasoning “if this does not happen to country A then it will not happen in country B”….

I’m worried about this too.

The situation is *guaranteed* to cause a bank run in countries like Spain and Italy, but I explained in a comment below that the bank run will be … slow, due to people unravelling their dependency on the banking system first.

So it won’t look like it’s caused a bank run right away. This could cause the idiot German bankers to double down, even while the bank run is quietly starting in the background.

By making demands on Serbia in July 1914, demands the Autro-Hungarian Empire knew full well the Serbs could not accept, it precipitated a chain of events that led to a European War of mass destruction.

It would seem that the GFC that originated in the USA in late 2006 is playing out similar to the events that led to a great war in Europe, particularly if we look at Russia.

FWIW, legalised theft from the ‘Troika’ is still theft and brings the Euro project into disrepute – I’m not sure who this serves best, apart from the 0.1%, but surely, given the banks fucked up, why on earth are the citizens of Europe paying for this lunacy – as are our cousins across the pond.

All I can say, is I hope Grillo is taking note of this, it would be nice to see some of those that caused this mess pay for their crimes.

“time to switch to safer (presumably German or maybe even Swiss) banks”

Ah, there’s the money! Now that’s a good reason for German bankers to play hard ball. Never overlook the money trail when the guano encounters the ventilation system.

Interesting note, Yves.

Swiss, probably, because that gets the money out of the poisoned euro.

Now, the Swiss government is still quite solid on its money-printing policy — if there are capital inflows, the Swiss WILL print money in order to force the exchange rate down. So that might discourage large depositors.

A small bit reported in Spanish media: Cypriot president offered recently discovered natural gas reserves as collateral for a larger loan and then a reduced depositor’s tax, and Schäuble laughed.

Also,

Cyprus must have a constitution that protects against confiscation. Confiscation is rarely called such when practised, but may instead be called “an extra tax”.

Even if the country’s parliament votes yes, there could be ways for citizens to attack this through the courts, which would take a long time, of course.

Constitutions often proctec citizens stronger than foreigners (such as oligarchs with their cash stashed on the island. Thus yet another argument to tax/confiscate the foreigners more than the nationals.

The interesting point is that greek banks were excluded from taking a hit. Wonder how the Turks feel about that.

Time to park your money in Greece, as they get the kid glove treatment?

Is this the future of global electronic banking.

The IMF has declared a .0001 global tax(carbon or whatever) on deposits to save the planet.

Bend over and pray.

Greece and Cyprus are opposite ends of the same problem. In Cyprus, the banks are broke and can take down the government, which was mostly ok. In Greece, the banks were mostly ok, but the government was broke.

Banks are the problem in Iceland, Ireland, Spain, and Cyprus. Government debt is the problem in Greece, Portugal, and Italy. Since Iceland and Ireland have nationalized their banks, the real threat by the Cyprus precedence is Spain.

The Cypriot government has now extended the “bank holiday” until *at least* Friday.

“As European stock markets faltered and the euro fell against major currencies, the government said it would also keep Cypriot banks shuttered until at least Friday, well beyond a bank holiday that was supposed to end Monday. The move was aimed at staving off a possible bank run. ”

http://www.nytimes.com/2013/03/19/business/global/asian-markets-drop-on-latest-euro-concerns.html

This is how American banksters held American citizens’ cash hostage in the aftermath of the Crash of 1929.

Uh-oh.

In the Hoover administration, when the banks were shuttered, they were dead. If they reopened, they reopened to a bank run, because being closed was a clear sign of unsafeness.

In the FDR administration, the “bank holiday” worked, because FDR declared that (1) he would shut down ALL the insolvent banks — he shut down about 1/3 of all banks; (2) when the banks reopened, the remaining ones WOULD be solvent — they were; (3) he was instituting emergency measures to revive the economy (the 100 Days legislation) — he did; (4) people with deposits in insolvent banks would get their percentage within a few weeks — they did; (5) he was establishing the FDIC to prevent the banking crisis from happening again — he did.

The huge combination of sensible actions meant that when the banks reopened after FDR’s bank holiday, people had confidence in the banks which reopened.

There is nothing comparable going on in Cyprus; there is no reason for people to have confidence in any of their banks, given that the government is actually *abrogating* the deposit insurance guarantee. Accordingly, if they reopen, it will be like banks which closed “temporarily” under Hoover; they will reopen to instant bank runs.

FWIW, my maternal grandparents had $ in three banks. All failed. They got three cents on the dollar.

My maternal grandparents had their money in the stock market.

….or so they thought. They were invited out to a lobster dinner at the house of their broker, along with his other clients. In the middle of dinner, he went upstairs and shot himself dead.

Turned out he’d been defrauding all his investors — he’d been telling them he was investing in one thing, while actually buying another. His actual purchases He’d lost everything, and only had enough money left for one lobster dinner. At least he felt bad about it.

That’s the root of my lack of trust of bankers and brokerages. There’s a reason that I pay attention to SIPC and FDIC insurance, and *also* check the bank and brokerage underlying financial statements, and *also* check their reputation, and *also* get as much “rumor mill” information about them as possible.

Thank you for the detailed review of what sensible government action could look like, N.

So…

You, who regurlarly complains about crony capitalism and the corruption of the system, are actually recommending to make rich depositors whole and to prefer private bank accounts in private banks to public debt?

Interesting.

Just to remind you, it was the idea of the Cypriot Government scrapping the deposit insurance in order to stay an attractive offshore paradise.

Funny to see how your pathologic hatred of Germans overrides your resentment of rich people.

Good entertainment.

‘Wolfgang Schäuble, the German finance minister, said Nicosia would immediately have to raise as much as €7bn from depositor haircuts.’

Here is an exclusive photograph of Dr Schaeuble, delivering his harsh message to the stunned Anastasiades:

http://farm9.staticflickr.com/8246/8566551117_2b5b521c3e_b.jpg

Ha! One news source is quoting him now as denying any (personal) involvment in fashioning the confiscation maneuver as a way of meeting ECB/German austerity demands.

Not just a petulant boy scout, but one with no honor!

MF Global — Corzine stealing customer accounts and the Government implicitly sanctioning the grab — was the first test case. (JP Morgan was apparently another, but it did not receive public coverage until Josh Rosner’s painstaking review of JPM sanctions.)

Cyprus is MF Global applied to a (small) country. Cyprus is just the next state in the testing process.

Next?

PS — Obamacare (forced purchases of private sector products) is the same thing applied via large government programs. So is the Grand Bargain. When you strip away the semantic differences (“haircut,” “solidarity levy,” “equitable sharing,” “Shared sacrifice,” etc.) it becomes very clear that we are currently experiencing the end-game strategy in the One Percent’s plan to take 100% of the world’s wealth and assets for itself.

Correct, Ms G.

And the number of private purchases of health care may dwarf expectations as AR (done deal) and FL (in consideration) consider fully privatizing Medicaid.

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/03/08/privatizing-the-medicaid-expansion-every-state-will-be-eying-this/

Exactly.

Comical to use “expectations” in this context, where the results/numbers are basically being rigged from the get go :) You don’t need fancy algorithms to make money!

Also, I love how Krugman drops a little item about Cyprus as if to tell everyone to move along, nothing to see here, because the “haircut” is really only affecting those Russian gentleman of ill-repute.

http://krugman.blogs.nytimes.com/2013/03/17/the-cypriot-haircut/

Was Krugman taking a nap thirty days ago when we learned that HSBC was laundering for drug Cartels and sheltering money for countries on the OFAC list? Is there something about Russian Oligarchs that’s special that way? Talk about ignorant stereotypes and, more importantly, false (albeit convenient) “categories.”

If you hit Krugman’s links, you are only helping him

monetize stupidity.

You win, I lose!

‘Now the EU officials could easily calm nervous depositors by announcing an ECB-backstopped deposit guarantee.’

My understanding is that by calling the stability levy a ‘tax,’ deposit insurance is not triggered because governments of course have the right to tax.

In other words, the central problem is legal legerdemain being invoked to defeat deposit guarantees. That’s not an issue that an ECB backstop would address.

“In other words, the central problem is legal legerdemain being invoked to defeat deposit guarantees.”

Coming soon to a US bank near you and me? All they’d have to do is cite Justice Robert’s opinion upholding the forced purchases of private health insurance as a “tax.” Voila.

PRECISELY.

Once courts accept the principle that the power to tax is completely unconstrained, then anything labeled as a tax is prima facie legal, constitutional, and beyond challenge.

If you drive a car, I’ll tax the street,

If you try to sit, I’ll tax your seat.

If you get too cold I’ll tax the heat,

If you take a walk, I’ll tax your feet.

— George Harrison

As a “small saver” on a fixed income, the message that comes across is “your savings ARE NOT SAFE ANYMORE,” even in the U.S. Obama & the Dems have already said they will rob Soc. Sec. What will prevent them from outright robbery of savings (more than the 0% interest has been doing).

I think most people in the U.S. will only get the message about confiscation and not any of the “extenuating circumstances.”

You mean”obama and the dems, AND the republicans and the rest of the petersen parade of charlatains,banging their human skin drums on wall st and london,et al.”,don’t you?

There is one thing to stop them. The fact that most Americans have no savings.

Here’s the thing: whether it’s “legal” isn’t the issue. Whether it causes everyone to take all of their money out of the banking system and put it under their mattresses — THAT is the issue.

This is why commentators at the FT and so forth consider this insane. Apparently the idiots at the ECB (and at the Cyprus government) think this is a reasonable plan.

I suspect that our government idiots aren’t quite that idiotic, but who knows!

So far they have just been more subtle (i.e., better foxes) — see, e.g. ZIRP, sequester, increase in taxes for working middle class, etc.

Tax changes are not sprung overnight. If they are they constitute theft, just like this is.

That is a quibble with *process*. Cyprus is the lab experiment to see if the advance notice and legal process (through a captured Congress and Supreme Court, for example)can be dispensed with. The .01% are tired of wasting so much money and time on the latter and want to accelerate and lower the costs of loot grabbing.

Don’t you think?

This Cyprus thing is huge as it shows us the next actions the crooks will take to keep the global racket going. Gerald Celente has always warned that if you don’t have your money in your own possession then you don’t own it.

What’s striking is that we’ve moved beyond the stealth attacks on our personal wealth to something much less subtle. Curious as the elites have been very good at convincing the majority of people that the status quo remains and all is business as usual. There is nothing normal about taxing depositor savings or bank holidays. They do risk shaking people’s confidence in the entire system.

Now we find out how many people really do distrust the banks and politicians. It’s just theatrical shooting ones mouth off on internet blogs. Real distrust means withdrawing from the system. In this case getting your money out of the banks. Not just in Cyprus or Greece/Spain/Italy but in all western banks. The IMF was very much a part of this deal. People with sense should know that all our financial elites are the same in every country.

Perhaps this is just another false alarm, another moment in the new status quo. Maybe it’s a tipping point. For those with savings in any western bank there isn’t any good reason to keep your money in the bank now. Unless you actually trust the system and our ruling elites. If that’s the case then good luck to you!

“What’s striking is that we’ve moved beyond the stealth attacks on our personal wealth to something much less subtle. Curious as the elites have been very good at convincing the majority of people that the status quo remains and all is business as usual. There is nothing normal about taxing depositor savings or bank holidays. They do risk shaking people’s confidence in the entire system.”

Isn’t it? This confirms something I’ve been saying, which is that our current elites are monumentally stupid, Versailles levels of stupid. Smart thieves could have set something up where they ruled for ever. These people are not doing that; they keep going too far.

It’s called hubris. The very same “Mission-Accomplished” hubris we saw back in 2003.

Wondering…why is this surprise? There is nothing new here. This has happened trough history of capitalism all the time – true, under different name, depending upon of location and culture of targeted country. So, we had “La mission civilastrice” or colonialism in Africa, Asia, S. America etc., we have spreading “democracy” and “human rights”. The very term “Shock Doctrine” or “restructuring” is around 20 year old and it’s applied in S. America and E. Europe, mainly.

Neofeudal EU/US elite invented the terms “austerity” and now “tax”, because targeted countries are within their “cultural” circle. Its citizens shouldn’t perceive that as failure of domestic policy because there are so-called democratically elected.

In Marxist’s lexicon and terminology this is know as: Accumulation by dispossession, http://en.wikipedia.org/wiki/Accumulation_by_dispossession or, if you will, originally known as Primitive Accumulation of Capital. Common folks would say theft or robbery.

This is not just about the “tax” and bank deposits. Red this: http://www.cyprusnewsreport.com/?q=node/6556 it is easy to see this is about “Shock Doctrine”. Those pesky twenty and something points are self-telling. Cyprus public enterprises are going to be sold for nothing, social institutions and its expenses slashed to the bone.

All this tells us that EU is devouring itself, there is no new frontiers to be open, i.e. to steal, plunder and loot. Last successful one was Libya, Syrians bitterly fighting Western mercenaries and resist to “liberalize” its “market”. And anyway all wealth accumulated over time has come from overseas/colonies and free labors/slaves.

I’m sure this couldn’t be done without the Russian approval, they wouldn’t tolerate any loss, easily. I was surprised recently to read that Russian Sberbank acquires Austrian Volksbank, thus Russian’s are covering almost entire East Europe. This is probably what’s behind Russian’s blessing.

So… basically any money or property that a Russian has in EU is no longer safe, yes? EU officials are openly discussing how Cyprus should optimise the confiscation brackets to take as much Russian money as they can, without touching other depositors.

Would Cyprus police investigate robberies where the victim is a Russian?

What’s interesting here is that according to chatter on some Russian blogs…many Russians got wind that this was coming in Cyprus and got their cash out early. On some level, it’s reminiscent of what happened when the soviet union fell and ordinary citizens lost their wealth–while those with ties to the government knew and avoided the pain.

Well, well. Isn’t *that* interesting.

So the smoke-blowing media focus on how this is an anomaly that *just* affects dirty Russian money is not just a diversion but potentially misinformation (i.e., lies).

Can someone explain why the Cyprian govt. would have to immediately come up with c. 30B Euro to cover deposits in the event that the largest banks fail? I’m talking about a nationalization, here, not a liquidation. Couldn’t the govt. cancel all liabilities (ex deposits and secured debt) and keep the assets in the new, nationalized bank? As long as depositors didn’t withdraw all their money immediately, why would the govt. have to have 30B in cash in order to cover them? It’s not like the banks themselves (any banks anywhere) have cash on hand to cover deposits — because they don’t need to.

Why would a nationalized bank need to have total deposits IN CASH? Or is this just the usual fear-mongering?

Why did Cyprus need any kind of a bailout? What went wrong with their public finances? If the particulars of this bailout give great pause for concern of a contagion, why not let Cyprus get their own house in order in whatever manner they see fit? They’re on an island for goodness sake – just tell them to report back in a couple of years on how things are going; or not if they don’t want to.

Resist the urge to ‘do something’.

Please get on top of the plot. The key elements are in the post if you read it carefully.

This is not about bad public finances but a bad banking system. Bank assets are ~7x GDP. The banks lent a lot to Greece. Ooops!

This is similar to Ireland, where the state was too small to rescue its banks on its own, with one exception: the Irish were willing to cut them loose, since they were owned by a very small group who’d benefitted staggeringly from the Irish real estate bubble. But the Eurocrats weren’t at all willing to let that fly since German (and I think French too, but definitely Hypo Bank) were really exposed to Irish banks. Major contagion potential.

Here the Cypriots didn’t want their banks to fail because banking is a major anchor of their economy, apparently. And a lot of expat retirees have $ in local banks.

Why bankers are intellectually naked

http://www.ft.com/cms/s/2/39c38b74-715d-11e2-9b5c-00144feab49a.html#axzz2NsN8o3gj

I suppose this tells us something about how sovereignty and an economy based on the type of banking built on lending to non-citizens (and expat retirees) are not entirely compatible. Shorter — Cyprus is not a country, it is a vehicle for funneling money and relies critically on collecting interest and fees on money. Hmm … in micro it’s almost as though we’re talking about a much bigger country half way around the globe.

So far the market is yawning at all of this. What does it know that we don’t?

well, because ben.

Hypothesis – Cyprus is being trashed in order for the major western oil companies to get the gas for pennies on the dollar. A cash flight to the core EU countries would also be of benefit to the core.

No good as a hypothesis. The gas can’t be exploited because (a) the Turks won’t allow it to be exploited unless the Cyprus territorial conflict is resolved, and (b) the only gas well which has been drilled wasn’t profitable enough.

Now the optimists are hoping that (depositors) citizens in other periphery countries will see the (Cyprus deposit-seizure, formally a tax,) invasion of the Sudetenland as a one-off. After all, (Cyprus) the Sudetenland is just an itty bitty country (with a banking system) full of ethnic Germans (Russian suitcase money)…

(Stability) Peace in our time. (Nicely done)

For those that think that Cyprus is a special case, the Bush Administration was a nonstop collection of “special” cases, almost all of which were subsequently institutionalized and legitimized under Obama.

Also after the 2008 meltdown in the US, we heard a lot about the sanctity of contracts when it came to the bonuses of those who engineered the meltdown but when it came to autoworkers all bets were off and slicing and dicing their contract was portrayed as completely in order.

And before Cyprus, it was Greece which was the special case. And Spain could say, it was not Greece, and Italy could say it wasn’t Spain, and France could say it wasn’t Italy, and Germany could say it wasn’t France. But each year that goes by, the relative order does not change but the conditions in each country worsen. So Spain is where Greece was a year or two ago, and Italy is where Spain was, and France where Italy was.

If you look at this from the kleptocratic perspective, what is happening in Cyprus specifically and in Europe generally makes perfect sense. Kleptocrats will loot each other but in the main they prey upon the state and the 99%, and there is nothing exceptional or special about that. It’s how kleptocracy works. The unthinkable today is standard practice tomorrow.

Ha! It’s the farcicality of contracts for the 99%, and the sanctity of contracts only and always for the sanctimonious 1%, who own the state after all. So Russian Oligarchs, money launderers, Greek tax-evaders and wealthy investors are protected from (legitimate) large losses by stealing from legally-insured small depositors. This is the state committing bold daylight robbery for its bankster masters. It is a manifest crime that heaps insult upon injury with smug impunity.

And of course it is not a one-off crime as you say, not a blunder. It is a calculated crime, IMO, as strategic as Obama’s shrewdly “reluctant” assault on the safety net. Following misallocated austerity in nation after nation, this theft looks like a critical escalation to test the kleptocracy system — to gauge the water temperature and reflexes of the semi-comatose frogs featured on the Shock Doctrine menu.

It confirms that the relentless march toward fascism is accelerating by careful design. And I suspect it will get a lot worse before people efffectively rebel, if ever.

“… this theft looks like a critical escalation to test the kleptocracy system …”

Yes, the Peter Pinguid Society is now in 6th gear, boring full speed ahead. End game.

I’d like to make a short explanation of why the Euro-wide bank run will be slow, taking place over weeks or months.

(1) People have “automatic deposit” for paychecks and “automatic withdrawal” for bills. It takes a while to dismantle all of these. When someone decides that the bank isn’t safe, the first thing they will do is to dismantle the automatic withdrawals (which can take days or even weeks). After that they dismantle the automatic deposits (which can also take days or weeks).

Only then do they start stripping the account bare. They may pull some cash from the accounts immediately, but the full-scale account closures only happen after the “loose ends” are tied up.

(2) Several countries have “withdrawal rate limits”. Rather than triggering government investigation by taking out a huge amount of cash all at once, people will start taking out the maximum daily rate each day to drain their accounts.

(3) People will worry about the safety of cash, and so will spend some time setting up safe deposit boxes, buying safes, etc. This *also* takes time.

(4) Many businesses make it difficult to pay by cash.

People will spend their time figuring out how to make cash payments to their cellphone provider (for instance), before shutting down the bank accounts entirely.

(5) Most countries have stupid reporting requirements for large cash transactions, and people will have to figure out how to file those forms and all that.

—-

In short, since the situation threatens *all* bank accounts in Europe, the only alternative is cash, and switching to cash requires work and research. It won’t happen immediately.

Result: We will get a *slow-motion* or *delayed*( bank run rather than an instant bank run. This is actually extremely dangerous, because it will lead the idiots running the European Central Bank to believe that they haven’t caused a bank run. And then the bank run will happen.

Nathanael-

Allow me to play devil’s advocate.

1) While your points about the hassles of setting up automatic withdrawals / deposits are noted, nothing focuses the mind like the impending loss of your life savings. So I think people can and will move rather faster than usual.

2) For those transactions, you only need a bare amount of float. Yet plenty of people keep their savings in money markets and savings accounts. This money can easily be transferred to a new bank account. People can easily keep their local Spanish account for the various automatic transactions, while transferring any excess money to a new German account. They can do this tomorrow, then worry about eventually transferring all the automatic transactions later on.

3) There’s no need to take out cash. You only have to transfer to a stronger bank. While some very worried people might literally stuff Euros in their mattress, I think most people would just open up a Euro account in another country, then do an electronic transfer of their savings into it. Even if the new account is within the Euro (e.g. Germany) it will force real stress on local banks. And if they transfer out of the Euro (say to Swiss, British or American banks) it can transform into a run on the entire Euro system.

4) You don’t need much of a bank run to close a bank. The reserves against withdrawals, especially cash withdrawals, are tiny. Recall that the concerns about a Spanish bank run that prompted intervention last summer was due to capital flight of ~10% of Spanish deposits. And that was with assurances of deposit insurance. I’d imagine a true bank run could drain 10% of the deposit base quite quickly even with the obstacles that you cite.

Your points are well taken. Some further points, though, in favor of a slow bank run:

“This money can easily be transferred to a new bank account. People can easily keep their local Spanish account for the various automatic transactions, while transferring any excess money to a new German account

….. And if they transfer out of the Euro (say to Swiss, British or American banks) it can transform into a run on the entire Euro system.”

This is a lot harder than it looks. The “know your customer” rules introduced after 9/11 were designed to make it very hard for “little guys” to open foreign bank accounts. Pay attention to that fact, it’s important.

As people discover how slow the process of opening a bank account in a city you don’t live in actually is (if you aren’t a 0.1%er — they just fly one of their lackeys in to open the account), they will get more nervous and will decide to go with cash-in-the-mattress. But this process will take weeks.

However, your final point is well taken: “4) You don’t need much of a bank run to close a bank. ”

I still think the bank run will be just slow enough that the idiots at the ECB will think that there’s no bank run. Then the banks will start closing.

I don’t live in Europe so I’m curious, but is it all that difficult to open a foreign bank account? After all, I thought one of the sticky points about Iceland’s banking crisis was the presence of so many British retail depositors chasing yield on their savings accounts. Plus I read about Euro-denominated mortgages from Swedish banks imploding in Latvia, etc. From my American vantage point, it doesn’t seem too difficult for average retail customers to use foreign banks.

Am I correct in assuming that references to “Cyprus” in this context refers to the southern 2/3’s of the island and not to the northern 1/3 controlled by Turkey. I wonder if the troubled banks operate in the Turkish area and does Turkey have any skin in the game. Given the animosity between the two there is probably a financial firewall in place but Turkey is a large economy outside the EU.

Jim

The Turkish Republic of Northern Cypress is fine, and the ethnic Greeks resident there are probably thanking their lucky stars.

I don’t know how many of them have deposits south of the Green Line, though.

Uh, “Northern Cyprus”

Edward Harrison has a nice discussion pointing out that taxing “stocks” (wealth) rather than “flows” (income) is a time-incoherent, unstable procedure which creates uncertainty and lack of trust.

Basically, pointing out that you can suddenly add an income tax without triggering financial collapse, but suddenly adding a wealth tax will make a mess.

Yves, Lambert, Please tell me you are on top of responding to this terrible, awful Andrew Ross Sorkin article about Cyprus that’s making absolutely no sense:

http://dealbook.nytimes.com/2013/03/18/a-bank-levy-in-cyprus-and-why/

Thanks for the link, but see Yves on assignments.